Taxation of pensioners is regulated by laws

There is a regulatory framework that regulates the pension taxation sector both globally by laws and locally by regulations or decrees at local levels. Regions are also allowed to make adjustments.

Before clarifying what taxes pensioners do not pay in 2021 , it is advisable to familiarize yourself with the legislation regarding tax obligations. They apply to all categories of the population.

- Residents of remote areas of the country know nothing about government extortions for the use of plots of land.

- Heroes of Russia, full holders of the Order of Glory, combatants, military personnel and veterans of military service, liquidators of the Chernobyl accident, as well as those working at other facilities when eliminating man-made factors do not transfer funds to the treasury for the use of apartments, cars, etc. They are not charged to disabled people of all groups, as well as families without a breadwinner, if he was a military serviceman.

As you can see, the list is quite wide, but it says little about people of advanced age. However, there are articles and regulations that provide concessions for them as well.

Is the pension subject to income tax?

At its core, a pension is a social benefit that citizens in need of special material support can count on. The circle of its recipients is quite wide and this is not only the elderly. The pension is paid:

- military personnel with a certain length of service;

- disabled people;

- minors due to the loss of a breadwinner.

These social payments are not subject to personal income tax.

However, the majority of pensioners are elderly people who have reached the appropriate age and have the necessary work experience. How is such a pension formed?

Every month the employer pays so-called insurance premiums for each employee. Their amount is a certain percentage of the employee’s salary. Part of these funds goes to the Social Insurance Fund, the Compulsory Medical Insurance Fund, and the Federal Compulsory Compulsory Medical Insurance Fund. These are social and health insurance. Most of the funds paid by the employer go to the Pension Fund for the formation of the employee’s future pension . It, in turn, consists of insurance and savings parts.

Reference! If contributions for employees are made by their employer, then persons engaged in entrepreneurial activities pay for themselves at fixed rates.

According to current legislation, a citizen can leave the funded part in the state pension fund, or can choose a non-state pension fund (NPF). NPFs offer higher interest on these savings , so it is expected that the amount of pension received through them in the future will be higher.

Having figured out what types of pensions there are and what they consist of, you can answer the question regarding the taxation of pension payments with income tax.

Personal income tax is not withheld from payments from the state fund. If the pension comes from a non-state source, then it is subject to income tax. However, there are exceptions here. Thus, personal income tax is not paid on pensions paid by non-state pension funds that have the appropriate license .

There are also common cases when large employers independently enter into agreements with non-state pension funds of their choice or have their own fund. Their employees also do not pay tax upon retirement. In other words, personal income tax is taken only from the funded part of the pension, paid by a non-state pension fund that does not have a state license, with which the employee entered into an agreement directly on his own behalf.

The legislative framework

The rule that state pension payments are not taxed is supported by clause 2 of Art. 217 of the Tax Code of the Russian Federation. However, the same norm establishes that income tax is taken from the voluntary insurance of the funded part of the pension.

Which pensioners enjoy fiscal benefits today?

Once a person of advanced age officially receives pensioner status, he can be exempt from a number of taxes and receive some benefits. This rule applies even to those pensioners who are still working.

The 2021 retiree property tax includes a number of benefits for retirees. However, there is nothing complicated here. They simply do not pay this fee.

Categories of the population, the list of which is presented in the above-mentioned second paragraph (Heroes of Russia, liquidators of the Chernobyl accident, etc.), are entitled to a deduction for land tax in the amount of ten thousand rubles. If they are car owners, the state has provided for their free use by these citizens.

Preferences, no matter what region of Russia the pensioner lives in, are of a declarative nature. Tax officials do not search for beneficiaries in their databases, since their activities are related to other manipulations. Beneficiaries at all levels must declare themselves to local divisions of the tax department.

The following people have the right to receive the above property benefits: retired military personnel with more than 20 years of service, the elderly population, elderly people who own creative workshops.

But there are some caveats. About the pleasant thing: pensioners who have not quit their jobs receive the same tax preferences as people who are not working. However, pensioners - business owners, for example, this is a simple individual entrepreneur, pay fees for entrepreneurs.

New provisions of the Ukrainian tax system regarding pension tax

The minimum wage (minimum wage) was set on May 1, 2016 at 1,450 hryvnia. Translated into Russian money, this is 3,724 rubles. The amount is small and it is not very clear how to live on it in a modern, crisis-stricken world.

By decision of the government, Ukrainian pensioners receiving more than 11,172 rubles (4,350 hryvnia) are required to pay money to the state budget.

The amount of tax levied is:

- 15% of the income received by an individual.

