Pensioners are the most numerous, but at the same time low-income social group. They are provided by the state in the form of monthly pension payments, but often they are not enough to live a normal life. In such conditions, the law provides for a huge number of social benefits and benefits intended specifically for the elderly.

Legal regulation

All measures and actions taken by the state to support low-income groups and elderly people are based on Federal Law No. 122 of August 2, 1995 “On social services for elderly and disabled citizens.” It describes the main provisions that form the basis of state policy regarding pensioners.

Detailed information and instructions are provided by the government decree “On the provision of free social services and paid social services by state social services,” etc. These documents determine what benefits a person is entitled to claim.

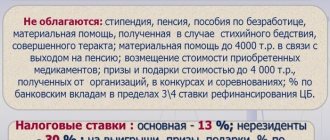

Taxation of citizens at retirement age

The status of a pensioner gives a citizen advantages. For example, they do not pay some taxes. They will not have to pay for the following tax categories:

- payments assigned by the Pension Fund due to reaching the legal age;

- according to Article 407 of the Tax Code of Russia, a fee for one type of property;

- tax for owned land plot, if this right is registered in St. Petersburg, Novosibirsk, Saratov or Rostov (no more than one plot is allowed).

In the Leningrad, Sverdlovsk regions, Krasnodar Territory and Chelyabinsk, age pensioners do not pay car tax.

What benefits do pensioners have?

Benefits for old-age pensioners affect the areas of services and taxation. At the same time, their meaning is to partially reduce payment or completely reset it to zero.

Tax benefits

According to Article 407 of the Tax Code of the Russian Federation, people of retirement age are exempt from land and real estate taxes. For example, the amount is not charged if the property belongs to one of the following categories:

- apartment;

- private residential building;

- creative studio;

- extension with an area of less than 50 square meters;

- garage.

In order to apply for tax exemption, it is important to take into account that:

- the property is listed as the property of the pensioner;

- its cadastral value does not exceed 300 million rubles;

- You cannot get a benefit by using it for commercial purposes.

Tax deduction for working pensioners

If people are retired and continue to work, then they officially pay personal income tax on their salaries and are considered full subjects of labor relations. They easily apply for a tax deduction when purchasing an apartment, not only for the current period, but also for the last 3 years. This period must begin no earlier than January 1, 2014, the date on which the particular piece of legislation was adopted.

Who is entitled to benefits on public transport?

Social benefits and payments

The laws of the Russian Federation and its constituent entities provide for the introduction of a large number of social benefits for disabled citizens and elderly people. They cover all areas of services and are provided free of charge upon preparation of the necessary documents. Many of them significantly reduce payment amounts and help you live on your retirement.

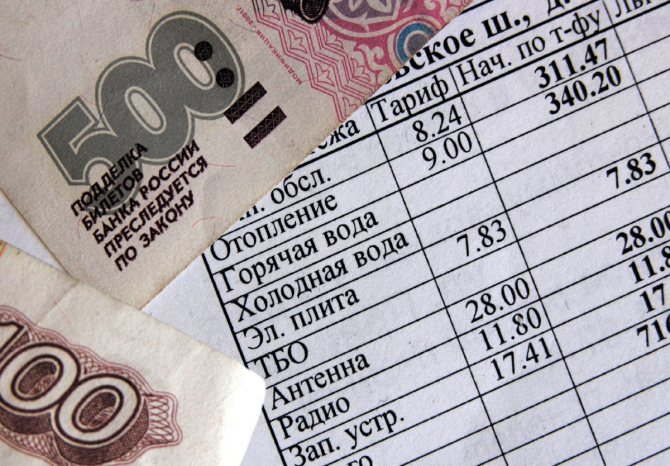

Benefits and subsidies for housing and communal services

One of the most important benefits involves reducing the cost of utility bills. Compensation is provided in varying amounts depending on the region and status of the applicant. So, for heroes of the Russian Federation and the USSR it is 100%; for pensioners it is calculated depending on the amount of utilities consumed and the person’s total income, but in most cases it is half of the amount in the receipt.

Reimbursement for telephone expenses

Veterans and pensioners can, in addition to the above benefits, also enjoy a discount on telephone communications. The amount of compensation is calculated either through housing and communal services directly on the receipt, or in a communication shop upon presentation of a pension certificate and a document confirming the status of a veteran.

Free and discounted medications

One of the significant pension benefits is discounts on medications, which often make up a large portion of the expenses of older people. According to statistics, it is this category that is in most dire need of medicines, but, unfortunately, does not always receive them in full and cannot afford to purchase the missing ones. Therefore, according to the law, elderly citizens have the right to priority receiving free medicines. Moreover, in each region this issue is resolved differently. The number and amount of preferential drugs differs.

Medical service

According to the order of the Ministry of Health dated November 22, 2004 “On the procedure for providing primary health care to citizens, pensioners have the right to receive a set of social services.” Every citizen of retirement age can apply for a one-time preference (for one to two years) - receiving vouchers to sanatorium-resort institutions. In this case, all costs associated with transport, visit and accommodation are borne by the state.

Benefits for asthmatic children without disabilities

Monthly compensation payments to working pensioners

Regular social support measures are taken mainly at the regional level. In most cases, these are one-time payments, the size of which depends on the decision of the government of the constituent entity of Russia. Amounts do not exceed 1000 rubles and are credited as an increase in pensions. For example, in St. Petersburg the additional payment is 576 rubles per month from January 1, 2021.

Transport benefits

Similar to most other preferential benefits for citizens who have reached retirement age, benefits and compensation for movement around cities are determined independently in each region. The most common measures are:

- issuing unlimited transport cards to pensioners;

- reduction in the cost of one trip;

- increasing the number of preferential routes, etc.

