Wage legislation

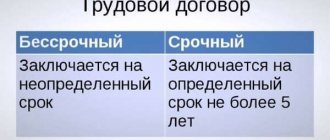

Article 131 of the Labor Code of the Russian Federation states that wages must be paid in the national currency of Russia (rubles) at least twice a month on days established by the internal regulations of the enterprise, a collective or labor agreement. If this regime is not observed, we can talk about a violation of the employee’s rights and liability for non-payment of wages arises.

There are often cases when employers try to make a kind of mutual settlement with workers, paying for their work not with money, but with manufactured products. If such a situation occurs and does not suit the workers, they should seek help from specialists. Legal advice will provide the necessary knowledge to combat such a cunning employer.

The fact is that Article No. 131 of the Labor Code clearly states that these calculations can be made only with the consent of the employee and in an amount not exceeding 20% of the monthly salary.

When there is a delay in wages

Delayed salary is any payment of remuneration to an employee that is made later than the due date.

For the current monthly salary payment, the deadlines are set by the employer himself, but he must comply with the requirements of Art. 136 Labor Code of the Russian Federation.

Salaries must be paid at least twice a month, and employees must receive final payment no later than the 15th of the next month.

Within this framework, the employer establishes the procedure for paying wages, for example: an advance on the 25th, and the final amount on the 10th of the next month. The ratio between the advance and salary amounts is also determined by the employer, but taking into account how much the employee actually worked in the first half of the month.

For certain cases, a special procedure for settlements with employees has been established:

- When going on vacation, the employee must be paid vacation pay no later than three calendar days before it starts.

- Upon dismissal, the employee must receive all due payments on the day of termination of the employment contract: the balance of the last month’s salary, compensation for unused vacation, etc.

If the deadline for any payment coincides with a weekend or holiday, then the employee must receive the money earlier, i.e. on the eve of a weekend or holiday.

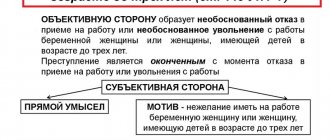

Responsibility for non-payment of wages

Methods of combating the protection of workers' rights provide for the employer's liability for non-payment of wages under influence on the employer both from the state and from the workers themselves. The legislation of the Russian Federation provides for very strict punishment for non-payment of wages. According to Article 145 of the Labor Code of the Russian Federation, the employer is criminally liable for non-payment of wages in the event of an established fact of delay in wages. There are three gradations of responsibility under this article:

- If the non-payment of wages is partial (if less than half of the due wages are paid per month) with arrears of more than three months, the manager may be prosecuted and fined for non-payment of wages from 120 thousand rubles or in the amount of its annual wages. The article also provides for the release of such a boss from his position (with a ban on holding leadership positions) and even imprisonment for a period of one year.

- If wages are not paid in full for more than two months, the company’s management faces even greater sanctions: a fine for non-payment of wages of 100-500 thousand rubles or in an amount equal to three years’ wages. And there is the possibility of losing freedom for up to three years.

- If such actions of the manager lead to grave consequences for the employee, then Article 145 of the Labor Code of the Russian Federation provides for penalties in the amount of 200-500 thousand rubles or imprisonment for a period of 3-5 years.

Administrative fines for late wages

In addition to compensation to the employee, fines are also provided for violation of the terms of payment of wages (clauses 6.7 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). The amount of the fine depends on the category of the employer and whether the violation was the first or repeated.

For example, if the violation was committed for the first time, the court may limit itself to a warning. Usually, penalties are avoided if the delay is considered insignificant: a small amount, a short period (1-2 days), there are no complaints from the employees themselves.

But even with the first delay in payment, a fine may be imposed: for individual entrepreneurs in the amount of 1 to 5 thousand rubles, and for legal entities in the amount of 30 to 50 thousand rubles.

If the delay is repeated, the amount of the fine will increase significantly. For individual entrepreneurs it will be from 10 to 30 thousand rubles, and for a legal entity - from 50 to 100 thousand rubles.

