When is such a statement necessary?

The pilot project of direct payments of social benefits from the Social Insurance Fund covered almost all regions of the Russian Federation. The Krasnodar Territory, the Perm Territory, the Moscow, Sverdlovsk, and Chelyabinsk regions, the Khanty-Mansiysk Autonomous Okrug, and the federal cities of Moscow and St. Petersburg are not yet participating in the project. They will join from January 1, 2021.

The essence of the project is that the benefits are paid not by the employer, but by the Social Insurance Fund itself. Its rules are set out in government decree No. 294 dated April 21, 2011.

To assign benefits you need:

- certificate of incapacity for work or other documents (for example, a birth certificate from the registry office);

- application for calculation of sick leave from the employee.

When making direct payments, the employer collects a package of documents from the employee and transmits the information to the Social Insurance Fund. And the fund itself makes calculations and payments to the recipient.

What benefits are they asking for?

In the pilot project, the Social Insurance Fund pays all social benefits that the employer previously compensated for through insurance contributions:

- due to illness;

- for pregnancy and childbirth;

- for child care;

- at birth;

- one-time when registering in the early stages of pregnancy;

- payments for temporary disability due to an accident at work or occupational disease;

- additional admission for treatment and travel to and from the place of treatment.

The employer continues to pay social benefits independently:

- for burial;

- to pay for additional days of rest to care for a disabled child.

These accruals paid to employees will be reimbursed in full by the Social Insurance Fund of the Russian Federation to the organization upon request.

In addition, the employer pays for the first three days of the employee’s illness at his own expense. The organization is obliged to pay these amounts to the employee itself.

GLAVBUKH-INFO

In field "Type of benefit" you must select the appropriate code and type of benefit, namely “1 – Disability”.In the “Characteristic” , select the code “0” if information is submitted for the first time or “1” if a recalculation is submitted.

The fields “Sequence number of information” and “Date of application” are filled in automatically.

If the application is submitted personally by the employee, then it is necessary to make a mark in the “Applicant” , if - by the employee’s representative, then a mark is made in the “Authorized Representative” and all his personal data are indicated: full name, series, number and date of issue of the identity document.

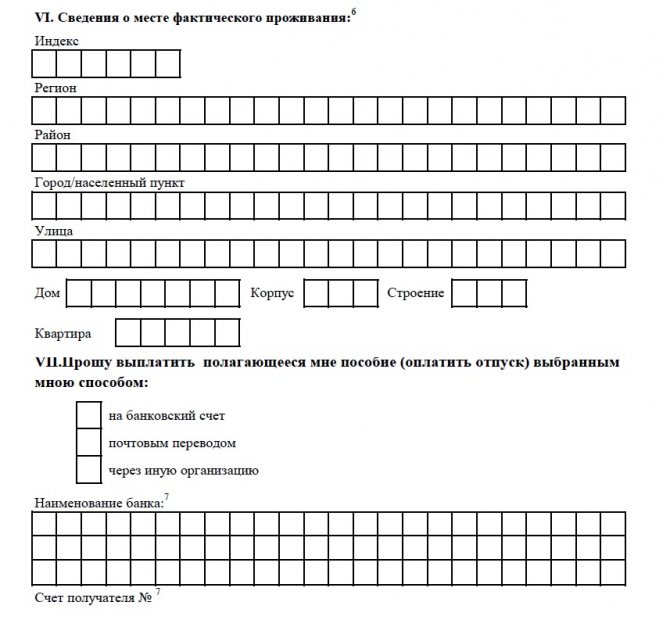

The application indicates the method of payment of benefits to the insured person: by transfer to a credit institution, by postal order or through another organization. If a person selects in the “Payment method” - through a bank, then it is also necessary to indicate the name of the bank in which the recipient’s account is opened, the bank’s BIC and the account number for transferring the benefit.

In the “Availability of a WORLD card” , select the appropriate attribute:

- 0 – if the card is missing;

- 1 – if you have a card of the national payment system MIR.

In the “Card number” , indicate the payment card number.

“Card number” field is filled in if the “1” attribute is selected in the “Availability of a WORLD card” .

If a person wishes to receive the payments due to him by mail, then he makes a mark in the “Payment method” - by postal order.

