Distribution of property deduction for shared property of spouses

When registering ownership of purchased real estate, only a few indicate the general joint nature of ownership.

Basically, real estate is registered for one owner. For the purposes of obtaining a deduction for spouses, it does not matter whether it is common joint property or individual property, unless, of course, a marriage contract has been concluded providing for the separate nature of property ownership. In case of common joint ownership, the owners have the opportunity to distribute the deduction by filling out an application for distribution. What situations may arise and what to do when registering real estate as joint ownership:

- If the right to deduction arises before January 1, 2014:

- If in the future none of the owners plans to buy more real estate or will retire soon, then the deduction can be redistributed in proportion to the size of each person’s salary. The basis for such a redistribution of property deduction is the completed application. An application for redistribution of a property deduction does not require notarization. Thus, the time to receive a deduction is significantly reduced;

- If a new purchase of real estate is planned in the future, then the property deduction can be redistributed so that one of the owners receives the entire amount of the deduction (2 million rubles), and the second, having refused the deduction from this purchase, retains the right to deduct from the future. It is up to you to decide for which of the owners it is better to register: whether one of the owners is planning maternity leave, retirement, salary increase/decrease;

- If one of the owners has already exercised their right to deduction in the past, then the distribution statement allows the second owner to receive the full deduction.

- If the right to a deduction becomes available after January 1, 2014, the amount of the deduction is 2 million rubles for each owner, and it can be obtained with the next purchase. You can win here on the timing of receiving the deduction due to redistribution in favor of someone who has a higher salary and who does not plan to go on maternity leave in the next couple of years. In general, if there is no goal to get a deduction as quickly as possible, then you should not engage in redistribution. The rest of the tax deduction can be collected on your next purchase, unlike those who use the right to deduction received before 2014.

If a husband and wife bought an apartment as joint property, they jointly use and manage the property without allocating a share to each of them. Unless otherwise provided by law or contract, they are presumed to own equal shares.

The second regime assumes that the shares of the spouses are clearly defined. Moreover, they can be either the same or different.

A property tax deduction for the purchase of an apartment by spouses represents the right to monetary compensation for the costs incurred for the purchase of a real estate property. In other words, this is the amount by which the tax base is reduced.

Articles on the topic (click to view)

You can exercise this right immediately when purchasing an apartment or postpone it until the home is sold. The choice remains with the taxpayer.

As noted earlier, changes were made to tax legislation in 2014. If housing was purchased before January 1, 2014 in common shared ownership, the tax discount is distributed in accordance with the established shares.

Many people are interested in whether a husband can return apartment taxes for his wife. According to the law in force at that time, neither party can refuse its share or receive a deduction for another person. Everything is determined within the spouse's share.

If the property was acquired as a joint property, then, regardless of who incurred the expenses, the couple is considered to have participated in them jointly.

Therefore, answering the question of which spouse can receive a tax deduction, we can safely say - any of them. By default, it is distributed in equal shares, but the couple can, by agreement, distribute it in any proportion.

The conditions for granting the deduction depend on what type of property ownership the spouses have. Changes are taken into account if the extract from the Unified State Register indicates a state registration date later than January 1, 2014.

We have already figured out whether both spouses can receive a tax deduction when buying an apartment. It was also mentioned that it directly depends on the type of property in which the housing is located.

In most cases, the couple prefers to split the discount. To take advantage of the maximum possible limit (2 million each), you need to make a 50/50 split.

If a husband and wife decide that one of them will receive 100% and the other nothing, they will not be able to count on more than 2 million.

This point should be taken into account by those who are interested in whether it is possible to obtain a tax deduction when purchasing an apartment for both spouses.

Most often, spouses in our country own joint property, without allocating shares, since they do not think about dividing property before the dissolution of the marriage relationship.

All expenses are by default recognized as common, regardless of who actually incurred them. As a result, many are interested in how to get a deduction if the apartment is in common joint ownership.

It is important to correctly distribute the ratio according to which the spouses will receive a deduction, because after writing the application, the conditions cannot be changed.

