Of all banking credit products, mortgages are the most onerous and time-consuming. But sometimes it is precisely such a loan that allows citizens to realize their dream of purchasing their own home. In this article we will tell you how to return interest on a mortgage aimed at purchasing real estate using a tax deduction.

According to Russian legislation, a citizen can return part of the funds paid for taxes or reduce the tax itself when buying a home on credit. This deduction option is called property deduction and was created for the purpose of social assistance to citizens who purchase housing with their own money.

How to get your mortgage interest back

Declaration, 2-NDFL certificate and application

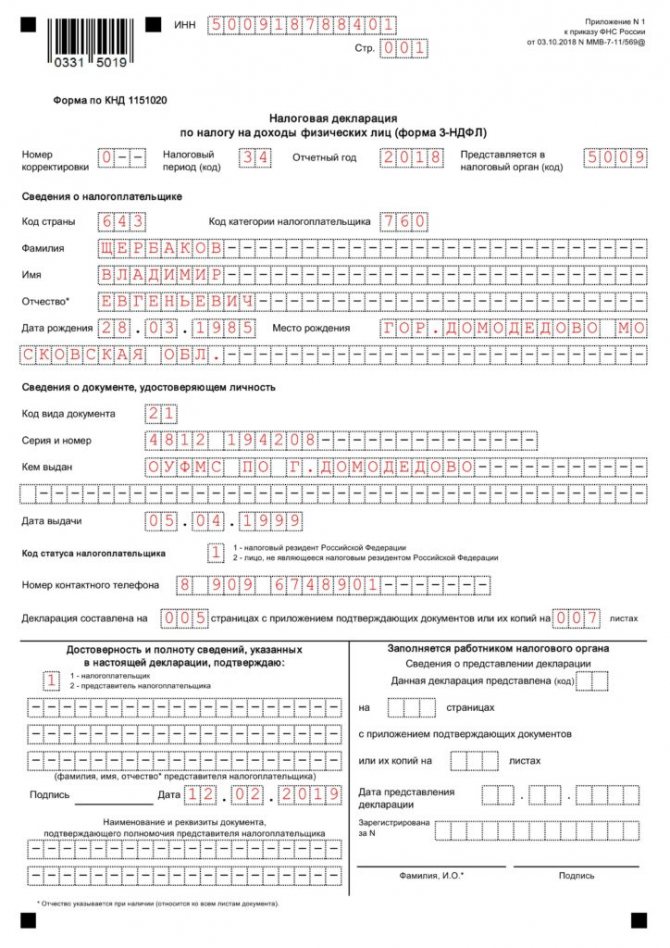

1. Completed tax return in form 3-NDFL (original).

It can be filled out on our website in the “3-NDFL Declaration” / “Fill out online” section. 2. Application for tax refund with details of the bank account to which the money will be transferred to you (original). The correct statement will be generated for you along with the declaration by our website: “Declaration 3-NDFL” / “Fill out online” (only for declarations starting with the declaration for 2014).

3. Certificate(s) 2-NDFL about income for the year for which you want to return taxes, issued by the employer (original). Your employer's accounting department will know what Form 2-NDFL is.

To receive a tax deduction, you must provide the Federal Tax Service with a certificate from the bank. Let's consider a document based on the example of a certificate from VTB24, in which the main information is considered to be information about the interest that the client has already paid.

It is received on the day of application; you only need a Russian passport. It contains the following information:

- Type of lending;

- Loan repayment period;

- Interest rate set by the bank;

- Total loan amount;

- Operation status.

The application for tax refund on mortgage interest must be completed independently.

In the header - the name of the Federal Tax Service at the place of registration, as well as the applicant’s passport details and his postal address,

The body of the letter contains the period and amount of tax refund when purchasing an apartment with a mortgage, the name of the income (income), its BCC and OKTMO, which can be found in the classifier

Below are bank details with the obligatory indication of a current account for transferring deduction amounts.

At the end - the date and the personal signature of the applicant.

Reimbursement of mortgage interest when buying an apartment: main nuances

Many people who are already burdened with a mortgage are interested in the question of the time frame for filing an application for partial interest reimbursement. The conditions of the Tax Code of the Russian Federation are quite loyal and do not oblige the borrower to immediately collect all documents when applying for a mortgage.

The right to take advantage of state fiscal compensation arises in the next calendar year after the transaction took place and the mortgage agreement was drawn up

The client has at least three years to submit an application to the fiscal service for a mortgage deduction. The total calculation of the deduction is formed from the moment the mortgage agreement is signed.

The procedure for applying for a tax deduction contains a lot of nuances that you need to know before submitting your application.

Basic moments:

- When choosing the main property deduction, the payment can be received several times, for several housing properties, until the maximum established limit is reached (this applies only to those citizens who purchased housing after 01/01/2014 and did not use the property deduction before 01/01/2014). When a client chooses to deduct interest, this service can only be used once.

- Only a resident of the country can apply for fiscal compensation. At the same time, he must have an official income and pay taxes regularly.

- To calculate the total deduction, data for all the past three years is taken into account if the client submits an application after this time after signing the contract. If the amount of personal income tax paid is less than the estimated deduction, it will be transferred to the borrower’s account on an annual basis until it reaches the maximum established limit.

