A tax deduction is a benefit provided by the state, which allows you to return part of the taxes paid. We are talking about taxes for individuals such as personal income tax, which are usually paid by the employer for his employee. The most common situations when the state considers the return of deductions are the purchase of real estate, payment for education, and paid treatment. Citizens can return up to 100% of the amount paid in tax.

| Service | Price |

| Assistance in obtaining tax deductions | 5,000 rubles |

How to calculate the amount of a possible deduction refund?

The personal income tax paid by a citizen is 13% of officially received income. This 13% can be returned under certain conditions.

The state clearly regulates the amount of deduction that a citizen can receive and sets certain boundaries and limits. For example, when purchasing real estate, there is a maximum limit on the value of the property, from which the amount of the deduction is calculated. This limit is 2,000,000 rubles. And 13% of this amount will be 260,000 rubles. It turns out that a person cannot receive more than 260,000 rubles, regardless of the fact that the purchased property can cost much more.

If real estate is purchased in shares, then the amount of tax deduction for each owner of this object will be determined in proportion to the share owned by him.

Calculation example

First, you need to determine the income that the citizen received in the current year. The amount taken into account is already minus income tax, that is, the amount that the person ultimately received in his hands. This figure can be seen in the 2NDFL certificate issued by the employer; in the same certificate, a separate column reflects the amount of tax paid by the employer for the employee.

For example, for a year a citizen’s income before tax was 400,000 rubles. From this income he paid the state an income tax of 13%, which amounted to 13% * 400,000 or 52,000 rubles.

It is these 52,000 that a citizen can return. Even if the state requires a refund of a larger amount, the citizen will still receive only 52,000. Next year, it will not be possible to “receive” the funds due. An exception is receiving a deduction when purchasing real estate, here the tax refund can be stretched over several years until the entire due amount is received citizen.

Tax deduction - simple definition

A tax deduction is an amount established by law that reduces your taxable income. As a result, income becomes less. Accordingly, the amount of tax you must pay is reduced. If tax was withheld from you without taking into account the deduction (that is, in an amount greater than necessary), you are required to return the overpayment.

Why is this amount “certain”? Because it varies depending on the specific situation. The amount of the deduction can range from 1 ruble to an amount exceeding 2,000,000 rubles. There are three types of tax deductions: property, social and standard. But we won’t dwell on these details for now. We will demonstrate only the general principle of how a tax deduction of any type works. It is the same for all listed deductions.

Example Let's assume that your salary is 50,000 rubles. per month. You don't have any deductions. The income tax that will be withheld from her will be: 50,000 rubles. x 13% = 6500 rub.

The company you work for will pay this amount to the budget monthly. Consequently, “in your hands” you receive a monthly salary minus tax, that is, only in the amount: 50,000 - 6,500 = 43,500 rubles.

For the year you will receive a salary in the amount of: 50,000 rubles. x 12 months = 600,000 rub.

For the year, tax will be withheld from her in the amount of: 6,500 rubles. x 12 months = 78,000 rub.

So, the company where you work has withheld tax from you for the year - 78,000 rubles. and paid it to the budget.

Let's assume that in the same year you received the right to a tax deduction (which one is not important). Therefore, your annual income must be reduced by this amount. Let's consider several situations.

Situation 1. Deduction is less than income

The amount of your deduction is 120,000 rubles.

In this case, your annual taxable income will be: RUB 600,000. (salary for the year) - 120,000 rubles. (deduction) = 480,000 rub. (taxable income)

Tax must be withheld from him in the amount of: RUB 480,000. (taxable income) x 13% = 62,400 rubles.

However, you have already been deducted 78,000 rubles. The company that paid the tax for you calculated your income without taking into account the deduction. Therefore the tax was overpaid. And you have the right to return part of its amount from the budget in “real” money.

This part will be: 78,000 rubles. (tax already withheld) - 62,400 rubles. (tax to be withheld) = RUB 15,600. (tax that can be refunded)

Situation 2. Deduction equals income

The deduction amount is RUB 600,000.

In this case, your annual taxable income will be: RUB 600,000. (salary for the year) - 600,000 rubles. (deduction) = 0 rub. (taxable income)

It turns out that you didn't have to pay tax at all this year. Therefore, the state is obliged to return the entire amount of tax withheld from you (RUB 78,000).

Situation 3. Deduction of more income

The deduction amount is RUB 950,000.

