Mortgage lending rates are gradually decreasing. If in 2009 the average mortgage rate was 14.6%, then in 2017 it was already 11.7%. At the same time, individual offers may be even more profitable. At the beginning of 2018, Sberbank and Gazprombank set interest rates at 9.2-9.5%. The Government of the Russian Federation has set trends to reduce mortgage rates to 7% per annum. This makes refinancing a mortgage more attractive because it allows you to lower your monthly payment or shorten your loan repayment period.

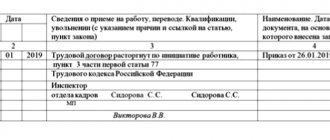

The refinancing procedure is similar to applying for a mortgage loan. The following information is submitted to the bank:

- about the borrower - employment, income, marital status, permanent registration address, etc.;

- about the property - title documents, technical documents, certificate from the BTI, etc.

Additionally, documents and information about the loan being refinanced are transmitted: a copy of the loan agreement, a certificate of the balance of the debt, etc.

To refinance, a real estate assessment must be carried out, which will be used as collateral for the loan. You can order it from Invest Consulting.

How many times can you refinance a mortgage on one property?

According to the laws of the Russian Federation, there are no strict restrictions on on-lending. Limits can only be set by banking institutions. As a rule, they are happy to accept conscientious payers with an ideal credit history. If there are debts and arrears, they will refuse. Thus, the main condition is not the number of issued loans, but the quality of their servicing (conscientiousness, solvency).

There is no limit to how many times you can apply for mortgage refinancing. Theoretically, you can refinance 10 times. If you are ready to spend your time collecting papers and closely communicating with two creditors (new and old).

Mortgage refinancing procedure

Refinancing a mortgage is very similar to taking out a new loan. It includes:

- Submitting an application for mortgage refinancing by a potential (or existing) client

- Review of an application for mortgage refinancing by a bank employee. The decision depends on:

- solvency

- how the obligations under the old loan agreement were fulfilled - if there are delays, especially more than 3 months, then the answer may be negative

- Valuation of real estate by an independent company

- Signing an agreement with an insurance company

- Transfer of funds to the client's bank account

- Early repayment of an old loan with removal of the encumbrance from an apartment or residential building

- Applying for a new loan for an apartment or residential building

How does the refinancing procedure work?

First of all, the borrower is concerned with the question of how long it will take to refinance the mortgage with his own bank. It is impossible to give a definite answer here. Typically, banking institutions are reluctant to refinance their own loans. Although there are examples of such cooperation.

The debtor is also interested in the question of how long it will take to refinance a mortgage with someone else’s credit institution. The standard period is estimated at 6 months. During this time, the borrower manages to become convinced that he needs a new lender. And the bank has time to evaluate the accuracy and solvency of the new client.

So, with rare exceptions, an application for re-lending is submitted to another bank. Once approved, the borrower goes through the following steps:

- draws up a loan obligation at a new financial institution, receives the amount necessary for full settlement;

- repays the mortgage, receives official confirmation that the money was spent for its intended purpose;

- re-registers the pledge to a new lender.

Important information! Until the collateral property has been re-registered with Rosreestr, the loan is considered unsecured. The borrower pays increased interest on it.

How to refinance a mortgage, stages

Myth #8. A refinanced mortgage cannot be paid off with maternity capital

Can. When refinancing a mortgage, you need to draw up a contract correctly, it must stipulate that the loan is issued to repay a mortgage (housing) loan. Without this clause, it is really impossible to repay a refinanced mortgage with maternity capital; the subsidy cannot be spent on paying for other forms of lending.

Refinancing a loan at Otkritie Bank

Apply now

The rule works even if the primary mortgage has been refinanced several times, which is not prohibited by the policies of some banking institutions.

Why do banks that issued loans agree to refinance?

Lending programs are structured in such a way that bank interest is paid unevenly throughout the entire term. The peak of their payments occurs in the first years. Then the borrower gradually repays the loan amount.

Important! Be sure to check whether early repayment is allowed under the terms of your loan agreement.

When can you apply for mortgage refinancing: profitable 50/50 formula

It is unlikely that the lender will agree to refinance if less than six months have passed since the loan was issued. In this case, he will not have time to assess your reliability as a payer. It is also almost impossible to achieve agreement if there are less than 180 days left before the end of payments (only in Sberbank this period is 90 days). The most beneficial formula for both parties is: 50/50. That is, it is profitable to apply for refinancing after half the term has passed.

Recommended article: Documents and conditions for refinancing a military mortgage at Promsvyazbank

When is mortgage refinancing beneficial?

