Step 1. Documents for a tax deduction for life insurance Step 2. Filling out the 3-NDFL declaration Step 3. Sending documents to the tax authority Step 4. Verification of documents by the tax office Step 5. Crediting money to your account How to certify documents

A tax deduction for life insurance (clause 2 of Article 219 of the Tax Code of the Russian Federation) can be obtained in two ways:

- Through the employer. In this case, you bring a notice from the tax office, and the company’s accounting department does not withhold income tax from your salary. This happens until the amount of overpaid personal income tax is exhausted.

- Through the tax office. Let's take a step-by-step look at how to do this.

Receive a tax deduction within a week with the Quick Deduction service!

Get a service

We created a video instruction in which we explained in detail what a tax deduction for life insurance is, what conditions must be taken into account when concluding an insurance contract, who is entitled to the deduction, and much more.

Main parameters of the Avantage Online product

Let's take a closer look at what the NSZh product from Ingosstrakh-Life is.

- Insurance period: 5-35 years An interesting option. The minimum contract period of 5 years makes it possible to increase profitability by taking advantage of the social tax deduction (NDFL).

- The age of the insured is from 18 years, but not more than 65 years on the date of expiration of the contract. That is, if you are currently 50 years old and you want to enter into a contract for 35 years , then this will not work , in which case the maximum contract term is 15 years . Fairly standard range: the product is intended for adult customers.

- Contributions – monthly, quarterly, semi-annually, annually, or in a lump sum. All possible options, perhaps, only without daily write-offs, although we have not yet encountered such.

- The insured amount after completion of the contract (for the “survival” risk, that is, at the end of the contract term) As for additional income options, the program includes investment income, the amount of which depends on the final investment activity of the company. The guaranteed return of premiums (guaranteed sum insured) ranges from 100 to 300%, depending on the duration of the contract. The longer the contract, the higher the percentage. You can see the amount of the guaranteed sum insured immediately in the calculator when choosing the parameters of the insurance contract.

- Risk part The main risks are survival and death for any reason (included in the basic tariff. Payment is made immediately after the occurrence of the insured event, and not at the end of the contract, as is often provided for by other savings programs. The concept of “for any reason” includes not only death as a result of an accident, but also due to any disease. Separately, it is worth paying attention to the health status of persons accepted for insurance - for this it is necessary to confirm a health declaration. Additional service options (included in the basic tariff): Telemedicine - consultation with the doctor on duty, as well as specialized specialists, selection of a medical institution and doctor to solve a specific health problem, consultation on medications, issues related to the organization of medical care under compulsory medical insurance. The service is provided by the company’s partner - Digital Medical Operations LLC. The required free option, which will help you understand where to go and even get initial medical advice.

- Social tax deduction “turnkey” - the option involves oral consultation on issues, as well as assistance to the policyholder in registering the START. A very convenient option. This is especially suitable for those who either do not take advantage of this opportunity to receive a tax benefit for up to 120,000 rubles of income received, or do not have other expenses (such as voluntary health insurance, education of children, etc.) Now it is enough to simply fill out a declaration on the nalog website yourself .ru and include all the necessary options for the return, including training, dentistry, etc.

- According to program 1 , the following risks are provided: disability as a result of an accident, injury, hospitalization as a result of an accident, surgery as a result of an accident; A moderately expensive option, which affects the final amount of “survival” (accumulation) by up to 10-15%, but is interesting as protection for both the insured person and the financial condition of his family. This option works well for high insured amounts, since payments are often calculated as a percentage of the insured amount. Significantly cheaper for insured people under 30 years of age.

will pay

these contributions for him. Significantly cheaper for

insured persons under

35-40 years of age.

Important! The protection you choose will be valid for the entire insurance period and comes into force from the first day.

For your convenience, there is good navigation and there is an FAQ section - answers to frequently asked questions.

On the plus side, there is a hotline number where specialists will advise you, or you can request a call back.

Ingosstrakh-Life answers to calmins.com questions

For a more objective assessment and understanding of the product, we asked the insurer several questions and are sharing them with you. We supplemented the answers with our comments in blue.

What audience is the product most intended for?