In this case, your annual taxable income will be: RUB 600,000. (salary for the year) - 950,000 rubles. (deduction) = 0 rub. (taxable income)

As in situation 2, it turns out that you did not have to pay tax this year. Therefore, the state is obliged to return the entire amount of tax to you (78,000 rubles).

How quickly can I receive a deduction?

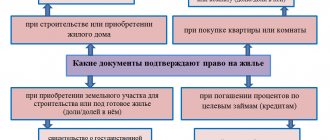

Initially, you need to collect a complete package of documents, what exactly it should contain depends on what type of tax deduction the citizen wants to receive. This information can be obtained from the tax office.

According to Article 88 of the Tax Code of the Russian Federation, an inspection cannot last more than three months from the moment all documents and applications are submitted. If, based on the results of the audit, it is determined that all documents are genuine and all calculations are correct, then the tax authorities make a decision on making the payment due from the state.

After this decision, the citizen must write an application for payment; the funds will be transferred within a month. If the application is submitted along with the declaration, then the monthly report begins after the tax authorities make a positive decision.

In addition to it, the military provides:

- Documents confirming ownership.

- Documents confirming the fact of purchase of housing (bank statements about the transfer of money, a receipt from the former owner, etc.).

- Military statement.

- Agreement with the creditor bank.

- Document confirming the receipt of a loan.

- Documents confirming the deposit of funds subject to deduction.

The military also has the right to compensation when selling housing . In this case, a refund is issued for the amount of the difference between the sales and purchase amounts.

Receiving a deduction when purchasing real estate

Individuals who have purchased real estate can receive a tax deduction; its maximum amount is regulated by the state. The cost of the purchased object is taken into account, not exceeding 2,000,000 rubles. Even if the housing cost 10,000,000, then the amount of income tax refund is calculated from 2,000,000 rubles.

Calculation example

Let’s say a citizen purchased an apartment worth 3,000,000 rubles. The deduction will be calculated based on the maximum limit of 2,000,000 rubles established by the state.

The citizen’s income for the current year amounted to 500,000 rubles. According to his income, he paid 65,000 rubles in taxes. The deduction that he can count on is 2,000,000 + 13% = 260,000 rubles

The expected deduction is more than the citizen paid in taxes this year, so he can apply for a tax deduction in subsequent years exactly until he receives an amount of 260,000 rubles.

Services > Services to individuals > Tax deductions > Social tax deductions

Tax deduction is the amount by which a taxpayer can reduce his tax base when he receives income and calculates the amount of tax payable to the budget.

Also, a tax deduction refers to the return of part of previously paid tax , which can be obtained in connection with certain facts.

Who can take advantage of social tax deductions?

Tax deductions are provided ONLY:

- tax residents of the Russian Federation - both citizens of the Russian Federation and foreign citizens

- only in relation to those incomes to which the personal income tax rate of 13% is applied

Who can NOT take advantage of social tax deductions?

The right to tax deductions cannot be used by:

- unemployed persons who do not have any source of income other than state unemployment benefits

- individuals whose income is subject to personal income tax at rates of 15%, 30%, 35%

- Individual entrepreneurs using special regimes 6%, 15%

Tax deduction for education

If your children (under 24 years old) or you personally are studying ( children - only full-time, you personally - any form ) in an institution that has the appropriate license - this can be either a state or non-state university, FOREIGN UNIVERSITIES and COLLEGES, advanced training courses, trainings, driving schools, sections, clubs, etc., you have the right to receive a tax deduction in the amount of training expenses incurred for the past reporting year. At the same time, the amount of such social tax deduction cannot be more than 50,000 rubles. for each child in a family for both parents, if you pay for the education of your children, and the maximum deduction amount for your own education is 120,000 rubles.

At the same time, you can RETURN 13% of the amount actually spent on training, but taking into account the specified maximum tax deduction amounts: 50,000 x 13% = 6,500 rubles. 120,000 x 13% = 15,600 rubles.

EXAMPLE 1 (child education): In 2021, you paid 190,000 rubles for your son’s full-time education at a university. At the same time, your WHITE salary is 50,000 rubles. (this means for 2018, the amount of personal income tax that your employer will pay for you will be 50,000 x 12 months x 13% = 78,000 rubles). To calculate the amount that in this case can be received back from the budget, the following calculations must be made:

1) determine the maximum return amount for the reporting year: 50,000 rubles. (max. amount per 1 child) x 13% = 6,500 rub. 2) determine the amount of personal income tax that you (or your employer for you) paid to the budget for the same reporting period: 50,000 x 12 months. x 13% = 78,000 rub. 3) compare the amounts received: if the personal income tax amount you paid is greater than the refund amount (78,000 rubles more than 6,500 rubles), then you have the right to receive a refund in full (all 6,500 rubles) for each reporting year of study.

