Bank requirements when buying a car on credit

Most financial institutions issue car loans subject to life insurance.

At the same time , employees explain that the policy significantly increases the likelihood of approval.

Sometimes the client may not be aware of the presence of insurance, since it is included in the main cost of the loan.

However, despite this, the benefits of insurance are present for each of the parties:

- The bank minimizes its risks if the borrower fails to fulfill its obligations and receives income from the insurer.

- The insurance company makes a profit in the form of insurance premiums.

- The borrower can count on the loan being closed if he loses his ability to work.

If the borrower meets all the bank’s requirements, then life insurance is not required by law.

However, banks can set their own requirements, and if they refuse insurance, they can increase the interest rate, issue smaller amounts, or refuse the loan altogether.

Also, information about insurance may be written in small print in the contract. Therefore, you need to study as much information as possible in advance.

Refusal of insurance after receiving a car loan is possible by contacting the insurance company or through the court. At the same time, no one guarantees a positive result, since creditors know how to turn such a case to their advantage.

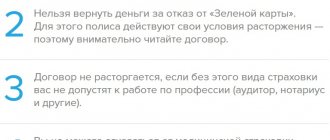

Three answers to the question of how to refuse life insurance with a car loan if a policy is imposed upon registration

Will the money be returned after termination of the contract?

By default, refunds are not provided under insurance. The legislation (namely, the same Article 958 of the Civil Code of the Russian Federation) states that the insurance premium in case of early termination of the contract, unless otherwise stated in it, remains with the insurer. However, some companies accommodate clients halfway and indicate in the terms of termination the opportunity to return part of the money for the unexpired period.

Typically, the calculation uses a formula that takes into account the reduction factor, compensation for insured events (if any), time until the end of the contract, and so on. Also, the costs of conducting the case may be deducted from the refund amount. As a result, the payment will not be very impressive, but, nevertheless, it will be possible to receive part of it. Therefore, before concluding a contract, it is important to read it in full and, other things being equal, choose an insurance company that offers this option.

When can you legally refuse?

958 of the Civil Code, the borrower can return the money for car loan insurance if the need for the service ceases. If the car loan is fully repaid on time or ahead of schedule, you can partially return the installment for the unused time period.

Refund of insurance is possible in the following situations:

- Upon termination of a life insurance contract due to unnecessary use. It should be taken into account that early termination of the insurance contract if there is a balance of debt may cause an increase in the interest rate, if this is stipulated in the contract.

- The easiest time to pay back your life insurance is when the car loan is paid off in full.

- If life insurance was imposed when applying for a loan. Action will have to be taken through the court if the client manages to prove that the service was imposed.

Thousands of Russians are confused about whether life insurance is necessary for a car loan, let’s look into the issue

What will be needed for a return?

It is also necessary to terminate the insurance agreement.

The following documents must be submitted to the insurance company:

- application for termination of the insurance contract;

- a copy of the loan agreement for the purchase of a car;

- a document confirming that the loan has been repaid.

An application for refund of car loan insurance must be made in writing. Two copies of it are needed, one of which remains with the borrower.

When drawing up an application or claim, you must ensure that it contains the following information:

- exact details of the institution that issued the loan (they can be found in the agreement or on the lender’s official website);

- borrower data;

- data on the loan agreement (its number, name, date of signing;

- legal grounds for return;

- deadline for providing a written response (usually 10-30 days);

- a clause stating that the document is sent in accordance with the law;

- the exact amount paid for insurance, account details that will be used to transfer funds.

The application is considered within ten days from the moment it was received by the creditor.

How to issue a refusal?

Insurance returns will differ depending on the period and on what grounds the borrower wants to do this.

Immediately upon receipt

In accordance with the law, you can cancel your insurance during the “cooling off period.” If insurance was not used, the amount must be refunded in full.

This period is 14 days.

It should be taken into account that this rule does not apply to collective insurance - in this case, the possibility of refusal is determined by the internal charter of the bank.