- Those who receive larger sums are even less fortunate. Pensioners to whom money is transferred in the amount of 10 times the minimum wage will have to pay 20%.

It is important that not the entire pension is taxed, but only the amount exceeding the agreed level. When a citizen is charged 5,000 hryvnia (12,841 rubles), 4,350 are exempt from payment. You need to pay tax on 650 hryvnia or 1,669 rubles.

Experts have calculated the number of people who will be affected by the innovations. The result of the calculations is that 1.7% of the Ukrainian population will pay according to the new tax rules. This is exactly the number that receives increased pension payments in the country.

The Pension Fund of Ukraine has been entrusted with collecting fees from older people. This is enshrined in the Tax Code by Article No. 14. The law has been working for more than a year and pensioners’ transfers are regularly arriving in government accounts.

What taxes are paid, what are they exempt from, and what fees are there benefits for pensioners?

By the way, this very much depends on the places of residence of categories of the population of retirement age. Some regions provide a wide range of concessions, while in other regions there are fewer.

The situation in relation to pensioners - residents of other regions, and benefit recipients in the capital - is relatively good. Why? Moscow, like the cities of the Moscow region, has a huge budget. Due to this, the authorities provide pensioners with a high pension (for those who have been registered in cities for more than 10 years), provide a greater number of benefits and are not burdened with taxes, but partially. Moderately wealthy regions do not allow their population to do this.

However, any of the territories does not have the right to cancel benefits, since this category is protected at the state level. There are federal beneficiaries. Regional authorities can only allow their regulations to be slightly adjusted without providing some preferences, but the main deductions are in effect.

A pensioner of any category is unconditionally exempt from 2 types of fiscal taxes: taxes on personal income and property.

Important: property tax is not collected from elderly people.

Let's look at this question by ranking the available data:

- Pensioners - disabled people of all groups do not pay personal income tax on vouchers and pension benefits. They have a land tax deduction of ten thousand rubles. Tax for using a vehicle is not charged to this group.

- Pensioners with disability groups 1 and 2 are not forced by the state to pay a fee on inherited property.

- As for labor veterans, they are exempt from taxes on real estate and other property. They do not charge personal income tax for paying for treatment at specialized resorts. They have preferences for owning plots of land and cars. Labor veterans receive regional benefits in full. If regional authorities withdraw part of the funds, citing tax revenues, it is worth going to court.

- Military pensioners have the same benefits as other pensioners.

- Pensioners who also receive income from work at enterprises or in another field are provided with benefits on basic taxes, and are completely exempt from property taxes.

The following are not included in the list of fees for this category of the population: alimony, donor payments, monetary incentives in connection with professional activities, gratuitous contribution from the employer if it is less than 4 thousand rubles. Of course, the land tax for pensioners in 2021 provides some benefits for pensioners. Now they will not pay from pensions, social benefits, compensation for treatment, purchase of necessary medical equipment or sports equipment.

Taxes for working pensioners

Often a person, upon reaching retirement age, continues his personal work activity. The system for calculating the amount of the gratuitous income payment for such persons is changing. They must necessarily pay 13% personal income tax, despite their own age and pension status. Part of the pension from a non-state pension fund is also subject to personal income tax.

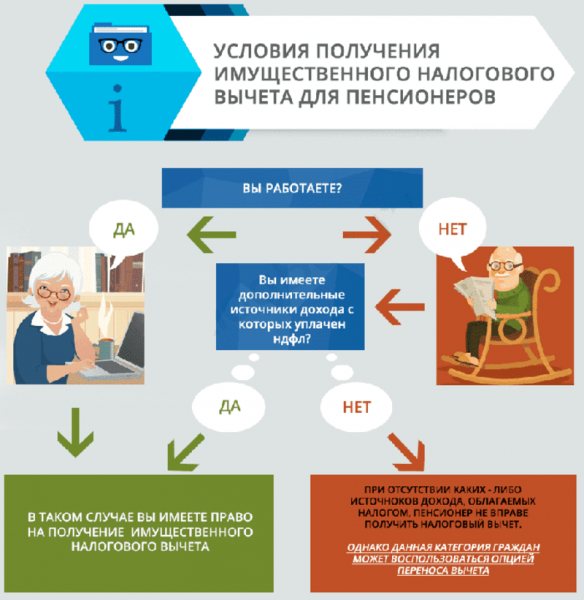

Both working persons and those who have retired are exempt from property payments . If people want to sell or buy real estate, they can return 13% of the total cost. But this privilege can only be used for one type of real estate.

