Online magazine for accountants

Additionally, a document from the second parent’s place of work confirming that this payment has not been accrued again is provided.

- When compensating the costs of paying a monthly allowance when a child reaches one and a half years old, you need to focus on Federal Law No. 255 (Part 6 and Part 7 of Article 13). It reflects the necessary documents.

- The Social Insurance Fund may reimburse funeral benefits.

AttentionA copy of the death certificate will be required for a refund. The document is provided by the civil registry office. It must be certified.

Sample of a certificate-calculation Certificate-calculation A certificate must be submitted, which provides the calculation of certain indicators for the reporting period.

Return Features

Reimbursement of expenses received from Social Insurance is necessarily reflected in the calculation of insurance premiums, which is submitted to the tax office.

The amounts should fall into line 080 of Appendix No. 2 of the report form. The data is filled in monthly and on a cumulative basis.

We discussed the nuances of filling out the report in the article New reasons why tax authorities will stop calculating contributions in 2019.

Insurance premiums accrued after 2021 are paid to the territorial tax office where the employer is registered. If there is an overpayment in insurance contributions for compulsory social insurance in 2021, you can do the following:

- leave the overpayment for payment of contributions of future periods;

- write an application to the tax office for a refund of the resulting overpayment.

Clause 1.1 art. 78 of the Tax Code of the Russian Federation indicates that it is impossible to offset the overpayment of one contribution (that is, one BCC) against the payment of other contributions or taxes (that is, other BCCs).

One of the previous sections already contains an application form for the return of overpayments on disability insurance premiums as of 01/01/2017.

There is no need to attach any documents to the application.

But if Social Insurance decides to conduct an inspection before agreeing on the amount of compensation, then upon a separate request it will be necessary to show the Fund’s specialists the necessary documents. It can be:

- sick leave;

- children's birth certificates;

- certificates from medical institutions;

- payroll statements;

- orders for admission;

- certificates of earnings from previous places of work;

- other documents confirming the legitimacy of the application for compensation of expenses, as well as confirming the settlement amounts.

The specific list depends on the type of benefit being reimbursed.

Contributions for accidents are paid directly to Social Security, so there are no difficulties in this case. An application for the return of overpaid contributions is submitted to its branch of the Fund, and the Fund transfers the payment within 10 days.

The return of funds from the Social Insurance Fund for any reason (overpayment or reimbursement of expenses) is not considered income under any tax regime.

But you should pay attention to whether payments for social benefits were accidentally included earlier in expenses for tax purposes and whether they reduced the single tax under the simplified tax system of 6% or under other taxation systems.

If the amount of contributions accrued in a certain month does not exceed the amount of benefits accrued to employees, money can be returned from the Social Insurance Fund in several ways:

- Reducing the amount of contributions in subsequent months by the amount of overpayment of benefits until the difference is finally eliminated. Relevant for companies on OSNO that have made mandatory payments from their own funds.

- Refund of expenses. The most acceptable option is when, according to first estimates, the total amount of benefits paid cannot be repaid through the payment of contributions, as well as for enterprises using a special regime.

Steps that an employer needs to take to receive “real” money from the Social Insurance Fund:

- Within 10 days from the date of formation of the debt for the Social Insurance Fund, contact the branch of the Fund at the place of registration of the enterprise.

- Submit an application written in any form or according to the model used in this social insurance department.

- Submit a complete set of required documents, including calculations in Form 4 of the Social Insurance Fund.

Social insurance is obliged either to transfer the amount indicated in the application to the enterprise within 10 days, or to give a refusal within 3 days, followed by a check to clarify the information provided.

According to Article 41 of the Tax Code of the Russian Federation and Letter of the Ministry of Finance dated June 1, 2005 No. 03-03-02-02/80, money reimbursed by the Fund to the employer is not taken into account when calculating income tax and simplified taxation.