It is more profitable to choose the 50/50 option, but after analyzing the situation, perhaps some will come to the conclusion that a different ratio will be more profitable for them.

To better understand the situation, let's look at an example. Tax deductions for the purchase of an apartment by spouses as joint property in 2021 will occur as follows.

The Ivanov family purchased an apartment worth 5 million rubles in 2021. The husband earned 3 million rubles this year, and his wife earned 2.5 million rubles. The couple decided to take a 50/50 deduction. Therefore, both will receive a deduction of 2 million rubles. × 13% = 260 thousand rubles.

Many citizens also ask how to return a tax deduction for the purchase of an apartment in shared ownership, because common shared ownership is a common type of property ownership among married couples.

After January 1, 2014, significant changes occurred in the calculation of tax deductions for this category of cases.

If previously the size of the deduction directly depended on the share of each person, today the property tax deduction for common shared ownership is calculated based on the actual expenses incurred.

We invite you to read: Complaint to the tax office: sample 2020

In this case, the couple can independently distribute expenses as they see fit. The main thing is that this is confirmed by payment documents.

If one of the couple does not work, it is worth documenting the expenses for the working spouse.

If the property is shared, let's look at how the tax is returned using an example. The Ivanovs purchased an apartment in shared ownership in 2021, each of them owns ½ part. During the current year, the husband earned 2.5 million rubles, and his wife did not work. In this case, the husband will be able to count on 2 million rubles. × 13% = 260 thousand rubles, and his wife will receive a tax deduction only when she gets a job.

In accordance with the law, it is also possible to return personal income tax on mortgage interest in shared ownership.

If the living space was purchased by both spouses and is registered as joint ownership together with a minor child/children, the parents or one of them can receive a tax deduction for the children’s shares.

In addition, one of the parents or both spouses has the right to increase the amount of their deduction at the expense of the minor’s share. The spouses themselves decide what to do in this case.

Let's figure out how to make a deduction for spouses for one apartment. It is worth noting that the entire accrued amount is not paid instantly at one time. How much was withheld from tax this year will be returned.

All documents should be submitted to the district tax office at your place of residence. The address of the purchased property, as well as the actual place of residence, do not matter.

There are several ways to submit documents:

- bring it in person to the department;

- send by mail;

- submit online.

Tax deductions for property in your personal account are possible on the official website of the Federal Tax Service of Russia.

Required documents

Along with the application for a deduction, the following package of documents must be submitted to the tax office:

- applicants' passports;

- certificate of registration of property rights or an extract from the Unified State Register of Real Estate;

- income certificate form 2 personal income tax;

- purchase and sale agreement or equity participation agreement;

- act of transfer of shared construction object;

- declaration 3-NDFL;

- documents confirming the fact of transfer of money.

The declaration of form 3-NDFL must be submitted in the original. In order to correctly fill out the document, you can seek help from the clarifications from the letter of the Federal Tax Service dated 08/06/2013 No. ED-4-3/14346 “On the procedure for filling out section 7 of the VAT return for calculating VAT”. Section 7 of VAT on the sale of an apartment is described in detail here.

The financial situation of many families does not allow them to immediately purchase housing with their own money. Therefore, for many, the solution is to buy an apartment on credit.

This procedure is very common, but many are interested in the question of whether it is possible to get a tax deduction when buying an apartment with a mortgage for two spouses.

When purchasing housing with a mortgage, you can register it as shared or common joint property of the spouses. When a couple buys a home on credit, one of them is in any case a borrower, and the second is a co-borrower.

Depending on who earns more, the main person under the mortgage agreement is selected.

According to the law, if the borrower is a husband, then the spouse can apply to grant him the right to a tax deduction.

In accordance with the changes that came into force in 2014, benefits are provided not in relation to the property, but in relation to its owner.

In this case, the deduction is first returned for the cost of real estate, and then for the cost of interest. A return of 13 percent from the purchase of an apartment on a mortgage by spouses is possible in both the first and second cases.

