Is it possible to return AlfaStrakhovanie insurance if the loan is closed on time?

The main condition for the return of 100% of the insurance premium is to notify the insurance agent within the period established by law for terminating the agreement.

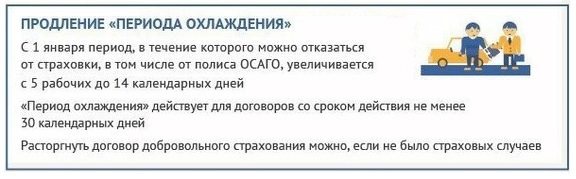

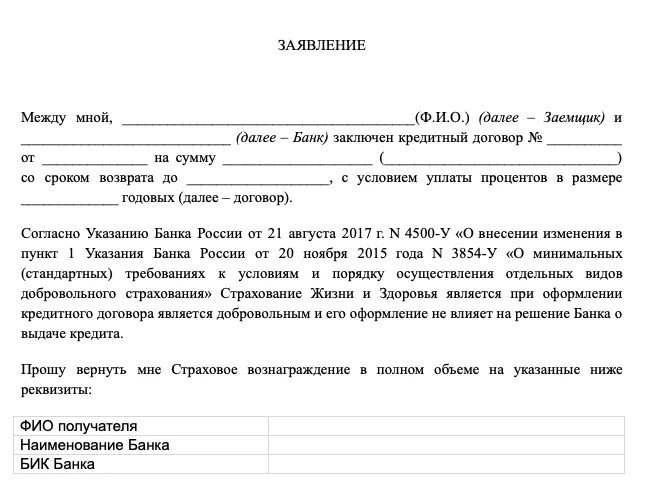

The insurer, on its own initiative, has the right to increase the period for canceling the agreement. According to the Directive of the Central Bank No. 4500-U dated August 21, 2021, amendments were made to the Directive of the Central Bank No. 3854-U dated November 20, 2015 to increase the period of the “cooling period”. The minimum period for requesting cancellation of the agreement is two weeks (14 calendar days).

This grace period applies to most types of insurance, with the exception of:

- purchased for travel outside the country (to cover medical expenses if necessary);

- Green Card policy, for which separate cancellation rules are established (specified in the concluded agreement);

- required to carry out a specific professional activity (for example, notaries, auditors, etc. will not be allowed to work without an insurance contract);

- absence of Russian citizenship when a health insurance agreement is drawn up, if it was concluded to obtain a patent or for employment.

Receiving a loan is not included in the specified list of exceptions, so the return of insurance is possible and legal.

The deadline for applying for a refund of the insurance payment paid by a citizen under the AlfaStrakhovanie program is also two weeks or 10 working days. An increase in the deadline for filing an application is not provided, unless otherwise reflected in the contract or other acts of the insurance company.

As a rule, a standard contract for the provision of services is concluded between a citizen and IC AlfaStrakhovanie, therefore an increase in the cooling-off period is not provided for.

To return the insurance premium paid in accordance with the agreement with the company, the borrower must simultaneously comply with two conditions:

- Contact the insurer with a request to terminate the agreement within a period not exceeding two weeks from the date of actual payment for its services.

- To prevent the occurrence of an insurance situation in which the insurer is obliged, on the basis of a concluded agreement, to make payments in favor of the insured person.

Any signs of an insured event recorded by the insurance organization, as well as the omission of the legally established deadlines for filing an application for cancellation of a previously concluded agreement, are grounds for the insurer’s refusal to return the premium received.

Agreements between individuals and AlfaStrakhovanie-Life LLC come into force from 00:00 on the day of payment of insurance obligations.

The deadlines for cancellation of agreements between the policyholder and the insurance company apply to the following insurances:

- Life (health), regardless of the reason for concluding the agreement - processing a loan or the personal desire of a citizen with periodic insurance payments;

- Movable property – car;

- Real estate and property with declared value, for example, objects of art;

- Liability of owners of movable property in case of an accident;

- Liability of the insured for causing any harm to other persons or their property;

- Medical insurance, etc.

Despite the legislative establishment of a voluntary registration procedure, most banking institutions force their clients to sign an agreement with insurance companies.

To waive insurance and receive your funds, you just need to contact the bank where the loan was issued (Alfa-Bank) and submit an application for waiving insurance.

If the creditor is another financial organization, the application for refusal should be sent directly to.

