Every citizen can send his funded pension not only to the state pension fund, but also to various non-state funds that offer higher profits and interesting terms of cooperation.

You can use this money only after reaching the age of a pensioner. The money is given in a lump sum or paid monthly for the rest of your life, and there is also the option of a term program where the money is paid over a specific period of time.

If citizens cooperate with a non-state pension fund for no more than 5 years, then funds are usually issued as a lump sum payment based on the investor’s application.

Rules for filing an application for a one-time payment of pension savings

A one-time payment of funds allows you to receive a large amount that has been accumulated over a long period of time when insurance premiums were transferred. Savings are formed for every officially working citizen.

Money can be transferred not only by the employer, but also by the direct employee , if he cares about his secure old age. You can receive money after reaching the age of a pensioner or when registering a disability group in which a person cannot continue to work.

Funds are paid based on an application drawn up by the direct depositor.

The text contains the following data:

- information about the applicant, provided by his full name, passport details, date and place of birth, citizenship, gender, registration address and SNILS number;

- citizen's contact phone number;

- information on the assignment of an old-age pension;

- the method of receiving money from the fund, for example, if it is planned to transfer it to a bank account, then its details are indicated;

- date of application;

- the exact number of the pension account on the basis of which the applicant is identified;

- depositor's signature.

Attention! If the investor died before applying for his savings, then the legal successors specified in the will or determined on the basis of legal requirements have access to these funds.

You can bring an application to the fund yourself or use the help of a representative. In the latter case, the authorized person must have a power of attorney certified by a notary.

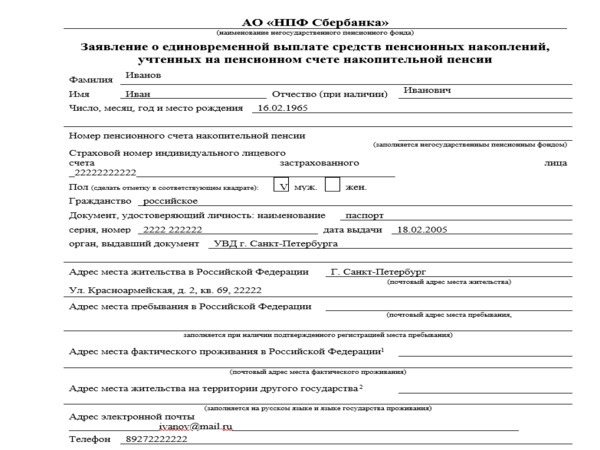

Sample application for a one-time payment of the funded part of a pension:

Instructions for drawing up an application for a one-time payment

If a pensioner applies for payment to the state government, then he has to fill out a unified application form. The procedure is carried out on paper or by completing an electronic application.

To avoid mistakes, it is recommended to use simple instructions on the basis of which the paragraphs of the document are sequentially filled out.

Therefore, the following rules are taken into account:

- The first line is intended for the name of the non-state fund in which the capital was formed.

- Clause 1. It contains information about the insured person who is applying for a funded pension. This information includes the citizen’s full name, and the information is written in the nominative case. The insurance number of the individual account is provided, on the basis of which the citizen is identified in the system. The citizenship of the applicant is indicated, and if he has dual citizenship, then the information is listed separated by commas. If necessary, information is entered indicating that the person does not have citizenship. Next, indicate the place of residence or stay, as well as the registration address. Contact information is provided, represented by telephone number and email address. If a citizen lives outside the Russian Federation, then he indicates the exact address in another state. The details of the passport and other documents presented by the residence permit or temporary residence permit are listed. Not only the number and series are given, but also the date of issue, as well as the name of the government agency that issued the document. At the end, the applicant’s place of work and gender are indicated.

- Clause 2. It is filled out if the application is submitted not by the direct pensioner, but by his representative. Information about the legal representative, guardian or trustee is provided. Data on the citizen’s full name is entered, and passport details and place of residence are also listed. If the representative is an organization, then its name, legal address and contact details are indicated. The telephone number of the representative must be provided, as well as the details of the power of attorney on the basis of which the authorized representative acts. This document must be notarized.

- Clause 3. It is completed if the applicant has accounted funds in his account, generated through additional contributions and transfers from the employer. Information about participation in the co-financing program or the use of maternal capital is entered. The insured person independently determines whether these savings will be taken into account when assigning a pension.

- Paragraph 4. Marks are placed on whether an old-age pension was assigned, and the date of its registration and the basic amount are indicated.

- Clause 5. Indicate whether the citizen was assigned an urgent pension payment.

