Who receives the subsidy?

According to Federal Law (FZ) No. 541 of August 29, 2005, payments can be received by families who devote more than 22% of the total budget to paying for housing and communal services. But for some regions this percentage is lower:

- in Moscow it ranges from 0 to 10%, which depends on the average family income;

- for St. Petersburg – 14%;

- in Omsk - 18% for disabled people and pensioners, and for all other citizens - 20%;

- in the Kemerovo region it is 7-15%.

Subsidies are also provided to pensioners, disabled people, large families and other groups of people who are considered beneficiaries.

Special cases

There are other cases in which the amount of payment for housing and communal services is reduced by receiving a subsidy. This is possible if one of the family members left the apartment, but the rest of the residents still remained in it. You can receive a subsidy if an able-bodied family member:

- serving in the Army;

- is in prison;

- sent for compulsory treatment;

- is listed as deceased.

In such cases, receiving a subsidy is possible, but only if other family members remain living at the same address. When applying for a subsidy, documents are submitted that confirm that one of the family members has left.

How to apply for a subsidy for utility bills online in the Moscow region

Since November 2021, residents of the Moscow region have the opportunity to apply for a subsidy to pay for housing and housing and communal services without leaving home. The size of the subsidy depends on regional standards for calculating payments for housing and communal services and living space standards. How to apply for a subsidy and what nuances may arise in this case, read the material of the mosreg.ru portal.

How to avoid suffering from faulty heating equipment for residents of the Moscow region>>

Who is eligible for the subsidy?

Source: Photobank of the Moscow region, Viktor Anashkin

Citizens registered at their place of residence in the region can apply for compensation to pay for housing and utilities (housing and utilities) in the Moscow region. This means that you must definitely have a residence permit in the Moscow region. The second necessary condition: expenses for housing and communal services must exceed 22% of the total family income.

The amount of the subsidy is calculated based on the size of regional standards for the cost of housing and communal services and standards for the standard area of residential premises, namely:

- 33 square meters - for citizens living alone;

- 21 square meters for each member of a family consisting of two people;

- 18 square meters for each member of a family consisting of three or more people.

Mortgage holidays in the Moscow region: how to get a deferred payment>>

Required documents

Submission of documents

Source: Photobank of the Moscow region, Boris Chubatyuk

For the convenience of residents of the Moscow region, compensation can be submitted online on the regional government services website.

To receive a subsidy you need to collect the following package of documents:

- passport;

- statement;

— rental agreement for specialized residential premises;

— social rental agreements for residential premises;

— payments for housing and communal services accrued during the period of provision of the subsidy;

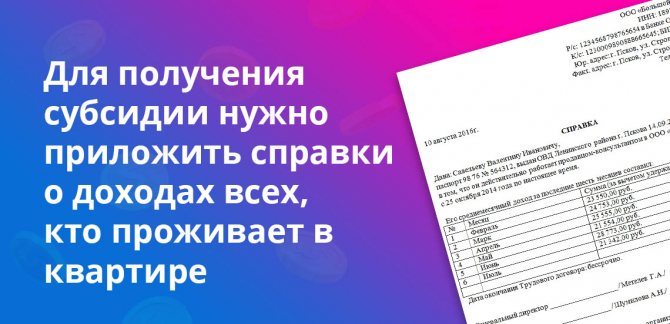

— information about the income of the applicant and his family members;

— documents confirming the right to benefits, social support measures, compensation for housing and communal services.

Government services are not provided to foreigners. But if such an applicant is a citizen of a country with which the Russian Federation has concluded a corresponding international agreement, he has the right to count on payment. To do this, you need to present a document proving citizenship.

If desired, you can attach an extract from the house register.

How to obtain a certificate of participation or non-participation in the privatization of municipal housing in the Moscow region>>

Regulations for the provision of services

application, complaint, pen, paper, notes, notes

Source: RIAMO, Anastasia Osipova

The public service is provided free of charge.

The application is registered within one business day. After 10 working days, the citizen receives the result - compensation for payment of housing and communal services or a corresponding refusal.

How to register real estate in the Moscow region>>

Grounds for refusal

The second MOBTI consultation center was opened in Krasnogosk

Source: , press service of the Krasnogorsk city district administration

It will not be possible to apply for a subsidy if the package of necessary documents is incomplete. It will also be denied if the applicant has not brought the originals to the MFC for verification with electronic images submitted through the government services portal.

They will refuse to provide services for debts on bills, as well as if the actual payment for them does not exceed the maximum allowable share of expenses in the total family income.

