The pension of Russians consists of three components: funded, fixed, and insurance. The size of the latter is determined by pension points, which take into account such initial data as work experience, salary, and the age at which a person retires. The new rules apply to everyone who applies for a pension. The amount can be reduced (increased) depending on the calculated pension point. Where and how to find out pension points?

What are pension points and how are they calculated?

Pension points are conditional indicators that reflect a person’s contribution to a future pension. They are accrued annually to citizens based on paid insurance premiums, salaries, and type of insurance contributions. The latter can be paid towards a funded pension or an insurance pension, if the citizen prefers the latter. Additional factors influence the calculation of points:

- length of service in the army;

- time of maternity leave;

- time off to care for the elderly.

How to calculate the number of accumulated points?

In addition to work experience, the number of points is influenced by socially significant periods in a person’s life: maternity leave, military service, caring for elderly people over 80 years of age or the disabled. So how to calculate points for a pension using the new formula on a calculator?

The number of points accumulated depends only on the citizen himself. First of all, from his salary: the higher it is, the more insurance contributions the employer will transfer to the Pension Fund.

Please note: the legality of wages has a great influence: does a citizen receive “white” or “gray” wages? Pension Fund contributions are paid only from “white” wages. If on paper the salary barely reaches the guaranteed minimum, then you should not expect a large number of points.

The last factor on which the number of points depends: the integrity of the employer, that is, how promptly and completely he pays insurance premiums.

Pension points for the year can be calculated by dividing the amount of insurance contributions transferred for a citizen by the employer by the amount of insurance contributions transferred from the maximum taxable salary, and multiplied by 10. You can calculate points for a pension using a calculator using the following formula.

Point = salary * 12 months * percentage, insurance premiums/maximum taxable salary * percentage of insurance payments * 10.

How pension points are calculated in 2021

Since 2015, pensions are calculated based on earned pension points. Pension points are calculated using a special formula based on the employee’s annual earnings. Accordingly, the higher the salary, the higher the number of pension points.

The minimum number of pension points for calculating a pension in 2021 is: 18,6.

The maximum amount of pension points that a citizen can “earn” in a year is 9.57 points.

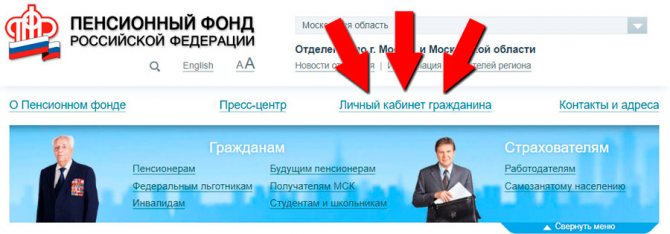

You can find out about the number of accumulated pension points on the official website of the Pension Fund pfrf.ru by logging into your personal account.

How to calculate a pension using the new formula using accumulated points?

The pension is accrued if three conditions are met:

- a citizen has reached a certain age (55 years for women and 60 years for men);

- a certain number of points scored;

- length of experience.

If a citizen reaches retirement age and does not have enough experience or points, he will receive the pension due to him under the state pension provision (social).

If you need to calculate your pension using points on a calculator in 2021, you need to know that they depend on the salary that the citizen received while working.

Please note that only official wages are taken into account, that is, which is taken into account in the information of the Russian Pension Fund. You can view the number of accumulated points in the electronic service of the Pension Fund of the Russian Federation: “Personal account of the insured person.”

All information about contributions made by the employer can be viewed on your personal account.

How to calculate pension using points on a calculator? The pension is formed according to the formula: pension points multiplied by their value plus a fixed payment. That is, it can be visually represented as follows.

Pension = number of points * cost of 1 point + fixed payment.

The value of a pension point is determined by law and is subject to annual indexation. To correctly calculate a pension based on points in 2021, you need to take into account that one point costs 98.86 Please note that this figure is constantly changing, and the pension will be calculated based on the value of a point, which will be in the year of the citizen’s retirement.

The fixed payment is also established by law and is subject to annual indexation. In 2021, it is paid in the amount of 6044.48 rubles. .

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

If a citizen does not plan to retire upon reaching a certain age, but wants to defer its payments, then the fixed payment due to him increases. For example, if you postpone retirement for 7 years, then the fixed part of pension payments will increase by 1.5 times; if for 10 years - more than 2 times.

When making such a decision, a citizen needs to take into account his state of health and performance.

Additional information: when living and working in the north or in regions equivalent to it, the size of the fixed payment and the number of points are multiplied by the northern coefficient. That is, now the calculation of a pension based on points on the calculator will look like this.

Pension = number of points * cost of 1 point * northern coefficient + fixed payment * northern coefficient.

How much is a pension point worth in 2021?

The cost of 1 pension point in 2021 is 93 rubles .

Fixed payment supplementing the amount of the insurance pension in 2021 - 5686 rubles. 25 kopecks In the future, the value of the pension point, together with the additional amount, will be indexed by the state, taking into account inflationary processes and changes in the level of wages. Dynamics of pension point value

| Year | Cost of pension point, in rubles |

| 2015 | 71,41 |

| 2016 | 74,27 |

| 2017 | 78,58 |

| 2018 | 81,49 |

| 2019 | 87,24 |

| 2020 | 93 |

Calculation examples

Let's consider the given algorithm using conditional examples.

Example 1

The woman is retiring in 2015. The total work experience as of January 1, 2002 is 22 years. Of these, up to and including 1990, 12 years. Her insurance experience is over 20 years, which means that the coefficient of 0.55 is applicable. Add 0.01 * 2 = 0.02 for each additional year. The overall figure is 0.55 + 0.02 = 0.57.