Refunds must be made no later than 10 business days from the date of the client’s request or receipt of a written application.

Bank account details for transferring funds are indicated when filling out the application. This period includes the acceptance of an application for refusal of insurance, its consideration and the transfer of funds (if a positive decision on the application is made).

An application for termination of a previously concluded agreement with IC AlfaStrakhovanie is possible during a “cooling off period”, which is 14 calendar days from the date of payment of the insurance premium by an individual.

AlfaStrakhovanie does not provide for an extended cooling-off period, so the policyholder cannot count on a longer period of reflection and decision-making regarding cancellation or retention of insurance.

There are several ways to express your desire to terminate the insurance agreement:

- In a written form. This type of application is carried out through a personal visit to the institution by the policyholder or by sending documents using the postal service.

- In electronic form on the AlfaStrakhovanie website or by sending an application by e-mail.

There are no other ways to notify the insurance company of termination of the contract at the initiative of the policyholder. A sample application is provided by the insurer on the official website or in person.

The application for refusal of the insurer's services must be filled out in accordance with the sample presented on the AlfaStrakhovanie IC website and sent to the company's address for receiving correspondence: 115162, Moscow, st. Shabolovka, house 31, building B.

In accordance with Art. 958 of the Civil Code of the Russian Federation, the client can return the insurance premium upon early repayment of his loan obligations only in one case - if such a right is enshrined in the agreement.

Alfastrakhovanie does not include such a clause in its contracts, so it will not be possible to return the money by closing the debt ahead of schedule.

Refund of the insured amount when concluding an agreement with IC AlfaStrakhovanie is possible only during the first 14 calendar days from the date of commencement of the contract. The starting point is considered to be 00 o'clock on the day when the full payment of the insurance premium was made.

We suggest you read: How to return money from Sberbank if you transferred it to the wrong place or to scammers

In accordance with the provisions of clause 7.4 of Section 7 of Conditions No. 2 of Alpha Life and Health Insurance of a citizen, in case of early repayment of loan obligations, the insurance premium is not refundable, and clause 5.5 of Section 5 establishes that the insurer’s obligations are fulfilled in full.

These provisions contain additions “unless otherwise provided in the insurance contract,” however, the composition of the standard agreement has no exceptions and additional provisions, the Policy offer is valid on a general basis without refund of the insurance premium.

Civil legislation enshrines the right of the insurer not to return the premium amount to a citizen if he filed a claim after the “cooling-off period.” The policyholder retains the right to terminate the agreement before the end of its validity period without receiving compensation.

The policyholder also retains the right to appeal to the court. The basis is any discrepancy between the provisions of the contract and current legislation, as well as infringement of the rights and legitimate interests of an individual by the insurance company.

Particularly interesting is the Determination of the Judicial Collegium for Civil Cases of the Armed Forces of the Russian Federation dated May 22, 2021 No. 78-KG18-18 in the case of one citizen who repaid her loan ahead of schedule.

The bottom line is this: the insurer did not return her premium in proportion to the “unused” days. The citizen appealed to the court of first instance - it refused to satisfy her demands, then to the court of appeal, which also refused.

And only the Supreme Court of the Russian Federation did not agree with the decisions made and ordered the insurer to pay the premium for “unused” days.

When rendering its verdict, the Supreme Court noted that, according to the terms of the insurance contract, the insured amount is equal to 100% of the amount of debt under the loan agreement.

Since at the time of early repayment this debt became zero, the insured amount also became zero. This means that there is no point in insurance, in which the payment of insurance compensation is impossible.

It is also interesting that the RF Armed Forces noted that the norm of Part 1 of Art. 958 of the Code is still dispositive, not imperative. That is, not only the destruction of property or termination of business activity is the basis for proportional compensation of the insurance premium.

In relation to this case, this norm should be interpreted as “disappearance of insurance risks” (since the insurer no longer has the obligation to provide insurance compensation).

In accordance with clause 5.5 of Section 5 and clause 7.4 of Section 7 of Conditions No. 2, when issuing an AlfaInsurance Policy Offer, payment of loan obligations on time without the occurrence of an insured event is not the basis for returning the amount of the insurance premium to the policyholder.

The agreement between an individual and the insurer terminates on the basis of clause 7.1 of Section 7 of Conditions No. 2, and contractual obligations are recognized as fully fulfilled. Refunds of insurance premiums are not permitted.