There are also land and transport payments; they are established by the regions independently and on an individual basis. The land tax must be paid when purchasing a plot, and the transport tax must be paid when purchasing a car or other means of transportation. The pensioner should find out this information at the branch of the Pension Fund of the Russian Federation at the place of residence.

Tax obligations of working citizens apply to:

- income in the form of wages;

- lottery winnings, dividends and other payments;

- non-state pensions ( regular (monthly or weekly) cash payments to persons who: have reached retirement age (old-age pension), are disabled, have lost their breadwinner. Depending on the organization

); - other types of mandatory taxes, with the exception of property taxes.

All these provisions are also regulated by Federal Law No. 166-FZ “On municipal pension provision in the Russian Federation”.

The main level of taxation is federal.

Every pensioner of any category who is a citizen of the Russian Federation receives benefits of global significance.

When purchasing any real estate, a tax deduction is required. The same rule applies to those who use the land. They will not have to pay state fees in case of appeals to judicial structures. Regional authorities do not have the right to violate this requirement, since it comes from higher structures.

It is believed that the state protects pensioners at all levels, but the authorities of some regions do not consider it necessary to comply with the law. In addition to not adding benefits to this category of the population, they are trying to circumvent federal laws, citing local legal acts as the reason for the lack of benefits. This is a gross violation leading to legal proceedings.

Therefore, pensioners living in a particular region and who decide that they have been deprived of preferences should seek advice from experienced lawyers and properly understand the issues of tax benefits. In most cases, the courts take the side of unprotected plaintiffs and, if their demands are legitimate, give them the opportunity to receive the necessary deductions.

Who can apply

Pensioners who retired based on reaching a specific age are exempt from paying personal income tax on their state pension. Additionally, they receive benefits during the calculation of property and land taxes. At regional levels, senior citizens are often exempt from paying transport tax or can enjoy a significant discount.

Additional concessions on other types of fees are offered to labor veterans and disabled people. If a citizen continues to officially work even after receiving a pension, he still receives certain benefits for various fees.

Reference! Transport tax is a regional payment, so its size and the possibility of obtaining a discount are provided exclusively by local authorities.

What should a pensioner applying for benefits do?

You need to come to tax specialists and tell them about your intentions to get what you are owed. In each subject of the Federation, employees of the Federal Tax Service organize seminars and receptions for residents. During such meetings, explanations are provided on the main points of tax legislation. You can immediately submit an application, which will be reviewed as soon as possible and will provide you with the opportunity to use government preferences.

What is the procedure for applying to the Federal Tax Service? The pensioner needs to take with him to the appointment with the tax authorities:

- A document certifying the corresponding status.

- The disabled person submits a certificate from the ITU.

- If a family has lost its breadwinner, an appropriate certificate is needed.

Experts will advise, tell you about the basic rules and, if necessary, help fill out the necessary documents.

Government duty

A fee is a payment that is levied for the performance of any legally significant transactions or the issuance of documents by municipal or state bodies (officials). People who have reached retirement age and do not have the status of a federal benefit recipient (disabled person, WWII veteran, etc.) pay all duties provided by law on a general basis.

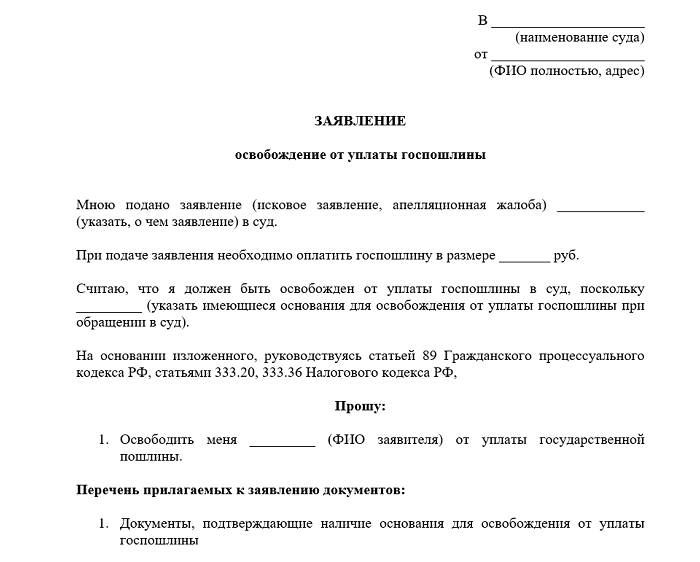

There is only one exception. Pensioners are exempt from paying state fees for filing a lawsuit if the appeal is related to a violation of pension rights. When the amount of claims exceeds 1 million rubles, the state duty is paid in full.