At the same time as the company, the guilty official may also be fined (Clause 3, Article 2.1 of the Code of Administrative Offenses of the Russian Federation). Usually the director is punished, but other persons can also be found guilty, for example, an accountant if the salary was transferred later due to his fault.

The fine for officials ranges from 10 to 20 thousand rubles. for the first violation, and from 20 to 30 thousand rubles. - when repeated. Instead of a fine for repeated delays in wages, the culprit may be subject to disqualification for a period of 1 to 3 years.

For the director, disqualification means dismissal under clause 8 of Art. 83 of the Labor Code of the Russian Federation and the inability to further manage organizations during the sentence.

Conclusion

Depending on the circumstances of the case, the punishment for late wages can vary from a warning to large monetary fines, disqualification or imprisonment.

In addition, if there are significant delays, employees may initiate bankruptcy proceedings for the enterprise. Also, employees (except for certain categories) have the right to suspend work if the salary delay exceeds 14 days.

Regardless of other sanctions, the employer must pay the employee compensation for delays, based on the key rate of the Central Bank of the Russian Federation.

Criminal liability for late wages

The most serious type of liability for late payment is criminal punishment under Art. 145.1 of the Criminal Code of the Russian Federation.

The amount of sanctions depends on the size and duration of the delay, as well as the severity of the consequences.

| Non-payment of wages | Fine | Disqualification | Forced labor | Deprivation of liberty |

| Partial over three months | up to 120 thousand rubles. or income for a period of up to 1 year | up to 1 year | up to 2 years | up to 1 year |

| Full over two months | from 100 to 500 thousand rubles. or income for a period of up to 3 years | up to 3 years | up to 3 years | up to 3 years |

| Fitting under paragraph 1 or 2 and causing serious consequences | from 200 to 500 thousand rubles. or income for a period of 1 to 3 years | up to 5 years | — | from 2 to 5 years |

Partial non-payment of wages in this case is a payment of less than 50% of the due amount. Payment of wages in an amount below the minimum wage is equivalent to complete non-payment.

For non-payment of wages, either a fine or punishment related to the restriction of personal freedom is applied. In case of complete non-payment of wages or the occurrence of serious consequences along with imprisonment or forced labor, disqualification may be applied.

An employer can avoid criminal liability if the violation was committed for the first time and all debt, including compensation, was paid within two months from the date of initiation of the case. If non-payment of wages entailed serious consequences, then such an exemption does not apply.

The concept of grave consequences of non-payment of wages is not explained in the law. But in general, in judicial practice, the consequences of a crime are considered grave if they are associated with danger to life, causing significant harm to health, destruction or damage to expensive property, etc. (Clause 21 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated October 16, 2009 No. 19).

Criminal punishment for delays in wages is applied to the head of an organization (branch), entrepreneur or other employer - an individual.

In order to bring the culprit to criminal responsibility, it is necessary to prove his mercenary or other personal interest in non-payment of wages.

What exactly is meant by selfish and personal interest - in Art. 145.1 of the Criminal Code of the Russian Federation is not specified. This does not necessarily mean that the manager has appropriated money intended for salaries.

If the director, due to a lack of funds, instead of paying salaries, paid off with suppliers, then this can also be considered a personal interest. We can say that in this way the director tried to maintain his reputation before contractors or founders of the company as a competent manager who fulfills his obligations on time.

The Supreme Court of the Russian Federation clarified that the manager should be held accountable under Art. 145.1 of the Criminal Code of the Russian Federation in all cases when he had a real financial opportunity to pay a salary (clause 17 of the resolution of the Plenum of the Armed Forces of the Russian Federation dated December 25, 2018 No. 46).