EXAMPLE 2 (child education): In 2021, you paid 40,000 rubles for your daughter’s driving school education. The remaining conditions are the same as in example 1. To calculate the refund amount, which in this case can be received back from the budget, the following calculations must be made:

1) determine the maximum return amount for the reporting year: because tax deduction limit 50,000 rubles. NOT exceeded, then the actual amount spent on training is taken into account: 40,000 x 13% = 5,200 rubles. 2) determine the amount of personal income tax that you (or your employer for you) paid to the budget for the same reporting period: 50,000 x 12 months. x 13% = 78,000 rub. 3) compare the amounts received: 78,000 rubles. more than 5,200 rub. You have the right to receive a refund of the full 5,200 rubles. for training in a driving school.

EXAMPLE 3 (your own training): In 2021, you paid for your own 3-month advanced training in the amount of 90,000 rubles. At the same time, your salary is 60,000 rubles, of which 15 thousand is the official part, and 45 thousand is in the envelope. The amount of refund you can receive is calculated as follows:

1) determine the maximum return amount for the reporting year: because tax deduction limit for personal training in the amount of 120,000 rubles. NOT exceeded, then the actual amount spent on training is taken into account: 90,000 x 13% = 11,700 rubles. 2) determine the amount of personal income tax that you (or your employer for you) paid to the budget for the same reporting period: 15,000 x 12 months. x 13% = 23,400 rub. 3) compare the amounts received: 23,400 rubles. more than 11,700 rubles. You have the right to receive a refund of the full 11,700 rubles. for training on courses.

EXAMPLE 4 (education of several children): In 2021, you paid 190,000 rubles for full-time education of your eldest son at a university, 100,000 rubles for your youngest daughter in a private school, 80,000 rubles for your youngest son in college. and your eldest daughter in a driving school 45,000 rubles. At the same time, your salary is 160,000 rubles, of which 20 thousand is the official part, and 140 thousand is in the envelope. The amount of refund you can receive is calculated as follows:

1) determine the maximum return amount for the reporting year: because tax deduction limit for children's education in the amount of 50,000 rubles. exceeded by the son and youngest daughter, then different amounts are taken into account: 50,000 (older son) x 13% + 50,000 (youngest daughter) x 13% + 50,000 (youngest son) x 13% + 45,000 ( senior daughter) x 13% = 25,350 rub. 2) determine the amount of personal income tax that you (or your employer for you) paid to the budget for the same reporting period: 15,000 x 12 months. x 13% = 23,400 rub. 3) compare the amounts received: 23,400 rubles. LESS than RUB 25,350, so you are entitled to receive a refund of only RUB 23,400.

EXAMPLE 5 (your own and your child’s education): In 2021, you paid 90,000 rubles for your son’s full-time education at a private school. and for your training in advanced training courses, which you completed in May, 90,000 rubles, as well as for training at a motorcycle school in November, 45,000 rubles. Your salary is 60,000 rubles, of which 40 thousand is the official part, and 20 thousand is in the envelope. The amount of refund you can receive is calculated as follows:

1) determine the maximum return amount for the reporting year: because tax deduction limit for children's education in the amount of 50,000 rubles. my son’s is exceeded, then he is taken into account: 50,000 x 13% = 6,500 rubles. Next for you: 90,000 (advanced training courses) + 45,000 rubles. (motorcycle school) = 135,000 tk. exceeds the maximum deduction amount, then 120,000 rubles are taken into account. x 13% = 15,600 rub. 2) determine the amount of personal income tax that you (or your employer for you) paid to the budget for the same reporting period: 40,000 x 12 months. x 13% = 62,400 rub. 3) compare the amounts received: 62,400 rubles. more than 22,100 rubles, so you have the right to receive a refund of 22,100 rubles.

As can be seen from the examples, in order to receive less than the maximum refunds established by the state (6,500 rubles and 15,600 rubles) from the maximum amounts of tax deductions of 50,000 rubles. and 120,000 rubles, it is necessary that the official income be in the area of the subsistence level of 15 thousand rubles, and 2 or more such deductions per year would be declared. In all other cases, you can exercise the right to receive a legal refund of personal income tax from the state.