Myth #5. This is not profitable and you will have to pay interest twice

Refinancing is indeed not always profitable. If, when drawing up a new contract, the borrower significantly increases the total repayment period, the amount of overpayment will increase, but the amount of the monthly payment will decrease. It is also not recommended to refinance if there are less than six months left until the end of the loan. With an annuity scheme, by this time all accrued interest has already been paid, and the client repays only the principal debt. Borrowing this amount again means paying interest again.

But in some cases, refinancing allows you to save significantly if you pay off:

- Credit card debt carries higher interest rates than consumer loans, and you also have to pay for insurance, SMS notification service, annual maintenance, and sometimes the ability to use a mobile app. The total overpayment on credit cards or overdrafts is several times higher than current refinancing rates.

- A mortgage taken out more than 5 years ago at a high rate. Savings in the future can reach tens or hundreds of thousands of rubles.

- Take several small loans at a time and pay for one. This step simplifies the management of banking products and saves money on additional fees that you have to pay several times when making three or four payments a month.

- A foreign currency loan, which increases in price every month due to the depreciation of the ruble.

How long does it take to refinance a mortgage and under what conditions?

While banks are looking for solvent clients, borrowers are busy looking for favorable rates. On the financial institution’s website, the conditions usually look very attractive. Is it really?

Yes, but subject to certain conditions. Carefully read all clauses of the contract, notes and footnotes, do not hesitate to ask questions on the hotline. Then you will understand when it is really profitable to refinance your home loan. It is advisable to do this if:

- the monthly payment becomes several thousand rubles less;

- the rate is reduced by 2-5%;

- you can change the collateral, co-borrowers, guarantors;

- It is possible, along with a mortgage loan, to receive an additional amount for your own needs (repairs, children’s education, travel).

Regarding the timing, the issue is resolved individually. It is known that as the time interval increases, the total overpayment on the loan obligation increases. At the same time, the monthly payment becomes noticeably lower. A family with a stable income can be recommended to enter into a long-term contract. If seasonal earnings are unstable, it is in the debtor’s interests to pay everything as quickly as possible.

Attention! Refinancing does not give the right to receive a repeated tax deduction provided for in Article 220 of the Tax Code of the Russian Federation!

The bets went to the second round

The reason is a general decline in rates on the market, says Evgeny Dyachkin, deputy head of the VTB retail business department. Refinancing of loans at Bank DOM.RF has increased 2.5 times, and the demand for refinancing is constantly growing, notes Igor Larin, director of the mortgage business of this bank.

Moreover, the peak of this year's refinancing has not yet passed. “Before the end of 2021, a new record for minimum rates is predicted, and therefore refinancing will be in demand,” says Igor Dmitriev, head of the center for mortgage products and digital partner business at Rosbank. According to DOM.RF, the share of refinancing in issuances in the first quarter was about 15%. In April, amid restrictive measures, refinancing probably slowed down due to difficulties in re-valuing the collateral, but in the future, lower rates will lead to an increase in demand for this product, says Ekaterina Shchurikhina, junior director for banking ratings at Expert RA.

With rates falling to historic lows, many are refinancing their mortgages again. There are no special conditions for borrowers who refinance the loan again. For banks, refinancing borrowers is an opportunity to get a client with good payment discipline.

The average refinancing rate is now 8.5%; more favorable offers, as a rule, require compliance with a number of conditions. The difference in rates at which it makes sense to think about refinancing a mortgage is 1.5-2%, says Mikhail Doronkin, head of bank ratings at the NKR rating agency. Since, in addition to benefits, refinancing also comes with a number of costs. When refinancing, the borrower expects three payments: appraisal of the apartment (approximately 5 thousand rubles), state duty for registering property rights (2 thousand rubles), insurance of the apartment and life of the borrower. The amount of insurance is individual in each case, but you can return part of the amount for the remainder of the term.

Some banks also introduce fees for issuing loans, opening accounts, and reducing interest rates.

Refinancing should be carried out in the first five to seven years of the loan’s life, maximum until the middle of the loan term. Since it is in the first years that the monthly annuity payment consists of interest as much as possible, and only a small part of it is the principal debt.

In the last years of the loan's life, on the contrary, the bulk of the monthly payment is the repayment of the principal debt, and refinancing during this period will not bring benefits.

Infographics "RG" / Alexander Chistov / Igor Zubkov

How long does it take to refinance a mortgage in large Russian banks?

Before contacting this or that institution, it is important to understand one nuance. The lender, in fact, does not care how many times you refinanced. Now you have ONE valid contract in your hands. If you have made all payments on time and have a reliable source of funds, refinancing should not be a problem.