Compensation for delayed wages

As a general rule, salaries are paid at least once every half month (Article 136 of the Labor Code of the Russian Federation), while specific terms are established by internal labor regulations, a collective agreement, and an employment contract. If the employer violates the established deadline for paying wages, he is obliged to pay it with interest (Article 236 of the Labor Code of the Russian Federation). This compensation is paid for each day of delay, starting from the next day after the established payment deadline up to and including the day of actual settlement. The amount of compensation is not less than 1/300 of the Bank of Russia refinancing rate in force at that time for amounts not paid on time.

If the day of payment of wages coincides with a day off or a non-working holiday, its payment must be made on the eve of this day (paragraph 12 of Article 136 of the Labor Code of the Russian Federation). So, if the salary payment day falls, for example, on Sunday, then payment on Monday is considered overdue. And the employee in this case has the right to demand payment of monetary compensation.

When calculating the amount of monetary compensation for delayed payment of wages, all calendar days are taken into account. Therefore, if during the period of delayed payment there are weekends and holidays, then they are also taken into account when calculating the amount of compensation for delayed wages.

Example

According to the employment contract, wages must be paid twice a month: on the 25th of the current month (advance payment), on the 10th of the next month (salary). The salary of driver V. Ivanov is 25,000 rubles. On November 23, 2012, he was paid an advance in the amount of 10,000 rubles, and his salary was 11,750 rubles. (RUB 25,000—RUB 10,000—(RUB 25,000 x 13%))—December 24, 2012.

Payment of wages for the second part of November was delayed by 14 days. The refinancing rate of the Bank of Russia on the payment date is 8.25% (instruction of the Bank of Russia dated September 13, 2012 No. 2873-U). Thus, compensation for delayed payment of wages will be 45.24 rubles. (RUB 11,750 x 8.25%: 300 x 14 days).

As you can see, the amount is small. But it should be remembered that the amount of such compensation can be increased in accordance with a collective or labor agreement.

The obligation to pay the specified monetary compensation arises regardless of the employer’s fault (Article 236 of the Labor Code of the Russian Federation). However, the employer must compensate not for direct actual damage, but for those losses that the employee may suffer due to the fact that wages were not paid on time.

If wages are delayed for more than 15 days, the employee has the right, by notifying the employer in writing, to suspend work for the entire period until the delayed amount is paid. This is only possible if the employee is allowed to do so. The categories of employees for whom such actions are prohibited are established by Article 142 of the Labor Code of the Russian Federation. Suspension of work is not allowed:

• during periods of martial law, a state of emergency or special measures in accordance with the legislation on a state of emergency;

• in the bodies and organizations of the Armed Forces of the Russian Federation, other military, paramilitary and other formations and organizations in charge of ensuring the country’s defense and state security, emergency rescue, search and rescue, fire-fighting work, work to prevent or eliminate natural disasters and emergency situations, in law enforcement agencies;

• civil servants;

• in organizations directly servicing particularly hazardous types of production and equipment;

• employees whose job responsibilities include performing work directly related to ensuring the life of the population (energy supply, heating and heat supply, water supply, gas supply, communications, ambulance and emergency medical care stations).

Accounting for compensation payments

In accounting, compensation for late payment of wages is included in other expenses (clause 11 of the Accounting Regulations “Expenses of the Organization” (PBU 10/99), approved by order of the Ministry of Finance of Russia dated 05/06/99 No. 33n).

The accrual of compensation payments for late payment of wages is reflected in the credit of account 73 “Settlements with personnel for other operations” and the debit of account 91 “Other income and expenses” subaccount 2 “Other expenses”. Payment of compensation is reflected in the debit of account 73 “Settlements with personnel for other operations” in correspondence with the credit of account 50 “Cash” or account 51 “Settlement accounts”.

When calculating income tax, labor costs include any accruals to employees in cash and (or) in kind, incentive accruals and allowances, compensation accruals related to working hours or working conditions, bonuses and one-time incentive accruals, expenses related to the maintenance these workers, provided for by the norms of the legislation of the Russian Federation, labor agreements (contracts) and (or) collective agreements (Article 255 of the Tax Code of the Russian Federation).