Funds compensated by the Fund are reflected only in Form 4 of the Social Insurance Fund during the period of their crediting to the enterprise’s account. For example, in the second quarter in April. This means that in Table 1 the amount is entered in the cell of the first month, and dashes are placed in the boxes for May and June.

The Social Insurance Fund proposes not to accumulate refund amounts in order to minimize the burden and free the employer from mandatory payments from his own funds.

Reimbursement for sick leave from the Social Insurance Fund: deadlines, documents, where to submit

To return funds to the organization, you will need to collect a certain package of documents, and follow the necessary procedure.

Documents required for reimbursement of sick leave benefits:

- An application from the manager, indicating the full name of the company, its address, registration number, and the amount he wants to return;

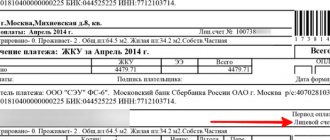

- Completed form 4-FSS with expenses for social benefits;

- Full calculation of accrued and paid contributions;

- Expense register of all benefits, where you need to indicate the amount that needs to be reimbursed;

- Certified copies of all documents.

The second and third documents must be in duplicate.

For a company that has a small number of employees, it will be easier to return funds to its account rather than accept them for credit.

Upon receipt of all documents, the Social Insurance Fund is obliged to make a decision within ten days. If all the paperwork is correct, the fund transfers the amount to the employer’s account. In case of errors or suspicion of forgery, the decision is postponed for three months and an inspection is scheduled.

The Social Insurance Fund can reimburse funds in two ways:

- The employer will simply stop paying disability insurance premiums to the fund until the sick leave amount is spent; this rule only applies for a year.

- The employer collects a package of papers and submits an application for a refund to his account.

There is no specific statute of limitations for sick leave compensation. As a rule, when debt arises, the fund simply returns the money. A refund can be delayed only when the FSS suspects that the requested compensation is illegal, then the refund will occur after all the necessary checks.

Employees who have recently worked are also entitled to receive sickness benefits. Only they need to provide certificate 182n from their previous place of work. If this is not possible, you must request it from the Pension Fund.

If the Social Insurance Fund owes money to the policyholder

In accordance with the order of the Ministry of Health and Social Development of Russia dated December 4, 2009 No. 951n, it is necessary to submit to the territorial body of the Social Insurance Fund: a written application, a calculation in form 4-FSS, copies of documents confirming the legality of assigning the appropriate benefit to the insured person (certificate of incapacity for work, birth certificate of a child, certificate from the antenatal clinic about registration in the early stages of pregnancy, etc.).

Due to the fact that the new Form 4-FSS does not contain information on accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and expenses incurred, to reimburse expenses for benefits paid after January 1, 2021, you will need additionally submit a calculation certificate, which must include all the data specified in clause 2 of Order No. 585n.

Reimbursement of payments for ballots

After the accounting department has made a total calculation of the benefit for the sick employee and it has been paid, the employer can replenish this amount. This can be done in two ways:

- reduction of “going” contributions (for disability) to the insurance fund;

The essence of this method is as follows: the transfer of contributions will not be made until the entire total amount of sick leave has been spent. This rule is applicable only for one year, for example, the payment was made in the current year. The amount of this benefit can be used to reduce the contributions that need to be made. This applies to any month of the year during which the corresponding payment was made for the employee’s sick leave.

- Reimbursement of benefits that were previously paid by the fund.

The essence here is as follows: the employer submits an application on behalf of the organization to the fund for reimbursement of insurance costs.

The application must contain the following:

- Header, sample content:

- To whom is the application addressed (the head of the Social Insurance Fund...);

- Who is the “author” of the statement (LLC “...”);

- legal address of the company;

- actual address of the company;

- policyholder registration number;

- TIN of the organization;

- checkpoint of the organization.

