SUBJECT OF THE EMPLOYMENT AGREEMENT

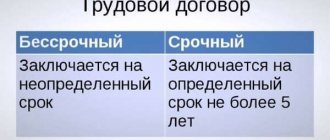

1.1. The employee is hired by the Employer to perform work in a position in.

1.2. The employee is required to start working in 2021.

1.3. This employment contract comes into force from the moment it is signed by both parties and is concluded for an indefinite period.

1.4. The work under this agreement is the main one for the Employee.

1.5. The Employee's place of work is at: .

Articles on the topic (click to view)

- Legal address for LLC registration

- Universal transfer document (UDD)

- Within 3 years from the date of state liquidation, tax authorities can return to the liquidated company.

- Russian Patent Office Rospatent: functions, structure and features of interaction

- Criminal procedural guarantees: concept, types, meaning.

- Conditional release of goods subject to technical regulation measures

- Simplified bankruptcy procedure for individuals: bill 2021

What documents are needed to draw up an employment contract?

The employee submits the following documents to the personnel department of the enterprise in which he plans to work:

- Passport.

- Diploma of completion of a higher or secondary specialized institution.

- Work book.

- Certificate of assignment of TIN.

- Certificate of state pension insurance.

- Medical insurance policy.

- Military ID.

If an employee is officially employed for the first time, the employer is obliged to help with the preparation of a work book, insurance certificate and TIN.

Those who draw up a part-time contract, instead of a work book, are required to present a copy of it or a certificate from the place of their main job.

The employer must familiarize the employee in detail with the work rules and internal documentation related to upcoming activities in this organization. The employee puts his own signature, which confirms his familiarization with the documents and his willingness to undertake the responsibility to fulfill the above.

Important!

The requirements for drawing up an employment contract are established by Art. 57 Labor Code of the Russian Federation

RIGHTS AND OBLIGATIONS OF THE PARTIES

2.1. The employee reports directly to the General Director.

2.2.1. Perform the following job responsibilities: .

2.2.2. Comply with the internal labor regulations established by the Employer, production and financial discipline, and conscientiously perform their job duties specified in clause 2.2.1. this employment contract.

2.2.3. Take care of the Employer’s property, maintain confidentiality, and not disclose information and information that is a trade secret of the Employer.

2.2.4. Do not give interviews, conduct meetings or negotiations regarding the activities of the Employer without the permission of its management.

2.2.5. Comply with labor protection, safety and industrial sanitation requirements.

2.2.6. Contribute to the creation of a favorable business and moral climate at work.

2.3.1. Provide the Employee with work in accordance with the terms of this employment contract. The Employer has the right to require the Employee to perform duties (work) not stipulated by this employment contract only in cases provided for by the labor legislation of the Russian Federation.

2.3.2. Ensure safe working conditions in accordance with the requirements of the Safety Regulations and labor legislation of the Russian Federation.

2.3.3. Pay the Employee in the amount established in clause 3.1. this employment contract.

2.3.4. Pay bonuses and remuneration in the manner and on the terms established by the Employer, provide financial assistance taking into account the assessment of the Employee’s personal labor participation in the Employer’s work in the manner established by the Regulations on remuneration and other local acts of the Employer.

2.3.5. Carry out compulsory social insurance for the Employee in accordance with the current legislation of the Russian Federation.

2.3.6. Pay for training, if necessary, in order to improve the Employee’s qualifications.

2.3.7. Familiarize the Employee with labor protection requirements and internal labor regulations.

- the right to provide him with the work specified in clause 1.1. this employment contract;

- the right to timely and full payment of wages;

- the right to rest in accordance with the terms of this employment contract and legal requirements;

- other rights granted to employees by the Labor Code of the Russian Federation.

- encourage the Employee in the manner and amount provided for by this employment contract, the collective agreement, as well as the conditions of the legislation of the Russian Federation;

- bring the Employee to disciplinary and financial liability in cases provided for by the legislation of the Russian Federation;

- exercise other rights granted to him by the Labor Code of the Russian Federation.

Minimum wage

In addition to the fact of reflecting salary information, the level of remuneration is also mandatory for compliance. The salary of someone who has worked the full standard time or who has fulfilled the full standard of work under a piecework contract cannot be lower than the minimum wage established by law. From January 1, 2021, the federal minimum wage is 12,130 rubles.

