How to check the authenticity of a sick leave certificate

Any employee who is absent from work due to illness is required to provide the employer with a certificate of incapacity for work.

Within 5 days, the accounting department transfers it to the Social Insurance Fund. See here for details.

We remind you! Since 2021, the FSS pilot project has been operating throughout the Russian Federation. Our experts have prepared a special guide for accountants on direct benefit payments in 2021. Go to this material and see the recommendations of professionals.

If the sick leave is issued in electronic form, the possibility of forgery is excluded.

Since paper sick leave certificates are currently used on a par with electronic ones, risks associated with paper sick leaves remain. If the sick leave turns out to be fake, the Social Insurance Fund will not pay the employee benefits.

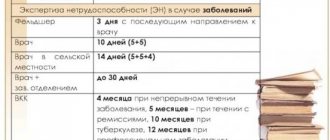

To avoid such trouble, the employer should check the authenticity of the document independently. The original document form contains several degrees of protection:

- watermarks with the “FSS of Russia” logo, which are easy to see by shining a light through the document;

- microtext “Certificate of Incapacity for Work”, written on the line under the column “Doctor’s signature”;

- microfibers in paper;

- in the upper right corner on the back of the document is the company name;

- luminous words that are visible when the specimen is illuminated with ultraviolet light;

You can also check the sick leave certificate by number, since it is printed and has irregularities that can be easily felt if you run your finger over them.

For other features of visual verification of the sick leave form, read the material “Sick leave - 10 signs of fraud” .

In addition, you can check the authenticity of the sick leave certificate on the FSS website.

Preparing for work

Step 1. Register in the system

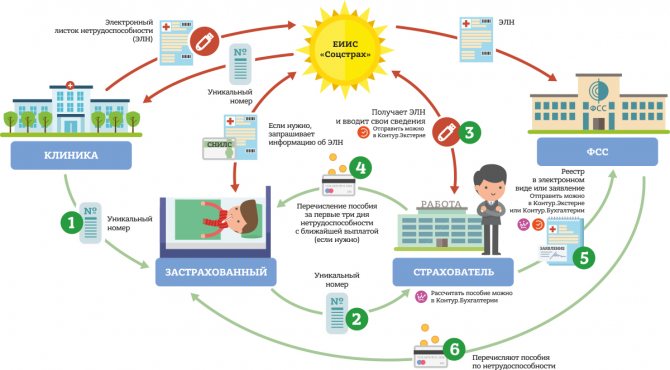

To work with electronic sick leave certificates, an organization will need to create a personal account in the Unified Integrated Information System “Sotsstrakh” of the FSS at cabinets.fss.ru (hereinafter referred to as the UIIS “Sotsstrakh”).

You can log in through your legal entity account on the State Services portal. If your organization does not have a confirmed account on State Services, create one in the Unified Identification and Authentication System (USIA):

- On esia.gosuslugi.ru go to the “Organizations” tab.

- Create a verified account using a qualified electronic signature issued in the name of an executive or a person authorized to act without a power of attorney.

- Fill out the card with the details.

If you have an accounting service, read about how to receive sick leave for employees in the article.

After registering in your UIIS “Sotsstrakh” personal account, fill out information about your company and read the instructions.

Each participant in the system has its own personal account functions:

- Hospitals will upload electronic forms into the system, signing them with a qualified electronic signature.

- The accountant will see employee sick leave, receive the necessary information for calculating benefits and fill out the employer section.

- The insured will be able to check whether the sick leave certificate has been filled out correctly and whether the benefits have been accrued correctly.

- Federal Law No. 86-FZ provides that a doctor will be able to issue an electronic sick leave for temporary disability, pregnancy or maternity if these two conditions are met:

- The medical institution and the employer of the insured person are registered in a special automated system of electronic forms.

- The patient agreed in writing to issue a certificate of incapacity for work in electronic form.

A list of data required for conducting a medical and social examination of the insured and calculating benefits, as well as the deadlines for their submission, have been approved (Resolution of the Government of the Russian Federation dated December 16, 2017 No. 1567).

Step 2: Redistribute responsibilities

Appoint an accountant responsible for working with electronic sick leave, obtain an electronic signature for it and provide access to the Social Insurance Unified Information System. If necessary, teach new work rules to those accountants who previously worked only with paper sick leave.