- The word “STATEMENT” (without quotes);

- Date and number of the application, city;

- Title (subject) of the application “On reimbursement of expenses for insurance coverage (without quotes);

- Contents, sample:

In accordance with Part 2 of Article 4.6 of Federal Law No. 255-FZ of December 29, 2006, we apply for compensation for insurance costs, namely: payment of temporary disability benefits for (specify the year and month, for example, May 2014), amounting to an amount of ( indicate the amount in numbers and words, for example 16,200 rubles (sixteen thousand two hundred rubles)).

Please translate this total using the details below:

(indicate company details, current account)

- Appendix (calculation according to the Social Insurance Fund-4 form for the 2nd quarter (indicate the quarter corresponding to the month) 2014).

- Signatures of the General Director and Chief Accountant.

- Seal.

When paying the above funds, the Social Fund has the right to require additional documents regarding personnel:

- the sick leave itself;

- order of the organization to hire an employee;

- a copy of the employee’s work book;

- a copy of the employee’s employment contract;

- necessary calculations.

Necessary documents and procedure for reimbursement of benefits from the Social Insurance Fund in 2018

Funds that were paid before 2021 are still returned by the fund. After January 2021, tax authorities handle refunds.

Legislatively, Order No. 585n of the Ministry of Labor of the Russian Federation, issued on October 28, 2018, defines a list of documents that must be provided to the employer to reimburse paid benefits to the Social Insurance Fund. The rule applies to cases where the payment was made after January 2018.

The list of papers may vary depending on the period of refund. According to the law, there are basic documents that must be presented upon reimbursement.

It is necessary to draw up an application on the basis of which compensation will be made. In addition, it is accompanied by a certificate containing the calculation.

Therefore, it can be assumed that policyholders will be able to draw up a calculation certificate using an independently developed form. The main thing is that such a certificate includes all the necessary information, which is mentioned in paragraph 2(1) of the List approved by Order of the Ministry of Health and Social Development of Russia dated December 4, 2009 No. 951n (as amended.

How to report the return of benefits from the Social Insurance Fund from 2021?

Key steps that an employer needs to take to compensate for funds spent on mandatory payments:

- Submitting a package of documents to the Social Insurance Fund office at the place of registration of the enterprise:

- Application indicating the amount for refund for 2021. Important! Filing your claim early increases your chances of receiving a refund.

- A copy of the calculations in accordance with Form 4 of the Federal Tax Service of the Russian Federation.

- Copies of documents justifying and confirming the correctness of payments.

- Waiting for approval from the Social Insurance Fund.

- Receiving funds from the Social Insurance Fund.

- Reflection of the received amount in the reporting.

It is very important to start preparing a package of documents in advance (even if your events are scheduled for the end of the year - a medical examination or a special assessment of working conditions) and submit it as early as possible - for example, May-June. This action is due to the possibility of collecting additional documents for the Social Insurance Fund and in this case you will have time to provide them.

Most employers assume that they should accrue benefits only after receiving funds from social insurance. Is their opinion wrong or not?

Payment terms

The periods of payment to employees of various types of benefits on the basis of supporting documents are regulated by federal legislation and are made:

- From the first day of payment of wages in the presence of sick leave.

- Within a ten-day period from the date of filing an application for payment of benefits, if there are documents indicating registration in the early stages of pregnancy, the birth of a child and disability due to pregnancy and childbirth.

- Every month on the day of salary payment if there is a child care application.

- On the day of application based on the application for burial.

These are mandatory payments that are made by the employer regardless of transfers to the Social Insurance Fund. The absence or untimely payment of these benefits entails the accrual of interest in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation on the total amount of benefits for daily delays, which are not reimbursed by the Fund.

Moreover, in accordance with Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation, such negligence may result in penalties and inspections by inspection bodies for the employer.

What are the main documents submitted by the employer to return money from the Social Insurance Fund:

- Application - filled out by the employer in any form and contains the desired refund amount, detailed for each individual type of benefit. Clearly defined expenses are convenient for both social insurance and the policyholder. An application form of a specific form is used if it is applied to the Social Insurance Fund at the place of registration of the enterprise.