If, in addition to training expenses in the reporting year, you also incurred medical expenses, then the total maximum amount of all social tax deductions in this reporting year is 120,000 rubles. The maximum refund amount for all social tax deductions will be 120,000 x 13% = 15,600 rubles.

You can submit documents for a tax refund for 2021 within 3 years (starting from 2021) and NO MORE than for a 3-year period.

Tax deduction for treatment

The social tax deduction for treatment allows you to return part of the tax in connection with treatment and the purchase of medicines. The treatment performed must be included in the relevant List approved by Government Decree No. 201 of March 19, 2001. You can use the deduction both for your own treatment and for the treatment of children (under 18 years old), spouse, and parents. The maximum deduction for treatment is 120,000 rubles. The maximum amount of refund that you can receive from the budget for treatment: 120,000 x 13% = 15,600 rubles.

For treatment that, in accordance with the above Resolution, is classified as “expensive”, the maximum amount of deduction is NOT applied - for expensive treatment, a refund is provided in the amount of 13% of the ENTIRE cost of treatment.

Treatment must be carried out in a medically licensed facility.

An important point is the fact that the total amount of social tax deductions in the reporting year (for education, treatment, etc.) should not exceed 120,000 rubles. And you can return for ALL social deductions for the reporting year no more than 120,000 x 13% = 15,600 rubles.

You can read the comments and answers of our financiers to the most frequently asked questions in the FAQ Tax deductions section

When can I apply for a deduction?

This can be done after a year has passed from the date of registration of the purchased property. You can apply for the required payment within 3 years following receipt of the state registration certificate. It turns out that in 2014 a citizen can receive a deduction for 2011-2013.

It is recommended to apply to the tax authorities to receive a deduction at the beginning of the year; during this period you can avoid queues. In March-April there will be an influx of people wanting to submit income declarations, and long queues will form. Therefore, it is much easier for a citizen to apply for a deduction in January-February.

There is no need to run to the tax office immediately after a year has passed since the purchase of real estate; there is nothing terrible if a citizen applies after 1.5 years. But it’s better not to put the matter on the backburner; when applying for a deduction after 3 years, problems may arise with collecting documentation.

Required documents:

- TIN;

- 2NDFL certificate for the current year received from the employer;

- contract bought real estate. If a citizen has become a shareholder, then a shared construction agreement;

- a receipt stating that the citizen transferred the money to the seller. The receipt can be replaced with receipts, checks, bank statements;

- certificate of ownership;

- application for a deduction;

- income statement;

- account details for transferring funds;

- application for the transfer of funds to the specified details.

Before collecting documentation, it is better to first visit the tax office and take an exact list of required papers. After submitting all documents, you must wait for the papers to be verified, which can take up to three months. Upon completion of the inspection, the citizen is contacted and invited to the tax office to confirm the operation.

Child tax credit in 2021

To receive this type of assistance, an officially employed person will need to collect the following package of papers:

- filing a standard application for a deduction for each child;

- providing data confirming the right to take advantage of this type of benefit;

- if the person is the only parent or legal representative of a minor, the package of papers is supplemented with a document confirming this fact;

- If a guardian applies for this type of assistance, the data is supplemented with a document confirming the guardianship established over the child.

After preparing the required papers, the citizen should contact his employer with a request for a deduction. You should have legal documents with you for this type of assistance. At the same time, it is important to take into account one point: in order to correctly determine the amount of such a benefit, the applicant needs to line up the children. And in this matter the age of the eldest child does not matter.

If a person has not received this type of assistance for a year, and he has legal grounds to use it, the procedure should be as follows:

- at the end of the reporting year you need to fill out the form 3-NDFL;

- order a certificate from the place of employment about income and withheld taxes for the past year;

- add to the package a document confirming the right to receive this type of benefit;

- take the collected papers to the tax structure at the place of registration.

In addition, a completed handwritten application should be attached to the main package of papers. As a rule, after reviewing the submitted papers, the required funds are returned to the citizen within one month.

It should be noted that in the case when an inspector conducts a desk inspection, the return of money may take up to four months. The reason for this is the length of time it takes to complete a desk audit.

As a rule, the process of verifying submitted papers takes up to three months, and another month is spent on transferring money, in case of a positive decision.

- A parent (adoptive parent, guardian, trustee) has the right to receive a tax deduction for a child (children) in double the amount, but only if there is one of two grounds:

- 1) if there is a refusal of one of the parents to receive a deduction;

- 2) if the parent (foster parent, guardian, adoptive parent) is the only one and this is documented.

