Total cost of loan (FLC)

— payments by the borrower under the loan agreement, the amounts and terms of payment of which are known at the time of its conclusion, including taking into account payments in favor of third parties determined by the agreement, if the borrower’s obligation to make such payments follows from the terms of the agreement. The total cost of the loan is calculated in annual percentage.

Initially, the calculation of the PSC was carried out in accordance with the instructions of the Bank of Russia dated May 13, 2008 No. 2008-U “On the procedure for calculating and communicating to the individual borrower the full cost of the loan.” The credit institution is obliged to provide the borrower with information about the PSK before concluding a loan agreement. The same regulatory act establishes the formula for calculating the PSC. This instruction was canceled [1] from 01.07.2014 (Instruction of the Bank of Russia dated 30.04.2014 No. 3254-U) due to the entry into force of Federal Law No. 353-FZ of December 21, 2013 “On consumer credit (loan)”.

Until June 12, 2008, the phrase “effective interest rate” was used instead of the term “full cost of credit.”

The total cost of the loan is analogous to the term annual percentage rate of charge (APR). In the European Union, the calculation is determined by EU Directive 2008/48/EC. [2]

Calculation of the total cost of the loan [edit | edit code]

Payments included in the PSK [edit | edit code]

1. Payments by the borrower under the loan agreement related to the conclusion and execution of the loan agreement, the amounts and payment terms of which are known at the time of concluding the loan agreement, including:

- to repay the principal amount of the loan;

- on payment of interest on the loan;

- fees (commissions) for reviewing a loan application (drawing out a loan agreement);

- commission for issuing a loan;

- commission for opening, maintaining (maintenance) of the borrower's accounts (if their opening and maintenance is conditioned by the conclusion of a loan agreement) [3] ;

- fees for settlement and operational services;

- commissions for the issue and annual servicing of credit and settlement (debit) cards (hereinafter referred to as bank cards).

2. Payments by the borrower in favor of third parties, if the borrower's obligation to make such payments arises from the terms of the loan agreement, which defines such third parties (for example, insurance companies, notary offices, notaries). These payments include payments for the assessment of the property pledged as collateral (for example, an apartment), payments for life insurance of the borrower, the liability of the borrower, the collateral (for example, an apartment, a vehicle) and other payments.

If the terms of the loan agreement specify a specific third party, the tariffs of this person are used to calculate the PSC. The rates used to calculate the full cost of the loan may not take into account the individual characteristics of the borrower (for example, his age or driving experience) and the collateral (for example, the manufacturer, model or year of the vehicle). If a credit institution does not take such features into account, the borrower must be informed about this. If, when calculating the PSC, payments in favor of third parties cannot be unambiguously determined for the entire loan term, the calculation of the full cost of the loan includes payments in favor of third parties for the entire loan term, based on the tariffs determined on the day the PSC is calculated.

If the loan agreement specifies two or more third parties, the calculation of the PSC can be carried out using the tariffs of any of them, indicating information about the person whose tariffs were used to include in the calculation of the full cost of the loan, as well as information that in the event when the borrower uses the services of another person, the size of the PSC may differ from the calculated one.

Payments by the borrower for insurance of the collateral are included in the calculation of the PIC in an amount proportional to the cost of the goods (services) paid for by the loan, as well as the ratio of the loan period and the insurance period, if the loan period is less than the insurance period.

Payments not included in the PSK [edit | edit code]

1. Payments by the borrower, the obligation to make which by the borrower arises not from the loan agreement, but from the requirements of the law (for example, when concluding a contract of compulsory civil liability insurance for vehicle owners).

2. Payments related to the borrower’s failure to comply with the terms of the loan agreement.

3. The borrower’s payments for servicing the loan provided for in the loan agreement, the amount and (or) terms of payment of which depend on the decision of the borrower and (or) his behavior, including:

- commission for partial (full) early repayment of the loan;

- commission for receiving (repaying) a loan in cash (for cash services), including using ATMs;

- penalty in the form of a fine or penalty, including for exceeding the overdraft limit established for the borrower;

- fee for providing information about the status of the debt.

For bank cards, the following are not included in the calculation of PSC:

- commissions for carrying out transactions in a currency other than the account currency (currency of the loan provided);

- commissions for suspending bank card transactions;

- commissions for crediting funds to a bank card by other credit institutions.