The possibility of return remains only in the situation if the insured event does not occur during the specified period.

After a cooling off period, during payouts

By law, you can cancel voluntary insurance at any time, but the chance of getting funds back will be determined only by the terms of a specific contract.

The terms of the contract rarely provide for the possibility of return. The borrower, with a firm intention to return the insurance, will have to admit through the court the invalidity of the contract or the insurance clause in it.

Example from judicial practice No. 1

The human rights organization appealed to the court in the interests of the plaintiff to RusFnans Bank with a demand to invalidate the clause of the car loan regarding the borrower’s obligation to pay for CASCO and life insurance of the borrower.

Lawyers were able to prove that the insurance requirement in the contract is mandatory. And the borrower signed these terms under duress, having no other choice.

The court sided with the plaintiff and ordered the bank to pay the borrower both the insurance premium for the life protection policy and for CASCO insurance, and a total amount of almost 65,000 rubles.

Decision No. 2-831/18 of 2021

Example from judicial practice No. 2

The plaintiff filed a claim against PJSC VTB Bank and demanded that the terms of the contract regarding life and health insurance and CASCO be invalidated.

Since the court was unable to establish how the plaintiff was given the opportunity to accept or refuse the provision of additional services in the form of the Autolight insurance product, and also was not given the right to choose an insurer, these services were regarded by the court as concluded under duress.

Thus, the consumer’s right to freedom to conclude a contract, provided for in Article 421 of the Civil Code of the Russian Federation, was violated. The court sided with the plaintiff.

Decision No. 2-2330/2018

Why do many people take out life insurance on a car loan if it is voluntary?

After full payment

In this situation, a refund is possible if the duration of the insurance exceeds the term of the loan. Its possibility also depends on the terms of the agreement. If insurance is mandatory, you can cancel only after the payments have been completed.

Typically, the terms of the insurance and loan agreements are the same, so there is no point in talking about a return.

In case of early repayment

The amount is returned for the period during which the insurance is not actually used , that is, for the difference between the established repayment date of the loan and the date when it was actually repaid.

The general procedure for terminating an insurance contract is as follows:

- Full repayment of debt to the bank.

- Obtaining a certificate from a credit institution regarding early repayment of obligations.

- A written statement to the insurer about termination of the agreement and previously paid insurance payments.

- The insurer makes a decision and directly returns the funds.

- Appeal to court if the insurer refuses to return the previously paid insurance amount.

An example from judicial practice

The plaintiff filed a claim against SK MetLife JSC for the protection of consumer rights. In justification, she indicated that she paid off the car loan ahead of schedule, leaving a life insurance amount of about 100,000 rubles.

And since the amount of the insured amount is determined as the actual amount of the debt balance, then upon the occurrence of an insured event, the amount to be compensated will be equal to zero.

In accordance with paragraph 1 of Art. 958 of the Civil Code of the Russian Federation, the insurance contract is terminated if the possibility of the occurrence of an insured event has ceased. The court satisfied the plaintiff's demands.

Decision No. 2-3812/2018

Return of CASCO insurance upon early repayment

CASCO insurance is a mandatory type for car loans. Because CASCO is a type of collateral insurance. And since a new car is most often pledged to the bank, the lender can demand insurance of its property.

But, as soon as the borrower repays the car loan ahead of schedule, having received a mortgage or collateral obligation from the bank, he has every right to return CASCO.

The insurance company is reluctant, but will accommodate you halfway. It is important to understand that not the entire amount of the insurance premium you paid for the year will be returned. But only the remaining amount is proportional to the remaining period.

When will it not be possible to get rid of it?

Refund of insurance is not possible if this is specified in the contract.

If, in accordance with the loan agreement, the insurance is voluntary, and it must be valid for the entire payment period, then it cannot be returned until the obligations are fully repaid.

"AlfaStrakhovanie" - List of documents for receiving payment

Each document submitted must be completed correctly. Depending on the nature of the application, an application form is filled out, which is confirmed by a signature and transcript. Once completed, each form is marked with a date.