Information about the recipient of benefits (vacation pay)

This section of the application contains the following information:

- in the field “Last name, first name, patronymic” the full surname of the benefit recipient, his first name and patronymic (if any) are indicated in accordance with the identity document;

- in the “Date of Birth” field, the date of birth of the benefit recipient is indicated in accordance with the identity document;

- the insurance number of the applicant’s individual personal account is indicated in the “SNILS” field. This number can be found on the compulsory pension insurance insurance certificate;

- in the “TIN” field, the taxpayer identification number is indicated in accordance with the certificate of registration with the tax authority;

- in the field “Information about the identification document” the type of document proving the identity of the benefit recipient (passport, temporary identity card or other document), its series and number, as well as the day, month and year of issue of the document are indicated;

- in the field “Information on documents confirming permanent or temporary residence on the territory of the Russian Federation” the type of document (residence permit or temporary residence permit), its series and number, as well as the date of issue or renewal are indicated. This field is filled in if the recipient of the benefit is a foreign citizen or stateless person permanently or temporarily residing in the territory of the Russian Federation;

- in the “Information about the place of registration” field, the place of registration at the place of residence, place of stay, temporary residence (postal code, name of an urban or rural settlement, street, house number, building, apartment) of the recipient is selected from the directory based on the entry in the passport or document , confirming registration at the place of residence, place of stay, temporary residence;

- in the “Information about place of residence (stay)” field, the address of the place of residence (stay) of the benefit recipient is selected from the directory.

If, at the request of the recipient, the benefit should be transferred by mail, then this field must be filled in; If the transfer is made through a credit institution, then this field does not need to be filled in.

Details of documents attached for appointment

In this part of the application, it is necessary to indicate the initial data for the assignment and payment of temporary disability benefits to the recipient.

The line “Certificate of incapacity for work” indicates the number and date of issue of the certificate of incapacity for work.

If a certificate of incapacity for work is presented for payment, which is a continuation of a previously issued certificate, then by going to the “Certificate of Incapacity for Work” , in the field “Continuation of LN No.” the number of the previous certificate of incapacity for work is indicated. This field is filled in when the checkbox next to the “primary” .

In the field “Certificate of non-receipt of benefits at other places of work” the number and date of issue of the certificate is indicated.

This field is filled in only by those persons who are employed by several employers (insurers).

Persons living (working) in resettlement zones, with the right to resettlement or with a preferential socio-economic status, must fill out the fields “Residence/work conditions” and “Type of document confirming the permanent residence of the benefit recipient in the specified zones, and its details " .

In the field “Name of the applicant’s employer” the full name of the employer is indicated in accordance with the constituent documents.

This field and similar lines are filled in by the employer.

In the “Type of employment” it is made about or “part-time”.

In the “SNILS of a disabled person” , the insurance number of the applicant’s individual personal account is indicated. This number can be found on the compulsory pension insurance insurance certificate.

In the field “TIN of a disabled person” the taxpayer identification number is indicated in accordance with the certificate of registration with the tax authority.

The fields “Employee’s application for changing calendar years” and “Employee’s application for calculating maternity benefits in accordance with the legislation in force in 2010” are not filled in, except when the applicant for temporary disability benefits is a person on maternity leave or child care. In this case, applicants wishing to change calendar years must fill out the specified fields. The procedure and conditions for replacing calendar years when calculating temporary disability benefits are provided for in paragraph 1 of Art. 14 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.”

In the field “Number of calendar days falling within the period for which wages are taken into account” for Crimea and Sevastopol in 2021, “654” is indicated (in 2015 – “289”), for other regions – “730”.

“Bid rate” field is filled in only for part-time (weekly) work. The value is entered here as a decimal fraction (for example, 0.75).

In the field “Official salary (tariff rate)” its size is indicated.

The section “Data on idle periods” indicates the start and end date of the idle period, as well as the amount of average daily earnings that is retained by the employee during the idle period.

This section is completed only in the case of temporary disability that occurred before the downtime period and continues during the downtime period.

The section “Data for periods for which benefits are not assigned” indicates the start and end date of the period.

After the application is completed, the employer must upload the benefit recipient's disability certificate into the program. This can be done either by downloading a sick leave sheet from a file, or by scanning it or filling it out directly in the program, transferring all the information from the sheet. The employer (insured) must fill out his part of the disability certificate, indicating the following information:

- name and registration number of the employer;

- INN and SNILS of the employee (beneficiary);

- calculation conditions (the appropriate code or codes are selected);

- date of start of work with the employer and the employee’s insurance period;

- the amount of average earnings for calculating benefits and the number of days to be paid;

- the amount of the calculated benefit, financed from the employer’s funds (the first three days of illness) and from the Social Insurance Fund.

Next, the employer needs to fill out “Additional information” . This section specifies:

- in the “Employment contract” – the start and end date of the contract;

- “District coefficient” - selected from the directory (if available) and the “Name of the district” ;

- “Code of the cause of radiation exposure” - selected from the directory (if available).

In a separate field in this section, other information that is important when deciding on the assignment of benefits or determining its size may be indicated.

