Land tax legislation

The Land Code, adopted by Law No. 136-FZ of October 25, 2001, provides for the use of land on a paid basis.

It also establishes the delimitation of lands according to their purpose, ownership and other parameters. Payment for the use of land involves payment of land tax. For the first time, land tax was introduced by law dated November 29, 2004 No. 141-FZ. This law introduced Chapter 31 into the Tax Code of the Russian Federation, dedicated to land tax, which is classified as local - municipal or city authorities adopt legal documents on the introduction of this tax on their territory. At the same time, they are based on the provisions of the Tax Code, determining tax rates and deadlines for its payment. When determining benefits for taxpayers, they are based on local specifics.

https://www.youtube.com/watch?v=https:tv.youtube.com

Land tax must be paid by organizations and individual entrepreneurs, as well as ordinary citizens. The main requirements when the need for payment arises are:

- location of land in the territory where the tax is introduced;

- the lands are owned, in perpetual use or lifetime possession by the taxpayer;

- the grounds for acquiring land are provided for by the legislation of the Russian Federation.

Find out who pays land tax here.

Deadlines for payment of land tax and tax period for individuals and legal entities

Land tax and advance payments for it are required to be made by taxpayers based on the procedure and deadlines established by the regulations of the representative bodies of municipalities (Article 397 of the Tax Code of the Russian Federation).

For legal entity taxpayers (organizations and individual entrepreneurs), the tax payment deadline cannot be set earlier than February 1 of the year following the current one. Advance payments cannot be collected before the last day of the month following the expired quarter, that is, you do not need to make an advance tax payment before May 1, August 1, and November 1.

For individual taxpayers (citizens), the deadline for paying land tax cannot be set later than December 1 of the year following the expired tax period (calendar year).

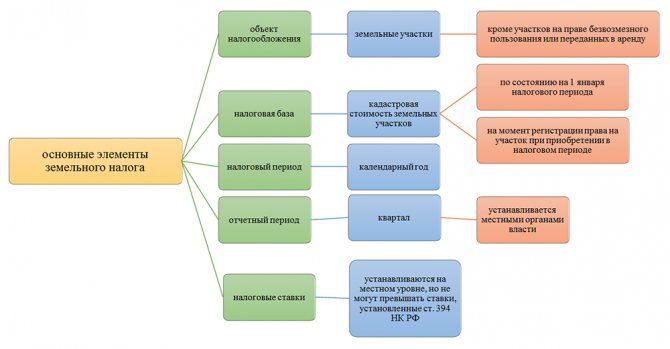

The tax period in accordance with Article 393 of the Tax Code of the Russian Federation, Chapter 31 “Land Tax” is a calendar year.

The reporting period for legal entities (organizations and individual entrepreneurs) is the first, second and third quarters of the calendar year. The representative body of each municipality has the right not to determine the reporting period at all.

Before the adoption of the Federal Law of July 27, 2010, which introduced significant changes to Chapter 31 of the Tax Code, there was confusion regarding payment deadlines for citizen taxpayers. The entire tax was divided into three parts of payments at different times, which confused many.

The new procedure, starting January 1, 2021, abolished advance payments for individuals, as a result of which a single deadline for tax payment was determined - no later than December 1 of the year following the end.

Specific payment dates are determined by the “standards” of the representative bodies of municipalities in each specific region.

Tax calculation on land owned by individuals (individual entrepreneurs incl.) is carried out by the Federal Tax Service (clause 4 of article 391, clause 3 of article 396 of the Tax Code of the Russian Federation), then sending the result of this operation to the individual in a package of documents with a notification of tax payment (clause 4 of article 397 of the Tax Code of the Russian Federation).

When should you expect such a notification and what to do if it does not arrive, read the material “How to find out the land tax debt?”

https://www.youtube.com/watch?v=ytcopyright

The calculation here is based on the same set of initial parameters (for individuals they may differ in values from those used for legal entities) and also taking into account the fact that some of them (rates and benefits) may be individual for the region:

- cadastral value at the beginning of the year;

- share of ownership;

- category of land on which the rate depends;

- accounting for the number of months of ownership for an incomplete period;

- circumstances leading to an increase in the amount of calculated tax;

- the availability of benefits applied to the base, rate or amount of the tax itself.