Similar provisions are established by federal legislation, so court proceedings regarding such disputes can only end with a decision refusing to satisfy the applicant’s claims.

Cash is the income of the insurer.

Thus, the refusal of the insurance company to return money after timely repayment of the loan is legal.

Refunds for obtaining insurance through legal proceedings are carried out after all other methods have been exhausted, when the insurance company has refused and the policyholder has no other options to return the remuneration paid.

The grounds for going to court are:

- Early repayment of loan obligations;

- Inability to use an insurance policy;

- Cancellation of the Policy offer with the insurance company, in which the Insurer refused to return the reward received;

- Compulsory insurance when applying for a loan.

The advantages of going to court are that the following factors are taken into account:

- lack of explanation to the plaintiff about the procedure for refusing insurance and his ignorance of his rights;

- automatic inclusion of insurance in the loan agreement;

- imposition of services by bank employees when applying for a loan.

When considering the case on the merits, the court may require the provision of other documents and evidence from the plaintiff or defendant in order to make the most fair decision on the stated dispute.

What types of insurance does it cover?

The cooling period applies to the following types of insurance:

- life insurance in case of death;

- survival to a certain age or period;

- before the occurrence of a certain event;

- life insurance with the condition of periodic insurance payments (annuities, annuities);

- life insurance with the participation of the policyholder in the investment income of the insurer;

- accident and illness insurance;

- health insurance;

- insurance of land transport vehicles (except for railway transport vehicles);

- insurance of citizens' property, with the exception of vehicles;

- civil liability insurance for vehicle owners;

- insurance of civil liability of owners of water transport vehicles;

- insurance of civil liability for damage to third parties;

- insurance of financial risks.

Is it possible to return AlfaStrakhovanie insurance if the loan is closed on time?

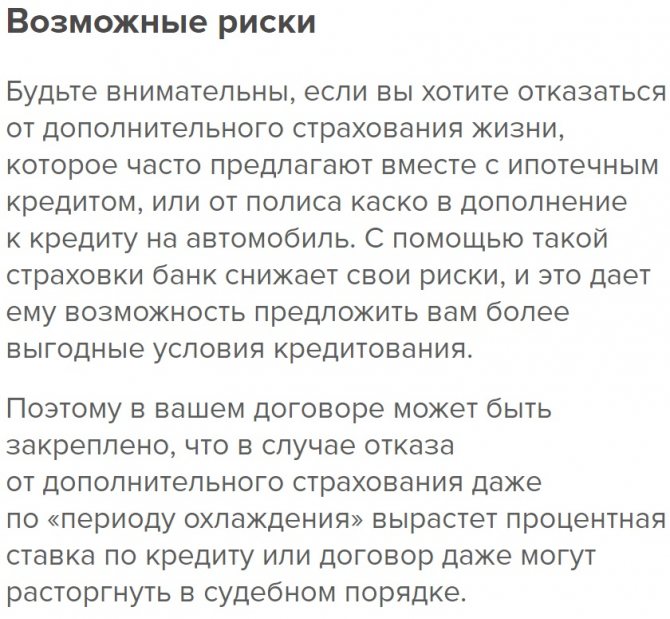

A banking organization, on the basis of Federal Law No. 353-FZ, has the right to offer the borrower a number of services to insure credit obligations when applying for a loan, but does not have the right to oblige the borrower to agree to additional conditions.

The legislation provides for a strictly defined list of loans for which credit insurance is mandatory, these include:

- Insurance against loss of property rights (title) to housing when purchasing real estate on the secondary market. The period of compulsory insurance is limited to three years, since according to the provisions of the Civil Code of the Russian Federation, after this time the limitation period expires.

- Car loans, a prerequisite for which is the issuance of a compulsory motor liability insurance (CASCO) policy. Without consent to insurance, the borrower is guaranteed to receive a refusal.

In other cases, the issuance of an insurance policy in accordance with current legislation is voluntary and cannot be forcibly imposed on the borrower without the right to refuse such services.

Taking out a policy is necessary for banking organizations, since it guarantees the return of borrowed funds in the event of disability or death of the borrower, therefore lenders often offer clients improved conditions:

- A reduced interest rate, which can be significantly lower than the standard rate by 2-2.5% depending on the type, size and term of the loan;

- Preferential conditions for obtaining a loan, which involve calculating the interest rate based on the amount of the actual debt, and not the total size of the loan, which allows you to reduce the rate for the entire term of debt obligations by 1.5-2 times;

- A longer lending period, which allows you to reduce monthly payments on obligations and other more favorable conditions.

