In the case of Zabuldygin, everything is somewhat simpler. The main thing is to make sure that his “piece of paper” is really a fiction. And once you are convinced, don’t pay. And Zabuldygin himself will either be deprived of the promised bonus or fired altogether.

The Social Insurance Fund will not reimburse the employer if it detects a fake sick leave. In this case, you will either have to pay for the employee’s illness at the company’s expense, or recover money from the employee through the court. To avoid things like this, you must know about new ways of falsifying sick leave and be able to identify them in a timely manner.

Paper color and quality

A sick leave certificate is a document of strict accountability, the falsification of which will serve as a basis for bringing the employee to criminal, material and disciplinary liability. The sick leave serves a dual function. The first is a financial document that serves as the basis for the payment of benefits. The second - sick leave certifies the employee’s incapacity for work and confirms that he was absent for a good reason.

When an employee submits a sick note, make sure the form is valid and check that the basic security features are present. The form of the sick leave form was approved by order of the Ministry of Health and Social Development dated April 26, 2011 No. 347n. A sample of it can be found on the official website of the Social Insurance Fund, where the protective elements of the form are described. This information can be used to determine the authenticity of the sick leave certificate.

Form color mismatch

The form must be blue with a characteristic background grid. The left edge of the sheet, as well as the columns “Signature of the doctor” and “Signature of the head of the ITU bureau” have a dark blue tint.

Cells for filling out information are yellow; a field with a barcode in the upper right corner, as well as an empty square in the upper left corner - white. In fakes, most often there are white cells instead of yellow, and there is no background grid.

There is no watermark with the FSS logo

Look at the form against the light, you should see watermarks - two ears of corn, above which is the FSS logo surrounded by the words “Social Insurance Fund of the Russian Federation.”

On a fake sick leave certificate, the watermarks do not match the picture or are missing altogether.

Paper quality does not match the original

The sick leave form feels like a banknote and creates a characteristic rustling sound when shaken. Counterfeit forms are usually printed on regular paper, which does not have this characteristic.

No protective fibers

The sick leave form has three types of protective fibers: blue, pink and light green, which, like the FSS logo, are clearly visible in the white square in the upper left corner. On a counterfeit form, as a rule, the security fibers are absent or made in one color.

Wrong seal

The sick leave certificate must contain the name of the medical organization and its address. A discrepancy between the seal and the information about the name of the medical institution may indicate a forgery of the sick leave certificate.

Wrong clinic

Check whether the medical organization included in the form exists. You can check information about the validity of a medical organization, its name and location address using the website of the Federal Service for Surveillance in Healthcare – roszdravnadzor.ru in the “Unified Register of Licenses” section. Similar information can be obtained on the government services portal, as well as in the register of medical organizations of the Federal Compulsory Medical Insurance Fund: ffoms.ru.

Wrong OGRN

The OGRN on the sick leave must correspond to the name and address of the specified medical organization. You can identify your OGRN on the Federal Tax Service website: egrul.nalog.ru.

Wrong doctor

The names of doctors who do not work in a medical organization are indicated. Check the “Physician Position” column on the form. The sick leave must be signed by a doctor who is working in a medical organization at the time the sick leave is issued. You can obtain information about this, for example, by calling the medical organization where the employee issued a sick leave, or by sending an official request. The position should be filled as follows: therapist, pediatrician, surgeon, ENT. Abbreviations are possible: “stomatol”, “ophthalmol” (letter of the Ministry of Health and Social Development dated October 28, 2011 No. 14-03-18/15-12956). On fake forms you may see simply “doctor”.

We contact the medical institution or the Social Insurance Fund

To confirm suspicions of falsifying sick leave, you can contact the medical organization that issued it. For example, to clarify information about the fact that sick leave was issued to an employee or to check information about a doctor and other data. Please submit your request in the form of a written request on official letterhead. Please attach a copy of your sick leave certificate to your request. In your request, you can indicate the circumstances or information that served as the basis for doubting the authenticity of the document. Please submit your request on behalf of an authorized person. If you are making an application signed by a person who is acting under a power of attorney or on the basis of an order, attach a certified copy of the power of attorney or order to the request.

Check the numbers

Check the sick leave number with the Social Insurance Fund. All sick leaves have their own unique numbers. They are located in the upper right corner of the form - under the barcode. These numbers are recorded in the FSS database. To obtain information about the existence of the number, you can call the regional office of the FSS. The absence of a number may indicate a fake. However, this is not a universal rule, since the number of an existing form can be used in a fake sick leave.

By the way, a regularly updated list of stolen and lost sick leave forms over the past seven years has been published on the FSS website. The document was last updated in August; it now contains information about 2,486 sick leaves. The fund recommends that employers check the sick leave numbers presented by employees with the numbers of the forms from the mentioned list. Regardless of the status of the certificate of incapacity for work - “lost” or “invalid” - all sick leave forms listed in the list are considered invalid, and therefore cannot be accepted from employees for payment.

What is a sick leave?