In addition to the other documents discussed above, along with the application if you purchase an apartment with a mortgage, you must submit a mortgage agreement. It must be targeted at the purchase of housing.

Education deduction

In this case, the deduction is due to everyone who is a full-time student, but who is under 24 years of age. At the same time, education must be paid. This includes either the citizens themselves or their parents.

The same applies to visiting paid schools and kindergartens. Also, money can be returned to those people who improved their skills or improved their specialty. In this case, the cost of expenses must exceed 50,000 rubles. If the taxpayer studied himself, then deductions are returned to him when the amount exceeds 120,000 rubles per year. This also includes payment for treatment, as well as pension contributions.

We bought an apartment and want to get deductions. How to arrange everything correctly now?

The deduction for the purchase of an apartment works on its own and is not related to the deduction for interest.

It doesn’t matter whether a family buys an apartment with a mortgage or with their own money. You can get 13% back on the entire amount of expenses within the limit. Every spouse can do this.

The costs of purchasing an apartment can be distributed among each other as you wish.

Example 1. An apartment costs 3 million rubles. The husband will claim 2 million deductions, and the wife only 1 million, or vice versa. Or they will divide the deduction equally - 1.5 million each. In any case, the state will return 390 thousand rubles to the family, and the rest of the deductions can be transferred to other objects.

Example 2. An apartment costs 4 million rubles. Both spouses can claim a deduction of 2 million rubles each and return not 260 thousand rubles of tax for two, but 520 thousand.

Example 3. An apartment costs 2 million rubles. The husband can receive the entire deduction now, and the wife uses her right when purchasing other real estate. Or both will now declare 1 million each, and another 1 million each when they build the house. In any case, you can return 260 thousand rubles from this apartment, and another 260 thousand later.

The Ministry of Finance says that spouses must agree on the distribution of property deductions when purchasing a specific apartment in advance and once - before they begin to receive tax refunds. It is supposedly impossible to redistribute the balance of the deduction when buying an apartment after the tax office has provided it and started returning personal income tax. This also applies to the remainder of the deduction, which will be transferred to the following years: the Ministry of Finance says that it also cannot be redistributed.

The Ministry of Finance says that the deduction cannot be redistributed. The IRS seems to agree with this. But the Supreme Court does not.

In the summer of 2021, the case of the spouses was considered, who first distributed the deduction equally, and then changed their minds: they entered into a marriage contract and the apartment with a mortgage went to the wife. She claimed a deduction, but the tax office only gave her half. Like, you agreed earlier, but you can’t change your mind. Two tax authorities supported it, and the Supreme Court overturned these decisions.

Said so. Both spouses are entitled to the full deduction. If the deduction cannot be used immediately and a balance appears, it is carried over to the next year. You can distribute the deduction and balance as you wish. Agreements can also be changed. The main thing is that the total deduction amount for each spouse is within the limit.

The central apparatus of the Federal Tax Service had a similar position. And this is despite the fact that the Ministry of Finance previously believed that it was impossible to redistribute the deduction.

It seems that the departments still have not reached an agreement. But you need to be aware of all positions in order to use them legally and to your advantage.

We invite you to familiarize yourself with: Application for loss of a driver’s license after deprivation: form and sample filling

This deduction is also due to both husband and wife. Each person receives a maximum of 3 million rubles within the limits of interest actually paid. But the remainder of this deduction cannot be transferred to other objects. But it can certainly be redistributed every year. The Ministry of Finance allows this.

Example. The couple paid 200 thousand rubles in mortgage interest for the year. We decided that the husband would return the tax on the entire amount in 2021. And in 2021, the amount of interest will be divided equally and everyone will return tax on half the amount. You just need to write an application and distribute the balance in a new way.

You can divide it as you like until the amount of interest on the mortgage reaches 3 million rubles for each person. Not for the whole family, not for one apartment, not for one loan, but specifically for everyone - a family can claim 6 million rubles as a deduction from interest and return 780 thousand rubles in taxes. Well, this is if the mortgage is very expensive or for a large amount.

