APPLY FOR A MORTGAGE AND FIND OUT A DECISION QUICKLY When studying the terms of housing loans, you often come across different names for repayment schemes - annuity or differentiated mortgage. These are two fundamentally different systems for calculating monthly payments, each of which has its own strengths and weaknesses.

- Features of two payment options Differentiated contribution

- Annuity fee

- Mortgage with annuity Sberbank of Russia

- "Gazprombank"

Calculation of monthly payments using a differentiated system

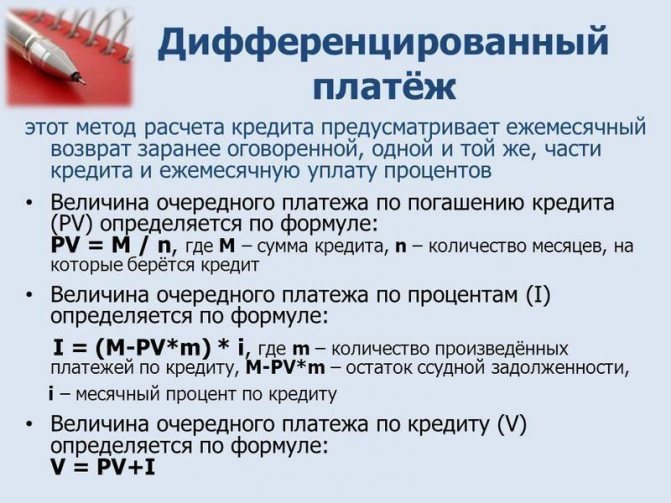

So, first, it’s worth answering the question of what a differentiated mortgage payment is. Currently, banks offer two systems for calculating monthly payments - annuity and differentiated. What an annuity system is probably familiar to everyone is when the amount of the monthly payment is equal, that is, each period you need to contribute the same amount to pay off the loan. When it comes to a differentiated payment system, the monthly payment amount will decrease with each payment transfer.

In simple terms, what a differentiated payment is, we can explain it this way: the entire amount of the principal debt is divided by the number of periods; accordingly, the monthly payment will invariably include the amount of the principal debt. The other part of the payment is the interest, which will be calculated not on the loan body, but on the balance of the principal debt.

In fact, a mortgage under a differentiated system is no different from an annuity; when repaying a loan early, the client reduces the amount of the principal debt, which means he can also choose either to reduce the amount of the monthly payment or to shorten the loan term. But if you take the advice of experts, it is best to shorten the term, since when the amount of the principal debt is reduced, the interest accrued monthly will be lower, and, therefore, the amount of the monthly payment is automatically reduced.

Please note that banks rarely use a differentiated system when calculating loans and mortgages. First of all, this is unprofitable for the lender because in the end the overpayment will be less, and with the annuity system the client initially pays bank profit, and at the end of the loan period the amount of the principal debt.

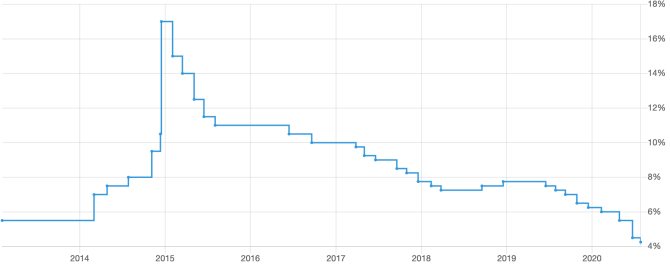

What is the interest rate and what does it depend on?

The interest rate is the most important parameter when calculating a loan. It is measured as a percentage per annum. It shows how much interest is charged on the debt amount for 1 year. But in fact, interest is accrued not once a year, but daily at the rate divided by 365 days.

Each bank has its own lending programs and interest rates. Main factors influencing the interest rate:

- Central Bank key rate

.

To give you a loan, the bank borrows from the Central Bank at a rate equal to the key rate, adds a few more percent on top and lends you a loan at a higher interest rate, making money on the difference. It is more profitable to take out a loan when the key rate is lower: you will pay less interest. At the next meeting, the Central Bank can either raise or lower the rate or leave it unchanged. This decision is made depending on the economic situation. Currently the key rate is 4.50%. And this is how it has changed in recent years:

- Loan type

.

The more risk a loan carries for a bank, the more expensive it is. For example, a mortgage loan is cheaper than a personal loan or a cash loan. The reason is simple - when issuing a mortgage, the bank takes real estate as collateral, thereby leveling the risks of non-payment of the loan. When issuing a cash loan for any purpose, the bank has no way to guarantee repayment, so the rate is much higher. - Borrower characteristics

.