- In the first case, the second parent is required to provide a statement of his refusal to receive a deduction for the child (children), as well as a copy of the 2-NDFL certificate from his place of work, which will confirm that the second parent did not receive the deduction.

When determining the amount of the deduction, the total number of children is taken into account. That is, the first child is the oldest in age, regardless of whether a deduction is currently provided for him or not.

The order of children is determined in chronological order by date of birth (letters from the Ministry of Finance of Russia dated November 8, 2012 No. 03-04-05/8-1257, dated April 3, 2012 No. 03-04-06/8-96). The amounts of deductions for disabled children are summed up with regular deductions depending on the child’s priority (clause 14 of the Review, approved.

by the Presidium of the Supreme Court of the Russian Federation on October 21, 2015, letter of the Ministry of Finance of Russia dated March 20, 2021 No. 03-04-06/15803).

An employee of the organization, Maria Sidorova, is the parent of three children aged 25, 15 and 10 years. Deductions will be provided to her as follows:

- for the first child aged 25 years - no deduction is provided;

- for a second child aged 15 years - a deduction of 1,400 rubles;

- for a third disabled child aged 12 years - a deduction of 3,000 + 12,000 rubles.

The child deduction is provided from the month the baby was born, adopted, or taken under guardianship or trusteeship. This month is indicated on the birth certificate or other supporting document.

- The deduction ceases to be provided if one of the conditions is met:

- 1. The employee’s income exceeded 350,000 rubles - from the month in which the limit was exceeded;

- 2. The child turns 18 years old - from January of the next year;

- 3. The full-time student is 24 years old, but the child continued studying during this year - from January of the following year;

4. A full-time student is 24 years old, but the child stopped studying before the end of the year - from the month following the end of studies.

A student's stay on academic leave does not deprive the parent of the right to receive a deduction. The main thing is to have a certificate from the educational institution and a copy of the order granting leave

The rules are different for guardians and trustees. Guardianship automatically ends when the child turns 18 years old or acquires full legal capacity before adulthood, such as marriage.

It does not matter whether the child is studying full-time. Therefore, the trustee will lose the right to deduction from the beginning of the year following the one in which the ward received legal capacity (letter from the Ministry of Finance dated October 25.

2013 № 03-04-05/45277).

Calculate personal income tax automatically in the online service Kontur.Accounting. Here you can keep records, calculate salaries and send reports.

Try for free

Receiving a deduction through your employer

In this way, you can start receiving a tax deduction earlier than after the end of the year. A citizen can contact the tax office immediately after completing a transaction and receiving documents for his own property. In this case, the deduction is not realized in a single amount, but gradually.

The employer will not withhold a 13% tax when transferring wages; this is how the right to receive a tax refund will be gradually exercised.

Initially, the design scheme will not differ from the standard one. A citizen applies to the tax authority, collecting a package of documents; information about the employer must be attached to this package.

After reviewing the documents and confirming the right to an income tax refund, the citizen receives a notification that must be submitted to the employer. From the moment this notice is given to the employer, income tax will be collected from the citizen.

Amounts of deductions for children

The deduction amounts are currently as follows:

— for the first and second child — 1,400 ₽

— for the third and each subsequent — 3,000 ₽

Children are counted regardless of age. For example, an employee has three children. Two are already adults: 25 years old and 23 years old, and the third is 16 years old. An employee is entitled to one deduction for a third child - 3,000 rubles.

There are more deductions for disabled children:

— for parents and adoptive parents — 12,000 ₽

— for guardians, trustees, foster parents — 6,000 ₽

It does not matter what type of disabled child is in the family. You can also add general deductions for children. For example, for an only disabled child, the deduction will be 13,400 rubles. After all, parents are entitled to a deduction for their first child - 1,400 rubles and for a disabled child - 12,000 rubles.

Important: provide a standard tax deduction for a child until the month in which the employee’s income from the beginning of the year exceeds 350,000 rubles.

Interesting fact

If a child grows up quickly and gets married, then you can no longer get a deduction for him - now he provides for himself. But if he decides to try his hand at work, then his parents still have the right to a deduction. In general, marriage is a responsible matter :)

How many times can I get a tax refund?

Previously, the deduction could be issued only when making one transaction of purchasing a home, but this turned out to be unfair to residents of cities where the cost of housing is less than 2,000,000 rubles. It turned out that they received a smaller deduction than a resident of large cities.