If one of the spouses previously received a deduction for interest, but did not use all of it, they will not be allowed to claim it a second time. Therefore, it is also important to think through everything in advance. Maybe the husband will use the entire deduction for one apartment, and the wife will use it when they buy a second apartment. Suddenly she will also have a mortgage.

Even if it doesn’t appear, and you want to distribute the deduction differently, your tax office will decide. And as a last resort, there is a court. As you can see, he is not always on the side of the inspectors.

The deduction can be obtained from the employer or the tax office. It's the end of the year, so it's worth waiting until January to file your 2017 return to get your full tax refund at once. At the same time, you can receive a notification for 2021 so as not to pay personal income tax at all.

But every story has nuances. If in doubt, consult your tax office.

Whatever they answer, make allowance for the fact that inspectors themselves often do not know what is correct. Their responses were sent to us several times. We hope it will be different for you.

However, just because the apartment was purchased by legal spouses does not mean that the property is jointly owned. The fact that you are married does not deprive you of the right to determine the exact size of the share attributable to each of you and to register the apartment as common shared ownership. These two types of registration of ownership for the purpose of obtaining a property deduction are fundamentally different.

In addition, the type of right can be found in your certificate of registration of ownership. If there is no certificate yet, as a rule, the type of right is described in the contract (purchase and sale agreement, investment agreement in housing under construction or other agreement).

If the expenses for housing purchased as common joint property were more than 4 million rubles (or exactly 4 million rubles), the deduction does not need to be distributed. Each spouse can receive a deduction of 2 million rubles. 2 million rubles is the limit established by law.

If the expenses are less than 4 million rubles, the deduction is distributed in any proportion at the request of the spouses. This could be, for example, 50/50 or 30/70. The deduction for housing purchased as common joint property does not depend on who the apartment is registered in or who specifically contributed money to pay for it.

The deduction can be distributed even in the proportion of 100/0. With such a division, the spouse with a zero share of his legal right to a deduction does not lose and will be able to return the tax in the future on another property in full.

The distribution of the deduction does not entail the obligation of both spouses to submit documents to the tax office. If one of the spouses takes advantage of the right to deduction, but the second does not do so for some reason, the latter retains his right to return the tax in the future for subsequent home purchases.

To inform the tax office about your decision, you must document it. To do this, spouses need to draw up and sign an Agreement on the distribution of deductions. This document is submitted along with the 3-NDFL declaration (or an application for notification if you are going to receive a refund through your employer).

It is important to remember that the ratio is determined only once for each property. It will no longer be possible to change the proportion or transfer the remainder of the deduction to the spouse.

How to get the maximum deduction quickly and easily?

The easiest way is to quickly prepare the correct documents for the maximum refund and submit these documents with the Tax Office. With the Tax Inspectorate, the documents will be approved and you will not have to redo them. You will receive the correct documents and expert advice. And then you can choose whether to take the documents to the inspectorate yourself or submit them online.

If the right to a tax refund arose from January 1, 2014, then the interest deduction is distributed in the same proportion as the deduction for the apartment for which this mortgage was received. This is due to the fact that until 2014, the interest deduction was part of the deduction for the purchase of housing.

Since 2014, the deduction for mortgage interest has been enshrined in the Tax Code as a separate basis for a tax refund. In this regard, the ratio chosen to distribute the deduction over the apartment does not in any way affect the percentage in which the spouses decide to divide the return on the interest paid among themselves.

If housing was purchased after January 1, 2014, the ratio of the deduction from mortgage interest is determined by the spouses independently by concluding a separate Agreement on the distribution of the deduction. But this distribution procedure (two separate agreements) is just emerging, so we recommend not using it (and making one agreement - both for the cost of housing and for the mortgage interest) so that your return is processed as quickly and without problems as possible.

| Get the correct documents from the Tax website. With us, obtaining the correct documents for deductions (declaration and application) will be quick and easy. |

| Attach the list of documents to the declaration. The list of documents for deduction can be found in the “Useful” / “Documents for deduction” section of the website. |

| Submit documents and receive money. All you have to do is submit the prepared documents online through the Tax Office or take them to the inspectorate and receive the money. |

To obtain a completed return and tax refund application on our website, please click the Next button below.