- In the case of a tax refund on mortgage interest, a limit is set at 390 thousand rubles or 13% of the maximum amount of 3 million rubles. This is the amount of interest on the loan. In addition to paying the principal (loan body), the borrower also pays interest monthly. So, fiscal compensation allows you to return an amount of 13% of the interest actually paid. This is the rule, i.e. the limit of 3 million rubles applies only to mortgage loans issued after the changes were made in 2014. There is no limit on repayment of mortgage loans purchased before 01/01/2014, i.e. 13% is returned from all interest actually paid. The right to use the interest deduction is given to the client only once. However, this option is only possible if during the entire billing period the borrower had official income taxed at a rate of 13%.

- The deduction can only be made for housing purchased within the country.

- The amount will not be refunded if the tax office finds that the purchase and sale transaction took place between close relatives.

- The amount of the annual refund is limited by the taxes paid (cannot be more than the amount of taxes paid).

- There is no limitation period for fiscal compensation, however, the calculation will be made on the date when the transaction was concluded and, accordingly, the current tariffs of that period are applied.

- When applying for a property deduction for housing purchased with a mortgage before 2008, the value limit will be 1 million rubles. Registration of purchase and sale after 2008 limits the amount of the main deduction to 2 million rubles. Even if the apartment costs more, the deduction will be calculated based on the maximum amount. If the price of the property is less, then it is calculated from the amount specified in the contract.

- When refinancing a loan with another bank, the borrower can also count on a partial refund of the funds paid. However, the agreement must be formalized as a target agreement. Otherwise, the taxpayer will be denied compensation.

For borrowers who signed a mortgage agreement after January 1, 2014, the deduction is limited to 3 million rubles.

Thus, when submitting an application and preliminary calculating the amount of compensation, it is important to take into account the date of the transaction.

The calculation scheme is quite simple. A citizen who has taken out a mortgage is exempt from income tax. However, such a refund can only be made for the interest actually paid.

The borrower can determine the repayment amount independently. To do this, two factors need to be taken into account:

- total amount of real estate;

- the total amount of tax paid.

The amount of the property is specified in the contract. At the same time, the law provides for the inclusion of finishing works in the total cost, if this is included in the contract. When purchasing housing in a new building, a total amount is often included in the mortgage agreement, which includes finishing work along with the purchase of materials. So in this case, the property deduction will be calculated from the total amount.

Given the different maximum rates for calculating the mortgage deduction, let's look at specific examples of what you can expect.

Example No. 1

You took out a mortgage worth 50 million rubles in the summer of 2013 (i.e., before the new rules came into force on January 1, 2014). For the entire period of using the loan, interest payments amounted to 6 million rubles. In this case, you can claim a tax refund in the amount of 1.040 million rubles (2,000,000*13% +6,000,000*13%).

If exactly this situation had occurred after January 1, 2014, then the deduction would have been 650 thousand rubles (2,000,000*13% +3,000,000*13%).

Example No. 2

Citizen N. took out a mortgage to build a house in the amount of 3.5 million rubles. According to the established limits, only 2 million rubles are deductible. Thus, the calculation will be made as follows:

2 million * 13% = 260 thousand rubles (this is the amount of compensation for the mortgage loan).

The meaning of tax deduction

A mortgage loan will not be approved for a person who does not have official employment. This means that each borrower regularly makes contributions to the Federal Tax Service in the form of income tax, which is 13% of wages.

In the corresponding article (21) you can find provisions that regulate the procedure for returning tax deductions. There are restrictions; the client will not be able to receive more than the required amount. Sometimes documents are drawn up for several years, but tax refund certificates are provided anew every year.

This public service allows you to slightly ease your financial situation after purchasing living space. Some manage to make repairs with the money received, others ask the employer not to charge him a percentage of 13% on the official salary.

Potential recipients of government assistance

The Tax Code has established that the return of personal income tax funds for a mortgage is due:

- People who have taken out a targeted loan to purchase a home (mortgage).

- A person with an official salary who regularly pays taxes.

- Foreign citizens who are employed and fulfill tax obligations to the state.

- Spouses who have distributed shares of property peacefully.

No deduction allowed:

- Persons who have taken out a consumer loan for any purpose.

- Individual entrepreneurs with existing simple tax payment schemes.

- Women who are on maternity leave and do not receive a salary. Pensioners aged 70.

- A person who has loan debts to the bailiffs.

Interest on mortgage loan

7. Credit (mortgage) agreement (copy).

8. Loan repayment schedule and interest payment under the loan (mortgage) agreement (copy). Such a schedule can be a clause or annex of the contract, or it can be some kind of separate document. The repayment schedule can also be described in words.

9. Bank certificate on interest actually paid for the year (original). Bank employees usually know what they are talking about. Each bank provides a certificate in its own form. The main thing is that the certificate contains the amount of interest paid for the year in rubles and indicates the year.

10. Documents confirming payment (cash receipts, receipts, payment orders, bank statements, etc.) (originals or copies). Despite the fact that you provide a certificate of interest paid, you will need to attach documents confirming payment. This is a formal requirement of the inspection.

Declaration, 2-NDFL certificate and application

It is easy and safe to return the money that the payer contributed to the state treasury.

