How does an encumbrance appear on real estate?

Encumbrance is when you are not allowed to sell real estate that you own. This can be an apartment, a house, or non-residential premises. Of course, you can make cosmetic repairs, live or work in it, but you cannot sell it to someone - an encumbrance has been imposed. And now we have to wait for the restrictions to be lifted.

An encumbrance arises by contract or by law. It does not allow the owner to completely dispose of the property: until the restriction is lifted, the property can be used, but alienated in any way.

The encumbrance can be forced or voluntary. The legislation of the Russian Federation names such types of encumbrance as: pledge by force of law under an agreement, arrest by a court decision, lease or rent.

An example of collateral under a contract is a mortgage. This is when you buy an apartment or house with bank money, live in it, do renovations, and invite guests. You can even register your parents, but you cannot remodel or sell without the bank’s permission. If you pay the bank on time, then no difficulties will arise. And when you repay the loan in full, the restriction on the apartment will be lifted.

Important! If you pay the bank the entire amount before the deadline specified in the agreement, then no one can prohibit the removal of the encumbrance.

When you have paid off your mortgage, you need to remove the encumbrance. After paying off your mortgage debt, only some banks can automatically remove it. For example, this is what Sberbank does when a mortgage was not issued.

Recommended article: Mortgage with a residence permit in Russia: banks and conditions

Documents for removing the encumbrance

To remove the encumbrance from an apartment, you need to prepare an impressive list of documents. For convenience, we divide it into 2 categories:

- Main documents:

- statement from the owner;

- his passport;

- title document for the apartment;

- a receipt indicating payment of the state fee.

- Additional documents (depending on the form of encumbrance imposed on the real estate).

The absence or incorrect execution of even one document is grounds for refusal to remove a previously imposed encumbrance on the apartment.

How to remove the encumbrance from an apartment after paying off the mortgage

In short, there are two ways:

- on the Internet through the official website of Rosreestr, or

- removal of mortgage encumbrance at the MFC in person.

If the borrower has a digital electronic signature, then you can use the first option. But most often the owners of an apartment or house do not have an electronic signature. Then a suitable method is when the restriction is removed through, another name for the center is MFC.

We talk in detail about the first and second methods.

How to remove mortgage encumbrances at the MFC: step-by-step instructions

As soon as you make your final mortgage payment, you need to do the following:

Step 1. Contact the bank, write an application on the spot, according to which you will be issued a mortgage note with a note on the repayment of loan obligations (according to the law, a joint visit with you by a representative of a credit institution or mortgagor to the MFC or Rosreestr is allowed).

Step 2. Make an appointment in advance at the MFC, otherwise you arrive at the nearest branch and receive an electronic queue coupon, in addition, you can request a preliminary consultation by calling the hotline.

Step 3. At the reception, the MFC specialist will once again check the mortgage and the presence of marks on it, and will help you fill out the application.

Step 4. If everything is in order, it will issue a receipt for acceptance of documents, by the number of which you can track the status of the application.

Step 5. As soon as the procedure is completed, you will be able to receive a document (extract from the Unified State Register of Real Estate) from the same branch of the MFC confirming your full ownership of the home without encumbrances.

If there was an apartment or house under encumbrance, now you have the right not only to live on their territory, but also to perform legally significant actions with the property:

- sell;

- give;

- exchange.

What documents are needed

- Application (to be filled out at the MFC, sample and printed in advance).

- Passport of a citizen of the Russian Federation.

- A mortgage note from a bank with a note indicating the repayment of loan obligations.

- A power of attorney certified by a notary if the procedure is carried out by another person.

Terms of provision of services at the MFC

The time during which the MFC will carry out the procedure for removing mortgage encumbrances, including military ones, is 3 business days; in some cases, it may take another 1-2 days to send documents to (from) Rosreestr divisions.

Read also: Replacement of driver's license through State Services

In addition, if the borrower repaid the mortgage and at the same time participated (bought) an apartment in shared construction, the period is 5 working days.

If the bank undertakes to submit an application on its own, the deadline may take up to two weeks.

Amount of state duty in 2021

The procedure for removing encumbrances from real estate purchased with a mortgage is not subject to state duty and is carried out free of charge.

We remove mortgage encumbrances through the MFC

The first thing to do is to find out from the bank whether the entire debt has been paid.

Next, we collect documents: call or come to the bank and order a certificate stating that you have paid the bank in full. The certificate will be issued the next day after the debt is closed.

Before contacting the MFC, you need to take from the bank not only a certificate, but also a mortgage for an apartment or house. This document needs to be prepared; the bank will not be able to issue it immediately. Each bank has different terms, you can wait ten days, or you can wait two weeks. All certificates you obtain from the bank are free.

There have been changes since July 1, 2021. The client can be issued not a paper, but an electronic mortgage, if he wants.

How to remove an encumbrance after closing a mortgage: features of the procedure, documents

- Borrower's passport . The original and copies of pages with photographs and registration of the borrower and co-borrowers are required. All apartment owners must be present in person, or one of the owners must have notarized powers of attorney from the other owners.