Those who are registered in another region of Russia, although they live in the Moscow region, cannot take advantage of the benefit.

Where to buy a townhouse in the Moscow region: features of country housing>>

Nuances for co-owners and divorced spouses

New flat

Source: , press service of the Khimki city district administration

There are situations when former spouses who used the benefit remain to live in the same apartment, since both are registered in it. The right to a subsidy remains with the owner of the premises. The right of the second party as a former family member of the owner depends on how his residence in the premises is registered. If a divorced spouse lives under a rental agreement, this corresponds to the condition for providing a subsidy, but if he lives under an agreement for the gratuitous use of residential premises, this does not comply.

If the housing is in shared ownership, and the owners are not or do not consider themselves members of the same family, then each of them can submit a separate application for the subsidy. The actual expenses of each of them are determined in accordance with their ownership shares. If, for example, there are two owners, then when calculating the payment, the size of the regional standard for the cost of housing and communal services, established for one member of a family consisting of two people, is taken into account.

What services of the Moscow Region BTI can be obtained online>>

At what income is the subsidy given?

If the amount of housing and communal services costs is higher than 22% of the family budget, it is possible to receive a subsidy. In this case, part of the costs is compensated by the state.

To calculate family income, you need:

- Add up the money you received over the last six months and divide that number by 6. When calculating total income, money before taxes is taken into account. Moreover, it is necessary to take into account the income of all family members registered in the residential premises - able-bodied persons, pensioners, minor children.

- To ensure accurate calculations, it is recommended to use a calculator.

- Only money received officially is taken into account.

Compare the result obtained with the maximum income for the existing family composition. This amount differs depending on whether residents are users or owners. This information is presented in the table below.

| For premises users | For premises owners | ||

| Number of persons | Maximum income (in rubles) | Number of persons | Maximum income (in rubles) |

| 1 | 47769 | 1 | 46112 |

| 2 | 73547 | 2 | 71439 |

| 3 | 102280 | 3 | 99569 |

| 4 | 136373 | 4 | 132759 |

| 5 | 170467 | 5 | 165949 |

| 6 | 204560 | 6 | 199138 |

| 7 | 238653 | 7 | 232328 |

| 8 | 272747 | 8 | 265518 |

| 9 | 306840 | 9 | 298708 |

| 10 | 340934 | 10 | 331898 |

It is also necessary to calculate what percentage of income goes to paying utility bills. To do this, use the following formula:

Amount of housing and communal services/total income * 100%

When calculating your total family income, you need to consider the following:

- official salaries of all working family members;

- benefits received (for example, for a child or for caring for a pensioner);

- inheritance, if it was received in money;

- child support payments;

- official profit if a person is engaged in private business;

- interest received from deposits;

- money received from the sale of real estate or a car;

- pensions and scholarships.

If the average income is below the established minimum, you can receive the status of a low-income family. It is issued for 3 months. If after this period the income increases, the new status may be denied. The cost of living differs for different regions of Russia. Therefore, before going to the administrative authority to submit an application, it is recommended to make sure that there are grounds for this.

What documents confirm lack of income?

To prove the lack of income, you need to submit the following official documents:

- Certificate stating that there is no scholarship. This document is issued to students.

- Confirmation that the person is not receiving unemployment benefits. Issued to citizens who have official unemployed status.

- Certificate of education - for students aged 16-18 years.

- Certificate that the woman is on maternity leave. A certificate of pregnancy registration may also be required.

- Documents confirming that a person is in prison.

- Certificate of death of a person or that he is missing.

- A certificate confirming that the person is undergoing long-term treatment.

- Confirmation that the person does not receive other benefits.

If wages are too low and people rely on subsidies, they must provide paperwork confirming their wage level.

Example

A family living in Moscow consists of 4 people: a husband, a wife and two minor children (school students). Housing is owned and, in accordance with housing legislation, homeowners pay contributions for major repairs of the common property of an apartment building.

The husband’s income for 6 months was 240,000 rubles, the wife’s income for the same period was 120,000 rubles.

When calculating the total family income (regardless of separate or joint residence), the income of citizens who are in relation to the applicant for the subsidy is taken into account:

- spouse;

- parents or adoptive parents of minor children;

- minor children, including adopted children.

If an applicant for a subsidy (a member of his family) is declared unemployed on the day of submitting an application for a subsidy, then when calculating the average per capita family income, his income from the labor activity of the applicant (a member of his family) is excluded. This rule will be in effect until December 31, 2021.

According to the conditions of our example, the average monthly family income will be: (240,000 rubles 120,000 rubles) / 6 months = 60,000 rubles.