If the loan agreement provides for different amounts of the borrower's payments on the loan depending on the borrower's decision, the full cost of the loan is calculated based on the maximum possible loan amount (overdraft limit) and the loan term (validity period of the bank card), equal payments under the loan agreement ( repayment of the principal amount of the loan, payment of interest on the loan and other payments determined by the terms of the loan agreement). If the loan agreement provides for a minimum monthly (regular) payment, the PSC is calculated based on this condition.

A nuance when calculating the UCS [edit | edit code]

The PIC is calculated using the compound interest formula and also includes the income lost by the borrower from the possible investment of the amount of interest payments on the loan during the loan period at the same interest rate as on the loan. Thus, the total cost of the loan exceeds the interest rate specified in the loan agreement even in the absence of commissions and other payments, but in the event that the end of the interest period coincides with the time of interest payment. As the time between the end of the interest period and the moment of payment of interest increases, the total cost of the loan (in the absence of other fees) begins to decrease and may be several tenths of a percent less than the nominal rate under the agreement [4].

What does the full cost of a personal loan include?

Main part:

- Borrowed money.

- Interest on this money.

Commissions:

- For the production of plastic, its annual maintenance.

- For settlements and other transactions with money.

- For opening and maintaining an account.

- For the loan itself.

- For registration, consideration.

If the loan requires insurance, it is not included in the full price. If insurance is voluntary, but refusal of it entails an increase in interest, this should be reflected.

The situation with the commission for cash withdrawal through an ATM is interesting. Let's say you take out a consumer loan in cash, and there is a condition - they give it to your card, and you withdraw money from an ATM. However, there is a cash withdrawal fee for this product. On the one hand, the law says nothing about this. On the other hand, paragraph 4 of Article 6 says: “The PSC includes payments ... to the creditor, if the issuance of a loan is made conditional on the making of such payments.” It turns out that the commission for cash withdrawal should be included in the PSC.

What do you need to know about this term?

The full cost of the loan includes all payments that are collected from the debtor during the period of execution of the contract. Their sizes and all associated deadlines are calculated in advance. This is carried out at the time of signing the loan agreement. The full cost of the loan is presented in the form of a special table where monthly payments are indicated. Special attention should be paid to the features of this indicator.

- Data on the full cost of the loan must be indicated on the first page of the agreement. They are always located in the upper right corner. Additionally, the indicator is prescribed in the individual conditions of the drawn up contract.

- The total cost should be the main guideline for the borrower, which allows them to correctly determine how profitable the chosen loan offer is.

- The value of the total cost is necessarily displayed as a percentage based on the annual period.

- In cases where the borrower is not notified of the PSC when drawing up and signing the agreement, such an agreement may be declared invalid in court proceedings.

- The PSK is established by the Central Bank. The indicator cannot be higher than 1/3 of the average market value of the cost of a consumer loan. Up-to-date information at the time of using the loan can be requested directly on the official website of the Central Bank.

A special formula is used to calculate the indicator. It is indicated in a separate article of Federal Law No. 353. It also provides detailed explanations of the calculations made. It is this article that obliges all financial institutions to display the PSC on the first page of the loan agreement, using exclusively bold font and highlighting the indicator with a square frame.

This allows the borrower to pay special attention to the interest rate. After all, the size of the font used to write USC is significantly larger than all others on the page.