- Application for removal of encumbrance . The application includes information about the owner, borrower and real estate, and details of the loan agreement are indicated. The application must contain the date of registration and signatures of the borrower and the bank employee who executed the agreement.

- Mortgage for an apartment . A mortgage is a document containing information about the apartment, the owner of the property and the third party with whom it is pledged. The parameters of the apartment and the terms of the contract, payment rules, etc. are indicated. The mortgage is kept in the bank and issued to the borrower only at the time the encumbrance is lifted.

- Loan agreement . An original and a copy of the mortgage agreement indicating payments and confirmation of repayment of the debt with interest are required. The document must contain a record that the borrower has no debts to banks and the credit institution has no claims against the borrower.

- Documents for the apartment. When contacting Rosreestr, you must present a certificate of ownership of all borrowers and co-borrowers, and a purchase and sale agreement with copies.

- Receipt for payment of state duty . Before you can remove the mortgage encumbrance by force of law, you need to pay a state fee. When removing an encumbrance, the fee is small, but without a receipt provided, the registrar will not accept the documents. The owner finds out the amount and receives the receipt itself from Rosreestr, pays it at the post office or Sberbank branch and gives the registrar the payment receipt or a copy thereof.

After paying off the mortgage, many borrowers are interested in how to remove the encumbrance from the apartment. There are no penalties for failure to remove the encumbrance, but it is not recommended to delay the procedure. The encumbrance does not allow real estate transactions. After a long period of time, it will be more difficult to withdraw it; you will have to contact the bank, raise all the documents and contact Rosreestr.

What to do if there is no mortgage

And if after you have received a mortgage, but there is no mortgage, is it possible to remove the encumbrance without the mortgage? We answer - it is possible.

The mortgage could have been issued by another organization, for example, a credit cooperative, which does not issue a mortgage. In this case, a representative of a bank or other organization comes with you to the MFC to write an application for repayment of the mortgage record.

At the same time, the borrower’s package of documents will not change. An employee of a bank or other organization will need to bring an order of appointment, a power of attorney for the right to sign on behalf of the organization, a passport, a copy of the charter or an extract from the Unified State Register of Legal Entities. There is no payment for the service; it is free.

Important! Additional documents may be requested in a separate subject of the Russian Federation. Therefore, it is better to check with a bank employee or employee what package of documents is needed.

How to remove an encumbrance through State Services

The service of canceling an encumbrance imposed on a property is available only to authorized users. To create an account and go through identification you will need:

- Go to the website gosuslugi.ru.

- Click the “Registration” button.

- Fill out the user form.

- Confirm the specified information by phone or email.

- Complete your user profile.

- Go through identification in a convenient way (apply for your passport and SNILS at the MFC or go through a simplified procedure using online banking).

Most often, mortgage encumbrances are removed through State Services. The algorithm of actions of a borrower who has repaid his debt to the bank should look like this:

- Go to the State Services portal and log in.

- In the search bar, enter the query “state registration of residential mortgage.” The system will provide many services, from which you will need to select the one you need.

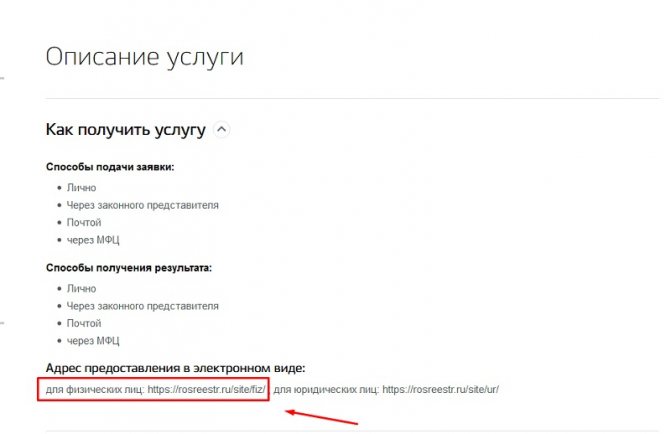

- After going to the service provision page, you need to follow the link to submit an application electronically for individuals.

- On the new page in the main menu you will need to select the “State registration of rights” section.

- In the menu that appears, select the desired one: for example, “Repayment of the mortgage registration record.”

- Click the “Go to request details” button.

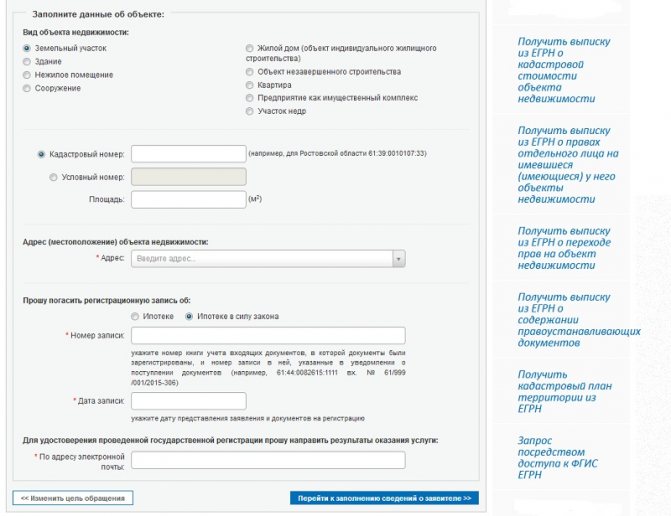

The system will redirect the user to the page for filling out the electronic application. You will need to provide the following information:

