What is salary according to the Labor Code

The term “salary”, as well as the accompanying definitions “basic salary”, “official salary” and “wages” are deciphered in Art. 129 Labor Code of the Russian Federation. To understand how to calculate the salary from the salary and apply the appropriate formula, let’s understand these terms:

Based on the definitions given in the Labor Code of the Russian Federation, salary is the minimum fixed amount of money that the employer is obliged to pay to the employee for each month worked, subject to the fulfillment of the job duties assigned to him.

Recommendations from ConsultantPlus experts will help you check whether you have set the salaries of your employees correctly. Get free demo access to the system and go to the Ready-made solution.

Salary is a more expanded concept, which includes, in addition to salary, various additional payments, bonuses and bonuses to which an employee is entitled.

Salary and wages are the same in value if for a fully worked billing month the employee, in addition to the salary, is not accrued compensation and incentive payments.

Wages can be calculated not only on the basis of salary, but also on the basis of the tariff rate - a fixed amount of remuneration for fulfilling a standard of work of a certain complexity per unit of time (hour, day, decade, month) without taking into account compensation and additional payments.

The formulas for calculating wages based on salary and based on the tariff rate are different. Next, we will tell you how to correctly calculate salary based on salary.

Payroll in Belarus example

Our clients, partners, acquaintances and friends often ask us questions about correct accounting.

Therefore, we decided to launch a column in which we will talk about the most pressing accounting topics.

We invited our partner as an expert: Margarita Novoseltseva, the founder of two accounting companies - Raikiri and Do Your Business.

Margarita, chief accountant with more than 10 years of experience and more than 8 years of tax and accounting consulting experience. Author of useful articles, speaker at seminars and conferences, as well as training courses on various platforms for small and medium-sized businesses. The client portfolio includes more than 100 companies.

Personnel and Salary

A large proportion of questions asked to us are related to Personnel and Salaries.

It is with an article on this topic that I would like to start our column.

A little about myself: I am the founder of two accounting companies. We have more than 100 companies in our service. There are small ones, with a staff of 2-3 people, but there are also companies with 50-100 people. Therefore, optimizing work with the Personnel and Salaries block is very important for us!

In this article we will look at how we work with labor relations.

Difference between labor and civil law relations:

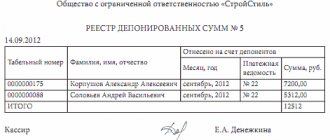

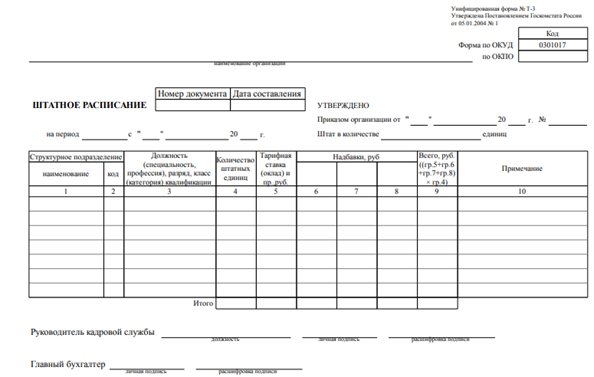

Staffing table

Today, we cannot employ an employee without a staffing table. The staffing table must be up to date, because if we did not change it in time (we did not remove an extra vacancy), we will have to submit data to the employment center.

Do you need it?

Source: https://owenural.ru/nachislenie-zarabotnoj-platy-v-belarusi-primer/

How to correctly collect source data for payroll calculations

To calculate wages based on salary, initial data is collected:

- about the amount of salary;

- number of working days in the billing month;

- number of days worked in a month;

- payments due to an employee in addition to salary.

Where can I get this data from?

Salary size

Salaries for each position are reflected in the staffing table:

In addition, the salary amount must be specified in the employment contract:

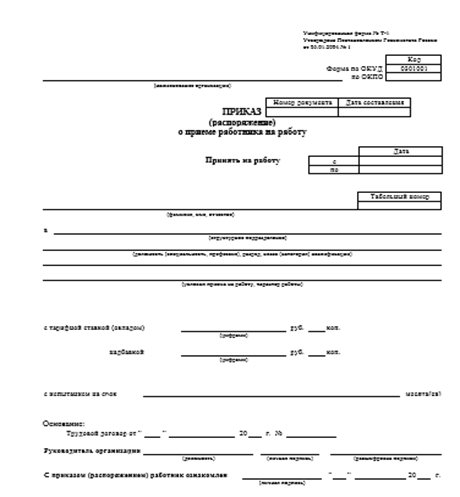

And also reflected in the employment order:

See what a sample T-1 order looks like.