In a subject of the federation, it is allowed to establish a higher regional minimum wage than the federal one, taking into account socio-economic conditions. Minimum wage in individual regions of the federation in 2021:

| Region | Minimum wage, rub. |

| Moscow | 20 195 |

| Saint Petersburg | 19 000 |

| Kaliningrad region | 13 000 |

| Leningrad region | 12 800 |

| Moscow region | 15 000 |

| Rostov region | 14 556 |

| Republic of Tatarstan (except for budget employees) | 14 000 |

It is the regional minimum wage that the employer focuses on when setting the minimum wage for employees.

CONDITIONS OF PAYMENT FOR EMPLOYEES

3.1. For the performance of labor duties, the Employee is paid a salary in the amount of rubles per month.

3.2. When performing work of various qualifications, combining professions, working outside normal working hours, at night, on weekends and non-working holidays, etc. The employee is paid the following additional payments:

3.2.1. Work on weekends and non-working holidays is paid double.

3.2.2. An employee who performs for the same employer, along with his main work stipulated by an employment contract, additional work in another profession (position) or performing the duties of a temporarily absent employee without being released from his main job, is paid additionally for combining professions (positions) or performing duties of a temporarily absent employee in the amount determined by the additional agreement to this agreement.

3.2.3. Overtime work is paid for the first two hours of work at least one and a half times the rate, for subsequent hours - at least twice the rate. At the Employee's request, overtime work, instead of increased pay, may be compensated by providing additional rest time, but not less than the time worked overtime.

3.3. Downtime caused by the employer, if the Employee warned the employer in writing about the start of downtime, is paid in the amount of at least two-thirds of the Employee’s average salary.

Downtime due to reasons beyond the control of the employer and the Employee, if the Employee has warned the employer in writing about the start of downtime, is paid in the amount of at least two-thirds of the tariff rate (salary). Downtime caused by the Employee is not paid.

3.4. The conditions and amounts of payment of incentives by the Company to the Employee are established in the collective labor agreement.

3.5. The Employer pays wages to the Employee in accordance with the “Regulations on Remuneration” in the following order: .

3.6. Deductions may be made from the Employee's salary in cases provided for by the legislation of the Russian Federation.

Drawing up a contract with piecework payment

It is permissible not to indicate a specific salary figure in the employment contract in the only case - if the employee has a piece-rate wage system. This method is used in organizations where the use of labor standards is realistic, mainly in manufacturing enterprises. This system is designed to stimulate an increase in the volume of manufactured products. For the production of a unit of product, the performance of a certain amount of work, a piece rate is established. Based on it, the amount of the employee’s salary is calculated.

WORKING AND REST TIMES

4.1. The employee is assigned a five-day working week of 40 (forty) hours. Weekends are Saturday and Sunday.

4.2. During the working day, the Employee is given a break for rest and food from one hour to one, which is not included in working hours.

4.3. Work of the Employee in the position specified in clause 1.1. agreement is carried out under normal conditions.

4.4. The employee is granted annual leave of 28 calendar days.

Vacation for the first year of work is granted after six months of continuous work in the Company. In cases provided for by labor legislation, at the request of the Employee, leave may be granted before the expiration of six months of continuous work in the Company. Leave for the second and subsequent years of work may be provided at any time of the working year in accordance with the order of provision of annual paid leave established in this Company .

Expert opinion

Musikhin Viktor Stanislavovich

Lawyer with 10 years of experience. Specialization: civil law. Member of the Bar Association.

4.5. For family reasons and other valid reasons, the Employee, at his request, may be granted short-term leave without pay.

Is it necessary to indicate the place and address of work in an employment contract?

The Labor Code of the Russian Federation most clearly distinguishes between the concepts of “place of work” and “workplace”. The term “workplace” is used repeatedly in the code (Article 72.2, subparagraph “a”, “b”, paragraph 6, part 1, Article 81, Article 142 of the Labor Code of the Russian Federation, etc.). Part 6 of Article 192 of the Labor Code of the Russian Federation states that a workplace is a place where an employee must be or where he needs to arrive in connection with his work and which is directly or indirectly controlled by the employer.