- Clause 6. The applicant confirms that he is familiar with the rules for registering a funded pension.

- Clause 7. The documents attached to the application are listed. The serial numbers of these papers, their names and dates of completion are indicated.

- At the end, the date of drawing up the application is indicated, and the applicant’s signature is also placed.

Attention! With the help of a signature, the citizen confirms that all specified data is reliable, and he is also familiar with the information about the rules for drawing up an application.

The application is prepared in two copies, since one paper is handed over to the fund’s representative, and the second is marked with acceptance. The application is a copy of your passport and SNILS, and it is also advisable to make a copy of your work book. A certificate from the Pension Fund must be submitted confirming that the citizen receives a pension from this fund.

The complete package of documents is transferred by the applicant or his representative directly to the PF employees during a personal visit, and you can also use the help of the MFC or send the papers electronically through the fund’s website or the State Services portal.

The application is submitted one month after retirement. The documentation is reviewed within 10 working days, after which the citizen is notified of the response by written notification.

Refusal is often due to the lack of necessary documentation or errors in the application. Usually, you are given the opportunity to submit papers or make corrections within three months. If the decision is positive, the citizen will receive a funded pension starting next month.

Money can be issued at post offices or transferred to a bank account. If a citizen wishes to receive funds into his account, his details must be indicated in the application.

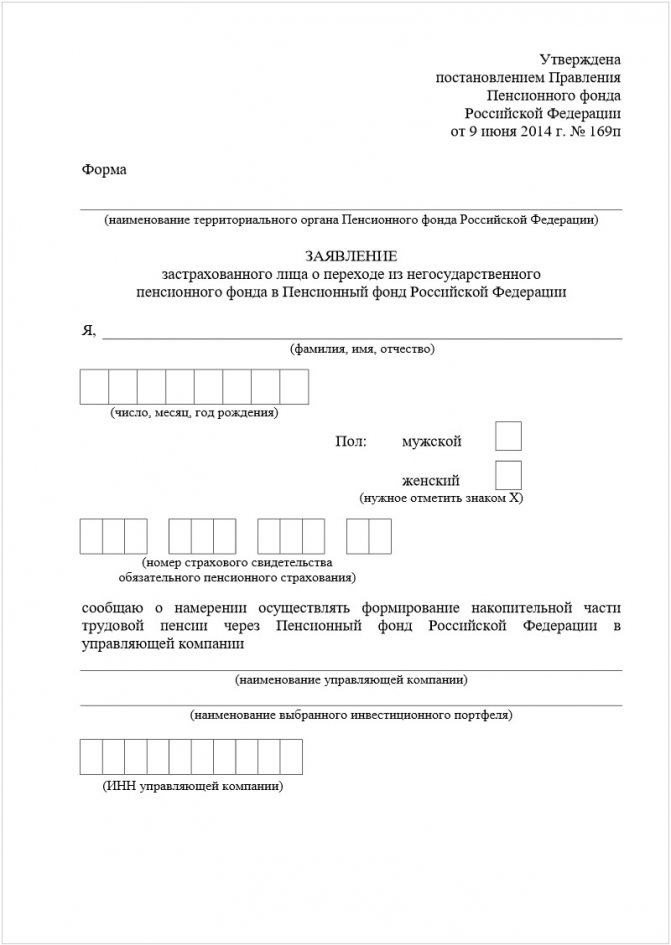

Sample application from an insured person for a funded pension:

Who receives the lump sum payment?

All savings are paid to citizens at a time only in certain situations, which include:

- the citizen registered a disability group before retirement, and therefore cannot continue working;

- a person requires financial support due to the loss of a breadwinner;

- the investor was unable to apply for a regular old-age pension because he did not have the required length of service and the number of points;

- the amount of financial support reaches no more than 5% of insurance payments, but a person must transfer funds to a pension account in the period from 2002 to 2004;

- persons who participated in the state program for co-financing pensions, which was carried out until 2014, receive a one-time payment;

- Citizens whose monthly payment is less than 5% of possible charges can count on this amount.

Important! In 2021, money for a funded pension is paid only once every 5 years, although previously it was paid out annually.

A one-time payment is offered to pensioners who are disabled. To do this, they must reach the age of a pensioner, and they must also have at least 5 years of experience. Funds are paid based on an application submitted to the branch of the Pension Fund or Non-State Pension Fund.

When and by whom is it issued?

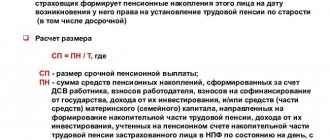

The main purpose of drawing up an application is to receive a funded pension. It is assigned exclusively to citizens who have reached retirement age. From the salary of each working citizen, 22% is transferred to insurance premiums, of which 6% is allocated to a funded pension.