As for the interest rate, at the moment it is in the range of 9-11%. Of the top five large creditors, the most favorable percentage is with Rosselkhozbank (9.05%), the highest is with Sberbank (10.9%). At the same time, for all lenders the final rate depends on:

- loyalty to customers (“our own” discount is higher);

- loan term;

- assessment of a collateral apartment or house;

- willingness to take out insurance;

- the nature of the property being purchased (a house with a plot of land is more expensive; an apartment on the secondary market is cheaper).

Important nuance! For all institutions, the percentage increases when they refuse insurance and for the period until the housing is officially the property of the bank.

Rosselkhozbank

The institution is ready to refinance the borrower in an amount from 100 thousand to 20 million rubles. True, the last figure is relevant for residents of Moscow and St. Petersburg. For other Russians, the upper limit is limited to 5 million rubles.

Current rates:

- 9.05% (for bank clients);

- 9.10% (for state employees);

- 9.2% (for other categories).

Important! If you refuse insurance, the percentage increases by 1%.

The conditions for obtaining a new loan are quite flexible:

- no commissions;

- the consent of the original creditor is not required;

- the possibility of prolongation of the contract and early repayment is provided;

- independent choice of repayment scheme (annuity or differentiated);

- compulsory insurance of collateral (life and health - voluntary).

It is possible to attract one, two or three co-borrowers - not necessarily those specified in the current agreement. In addition, the bank does not necessarily require your spouse to be involved as a co-borrower. The application review period is up to 5 working days.

Attention! Before submitting an application for refinancing to Rosselkhozbank, make sure that 6 months have passed since the date of conclusion of the original agreement (relevant for bona fide borrowers) or 12 months (for borrowers who have made minor delays).

Alfa Bank

The organization lends to bona fide borrowers at a rate of 9.99% for amounts from 600 thousand to 50 million rubles. These are the conditions for salary clients. For third-party borrowers, the loan will cost 0.3% more. On the website you will see an online calculator that will help you calculate your planned financial burden.

Recommended article: How to refinance a mortgage after the birth of a second child

The financial institution will definitely require that the collateral property be insured, and this must be done in an accredited company. Offers refinancing with the TOP UP service (at the client’s request). This means that the borrower will be able to receive additional money along with the required amount.

Mortgage refinancing at Alfa-Bank - conditions and documents

Sberbank

Sberbank is ready to provide a loan from 300 thousand to 7 million rubles (relevant for residents of Moscow and the region) or up to 5 million rubles (for residents of other regions). The bank puts forward standard conditions for security, registration, documentation, and length of service. Lends only to careful borrowers who strictly adhere to the payment schedule. The loan can be taken either at the place of residence or at the legal location of the employer. The application is considered within 8 working days.

Attention! To see the real benefits, it is convenient to use the online calculator on the DomClick website. You can also make a preliminary application here.

Conditions for refinancing a mortgage at Sberbank

VTB

Compared to Sberbank, which uses very strict assessment methods, VTB has more favorable conditions. People come here to renegotiate the contract without unnecessary paperwork and red tape (albeit at an increased rate). The minimum percentage is 10.1%, the maximum amount is 30 million rubles. There are reduced rates and bonuses for preferential categories.

Conditions for refinancing a mortgage at VTB

Gazprombank

The financial institution offers on-lending from 10.5%. This is a preferential rate and is subject to insurance. If you refuse insurance, the percentage increases by 1 point - to 11.5%. According to information on the official website, a Russian citizen can borrow up to 45 million rubles for a period of up to 30 years.

Attention! The organization has a minimum loan term requirement. It is 3.5 years. That is, you cannot enter into a loan agreement for 2 or 3 years. But you can increase the mortgage term compared to the original one. The main thing is that the total time interval does not exceed 30 years. Gazprombank also offers an increased loan amount (current mortgage + consumer loan for personal needs).

How long does it take to apply for mortgage refinancing and what documents are needed?

Refinancing is a rather troublesome process. You will have to re-assemble the complete package of documents. At the same time, “settle” matters with both the new and the old creditor.

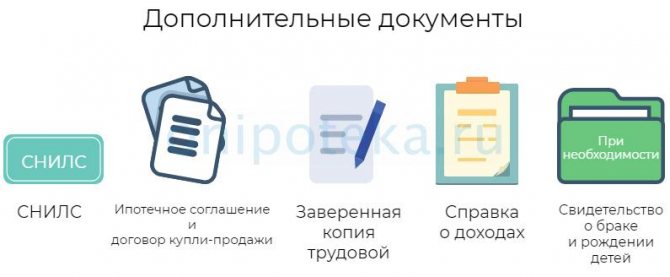

Along with your passport you will need:

- SNILS insurance certificate;

- current mortgage agreement and purchase and sale agreement;

- papers confirming ownership of the pledged item;

- a copy of the work record book (certified by the employer);

- income certificate (for employees) or tax return (for entrepreneurs).