Many services are developing new capabilities for working with electronic sick leave. To work with electronic sick leave, you can also use a free program that the Social Insurance Fund offers to download in the employer’s personal account.

In Externa you can download, fill out and send electronic sick leave to the Social Insurance Fund. Regions with direct payments can create a register based on ELN data and send it to the Social Insurance Fund.

Register

Step 3: Tell employees about the changes

Once the company has connected to the system, tell employees that they have the right to file sick leave electronically. You can issue an order against signature or send it by email.

The employee himself decides in what form he wants to draw up the document: paper or electronic. But electronic sick leave has advantages, convey them to your employees:

- It is easier to complete; there is no need to additionally certify it with seals at the registry office.

- It cannot be spoiled, forgotten, or lost. If the insured person loses his sick leave number, he will be able to restore it in his personal account using the SNILS number and the State Services password.

- An electronic sick leave does not need to be carefully stored and transferred to an accountant, like its paper counterpart. It is enough to provide the sheet number by phone or by mail. This is especially true for companies with branches, different offices or separately located accounting departments.

Tatyana Ogorodnikova, accountant at Agency Bonus :

— The FSS itself sent us a letter inviting us to become a participant in the system and entered into an agreement with us on information interaction. We plan to notify employees about the possibility of filing sick leave electronically in mailings on behalf of department directors. From the introduction of electronic certificates of incapacity for work, we definitely expect only positive changes in work: for example, we will no longer have to send an employee to the doctor to reissue the document due to an error. This has happened before.

Official website of the FSS for checking certificates of incapacity for work

The FSS portal can be found at: portal.fss.ru. However, this site will only help you calculate the amount of benefits payable to the employee, but will not allow you to check your sick leave online.

In order to check the sick leave certificate online at the FSS, you need to go to the official website of the department via the link fss.ru and download the database of invalid forms (for example, stolen or lost).

You will be introduced to the nuances of calculating and paying sick leave by materials and messages prepared by specialists on our website:

- An employee is overdue for an appointment with a doctor - should I pay for sick leave?;

- Payment of sick leave for a domestic injury;

- Sick leave pay after dismissal.

Who may need sick leave verification

We can talk about checking:

- A regular paper sick leave certificate. The check here will be carried out, first of all, for the authenticity of the document. The main stakeholders in this are the employer and the employee for whom the sick leave is issued.

- Innovative electronic sick leave. Since July 2021, electronic sick leave began to operate at the federal level (before that in several regions). Unlike paper ones, which are handed out to patients, they are stored on the FSS servers. If necessary, they can be accessed by:

- FSS;

- medical organization that issued the document;

- employer;

- employee-patient.

Each of them can request access to sick leave for different purposes.

Read more information about electronic sick leave. Let's take a closer look at how to check sick leave in the two indicated varieties when using the FSS website and other available resources. Let us agree that such a check is required to be carried out by the employer, a representative of the medical institution and the patient himself.

Where to download the database of invalid certificates of incapacity for work in 2021

Social Insurance regularly updates the database of sick leave certificates that have been lost or stolen.

You can check the sick leave number on the FSS website and download the database in the “Information for employers (forms, reporting, forms)” section and find the line “Invalid sick leave forms.” The database is laid out in Excel format. To find the number you are looking for, you can use the “Find” service and enter the first 9 digits of the code designation of the number of the certificate of incapacity for work.

There is no other way to check sick leave by number online on the department’s website.

At the territorial office of the Social Insurance Fund, checking sick leave by number is also possible (this is provided for in paragraph 7 of Article 59 of the Law “On the Protection of the Health of Citizens in the Russian Federation” dated November 21, 2011 No. 323-FZ). To do this, you can contact the branch at the place of registration with a request to check the suspicious document by number, attaching the document itself. The FSS records the numbers of the forms that were received by each medical institution. Consequently, branch employees can determine whether the copy number belongs to the organization that issued it.

Is it possible to fire an employee if an inspection by the Social Insurance Fund reveals a fake sick leave? The answer to this question is in ConsultantPlus. Get trial access to the system and start learning the material for free.

At the stage of benefit payment

Step 6. Submit information to the Social Insurance Fund for payment or reimbursement of benefits

The completed sick leave will instantly be sent to the Social Insurance Fund office at the insured person’s place of work. The Social Insurance Fund will take this information into account when calculating and checking benefits.