You just need to follow a number of basic rules:

- Collect all the documentation necessary to receive a deduction in 2021. It is especially important to be accurate if you are sending by mail. By the time the inspector finds the mistake and sends the papers back, too much time may pass.

- Correctly fill out the declaration type 3NDFL. There you need to note the payer’s personal data, the amount of the loan from the bank, and the level of wages.

- Submit the collected package of documents to the fiscal department. If you are sending a postal item, you must include an inventory of the contents of the parcel.

- The final stage is verification of papers by the tax office. If you were given a positive answer, then you receive a refund after indicating the bank account where the deposit should be made.

When preparing paperwork for a tax deduction for a mortgage, the main thing is a well-written declaration. There are several reasons for refusal:

- Incorrect declaration template. In 2021, examples from 2010, 2015 and 2021 will not apply.

- Violation of basic rules when filling out a declaration.

- Providing incomplete information about the owner of the property.

It is mandatory to fill out the 3NDFL declaration as follows:

- Indicate the owner's mobile phone number;

- Specify the number of pages;

- To fill out the first section, take data from the 2NDFL certificate, which includes income data;

- In the sixth section you need to write the exact amount of tax you want to refund;

- Enter the budget classification code.

The following codes are valid in the Russian Federation:

- For individual entrepreneurs and legal entities – 18210102020011000110;

- For persons whose source of income is a tax agent - 18210102010011000110;

- Individuals – 18210102030011000110.

Follow a clear algorithm:

- Find the form on the Internet, print 2 copies;

- Fill out the sample form from 2021;

- Attach a package of necessary documents;

- Send the papers by mail;

- After submitting, you need to receive a copy of the description.

A 3NDFL type declaration can be submitted by email:

- Check with the tax inspector about the possibility of sending via the Internet;

- Install a special program on your computer.

If you applied on time and filled out the required documents, then you won’t have to wait long to get your mortgage money back.

We suggest you read: What documents confirm ownership of an apartment?

^Back to top of page

2 We receive a certificate from the accounting department at the place of work about the amounts of accrued and withheld taxes for the corresponding year in form 2-NDFL.

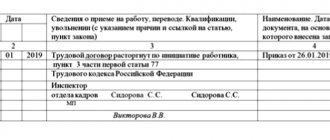

3 We prepare copies of documents confirming the right to housing, namely:

- when constructing or purchasing a residential building - a certificate of state registration of the right to a residential building;

- when purchasing an apartment or room - an agreement on the purchase of an apartment or room, an act on the transfer of the apartment or room (share/shares in it) to the taxpayer, or a certificate of state registration of the right to the apartment or room (share/shares in it);

- when purchasing a land plot for construction or for finished housing (shares/shares in it) - a certificate of state registration of ownership of the land plot or share/shares in it and a certificate of state registration of ownership of a residential building or share/shares in it;

- when repaying interest on targeted loans (credits) - a targeted credit agreement or loan agreement, a mortgage agreement concluded with credit or other organizations, a schedule for repaying the loan (loan) and paying interest for the use of borrowed funds.

Since the issuance of a certificate of state registration of property rights has been discontinued since 2021, instead of it the taxpayer has the right to submit an extract from the Unified State Register of Rights to Real Estate and Transactions with It (USRP) as a supporting document.

4 We prepare copies of payment documents:

- confirming the taxpayer's expenses when purchasing property (receipts for receipt orders, bank statements about the transfer of funds from the buyer's account to the seller's account, sales and cash receipts, acts on the purchase of materials from individuals indicating the address and passport details of the seller and other documents) ;

- evidencing the payment of interest under a target credit agreement or loan agreement, mortgage agreement (in the absence or “burnout” of information in cash receipts, such documents can serve as extracts from the taxpayer’s personal accounts, certificates from the organization that issued the loan about the interest paid for using the loan).

5 When purchasing property for common joint ownership, we prepare:

- a copy of the marriage certificate;

- a written statement (agreement) on the agreement of the parties to the transaction on the distribution of the amount of the property tax deduction between the spouses.

6* We provide the tax authority at the place of residence with a completed tax return with copies of documents confirming actual expenses and the right to receive a deduction when purchasing property.

*If the submitted tax return has calculated the amount of tax to be refunded from the budget, together with the tax return it is necessary to submit to the tax authority an application for a refund of personal income tax in connection with the costs of purchasing property.

What is a tax deduction

The legislation of the Russian Federation offers preferential conditions for the purchase of real estate - an apartment, house, room, land plot, as well as shares of this property.

The essence of the benefit is that after purchasing and completing the transaction, you have the right to a partial refund of the money spent.

In order to get a tax refund for a mortgage, you must contact the tax authorities and declare your right to receive a tax deduction: fill out a 3-NDFL declaration and attach the accompanying documents.

What does the property tax deduction consist of?

Every month your employer contributes 13% of your salary to the budget - income tax. If we switch to the language of tax legislation, your salary is a taxable base, which can be reduced by the amount of the tax deduction. Due to this, the amount of monthly contributions to the budget is also reduced.

After applying the deduction, you, as a taxpayer, will have a surplus on the personal income tax paid during the year. You can choose one of the forms of reimbursement - receive the excess into your account or exercise the right not to pay payroll tax until the entire refund amount has been exhausted.