In the “Accompanying Documents” , the employer indicates all the documents that will be sent to the territorial office of the Social Insurance Fund for the assignment and payment of appropriate benefits to the insured person.

After all the necessary information has been filled out, the documents prepared for sending to the FSS are checked.

Based on the completed application, a list of documents and a register of information necessary for the appointment and payment of temporary disability benefits, maternity benefits, and one-time benefits for women registered in medical institutions in the early stages of pregnancy are formed.

| Next > |

Form and filling rules

For the pilot project, a unified application form to the Social Insurance Fund for sick leave in 2021 was developed, which was approved by Order No. 578 of the Social Insurance Fund dated November 24, 2017.

The employer fills out the sick leave according to the usual rules, with the exception of two lines (they are left blank): “Amount of benefit at the expense of the Social Insurance Fund” and “Total accrued.”

Instructions on how to fill out an application for sick leave:

- We indicate the exact name of the territorial body of the Social Insurance Fund at the location of the employer.

- We write down the full name. applicant (employee).

- We put a mark in the line corresponding to the requested social benefit. The form is used both when assigning and recalculating payments. It is necessary to put the appropriate mark.

- We indicate the payment method and recipient details.

- We fill in the passport details, date of birth and place of registration of the applicant.

- We write down the details of the document on the basis of which the benefit is assigned (certificate of incapacity for work, certificates, birth certificate, etc.).

- Information on the assignment of benefits is filled out by the employer. It indicates the SNILS and INN of the employee, data on earnings excluded from the billing period.

- The completed form is signed by the applicant (employee) and an official of the organization.

Sample application to the Social Insurance Fund for payment of sick leave from an employee:

Information about the insured person

This document will replace the application for payment of benefits. But if applications were drawn up for each insured event, then the new document will serve as a kind of data register, which is stored by the employer.

The document is filled out once - upon employment or during the work period (Resolution of the Government of the Russian Federation of December 30, 2020 No. 2375). When exactly, the resolution does not say. You will probably have to fill out information for a working employee when the need for sick leave arises. Then the document can be supplemented or corrected.

You will need to fill out information about the insured, including personal data, and payment details for transferring benefits. Details of additional documents are not included in the information: they will only need to be indicated in the register. This could be a child’s birth certificate, an order for child care leave, etc.

Information about the insured person, section I

Information about the insured person, sections VI and VII

The form is more convenient than the old application. For example, if fields are not filled in, they are hidden. This means that you won’t have to print them and waste extra paper. You can store the document on paper or electronically with a simple electronic signature.

How to transfer to the FSS

Having explained to the employee how to write an application for paid sick leave, and having received a complete package of documents from him, submit them to the Social Insurance Fund in paper form. The employer has five calendar days to do this. The package of documents must be accompanied by an inventory.

If there are more than 25 people, organizations submit to the Fund an electronic register of information necessary to assign benefits. Companies with fewer than 25 employees are entitled, but not required, to use an electronic registry. When using an electronic registry, the sick leave certificate, the employee’s application for sick pay and other original documents remain in the custody of the employing organization.

Application for sick leave after dismissal of a subordinate

If the employment contract with a subordinate is terminated, and the employer has issued him a work book with the corresponding entry, then the dismissed person has 30 days to, if necessary, provide the former company with a certificate of incapacity for payment.

In this case, the subordinate must draw up a statement that the benefit is transferred to him after he leaves the company, if the employer operates in a region where there is a pilot project for direct transfers of benefits from the Social Insurance Fund. In this case, the completed application is drawn up in the form determined by order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578.

Application for reimbursement of expenses for temporary disability benefits (form)

Currently, the employer does not transfer benefits - funds are paid from the Social Insurance Fund. A person can receive them by money transfer at Russian Post or to his bank account.

Thus, the dismissed subordinate draws up an application for payment of sick leave, transfers the completed application and sick leave to the former employer, and the employer sends a package of documents to the Social Insurance Fund.

But if the company operates in a region in which the pilot project is not yet operational, then in this situation it is recommended to obtain a sick leave application from a subordinate. Thanks to the application, it is possible to record the date the person applied for help for further tracking of the payment of benefits.

Application for sick pay after dismissal (sample)

Timeframe for making a decision

The Social Insurance Fund makes a decision on the assignment and payment of benefits within 10 calendar days after receiving the necessary documents from the employer. Payment is made to the recipient's details specified in the application.

If errors are detected in the documents provided, no later than five days from the date of receipt, the Social Insurance Fund notifies the employer of the need to make corrections. The corrected certificate of incapacity for work is processed in an expedited manner, which takes no more than 3 working days.