The average per capita family income will be: 60,000 rubles / 4 people. = 15,000 rubles.

According to the Moscow standard (approved by Law No. 54), the maximum allowable share of citizens' expenses for housing and communal services in the total family income with an average per capita income of over 2,500 rubles is 10%.

The website of the City Center for Housing Subsidies (https://www.subsident.ru/info/6/107) lists the maximum family income that gives the right to receive a subsidy from July 1, 2021. The amount of income is different for owners and users of residential premises. For example, for a family of 4 people, the maximum total (monthly) income will be 141,586.40 rubles.

According to the conditions of the example, the family (subject to other conditions) has the right to apply for a subsidy.

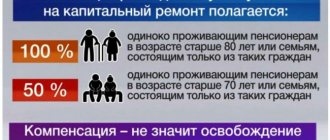

Often the reason for refusal of a subsidy is non-payment of contributions for major repairs. Thus, a pensioner aged 80 was denied a subsidy by the Moscow City Center for Housing Subsidies due to non-payment of contributions for major repairs. The woman sued, indicated that she is a pensioner living alone, the pension she receives is spent on paying for housing and communal services, treatment, minor apartment repairs and paying off a debt in the amount of 86,200 rubles for a medical operation. For this reason, she could not pay contributions for major repairs

However, all courts considered the authorities’ actions to be lawful, since contributions for major repairs are included in the structure of payments for residential premises and utilities. And the presence of debts does not allow you to receive a subsidy (“Review of the practice of courts considering cases on disputes related to the implementation of social support measures for certain categories of citizens,” approved by the Presidium of the Supreme Court of the Russian Federation on June 17, 2020).

Where to start applying for a subsidy

To receive benefits you must submit an application. You can do this in:

- social protection authorities;

- through the MFC - valid only for Moscow residents;

- through the official website of the mayor of Moscow (also only for residents of the capital), and then go to any;

- on the State portal

Regardless of the chosen location for obtaining the subsidy, you need to collect the same documents.

Documents for the legal calculation of subsidies

When applying for a grant, you must have the following official documents with you:

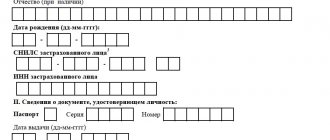

- Passports for all residents registered in the apartment. If there are persons under 14 years of age, birth certificates must be attached.

- Certificates of income or lack thereof. Indicated for all residents of the premises over 16 years of age. Income information must cover the last 6 months.

- The latest receipt for housing and communal services and confirmation that there are no debts.

- Number of the card or bank account where the funds will be credited.

- If the application is submitted by a representative, you must additionally attach his passport and a power of attorney for him.

It must be taken into account that each case is considered individually. Therefore, additional documents may be required. For example, for pensioners a certificate of pension payments may be required, and for large families a certificate confirming their official status.

If the applicant lives in a communal apartment, he does not need to indicate the details of strangers. However, he must provide evidence that different families in the apartment have separate meters for gas, electricity and water.

Documents for receiving a subsidy

To apply for benefits, collect the following documents:

- the passport of the person applying for subsidies; if there are children under 14 years of age, their birth certificates will also be needed; if they are older, their passports;

- title deed or rental agreement;

- receipts and checks for payment of utilities;

- certificate of family composition with dates of registration;

- income certificates for each family member living in the apartment;

- bank account number and card number of the subsidy recipient.

You will also need to fill out a refund application and attach it to the rest of the documents.

Receipts for payment of housing and communal services must be submitted for the previous month once when applying for benefits. That is, if you apply for compensation in May, then present receipts for April. If you make payments online, print electronic payment receipts from Internet Banking.

A certificate from your employer is suitable to confirm your income. If one of the family members receives social benefits, you must present certificates indicating the monthly payment and the period of receipt - within six months, indefinitely or one-time. They can be obtained from the authority that issues these benefits. When calculating the total family income, all types of payments are taken into account, except:

- benefits for unemployed citizens who care for a disabled person;

- one-time insurance payments in case of damage to health;

- alimony.

Typically, income certificates are accepted for the previous six months, but in some regions they are requested only for 3 months. For example, in the Nizhny Novgorod region.

If one of the family members receives only a pension, no certificates need to be provided. The subsidies department can request information from the Pension Fund on its own.

How to apply

When applying for a subsidy, you must follow the following procedure:

- First, contact your local authorities to clarify the application rules and who can qualify for payments.

- Fill out the application form and provide all the required information.

- Submit a package of documents. You must submit your application in person or through an authorized representative. You can also do this remotely – through the State Services portal.