Please note that the workplace condition does not apply to the mandatory terms of the employment contract and can be indicated as an additional one along with the mandatory work place condition. However, its stipulation in the employment contract may be significant

Firstly, in order for the employee to exercise the right to labor protection and the employer to fulfill the corresponding obligation. So, for example, according to Part 1 of Art. 21 of the Labor Code of the Russian Federation, the basic rights of an employee include the right to a workplace that meets state regulatory requirements for labor protection.

Secondly, fixing the terms of the place of work in the employment contract will be important for determining the procedure for moving the employee to another workplace. According to Part 3 of Article 72.1 of the Labor Code of the Russian Federation, if the condition of the workplace was not defined in the employment contract, then the employee’s consent to move him from the same employer to another workplace located in the same area is not required. If the terms of the workplace were determined in the employment contract, then the employer does not have the right to change it unilaterally.

Thirdly, the inclusion of a workplace provision in an employment contract is important in the event of termination of the contract or application of other disciplinary measures to the employee for absenteeism (subparagraph “a”, paragraph 6, part 1, article 81, articles 192 and 193 of the Labor Code of the Russian Federation )

Since absenteeism in the Labor Code of the Russian Federation means the absence of an employee from the workplace without good reason.

Fourthly, the workplace condition will be mandatory for the employee to exercise his right to be absent from the workplace during the period of suspension of work caused by the employer’s violation of the terms of payment of wages and other amounts (Article 142 of the Labor Code of the Russian Federation). In this case, the use of the term “workplace” does not correspond to the purposes of legal regulation, since it assumes that the employee is obliged to appear at the place of work (on the employer’s territory).

The fact is that the terms “workplace” and “place of work” have different independent legal meanings. While the purpose of this rule is to provide the employee with the opportunity not to appear at work (on the employer’s premises) at all and not to incur associated costs for travel, food, etc.

As we can see, defining a workplace condition in an employment contract is necessary if the parties to the contract pursue specific legal goals. First of all, in our opinion, this is necessary in the interests of the employee, who is interested not just in a certain place of work, but also in a specific workplace.

Father-in-law wrote: Art. 57 of the Labor Code of the Russian Federation The employment contract specifies working conditions at the workplace

Art. 212 of the Labor Code of the Russian Federation The employer is obliged to ensure: - a special assessment of working conditions. -informing workers about labor conditions and safety in the workplace.

Federal Law from SOUT, art. 17 1. An unscheduled special assessment of working conditions should be carried out in the following cases: 1) commissioning of newly organized workplaces. 2. An unscheduled special assessment of working conditions is carried out at the relevant workplaces within twelve months from the date of occurrence of the cases specified in paragraphs 1.

We suggest you read: Vehicle rental agreement with driver

How to fulfill the requirement of Art. 57 before receiving the results of the SUT at the new workplace?

Gitovets got hooked on this. The labor contract does not contain information about working conditions in the workplace, because there is nowhere to get this information from; 6 months (now 12) for carrying out special labor and labor conditions have not yet expired.

There is no need to wait until 12 months are up; you need to complete the SOUT within 12 months. Draw up an agreement with the organization conducting the SOUT, so at least there will be a reason that you have at least done something. First send your application by official letter and don’t forget to take the incoming number.

Messages: 523 Points: 540 Registration: 01-02-2016

How to fulfill the requirement of Art. 57 and art. 212 (informing workers about the conditions at the workplace) before receiving the results of the SOUT at the new workplace?

To help, lists for additional leave and a shortened working day and a standard provision on lists of work with equipment, plus the results of production control over sanitary regulations

Messages: 981 Points: 994 Registration: 05/14/2014

How did the GITovets propose to describe this situation in the TD, if the deadline for carrying out the SOUT has not yet expired?

- You can leave if you want. “Then I guess I’ll go.” - But keep in mind - we have long arms! - Then I guess I’ll stay...

Messages: 719 Points: 724 Registration: 10/17/2012

Maria Maria wrote: How did the GITovets propose to describe this situation in the TD, if the deadline for carrying out the SOUT has not yet expired?

But for him, the fact of violation of Art. Art. is simply obvious. 57 and 212 of the Labor Code of the Russian Federation. Already getting a fine.

registered mass media, certificate El No. FS77-39732 dated 05/06/2010.

ATTENTION! Any use of site materials is possible only in strict accordance with the established Rules. Any commercial use of site materials and their publication in print media is permitted only on the basis of agreements concluded in writing.