The product is designed for any client who does not have specialized knowledge and skills in the field of finance and insurance. By saving an amount equivalent to one cup of coffee per day, the client begins to form capital and is under insurance protection from the first day of the contract.

Will it be sold through insurance agents, including Ingosstrakh?

The product can only be ordered online on our website. However, if you need additional advice, you can always contact our insurance agents or call the hotline and ask your question.

Why is there no guaranteed profitability on the product?

Instead of guaranteed profitability, it is proposed to pay an insured amount greater than the amount of the insurance premium at the end of the contract. The return of the guaranteed sum insured can reach 300% depending on the duration of the contract.

From our analyzed examples, it can be seen that the sum insured is actually slightly higher than the premiums paid, and it is higher if the regularity of payments is different, for example, an annual premium.

What kind of return should you expect on investment income?

Investment income depends on the results of investment activities, and in past periods the average value was 7%, however, please note that income from past periods cannot guarantee the profitability of future periods.

In practice, additional investment income is about 2-8% per annum on the amount of contributions from the moment they are received by the insurer. Regulated by clause 8 of the “Terms and Conditions of Life Insurance under the Avantage Program” of LLC Ingosstrakh-Life Insurance Company dated 02/26/2021.

Why are you a pioneer in the online space?

Ingosstrakh-Life was one of the first companies to begin offering its clients the opportunity to receive high-quality insurance coverage without a personal visit to the office.

Why is the Gosuslugi service used?

In accordance with Federal Law No. 115-FZ of August 7, 2001, companies are required to identify clients before serving them. The procedure for identifying a client in banks is as follows: when opening a current account, the bank collects information about the client, based on the originals of his documents and certified copies. And in the case of registration of the Avantage Online product, the State Services service does the same, but online. Data on the policyholder registered on the Gosuslugi portal is automatically pulled from the account, which significantly saves time and simplifies the registration procedure. According to the Federal Law, the insurance company is obliged to fully identify the client if the insurance premium under the contract exceeds 15,000 rubles.

Is there a period of delay in paying the next installment during which you continue to be liable?

Insurance premiums are paid before the dates specified in the contract (policy). For insurance premiums paid in installments, a grace period for payment of 30 (thirty) calendar days is established, with the exception of insurance premiums paid in monthly installments. For the payment of monthly insurance premiums, a grace period of 10 (ten) calendar days is established, unless otherwise provided by the contract. The grace period begins from the date of payment of the next insurance premium established in the contract.

It’s good that there is a “grace period” option for 10 days, since the client may accidentally simply not have money on the card. This makes it possible to avoid termination of the contract.

What documents does the client need to submit to receive payment under the basic program and within what time frame?

To receive an insurance payment for an insured event in connection with the survival of the Insured (clause 4.2.a. of the Policy Conditions), the Insured is obliged to:

a) confirm the fact of survival until the expiration date of the insurance period (personally appear to the Insurer or provide the opportunity for the Insurer’s representative to attest to this);

b) provide the Insurer with the original insurance policy and an application for receiving an insurance payment indicating full bank details (if the insurance payment is made to a bank account).

What documents does the client need to submit to receive payment under additional programs and within what time frame?

The list of documents depends on the specific list of risks. We strongly recommend that our clients, before starting to collect documents, contact the company’s hotline by phone +7-495-921-32-23. Our specialists will advise on the list of necessary documents specifically for your program. Basically, this is the following list of documents:

- For risks of disability: a notarized copy of the ITU certificate and medical documentation.

- For death in an accident or air transport: a resolution to initiate a criminal case and a certificate from the scene of the accident, certified by an official.

A small minus is that there is no toll-free number 8-800, which the client can call and resolve their issue.

If the client does not comply with the declaration, will he be able to apply for Avantage Online?

The Avantage Online product is completely remote, therefore individual underwriting for this product is not provided. However, the client can contact the company by phone or visit the office, and our employees will help you choose another insurance program taking into account his needs.

Perhaps adding custom underwriting would increase the number of clients.

What redemption amounts will be established for a contract for a period of 5 and 10 years, broken down by year?