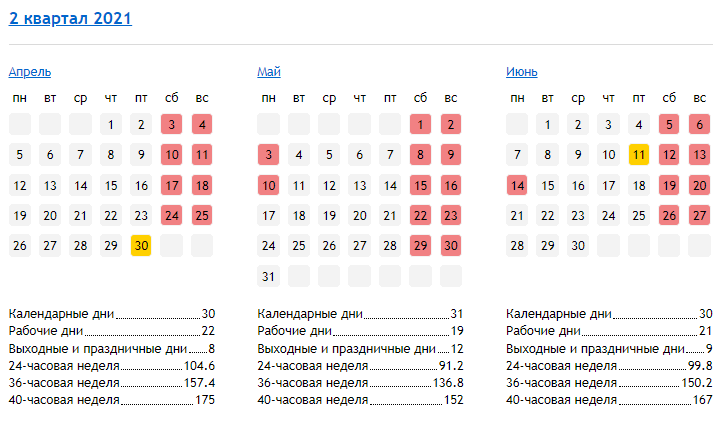

Number of working days in the billing month

The working days for each month are calculated based on the production calendar. This indicator depends on the length of the working week: from Monday to Friday (five-day week) or in another mode (for example, with a working Saturday):

Number of days worked in the billing month

This indicator for calculating wages is taken from a time sheet or other document with which the company records days worked, rest days and other periods (business trips, sickness absence, absenteeism, vacations, etc.).

The following materials will help you organize time tracking in your company:

- “Working time sheet according to form T-12 - form”;

- “Notations used in the time sheet”;

- “What is the shelf life of a time sheet?”

Payments due to an employee in addition to salary

Premiums, additional payments, compensations, bonuses and other payments that an employee can count on in addition to salary are established in employment contracts, agreements, orders or other internal regulations (collective agreement, regulations on remuneration, etc.).

The following articles will introduce you to the nuances of assigning various additional payments and compensations to salary:

- “The procedure for paying bonuses under the Labor Code of the Russian Federation”;

- “Regulations on the provision of financial assistance to employees”;

- “Additional payment for combining positions according to the Labor Code of the Russian Federation.”

We will explain below how to calculate salary based on salary.

Definition

The concept of tariff rate denotes the amount of monetary payment that is due to an employee in accordance with the level of his qualifications and the degree of complexity of his work for the performance of his work duties in a certain unit of time.

It is not used in all remuneration systems, but only in tariff ones. Russian labor legislation provides for the fixed rate of pay in the employment contract.

This concept is not always identical to the concept of wages. The salary may also include various bonuses and payments.

The tariff rate is the initial parameter, depending on which the employee’s monetary remuneration is calculated.

Depending on the period for which a fixed payment is provided, there are three types of tariffs:

- hourly;

- day;

- monthly.

Such a remuneration system is typical mainly for large organizations, where a single template for rewarding employees and meeting certain targets plays an important role.

Each private company sets its own tariff schedule, and for budgetary organizations there is a Unified tariff schedule established by the state.

The advantages of such a remuneration system include:

- constant indexation of salary in accordance with the indexation of the minimum wage;

- taking into account the employee’s qualifications;

- taking into account difficult or harmful working conditions;

- equality in payments to employees with the same qualifications and the same working conditions.

But the tariff system is not without a number of disadvantages:

- When calculating wages, it is not the quality of the work performed that is of paramount importance, but the qualifications of the employees;

- when forming the wage fund, the main thing for the manager will be to comply with the requirements of legal norms and the tariff schedule;

- a large profit of an enterprise may have a very weak effect on the level of income of employees;

- The personal contribution of each employee to the common cause may be different, and with such a system it is more difficult to take into account.

Basic calculation formula

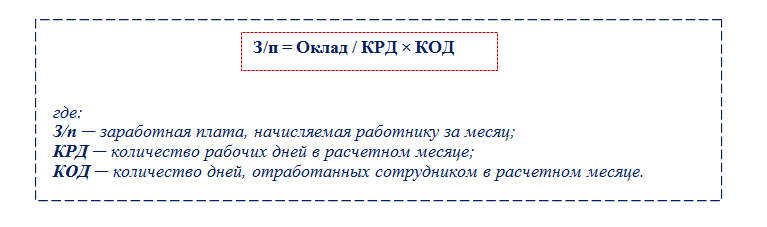

The basic formula for calculating wages based on salary is:

Using the basic formula, you can calculate the salary if in the billing month the employee does not receive bonuses and other payments in addition to the salary.

We will demonstrate the calculation of salary based on an example.

Employees of Kornet LLC work on a five-day basis. The salary regulations of Kornet LLC indicate that the company's employees are paid a monthly bonus in the amount of 15% of the salary. But there is a limitation: the bonus is not paid if the employee did not fulfill the production plan in the billing month and/or received a disciplinary sanction.