- A copy of the calculations in accordance with Form 4 of the Federal Tax Service of the Russian Federation. The refund amount is entered in lines 9 and 10 of Table 1 of the first section. According to Art. 10 FZ-212, the calculation can be made on any day of the month at the time the expenses appear. In the case under consideration, an interim calculation is required in Form 4 of the Federal Tax Service of the Russian Federation, covering the period from the beginning of the year to the current date. To do this, enter the following into the “Reporting period” cell of the intermediate form:

- in the first two windows - tax period code;

- in the second two - the number of the application for reimbursement of the debt amount.

- Copies of documents justifying and confirming the correctness of benefit payments. The clause applies to enterprises receiving benefits that either do not pay contributions or pay them in the minimum amount.

- a register of expenses with details of the accrual of benefits;

- copies of payment slips indicating payment of contributions to the Social Insurance Fund for the period of refund.

In addition to basic documents, social insurance may require additional information:

Order of the FSS No. 49 dated February 17, 2015 approved seven forms of applications for offset and reimbursement of funds (from 21-FSS to 27-FSS), each of which is filled out for a specific type of accrual, including:

- act of joint reconciliation of calculations for contributions, fines and penalties in the Social Insurance Fund;

- offset of funds paid in excess to the Fund;

- refund of the amount of excess social security contributions;

- reimbursement of excessively collected fees, fines or penalties;

- act on offset of excess paid amounts of contributions, fines or penalties;

- decision on compensation of excess amounts paid, penalties or fines;

- act on offset of excess collected amounts of contributions.

You can apply for reimbursement of expenses from Social Insurance at any time, but you should keep in mind that Social Insurance has the right to order an audit at its own discretion, guided by data from the tax office on expenses reflected in the reports.

Therefore, it is not recommended to delay submitting an application for too long, because it is easier to plan the time of the inspection yourself than to wait for Social Security to show up at an inopportune time.

For example, the verification of reimbursement of expenses from the Social Insurance Fund in 2021 in St. Petersburg takes place quite quickly, and the Fund’s specialists require documents only within the framework established by law.

Reimbursement of benefits for sick leave from the Social Insurance Fund

But what if the amount of the benefit itself is higher than the monthly contribution? In this case, the employer must contact the Social Insurance Fund at the location of the organization for a refund of the difference between the amount of the benefit and the contribution paid.

It is important to understand that from 2021, disability and maternity contributions are now administered by the tax authorities. At the moment, every entrepreneur will have to submit reports on them. Contributions for injuries remained in the possession of the fund, but a new reporting form 4-FSS appeared.

There are several types of benefits that will be reimbursed by the Social Insurance Fund:

- Temporary incapacity. Reimbursement will be made starting from the fourth day;

- Pregnancy and childbirth;

- A benefit that is paid once for early pregnancy;

- Birth of a child;

- Allowance for caring for a child up to one and a half years old;

- Funeral payments.

Then, when the benefit does not exceed the amount of the monthly contribution, there is no need to contact the Social Insurance Fund. You just need to reduce the contribution for it and indicate this information in the reporting. After that, the tax authorities send all the data to the Social Insurance Fund, which checks and makes a decision. If everything is correct, then they count the reduction in the contribution; if something is incorrect, they send a request to pay the contribution.

What documents are needed to reimburse sick leave under the Social Insurance Fund in 2021?

In the case of a claim for reimbursement of expenses for ordinary sick leave, the list of documents is similar to a maternity certificate of incapacity for work. To receive a refund, you must fill out an application, a calculation certificate and a transcript.

Remember that the first 3 days of illness are paid from the funds of the organization or entrepreneur, and only payment for days starting from the fourth can be requested for compensation.

If the policyholder applied a reduced rate or calculated Social Insurance contributions at a zero rate in 2017-2019, then a copy of the sick leave certificate with the benefit calculation is additionally attached to the application and attachments.

Other insurers provide copies of supporting documents only at the request of Social Insurance as part of the audit.