The AlfaStrakhovanie group combines several divisions of the company engaged in different types of insurance activities, including AlfaStrakhovanie-Life LLC and AlfaStrakhovanie JSC.

After the expiration of the application period, the law does not provide for the return of the insurance payment paid to the insurer for the provision of services. Civil legislation establishes the right of the insurance company to return part of the funds to the client, but does not force compliance with this rule.

We suggest you read: How to complain about a school teacher

Insurers, guided by current legal norms, do not return funds if the deadline for submitting an application for cancellation of an insurance policy is missed. The relevant provisions are specified in the agreement between the insurance company and the individual.

Standard Conditions No. 2 of Alpha Insurance in Section 7 provide for the following grounds for termination of the agreement:

- Fulfillment of the obligations assigned to the insurer to pay funds or fulfill obligations in the event of an insured event;

- Termination at the initiative of the policyholder;

- Liquidation of the insurer's organization;

- Recognizing the clauses of the agreement as unlawful through legal proceedings;

- In other circumstances established by the legislation of the Russian Federation.

According to the provisions of clause 5.5 of Section 5 of Conditions No. 2 for life and health insurance, if the policyholder has not terminated the contract with the insurer during the “cooling off period,” then its provisions are considered fully fulfilled, regardless of the loan repayment period or the absence of insured events.

In such a case, the refund will be issued through the court. It should be borne in mind that you should not count on a large amount, because:

- the legal process takes time;

- the company will claim that funds during the contract period were used to provide insurance.

However, some amount will be returned, and exactly how much money will be transferred depends on the cost of insurance and the number of days that have passed since the conclusion of the contract.

To protect your interests in court, you can refer to the fact that the fact that insurance was included in the loan amount was unknown to you, or you can point out that the service was imposed.

But these facts are quite difficult to confirm. Success is possible if the credit agreement or loan application already contained consent to insurance.

In this case, the insurance premium is automatically included in the amount of borrowed money issued. In other cases, you will need evidence of the imposition of the service or the absence of information about it. Their role may include witness testimony, audio/video recordings, etc.

- Statement of claim;

- Passport or other identification document;

- Loan agreement;

- Insurance policy;

- An extract on loan repayment, if the basis for going to court was the refusal of the insurance company to pay part of the insurance premium for early repayment of the loan;

- A copy of the policyholder's application for termination of the agreement between him and the insurer;

- Official refusal of the insurer to return the funds paid by the citizen;

- A receipt or other document confirming payment of the state fee.

Civil law does not prohibit independent representation of one’s interests, however, if there are conflicts between citizens and insurance companies, a lawyer is needed. Citizens will not be able to file a claim, and it will also be difficult to compete with the insurer’s professional lawyers.

If the statement of claim is drawn up in violation of the current civil procedural legislation, it will be rejected, indicating the justifications and errors. It is not a fact that when filing a new claim, other inaccuracies and errors will not be discovered.

A qualified lawyer will help you defend your rights and increase the likelihood of success in your legal case. If a line of defense is built and all the necessary documents are collected to convince the judge that he is right, the plaintiff not only will not lose anything, but will also be able to make money from the insurance company’s reluctance to follow the letter of the law.

When applying for a loan or credit card at Alfa-Bank, managers in most cases will offer to join the insurance program. You should choose a suitable policy wisely, since you can only obtain return insurance on a loan for a limited set of products.

Please note that refusal to obtain an insurance policy at the stage of applying for an Alfa-Bank loan without certificates (or with such) does not in any way affect the likelihood of approval or the interest rate. Therefore, no one will be able to force you to enter into an agreement if the insurance conditions are completely unsuitable for you.

At Alfa-Bank, in most situations, it is possible to issue an insurance waiver. However, this does not apply to the following cases:

- when taking out insurance is mandatory - when taking out a mortgage, car loan or loan secured by property: in this case, the collateral itself is insured in accordance with the law;

- if the client has joined collective life insurance, the beneficiary in this case will be the bank, and not the borrower himself, there are no mechanisms for terminating such an agreement;

- if the borrower has purchased comprehensive insurance, including protection of property, life and health during a mortgage.