For this reason, since January 2014, the deduction is not tied to a specific property; it is tied to the citizen who has the right to receive it.

Now, when purchasing a home, everyone has the right to return income tax in the amount of 260,000 rubles (calculated based on the required maximum cost of housing of 2,000,000 rubles). This right can be exercised until the state pays 260,000 rubles. You can make as many transactions as you like within 2,000,000 rubles.

Participants in shared ownership can also receive full tax deductions. First, register a part proportional to the share, and then at any time you can buy another property and “raise” the due deduction to the full amount of 260,000 rubles.

Mortgage

When buying an apartment with a mortgage today, it is also possible to get a refund, however, in this case there are several features:

- distinguish varieties depending on the percentage established under the loan agreement;

- the maximum value of real estate with a loan is 3 million rubles, while the maximum amount of allowable repayment is 390,000 rubles;

- Interest refund can be obtained only on one object. Thus, if the owner did not choose the maximum return amount the first time, this will not be possible the second time.

The situation with purchasing real estate with a mortgage

By taking out a mortgage loan, in accordance with current legislation, a citizen can receive a standard tax deduction, as well as receive an additional deduction for the interest paid under the loan agreement.

The maximum amount of interest with which you can receive a deduction is 3,000,000 rubles. It turns out that when applying for a mortgage, a citizen can receive a deduction from the amount of 5,000,000 rubles, which will amount to 650,000 rubles.

An income tax refund on mortgage interest can be issued for only one property. It will not be possible to apply for a mortgage a second time and receive a deduction again, even if this right was not fully exercised when closing the first loan agreement.

You can also return income tax on interest annually; for this, you will need to provide the tax office with certificates from the bank, which will tell you how much interest the citizen paid for the previous year.

Types of tax deductions

Tax deductions can be divided into three main categories:

- first , they are provided when selling property (apartment, car, dacha, garage). This deduction is called property deduction. After all, you often need to pay taxes on such income. You can find out more about deductions when selling property by following the link. This tax deduction is written about in Article 220, paragraph 2, subparagraph 1 of the Tax Code.

- second , they are provided when paying for certain types of expenses. Namely: - expenses for the purchase of real estate (this is also a property deduction). Read about how to get a deduction when buying real estate at this link. This tax deduction is written about in Article 220, paragraph 3, subparagraph 1 of the Tax Code; - expenses for treatment or training (this is a social deduction). This link says in detail about the deduction for treatment, this link says about the deduction for education. The law about these tax deductions is written in Article 219, paragraph 1, subparagraph 3 (treatment) and subparagraph 2 (training) of the Tax Code;

- third , they are provided to some people if certain conditions are met (this is a standard deduction). For example, parents of minor children, disabled people, war veterans, Chernobyl victims, etc. are entitled to it. This tax deduction is written about in Article 218 of the Tax Code.

Each of these deductions has its own characteristics (see relevant links).

Portal "Your taxes" 2021

Changes effective January 2014

Since the legislation regarding obtaining a tax deduction for those purchasing real estate has been changed, now all citizens can be divided into two legal parts.

- Those who purchased a property before January 1, 2014 and have never used the right to a tax refund, and those who still receive a deduction for transactions of past years. For these citizens, the norms of the previous law apply.

- Those who made a transaction after January 1, 2014 will receive an income tax refund under the new rules and regulations.

Is there a tax deduction for housing purchased with a “military mortgage”?

From the point of view of the law: A NIS participant receives a housing loan, which is budgetary funds. Loan repayment is carried out by Rosvoenipoteka. Accordingly, the military does not pay income tax on this income, and the state cannot return the funds.

If a NIS participant...

- Adds own savings to state subsidies.

- He applies for a consumer loan, the payment for which comes from his personal salary.

- Invests his funds in building materials or finishing work in the purchased apartment (the contract must include a note indicating the absence of interior finishing).

...then he has the right to a refund for these expenses. That is, the calculation is made exclusively from the amount that the military spent from its own funds.

As for the return of interest on finishing , it is only possible for housing in new buildings that were purchased during the construction stage.

In addition, the purchase/installation of plumbing fixtures is not included here , and all payment facts must be confirmed by cash receipts, receipts, purchase certificates with seller data, etc.

Example: A serviceman adds his own funds in the amount of 210,000 rubles to the state subsidy for housing. Accordingly, from this amount he receives a payment equal to 13% or 27,300 rubles.

Your loan has been approved!