An individual must declare the right to tax benefits established by the Tax Code of the Russian Federation or the region independently, confirming it with supporting documents (clause 10 of Article 396 of the Tax Code of the Russian Federation).

The deadline for paying land tax for the year for individuals was introduced by law (clause 1 of Article 397 of the Tax Code of the Russian Federation) and is a date common to the entire territory of the Russian Federation. It ends on December 1 of the year following the one for which payment is made.

For legal entities, the payment situation is different. During the year, at the end of each quarter, they pay advances on tax, if the region in which the land is located has not refused to divide the year into reporting periods (clause 2 of Article 397 of the Tax Code of the Russian Federation). Calculation for the year takes into account advances already paid. If the year in the region is not divided into reporting periods, then payment is made 1 time in the amount of tax accrued for the entire year.

Each region sets the deadlines for payment of advances and the final settlement (clause 1 of Article 397 of the Tax Code of the Russian Federation). The only restriction for payment by year is that it cannot occur earlier than the deadline for filing a declaration, the deadline for submission of which is specified in the Tax Code of the Russian Federation and corresponds to February 1 of the year following the reporting year (clause 3 of Article 398 of the Tax Code of the Russian Federation).

Land tax is local, so local authorities determine:

- tax rates;

- payment terms;

- mandatory advance tax payments;

- tax benefits.

The income from it goes to replenish the treasury of municipalities, and it must be paid to the budget of the municipality on whose territory the land plot is located.

What to do if the site is located on the land of several municipalities at once? In this case, payment must be made to the local budgets of all municipalities in whose territory it is located. Such clarifications were given by the Ministry of Finance of Russia, in particular, in Letter No. 03-06-02-02/59 dated May 5, 2006 (paragraph 6).

We suggest you read: How to permanently expel your non-owner ex-husband from an apartment

The tax base for each municipality is determined in this case as a share of the cadastral value of the land plot in proportion to the part of the plot falling on the corresponding municipality. Payment of the tax must be made in the manner and within the time limits established in the territory of each municipality.

Organizations must independently calculate the tax after the end of the calendar year (tax period). Next, they must pay the tax within the deadlines set by local authorities. Moreover, such a period cannot be earlier than February 1 of the year following the expired one. This follows from paragraph 1 of Article 397 and paragraph 3 of Article 398. For example, based on the results of 2021, the payment deadline cannot be set earlier than 02/01/2017.

Taking into account this rule, municipalities determine the deadlines for paying land tax in their territories. For example, in Moscow, organizations must pay land tax for 2021 no later than 02/01/2017. In St. Petersburg, tax for 2021 must be paid by a legal entity no later than 02/10/2017.

In addition, local authorities (authorities of St. Petersburg, Sevastopol, Moscow) have the right to determine the frequency of payment of advance tax. However, local authorities may provide in their regulations that advance payments are not made.

In Moscow and St. Petersburg, advance tax payments must be made before 30.04, 31.07, 31.10 inclusive. That is, 1 calendar month is given to pay the advance after the corresponding reporting period.

You can find out about tax payment deadlines on the Federal Tax Service website. This service provides information on almost any region and municipality. To get the information you need, you need to fill out an intuitive search form, after which the service will display data for the relevant territory.

Individuals, including entrepreneurs, do not have to calculate tax on their own, and therefore they do not have to submit tax returns. Payment of land tax is carried out on the basis of a notification received from the tax authorities, which must be sent out no later than 30 days (working days) before the payment deadline.

As for advance payments, unlike organizations, individuals do not pay an advance, and local authorities do not have the right to establish it.

Land plots become subject to taxation if the above requirements are met. The lands specified in Art. 389 Tax Code of the Russian Federation. The tax period is a calendar year. Organizations calculate taxes on their own; for individuals and individual entrepreneurs (starting with the tax for 2015), the Federal Tax Service Inspectorates calculates and provides notifications for payment.

ZON = NB × St,

NB - tax base equal to the cadastral value of the land plot as of January 1 of the reporting year;

Find out whether to pay land tax if the cadastral value of the plot has not been established in our article.

St is the tax rate approved by municipalities in local legislation.

The St indicator cannot exceed the limits established by the Tax Code:

- 0.3% for lands:

- 1.5% for other categories of land.