- real estate object (residential building, apartment, land plot, etc.);

- cadastral number (indicated in the cadastral passport or extract from the Unified State Register of Real Estate);

- address of the real estate location;

- the number and date of the registration of the mortgage or mortgage by operation of law;

- email address to which the result of the service will be sent;

- FULL NAME;

- SNILS number;

- passport data (series, number, date of issue, name of the authority that issued the passport, department code);

- contact information (telephone, email address).

After filling out the personal data, you will need to upload scans of documents confirming that the terms of the mortgage have been met and the property is no longer pledged to the bank. The list of required papers includes:

- applicant's passport;

- bank mortgage;

- certificate received from the bank about the absence of debt and claims against the applicant.

Registration of documents at the MFC

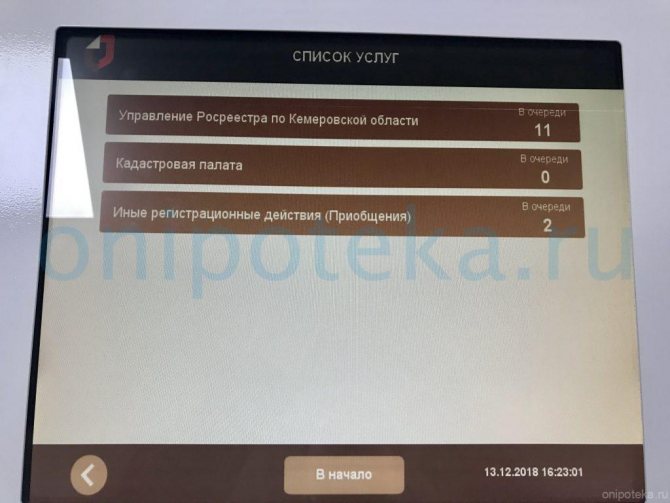

Now that you have collected the documents, you need to take them to the MFC for registration. And here you have a choice:

- bring it any day, sign up for the electronic queue through the terminal and wait in the center building, or

- Sign up in advance through State Services.

If you have already signed up for State Services, you need to arrive ten minutes earlier than the appointed time and pick up a coupon at the terminal.

Important! If you are late, you will have to wait in the live queue.

When your time comes, the MFC employee will give an application on his form. It does not need to be filled out, but only to verify the information already entered. The employee will take your documents and in return give you an inventory of the documents.

Deadlines for removing encumbrances from an apartment

The period for lifting the restriction is from 3 to 5 days. The date is written on the inventory of documents. If you require documentary evidence of the absence of restrictions on real estate, you must separately request an extract from the Unified State Register of Real Estate, paying 400 rubles for it.

An MFC employee needs 1-2 days to process the documents and transfer them to Rosreestr. If everything is in order, the mortgage will be removed on the third day.

There are times when Rosreestr needs a couple more days to make an entry about the lifting of restrictions. But no longer than five days.

When the deadline approaches, you can sign up again at the MFC, come with your passport and inventory, and pick up the certificate. Or you can not go to the MFC, but check through the Rosreestr website.

Basic documents

In the application sent for consideration to the registration authority (USRN), it is necessary to indicate a request to remove the encumbrance. If the employee liquidates it, you will be able to fully own, use and dispose of the real estate.

The application must indicate:

- Personal information about the applicant:

- FULL NAME,

- Date of Birth,

- passport series and number,

- residential address.

- Information about the encumbrance (for example, if a mortgage is issued, its size, term and other conditions are reflected).

- An indication of the actual elimination of the encumbrance (full repayment of debt, compensation for damage caused, etc.).

- Appendix - a list of documentation attached to the application. A Russian passport is required, identifying the applicant, and a title document for the apartment (for example, a purchase and sale agreement, exchange, etc.).

You can fill out an application and pay the state fee (as of 2021 it is 350 rubles) at the branch of the registration authority. When accepting documentation for consideration, the applicant is given a receipt with which he needs to come back in 3-5 days for a new extract from the Unified State Register.

Is it possible to remove the encumbrance if the apartment is seized?

If the apartment is under arrest, then the encumbrance can be removed. The very essence of the arrest is a prohibition of any registration actions, designed to limit the registration of rights and the transfer of property rights. The repayment of the mortgage record is not related to alienation or other disposition. The court's position on this issue can be found in detail here.

Judicial practice on this issue:

- Decision of September 22, 2014 _ Arbitration Court of the Kaliningrad Region _ In case No. A21-5248_2014

Rate the author

(

1 ratings, average: 1.00 out of 5)

Share on social networks

Author:

Maria Yurievna Sokhan

Date of publicationDecember 18, 2018February 25, 2019