Her average salary is calculated at 250 rubles, the national average is 210 rubles. The salary coefficient is 250 / 210 = 1.19. It is not higher than the established limit.

We multiply the coefficients by each other and by a fixed amount of 1671 rubles. 0.57 * 1.19 * 1671 = 1136.28 rubles. We deduct 450 rubles. 1136.28 – 450 = 686.28 rub.

The employee has work experience up to and including 2001, which means valorization of 10% is applicable. Let's add 1% for each year of experience available up to 1990 inclusive. According to the condition, this is 12 years. The total interest is 10 + 12 = 22%. Let's increase the calculated amount by them: 686.28 * 22% = 150.98. 686.28 + 150.98 = 837.26 rubles. Let's adjust the result to 5.6148. 837.26 * 5.6148 = 4701.05 rubles.

The fixed part of the insurance pension during the retirement period is 4383.59 rubles. If the employee does not have more work experience, then together with the fixed part her calculated pension will be 4,701.05 rubles. + 4383.59 = 9084.64 rub.

How to calculate points for retirement in 2021?

The Pension Fund of the Russian Federation makes no secret of the pension calculation scheme. It is worth starting the calculations with the pension points that a person is entitled to: their number depends on the amount of monthly earnings before deduction of income tax. So, in 2021, a person who has reached retirement age needs:

- Have 10 or more years of experience;

- Accumulate at least 18.6 pension points.

The higher the earnings, the more pension points a person will receive. For example, if a Russian’s income is 50 thousand rubles, then in 12 months he will be able to accumulate 4.64 points. For the highest number of points that can be earned - 9.57 - earnings should be 105,000 thousand rubles. Next comes the calculation:

Formula for calculating insurance pension

PB * ST + FV

- PB - Pension points accumulated by a person

- ST - Cost of a point in the year the pension was assigned

- FV - Fixed payment amount

We remind you that in 2021 the fixed payment amount is 5686 rubles. 25 kopecks, and the cost of a pension point is 93 rubles. In addition to the three parameters indicated in the formula, the size of future payments will be affected by:

- Experience (labor or insurance);

- Retirement age;

- Years of military service, caring for a child or disabled person (if any).

Let’s assume that a Russian woman was born in the late 1960s, spent a year and a half on maternity leave with her child, has no dependents and earns 70 thousand rubles. per month. If she is ready to work for a total of 35 years before retirement, her pension will be 30 thousand rubles. And if a citizen applies for payments immediately upon reaching retirement age, she will receive 10 thousand rubles. less.

We can conclude that to increase points, Russians need:

- Have impressive experience;

- Get of. earnings;

- Apply for your pension as late as possible.

The Pension Fund also reminds that pension points can be purchased. This opportunity applies to those who want to retire earlier or earn more, those working abroad, as well as the self-employed - entrepreneurs, specialists in private practice, translators, farmers and tutors.

To receive an old-age pension, citizens must:

- reach retirement age.

- have 15 or more years of work experience;

- have at least 30 pension points.

The amount of pension points can be greatly increased by applying for a pension significantly later than retirement age. Each year of overtime increases pension points by corresponding factors. The fixed payment will also increase.

If you claim your pension at age 65 instead of 60, your fixed benefit will be 36% higher and your pension points will be 45% higher. If at 70, then the growth will be 2.11 and 2.32 times.

Multicard from VTB Bank - cashback for purchases

Apply now

More about odds

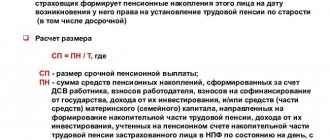

The IPC is the number of points that are issued for the year worked. The coefficient is calculated using the following formula:

- Total IPC = (IPKs + IPCn) × K.

- where IPKs is the old personal coefficient, that is, the number of points the employee scored before 01/01/2015.

- IPKn is a new personal coefficient, that is, the number of points received after 2015.

- K is the coefficient for increasing the IPC, which is used when deferring applications for pension payments.

The amount of the IPC for one year depends on the amount of contributions that the employer transferred to the Pension Fund for his employee. It is calculated using this formula:

- IPC = (SV / NSV) × 10.

- where CB is the amount of CB paid by the boss for the employee.

- NSV - standard size of SV.

Fixed payments

For everyone except disabled people, persons without dependents or without the right to early retirement, in 2021 the FV is determined in the amount of 5334.19 rubles. Every year it will grow:

- from 2021 - 5334.19 rubles;

- from 2021 - 5686.25 rubles;

- from 2021 - 6044.48 rubles;

- from 2022 - 6401.10 rubles;

- from 2023 - 6759.56 rubles;

- from 2024 - 7131.34 rubles.

Premium odds

If you apply for old-age pension payments later, and not after reaching a certain age, then the coefficients for raising the personal coefficient and fixed payments are used in the calculation. For example, if a person came to receive a pension 5 years after retirement, then the PV will increase by 36% and the SP - by 45%. By the way, bonus coefficients (PC) for going on vacation later than the generally established age have different meanings for a fixed payment and insurance pension accruals. It is important that people who are already considered pensioners will be able to refuse to receive it for a specific period in order to receive a PC and increase their pension.

The size of such coefficients depends on how late the pensioner applied for state support. What coefficients are used if you do not apply for pension accruals immediately?

Change your future

And if you still have many years left before retirement, you can model future pension accruals. In the same section, you must indicate how many years you still plan to work and what your earnings may be. And the calculator will calculate how much you will get in the end. The calculation is approximate, so don’t worry too much. The amount depends on the level of inflation and subsequent indexation of pension payments.