From the norm of Article 255 of the Tax Code of the Russian Federation, according to financiers, it follows that the compensation payments provided for in this article must be related to the working hours or working conditions, as well as the maintenance of employees. Expenses for the payment of monetary compensation provided for in the aforementioned Article 236 of the Labor Code of the Russian Federation do not meet the conditions established by Article 255 of the Tax Code of the Russian Federation. Therefore, they cannot be included in labor costs. Therefore, officials strongly recommend not taking into account compensation payments to employees made by the employer in accordance with Article 236 of the Labor Code of the Russian Federation (letters of the Ministry of Finance of Russia dated 10/31/11 No. 03-03-06/2/164, dated 12/09/09 No. 03- 03-06/2/232).

Non-operating expenses include, in particular, expenses in the form of fines, penalties and (or) other sanctions for violation of contractual or debt obligations recognized by the debtor or payable by the debtor on the basis of a court decision that has entered into legal force, as well as expenses for compensation for damage caused damage (subclause 13, clause 1, article 265 of the Tax Code of the Russian Federation).

Expenses in the form of the amount of monetary compensation paid by the employer to employees on the basis of Article 236 of the Labor Code of the Russian Federation can be attempted to be qualified as sanctions for violation of contractual obligations.

The Ministry of Finance confirms the possibility of establishing the amount of monetary compensation paid by the employer to the employee in accordance with the provisions of Article 236 of the Labor Code of the Russian Federation, labor and (or) collective agreements. But the provisions of subparagraph 13 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation, in their opinion, are not applicable to the amounts of the specified monetary compensation (mentioned letter of the Ministry of Finance of Russia No. 03-03-06/2/164).

Following the above recommendations of financiers will oblige the organization to refer to the Accounting Regulations “Accounting for calculations of corporate income tax” (PBU 18/02) (approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n). The resulting difference in expenses in accounting and tax accounting is recognized as constant, since it is taken into account when forming the accounting profit of the reporting period and is excluded from the calculation of the tax base for income tax for both the reporting and subsequent reporting periods. And this obliges her to accrue a permanent tax liability (clause 4, 7 of PBU 18/02):

Debit 99 subaccount “Fixed tax liabilities (tax assets)” Credit 68 subaccount “Calculations for income tax”

— a permanent tax liability has been accrued.

However, this position of the Russian Ministry of Finance does not find support among judges.

From the norms of subparagraph 13 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation and Article 236 of the Labor Code of the Russian Federation, in the opinion of the judges of the Federal Antimonopoly Service of the Volga District, it follows that expenses in the form of the amount of monetary compensation paid by the employer to employees on the basis of Article 236 of the Labor Code of the Russian Federation are incurred due to violation of the deadline for payment of wages established by employment contracts, that is, they are actually a sanction for violation of contractual obligations. At the same time, subparagraph 13 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation does not contain any restrictions on the accounting of sanctions as expenses, depending on the framework of which legal relations (regulated by civil or labor legislation) a violation of contractual obligations was committed. Therefore, the compensation paid by the company to its employees on the basis of Article 236 of the Labor Code of the Russian Federation, in their opinion, is subject to inclusion in non-operating expenses when calculating income tax (resolution of the Federal Antimonopoly Service of the Volga District dated 08.30.10 No. A55-35672/2009, dated 06.08.07 No. A49 -6366/2006).

The judges of the FAS Volga-Vyatka District came to this opinion in the resolution of the FAS Volga-Vyatka District dated 08/11/08 No. A29-5775/2007.

Compensation for late payment of wages made by an organization in the amount established by the Labor Code of the Russian Federation is not subject to personal income tax (paragraph 11, clause 3, article 217 of the Tax Code of the Russian Federation). Moreover, if compensation is established by a collective or labor agreement in an amount exceeding that established by the Labor Code of the Russian Federation, then it is still not subject to personal income tax (letters of the Ministry of Finance of Russia dated April 18, 2012 No. 03-04-05/9-526, dated November 28, 2008 No. 03 -04-05-01/450).