Janitor Samoilov P.G. received a reprimand in January 2021 for absenteeism. As a result, out of 15 working days in January (according to the production calendar for a five-day working week), he worked only 14. His salary, according to the staffing schedule approved for 2021, is 16,250 rubles.

Considering that in the billing month P. G. Samoilov is not paid any additional amounts of an incentive or compensation nature, the basic formula can be used to calculate wages:

Salary = 16,250 rub. / 15 days × 14 days = 15,166.66 rub.

In this amount, P. G. Samoilov’s salary will be accrued for January 2021.

The basic formula cannot always be used. Typically, company employees are paid not in the amount of a “bare” salary, but with additional payments. Then the formula for calculating wages is used differently.

Procedure and formulas for calculating piecework wages

The formula for calculating piecework wages is as follows: the unit of work performed (services provided) is multiplied by the rate for the work performed.

Let's give an example of calculation . Employee Arkhipov works in production. For each part he makes, he is paid a salary of 80 rubles. for a unit. His plan is 100 parts per month, for each additional he is paid 15 rubles. premium. In June, Arkhipov produced 250 parts.

The calculation of his earnings will look like this:

- Salary for volume produced : 80 * 250 = 20,000 rub.

- Premium : (250 – 100) * 15 = 2250 rub.

- Total salary for the month : 22250 rub.

The salary received is divided into two parts in any order. The employer has the right to pay an advance in any ratio (for example, ½ of the salary) or in the form of a fixed amount (for example, 5,000 rubles).

Online calculator

Currently, most accountants use special programs to calculate earnings and do not make any calculations on their own. Typically, the payment procedure is of more interest to employees.

To calculate earnings, an employee can use a ready-made calculator. One of these calculators can be found on our website.

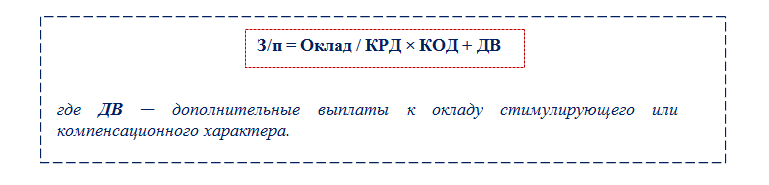

Advanced formula: how to take into account additional payments

If, in addition to salary, an employee receives incentive and compensation payments, an expanded formula is used to calculate wages:

Moreover, if the employee worked all working days in the billing month (KRD = KOD), this formula takes the form:

How to calculate the salary amount if the employee is paid a bonus or other additional amounts? Let's continue the previous example, changing the conditions in it.

Let's assume that the janitor P. G. Samoilov worked in January without any comments or disciplinary sanctions. Then he will receive a bonus (15% of the salary) in addition to his salary. And to calculate wages, you can use an extended formula (without adjusting the salary for days worked):

Salary = 16,250 + 16,250 × 15% = 18,687.5 rubles.

How to calculate salary for part-time work? ConsultantPlus experts know the answer to this question. Get trial access to K+ and you can see the calculation formulas and solution for this example.

Calculation of insurance premiums

Insurance premiums were described in detail in the previous article; let’s calculate them for this example.

Contribution to the Pension Fund = final accrued salary * 22% = 154429 * 22% = 33974.

Contribution to the Social Insurance Fund = final accrued salary * 2.9% = 154429 * 2.9% = 4478.

Contribution to the FFOMS = final accrued salary * 5.1% = 154429 * 5.1% = 7876.

Total amount of insurance premiums = 33974 + 4478 + 7876 = 46328.

Payroll entries

| Sum | Debit | Credit | Operation name |

| 154429 | 20 (44) | 70 | Accrued wages are written off against the cost of products, services, goods |

| 18646 | 70 | 68 | Personal income tax taken into account |

| 135783 | 70 | 50 | Employee wages paid |

| 46328 | 20 (44) | 69 | Accrued insurance premiums are written off against the cost of products, services, and goods. |

This completes the example of calculating and calculating wages for employees. Let me remind you that in order to pay wages, you must fill out a primary document - a payroll sheet in form T-49 or a separate payroll sheet T-51 and a payroll sheet T-53.

In the following articles, we will look at how vacation pay is calculated at an enterprise and provide examples of calculation.

Results

Salary is the minimum fixed amount of wages for a fully worked calendar month, excluding additional incentive or compensation payments.

To calculate salary based on salary, it is necessary to adjust the salary amount by the number of days worked in the billing month. Additional payments are added to the calculated amount if the employee has the right to receive them in accordance with the employment contract or other internal regulations. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.