Calculation algorithm

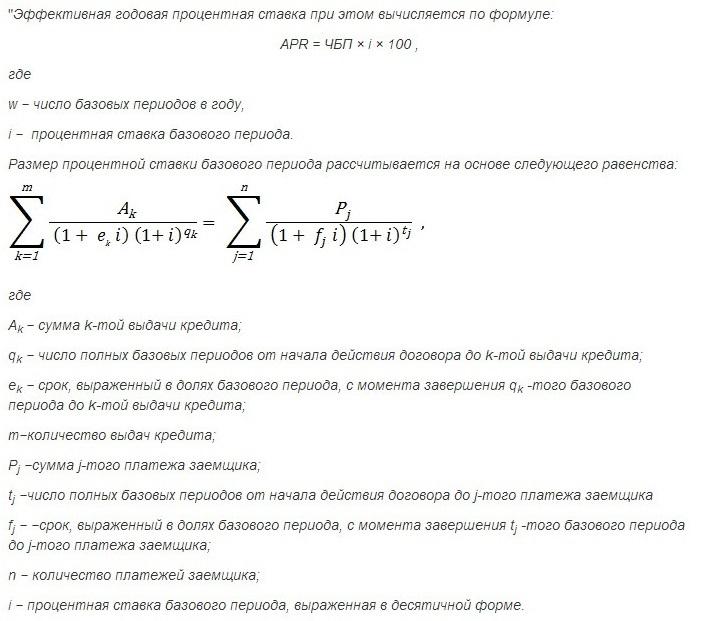

The PSK is calculated using a specially developed formula given in the Law “On Consumer Credit (Loan)”. This formula looks like this:

PSK = ix NBP x 100

The abbreviation PSK denotes the total cost of the loan expressed as a percentage per year. The numerical value is refined to the third digit after the decimal point (thousandths).

NBP stands for the number of base periods in the current calendar year. The base period is the time interval between payments, which is most often mentioned in loan agreements. If the contract did not mention the time interval between payments, 1 year is taken as the base period. If the payment schedule contains several different time intervals at the same time, the smallest of them or the arithmetic average between all the given figures can be taken as the base period. The length of a calendar year is considered to be 365 days.

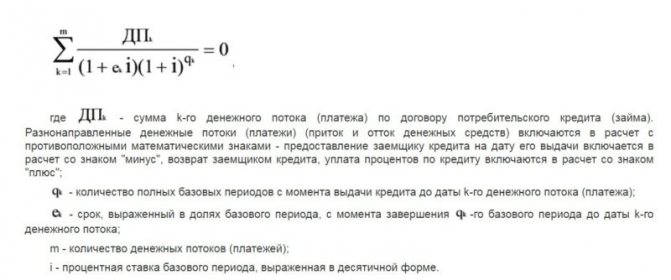

The letter i denotes the interest rate. It is calculated using a special formula. The following indicators are taken into account:

- Payment amount (cash flow). The receipt of funds by the borrower and their return to the lender are carried out as flows with different mathematical signs (the issuance of a loan is taken into account with a “minus” sign, and the repayment of debt by the borrower - with a “plus” sign).

- Number of complete base periods.

- Number of Payments.

- Interest rate for one base period.

For each creditor, its own PSC indicators are calculated. The results are processed by the Bank of Russia.

To obtain the amount of the average market PSC, information is collected from at least 100 creditors and a weighted average is calculated. If the number of creditors in this category does not exceed 100, data from at least 1/3 of all available organizations is processed.

What does the total cost of the loan consist of?

Until 2008, the EIR was known as the effective interest rate. However, the changed name of the indicator did not change its essence. Often, some financial institutions, while advertising bonus offers or offering standard lending services, do not draw customers' attention to data that relates to the full cost of the loan.

They prefer to announce an absolutely net interest rate, without taking into account additional commissions. But a modern borrower must know what the FCC (total cost of the loan) consists of.

- The amount that an applicant to a financial institution receives in hand or the body of the loan.

- Additional commissions charged for consideration of an application submitted to the bank.

- The interest the borrower pays for the use of funds provided.

- The monthly payment that repays the full amount of the loan.

- The fee charged for opening an account and its maintenance, if it is directly related to the concluded agreement, issuing a credit card.

- Commission fee provided for when taking out insurance.

All these points make up the total cost of the loan. Special attention should be paid to costs that are not included in the PSC, but they are also charged to the client of the financial institution. These include payments provided for registration of compulsory motor liability insurance if, for example, a vehicle is purchased, penalties for late monthly payments. There are also costs that are voluntary.

- Restoration in case of loss or damage, reissue of a credit card.

- A fee provided for early repayment of the amount requested by the borrower.

- Requests for the issuance of various statements, certificates, receipts, if required by a client of a financial institution when depositing maternity capital, using refinancing services, or subsidy programs.

- Commission provided for currency conversion if funds are transferred from ruble equivalent to foreign currency.

- A mandatory payment that is charged from an individual when transferring funds to a card of a third-party financial institution.