The User's use of the site's services is possible only under the conditions provided for in the User Agreement.

The site has an error correction system. If you find any kind of error, as well as information that does not comply with moral standards, violates the rights of third parties or the legislation of the Russian Federation, please select it and press Shift Enter. To send any page of the site to “My Bookmarks”, press Ctrl Z.

An employer is an individual who is not an individual entrepreneur, but may be a person who hires employees to run a personal, subsidiary or household household. For example, a citizen who has a large vegetable garden hires a gardener to help him. Moreover, his activities are not related to making a profit from this vegetable garden. He grows fruits and vegetables for personal consumption.

Such an employer does not have the right to make entries in the work books of employees, as well as to open a new work book for the employee. The guarantee of labor relations in this case will be a written employment contract.

Important: such an employer notifies the local government authorities at the place of his residence about the hiring and dismissal of employees.

Don't know your rights?

RESPONSIBILITY OF THE PARTIES

7.1. In case of failure or improper performance by the Employee of his duties specified in this agreement, violation of labor legislation, the Employer’s internal labor regulations, other local regulations of the Employer, as well as causing material damage to the Employer, he bears disciplinary, material and other liability in accordance with the labor legislation of the Russian Federation.

7.2. The Employer bears financial and other liability to the Employee in accordance with the current legislation of the Russian Federation.

7.3. In cases provided for by law, the Employer is obliged to compensate the Employee for moral damage caused by unlawful actions and (or) inaction of the Employer.

Is it necessary to indicate the place and address of work in an employment contract?

Due to the imprecise wording of the law regarding the indication of certain information, the question is often asked whether it is necessary to indicate the address of the place of work in an employment contract. Art. 57 of the Labor Code of the Russian Federation establishes a mandatory procedure for entering this data. They represent the specific address of the organization as a legal entity along with its name.

According to the above-mentioned Article 57, it is prohibited to indicate two places of work. This situation is due to the fact that recording this information essentially means the name of the organization, which can only be written down one way. The inability to clarify the two places of work arises due to the likelihood of conflict in determining where job duties and functions should be performed, as well as the issue of remitting taxes.

If an employee is transferred to another workplace, in the event of an organization move or promotion, the company must necessarily take into account the employee’s opinion. His consent must be obtained

If this condition is met, a new document is drawn up at the enterprise, which is called an additional agreement. It must contain the following information:

- Information about the document to which the addition relates;

- Date of registration;

- Description of job responsibilities and time;

- Transfer deadlines;

- A reference to the fact that unspecified items remain unchanged.

The agreement must be drawn up in two copies, which the employee must read and sign if he agrees.

The indication of the place of work is established in the contract as a mandatory clause. However, the question arises as to what address should be indicated if the employee is outside the organization and performs his duties remotely. In practice, this often happens. The answer is in Art. 312.2 Labor Code of the Russian Federation. The remote employee must indicate the address of the employer, as well as the name of the organization.

It is quite possible to change information about the workplace in an employment contract. The reason for this may be moving to another branch. In this situation, an additional agreement should be drawn up in accordance with Art. 57 of the Labor Code of the Russian Federation, which will indicate new relevant information. If you change your employer, such a change will be impossible, since in this case the agreement with one employer is terminated and a new one is concluded with another.

FINAL PROVISIONS

9.1. The terms of this employment contract are confidential and are not subject to disclosure.

9.2. The terms of this employment contract are legally binding on the parties from the moment it is signed by the parties. All changes and additions to this employment contract are formalized by a bilateral written agreement.

9.3. Disputes between the parties arising during the execution of an employment contract are considered in the manner established by the current legislation of the Russian Federation.

9.4. In all other respects that are not provided for in this employment contract, the parties are guided by the legislation of the Russian Federation governing labor relations.

9.5. The agreement is drawn up in two copies having equal legal force, one of which is kept by the Employer and the other by the Employee.

4.1. Payment of wages to Employees is made in cash in the currency of the Russian Federation (in rubles).

Expert opinion

Musikhin Viktor Stanislavovich

Lawyer with 10 years of experience. Specialization: civil law. Member of the Bar Association.

The salary of each Employee depends on his qualifications, the complexity of the work performed, the quantity and quality of labor expended and is not limited to the maximum amount, except for cases provided for by the Labor Code of the Russian Federation.