To add this page to your browser's favorites (software for browsing the Internet), please click the "Add to Favorites" link below. You can also use the buttons to the right of the Share link below to share this page on your social network. Then you will have a link to this page on your page on the social network, and you will not have to remember how to find this page.

We suggest you read: What is the inheritance tax?

one of the spouses claims the right to deduction, but the amount to be reimbursed should not exceed the legal limit;

spouses claim a deduction for one item in equal shares;

the deduction is distributed in accordance with the share of ownership of the property;

the distribution is carried out without reference to the share in the property; in this case, the agreements of the spouses on the ratio of deductions must be reflected in the application for the distribution of deductions.

- If shares in the ownership of property are indicated, then this is shared ownership.

- If the shares are not registered, then it is joint property.

But in the Family Code, the concept of joint property is expanded when it comes to married couples. The main condition for recognizing property as the common property of a husband and wife is that it was purchased after marriage.

Pleasant changes have also affected the Tax legislation on the calculation of deductions for property. Since 01/01/14, significant changes have occurred in it, including for joint ownership.

Legislative regulation

The return of income tax with all associated legal consequences is regulated by the Tax Code of the Russian Federation. In 2014, changes were made to it that significantly affected the provision of tax deductions. In this regard, the conditions depend on whether the property was purchased before January 1, 2014 or after this date.

Separate clarifications on this issue can be found in by-laws and letters from relevant authorities and ministries.

“Different” parts owned by the same person

Example. The couple have owned the apartment in equal shares since 2007. After the death of his wife in 2013, her share was inherited by her husband. It turns out that ½ of the apartment has been in his ownership for more than 3 years, and ½ for less. As required by law, in 2013 the spouse received a new certificate of registration of ownership of the entire apartment. If a man sells an apartment in 2014, will he pay personal income tax? From the whole apartment or just half?

In fact, there was no consensus on this issue even among the tax authorities until the corresponding clarifications were issued, namely the Letter of the Ministry of Finance No. 03-04-05/7-444 dated June 27, 2011, as well as the Letter of the Federal Tax Service of Russia dated 10/22/2012 No. ED-4-3/ [email protected]

These letters refer to Art. 235 of the Civil Code of the Russian Federation (“a change in the composition of owners, including the transfer of property to one of the participants in common ownership, does not entail for this person the termination of ownership of the specified property”) and Art. 131 of the Civil Code of the Russian Federation (“a change in the composition of property owners provides for state registration of such a change”).

Let's apply these tricky formulations to our example: since part of the housing belonged to the husband since 2008, then for tax purposes it will be considered that the entire apartment belonged to him from that time, regardless of the change in the composition of the owners and the size of their shares. The husband could initially own not half, but even at least 1/20 of the share. And it doesn’t matter that the certificate of ownership indicates a different date. In short, he doesn’t need to pay tax at all.

Another example. The spouses each own ½ share in the apartment, but the husband’s share in the property has been in the property for more than 3 years, and the wife recently acquired her half (maybe she bought it from her mother-in-law). Now the family wants to sell the apartment. How to make sure that your wife does not pay personal income tax? And let him give his share to his husband. Then, in the eyes of the tax authorities, the entire apartment belongs to the husband for more than three years. Gift transactions between close relatives are not subject to tax. You just need to compare the amount of costs for registering a gift transaction with the amount of tax saved.

Types of property deduction

Tax legislation distinguishes the following types of property tax deduction:

- When selling property or a share in it, part of the authorized capital, as well as when transferring funds in the event of liquidation of the company.

- When a land plot is withdrawn for state or local needs.

- When carrying out new construction or purchasing apartments in new buildings.

- When paying off interest on certain types of loans.