- Agriculture,

- housing construction,

- dacha settlements and gardening,

- defensive needs of the Russian Federation.

The advance payment is equal to ¼ of the tax amount calculated for the year.

Organizations listed in Art. 395 of the Tax Code of the Russian Federation, and representatives of the indigenous peoples of the North.

For more information on exemption from paying land tax, see the article “Who is exempt from paying land tax?”

Depending on whether the plot of land is in joint or shared ownership, the tax is determined. For joint ownership, the cadastral value of the plot is divided equally between all owners, for shared ownership - in proportion to the shares.

An example of calculating land tax can be found here.

Organizations are provided with payment of advance tax payments on a quarterly basis (clause 2 of Article 393 of the Tax Code of the Russian Federation). This provision must be confirmed in a law adopted at the municipal level. The terms for payment of advances are specified in it. But municipal authorities may not introduce advance payments (clause 3 of Article 393 of the Tax Code of the Russian Federation).

To find out the details on the timing and nature of payment of taxes and advance payments, you need to be guided by the legislative acts at the location of the land plot. In Moscow, for example, the deadline for making advance payments is no later than the last day of the month following the reporting quarter.

See here for details.

If advance payments are not made on time, only a penalty will be charged. Fines are assessed only if taxes are not paid on time at the end of the year. There are no penalties for advance payments.

The final deadline for tax payment is also set by local authorities. However, it cannot be set earlier than the deadline for submitting the declaration, i.e. earlier than February 1 of the following reporting year. Organizations pay taxes to the Federal Tax Service, which is in charge of this plot of land.

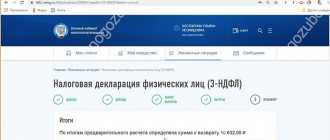

How to pay less taxes when calculating personal income tax

The taxpayer cannot change the tax rate. But he can pay less in two ways:

- if it reduces the tax base by applying a tax deduction.

- if it returns part of the taxes already paid in cases provided for by law.

This can only be done by residents of the Russian Federation who pay taxes at a rate of 13%.

To reduce the tax base, you need to prove that the actual income received was less.

Example. The landlord receives a rent of 30,000 per month (360,000 per year), the tax should be calculated on this amount and amount to (30,000 * 12) * 13% = 46,800 per year.

But if he pays utility bills and also made repairs to the premises at his own expense, he can reduce the size of the tax base by these amounts. For example, the average amount for utility bills is 5,000 per month (60 thousand per year), the amount for repairs (according to checks) is 50,000. Thus, he spent 110,000 personal funds, and the tax base should be reduced by this amount.

(360,000 – 110,000)*13%= 28,600 rubles.

There are 4 types of deductions for individuals

- Standard

- for children, disabled people of the Second World War, victims of the Chernobyl accident. This right is spelled out in Art. 218 Tax Code of the Russian Federation. In 2021, the tax deduction for disabled children for their parents is 12,000 rubles, for guardians – 6,000 rubles. - Social.

Article 219 of the Tax Code of the Russian Federation allows you to compensate for funds spent on treatment, education and even charity, and deduct these funds from the tax base. To exercise this right, you need to contact the tax authority at your place of residence and submit an application for a social deduction, providing supporting documents. - Property.

When purchasing housing, an individual can receive a property deduction in accordance with Art. 220 Tax Code of the Russian Federation. The limit is 2 million rubles per person. This deduction is provided to pay for the purchase of housing, construction, as well as to pay off interest on mortgage loans and targeted housing loans. - Professional

. Article 221 of the Tax Code of the Russian Federation gives the right to receive a tax deduction:

- people of creative specialties receiving royalties;

- people engaged in private practice (notaries, etc.);

- individuals working under civil contracts.

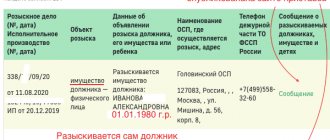

Who submits land tax reports?

The tax period for land tax is equal to a year (clause 1 of Article 393 of the Tax Code of the Russian Federation). Upon completion, the legal entity submits a declaration to the Federal Tax Service (Clause 1, Article 398 of the Tax Code of the Russian Federation). No other (interim) reports are provided for this tax.

We invite you to read: Do Afghans pay transport tax?