Further, the scenarios for calculating and paying benefits differ in different regions of Russia. Some regions are participating in the FSS pilot project “Direct Payments”, all of them are listed in Decree of the Government of the Russian Federation dated April 21, 2011 No. 294. In these regions, benefits are paid by the FSS directly to the employee. In other regions, benefits are calculated and paid to the employee by the employer. Let's consider scenarios for an accountant's work in both cases.

Credit system

Figure 1. Procedure for paying disability benefits under the offset system of insurance contributions.

With the credit scheme:

- Calculate the benefit and pay it to the employee with the nearest salary.

- The amount of expenses incurred to pay benefits can either be offset against social insurance contributions or reimbursed to the Social Insurance Fund. To receive a refund, you must go to the Social Insurance Fund office and provide an application or a certificate of calculation.

Direct payments

Figure 2. Procedure for paying disability benefits in the regions where the Direct Payments pilot project operates.

For direct payments:

- Use your accounting program to calculate the average earnings for the benefit.

- If the benefit for the first three days must be paid by the employer, calculate and include this part in the next salary.

- Prepare the register electronically (if you send data via the Internet) or fill out an application to the Social Insurance Fund on behalf of the employee (if you contact the Social Insurance Fund in person).

- Send the register to the FSS portal or take the application in person to the FSS office.

- Make sure that the employee receives the benefit: the Social Insurance Fund will pay it by bank or postal transfer.

Read more about the pilot project “Direct Payments”.

Report for employees through Kontur.Extern. Loading data into RSV from SZV-M. Importing data from 2-NDFL 5.06. Zero RSV in no time. Free for 3 months.

Register

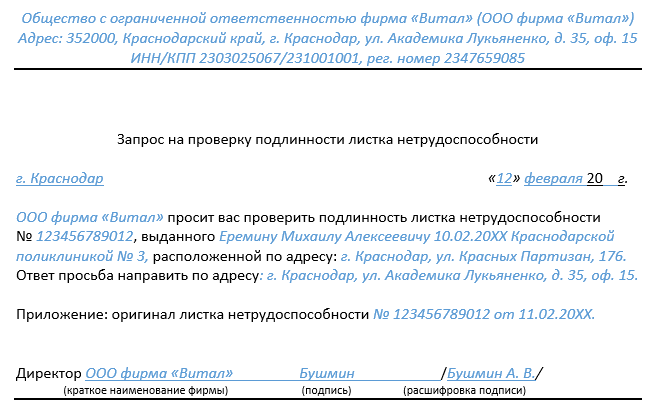

Letter to the Social Insurance Fund about checking sick leave if the check on the portal did not produce results (sample)

A request to the Social Insurance Fund to verify sick leave is made in any order and must contain the following information:

- about the policyholder: company name, INN/KPP/registration number in the Social Insurance Fund, legal address and telephone number;

- to whom, by whom and when issued, as well as the number of the certificate of incapacity for work;

- where and how the fund should send the response;

- about applications;

- signature of the head of the company and date of preparation.

The original sick leave certificate must be attached to the application. After verification, the department will return it.

Applications can be made on our website.

Since the FSS has the right to prepare a response within up to 30 days, you can contact a medical organization to check the authenticity of the sick leave. The request form is free. An example of the wording can be found in the Ready-made solution from ConsultantPlus, having received trial access to the system for free.

Procedure for providing BC

To reimburse the manager for sick leave payments, he must submit a certain package of documents. There are several ways to do this.

How to send through the Social Security Fund portal?

Document flow with the Social Insurance Fund is not properly established. How can I transfer a document? You have to submit documents in person. To receive reimbursement for sick leave payments, you must provide the following documents:

- Application from the policyholder. It must indicate the name of the enterprise, registration number, legal and actual addresses, as well as the amount to be reimbursed.

- For sick leave paid from the beginning of 2021, a certificate is provided with a calculation of accrued and paid insurance premiums. The certificate must contain all the data required in accordance with Order of the Ministry of Labor of the Russian Federation dated October 28, 2016 No. 585n. Additionally, a breakdown of insurance costs is provided.

- A document evidencing the occurrence of an insured event - a certificate of temporary incapacity for work.