4.2. The remuneration of Employees is established:

a) on the basis of the Labor Code of the Russian Federation, this Agreement, regulations on remuneration, other regulatory legal acts containing labor law norms, and other local regulations regulating the procedure, conditions and grounds for assigning incentive and compensation payments;

b) taking into account the requirements of the unified tariff and qualification directory of works and professions of workers, the unified qualification directory of positions of managers, specialists and employees or professional standards, as well as taking into account state guarantees for wages, recommendations of the Russian Tripartite Commission for the Regulation of Social and Labor Relations and opinions relevant trade unions (associations of trade unions) and associations of employers;

c) taking into account state guarantees for wages (Article 130 of the Labor Code of the Russian Federation).

4.3. The amounts and conditions for making incentive and compensation payments are determined by the Employer in accordance with the legislation of the Russian Federation and are enshrined in the regulations on wages and other local regulations of the Employer regulating the procedure, conditions, grounds for incentives and compensation payments.

In order to exercise this right, the Employer develops regulations on wages and other local regulations governing the procedure, conditions, grounds for incentives, compensation payments, which are adopted by the Academic Council of the Employer in agreement with the Trade Union Committee of the Trade Union organization and approved by the Employer.

4.4. For the performance by the Employee of additional types of work that are not included in the scope of his direct duties established by the employment contract and job description at the main place of work, the Employee may be provided with additional payment on the basis of a concluded additional agreement to the existing employment contract.

4.5. The Employer’s remuneration system for Employees includes:

– amounts of salaries (official salaries), monthly wage rates in accordance with the regulations on remuneration adopted by the Employer;

– compensation payments in accordance with the Employer’s local regulations governing the procedure, conditions, and grounds for assigning compensation payments;

– incentive payments in accordance with the Employer’s local regulations governing the procedure, conditions, and grounds for incentives at the Employer.

Compensation payments are established for Employees:

– for work under special conditions according to the list of heavy work, work with harmful and (or) dangerous and other special working conditions, determined by the Government of the Russian Federation (Article 147 of the Labor Code of the Russian Federation);

– for work in working conditions that deviate from normal, in the amounts provided for by law (Articles 149–154 of the Labor Code of the Russian Federation) and this Agreement, namely:

a) when performing work of various qualifications;

b) when combining professions, increasing the volume of work, expanding service areas, when performing the duties of a temporarily absent Employee;

d) when working on weekends and non-working holidays;

– for work in areas with special climatic conditions (Article 148 of the Labor Code of the Russian Federation);

– allowances for working with information constituting state secrets, their classification and declassification, as well as for working with codes.

4.6. The Employee's downtime is paid in accordance with Art. 157 Labor Code of the Russian Federation.

4.7. In accordance with Art.

136 of the Labor Code of the Russian Federation, payment of wages to Employees, as a rule, is carried out by transferring funds to the Employees’ personal accounts opened in the relevant banks. The employment contract with the Employee may stipulate that the place of payment of wages is the Employer's cash desk (the cash desk of its structural divisions).

4.8. When paying wages, the Employee is notified in writing of the amount and components of wages, deductions and the amount of payment for the corresponding period in the form of a pay slip.

The payslip is issued by the Accounting and Reporting Department of the Employer.

4.9. The deadlines for payment of wages for the first half of the month and the final payment for the month for employees of the main structural divisions are set on the 20th day of the current month and the 5th day of the month following the month worked, respectively.

The deadlines for payment of wages for the first half of the month and the final payment for the month for employees of other structural divisions are established on the 21st day of the current month and the 6th day of the month following the month worked, respectively (Article 136 of the Labor Code of the Russian Federation).

4.10. Payment for vacation is made no later than three days before its start in accordance with Art. 136 Labor Code of the Russian Federation.

4.11. Payment of all amounts due to the Employee upon dismissal is made on the day of dismissal (Article 140 of the Labor Code of the Russian Federation).

4.12. If, upon dismissal of an Employee, there are mutual claims between the Employer and the Employee, including due to failure to fulfill the agreement on full financial liability (Article 244 of the Labor Code of the Russian Federation) of the dismissed Employee, payment of the undisputed amount due to the Employee is made on the day of his dismissal (Article 244 of the Labor Code of the Russian Federation). 140 Labor Code of the Russian Federation).