Thus, travel for seniors costs 50% less, and a card with an unlimited number of trips costs the same as a regular one.

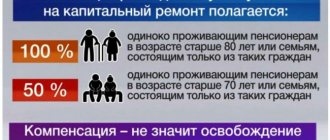

Benefits for major repairs

In this case, the age of the person applying for relief is also important. Thus, citizens over 70 years of age have the right to pay only half of the corresponding amount, and those who have crossed the threshold of 80 years do not have to pay in full.

Targeted assistance to pensioners

Elderly people who find themselves in difficult life situations can contact social support services to provide them with financial assistance. Social service workers are required to provide such citizens with food, temporary housing, clothing and personal hygiene products. They can also be the first to apply for a change of housing if their current one is considered unsafe or unsuitable for living.

Legal assistance

A person of retirement age has the right to free legal advice provided by the State Legal Bureau.

Rights of working age pensioners

All rights reserved for younger working citizens are retained by older people. An officially employed pensioner working on the basis of an employment contract has the right to count on the following benefits:

- annual leave with pay;

- tax deductions: property and social;

- payment for days of incapacity for work according to sick leave.

In addition to the above, other conditions are offered to old-age pensioners. They apply for an additional two weeks of vacation. This provision is reflected in Article 128 of the Labor Code of Russia, so the employer will not refuse the pensioner’s request. However, it will not pay for the vacation, for which it has legal grounds.

Tax benefits for retired citizens do not differ from those provided to other Russians.

This includes:

- deductions for income tax for children under the age of majority or in the case of their education in educational institutions, provided in Article 218 of the Tax Code of the Russian Federation;

- pensioners who transfer money to the funded portion or pay for the education of children under 18 years of age are entitled to social benefits under personal income tax;

- deductions for real estate tax if it is purchased, built or sold.

Pensioners who continue to work have their payments due recalculated every year. This is due to the depreciation of the national currency, the ruble. Economists call this process inflation.

In order for the size of your pension to correspond to the current situation, you do not need to go to the Pension Fund and write an application. This is done automatically. Moreover, when recalculating, newly earned pension points are also taken into account, which are added to the existing ones. As a result, payments increase faster for working old-age pensioners.

Benefits by category

It is necessary to highlight the preferences that pensioners have according to their category.

Lonely and poor

For single people of retirement age or with low income, special conditions for receiving benefits are provided. They affect the same social spheres as for the fairly wealthy, only the costs of services are even more reduced. However, to obtain such a privilege, it is necessary to prove the status of a low-income person and issue a special identification document.

Monetization of benefits in the Russian Federation

Benefits for military pensioners

Additional concessions are provided to former military personnel and war veterans. This category of the population, in addition to the payments required by law, has the right to:

- services and health improvement in military medical institutions once a year at the expense of the state;

- refund of funds spent on treatment and recreation of children under 15 years of age in health camps/sanatoriums;

- refund of taxes paid for land at the place of residence;

- other regional benefits.

For disabled pensioners

The law does not provide for the separation of people with disabilities by age. Any citizen with a 1st, 2nd or 3rd degree disability has the right to receive a social pension established by the state depending on the degree and conditions of its acquisition. Basically, people enjoy the same benefits as disabled senior citizens.

Labor veterans

This category of citizens can contact the relevant authorities in order to prepare documents and receive such types of social support as:

- compensation for utility bills;

- placing on a waiting list for public housing if there is evidence of the need for an urgent increase in living space and awarding the title “Veteran of Labor” until 2005;

- early leave at any time for working citizens;

- discounted travel on public transport and others.

For pensioners over 80 years old

People who have reached the age of 80 years or older count on the most significant support from the state. They may not pay housing and communal services, travel for free on public transport, receive an increase in pension and additional payments for elderly care.

Benefits for travel and medicine

Non-working pensioners living in the northern regions of the Russian Federation have the right to reimburse travel expenses to their holiday destination and return trip every 2 years.

To receive free tickets, you must contact your local Pension Fund office, write an application and attach the required documents.

Retired citizens over 60 years of age can receive a free flu shot. To do this, you need to contact a medical institution at your place of residence.

Privileges for military pensioners

A military pensioner can receive the same benefits as other categories of beneficiaries, but if a person previously worked in the Ministry of Internal Affairs or the Armed Forces, he is entitled to a number of additional privileges:

- Possibility of obtaining a military mortgage. Funds for the purchase of real estate will be issued at reduced interest rates. But not all banks have the opportunity to obtain such a mortgage.

- A military pension supplement that is added to the basic pay.

- Possibility of preferential employment even after retirement.

- Northern pension supplements, even if the pensioner travels to another region.

- 75% compensation for spa treatment.

Also, citizens receiving a military pension can receive an expanded list of medical services from the Pension Fund.

What do disabled pensioners claim?

Disabled people of groups 2 and 3 do not completely lose the ability to work. Working pensioners in this category are entitled to:

- 60 days of unpaid additional leave;

- working week limited to 35 days (only for group 2).

All pensioners classified as disabled receive the following social guarantees:

- admission without waiting lists and free education at universities;

- permission not to pay land and transport taxes;

- free medical services and dental prosthetics;

- discount on the purchase of medicines;

- benefits for travel on public transport and assignment of daily allowance.

Upon dismissal, pensioners are not required to work for the period established by the employer. The day of dismissal is set at their choice. It is impossible to terminate the employment relationship without their consent.

If working pensioners refuse to receive their old age pension, they accumulate the points needed to increase their monthly payments at an accelerated rate.