If the collective and (or) employment agreement does not indicate the procedure for calculating monetary compensation, then income exempt from personal income tax will only be the amount calculated based on the current refinancing rate of the Bank of Russia, that is, the minimum compensation. Amounts exceeding the specified amount are subject to personal income tax in accordance with the generally established procedure.

If a delay in the payment of wages causes moral harm to an employee, then compensation is possible in cash in the amount determined by agreement of the parties to the employment contract, in accordance with Article 237 of the Labor Code of the Russian Federation. In this case, the paid compensation amounts are not subject to personal income tax (clause 3 of Article 217 of the Tax Code of the Russian Federation, mentioned letter of the Ministry of Finance of Russia No. 03-04-05-01/450).

Monetary compensation for delayed payment of wages is not subject to insurance contributions to state extra-budgetary funds (subclause 2 “and” clause 1 of article 9 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund Russian Federation, Federal Compulsory Medical Insurance Fund").

However, recently, some pensioners believe that the employer’s payment of interest for delayed payment of wages is not compensation related to the employee’s performance of labor duties. Such amounts, in their opinion, are subject to insurance contributions for compulsory pension and health insurance. Not finding them in the taxable base during checks, they charge additional amounts of insurance premiums, penalties and fines.

The judges of the Federal Antimonopoly Service of the Volga-Vyatka District qualified these percentages as legally established compensation related to the employee’s performance of labor duties. Consequently, such interest is not included in the base for calculating insurance premiums to the Pension Fund and the Federal Compulsory Medical Insurance Fund (Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated October 25, 2012 No. A31-11529/2011).

These payments also do not accrue insurance contributions for compulsory social insurance against accidents at work and occupational diseases (subclause 2, clause 1, article 20.2 of the Federal Law of July 24, 1996 No. 125-FZ “On compulsory social insurance against accidents at work and occupational diseases").

Employer's liability

In addition to all of the above, the head of the organization, as well as other officials who delayed the payment of wages, may be subject to disciplinary, administrative and criminal liability in accordance with current legislation.

Thus, the employer is obliged, having considered the application of the representative body of employees about violation of labor legislation and other acts containing labor law norms, the terms of a collective agreement, agreement, to report the results of its consideration (Article 195 of the Labor Code of the Russian Federation). If the fact of violation is confirmed, the employer is obliged to apply disciplinary action to the head of the organization, the head of the structural unit of the organization, and their deputies, up to and including dismissal.

If such a reason is a delay in paying wages to employees or a violation of labor legislation, the head of the organization may be dismissed if his guilt is proven (Article 81, 278 of the Labor Code of the Russian Federation).

According to Article 233 of the Labor Code of the Russian Federation, financial liability of a party to an employment contract occurs for damage caused by it to the other party to this contract as a result of its culpable unlawful behavior (actions or inaction), unless otherwise provided by the Labor Code of the Russian Federation or other federal laws. Each party to the employment contract must prove the amount of damage caused to it.

Article 237 of the Labor Code of the Russian Federation provides for compensation for moral damage caused to an employee. Moral damage caused to an employee by unlawful actions or inaction of the employer is compensated to the employee in cash in amounts determined by agreement of the parties to the employment contract. In the event of a dispute, the fact of causing moral damage to the employee and the amount of compensation for it are established by the court.

If a collective agreement or employment contract determines the amount of interest to be paid by the employer in connection with the delay in payment of wages or other payments due to the employee, the court calculates the amount of monetary compensation taking into account this amount, provided that it is not lower than that established by Article 236 of the Tax Code of the Russian Federation (p. 55 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation”).

The accrual of interest in connection with late payment of wages does not exclude the employee’s right to indexation of the amounts of delayed wages due to their depreciation due to inflationary processes.