You cannot get a tax deduction while on maternity leave. There are options:

- you can wait for the year in which income taxed at 13% personal income tax appears (mostly wages), and then apply for a deduction, since the right to deduction is not lost;

- distribute the deduction in favor of the spouse if the spouse is not the owner of the property, but the purchase was made during marriage, the spouse did not use the deduction earlier, and a marriage contract was not concluded, which presupposes the separate nature of ownership of the property (according to the principle: “what is mine is mine”);

- distribute the deduction in favor of the owners of the acquired real estate, if the property is shared jointly.

Be careful: you cannot distribute the deduction in favor of your spouse if he is not the owner of the purchased property if the marriage was not concluded at the time of purchase.

What deductions are there?

When you become interested in the problem of tax deductions, then you need to think about what they are.

Among them the following can be noted:

- Standard option, which is assigned only to certain categories of citizens.

- Social, which provides for the purchase of medicines or payment for studies.

- Property, which arises when purchasing housing.

- Professional. Most often it is provided for individuals.

- Investment.

How to distribute the mortgage interest deduction?

- The deduction for mortgage interest will be distributed among the owners according to the application for the distribution of the main deduction, that is, you cannot receive a deduction from the cost of the apartment 50% to 50%, and from a mortgage 100% to 0% (if the right to deduction arises before January 1, 2014).

- The mortgage interest deduction will be distributed among the owners according to the application for the distribution of the interest deduction, which can be written annually (if the right to deduction arises after January 1, 2014). According to the letter of the Federal Tax Service of Russia dated March 23, 2018 No. BS-4-11/ [email protected] “On the procedure for applying the property tax deduction for personal income tax”

Self-calculation

How is the calculation done in practice?

Let’s assume that a couple purchased an apartment worth 5 million rubles with a mortgage at 16% per annum for 15 years.

If a tax deduction is issued for one of the spouses, you can claim 13% of the maximum amount in 2021 - 2 million rubles.

Additionally, the state provides the opportunity to receive 13% of half of the interest paid on the loan. This is 780 thousand rubles for the entire duration of the mortgage agreement.

It should be taken into account that if the amount of deductions for a citizen’s income tax for the reporting period is less than 260 thousand rubles, then you can receive a refund of partially paid amounts only for the amount of tax paid.

If a tax deduction is issued for two owners, the situation with the family budget will look like this: 520 thousand rubles from the purchase and sale transaction and 1,560 thousand rubles from the mortgage interest paid.

If you already understand the benefits of the service, then you can apply to receive a tax deduction from the Federal Tax Service yourself. If additional nuances arise, for example, you did not apply for a tax deduction for two owners immediately when completing the transaction, you are an entrepreneur, did not know about the possibility of getting a deduction for mortgage interest, or there is arrears or debt on your mortgage, it is better to contact professional companies . They will help you take into account all the nuances, advise, suggest the necessary documents and carry out the procedure for you.

The concept of tax deduction

General documents

- Declaration 3-NDFL (order registration at VseVychety.Ru);

- passport;

- certificate 2-NDFL;

- application for a personal income tax refund indicating the account details to which the funds should be transferred.

- application for distribution of deductions;

- marriage certificate when applying for a deduction entirely on the spouse;

- When receiving a deduction for a minor child:

- child's birth certificate;

- certificate of ownership of the child.

- When purchasing real estate under a sales contract;

- When purchasing real estate under an agreement of shared participation in construction / agreement of assignment of rights of claim;

- When purchasing a plot of land;

- When building a house;

- When purchasing real estate with a mortgage.

Read more: Main property deduction: how to calculate, how to get it, list of documents Property deduction for a mortgage Property deduction for a pensioner Property deduction in 2019

What will you need?

- Application to the tax office for the distribution of deductions under the agreement.

- A copy of the passport of each participant in shared housing.

- Bank documents for payment of purchase and sale.

- The act of acceptance and transfer of ownership of a land plot or apartment.

- Certificate of registration of property rights.

- Transaction agreement with all necessary appendices and additions.

- Certificate 2-NDFL from the place of work and tax return.

A sample application can be obtained from the tax office. All necessary documents are submitted to the Federal Tax Service at the place of registration of the taxpayer.

In addition, the legislation provides for a number of cases in which a tax deduction is not provided:

- The transaction is carried out between citizens, one of whom is interdependent in relation to the other.