These include credit history and relationship with the bank. Credit organizations evaluate the reliability of potential borrowers and make more favorable personal offers to potential clients in whose reliability they are confident. Many banks provide their salary clients with a discount of 0.3 – 0.6 percentage points.

Annuity payment and differentiated: the difference

Financial experts agree that if the borrower expects to pay off the loan in a short period of time (up to five years), then it is better to give preference to an annuity. However, there is controversy regarding medium- and long-term loans.

Mortgage for non-residential premises

For example, if a borrower takes out a long-term loan, say $100,000 for 10 years with an interest rate on the loan of 10%!g (MISSING)annual, then a differentiated payment is more profitable, and significantly. In our conditional example, the interest payment for ten years with differentiated payments will be $50,416.67, and with annuity payments - $58,580.88. Accordingly, the overpayment under the differentiated scheme will be less: by $8,447.53.

But let’s not forget that the example is conditional, and in practice everything does not look so simple. A number of banking experts do not hide that the idea of a significant financial advantage of differentiated payments is largely a marketing myth. The bank will never miss its profit. It is only important for him to convince the borrower that he can really save by choosing one or another payment plan.

“Credits.ru” note: the main thing you need to understand is that the method of calculating interest for both forms of payments is the same. In both cases, interest is calculated on the remaining balance of the debt.

pros

The most important thing is a lower overpayment on the loan. It is possible that this is partly why banks use a differentiated payment scheme very rarely. But in reality the difference will not be that big. Let’s say if you take out a loan of 300,000 rubles for 12 months at a rate of 24% per annum, then the difference in the overpayment will be 1,400 rubles in favor of the differentiated scheme.

Also a plus is more favorable early repayment. With an annuity scheme, the borrower pays off most of the interest in the first months; with a differentiated scheme, this happens more evenly, therefore early repayment is more profitable.

What are graduated mortgage payments?

Each loan under any repayment system consists of 2 parts: the amount of debt and the interest part. Differentiated (decreasing) payments are a method of loan repayment in which you pay the loan body in equal installments, and interest is charged on the balance of the debt. In the first quarter of the loan term, you will have to make the largest payments, and in the future the amount of monthly payments will decrease.

Few banks offer mortgages with differentiated payments. This is due to the fact that in this case you immediately begin to repay the loan amount. For the bank, this situation is unprofitable, because interest is considered the main source of its income. In case of early repayment, the borrower will be able to save a significant amount of money. More popular banks such as Sberbank, VTB, Otkritie do not have these types of mortgages.

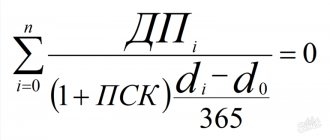

Formula for calculation

You can calculate your mortgage payment yourself using formulas.

Basic payment - C = A/D , where:

- C - monthly repayment amount of the loan body;

- A is the size of the mortgage loan;

- D is the mortgage term in months.

The percentage part is calculated using the formula - S=R*L/12 , where:

- S—accrued interest;

- R - debt balance for a given month;

- L is the annual mortgage interest rate.

Refund of insurance after loan repayment

R=A-(C*n) , where n is the number of loan payments paid.

Analysis by example

Let's calculate the differentiated mortgage payment if, for example, you decide to take 2,000,000 rubles at 12% annual interest for 15 years (or 180 months). The main payment to repay the debt will be: 2,000,000/180 = 11,111.11 rubles.

Now let’s calculate how much you need to deposit into your account every month:

| Month | Calculation | Total amount in rubles |

| 1 | 11111,11+(2000000-(11111,11*0))*0,12/12 | 31111,11 |

| 2 | 11111,11+(2000000-(11111,11*1))*0,12/12 | 31000 |

| 3 | 11111,11+(2000000-(11111,11*2))*0,12/12 | 30888,89 |

| 4 | 11111,11+(2000000-(11111,11*3))*0,12/12 | 30777,78 |

| 5 | 11111,11+(2000000-(11111,11*4))*0,12/12 | 30666,67 |

| 6 | 11111,11+(2000000-(11111,11*5))*0,12/12 | 30555,56 |

On the websites of banks that provide loans with differentiated payments, you can find a special calculator and do not count everything manually.

We count the benefits

So what is more profitable - annuity or differentiated payment? It all depends on what exactly you are used to calling benefit.