4.13. The Employer and (or) authorized person who delayed the payment of wages to Employees and other violations of wages bear liability established by Art. 142, 236 Labor Code of the Russian Federation.

In accordance with Art. 236 of the Labor Code of the Russian Federation, in case of violation of the established deadline for payment of wages, the employer is obliged to pay the delayed amount with payment of interest (monetary compensation) in the amount of one hundred and fiftieth of the key rate of the Central Bank of the Russian Federation in force at that time of the amount unpaid on time for each day of delay starting from the next day after the due date for payment up to and including the day of actual settlement.

In case of incomplete payment of wages and (or) other payments due to the employee on time, the amount of interest (monetary compensation) is calculated from the amounts actually not paid on time.

4.14. Compensations and guarantees established when Employees perform labor or other duties provided for by federal laws are provided on the grounds and in the amount of reimbursement of expenses provided for in Art. 165–188 of the Labor Code of the Russian Federation and local acts of the Employer:

– when sent on business trips;

– when moving to work in another area;

– in the performance of federal or public duties;

– in case of forced termination of work through no fault of the Employee;

– when providing annual paid leave;

– due to a delay due to the fault of the Employer or persons authorized by him in issuing a work book upon dismissal of the Employee;

– in some cases, termination of an employment contract;

– when transferring the Employee to another permanent lower-paid job;

– in case of an accident at work and occupational disease;

– when referred for a medical examination;

– when the Employee donates blood and its components;

– when sending an Employee for advanced training;

– in case of an accident at work and occupational disease;

– when using the Employee’s personal property.

4.15. Teaching Employees, no less than every 10 years of continuous teaching work, have the right to a long leave of up to one year, granted for writing monographs, textbooks, teaching aids, other scientific works, and in other cases only after completing the annual workload.

Depending on the purpose of the leave, the financial capabilities of the Employer, leave at the request of the teaching Employee can be provided with full, partial pay, or without pay. The decision on granting leave and the form of payment for it is made by the Employer on the recommendation of the Academic Council of the Employer.

4.16. Payments of a social nature are made by the Employer on the basis of the Employee’s application, taking into account the opinion of the Trade Union Committee of the Trade Union organization from the Employer’s funds in accordance with the standards approved by order of the Employer for each financial year.

The main areas of spending for these purposes:

– a one-time payment for special services to the Employer to distinguished professors and distinguished teachers of KFU resigning due to retirement. The specified payment is established by order of the Employer on the basis of a petition from the Academic Council of the Institute (Faculty) of KFU and the submission of the Trade Union Committee of the Trade Union Organization of Workers.

The amount of payment is established depending on the Employee’s work experience at KFU and can be: for emeritus professors - up to 10 times the monthly salary (excluding bonuses and hourly wages) for the main position based on the rate occupied (share of the rate) at the time of training petitions; for distinguished teachers - up to 6 times the monthly salary (excluding bonuses and hourly wages) for the main position based on the occupied rate (share of the rate) at the time of preparation of the application;

– monthly social payments until reaching adulthood in the amount of 2 minimum wages to orphans, one of whose parents was an Employee at the time of death and made a significant contribution to the activities of the KFU. The specified payments are assigned by order of the Employer upon the recommendation of the administration;

– monthly social payments in the amount of 2 minimum wages to students for the period of study at KFU, one of whose parents at the time of death was an Employee and made a significant contribution to the activities of KFU. The specified payments are assigned by order of the Employer upon the recommendation of the administration.

4.17. Social insurance of Employees is carried out and guaranteed:

Expert opinion

Musikhin Viktor Stanislavovich

Lawyer with 10 years of experience. Specialization: civil law. Member of the Bar Association.

– implementation of the federal laws “On the Basics of Compulsory Social Insurance”, “On State Benefits for Citizens with Children” and other regulatory legal acts in the field of social insurance;

– mandatory registration of the Employer with the territorial tax authority and the territorial authority for social, pension and health insurance;

– mandatory deduction (payment) of insurance premiums in the amounts and terms established by law.

An employment contract with an employee is an agreement between the employer (company or individual entrepreneur) and the employee (individual), according to which the employee undertakes to perform certain work, and the employer is obliged to provide the employee with work, pay wages on time and create working conditions that comply with the law.

The content of an employment contract is not strictly regulated by law and can be changed and supplemented depending on the specifics of the enterprise and the duties performed.