What about the transport tax for pensioners?

Transport tax benefits for pensioners in 2021 are determined by the authorities of the constituent entities of the Federation. The tax service department will tell you what the situation is in each region.

Car tax benefits for pensioners in 2021 are regulated by Art. 356 Tax Code of the Russian Federation. The fees are sent to the regional budget. Accruals for people of advanced age are the same as for other citizens, but discounts for this fiscal type should be obtained from the Federal Tax Service of the corresponding territory of Russia.

List of relaxations

In 2021, the transition period continues, based on which the age at which citizens retire is changed. The procedure is currently performed by women aged 56.5 years and men aged 61.5 years.

Citizens who become pensioners automatically receive the opportunity to apply for various tax benefits. For them, the amount of land and property taxes is reduced. In many regions, transport tax payments are being reduced. If a person stops working, he does not pay personal income tax, since no income tax is charged on the pension.

Attention! Benefits can be not only federal, but also regional, and some require registration by the pensioner, so you must independently contact the Federal Tax Service with official applications for recalculation.

Personal income tax

If the pensioner is still working, he will pay a monthly income tax of 13% (personal income tax). By the way, the employer does this. But the state will not take anything from the pension, which also relates to income, as well as from other income. What other surcharges are not subject to:

- Compensation for sanatorium treatment.

- Employer-paid health care.

- Gifts valued at no more than four thousand rubles.

As you can see, a very loyal approach. However, as with almost all types of taxes. Tax inspectors will also help you understand the intricacies.

Results

All pensions that retirees receive are income.

However, state pensions are not subject to personal income tax, and only pensions, payments of which are made by non-state funds, are subject to taxation. Thus, if a non-working pensioner decides to take advantage, for example, of a property deduction for personal income tax, he will be able to do this if, before the right to the deduction arose, he received taxable income during the three previous years or receives a non-state pension. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Is it possible to use the property without encumbrances?

Property tax benefits for pensioners remain unchanged, despite the fact that the amounts for other categories of citizens have increased significantly. Officially, since 2015, pensioners have not been subject to this type of fiscal fees.

However, in the case where the beneficiary owns more than one apartment or dacha, an object from which the corresponding fees will not be charged will have to be chosen. By the way, in this part the law excludes fraudulent acts when dishonest entrepreneurs, in order to avoid the tax burden, transfer part of their property to elderly relatives or friends.

What is not charged:

- From apartments.

- Rooms in dormitories.

- Own houses.

- Garages.

- Rooms for studios and workshops.

- Outbuildings with an area of less than 50 square meters. Moreover, they must be located on plots owned by pensioners. It is worth remembering that tax will not be levied on only one such premises. The rest are subject to the profile code.

The same rule applies to the number of apartments, houses, galleries. If a pensioner owns 3-4 types of property, fiscal contributions will have to be made on 2-3 of them. It is the larger amount of property in our state that is usually called surplus. It is believed that a person can own only one apartment or house, car, etc.

In this case, tax authorities independently select an object from the property of an elderly person, on which tax will not be assessed. This will be the property with the highest tax bill. By the way, this fact should be carefully checked.

Land tax

When calculating land tax for 2021, pensioners have the right to reduce the amount of tax by the cadastral value of 600 square meters for one plot of land, regardless of the category of land. If the plot is 6 acres or less, you do not need to pay tax. If it is larger, the tax will be calculated for the remaining area.

A person who has two or more plots can choose the one for which the deduction will apply and send a notification about this to any tax office before November 1. By default, the deduction will be applied automatically to the single parcel with the highest tax amount.

Let's sum it up

Our country belongs to the type of state with a social focus on budget spending, and yet, Russian pensioners do not live well enough. Their level of income today leaves much to be desired, while elderly citizens of prosperous Switzerland travel around the world on tourist trips and almost travel around the world. Of course, not all Europeans do this, but the majority do.

However, the state does not leave Russian pensioners in trouble, providing tax deductions and fiscal benefits. They are distributed by region and belong to categories of federal or local significance. Cancellations of fees for pensioners or reductions in tax amounts affect almost all points of the fiscal system. According to the articles of the law, regional territories do not have the right to cancel or downplay state benefits. But it is allowed to increase the number of preferences. For example, in the capital, people of advanced age have relatively more tax deductions than representatives of other regions. Also, pensioners living in the Far North and Far East benefit.

You should check with the Federal Tax Service about all benefits due. Department employees never refuse consultations and assistance when filling out relevant written requests.