The bank carries out all calculations under the PSK unilaterally, using the appropriate formula. Moreover, it is worth noting that this indicator, even in the complete absence of additional payments and mandatory commission fees, will exceed the interest rate specified in the loan agreement. All financial institutions follow this rule, thanks to which they are never at a loss from the combination of their activities of accepting deposits and issuing loans.

Expenses not taken into account when calculating the full cost of a consumer loan

Not all additional payments that are associated with a loan agreement can be taken into account when calculating the PSC. Such exceptions include:

1. Expenses incurred by the borrower as a result of legal requirements and not taken into account in the lending terms. This includes MTPL insurance when buying a car on credit.

2. Payment of penalties by the bank for failure to comply with the terms of the loan agreement. For example, some banks increase the interest rate on targeted loans if there are facts of misuse of loan money or in the absence of insurance of the property pledged as collateral, if such a condition is contained in the loan documentation. The most common case is a penalty for late payment.

3. Commissions stipulated in the consumer loan agreement, the amount and payment period of which are unknown in advance. The collection of such payments directly depends on the behavioral factors of the borrower and the decisions made by him. These include:

- fee for early loan repayment;

- commission for receiving loan funds. For example, a loan is often transferred to a bank’s free debit card, but if you withdraw money from a “someone else’s” ATM, or want to receive it at the bank’s cash desk, you will have to pay a fee for this;

- penalties accrued for late payments or other violations of the terms of the loan agreement, including for exceeding overdraft lending limits;

- payment to the bank for providing certificates about the status of the debt or the status of the debt in electronic form (by SMS message or email);

- commission payments for conducting banking transactions in a currency different from the loan currency, for example, for converting from rubles to dollars when paying for goods in an online store with a credit card;

- fee charged for crediting funds received from other credit institutions to a bank card;

- commissions for suspending banking transactions on a card (blocking a card).

How can I find out the final score?

You can even calculate the full cost of the loan yourself if you have at least minimal mathematical knowledge. Special norms that are established by the Central Bank are used as initial data. The formula and methods for calculating the total cost of a loan are systematically improved.

They may also be affected by changes in the legislative framework. To find out the most accurate data on the PSK and make independent calculations, you should visit the official website of the financial institution, where the lender is obliged to post complete information regarding the terms of the loan.

How does the PSC affect the calculation method and what does analysis of the indicator give the borrower?

Each financial institution calculates the interest rate based on individual data. The consumer loan calculator program includes various options. This is definitely reflected in the final results.

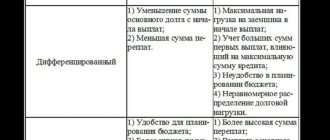

According to independent experts, it is much more profitable for a borrower to use loans with a differentiated payment method. They decrease as the interest amount decreases.

An approximate and exact version of the UCS calculation is also used. In the first case, each month will consist of 30 days. The second option takes into account the exact number of calendar days. The total cost of the loan is a conditional indicator that each financial institution is required to calculate based on certain client actions. However, the PSK makes it possible to compare similar loan offers, wisely selecting the most profitable options.

Why was there a need for a new formula for calculating consumer loans?

The formula for calculating consumer loans , which was approved on July 1, 2014, was introduced simultaneously with the law on consumer credit.

But there were many complaints about this formula from experts and legislators, because in fact it showed a completely different result of the borrower’s payments than he actually had to pay. That is, discrepancies arose between the full amount of the cost of the loan and the full amount of all payments on it.

As Anatoly Aksakov, Deputy Chairman of the State Duma Committee on the Financial Market, explained, using this formula it is impossible to see the actual payments that the borrower will have to make.

The formula can calculate compound interest, but it cannot calculate loans at all for small amounts (less than 200 Euros) and short periods (2-3 months).

+'Advantages of the new formula for calculating consumer credit:

Advantages of the new formula for calculating consumer credit:)

- Since the new formula for calculating consumer loans will help obtain more reliable results on the borrower's payments, it will be the main argument in making a decision to take out a loan.

- The new formula does not require mandatory interest multiplication , as was the case in the previous formula.