Annuity is beneficial, as we have already said, from the point of view of memorability. With a differentiated payment, the amount is unstable and changes every month. But this, of course, is unimportant.

If we consider the benefit regarding the amount of the loan received, then preference should be given to the annuity repayment scheme. The credit load is distributed evenly, and the borrower will be able to count on a higher loan amount, which is sometimes important!

Differentiated contributions, on the contrary, are characterized by a high credit load in the first months (or even years) of repayment, and only then the reduction in payment will become noticeable. Take the same mortgage - it is unlikely that you will pay the very first installments on it if you choose a differentiated repayment scheme.

The benefit may also depend on the period during which you plan to actually repay the loan. In our country, early repayment is not uncommon. But it will not be profitable if you chose annuity payments during the period of receiving the loan. It turns out that you have already paid the bank a huge amount of interest, but the principal debt has remained practically unchanged. Early repayment in this case will lead to the loss of money precisely on the interest that you paid in advance - in fact, you will repay the loan amount ahead of schedule and gain little. Therefore, with this scheme, it is advisable to repay the loan for the entire planned period.

With differentiated payments, the story is different - the loan body is gradually repaid in equal shares, and early repayment of at least part of the debt reduces the amount of accrued interest and, accordingly, all subsequent payments.

Similarities and differences

Both schemes are similar in that the payment amount includes interest and principal. Moreover, with any option, at the beginning of payments, the borrower repays a larger amount of interest compared to the months before the end of the loan agreement.

The fundamental differences between repayment methods are as follows:

- in the annuity scheme the payment is fixed, in the differentiated scheme it changes every month;

- under the same lending conditions, different amounts of overpayment are obtained;

- with an annuity, in the first years, the contribution amount includes a smaller amount of the principal debt;

- all banks use the annuity scheme, while the differentiated one is used much less frequently.

Pros and cons of differentiated payment

- a clear interest calculation scheme, it is easy to calculate at any time what payment needs to be made;

- a gradual reduction in payments reduces the burden on the borrower’s budget;

- In addition, purely psychologically, it is much easier to pay less and less every month, and taking into account inflation, the latest payments will be perceived as even less burdensome.

However, it is worth noting the disadvantages of differentiated payments:

- a fairly high amount of first payments;

- increased requirements for the borrower, since initially he needs to pay significant amounts;

- It is unlikely that you will be able to take out a large loan, since banks calculate the maximum monthly payment based on the borrower’s solvency (with differentiated payments, the first payments are 20-30% more expensive than with an annuity, therefore, you need to have an appropriate income);

- You need to check the payment schedule every time to know how much to “close” the next month.

In general, a differentiated loan repayment scheme is used for small loans or with a sufficiently high level of income. Then the first payments will not be so burdensome for your budget, and the reduced amount of overpayments will allow you to save money and, possibly, use the freed-up funds to repay the loan early.

Don't miss our new articles!

Subscribe to updates on Vkontakte, or by e-mail or RSS

How to make a calculation

A differentiated mortgage is not always easy for the client to understand, because he is not able to calculate the payment amount on his own. In principle, this is not necessary insofar as the bank attaches a schedule of monthly payments to the loan agreement; if you want to read the mortgage according to the differentiated system yourself, then there is nothing complicated here. Let's give an example with calculations; to do this, consider a mortgage with the following parameters:

- amount 1,800,000 rubles;

- annual interest – 8.9%!;(MISSING)

- loan term – 120 months.

To begin with, let's calculate the constant part of the monthly payment as follows: 1,800,000/120 = 15,000 rubles - this is the amount of the principal debt divided by the number of payment periods. Next, you should calculate the amount of the monthly payment, taking into account interest:

- 1 month 15000+(1800000*0.089/12)=28350 rubles;

- 2nd month 15000+((1800000-15000)*0.089/12)=28238.75 rubles;

- 3 month 15000+((1800000-15000*2)*0.089/12)=28127.5 rubles;

- 4th month 15000+((1800000-15000*3)*0.089/12)=28016.25 rubles;

- 5th month 15000+((1800000-15000*4)*0.089/12)=27905 rubles;

- 6 month 15000+((1800000-15000*5)*0.089/12)=27793.75 rubles;

- 120 month 15000+((1800000-15000*119)*0.089/12)=15111.25 rubles.

Please note that independent calculation of the monthly loan payment amount is preliminary insofar as these calculations involve not the nominal annual interest rate, but the effective one.