- The application is reviewed within 10 days. If any documents are missing, the procedure can take up to a month. During this time, the applicant must submit all the necessary certificates, otherwise he will be denied a subsidy.

If the grant is approved, the money will be transferred to the bank account specified in the application. Funds can be used exclusively to pay utility bills. They do not apply to rent.

The application contains the following information:

- At the top of the page, on the right side, you must write to whom this application is addressed.

- Then in the center of the page the word “Statement” is written, and below - from whom and on what issue.

- A list of all family members living in the housing in question is provided. The degree of relationship, passport numbers and the availability of benefits in the name of the people registered in the apartment are also indicated here.

- Next you need to write what documents were attached and in what quantity.

- Then comes the point that the applicant undertakes to use the funds received only to pay for utilities.

- After this, the applicant puts his signature. There is also room for specialist decisions. They must state in writing the grounds on which the application will be accepted or rejected.

It is not necessary to apply for compensation in the office. This can be done remotely – through the State Services website. The following algorithm of actions is performed:

- Register on the portal and identify yourself.

- Go to the “Benefits and Allowances” section, go to “Benefits for housing and communal services”.

- Fill out the form and submit it for review.

- If the service accepts the application, a notification will be sent to your Personal Account about the possibility of obtaining a subsidy. The date and time will be indicated when you need to come to the authority to apply for subsidies. You must take the originals of all documents with you.

The advantage of filling out the application online is that you will only have to visit the office once - when submitting documents. Otherwise, you will have to visit the administrative body two or more times (if you do not bring all the necessary documents the first time).

The subsidy will not be awarded if inaccurate information is provided when submitting the application. And if the applicant submits falsified documents, he may be criminally liable for this. After all, specialists check all income certificates that a citizen provides.

What is a subsidy?

A subsidy for the payment of housing and utilities (hereinafter referred to as housing and communal services) is an additional measure of social support for citizens with low incomes. When paying a subsidy, the total amount of citizens' spending on housing and utilities is compared with the amount of their income. And if the share of expenses for housing and communal services exceeds a certain amount, then the citizen has the right to apply for a subsidy.

Important!

Each region has its own maximum amount of expenses in relation to income and is established by local legislation.

In Moscow, the permissible amount of expenses should not exceed 10% (Clause 1 of Article 4 of Moscow Law No. 54 dated November 1, 2006, hereinafter referred to as Law No. 54), and in St. Petersburg - 14% ( Art. 2 of the Law of St. Petersburg dated June 30, 2005 No. 403-48). In the Chelyabinsk region - 22% (Resolution of the Government of the Chelyabinsk Region dated June 20, 2012 No. 336-P).

In addition, in Moscow, for pensioners who have the title “Veteran of Labor” or “Veteran of Military Service”, a 50% discount on housing and utilities is provided (clause 3, clause 1, article 6 of the Moscow Law of November 3, 2004 city No. 70). The same benefits are provided to pensioners who are participants in the defense of Moscow, as well as to pensioners from among rehabilitated persons.

Calculation of subsidies for housing and communal services

When calculating the amount of the subsidy, it is necessary to take into account family income, prices for housing and communal services, and the maximum amount for housing and communal services. You can carry out all calculations yourself or using online calculators. To calculate the amount of the subsidy you need to know the formulas.

Calculation formula

When calculating the subsidy, use the following formula:

SKU*number of people – MDR/100 * D, where

SKU – cost of utilities;

MDR/100 – the maximum amount that goes to pay for housing and communal services;

D – family income.

The value obtained as a result of calculations will be the amount of compensation. If the amount of the subsidy is equal to or exceeds the amount for paying for housing and communal services, the subsidy is 100%.

Payment validity periods

Subsidy payments may be suspended in the following cases:

- Utility payments are overdue for more than 2 months.

- The applicant does not comply with the terms of repayment of debts.

In this case, the applicant must contact the office to provide an explanation. If he has valid reasons why the conditions for receiving subsidies were not met, payments will be restored.

The complete termination of the subsidy is observed in the following cases:

- Change of permanent residence address.

- Change in the number of family members (for example, the return of a son from the army).

- Providing false information by the applicant.

- If, within 30 days after the suspension of the subsidy, the person does not repay the debt on housing and communal services. After this, the applicant must provide evidence that payments have been made.

It is advisable to submit an application between the 1st and 15th of the month. So the subsidy will be credited this month. If you submit an application after the 16th, payments will occur starting from the next month.

The subsidy is provided for six months. In the future, you will need to re-assemble the required package of official papers and submit an application. If the family's financial situation improves, they may be denied a subsidy.