There is no standard list that would apply to all programs. It all depends on the specific case, the insurance product, and the injuries received by the insured person. Several examples should be given.

"Refusal of insurance"

Clients of the AlfaStrakhovanie organization have the right to terminate the contract concluded with the insurer within 14 days. In this case, you need to pay attention to 2 nuances:

- The period is calculated from the moment the insurance premium is paid.

- If an insured event occurs within 14 days, it will be impossible to cancel the policy.

When filling out the application, you should indicate:

- FULL NAME;

- registration address;

- contact phone number and email if available;

- insurance contract number;

- details for receiving the unused portion of the insurance premium;

- what documents are an integral part of the application.

Along with the application you must have with you:

- identification document of the applicant;

- insurance policy;

- receipts indicating payment of the duty.

Providing these papers will speed up the procedure for returning lost amounts. The maximum period for consideration of a client’s request and transfer of funds to his account is no more than 10 days.

All documents must be presented in originals. At the end of the visit, each client should have a copy of the form with an acceptance mark. A copy of the application will be useful if the insurance company for any reason delays payment or refuses to transfer money.

Important! When terminating the MTPL agreement, the reason shall be additionally indicated. Within the framework of the law, return is provided only in case of sale of the vehicle, disposal, or death of the owner.

"Life"

Every citizen can insure the most valuable thing he has - his life. At the same time, within the framework of the program, accumulative insurance occurs, thanks to which you can earn money. Interest is accrued on the insured amount under an investment life insurance contract.

The application form is the same for all programs. The form should indicate:

- personal data of the insured person;

- the amount of the insured amount;

- contract number;

- telephone and email address;

- the nature of the insured event;

- details of the payee and personal account details;

- documents that are an integral part of the application.

Application forms for the program:

| Temporary disability or injury to the program owner | The funds are paid during the period while the client is unable to fulfill work obligations and earn income. |

| Dismissal from main job | The payment is due if the employee has lost income due to the fault of the employer. The form should contain the same information as in the application for temporary disability. |

| Disability of the program owner | Payment is provided in case of receiving any disability group. |

| Deadly disease | Compensation is provided if during the term of the contract the insured person is diagnosed with a dangerous disease. |

| Death of the policy owner | In this case, payment is provided to the beneficiary of the policy. If it is not established, then, within the framework of the law, compensation is paid to the heir by law. |

Is it worth going to court if insurance is imposed?

If a client took out a car loan, but believes that life insurance was imposed on him, you can try to cancel it through the court.

The basis for going to court is the article “On consumer rights laws”.

It prohibits the imposition of one service when purchasing another.

The client can also refer to Article 958 of the Civil Code of the Russian Federation, which includes information on the possibility of canceling the insurance contract when the need for it ceases.

However, if the loan agreement indicates the impossibility of returning the insurance, it will be quite difficult to resolve the issue through the court.

The situation may be resolved in favor of the plaintiff if he convincingly proves that life insurance for a car loan was imposed on him.

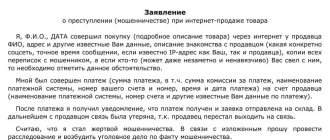

Before going to court, you need to draw up a claim in two copies. This is a must.

One of them, marked as accepted by the defendant, must be attached to the statement of claim.

The statement of claim must be sent to the arbitration court at the place of registration.

In order for the case to be considered, you need to provide a package of documents:

- insurance contract;

- loan agreement;

- application for refund.

You also need a certificate of early repayment of the loan (if any) and a response to the claim from the credit institution.

Often, if there are grounds for return, the court decides the issue in favor of the borrower.

But you need to understand that no one guarantees a positive result.

Find out how you can get a car loan without life insurance and without CASCO, and even with government support

If, when drawing up a contract, a condition was included secretly

But before you try to get your insurance back through the court, you need to consider a number of points:

- The limitation period for the claim should not be more than three years from the moment this issue became relevant.