When concluding a contract, carefully study the clauses regarding the conditions for its termination and check with the Alfa-Bank manager in what situations it is realistic to refuse insurance.

If you manage to repay the loan ahead of schedule, you can refuse loan insurance from Alfa-Bank and return the balance of unspent funds. This also applies to the financial protection of the collateral, as well as the loan itself. It will not be possible to receive compensation under a collective insurance contract.

The algorithm for how to return insurance on an Alfa-Bank loan in case of early repayment is similar to that during the “cooling off period” with a couple of caveats:

- The application will need to include a different wording: “I request a refund due to the early payment of the loan.”

- The list of documents will need to be accompanied by a certificate from Alfa-Bank confirming that it no longer has financial claims against you.

If an Alfa-Insurance specialist does not want to accept the application, then justify your desire by saying that the availability of a loan is an essential condition of the contract. And since it no longer exists, insurance essentially no longer protects anything.

We suggest you read: Dismissal in one day

The company will have to return the money after deducting the amount for the days when the insurance was in effect. In addition, the contract often specifies the amount of an additional fee for early termination - pay attention to this.

What is not covered

The cooling period does not apply to the following types of insurance:

- mortgage insurance – Art. 935 of the Civil Code of the Russian Federation and Art. 31 Federal Law “On Mortgage”;

- voluntary medical insurance of foreign citizens and stateless persons staying on the territory of the Russian Federation for the purpose of carrying out their work activities;

- voluntary insurance, which provides payment for medical care provided to a citizen of the Russian Federation located outside the territory of the Russian Federation and (or) payment for the return of his body (remains) to the Russian Federation;

- voluntary insurance, which is a mandatory condition for the admission of an individual to perform professional activities in accordance with the legislation of the Russian Federation;

- voluntary insurance of civil liability of vehicle owners within the framework of international systems of civil liability insurance of vehicle owners.

Refuse insurance during the “cooling off period”

We will figure out how to return the money paid towards the insurance premium in the near future after concluding a loan agreement.

Today there is a “cooling period”, i.e. the time when a borrower can refuse loan insurance from Alfa-Bank without giving reasons and even if this is not specified in the agreement itself has been increased from 5 to 14 days.

Thus, you will have two whole weeks if you decide to refuse the imposed insurance.

Refunds are not provided in full. The insurance company will retain money for the actual days of insurance.

For example, if you submit an application 10 days after the start of the policy, then the company's compensation for these same 10 days will be deducted from the total amount.

Procedure

So, you are convinced that you can cancel Alfa-Bank insurance within 14 days. First you will need to select documents and make a copy of each of them:

- your passport;

- the contract itself;

- insurance policy;

- receipts for payment of insurance premium;

- account details where the refund will need to be transferred (preferably with bank stamps).

The procedure for returning insurance on an Alfa-Bank loan will be as follows:

- contact the office of the Alfa-Insurance company, and not the bank (it is the insurer who handles refunds);

- fill out the application in two copies, attaching the necessary documents;

- hand over the papers to the specialist, make sure that both applications are marked with acceptance;

- take one copy of the application for yourself and the original documents, leave the rest to the insurer;

- expect a refund within 5 days or an official refusal.