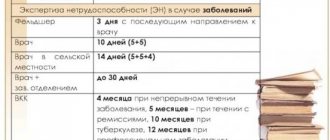

A certificate of temporary incapacity for work (sick leave) is issued by a specialized medical institution. It is issued in cases where a citizen has undergone outpatient treatment. Such forms are issued only by employees of structures that have received a license from the FSS. For example, blood transfusion stations or sanatoriums do not have the right to issue a certificate of temporary incapacity for work.

Doctors of inappropriate profiles also cannot issue certificates. For example, an oncologist cannot diagnose acute respiratory infections. Such a form will be considered a fake.

How to punish a “counterfeiter”

You can, as they say, give things full speed. For submitting a counterfeit, the employee faces criminal liability. A fine of up to 80,000 rubles or in the amount of wages or other income for a period of up to six months. Also, for falsifying a sick leave certificate, a worker can be subject to compulsory labor for up to 480 hours, correctional labor for up to two years, or arrested for up to six months (Part 3 of Article 327 of the Criminal Code of the Russian Federation). Employers, as a rule, rarely bring the matter to criminal proceedings and limit themselves to dismissing the employee by agreement of the parties or “under the article.”

By the way, the court may classify the fact that the employee received benefits on fake sick leave as fraud (Part 1 of Article 159.2 of the Criminal Code of the Russian Federation). For such a violation, a fine of up to 120,000 rubles is provided. or in the amount of wages or other income for a period of up to one year. An employee may be subject to compulsory labor for up to 360 hours, correctional labor for up to one year, forced labor for up to two years, or restrict freedom for up to two years, or be arrested for up to four months.

note

If you find inconsistencies in the hospital certificate, check the information with the medical institution or the Social Insurance Fund. Submit official requests to document the fact of forgery. To hold an employee accountable, the fact of forgery must be recorded. To do this, send the document for examination to the FSS.

If an employee submits a fake sick leave, you can subject him to disciplinary action and fire him. The mere fact of falsifying a document does not serve as grounds for terminating an employment contract with an employee. However, in this case, the employee was in fact absent from work without good reason (appeal ruling of the Moscow City Court dated September 8, 2017 in case No. 33-34171/2017). And this can be qualified as truancy (subparagraph “a”, paragraph 6, part 1, article 81 of the Labor Code).

But be careful and control your emotions. After all, if the employee submits documents to the court that confirm that he was absent for a good reason, he will be reinstated at work. Therefore, when you send a written request for an explanation, include a clause stating that the employee can provide other documents to confirm that there was no absenteeism.

When you fire an employee for absenteeism, it is important to follow the procedure provided for in Article 193 of the Labor Code of the Russian Federation and the deadlines for bringing them to justice. Ask the employee for a written explanation of the situation. If after two working days the employee does not submit it, draw up a corresponding report. Failure by the employee to provide an explanation does not prevent him from being held accountable.

Meet deadlines

This refers to the time frame for bringing to justice. Thus, apply disciplinary action no later than one month from the day the offense was discovered (Part 3 of Article 193 of the Labor Code of the Russian Federation). The day the misconduct was discovered is the date when the employer received the documental on-site inspection report of the Social Insurance Fund (appeal ruling of the Moscow City Court dated September 8, 2017 in case No. 33-34171/2017), or other documents that indicate that the sick leave is fake. For example, a letter from a medical institution stating that the employee was not issued a sick leave certificate.

You can record the date when you received documents confirming the forgery with a memo, an acceptance certificate, or postal documents if the documents were sent by Russian Post.

It is important for the employer to comply with one more condition. You can hold the employee accountable no later than six months from the day the employee submitted the forged document. And based on the results of an audit, inspection of financial and economic activities or an audit - no later than two years from the date of the commission of the offense (Part 4 of Article 193 of the Labor Code).

Draw up an order for disciplinary action. Please familiarize the employee with it against his signature within three working days from the day it was issued. This period does not include time when the employee was absent. If the employee does not sign the order, draw up a corresponding act.

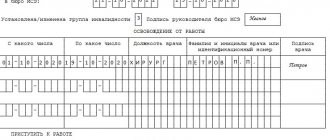

Information from the employer

The employer is responsible for transferring the payment. He must also enter informational information. We are talking about such important points:

- Information about the company. If there is not enough space for the full name, you can enter abbreviated words or an abbreviation;

- The type of activity performed is the main official job or part-time activity. If a person works at the main job and part-time at the same time, the number of the document intended for the main workplace is written on the sheet for additional work;

- Official registration number previously received from the Social Insurance Fund and subordination code. This is necessary to identify the enterprise;

- SNILS and TIN of a temporarily unemployed employee to establish his identity;

- Total official work experience. If it is less than a month, zeros are entered in the corresponding lines. If a person has special non-insurance experience, its time period must be indicated. This applies to time in the army, as well as employment in the police or city fire department;

- Line H 1 is filled in if an employee is injured at work;

- Information regarding the salary received. Such information is provided by accountants and strictly without including personal income tax. Here the average daily and monthly salary is calculated. The amount of accrued benefits is also stated. It consists of two parts - one from the employer and the second from the Social Insurance Fund.

At the conclusion, the official seals and signatures of the employer and the chief accountant are affixed.