An employment contract with an employee can only be terminated by mutual consent of the employer and employee, or if one of the parties fails to fulfill its obligations. Termination of an employment contract cannot be carried out if the employee is on vacation, sick leave, etc.

The employment contract is drawn up in two copies - one for each party to the employment agreement.

Contents and sections

The agreement must reflect the following information:

- Details and information about the parties. The number of the agreement, the date of its preparation, and the place of execution are indicated. Full name must be indicated. citizen, company name, full name. and the position of representative of the organization.

- General provisions. The section indicates who is being accepted for what position. The text records the fact of part-time work and indicates the duration of the contract. When concluding an employment contract with the general director, permission for part-time work is required from the owner of the organization.

The working hours in a part-time employment contract must be included in the text.

- Rights and responsibilities of an employee.

A citizen has the right:

- to provide specified work;

- for safe working conditions;

- for full and timely remuneration;

- other rights provided for by law.

The employee undertakes:

- perform the duties assigned to him;

- follow the internal rules;

- treats the tenant's property with care;

- comply with labor protection requirements.

In addition to standard provisions, a number of specific responsibilities should be included in the text of the document. It is unlikely that a separate job description will be developed for such an employee.

Thus, an employment contract with a part-time accountant may include a number of responsibilities:

- carry out reconciliations with counterparties regarding the facts of deliveries;

- issue invoices for the shipment of goods and material assets.

- Rights and obligations of the employer.

The employer can:

- adopt regulations affecting the activities of the employee;

- reward an employee for effective work;

- hold him accountable for the offenses committed;

- require the employee to perform his duties.

The employer is obliged:

- provide the employee with the agreed work;

- ensure safety in the workplace;

- provide the necessary tools and materials;

- transfer the agreed remuneration on time.

Payment Regulations

It is important to reflect in the document how much the employee will receive for his work. An alternative option is to establish production standards with appropriate payment based on results

An alternative option is to establish production standards with appropriate payment based on results.

- Social insurance is carried out in accordance with the legislation of the Russian Federation.

- The parties may be held liable in accordance with the standards established in the regulations of the Russian Federation.

- Other conditions. Persons can stipulate the procedure for storing trade secrets, processing personal data, etc.

- The procedure for changing and terminating an employment contract. An employee working part-time can be dismissed on special grounds. The agreement terminates if a full-time person is found to fill the position.

The text of the agreement is changed with the consent of each party.

- At the end of the document, the names of the parties, addresses, details are indicated, and signatures are placed. A part-time employment contract with a director, drawn up according to the sample, is signed by a representative of the organization’s governing body, for example, the chairman of the general meeting of participants.

The employment contract must indicate (Part 1 of Article 57 of the Labor Code of the Russian Federation):

- surname, name, patronymic of the employee;

- name of the employer or surname, name, patronymic of the employer - an individual;

- information about the employer’s representative who signed the employment contract, and the basis on which he is vested with the corresponding authority.

The authority may be provided for by the employer’s constituent documents (charter), a local regulatory act (for example, an order granting powers to an employee), an employment contract, job description or law;

- information about documents proving the identity of the employee and the employer - an individual;

- taxpayer identification number;

- place and date of conclusion of the contract.

At the same time, the conditions that are included in the employment contract are divided into mandatory and additional.

Responsibilities of employer and employee

An analysis of an employment contract is carried out to ensure that all provisions of the contract comply with current legislation. Violation of these standards may result in adverse consequences for both the employee and the employer.

The main responsibilities of the employer:

- Provide the employee with work in accordance with the job description.

- Pay employees for work performed on time.

- Provide comfortable and decent working conditions.

- Ensure safe working conditions.

The employee’s responsibilities as specified in the employment contract are to perform functional duties taking into account the interests of the employer and under his control.

There are a number of mandatory requirements for concluding an employment contract. Thus, the employment contract must be concluded in writing and in two copies. Each copy is signed by both parties.

It is worth noting that all such agreements can be concluded in two forms:

- For a specified period not exceeding 5 years.

- For an unlimited period.

An oral form of an employment contract is permitted by law if the citizen began performing work with the consent of the manager (that is, received permission). The validity period of an oral agreement cannot exceed three days. This is explained by the fact that the employee is in fact already doing his job. He does this either by order of the employer’s representative or with his knowledge.