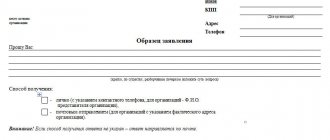

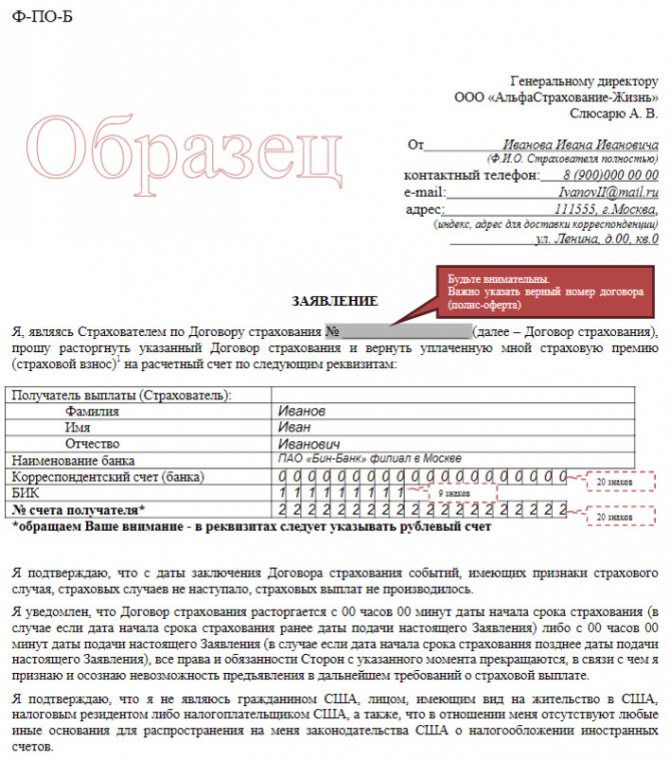

Sample application

You can ask for an application form at the company's office, but they may not give it to you - it is not profitable for them to return insurance.

This is what a sample application looks like, with which you can return insurance for an Alfa-Bank loan

How to terminate the insurance of IC "AlfaStrakhovanie Life" - features

Banking organizations may establish a mandatory condition for obtaining a loan - concluding an agreement with an insurance company. In the presence of such a situation, it is almost impossible to cancel bilateral obligations with IC AlfaStrakhovanie without any sanctions from the bank.

Credit insurance can be provided in several ways:

- Conclusion of an agreement between an individual (borrower of funds) and the insurer;

- An agreement between a lender and an insurer in which the borrower joins an existing group insurance program.

Cancellation of an insurance policy when concluding a separate contract will not entail negative consequences. If there is a mandatory insurance provision, the refusal of which may be considered a violation of the terms of the loan, can seriously change the attitude towards the borrower.

The lender can initiate the cancellation of the loan agreement and oblige the borrower to repay the borrowed funds before the specified period, as well as change the terms of the loan, for example, raise the rate.

The borrower has the opportunity to cancel the agreement with the insurance company voluntarily or in court, so you must first write an application to the bank with which the loan obligations have been established and to the insurance company.

You must contact us within two weeks. Usually banks accommodate clients halfway, and the loan amount is reduced by the amount of imposed insurance obligations, but if this does not happen, then the borrower needs to go to court and resolve the dispute there.

If the parties voluntarily agree to cancel the insurance policy, the contract for the provision of services is considered terminated from the moment the application is submitted by the citizen. If the institutions refuse to terminate, the court will decide the end of the dispute.

If the court takes the borrower’s side, then the contract is considered terminated either from the moment the corresponding application is filed in the name of the insurance company, or from the date the statement of claim is filed. It all depends on whether the citizen files a claim with the insurer.

As we have already indicated above, within 14 days you can safely cancel the life insurance contract and get back the entire amount of the premium paid.

Is it possible to return the insurance?

It is important to note that insurance itself remains a voluntary service for most clients and is issued only at your request. The client can refuse if he deems it necessary. Information about this was confirmed on the official website of Alfa Bank.

At the same time, the bank notifies its borrowers that the loan amount, monthly interest and other lending conditions are in no way related to the execution of an insurance contract or refusal of it. Today, only those clients who take out a loan to purchase real estate with a mortgage are subject to compulsory insurance.

What to do if insurance is not refunded

After a waiver of Alfa-Bank loan insurance has been issued, you should expect the remaining funds to be credited to the money details specified in the application within 5 days. However, as practice shows, insurance companies are very reluctant to return money.

What to do if all reasonable deadlines have passed, but no payments have been made?

First, you should get a document from the company with an official refusal to return the insurance - it can be appealed in court.

Secondly, it is necessary to send a complaint to Rospotrebnadzor and notify Alfa Insurance that this has been done. As a rule, this is enough for the money to be returned within the prescribed time frame.

All documents that are available should be attached, including notification of receipt of the application by mail. This will prove that you tried to reach out to the insurance company and will serve as an argument in your favor.

How to apply for an insurance return at AlfaStrakhovanie

To apply for a refund of the sum insured to AlfaStrakhovanie-Life, you need to fill out a standard application of the established form, indicating the following information:

- FULL NAME;

- details of the insurance company;

- insurance policy number;

- grounds for termination of the insurance contract;

- bank details for refund;

- date of application and signature.

A complete package of documents must be attached to the completed application:

- photocopy of passport;

- contract;

- certificate from the bank (if necessary).

Please note that the application for cancellation of insurance and refund of funds is submitted to the insurance company personally by the policyholder.