- The new formula approximates the values of the PSC and the interest rate in situations where no payments are made by the borrower other than interest. That is, the borrower will be able to realistically estimate the cost of his loan in advance.

- Calculation using the new formula will lead to an undistorted result even when calculating loan amounts for small amounts and short periods.

- When calculating the loan amount using the new formula, the borrower receives an exact payment schedule, that is, the coefficients ek and fj are equal to zero.

- If the borrower took out a loan with monthly or weekly payments in the form of annuities, the formula for calculating the loan amount becomes as simple as possible , and all calculations can be done practically using a regular calculator.

Ways to reduce PSC

Every person who decides to contact a financial institution with a request to provide him with a certain amount at interest should know that there are ways that can reduce the total cost of the loan. However, this requires compliance with some rules. Even before signing an agreement with a financial institution, it is necessary to carefully study the coefficients that they applied when calculating the PSC. They should be compared with the norms of the Central Bank of the Russian Federation. If any discrepancies are identified, you can safely demand a complete recalculation.

The total cost of the loan is directly dependent on the loan term and the frequency of payments made by the bank client. To reduce the rate, the average person can take all available measures that will allow him to increase the monthly payment to repay the amount used.

Accordingly, this fact will significantly reduce the duration of debt obligations. Also, at the time of signing an agreement with a financial institution, it is necessary to waive all additional costs that the bank does not envisage as mandatory. On this issue, it is better to obtain advice from a credit specialist in advance.

Formula for calculating the total cost of the loan

Today, financial institutions use a single algorithm for calculating the PSC:

100 * NBP * i = PSK

NBP stands for the number of base periods per year. According to the methodology used by the Central Bank, 12 months are calculated as 365 days.

i – base period rate. It should be expressed as a percentage.

PSK is an indicator of interest to the debtor, reflecting the full cost of the loan. It is expressed taking into account both whole numbers and thousandths.

In order to independently make calculations and identify the required indicator, the borrower will have to find out a number of certain data. You need to know the size of the loan, decide on its repayment period, ask the bank about the annual rate, take into account the type of payments, commission fees.

How is it calculated

Article No. 6 of the Federal Law of the Russian Federation “On Consumer Credit (Loan)” defines the conditions and procedure for calculating the full cost of the loan.

The formula looks like this:

PSK = ix NBP x 100,

where PSK is the total cost of the loan in annual percentage accurate to the third decimal place, NBP is the number of base periods in a calendar year (its duration is 365 days), i is the interest rate of the base period, expressed in decimal form.

The interest rate of the base period is determined as the smallest positive solution of the equation:

Calculation example

To calculate the full cost of an annuity loan for 100,000 rubles. with monthly repayment of 8884.88 rubles. for 12 months we will determine the values:

- m = 13;

- first payment - 100,000 rubles. and 12 payments of 8884.88 rubles;

- NBP = 12.

i is calculated using the Excel function = IRR: i = 0.01.

PSK = 0.01 x 12 x 100 = 12% per annum.

Reference! Self-calculation of the UCS is a rather difficult task. However, there are many sites with an electronic calculator for loan recalculation.

Video on the topic

Not everyone understands what the full cost of a Sberbank loan means, how it is calculated and why it is needed. When receiving all types of loans, in addition to the conditions offered by banks, it is important to refer to this parameter. It helps you compare offers and choose the more profitable one. The rules for its calculation are set out in the legal document Federal Law-N 353 dated 03/07/18.

What is the total cost of the loan?

The total cost of the installment plan implies the totality of the expected installments that the borrower undertakes to pay. It is calculated as a percentage, and sometimes as a monetary value. The assigned monthly and other fees are specified in detail in the agreement between the client and the financial company.

It is not easy for an ordinary consumer to understand what it is the first time. For example, on the Sberbank website there is an advertisement that the bank reduces the cost to 11.9% per annum for those who apply for a loan through the Sberbank Online service. But if you go to the website section, you can see information that the minimum value for the full cost of consumer loans is 12.51%. There is also information about the maximum value – 20.94%. It becomes unclear where all this information came from and what it means.

This concept is not synonymous with percentage. Her client pays for using the lender's funds. It is accrued for a certain period. There is also a whole list of payments, some of which are legally required to be included in the payment. The other part, due to certain circumstances, has the right not to be considered when calculating this value.