If you are married, do not forget about your spouse's documents. If there are children, their birth certificates. You will also need to notarize the husband/wife’s consent to re-loan. If maternity capital was used when applying for a mortgage, you will have to ask for a certificate from the guardianship and trusteeship authorities. The apartment will also have to be re-evaluated.

Important! Some financial institutions require information about income exclusively in form 2-NDFL. Others are ready to accept a certificate filled out according to the bank's form. In the latter case, you can declare additional income received outside your main job.

In fact, the list of additional documents can be very impressive. Sometimes banks require a certificate of absence of debt for housing and communal services, as well as registration information. They may be asked to provide a certificate from the previous creditor confirming the absence of debt.

Recommended article: Is it worth getting a mortgage through realtors - pros and cons

How to Apply Online for Mortgage Refinance

Reasons for refusing to refinance a mortgage

All banks are interested in good profits and reliable clients. Therefore, the main reason why an application is rejected is a bad credit history. Moreover, this may be a single overdue payment on a credit card or an old loan from a microfinance organization.

The second reason is the client’s financial situation. The bank evaluates solvency using a complex formula. This is not just income “minus” the loan burden. The average level of expenses in a given region is estimated. For example, in Moscow it is higher. In the outback, people live on more modest money. If the client has other loans, they will also be taken into account.

Mortgage refinancing was denied - please rate:

- your reliability as a borrower (have you always repaid your debts in good faith);

- age;

- level of real income;

- the average salary in the region in which you live;

- the value of the collateral property.

Perhaps apartment prices have fallen, and now your home no longer seems like a reliable security. Or there have been changes in marital status (divorce, remarriage, alimony expenses). You were in the military and took out a loan on preferential terms, but now you quit and are working as a civilian. In all these cases, refusal is possible.

What to do if refused without explanation

Refusal to refinance a mortgage is an unpleasant situation, but quite fixable. Lending is a business. A bank employee is least likely to be guided by personal motives. Therefore, there are completely understandable reasons for the refusal. Try to find them.

- Check your credit history. What you regard as a minor delay of 1-2 days can significantly damage your reputation. When entering information into the BKI, technical errors also occur!

- Evaluate your solvency wisely. Many clients believe that a new monthly payment must be subtracted from the official salary. This is not entirely true. The level of expenses is also assessed. If you live in rented housing and have minor children, it means that your solvency is lower than that of those who live in their own apartment.

- Think about age. Even if you have an above-average income, you may be denied if you are approaching the age of incapacitation. Unfortunately, in the Russian Federation, pensioners are considered a risk zone. Show other sources of income, real estate owned, open deposits. The bank will be more willing to make concessions!

- Have the collateral assessed by independent experts. Consider what you can offer as additional collateral.

- Submit an application to another institution or to a branch of the same bank, but in a different area. Screening programs for all banks are different. If your application is not approved at one institution, you can always contact another.

The bank is not obliged to explain the reasons for its refusal. The decision depends on the results of the special screening program and its current settings. Employees of field offices are rarely informed about the actual formulas and calculation algorithms. Therefore, they will not be able to explain to you the reason for their disapproval.

Reasons for refusal of a mortgage: what should borrowers take into account?

What to do if you receive a refusal?

Current legislation does not oblige lenders to refinance loans. In this regard, it is quite possible to be refused such a service.

You may find the following information interesting: How many times can you refinance your mortgage?

In addition, situations often occur when their bank delays the consideration of an application for refinancing, without announcing the final decision for a long time. In this case, it is advisable to contact another credit institution that offers more favorable conditions .

In order to retain their clients, some lenders include in the contract a condition prohibiting the issuance of a new mortgage (until the previous one is repaid). In this case, the borrower will not be able to refinance his debt even with another bank.

conclusions

It is difficult to pay large sums month after month. At the same time, mortgage conditions have become much more favorable than 7-10 years ago. When can you apply for mortgage refinancing - when you see that it is difficult to service your financial obligations monthly (for various reasons). Or they found a bank willing to lend at a more favorable rate. In general, switching mortgage lenders can be very beneficial. Do not miss your chance!

Rate the author

(

4 ratings, average: 4.25 out of 5)

Share on social networks

Author:

Mortgage specialist Maria Yurievna Sokhan

Date of publication March 24, 2019 July 20, 2019