For an insurance period of 10 years, the insurance amounts for annual payment will be as follows:

| Insurance period | Redemption amounts as a percentage of insurance |

| 1 | 0% |

| 2 | 0% |

| 3 | 19% |

| 4 | 29% |

| 5 | 40% |

| 6 | 50% |

| 7 | 61% |

| 8 | 72% |

| 9 | 84% |

| 10 | 97% |

For those who are not very well versed in insurance, it should be noted that redemption amounts are calculated as a percentage of the insured amount. If we compare the redemption amount with the amount of paid premiums, then for a 10-year contract the redemption amount in the 7th-8th year of insurance (depending on the age of the insured) exceeds the amount of paid premiums.

Currently, standard practice is for the first 2 years to have a redemption amount of zero rubles, however, in our opinion, 40% for the fifth year is a fairly low amount. In our opinion, it should be 60% or more.

What plans do you have for this product in 2021?

The popularity of accumulative life insurance is growing, and clients will definitely not ignore the new insurance product, because in addition to the opportunity to make savings while being under insurance protection, they will be given the option that is very popular in the modern world - to issue a policy online without spending extra time.

How does the Avantage Online life insurance calculator work?

It's simple : right on the website you choose one of 4 insurance programs, as well as the duration of the contract, the amount and frequency of contributions. Online you will see the amount of the guaranteed sum insured that you will receive at the end of your contract and the amount of social tax deduction.

Here is a list of forms you will need to fill out:

- Date of birth and gender;

- Insurance period;

- Amount of contribution and frequency of payments;

- Additional programs.

After clicking the “Buy” , a confirmation window appears.

The most important thing is to have valid, confirmed account in the State Services portal .

You can confirm your account at the MFC by presenting your passport and SNILS in person at the service center, or at branches of the Pension Fund, as well as at a branch of your bank. You can also confirm your account online using an electronic digital signature. You can view all account confirmation options on the official website gosuslugi.ru

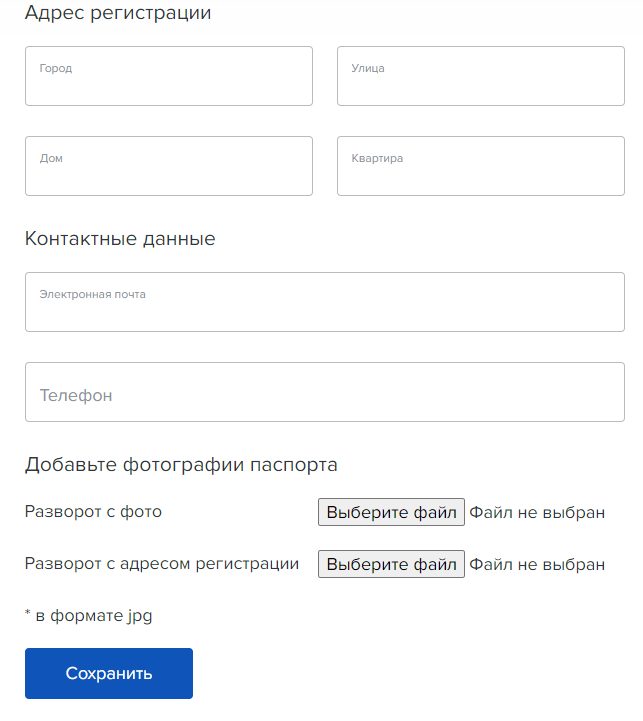

Immediately prepare a scan of your passport in jpeg format , namely, double-page spreads with a photo and registration . After logging in using “State Services”, you will be taken to a page with the following forms. Please note that the spread is photographed in full with the passport number, and the photo is clear without glare or blur.

After filling in all the data, you go to the payment page.

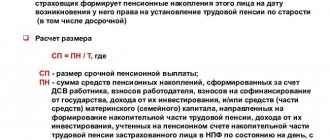

Who can apply for a deduction?