What should the bank include in the PSC?

At the legislative level, there is a list of payments that must be taken into account when determining the full cost of borrowed funds. Financial companies are required to fully disclose to the consumer all the nuances of providing a loan, including the prices at which the calculation was made.

Organizations take into account the following consumer costs when calculating the full installment plan:

- Closing the debt under the contract. It is calculated using a formula that can be found in regulatory documents.

- Repayment of interest, which is established by the terms of the agreement. The money issued is estimated as an overpayment - the amount that will be returned by the buyer in excess of the principal debt.

- Payments that depend on the disbursement of loan money. For example, in order to avoid possible risks in large transactions, you have to resort to a letter of credit payment system - opening a special account or placing cash in an individual safe.

- For a plastic card.

- Expenses for services to third-party partner companies. These include compensation for insurance, the work of an appraiser, a notary, etc. Services of transactions through other organizations are also paid. An exception would be the case with car lending - CASCO is not included in the total debt.

- Payment for insurance, where the recipient of the benefit is not the borrower or relatives, but the company itself. For example, in the event of an insured event related to the life and health of the borrower, the insurance company is obliged to transfer the entire cost to the lender.

- Additional types of insurance, depending on the conclusion of which the lender offers different conditions for issuing cash. For example, companies can reduce interest rates if the consumer agrees to enter into such an insurance contract, or, conversely, increase them if they refuse.

If the contract is renewed when the insurance company changes, the full cost of the debt changes. The company must notify the buyer of this in advance.

What is included in the calculation of the PSC?

The following payments are included in the calculation of the PSC:

- principal amount;

- interest on this amount;

- various payments in favor of the creditor, if they are specified in the agreement;

- fee for issuing and servicing an electronic means of payment (plastic card), with which you will repay the loan;

- various payments in favor of third parties (for example, insurance companies, developers, notaries, etc.);

- insurance premium amount;

- the amount of the insurance premium under a voluntary insurance agreement, if, depending on its conclusion, the bank offers other conditions for the loan (for example, when the repayment period, PIC, interest rate, other payments and commissions change).

These payments are the costs of the borrower.

Payments not included in the PSC calculation:

- fines for non-compliance with the terms of the contract;

- compulsory types of insurance (CASCO or apartment insurance);

- commissions for foreign exchange transactions;

- penalties under the contract;

- commission for suspension of operations;

- fee for non-cash money transfer;

- fee for receiving (repaying) a loan in cash (settlement and cash services);

- commission for using online or mobile banking, SMS notification.

What the bank does not take into account when calculating the PIC

There are payments that are officially allowed not to be taken into account when calculating the full cost of the installment plan. It turns out that the full price of the loan is a relative unit. All that remains is to rely on the integrity of the financial institution, which first discloses to the consumer all information about spending. You should only contact a reliable lender with a proven reputation.

The Bank reserves the right not to take into account:

- Fees specified in legal requirements. For example, compulsory motor liability insurance is not included, but in fact it is mandatory.

- Penalties and penalties for violation of the terms of the agreement. Most often they are associated with late payment. As soon as the creditor learns of the delay, the statute of limitations begins. During this time, the seller can collect the debt through court.

- Various deductions: when withdrawing cash from an ATM, when paying early, etc.

- Cash payments to insurance companies for collateral insurance.

- Payment for property protection services, which does not affect the loan price. For a car loan with simultaneous life insurance, the rates will be lower than for the same without insurance.

Valery Petrov, Chairman of the Advisory Board of Shareholders of VTB Bank:

“Exorbitant interest rates on loans will become a thing of the past. This will have a positive impact on stimulating the consumption system, while simultaneously reducing the volume of loan defaults.”

According to the new amendments to the law, the borrower has the opportunity to consider whether to receive a loan within five days. If the borrower changes his mind about using the loan he has already taken, within 14 days after receiving it, he has the right to return it and pay only interest on the actual use of the funds. If the borrower took out a targeted loan, then he can return the loan with payment of interest for use within 30 days.

What is really happening, what is taken into account as part of PSK Sberbank

Regulatory rules on lending do not provide specific information about calculations. There are also no clear boundaries for what should be included in the total cost of the loan. This becomes the reason for the double interpretation of the law. Organizations, taking advantage of this, think in such a way as to have maximum benefit for themselves.