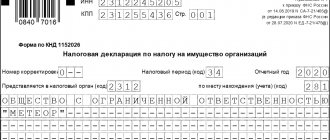

The declaration form for land tax for 2021 was approved by order of the Federal Tax Service of Russia dated August 30, 2018 No. ММВ-7-21/ [email protected]

Land tax reporting is expressed in the submission of a tax return. At the same time, only organizations need to submit a tax return (clause 1 of Article 398 of the Tax Code of the Russian Federation). Until January 1, 2015, individual entrepreneurs also had to file a tax return.

As a general rule, on the territory of the Russian Federation, the land tax declaration is submitted to the Federal Tax Service at the location of the land plot (clause 1 of Article 398 of the Tax Code of the Russian Federation). However, for organizations included in the category of largest taxpayers, they are required to submit a declaration to the inspectorate with which they are registered (clause 4 of Article 398 of the Tax Code of the Russian Federation).

If an organization has several lands at its disposal, all of them are located in the territories of different municipalities, while such territories are controlled by one tax office, then it is allowed to submit one general declaration. In the general declaration for each site, the 2nd section of the document will be filled out separately (letter of the Federal Tax Service of the Russian Federation dated 08/07/2015 No. BS-4-11/13839).

It is not necessary to submit such a declaration to all inspections; it is enough to submit one, and simply notify the others about it.

If the land plots of a large organization are located in different municipalities, which have their own tax authorities, then each municipality must pay tax in proportion to its share.

Attention! If a land tax declaration is not submitted on time, administrative and tax liability arises, expressed in Article 2.1 of the Code of Administrative Offenses of the Russian Federation and Article 106 of the Tax Code of the Russian Federation.

The fine according to Article 119 of the Tax Code of the Russian Federation is 5% of the amount of tax payable (additional payment) according to the declaration, but not transferred to the local budget within a certain period. As a result, the fine will have to be paid for each full and partial month overdue from the date determined for filing the declaration.

The final amount of the fine for the entire period of late payment should not exceed 30% of the tax amount according to the declaration and cannot be less than 1 thousand rubles.

If the tax was paid in full on time, but the declaration was not submitted on time, you will need to pay 1 thousand rubles - the minimum fine. If only part of the tax liability has been paid, the penalty will be calculated from the remaining amount of the required payment.

Today, the form and rules for filling out the declaration are used, approved by order of the Federal Tax Service of Russia dated October 28, 2011 No. ММВ-7-11 / [email protected] (as amended on November 14, 2013).

When filling out the declaration, there are some important points to consider:

- When filling out the declaration manually, you are allowed to use a pen with a blue or black tip;

- Various corrections or blots in the declaration must be marked by a tax official;

- Only one value is indicated per row cell;

- If there is no value in the cell (an empty “cell”), a dash is placed;

- The pages of the declaration must be numbered;

- Each page of the document must be printed on a separate sheet;

- Do not damage the paper in any way, including staple or staple it;

- It is not permitted to use corrective agents;

- The text must be written in printed characters only;

- Cost indicators are written in full rubles (rounded). For indicator values less than 50 kopecks, the remainder is simply discarded; for 50 or more kopecks, the amount is rounded to the nearest ruble.

According to the rules, the declaration is drawn up in two copies. One copy remains with the tax office, and the second with the taxpayer. Completed declarations can be sent by “regular” mail or by email.

The “Title Book” is filled out in the standard manner, like all tax returns. It contains information about the organization and the tax return being filed.

The title page of the declaration is filled out by the taxpayer (representative of the organization), except for the section “To be completed by a tax inspector.”

The title page contains the following information:

- TIN (taxpayer identification number) and KPP (reason code for registration with the tax authorities) for the organization;

- Correction number. The new declaration indicates “0–”, the updated declaration states “1–”, “2–”, etc.;

- Taxable period. In our case, the tax period is 1 year - code 34;

- The reporting year for which the declaration is submitted;

- Code of the tax office to which the declaration is submitted;

- Code for submitting a land tax return: as a rule, this is number 270 “At the location of the land plot (share of the land plot”);

- Full name of the organization. It must correspond to the name in the constituent documents (Latin transcription is also indicated in the name);

- Code of the type of economic activity in accordance with the new classifier OKVED 2 (All-Russian classifier of types of economic activity OK 029-2014, approved by Order of Rosstandart of January 31, 2014 No. 14-st., used since 2017);

- Taxpayer contact telephone number;

- Number of pages of the declaration;

- The number of pages of supporting documentation attached to the declaration.