- Resolving the issue through court involves certain costs for this process. In some cases, the amount to be returned is insignificant and cannot cover the costs of legal fees.

- Only part of the insurance payments for the period when they were not used can be returned. The entire amount under the insurance contract cannot be returned under any circumstances.

- The issue of return requires proof that the service was imposed, and this can be quite difficult to prove.

Different credit institutions approach the issue of refusal of insurance payments differently. When signing an insurance contract, borrowers rarely pay attention to the clause that states that this service is entirely voluntary.

How to return imposed insurance

In order to return unwanted insurance, it is necessary to clearly understand on what legal grounds the return occurs.

It should be said right away that, most likely, the bank will not return anything to you voluntarily. As a rule, a statement with clever phrases about the inadmissibility of imposing insurance, with references to articles of the law, does not scare the bank. Most likely you will need to apply to the court.

In our practice, the return of the imposed insurance occurs after preparing and filing a claim: by concluding a settlement agreement or by forcibly collecting it by a court decision.

What do we mean by “return of the insurance” imposed along with the loan agreement.

Refund of insurance - return of the insurance premium amount by the insurance company to the borrower's credit or other account, and a corresponding change in the terms of the loan agreement: the loan amount is reduced by the insurance amount, interest is recalculated, and a new repayment schedule is issued.

When the insurance premium is returned to the loan account, if by this time the borrower has not yet repaid the loan, the money, as a rule, is used to partially repay the loan.

✔ Method 1: cancellation of the insurance contract during the “cooling off period”

Directive of the Bank of Russia dated November 20, 2015 No. 3854-U “On the minimum (standard) requirements for the conditions and procedure for the implementation of certain types of insurance” established a “cooling period” of five days during which the policyholder has the right to refuse the contract.

It does not matter whether the insurance premium has already been paid. The only exception is the occurrence of an insured event after the conclusion of the contract, but before filing an application for refusal.

The insurance contract is considered terminated as soon as the insurer receives your application for refusal. Basis - art. 450.1 of the Civil Code of the Russian Federation. Now the insurer must return the insurance premium to the details specified in the application or to the credit account from which the payment was received.

A sample application for refusal of insurance you can

If at the time of filing the application, the insurance period established by the contract has begun, then the insurer has the right to withhold part of the insurance premium in proportion to the past period.

Here is an example of calculating the refund amount in this case. If the insurance premium is 50,000 rubles. for the insurance period of one year, then if you cancel the contract on the third day after the start of the insurance (if the insurance start date coincides with the date of signing the contract), the amount withheld by the insurer will be 410 rubles. 96 kopecks (50000/365*3).

How much will the insurance company return to you if the contract has already begun? Calculation example.

Insurance premium: 50,000 rubles

Insurance period: 1 year

When the insurance waiver was issued: on the 3rd day

50,000 - (50,000 / 365 * 3) = 49,589 rubles. 04 kop.

To be returned RUB 49,589. 04 kop.

✔ Method 2: cancellation of the insurance contract if more than 14 days have passed

According to the above Directive of the Bank of Russia, the insurer is obliged to inform the policyholder that he has the right to refuse the insurance contract, about the procedure and method for returning the insurance premium.

It follows that if you missed the 14-day period, but this information was not provided to you, you can refuse insurance after the 14-day “cooling off period” has expired.

✔ Method 3: establish document relationships

If, based on the contents of the documents, it is possible to establish the fact of imposition, this also gives you the opportunity to refuse insurance. This right is given to you by Article 16 of the consumer law, according to which this is unacceptable.

✔ Method 4: other reasons

There may be other legal grounds for termination or invalidation/non-conclusion of an insurance contract.

In order to understand whether you have grounds for refusing imposed insurance on such legal grounds, you need to show your contract to a lawyer from the consumer protection society for a free consultation.

You can sign up for a free consultation by phone:☎ (St. Petersburg)☎ (Moscow)