Today, the tax deduction for the purchase of an apartment and other real estate is 2 million rubles .

This means that you can return 260 thousand rubles (13% x 2 million) from the taxes that you have already paid to the budget.

If your annual salary is less than 2 million rubles, the property tax deduction can be spread over several years.

It is important to understand that the amount of your refund cannot be greater than the tax you paid for the same period. And the total tax deduction cannot exceed the cost of the purchased housing.

Example:

During 2021, your salary amounted to 1.5 million rubles. During this period, you (your employer) paid 195 thousand rubles to the budget. (13% x 1.5 million). In 2021, you bought a room for 500 thousand rubles. This means that in 2021 you have the right to file a 3-NDFL declaration and apply for a deduction for the entire cost of the purchased housing.

The calculation looks like this:

from 1.5 million rubles (your salary or, in other words, the tax base) 500 thousand rubles are deducted. (the cost of the room you bought - and as we remember, the deduction is up to 2 million rubles, but not more than the purchase amount). As a result, the tax base decreases and becomes equal to 1 million rubles. (1.5 million – 500 thousand).

This means that it was on this amount that you had to pay tax in 2019: 13% x 1 million rubles. = 130 thousand rubles. But since the declaration is drawn up next year after receiving ownership rights (in 2020), then in fact in 2021 you have already paid 195 thousand rubles in taxes. The difference should be credited back to your account. In total, for purchasing a room you will receive a refund of 195 – 130 = 65 thousand rubles.

We told above that tax legislation allows you to return up to 13% of 2 million rubles, that is, 260 thousand. But your return in the example above was 65 thousand. How to be? Is the remaining money going to waste? Fortunately, no!

For housing purchased after 01/01/2014, there is the right to transfer the balance of the tax deduction to the housing that you buy in the future.

In order to qualify for a property tax deduction, you must have ownership documents. When purchasing housing under a shared participation agreement, this is the Transfer and Acceptance Certificate. For housing purchased under a purchase and sale agreement, an extract from the Unified State Register is required.

How does the tax deduction work when purchasing real estate?

By applying for a tax deduction when purchasing real estate, you can get back part of the previously paid personal income tax. A deduction can be issued only after taking ownership (signing a transfer agreement) and only for tax periods (calendar years) following the purchase of housing. That is, you will get back some of the income taxes you paid in the years after your purchase. You cannot take advantage of the deduction for periods preceding the purchase of real estate. An exception is left for pensioners, who can transfer the deduction to periods in which they received income subject to personal income tax, but for no more than three years.

The maximum amount of property deduction when purchasing real estate is 2 million rubles (13% of this amount will be returned to you). That is, if you, for example, bought an apartment worth 3 million rubles, you can only claim 2 million rubles as a deduction. If the property you purchased cost less than 2 million rubles, the remainder of the deduction can be transferred to another purchase.

In the case of interest on credits (loans), the maximum amount to which a tax deduction can be applied is 3 million rubles.

You can apply for both of these deductions at the same time. In this case, the amount to be refunded when providing a deduction cannot be more than the taxes you paid for the year. However, you can get a deduction over several years by filing returns and claims for the deduction for the periods in which you paid income taxes.

There is no statute of limitations for obtaining a property deduction. But you can only declare it for the last three years (that is, you will get back part of the taxes paid for the last three years). For example, in 2021, you can apply for a deduction for 2021, 2018 and 2021 (if the property was purchased before 2017).

What is the main tax deduction for a mortgage?

Mortgage lending in Russia is becoming increasingly popular. And this is justified. Real estate is not getting cheaper, and it can be difficult to save up the entire amount to buy the apartment you like. Using borrowed funds is a convenient way not to postpone the purchase for many years, but to become the owner of your own home right now.

We would like to please you - if you have decided to take such a responsible step as buying an apartment on credit, tax legislation has provided preferential conditions for this option: a tax refund on mortgage interest.

Tax deductions when buying a home with a mortgage are:

- on the purchase price (basic);

- on interest paid.

The main deduction includes funds spent on the purchase of an apartment, house, land and other residential real estate. At the same time, it includes both personal savings and credit savings.

Above, we talked about the basic principle of calculating the property tax deduction - it is the same for purchasing housing with your own money and for purchasing with a mortgage. More detailed information is presented in the article “Tax deduction when purchasing an apartment, house, plot of land.”

To summarize:

- You must have an official place of work, a “white” salary and monthly contributions to the budget of 13% personal income tax. Or you have other sources of income from which you pay personal income tax. This could be, for example, income from rental housing.

- The maximum amount of tax deduction that you can receive when purchasing an apartment, house, land plot and other real estate is 2 million rubles. 260 thousand rubles are returned to your account. – 13% of the deduction amount.

- Claiming a tax deduction is allowed only after receiving a document of ownership. As mentioned above, for shared construction this is an Acceptance and Transfer Certificate, and for housing purchased under a purchase and sale agreement, this is an extract from the Unified State Register of Real Estate.

- You can contact the Federal Tax Service with documents for a personal income tax refund the next year after receiving the right to deduct.

What is the mortgage interest deduction?

When purchasing an apartment with a mortgage, you have the right to a tax deduction on the interest paid to the bank. All actual repaid interest is taken into account, but not more than 3 million rubles . Of this amount, 13% is returned to your account, that is, 390 thousand rubles. (13% x 3 million rubles).

These terms came into force on 01/01/2014.

Before January 1, 2014, the tax refund on the loan had no upper limit. What does this mean for the taxpayer? If your home was purchased before 2014, and you have not previously exercised your right to return personal income tax on your mortgage, you can receive a deduction in the full amount of the interest actually paid.

Example:

In 2009, you took out a mortgage loan in the amount of 14 million rubles. and bought an apartment for 17 million. From 2009 to 2021. paid the bank 5 million rubles. percent. The transaction was officially completed before January 1, 2014, so you have the right to claim a deduction equal to the amount of interest actually paid. As a result, 650 thousand rubles will be credited to your account. (13% x 5 million rubles).

Important point! If the cost of the apartment under the contract is lower than the amount of funds taken on the mortgage, then the tax refund will be calculated based on the actual cost of the apartment.

Example:

In 2010, you took out a mortgage for 17 million rubles. and paid the bank 6 million rubles. percent. At the same time, you bought the apartment for 13 million rubles, which is noted in the purchase and sale agreement.

The transaction was officially completed before January 1, 2014, so you have the right to claim a tax refund on the loan equal to the amount of interest paid. But since the deduction is provided specifically for the purchase of an apartment, it will include interest on 13 million, and not on 17 million rubles, that is, on the amount actually spent on purchasing the apartment.

The interest that will be deducted is calculated in proportion to the amount under the mortgage agreement and the actual purchase amount specified in the agreement.

When does the right to a tax deduction on mortgage interest arise?

The interest deduction, like the main one, can be claimed only in the year following the year of registration of ownership of the housing. If you received a transfer acceptance certificate (or an extract from the Unified State Register) in 2021, you can submit a 3-NDFL declaration no earlier than 2021.

It often happens that a mortgage agreement is concluded before receiving documents for an apartment. This does not affect the amount of the tax deduction for mortgage interest - the entire amount of interest you paid from the very first payment is included in the deduction.

Example:

In 2014, you took out a mortgage for shared construction of a house. Payment of principal and interest began from the first month of the mortgage agreement. You received the acceptance certificate from the developer in 2015, which means that your right to receive a tax refund begins in 2021. All interest starting from 2014 will be included in the calculation.

It must be remembered that only interest actually paid for past periods is included in the deduction. If your annual salary and the amount of taxes transferred are sufficient, you can immediately receive the entire main deduction. But the mortgage interest deduction is made only based on the total of your payments to the bank - annually for the previous year.

We recommend that you first receive the main deduction, and only then claim the interest deduction. Then you can get money in just a few years.

Example:

In August 2021, you took out a mortgage and bought an apartment for 3 million rubles. How your 3-NDFL declarations will be generated:

- 2018 – if your income is sufficient, you have the right to claim a full deduction for the principal amount – 2 million rubles. and receive 260 thousand rubles to your account at a time. In addition, you indicate the mortgage interest you paid from August to December 2017.

- 2019 – indicates the interest paid to the bank during 2018.

- 2020 – indicates the interest paid to the bank during 2019 and so on until the entire amount is exhausted.

What can be included in the cost of purchasing real estate to receive a deduction?

Actual expenses for new construction or acquisition of a residential building or share(s) in it, which can be claimed for a property tax deduction, may include:

- costs for the development of design and estimate documentation;

- expenses for the purchase of construction and finishing materials;

- expenses for the acquisition of a residential building or share(s) in it, including if its construction is not completed;

- expenses associated with construction work or services (completion of a residential building or share(s) in it, if construction is not completed) and finishing;

- costs of connecting to electricity, water and gas supply and sewerage networks or creating autonomous sources of electricity, water and gas supply and sewerage.

The actual costs of purchasing an apartment, room or share(s) in them may include the following costs:

- expenses for the acquisition of an apartment, room or share(s) in them or rights to an apartment, room or share(s) in them in a house under construction;

- expenses for the purchase of finishing materials and work related to the finishing of an apartment, room or share(s) in them, as well as expenses for the development of design and estimate documentation for finishing work.

Expenses for the completion and finishing of an acquired residential building or share(s) in it or the finishing of an acquired apartment, room or share(s) in it will be deductible only if the agreement provides for the acquisition of a residential building, the construction of which is not completed, an apartment, rooms or share(s) in them without decoration.

How to apply for a tax deduction - stages

There are three options for returning a tax deduction in 2019:

- When visiting the inspection at your place of registration.

- When filling out the appropriate form on the Internet, you will need to go to the portal “gosuslugi.ru”.

- When submitting an application at the multifunctional center (MFC).

Tax office addresses can be found on the government services website. The user must first register. There are several stages. With simple authorization, you have limited access to submit applications and register with government agencies.

If you pass identification, an expanded range of options will be open:

- Help in finding information;

- Registration at various branches online;

- Ordering certificates via the Internet;

- Review of statistics.

To authorize you need:

- Enter the series and number of the passport;

- If your last name has changed, you must indicate the old one;

- Enter TIN details;

- Fill in the place of residence column.

It is most convenient to submit an application in electronic format. To use this type of service, you must create a personal account. You must enter taxpayer information carefully, checking the accuracy of the data.

When contacting the MFC, it does not matter at all which specific department you decide to contact. They are not tied to areas, so it is not necessary to come to the authority located at your place of residence.

Refund of personal income tax on mortgage interest: determine the amount

The exact amount of compensation will be determined by specialists after approval of the application and verification of all documents. For each citizen it will be different depending on:

- housing costs;

- dates of the transaction;

- amount of interest paid.

When compensating for interest on a mortgage, the specialist calculates 13% from the total amount of interest already paid and makes a refund to the bank account

Example

Citizen N. took out a mortgage for a period of 20 years at 15% per annum, purchasing an apartment worth 1,900,000 rubles.

1.9 million * 15% = 285 thousand rubles (interest for the year)

285 thousand rubles * 13% = 37,050 rubles (this is the amount that will be returned in a year).

It is important to understand that when calculating the amount of compensation, experts take as a basis the total amount of taxes paid by the borrower. That is, in fact, if the amount of taxes was less than the deduction due, then this right will extend to subsequent years until the funds are fully used.

If a situation arises where it is necessary to return compensation for several years at once, the application procedure will be identical. If you first learned that you can get back part of the money spent on housing on credit, this does not mean that time is lost.

Here it is important to determine the fact of personal income tax deduction at the time of conclusion of the transaction. If you were officially employed and regularly paid income taxes, then you can write an application to the fiscal service for a refund for several years at once, but no more than for the previous 3 years

Where to contact?

To exercise the right to return a partial amount for the paid mortgage, you can choose one of three methods:

- Visit the tax office in person at your place of registration.

- Fill out the online form on the Russian Government Services Portal.

- Submit an application through the multifunctional center.

You can find out the number and address of the fiscal service in your city through the public services portal. To do this, you need to enter your personal data: TIN and address. Keep in mind that you need to choose a branch not according to your actual place of residence, but according to your registration address.

The electronic application option is the most convenient and simplest. In order to use the service, you must register on the site and log into your personal account.

When registering, you must provide the taxpayer’s personal information (passport number and series, TIN, registration address, SNILS). The opportunity to submit an application together in the completed declaration form will be available only after the administration has verified the accuracy of the entered data.

The multifunctional center is not geographically tied to specific addresses and accepts applications from all citizens of the Russian Federation. To use the deduction service, you must contact the center with the appropriate package of documents and submit an application for a refund of mortgage funds.

Who should submit and can I submit instead of another person?

17. Power of attorney (copy).

You can often hear the question: who has the right to apply for a tax deduction on a mortgage? Only the owner or spouses can apply for a tax deduction. However, for these categories there is no need to hand over everything under a notarized power of attorney.

All other persons (any other relatives and others) can submit a package of documents on behalf of the owner using a notarized power of attorney.

Getting tax deductions for mortgage interest is a huge plus for anyone's budget. Government agencies have made the application process as simple as possible. At the same time, many consulting, legal and accounting firms provide services to support the process.

Well, now you know what documents are needed to return 13 percent of the mortgage interest.

General procedure for filling out 3-NDFL for interest deduction

Since 2021, the 3-NDFL form (KND 1151020) has changed. The number of sheets has been reduced: only two sections, eight appendices and two pages remain for calculating the amount of profit from the sale of property and social compensation. The design of the title page remains mandatory.

In order to correctly fill out the declaration of KND 1151020 to receive a percentage of the loan for the purchase of a home, appropriate standards have been developed. Five main rules:

- The title page, the first section and the seventh appendix are drawn up.

- To send manually, the cells are filled in with capital printed numbers and letters from left to right: each cell corresponds to one character.

- Handle color: black or blue.

- The calculation of indicators must be correct, otherwise the form will be returned for correction.

- It is prohibited to correct information in the form. If an error is made, a new form is drawn up indicating the correction number at the top of the title page. There are corresponding cells for this.

To avoid mistakes, tax authorities recommend using special programs that are installed on a PC or filling out KND 1151020 in your personal account on the Federal Tax Service website by selecting the 3-NDFL tab. The system will automatically calculate the tax deduction for the mortgage.

What sheets need to be filled out?

After changes in the content of 3-NDFL, a citizen will receive interest on a mortgage by filling out Appendix 7, and previously they filled out sheet D1 for this. In addition to this paragraph, the resident fills out the title page, the first, second sections and the first appendix in the KND form 1151020. The registration procedure affects the correct calculation of the returned interest. First, fill out the title page, then the first, seventh appendix, second and first sections.

Title page

The first page includes information about the payer: passport information and personal data. The title deed consists of four blocks, three of which are prepared by the resident, and the last by the tax authorities.

- about yourself: full name, address, date and place of birth, country code, type of resident;

- about documentation: document code, passport data from the first pages;

- the status contains information about whether the citizen is a resident or not;

- contact number.

In the lower left part it confirms that the information is correct, and the lower right block is filled out by employees of the Federal Tax Service.

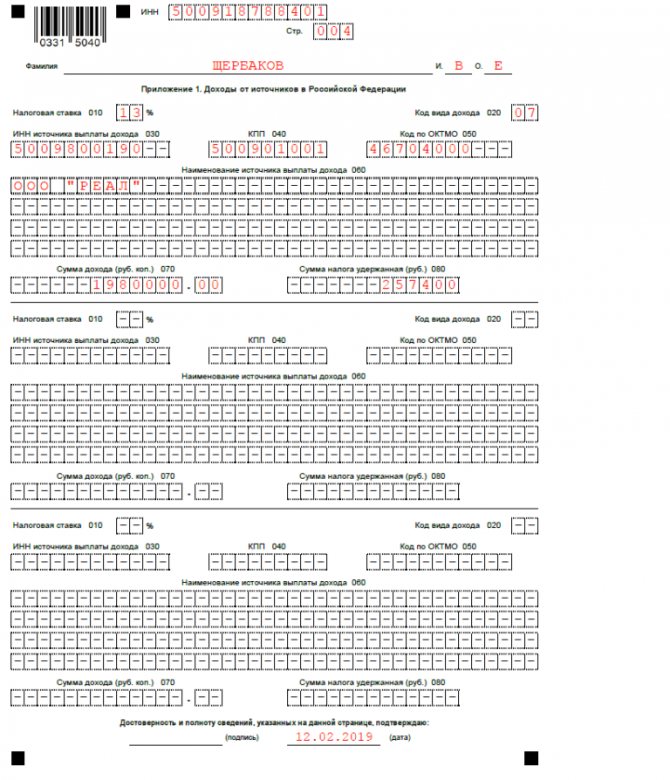

Annex 1

In this paragraph, the citizen indicates the sources of profit that he receives on the territory of Russia. This profit must be subject to 13% personal income tax. Required cells:

- TIN, KPP, OKTMO of the company where the person works;

- full name of the company with a description of the organizational and legal form;

- total profit for the tax period.

In the case of reimbursement of mortgage interest, zero is written in the line indicating the total amount of the withheld fee.

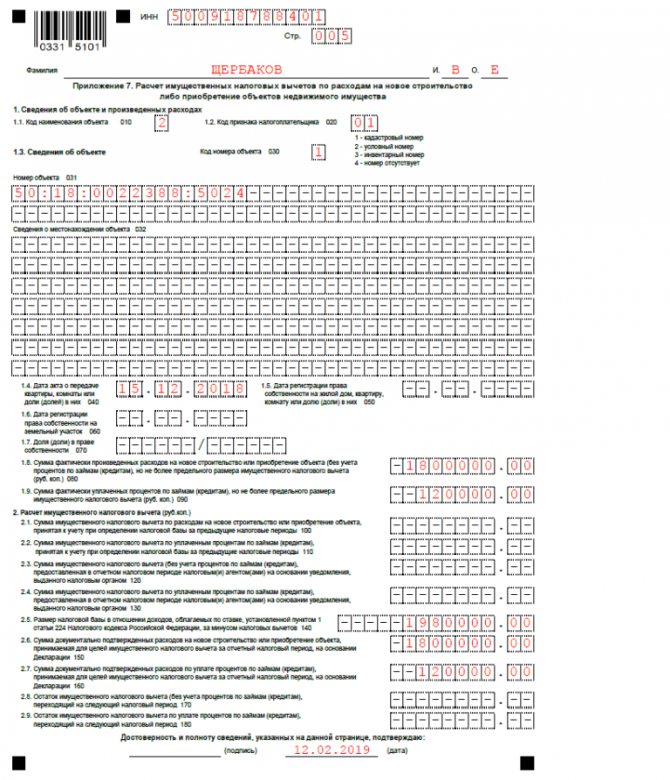

Appendix 7

Now the main page is filled in - the seventh section, reflecting information about the acquired property and the money spent on the purchase. The cells indicate:

- code of the name of the dwelling: apartment, room, house or other;

- sign of the payer who requested a refund of interest;

- choose a type of object numbering: cadastral, conditional or inventory;

- directly the housing number according to the documentation.

Below, a citizen provides information about money and registration:

- date of transfer and registration of property;

- housing costs;

- the total amount of interest paid over the entire loan term.

If the form is filled out in the program or in your personal account, the software will independently calculate the compensation.

According to the law, the maximum amount for property compensation for interest is 3 million rubles, or (3 million rubles * 13) = 390,000 rubles. Therefore, if more than 2 million rubles in interest have been paid, then the citizen will not receive more than 390,000 rubles at a time. But the balance can be returned in subsequent years.

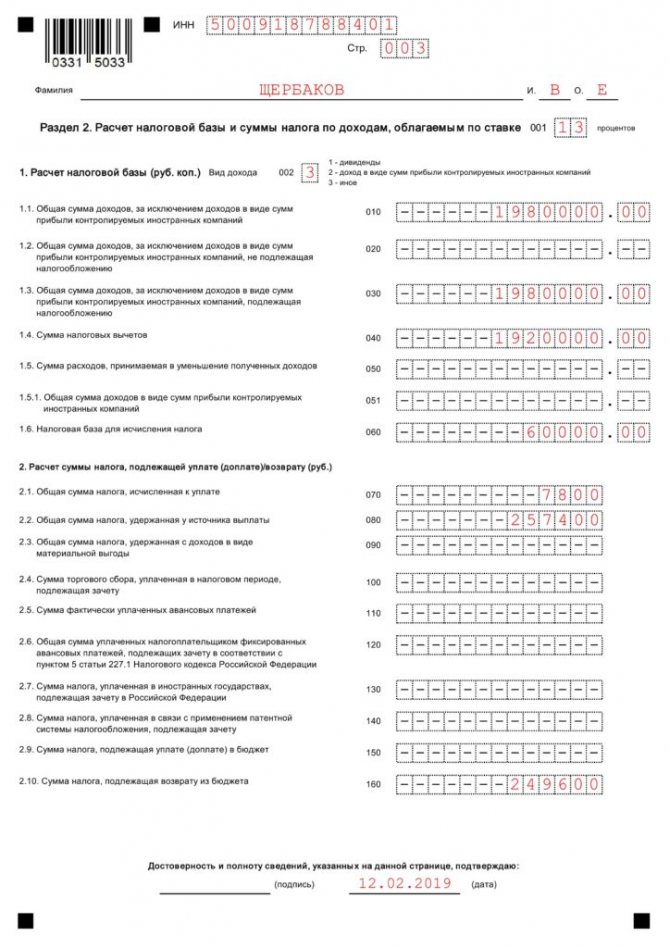

Section 2

The second paragraph fixes the amount of the collection base and other charges, which are taxed at a 13% tariff rate: profit from salaries, sales and other sources.

Since the main information is available, they are indicated on this page and the tax base is calculated: interest compensation for housing loans is deducted from the total profit including tax.

After this, in the second block in cell 070, the fee that the citizen must pay is calculated. And column 080 reflects the amount withheld from the one who pays the profit to the resident - the manager.

The last line 160 calculates the amount of compensation that the citizen will ultimately receive for the interest paid.

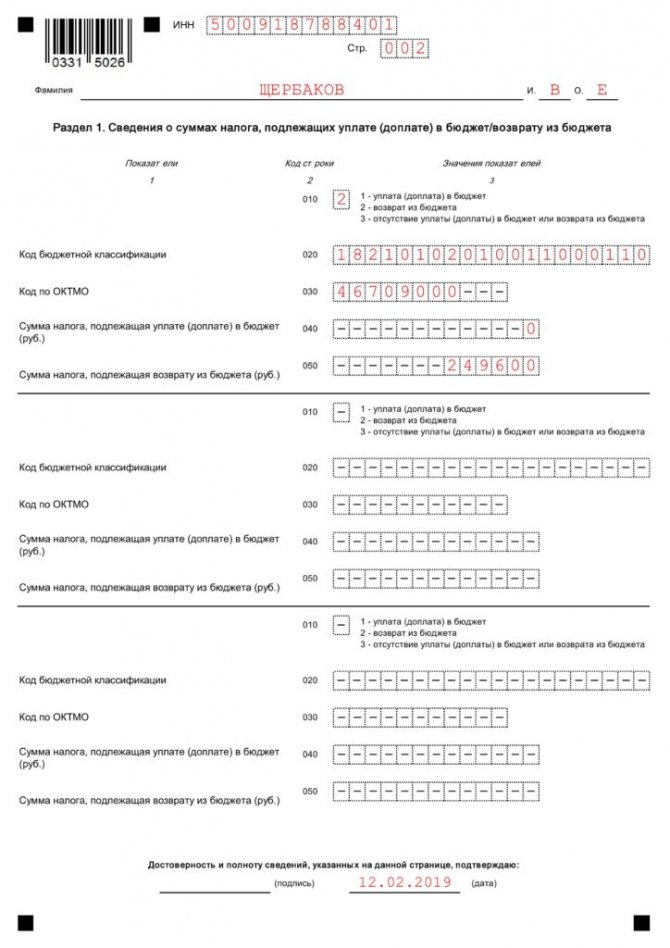

Section 1

In section one, the citizen indicates the total amount of the fee to be paid, as well as the amounts presented for refund. The lines are drawn up:

- KBK, OKTMO;

- fee to be paid and the lower amount of tax to be reimbursed.

Since the main task of a citizen in this case is to reimburse money and reduce the tax base, only the amount to be refunded is reflected here. The number is written in line 050 of the first block in section 1, and this amount is equal to the amount indicated in cell 160 of paragraph number two.

For 2021 in Russia, reimbursement of part of the money spent on the cost of housing and on credit interest are different concepts. According to the law, a citizen has the right to apply for either a refund of interest or a partial refund of the price of the apartment. Interest deductions can be claimed annually, while for housing - once every three years.

How to prepare and certify documents

The 3-NDFL declaration and application are submitted in the original. We also recommend submitting the original 2-NDFL certificate, a bank certificate about interest paid for the year and bank statements. As for other documents, you must submit either the original document, a notarized copy, or a self-certified copy.

In the latter case, we recommend filing the declaration in person (not by mail) and taking the original documents with you to the tax office. Inspection staff can verify that copies match the originals and put confirmation marks on the copies. Submitted documents are not returned, so we recommend submitting copies of documents when permitted, in order to keep the originals for yourself.

When certifying copies yourself, such certification must include the phrase “The copy is correct,” your signature, a transcript of the signature (preferably your full last name, first name, patronymic), and the date of certification.