The Central Bank of Russia sets quarterly restrictions with a maximum and minimum price range. This is unprofitable for financial institutions, so they have two solutions: reduce price tags, which will not bring profit, or eliminate additional payments.

Sberbank includes the following in mortgage debt:

- principal with interest;

- compulsory life insurance, the registration of which reduces 1%.

Other types of insurance and property valuation are not added to the total price.

When applying for a loan in the SB of Russia, there are several options for calculating the full price of the obligation. The organization deliberately tries not to take into account other payments. If any insurance is nevertheless included, it is deducted from the total amount.

If you borrow 150,000 rubles from the Security Service of Russia. with insurance of 8,000 rubles, then it will subsequently be included in the total debt. Thus, in fact, the borrower receives 142,000 rubles. instead of the stated amount.

How to find out the full cost of the loan

If it is not possible to pre-calculate the exact amount, experts indicate certain ranges of the full repayment cost. Some sellers post this information on their own websites on the Internet.

At the stage of document preparation, the client is provided with information about prices. In the contract, the full cost of the installment plan is placed on the 1st page in the upper right corner and is highlighted with frames. The information is printed in the form of readable text, contains specific numbers and their interpretation in capital letters. The area of such a frame in accordance with Federal Law-378 is no less than 5% of the entire page.

If the debt is closed early, the value of the full amount changes. The client can safely obtain this information from the seller in the form of a notification about the full cost of the loan.

Concept and components of the UCS

The total cost of the loan may differ significantly from the figures given on lenders' websites or in advertising. The concept of PSK was introduced into use in 2008 by order of the Bank of Russia. According to current legislation, the meaning of the PSC must be communicated to the borrower before concluding an agreement.

This amount includes:

- amount of borrowed funds (body) and accrued interest;

- commission for consideration of the application;

- fee for execution of the contract and issuance of funds;

- interest for opening and servicing an account or credit card;

- collateral and borrower insurance;

- payments in favor of third parties if they follow from the terms of the loan agreement;

- cost of notary registration.

In addition to these payments, additional funds may be collected from the borrower that are not included in the PSC. They do not affect the total cost of the loan or loan in any way. Payments may be mandatory due to current legislation or initiated by the borrower himself.

This category includes:

- fines and penalties for late payments;

- voluntary payments;

- voluntary additional insurance;

- MTPL insurance;

- bank commission for early repayment (not charged by all banks);

- payment for certificates and statements;

- payment of commissions for obtaining a cash loan in a currency other than that specified in the agreement;

- any borrower expenses associated with the use of electronic means and payment systems;

- recovery of a lost credit card.

Thus, this value represents the approximate amount of overpayment on the loan, taking into account all possible interest and commissions. The data is preliminary and may be subject to change in one direction or another.

For example, the PSC may be reduced in the event of early partial or full repayment of the debt. An increase in the amount is possible in case of late payments due to accrued fines.

According to the requirements of the law, this data is written in the upper right corner of the contract. Information must be printed in capital letters, large black font. The given numbers are placed in a square frame. Its size must be at least 5% of the area of the entire page. PSC is given in the document in annual percentages and in monetary terms. Further, the agreement specifies the individual terms of the loan.

How to calculate the total cost of the loan yourself

It is practically impossible to calculate the full cost down to the penny, since it depends on how well the conditions for issuing money are met and whether certain payments are taken into account.

The formula for finding the full cost of the loan is given in Article 6 of the Federal Law on Lending. In order to be able to count on it, special mathematical knowledge is required. Even bank employees sometimes find it difficult to calculate without a special program.

You can calculate it in a simpler way. It is necessary to sum up the following amounts: the cost of the monetary product (CDP), the number of additional payments (KDV), overpayment (P):

When calculating the CDV, all expected expenses, both one-time and monthly, are considered for the entire period of the agreement. The overpayment depends on the accrued interest. Numerical data are expressed in monetary terms.

Another way to do the math yourself is to use an online mobile calculator. In the empty lines of the calculator that opens, you must substitute the required values: probable costs, period, etc.