You can apply for deduction:

- physical the person who entered into the contract, or the spouse, provided that the contract was concluded during marriage

- physical a person who has income subject to personal income tax of 13%, excluding dividends, in the year of payment of contributions. It is important to pay personal income tax during the year when the contributions were paid, but the month is not important. Example 1: Contributions were paid monthly. Income was from February to May only. You can apply for deduction on all contributions made during the year. Example 2: Contributions are paid monthly from December 2021 onwards for 5 years. There was no income in 2021. Income has appeared since May 2020. You can apply for a deduction for all expenses paid since January 2021. There is no deduction for contributions made in 2021, since there was no personal income tax payment for 2021.

Avantage Online

Avantage (French avantage – transfer) – benefit, attractiveness, advantage, favorable position (of a person, group).

As you might already understand, the policy is called “Avantage Online” . I would like to immediately note that the site is very pleasant in design and easy to use, all the information is right before your eyes and you don’t have to look for something specific.

Advantages of the NSZH-online program

- A clear insurance program, with the ability to choose one of four insurance programs and service options.

- Client identification through the Gosuslugi portal , which allows you to speed up the process of issuing a policy.

- You will immediately find out the final price for you: using the built-in calculator directly on the website, you can choose the policy duration, amount and frequency of contributions that suits you.

- Registration is completely online - you don’t need to go anywhere, everything is completed remotely, fees can be paid by credit card.

- Interesting option. The minimum contract period of 5 years makes it possible to increase profitability by taking advantage of the social tax deduction (NDFL).

Let's look at specific examples of purchasing "Avantage Online"

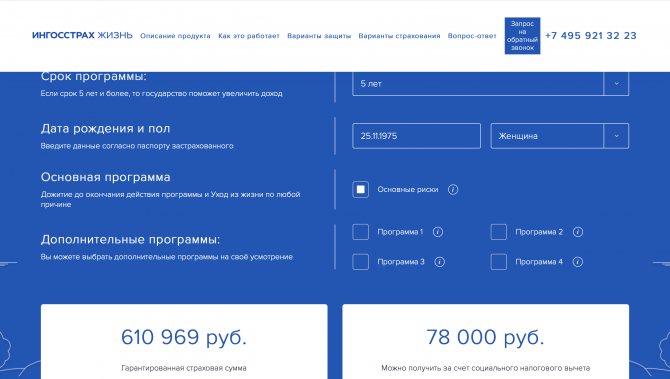

Client 45 years old, woman, 5-year program, monthly contributions 10,000 rubles. That is, the annual contribution of 120,000 rubles falls under the social tax deduction. (We will additionally make a comparison with a 30-year-old woman).

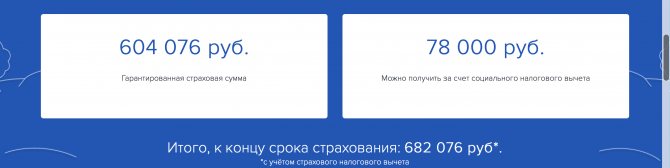

Basic program

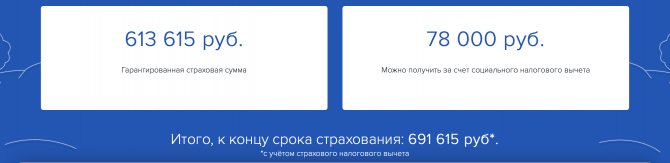

Even the guaranteed payment amount for it will be 610,969 rubles (instead of the 600,000 rubles paid), and in 5 years it will be possible to return another 78,000 rubles of social deduction for the entire amount (provided that you work and earn at least 120,000 rubles per year and do not have other programs for this benefit).

Moreover, from the first day of the contract, life is already insured for the full sum insured. In the event of the client's death, his heirs will not receive a refund of previously paid insurance premiums, but the full amount that would have been paid upon survival.

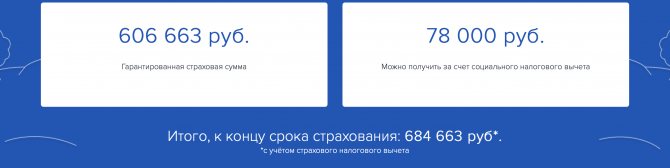

We changed the date of birth in accordance with the age of a 30-year-old woman and the amount of survival increased by almost 5,000 rubles.

Important! Do not forget that the calculator shows only guaranteed income - everything is transparent. But there is also additional (non-guaranteed) investment income that can increase your savings.