The title page has a separate section “I confirm the accuracy and completeness of the information specified in this declaration.” Here either the number “1” or the number “2” is placed.

The number “1” is entered if the accuracy and completeness of the information is confirmed directly by the head of the taxpayer organization or the individual taxpayer entrepreneur.

The number “2” is written if the accuracy and completeness of the information is confirmed by the taxpayer’s representative (authorized person).

Let's move on to section 1 of the declaration.

We suggest you read: Property tax after purchasing an apartment

Section 1 contains information about:

- Amounts of fees payable;

- Amounts of advance payments.

| First section line | What you need to indicate |

| 010 | KBK (RF budget classification code) – the value required to pay the amount of land tax according to the budget classification |

| 020 | OKTMO code (All-Russian Classifier of Territories of Municipal Entities), in accordance with which land tax is paid |

| 021 | Accrued amount of land tax payable to the budget for the tax period according to the taxpayer |

| 023 | The amount of the advance amount for land tax that is required to be paid in the first quarter of the current year |

| 025 | The amount of the advance amount for land tax that is required to be paid in the second quarter of the current year |

| 027 | The amount of the advance amount for land tax that is required to be paid in the third quarter of the current year |

| 030 | The amount of accrued land tax payable according to the taxpayer in accordance with the codes KBK and OKTMO. This value is calculated as the difference between the accrued amount in line 021 and the advance amounts 023, 025, 027. If the final value is negative, then a dash is placed in the column, if positive, then it is written down. There simply cannot be a negative tax payable |

| 040 | The amount of land tax determined to be reduced based on the results of the tax period, which is calculated as the difference between the accrued amount in line 021 and advance amounts 023, 025, 027. In this column, if the value is negative, then it is entered. If positive, then a dash. |

Section 2 of the land tax declaration is required in order to determine and calculate the amount of the fee for the reporting period (calendar year). Section 2 is filled out for each land plot and each share in the plot separately, if the owner organization has several of them.

In the second section for each land plot or share the following is indicated:

- Cadastral number and cadastral value of the land plot;

- KBK;

- OKTMO code of the municipality within whose territory the land plot is located according to the All-Russian Classifier approved by Order of Rosstandart dated June 14, 2013 No. 159-st;

- Land category code based on the Directory approved by Order of the Federal Tax Service of Russia dated October 28, 2011 No. ММВ-7-11/696;

- Tax rate;

- The tax base;

- The amount of tax assessed and payable.

If the organization has certain rights to preferential taxation, then lines 070 and 080 should be filled out.

In line 130 of section 2, the tax base is filled in. The tax base is based on the cadastral value of the land plot (if it has not been established, then the standard value of the land) as of January 1 of the reporting year.

How to calculate personal income tax

Personal income tax amount = tax rate * tax base

The tax base is the investor's actual income, and not the total amount of the sale of the property.

Example: If an investor (resident of the Russian Federation) bought a car less than 5 years ago and sold it at the same price or cheaper, he does not have to pay taxes.

If an investor (resident of the Russian Federation) bought an apartment 1 year ago and sells it for 500,000 more, these 500,000 are considered income, and tax is paid on it. But here you can apply a tax deduction. If he does not apply it, he must pay 500,000 * 13% = 65,000 rubles.

Results

Only payers who are legal entities have to calculate the amount of land tax for the year independently. For individuals, this calculation is carried out by the Federal Tax Service. The algorithm for both calculations is the same and is based on a set of the same parameters, the values of which may differ for legal entities and individuals.

The tax payment deadline for individuals expires on December 1 of the year following the one paid. And the region itself sets the deadline for payments transferred by legal entities (both for advances and for the final payment for the year). For annual calculations, it cannot be set as earlier than the date of filing the tax return (i.e., earlier than February 1 of the year following the one being paid).

The deadlines for payment of advance payments of land tax for organizations are set by local governments. The tax is paid regardless of the taxation system applied.

Individual entrepreneurs and individuals transfer tax before December 1 of the year following the reporting year. Advance payments are not provided for these categories of taxpayers. Tax calculation is carried out by the Federal Tax Service.