Next, you need to select the type of payment: annuity or differentiated. The first means equal fixed payments under the contract. The second type of payment - differentiated - means that contributions will not be the same. As a rule, in the initial period they have a maximum value.

After filling out the fields of the calculator, click the “Calculate” button. The program will give an approximate result.

PSK - what is it?

The cost of the loan consists not only of the loan amount: it also includes other established payments. The bank provides individual lending conditions for each client depending on his solvency and other factors.

In simple words, PSK is the total amount of the loan, taking into account interest for the use of credit funds and other services, which the client is obliged to repay on time.

What does the fee consist of?

PSK includes the following types of payments:

- the amount for the monthly repayment of the principal debt;

- interest on the use of loan funds;

- commissions for opening and servicing a client account;

- commissions for issuing and servicing bank cards, operational services;

- payments in favor of third parties providing insurance, notary and other services.

The PSC does not include:

- payments, the need for payment of which is determined by the legislation of the Russian Federation;

- penalties/fines accrued if the client fails to comply with the terms of the contract;

- commissions for currency transfers and loan repayments in various ways;

- penalties for exceeding the overdraft limit.

What is PSK in a loan agreement?

PSC includes the loan amount, interest on the use of loan funds and payment for other services.

The loan agreement displays complete information about all established payments, their schedule and monthly amounts for loan payment.

Example of total cost calculation

Once you know the specific data, you can make a simple calculation of the total cost using a formula. For example, there is a loan worth RUB 320,000. Term – 36 months at 16% per annum. There are additional fees: 2% for provision, 1.2% for service.

If you make the same contribution every month, the overpayment will be 85,000.

For issuing money the client will be charged:

The service cost is:

Total debt value:

- 320 + 85 + 6.4 + 4.86 = 416.26 thousand rubles.

The calculation is approximate, but it can be used to compare several proposals and choose something with the lowest cost.

New formula for calculating the amount of a consumer loan - example of calculation

The new formula is not a recent invention - it is successfully used to calculate the annual percentage rate in a number of countries - Australia, North and South America, New Zealand.

Your loan has been approved!

- This formula does not involve fractional powers , since the number of base periods is indicated by a natural number (1, 2, 3, etc.). The formula also does not show the daily interest multiple. This is precisely what was new for the previous Russian as well as European formulas.

- The effective annual percentage rate (APR) is equal to the nominal annual interest rate, which is obtained by multiplying the base period interest rate by the number of base periods in the year.

- A standard time interval is a day, a week, half a month, a month, N weeks or months not exceeding one year.

- The duration of all months of the billing period is considered equal.

- The base period in lending is a period of time that occurs especially often. If a loan transaction involves two periods of equal frequency, then the base period is the shorter of them.

- If there are no repeating time intervals in a given transaction , then the base period is taken to be the time period that is the arithmetic average for all periods, rounded to the standard time interval.

- The interest charged for part of the base period is equal to a fraction of the interest for the base period.

How to reduce the cost of a loan

The rules applied by banks for calculating the full cost are not always beneficial for ordinary consumers. Numerous monetary withholdings are placed on top of the underlying obligation.

In this situation, you can try to reduce the total cost of the obligation in several ways:

- Draw up an agreement with the lowest prices.

- After registering the contract, the client can try to refuse insurance if it really does not help reduce repayments. If it reduces, compare and choose the more advantageous side. In the absence of the possibility of refusal, it is necessary to carefully select an insurance organization, checking its reliability and the quality of the services offered.

- If possible, use a differentiated payment scheme. It involves different monthly payments at the discretion of the borrower. When you make a larger contribution, the principal debt is reduced, and the rest is repaid gradually. At the same time, the monthly fee is gradually reduced. A differentiated fee allows you to reduce the final overpayment by installments.

- Choose a personal loan that does not have early repayment fees.

- Avoid violations of the terms of the agreement, in particular, delays in depositing money into the account.

- If possible, choose a loan with a shorter term. The shorter the term, the lower the total cost of the installment plan will be.

- Use a money company through which the borrower receives his salary. Some money product sellers offer profitable programs to their customers.

You should not focus only on reducing the cost of the obligation. When refusing insurance, it is necessary to consciously analyze the possible risks that it can protect against in the event of an unforeseen situation.