Who has the right to claim compensation?

If the employer is an insurer and during the month paid temporary disability benefits and other social payments to employees, he has the right to request the return of sick leave from the Social Insurance Fund in 2021 or reduce the amount of the monthly contribution to VNiM by the amount of paid benefits from the fund (Part 2 of Article 4.6 255 -FZ of December 29, 2006, clause 2 of Article 431 of the Tax Code of the Russian Federation).

If the amount of the listed social benefits is greater than the insurance premiums calculated for the month, then the procedure for compensation for sick leave from the Social Insurance Fund in 2021 is as follows:

- Apply the excess balance toward the next month's payment.

- Write an application to the territorial department of the fund for monetary compensation of the difference.

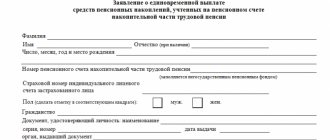

The application is sent according to the form from letter No. 02-09-11/04-03-27029 (approved by order No. 951n dated 12/04/2009). The following must be attached to the application:

- certificate-calculation;

- breakdown of expenses;

- supporting documents.

More information on how to fill out an application for a refund: “Instructions: fill out an application to the Social Insurance Fund for reimbursement of benefits.”

What documents are needed for reimbursement of maternity benefits from the Social Insurance Fund in 2021?

Reimbursement from the Social Insurance Fund for maternity benefits in 2021, if it entailed an inspection by Social Insurance, involves the transfer of the following documents for review by the Social Insurance Fund:

- sick leave for pregnancy and childbirth;

- continuation of sick leave, if available (for difficult pregnancies);

- certificates of the woman from previous places of work or from part-time employers;

- calculation of maternity benefits;

- other documents justifying the legality of the expense.

What documents are needed

Order No. 951n specifies how to reimburse sick leave from the Social Insurance Fund in 2020:

- Determine the amount to be reimbursed and fill out the calculation forms.

- To write an application.

- Submit the package with documents for reimbursement to the fund.

The list of accompanying documentation is given in Order No. 951n and the methodological recommendations of the fund. We collected everything in one table:

| Benefit | Necessary documents to the Social Insurance Fund for reimbursement of sick leave in 2020 (and other insurance payments) |

| For temporary disability |

|

| For pregnancy and childbirth | And these are the documents for returning sick leave from the Social Insurance Fund in 2021 for pregnancy and childbirth:

|

| At the birth of a child |

|

| Child care up to 1.5 years old |

|

| For burial |

|

List of documents for reimbursement of child benefits

With compensation from the Social Insurance Fund for paid child benefits, the situation is similar - you need to fill out an application, a calculation certificate and attachments.

Supporting documents for such benefits may be:

- document on the birth (adoption) of the baby;

- documents confirming that the born (adopted) child is not the first of these parents;

- a certificate from the second parent’s place of work confirming non-receipt of benefits;

- a document confirming the status of a single parent;

- other documents.

Requirements for the provision of documents are similar to other grounds for compensation - only those who are entitled to preferential rates submit copies along with the application. Other fee payers provide documentation for verification only upon request.

List of documents for reimbursement of benefits from the Social Insurance Fund in 2021

In some cases, the employer or the employee himself loses documents to confirm the right to social benefits. In this case, the most correct thing is to apply for duplicate documents. The absence of some documents will not prevent you from compensating for expenses.

Keep in mind that after the employer receives sick leave, the medical institution no longer issues a duplicate sick leave certificate even to the sickest person. In this case, you can make a request from an organization or individual entrepreneur directly to a medical institution to provide an extract from the book of records of certificates of incapacity for work, where data on document numbers, periods of incapacity, etc. are recorded.

If the matter is not the loss of a document, but simply the impossibility of drawing up this or that document (for example, in a situation where a young mother cannot obtain a certificate from her legal spouse from his place of work), then it is still worth paying the benefit, but it is recommended to obtain from employee's explanatory note to attach to the package of documents for Social Security.