Also, failure to pay wages on time may result in administrative liability. According to Article 5.27 of the Code of Administrative Offenses of the Russian Federation, persons guilty of violating labor legislation (rules for the payment of wages) are subject to an administrative fine in the amount of:

• for officials - from 1000 to 5000 rubles;

• for persons carrying out entrepreneurial activities without forming a legal entity - from 1000 to 5000 rubles. or administrative suspension of activities for up to ninety days;

• for legal entities - from 30,000 to 50,000 rubles. or administrative suspension of activities for up to ninety days.

Violation of the terms of payment of wages by a person previously subjected to administrative punishment for a similar administrative offense may entail disqualification for a period of one to three years.

Finally, Article 145.1 of the Criminal Code of the Russian Federation provides for criminal liability for non-payment of wages, pensions, scholarships, benefits and other payments.

Partial non-payment of wages for more than three months, committed out of selfish or other personal interest by the head of the organization, the employer - an individual, the head of a branch, representative office or other separate structural unit of the organization, is punishable by:

• a fine of up to 120,000 rubles. or in the amount of wages or other income of the convicted person for a period of up to one year, or

• deprivation of the right to hold certain positions or engage in certain activities for a period of up to one year, or

• forced labor for up to two years, or

• imprisonment for up to one year.

In this case, partial non-payment of wages means making a payment in the amount of less than half of the amount due.

Complete non-payment of wages for more than two months or payment of wages for more than two months in an amount below the minimum wage established by federal law, committed out of selfish or other personal interest by the head of the organization, the employer - an individual, the head of a branch, representative office or other separate structural unit of the organization , is punished:

• a fine in the amount of 100,000 to 500,000 rubles. or in the amount of wages or other income of the convicted person for a period of up to three years, or

• forced labor for a period of up to three years with or without deprivation of the right to hold certain positions or engage in certain activities for a period of up to three years, or

• imprisonment for a term of up to three years with or without deprivation of the right to hold certain positions or engage in certain activities for a term of up to three years.

If partial or complete non-payment of wages entails serious consequences, then more severe penalties are established:

• a fine in the amount of 200,000 to 500,000 rubles. or in the amount of wages or other income of the convicted person for a period of one to three years, or

• imprisonment for a term of two to five years with or without deprivation of the right to hold certain positions or engage in certain activities for a term of up to five years.

IMPORTANT:

The judges of the Federal Antimonopoly Service of the Moscow District rejected the argument of the fiscals that the company, in violation of Article 255 of the Tax Code of the Russian Federation, reduced the tax base for income tax on expenses in the form of compensation for the delay in paying wages, as not complying with the legislation of the Russian Federation and the materials of the case. Based on this, monetary compensation for late payment of wages due to the applicant’s employees, in their opinion, was wrongfully excluded by the tax authority from expenses (Resolution of the Federal Antimonopoly Service of the Moscow District dated March 11, 2009 No. KA-A40/1267-09).

The accrual of interest in connection with late payment of wages does not exclude the employee’s right to indexation of the amounts of delayed wages due to their depreciation due to inflationary processes.

If the day of payment of wages coincides with a day off or a non-working holiday, its payment must be made on the eve of this day (paragraph 12 of Article 136 of the Labor Code of the Russian Federation). So, if the salary payment day falls, for example, on Sunday, then payment on Monday is considered overdue. And the employee in this case has the right to demand payment of monetary compensation.

In accounting, compensation for late payment of wages is included in other expenses (clause 11 of the Accounting Regulations “Expenses of the Organization” (PBU 10/99), approved by order of the Ministry of Finance of Russia dated 05/06/99 No. 33n).

The head of the organization, as well as other officials who have delayed the payment of wages, may be subject to disciplinary, administrative and criminal liability in accordance with current legislation.

Dmitry KABULOV, expert of Alpine Wind LLC