- If payment for real estate was made at the expense of the employer or other funds, the owner of which is not the purchaser of the property. In other words, if you purchased an apartment or land with the money of close relatives, you will not be able to get a tax deduction.

- If the purchase of your own home was paid for using maternity capital funds or borrowed funds with the participation of maternity capital funds, then you can receive a tax deduction only for the amount of your own funds actually paid.

Grounds for receiving a deduction and its possible amount

The right to a discount arises depending on what funds were used to purchase the property: personal or credit. Based on this, the maximum amount allowed is determined:

- actual expenses incurred, but not more than 2 million rubles for each person;

- actual expenses incurred, but not more than 3 million rubles when repaying interest on the loan.

All expenses incurred for the apartment must be documented.

A personal income tax refund when spouses purchase an apartment in 2021 is possible if the following requirements are met:

- location of the purchased housing in Russia;

- lack of characteristics of a transaction in which the parties are interdependent persons;

- acquisition of property using own or borrowed funds;

- the person has a registered right of ownership or participation in shared construction;

- the person is an income tax payer.

Many are also interested in how spouses can get a double tax deduction for the purchase of an apartment. According to the law, the property deduction for the purchase of an apartment can only be used once. If the maximum amount is not exhausted, the remainder is used for other purposes.

Spouses have the right to apply for a double tax deduction, regardless of which of them is the owner of the purchase. The main condition is official employment, as well as the absence of a previously issued such right.

Who can apply for a tax deduction in 2021?

In 2021, the legislator expanded the list of applicants eligible to receive a tax deduction. Now the right extends to the following categories of taxpayers:

- citizens who purchased housing or land for residential construction or together with a residential building using their own or borrowed funds.

- citizens of foreign states who work and have a residence permit on the territory of the Russian Federation for more than 183 days a year.

- women on maternity leave if housing was purchased before maternity leave.

Accordingly, if you and your spouse fall into these categories of taxpayers, then the law allows you to receive two deductions when purchasing an apartment with two owners.

Important!

Certain categories of citizens will not be able to apply for a deduction: those who, for various reasons, did not pay income tax in the previous tax period (pensioners, registered unemployed), relatives on real estate transactions. Entrepreneurs operating under the requirements of a special tax regime will be able to receive partial amounts. They have the right to apply for a tax deduction, but without taking into account business income.

conclusions

Many people are interested in whether the owner’s spouse can receive a tax deduction for an apartment. In connection with the adoption of new amendments to the Tax Code of the Russian Federation, it is now profitable for spouses to purchase housing in joint ownership.

If previously the tax deduction was tied to the property, now it depends solely on the owner. This makes it possible to receive the unused portion of the money in the future. However, only officially employed citizens have this right. Therefore, it will not be possible to obtain a tax deduction if the apartment is registered to a wife who does not work.

Lawyer. Member of the Bar Association of St. Petersburg. More than 10 years of experience. Graduated from St. Petersburg State University. I specialize in civil, family, housing, and land law.

Housing in joint ownership: calculation of deductions

If the object is jointly owned, when the size of each share in the ownership of the apartment is not determined (this is possible if its owners are spouses), then the amount of the deduction is determined on the basis of a written agreement between husband and wife.

It is recommended that you contact an experienced lawyer to draw up this document. Example.

Antonov's spouses A.V. and Antonov Yu.S. bought an apartment for 3,000,000 rubles. Antonova A.V. wanted to draw up the deduction in question and concluded with Antonov Y.S. an agreement under which he agreed that his wife could receive compensation in the amount of 2,000,000 rubles. Yu.S. Antonov himself, in turn, if desired, will be able to issue a deduction from 1,000,000 rubles.

Citizens have the right to draw up the deduction in question:

- through the Tax Inspectorate (FTS);

- through the employer.

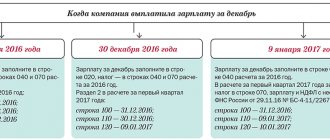

Let's study both mechanisms in more detail.