As you can see, it is quite possible to calculate the loan yourself; from this example it follows that the amount of the monthly payment will decrease with each period. This is truly beneficial for the client, especially given the long mortgage term. But, unfortunately, not all banks are ready to provide a mortgage loan using a differentiated system for calculating monthly payments.

Payment of a Post Bank loan through Sberbank Online: step-by-step instructions

Differences between annuity and differentiated payments

To clearly understand which scheme to give preference to when given the opportunity to choose, you need to compare these two loan repayment schemes.

Table. What is the difference between an annuity payment and a differentiated type of loan repayment?

| Insignia | Annuity scheme | Differentiated scheme |

| Component of payments | The amount consists of interest and a small part of the debt body | The amount consists of the principal and a small part of the interest accrued for the current month |

| Financial burden (amount of payments every month) | Uniform throughout the entire loan term | Increased at the beginning of the term and gradually decreases towards the end of the loan term |

| Payment amount | Unchangeable until the end of the loan term | Large at first, gradually becomes smaller, decreasing by the time the debt is fully repaid |

| Interest payment period | The borrower first pays a significant part of the accrued interest and only then the debt itself | The borrower pays interest upon the use of the loan (for each month), repaying most of the principal debt monthly |

| Payment structure | The payment is a fixed amount calculated by summing the principal and premiums for each year at the interest rate and dividing by the number of months of credit | The payment consists of a fixed part (constant) and a variable part. The fixed amount is part of the principal debt, and the interest is recalculated every month |

| Final overpayment | More | Less |

Thus, the differences mainly boil down to the fact that when establishing an annuity type of payment, a person repays the loan in equal parts every month, first paying interest, and with a differentiated repayment scheme, the amount of monthly payments gradually decreases, since interest is charged on the actual balance of the debt.

This is interesting: What is it?

Not for the borrower mortgage

Russian banks are not very fond of differentiated payments, since they imply a certain subtlety associated with assessing the borrower’s solvency (i.e., the ratio of income to the monthly payment).

The fact is that with a differentiated schedule, the biggest burden on the debtor’s budget comes from the first year’s payments, and the ratio to income is calculated specifically for this period.

Bank loans - what types and forms exist

For example, the borrower indicated in the application form an income of 60,000 rubles, and the first payment under the differentiated scheme will be 25,000 rubles, that is, it will “eat up” almost half of the income. And according to the law, loan payments in any case cannot exceed 50% of the income level. As a result, banks are forced to lower the maximum loan amount that can be issued based on the declared income level.

The situation is really difficult, both for the lender and for the borrower, since the debtor can either “fall off schedule” or be offended by the insufficient loan amount and go to another bank.

Some borrowers who have taken out a mortgage with differentiated payments overestimate their capabilities and ultimately cannot pay the loan.

Only “monsters” with government support, such as Sberbank, Gazprombank and a number of others, calmly take risks. They can afford to issue “differentiated” borrowers almost the same loans as “annuity” ones. But on average, the differentiated scheme is much less popular, and banks deliberately do not promote it, such are Russian realities.

Loan calculator – online calculate the payment amount

Bank loan calculators are the simplest scripts (programs) that are designed to calculate payments according to specified parameters. On the website of a specific financial institution, you can calculate the overpayment only for its loans, so when choosing a suitable program from several options, it is worth using the services of third-party resources, including our website.

A client who decides to calculate a loan must select a calculator taking into account the loan that will be issued. For example, for mortgages and car loans, the online calculator takes into account the size of the down payment, but when issuing a cash loan, this parameter is eliminated.

Depending on the service selected by the user, the accuracy of calculations for bank loans can vary significantly. A full-featured loan calculator is capable of calculating a loan with maximum accuracy, taking into account possible one-time and periodic commissions.

Users applying for a loan can use the loan calculator on our website to even take into account insurance costs by indicating its cost in the “Annual Fees” line.

Annuity and differentiated loan: the difference between the two types

Many potential borrowers are actively interested in the concepts of annuity and differentiated credit and the difference between these two types. In fact, these terms are not entirely correct, but they appeared in connection with the existence of two options for repaying a bank loan: monthly annuity payments and differentiated payments (we will consider which is better a little later).

When calculating a differentiated loan and an annuity loan using a calculator with the same initial parameters, the result (the amount of the monthly payment) always turns out to be different. This is due to the fact that interest for an annuity payment is calculated differently than for a differentiated payment. Below is a schematic comparison of these payments: