What is IIS tax deduction?

IIS is an individual investment account. This is a type of brokerage account in which you can receive a tax deduction for trading securities.

A tax deduction is a benefit that can be obtained from the state. In fact, this is part of the income that you paid to the state and can get back.

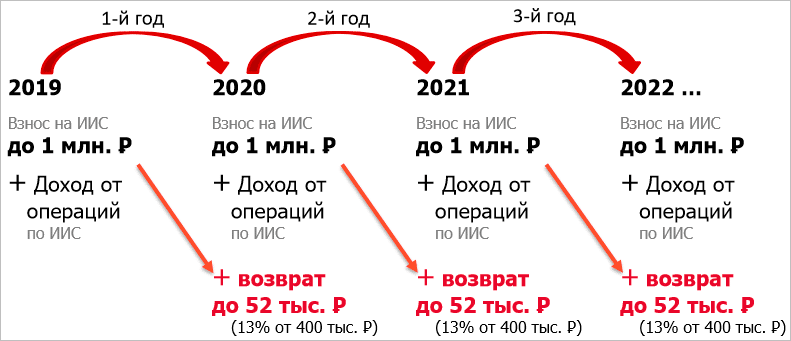

To receive a tax deduction, you must replenish an investment account, put money there, and the next year you will receive 13% of your contribution.

The maximum tax deduction for one year you can receive is 52 thousand rubles. That is, you need to invest 400 thousand to receive a tax deduction. You can invest more than 400 thousand, but you will not receive a larger .

If you have 800k, it would be logical to invest 400k at the end of the year (to get a 52k deduction next year). And next year another 400 so that you can then receive 52 thousand rubles. This can be done every year.

The maximum contribution you can make per year to an IIS is 1,000,000 rubles. By the way, contributions can only be made in rubles .

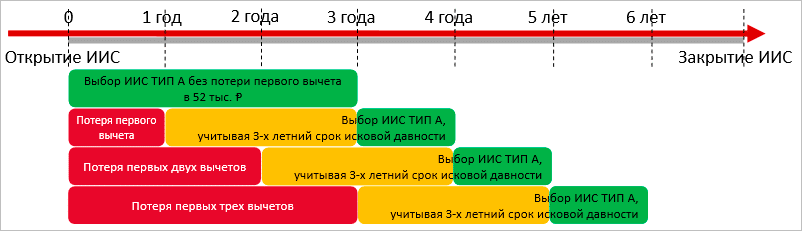

You can receive a tax deduction within 3 years after you deposited money into an IIS. After three years this right expires.

How many IIS can I open? You can open a second IIS account to transfer money from one broker to another. But you can get a tax deduction only from one investment account , and when you close the second IIS account (within a month). The tax service will definitely know about the opening or closing of an account because... the broker transmits all tax information about opening and closing accounts.

So you can have 2 open IIS, but only for one month. And you will not receive any benefits under the second IIS.

IIS tax deduction

Why is it more profitable to invest with IIS?

An individual investment account (IIA) is essentially a regular brokerage account, only with tax benefits for investors. This makes investing through an individual investment account more profitable than buying stocks, bonds and other instruments using a regular brokerage account.

It is not surprising that today more than 2.9 million private investors choose this method of investing, as follows from Moscow Exchange data as of October 1.

The contribution deduction (or type A deduction) makes it possible to return 13% of the amount you contributed to the IIS for the year, but not more than 52 thousand rubles, since the maximum base for calculating the tax deduction is 400,000 rubles.

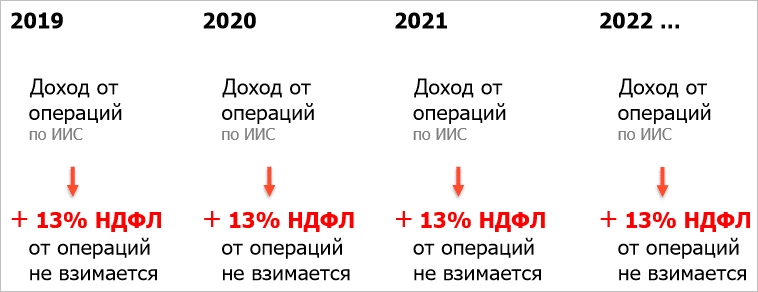

Type B deduction, or deduction from income that is subject to taxation, allows you, three years after opening an account, not to pay personal income tax on income from transactions with IIS funds in excess of contributions.

The investor himself decides which type of deduction to choose. For example, if you are a conservative investor, are used to investing mainly in bonds and use IRA as a tool for saving money, and are not actively trading in the stock market, then most likely it is more profitable for you to use IRA type A.

But if you are by nature a more active investor and try to regularly make transactions with securities, buying and selling stocks and bonds in your portfolio, then you will probably prefer Type B IRA.

However, the important thing is that no matter which of the two types of deductions - A or B - you end up using, you can qualify for either of them only on the condition that you do not close your IRA within three years.

The payment for “freezing money” in the account is a significant increase in investment profitability thanks to a tax benefit, for example, for IIS type A it is +4.33% per annum.

And from 2021, owners of Type B IIS will be able to save significantly on taxes on bond coupons.

Let us recall that in March the State Duma and the Federation Council approved a package of amendments to the Tax Code, which introduce personal income tax for all types of income from bonds. The changes will take effect on January 1, 2021. Previously, the holder of OFZ, as well as regional and municipal bonds, could not pay 13% personal income tax on coupons. The same benefit still applies to corporate bonds if they were issued after January 1, 2021 and the coupon rate on them does not exceed the key rate of the Central Bank + 5 percentage points. Now it's 9.25%.

From 2021, coupon income on bonds in an investor’s portfolio will be subject to personal income tax. But tax breaks on IIS for private investors will continue to apply.

New type of IIS: double benefits

Now the National Association of Stock Market Participants (NAUFOR) is discussing with the Central Bank the idea of creating an individual investment account of the third type (IIS-3). If the new type of IIS becomes operational, the restriction on withdrawals from such an account may be up to 10 years. But in exchange, the investor will receive double tax benefits: the right to an annual tax deduction on deposited amounts (as in Type A IRA) and exemption from income tax when withdrawing funds from the account after a specified period (as in Type B IRA).

Why does the state need to pay the IIS deduction?

It is beneficial for the state that you invest in a brokerage account by purchasing securities. Due to this, the economy will develop and conditions for business in the country will improve.

Hence the logical conclusion that the IIS deduction can only be obtained by opening an account with a Russian broker. But you can buy shares of foreign companies (they may soon be banned). That is, you can get a tax deduction by simply depositing money into an IIS; you don’t even have to buy shares.

What's the catch you ask?

The catch is that the IIS cannot be closed within 3 years . If you need the money and close the account (after having already received the tax deduction), you will have to return the tax deduction you received and pay a penalty.

also cannot partially withdraw money from an IIS. When withdrawing money, the IIS is completely closed. But some brokers allow you to receive dividends into your IIS account, which can be withdrawn.

There is a little secret. You can open an IIS and not invest money there for 3 years. At the end of the third year, deposit 400 thousand. The next year, receive a tax deduction of 52 thousand rubles and successfully close the IIS.

Several interesting life hacks to increase potential profits from IIS

Let's say you have an amount of 500,000 rubles and with it you want to return part of your money paid to the state in the form of taxes (by you or your employer - it doesn’t matter). To do this, you just need to open an IIS of the first type and deposit money into it.

Life hack #1

To get the maximum benefit from this, you will need to take into account a number of nuances:

Firstly , the validity period of an IIS begins to count not from the moment money is deposited into it, but from the moment it is opened. Therefore, having opened it at the beginning of 2021, money can be deposited only in December of the same 2021 and apply for a deduction within a month.

Secondly , there is no need to invest all available 500,000 rubles in IIS, since the maximum amount for providing a deduction for it is 400,000 rubles (the deduction for it will be 13% or 52,000 rubles).

Thirdly , From January to December, you can keep money on a bank deposit or in other conservative financial instruments (OFZ, reliable ETFs, etc.). And in December, transfer 400,000 rubles to IIS (leave 100,000 on deposit). Thus, your annual return will consist not only of the 13% deduction, but also of the interest received on the bank deposit (or one of its alternatives). In other words, instead of 13% you can get 18% or more.

Life hack #2

There is also such a trick that profit from investments credited directly to the IIS is not considered a replenishment and, therefore, the deduction is not calculated for it. Therefore, it makes sense to agree with your broker to withdraw all dividends on stocks and coupon income on bonds to a separate account.

Then you can transfer all the profit received in this way to the IIS (plus you can add to this money the tax deduction received over the past year) and this will be considered nothing more than another replenishment of the account. By replenishing it in this way, for example, by 50,000 rubles, you will receive an additional 7,500 rubles deduction.

Life hack #3

If you don’t yet have a sufficient amount of free money, it still makes sense to open an individual investment account. The fact is that its three-year validity period begins precisely from the moment of opening, and not from the moment of replenishment. Therefore, when in a year or two you have money and you top up your account, part of the 3-year period will have already passed and, as a result, you will be able to withdraw your profits earlier, without losing the tax preferences received.

How to choose the type of tax deduction?

Yes, yes, there are several types of tax deductions, but you can only choose one :

- Type A. _ Deduction for contributions . This type is worth choosing if you work and have official income (you pay 13% tax). If you are an individual entrepreneur or self-employed and pay taxes, this type of deduction is also suitable for you. In this case, income is limited to 52 thousand rubles. Pensioners and the unemployed cannot receive this deduction because they do not pay taxes.

- Type B. Profit deduction . When you choose this type of deduction, you do not pay the 13% tax on the sale of securities. This is a mandatory tax for all investors. Suitable for large investors who are ready to invest a large sum immediately for the long term.

If you are a working person with a regular salary and invest a small amount of money every year (up to 400 thousand). Then a tax deduction on contributions (type A) is definitely suitable for you.

And if you are a pensioner or you do not have a permanent official income, and you are going to deposit one large amount without replenishment, then a profit deduction (type B) will be beneficial for you.

If you chose type B deduction, you do not need to contact the tax office and fill out a 3-NDFL certificate (the broker will do this for you). Only when closing the account will you need to take a certificate from the Federal Tax Service that you did not receive a deduction for contributions and submit it to the broker.

When choosing a tax deduction, consider what will be beneficial for you. Tax deduction on contributions (type A) is more popular, as it is available to a larger number of the population.

Types of deductions and conditions for receiving them

We will consider detailed instructions for registering deductions for types “A” and “B” in the last section of the article. But I think it’s correct to first describe the conditions for receiving it.

Type “A”

By choosing this mode, the investor submits documents for a refund of previously paid income tax. And it can do this every year. The state gives the right to reduce the tax base by the amount of money deposited into the IIS, but not more than 400,000 rubles. There is one more limitation - your salary. If you paid the state less than the amount you want to return for your investment, you will have to reduce your appetite.

For example, the official income of an investor is 30,000 rubles. For the year, he transferred personal income tax in the amount of: 30,000 * 12 * 0.13 = 46,800 rubles. In a year, he will be able to return only 46,800 rubles using the IIS, although the maximum amount is 52,000 rubles. If next year the salary increases to 40,000 rubles, then the return will already be 52,000 rubles.

Who is type “A” suitable for? Working citizens who receive a white salary and officially transfer income tax to the budget.

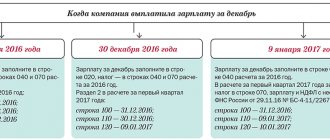

At the end of the year, many questions traditionally arise about when to open an IIS in order to take advantage of the benefit next year. The opening month is not important. For example, I opened an account in December 2017, submitted documents for a refund in January 2021 and received the money in May. You can only receive the deduction once per year. Deposit money into your account at least every day, at least once in December and apply for a tax refund next year.

There are situations when an investor has not submitted documents for deductions for several years. In this case, he can do this for the previous 3 years. For example, in 2021 for 2021, 2021 and 2019.

How type “A” IIS works is well presented in the diagram prepared by the Moscow Exchange.

Type “B”

It is chosen by officially unemployed citizens, pensioners, students, individual entrepreneurs and self-employed people, and other categories who do not pay personal income tax to the budget. In addition, tax benefits under type “B” can be beneficial to active traders who mainly make money from rising quotes and make frequent transactions for the purchase and sale of securities.

The essence of the mechanism is as follows: when the account is closed, the profit received from operations on the IIS is exempt from paying income tax. To receive the benefit, you must comply with the following rules:

- the minimum period of existence of the IIS is 3 years;

- You cannot use a deduction under type “B” if you have received a return under type “A” at least once.

Example. The investor bought shares for 150 rubles. a piece. After some time, he sold them for 200 rubles. Taxable profit – 50 rubles. from one share. Type “B” will allow you to avoid paying personal income tax.

How many times can I receive an IIS tax deduction?

You can receive a tax deduction every year using the type A deduction ( contribution deduction ). The main condition is a deposit (400 thousand rubles to receive a maximum deduction of 52 thousand rubles) once a year.

Let me remind you that you can withdraw this money only when you close your IIS (after 3 years); you cannot withdraw partially from your IIS. But no one will stop you from closing and reopening an investment account in a few months. True, there you will again have to wait 3 years (receiving a tax deduction) to close it.

You can deduct type B ( profit deduction once , when closing your account.

Maximum term of IIS

The maximum lifespan of an IIS has not been established. As well as the minimum. Those. you can open an account even now (and top up even after a year or two). And close it altogether in a day or in 10 years. However, there is a legislative provision according to which it is recommended to open an account for at least 3 years.

If you close it early, of course, no fines will be imposed on you. But in this case the right to deduction is lost. For example, you chose type B, but then decided to withdraw the money early. Then you will have to pay 13%. More precisely, the broker will do this for you, since he is your tax agent (just as, for example, the employer withholds personal income tax).

And if you also managed to receive a Type A deduction (you can apply for it the very next year after opening), you will have to return it in full. Moreover, there is a penalty for each day of use of the amount (in the amount of 1/300 of the refinancing rate).

For example, you received a deduction of 52,000 rubles, and exactly a year later you decided to close the deposit early. If we take the refinancing rate as an average of 7% (it changes periodically - information can be found on the official website of the Central Bank), then:

- 7% of 52 thousand is 3640 rubles.

- and 1/300 of this amount is 12.13 rubles.

Since you received the deduction a year ago, then 12.13*365 = 4428.67 rubles. Therefore, you need to return 52000 + 4428.67 = 56428.67 rubles. In other words, early termination leads to a loss of 155 rubles per day (provided that the deduction was maximum and received exactly 1 year ago).

Who can receive an IIS deduction

Only those who have opened and replenished an IIS can receive a tax deduction. And they, in turn, can open an IIS:

- Persons over 18 years of age.

- Tax residents of the Russian Federation (pay taxes in Russia). You are not required to be registered in Russia, but remain on the territory of the Russian Federation 183 days a year.

According to Russian legislation, you cannot engage in entrepreneurial activity if you are in the public service (clause 3, clause 1, article 17 of Federal Law No. 79-FZ). In general, you will be able to open an IIS, but with some restrictions. For example, you won’t be able to buy foreign securities and so on.

How to get an IIS tax deduction instructions

And so you opened an IIS, concluded an agreement with a broker, and replenished it. It's time to get a Type A tax deduction (contribution deduction).

Let me remind you that you can receive a deduction only the next year after you have replenished your IIS. If, for example, you replenished your IIS in 2021, you will only be able to receive a tax deduction in 2022.

You will need to do several steps:

- Contact the tax office.

- Submit an application 3-NDFL.

- Wait for a response from the tax office.

- Get money.

You can come to the tax office and the employees themselves will write a statement for you for money. But once you figure it out, you will understand that there is a maximum of 15 minutes of work involved. But you will have to pay a lot, and it is also unknown whether they will do everything right for you.

Register with the tax office

First of all, go to the Federal Tax Service website. Find a branch in your city and phone number. Call and find out how to get a login and password for your personal account. They will tell you that you can pick it up at the tax office at your place of residence at any working time.

You can receive a login and password automatically by logging in through State Services. But sometimes it happens that this function does not work and you will have to go to the login office at your place of residence to get the password.

In my case, it was just not possible to register through State Services. And I had to go to the tax office at my place of residence. You only need to take your passport .

I arrived at the tax office at my place of residence and took a coupon to the electronic queue. I had to wait very little (nowadays everything is done remotely and there are not many people there). He told the operator that he had come to get data from his personal account. She immediately gave me a piece of paper with the login and password for my personal account.

Through your tax service personal account you can:

- Send appeals to the Federal Tax Service without personal presence.

- Pay tax debt.

- Receive income certificates.

- Fill out the 3-NDFL declaration.

- Find out information about the property.

The first step has been taken, contact with the tax service has been established. Let's move on to the second step.

You may also need a Taxpayer Identification Number (TIN). The operator immediately found the TIN for me without any problems. If you have problems with your Taxpayer Identification Number (TIN), please call in advance how to obtain it.

How to get an electronic signature

A tax return is an official document. You will not be able to add your personal signature remotely, so the term electronic signature .

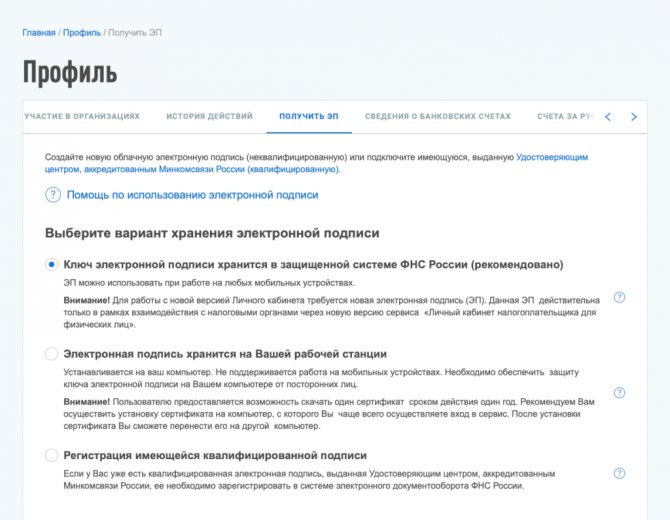

You can obtain an electronic signature (hereinafter referred to as ES) on the tax office website. To do this, go to the “ Profile ” tab and click “ Get an electronic signature ”.

Obtaining an electronic signature on the tax website

You will need to create and enter a password to access the electronic signature.

The most important thing is to remember and write down this password. If you lose it, you will have to go to the tax office and register a new electronic signature.

After this, you can fill out a 3-NDFL certificate to deduct tax from the IIS.

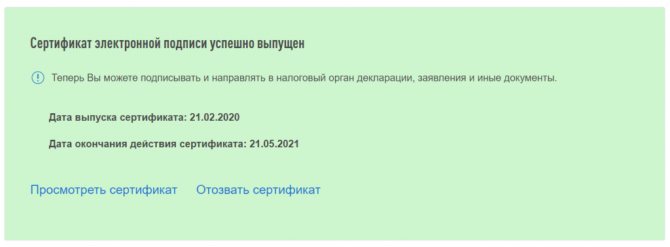

This is the simplest unqualified electronic signature. This signature can only be used to sign documents on the tax website (declarations, applications and other documents). It has a limited validity period. After some time, it will be necessary to obtain an electronic signature certificate again (15 months).

When the certificate is issued, you will see the following message in your profile:

Electronic signature certificate

What documents are needed to deduct IIS?

To receive a tax deduction, you need to submit a 3-NDFL along with a package of documents to the tax office. As I said, this can be done remotely immediately when submitting an application. An application template is also available on the website; below I will tell you how to submit it.

Prepare the required documents in advance:

- 2-NDFL . Certificate of income for the year that the IIS was replenished. It confirms that you paid 13% tax to the state. It can be obtained from the accounting department at your place of work.

- Scan of the account opening agreement . You receive this document when you open an IIS. It is called differently in different companies (agreement on maintaining an IIS account, application for accession, etc.).

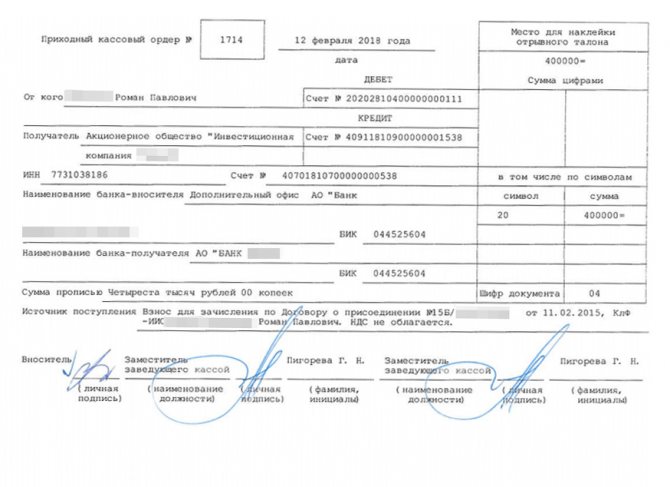

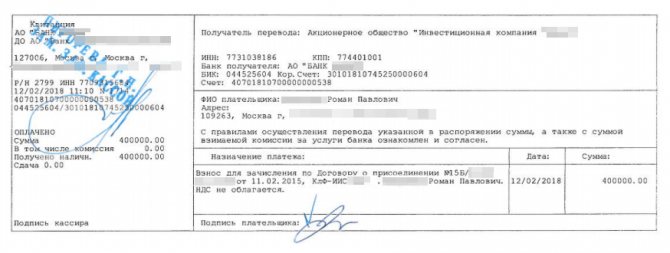

- Documents confirming the transfer of funds to the IIS account . This could be a cash order, payment order or receipt. You can find them in your bank’s personal account, or in the bank itself through which you replenished the IIS.

Receipt cash order

Receipt

How to fill out the 3NDFL declaration

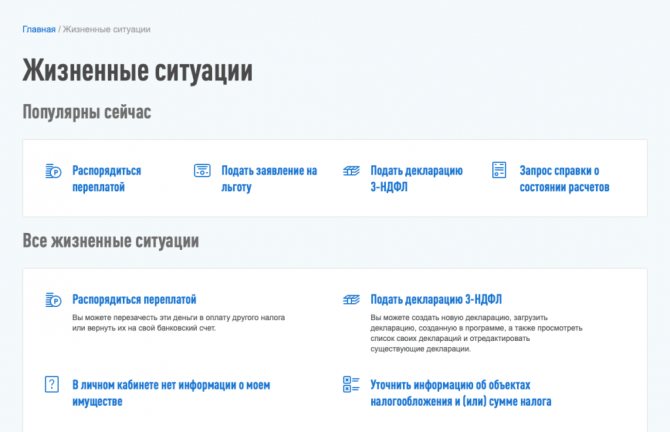

Now we will submit the 3-NDFL declaration to the tax service. We go to the taxpayer’s personal account and select “ Life situations ”.

“Life Situations” page in the tax office

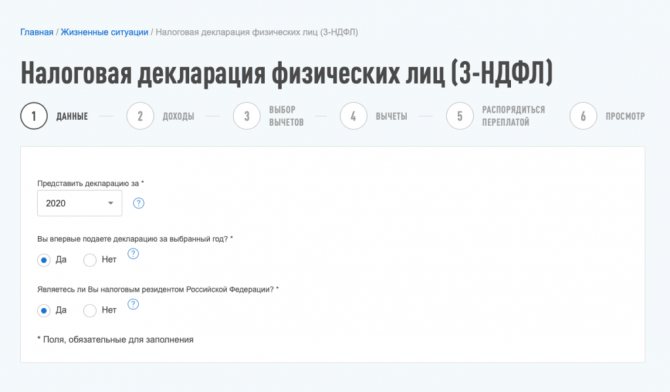

Here you will be asked to download or fill out an online tax return for individuals. If you do not have a declaration filled out in a special program, select “ fill out online ”.

Filling out the declaration using the template is very simple. All the necessary explanations will already be in the template; all you have to do is enter your personal data.

Select the year in which you replenished the IIS and indicate these fields:

Tax return data 3-NDFL

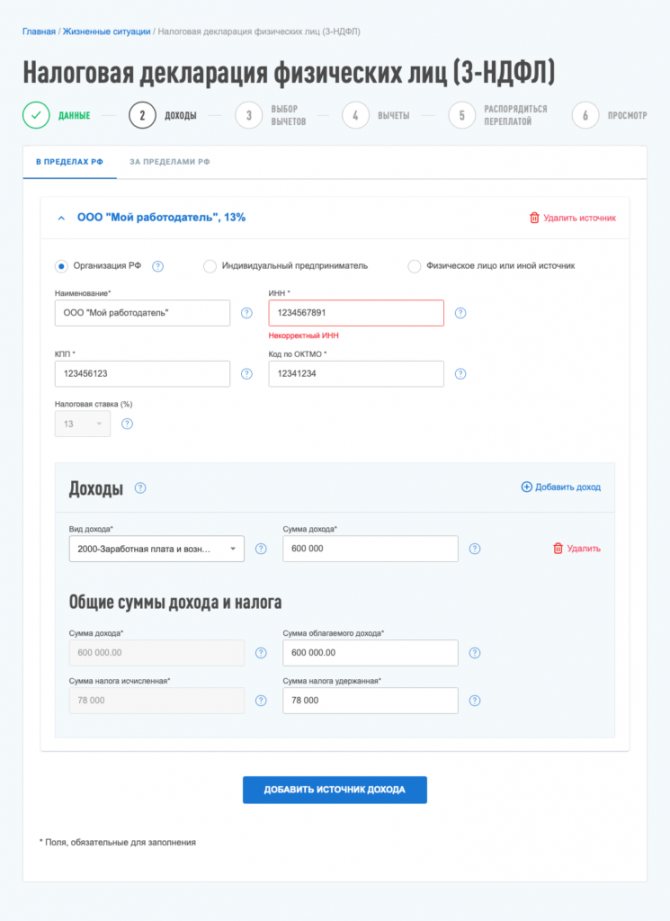

Next, you will need to provide information about your employer (KPP, INN, OKTMO). You can find all this data via the Internet by indicating the name of your company. Also the amount of income and tax from your 2-NDFL certificate.

Income tax return 3-NDFL

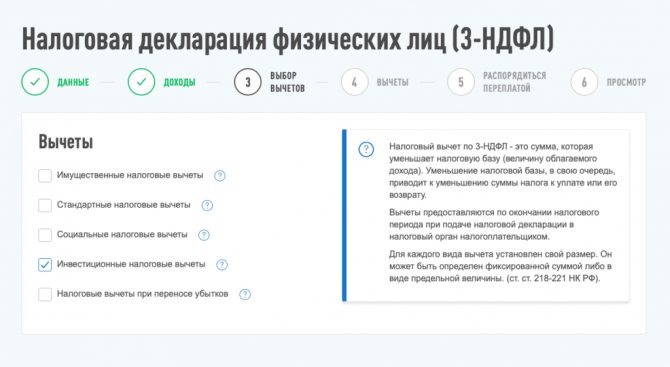

Next, select the type of deduction. If you replenished your IIS, this is an investment tax deduction.

Selecting 3-NDFL deductions

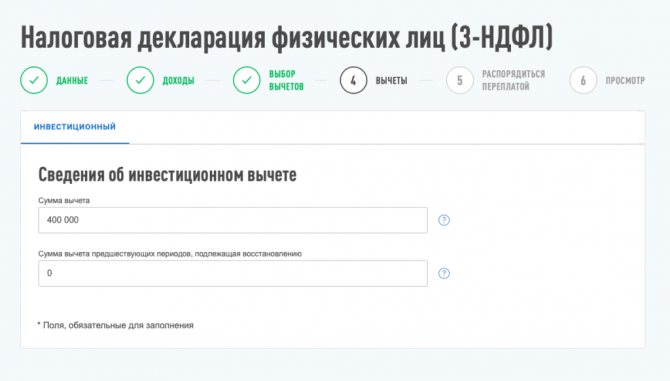

Then you need to indicate the amount that you contributed to the IIS.

Amount of deductions 3-NDFL

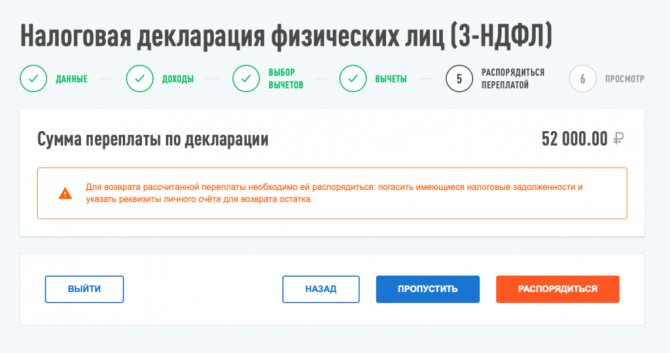

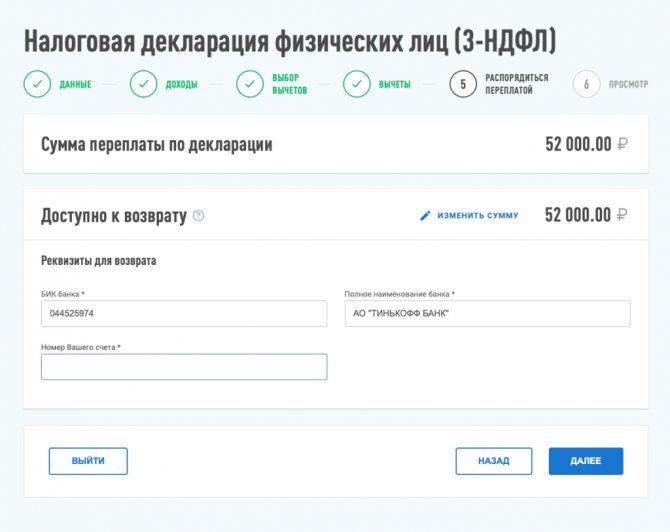

That's it, the application is ready. Another step is to click “ Dispose ”. Here you will need to provide your bank account details to receive a tax deduction. You can also skip this point and provide details later.

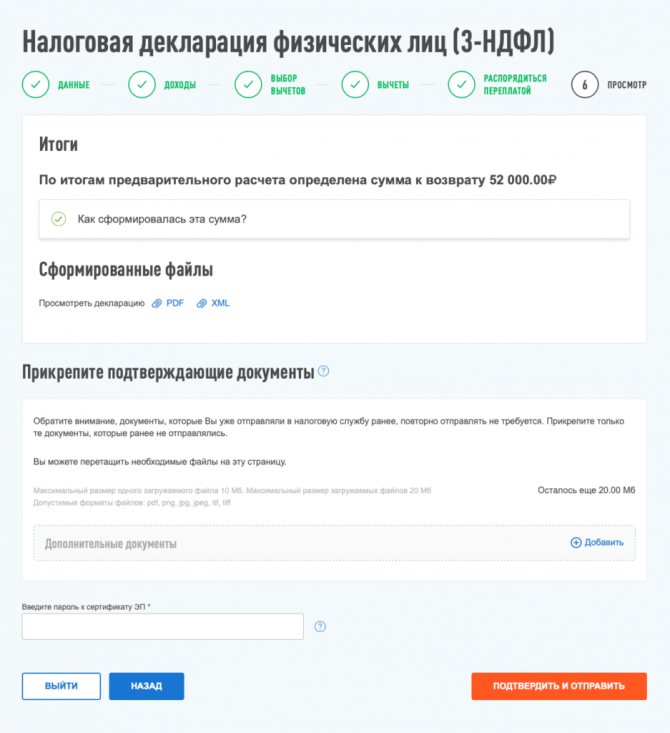

Amount of overpayment according to the 3-NDFL declaration

Here you will see how much money is available for you to return

Lastly, you will be asked to upload scans of the required documents (2-NDFL, account opening agreement and payment orders). The size of uploaded documents should be no more than 20 MB.

Attach documents to the 3-NDFL declaration

Enter the password for your electronic signature and click “ Confirm and send ”. That's all, it wasn't that difficult, right?

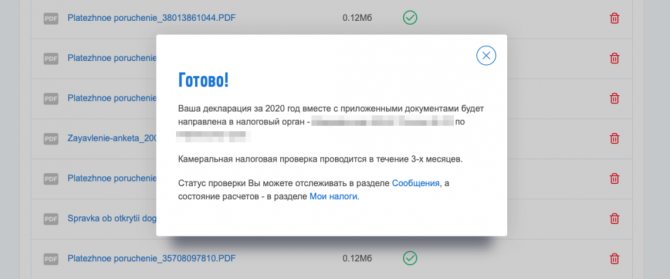

Ready 3-NDFL declaration along with uploaded documents

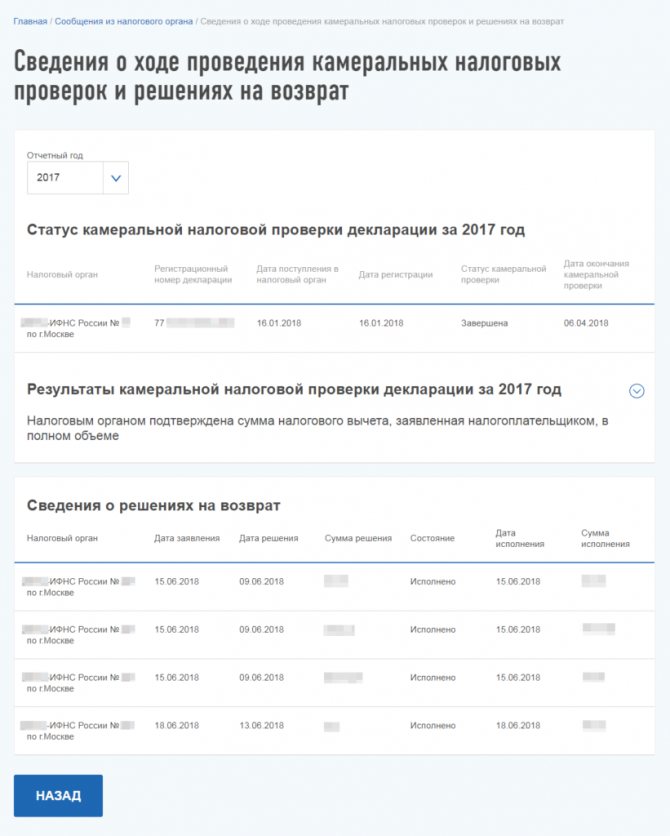

We are waiting for information about the progress of the desk audit and money

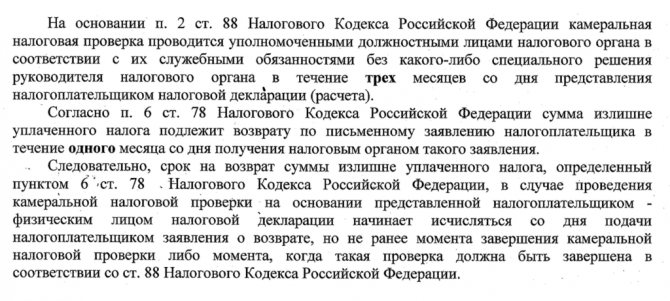

The money will arrive in your account within four months. The desk audit itself lasts three months after you send the declaration. And within a month after confirmation of the tax audit of your declaration, the money will be transferred to you.

Extract on desk audit from the Tax Code of the Russian Federation

Information about the progress of the desk audit