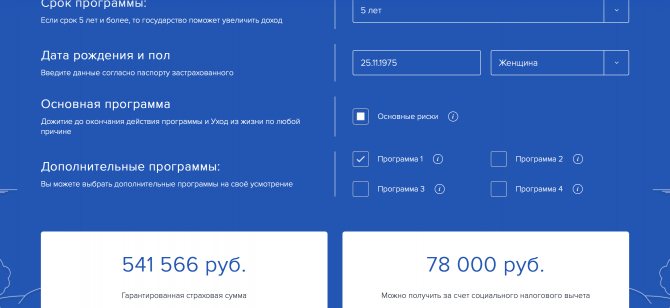

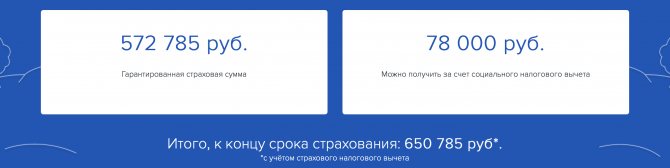

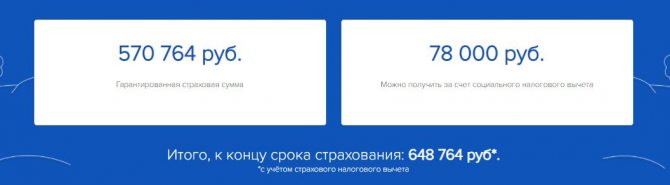

Basic program plus Program 1

Additional risks included : disability as a result of an accident, injury, hospitalization as a result of an accident, surgery as a result of an accident or illness

As we said earlier, the program “ate” about 12% of the final savings, that is, approximately 13,000 rubles per year, let’s say - not cheap .

How much will the program cost for a 30-year-old ? The answer is much cheaper. In just one year, a woman will pay 8,000 rubles for insurance against “accidents and illnesses.” And this is already more acceptable .

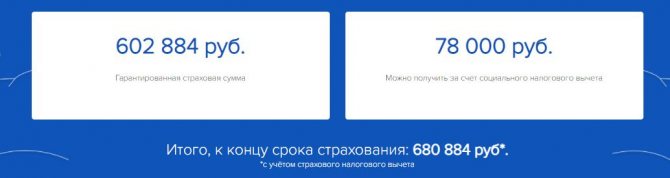

Basic program plus Program 2

Additional risks included: death as a result of an accident (additional payment +100% of the insured amount), death as a result of an accident on an air carrier's vehicle (additional payment +100% of the insurance), death as a result of an accident on railway transport (additional payment +100% to the insured amount);

For a 45-year-old woman, the program will cost about 1,500 rubles per year, which is quite good. When this program is enabled, the sum insured remains higher than the amount of premiums paid.

And for a 30-year-old client it’s about the same 1,500 rubles.

Basic program plus Program 3

Additionally, risks are included: exemption from payment of insurance premiums in the event of a disability of 1-2 groups as a result of illness or disease. If an insured event occurs, the policyholder is exempt from paying premiums and receives 100% of the insured amount at the end of the contract. Coverage for death due to accident or illness also remains in force for the duration of the insurance contract.

For a 45-year-old woman, the program will cost about 1,200 rubles per year, which is quite inexpensive, and for a 30-year-old woman, about 200-300 rubles.

When this option is enabled, regardless of the client’s age, the sum insured will not be less than the amount of paid premiums, which is a rather interesting option especially for older clients.

Basic program plus Program 4

Additionally included risks: Oncological diseases, heart attack, stroke, transplantation, paralysis, multiple sclerosis, etc.

Here is a great example of how the contribution will differ in the first and second cases.

For a 45-year-old woman, a program that includes protection against critical illnesses will cost approximately 8,000 rubles per year.

Let's carry out a similar calculation for a 30-year-old girl.

Insurance against dangerous diseases will cost only 2,146 rubles - an excellent price for such a product.

As you can see, the difference in the price of the option is colossal, however, at 40 years of age it is comparable to market prices for similar products. And at 30 years old, this is quite a profitable acquisition.