Additionally, a funded pension is paid to persons who used maternity capital funds or participated in a co-financing program.

Additional information on the issue in the video:

Where and how is it issued?

The rules for receiving a lump sum payment include:

- the application and other documentation are submitted exclusively to employees of the institution in which the savings were formed;

- You can contact state or non-state PFs;

- the application is submitted directly when visiting the organization or by mail, and you can also use the help of MFC representatives;

- it is possible to submit an application through the State Services portal;

- In addition to a correctly drawn up application, other documentation is prepared, which includes the pensioner’s passport, as well as a certificate from the Pension Fund, which confirms the registration of an old-age pension;

- it is allowed to use the assistance of a representative who has a notarized power of attorney;

- Fund representatives may require additional documentation from the client confirming certain circumstances under which the payment is made.

After submitting all the papers, representatives of the fund review the application and inform the citizen about the decision made. To do this, a written notification is sent by mail.

If a positive decision is made, a lump sum payment is transferred within 60 days to the account specified in the application. If this information is missing in the application, then the money can be received through post offices or a bank cash desk.

Reference! Citizens can apply for a new lump sum payment only after 5 years.

Assignment of old age pension

The application must be submitted to the territorial body after reaching the age specified by law, if you have work experience. There are no deadlines for filing, but it must be taken into account that the start date of the pension assignment will be considered the day the application is submitted.

The application is drawn up according to the standard form issued by the Pension Fund of Russia and approved by Appendix No. 4. Along with the completed form, you must provide a package of documents:

- passport,

- SNILS,

- identification code (TIN),

- work book,

- marriage and birth certificates;

- certificates of length of service, salary accruals from the last place of work;

- documentary evidence that can affect the increase in pension.

When receiving documents for granting a pension, a Pension Fund employee checks the accuracy of the information and makes copies of the originals. The applicant is given a receipt notification of registration of the application with the date of receipt. If any documents are missing, the deadline for their submission is indicated.

Payments from pension savings

Payment of the pension savings of the insured person to his legal successors in the event of his death.

In the event of the death of an insured person before the appointment of a funded pension and (or) an urgent pension payment, pension savings are paid to his legal successors, with the exception of maternal (family) capital funds, which are subject to return to the Pension Fund of Russia (the spouse and children have the right to apply to the Pension Fund for inheritance of maternity capital amounts). In the event of the death of the insured person after the assignment of a funded pension, payment of pension savings to legal successors is not provided for by law. In the event of the death of the insured person after the appointment of an urgent pension payment, the balance of funds in the pension account, including funds from maternity (family) capital, is subject to payment to legal successors. Additional funds from pension savings that were credited to the pension account of the insured person and were not taken into account when calculating the amount of the funded part of the labor pension and (or) fixed-term pension payment are paid to legal successors.

Procedure for legal successors to apply

To arrange the payment of pension savings to the legal successor of a deceased insured person - a client of JSC NPF VTB Pension Fund, you must submit an application for payment of pension savings to JSC NPF VTB Pension Fund. The application must be submitted before the expiration of 6 months from the date of death of the insured person. The application must be accompanied by originals or notarized copies of:

- documents proving the identity, age and place of residence of the legal successor of the deceased insured person (place of stay);

documents identifying the identity and powers of the legal representative (adoptive parent, guardian, trustee) of the legal successor - for legal representatives of the legal successor;

The deadline for applying for payment to the legal successors of the deceased insured person may be restored in court at the request of the legal successor of the deceased insured person.

The day of application for payment of pension savings is considered to be the day the Fund receives the application with all the necessary documents, and when sending the application by mail, the date of the postmark of the federal postal service organization at the place of departure of such application. The decision on payment to the legal successor of the pension savings of the deceased insured person is made no later than the last working day of the month following the month in which the period established for filing the application expired. Payment of pension savings to the legal successor is made no later than the 20th day of the month following the month in which the corresponding decision was made.

You can submit your application and required documents in one of the following ways:

- contact any branch of JSC NPF VTB Pension Fund;

- send an application by Russian Post or other correspondence delivery services so that the fact and date of dispatch is confirmed, to the postal address: Russia, 109147, Moscow, st. Vorontsovskaya, 43, building 1. In this case, the original documents are not sent and the identification of the legal successor, as well as certification of the accuracy of copies of the attached documents and verification of the authenticity of the legal successor’s signature on the application for payment of pension savings funds are carried out by a notary.