Note. In the regions that participate in the Pilot Project, there is a Social Insurance Fund gateway for sending sick leave. Over time, it is possible to increase users through the introduction of electronic sick leave certificates.

Is it possible through State Services?

Through the State Services website, it is possible to submit an application for the appointment and payment of temporary disability benefits in cases where it is not possible to receive payments from the employer. The provision period is 10 days and is provided free of charge.

To receive services electronically you need:

- Log in to the State Services website by logging in or registering as a new user. Services are provided only for verified accounts. Service page - https://www.gosuslugi.ru/26223.

- Fill out the electronic form. To fill it out you will need:

- application for payment of benefits;

- sick leave;

- certificate of the amount of salary and other remuneration or payments;

- application for sending a request to the pension fund;

- document confirming insurance experience;

- documents confirming the impossibility of establishing the location of the policyholder or his property;

- documents that confirm the insured’s inability to pay compensation;

- documents confirming the liquidation of the enterprise or a similar procedure;

- information on entering the claims of the insured person in the register of claims.

- Wait for registration and verification of the application. A notification will be sent to the user’s Personal Account as confirmation.

- Waiting for the results of the review. When the application is reviewed, a notification will be sent to the applicant’s Personal Account.

- Pick up a document confirming the assignment of benefits and another one confirming the transfer of funds from the Social Insurance Fund.

other methods

You can submit documents to the FSS:

- Through a legal representative.

- Via mail.

When sending by mail, an inventory of the attachment is made, on which the post office employees put a stamp with a mark on the date of dispatch; it must be compiled in two copies (the second is placed in an envelope for the Social Insurance Fund). Attention! It is better to send documents by valuable letter. - Through the Multifunctional Center (MFC). Documents are submitted to the administrative center by the applicant according to the “one window” principle, then interaction with government bodies occurs without the participation of the applicant.

Results

Checking sick leave in the Social Insurance Fund is possible on the official social insurance website, using a regularly updated database of lost forms, or at the territorial authority at the employer’s place of registration by sending an official request. The department does not provide other ways to check sick leave online.

Sources: Federal Law of November 21, 2011 N 323-FZ “On the fundamentals of protecting the health of citizens in the Russian Federation”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to get an electronic sick leave certificate in your FSS personal account

An employee can independently choose in what form a sick leave certificate will be issued to him. It is recommended that you first ask your accountant if he can accept the document in electronic form. If an employee decides to use a new service, but his organization does not yet accept such documents, then he will have to issue a sick leave certificate in the usual form.

In this case, the clinic must cancel the submitted form and issue a paper document. If you find out in advance whether the accountant can accept the electronic format, then there will be no problems. The employer is not obliged to use the new FSS personal account system. Everyone makes their own decision.

When registering a sick leave, the patient must give written consent to the doctor for the processing of personal data and execution of the document online. The sheet does not need to be certified by the registry.

The sick leave certificate has a unique code by which you can find it in your FSS personal account. You can bring it to work or tell the accountant by phone.

Unclosed sick leave - consequences

Russian legislation does not oblige a person to cover his sick leave. Each person has the right to make his own decision about the need to visit medical institutions. Thus, the workers themselves have no obligation to cover their sick leave. However, unclosed sick leave still has certain unpleasant consequences for all participants in legal relations, namely:

An employee who has not covered his sick leave will not be able to count on guaranteed temporary disability benefits. In addition, an unclosed sick leave may give the employer the right to fire an employee for absenteeism.

For the employee.- For the employer. If the employer decides to pay for unpaid sick leave, then he runs the risk of not receiving compensation from the Social Insurance Fund, and even if it is provided, this may lead to additional risks, including fines during the audit.

- For a doctor. A doctor may also be held liable for an unclosed sick leave issued to an employee.

Thus, it should be noted that although the employee may not cover his sick leave, it is better for him not to do this, at least if he wants to receive temporary disability benefits and not risk possible dismissal.

The legislation allows the closure of sick leave not only in the institution that issued it. Thus, there should be no problems with closing sick leave.

In situations where there is an open sick leave after hospitalization, you should remember that it must still be closed in the prescribed manner. Moreover, if an employee refuses to visit the hospital, appropriate notes may be made on the sick leave sheet, and days of failure to comply with the doctor’s orders may not be paid.