Home / Labor Law / Employment / Part-time and part-time work

Back

Published: 08/10/2016

Reading time: 8 min

0

6020

Labor legislation allows additional work activity for those working citizens who want to get a part-time job and increase their monthly income. There are two main types of such activities - part-time and combination.

Combination usually means three types of work functions: temporarily replacing an absent colleague, expanding the area of responsibility (the employee is busy with additional work in his own profession) or classic combination (performing duties in two professions at once - his own and those related to the vacancy).

In all of these cases, the employee copes with additional responsibilities without interrupting his main activity, that is, during working hours limited to one shift.

- Additional payment amounts

- Formula and calculation examples For part-time work

- Full time

- When paying for production

- If the employee did not work all working days

What is a surcharge

An additional payment is a payment that is in the nature of compensation, since it is assigned when the employee was in a state of increased work intensity (for example, worked on a holiday or day off, or combined activities with the work of an absent employee).

When an employee performs duties not provided for in the employment contract (for example, combining several positions or working overtime), in accordance with the law, the employer must pay additionally, compensating for the complexity of the work or the time spent.

Additional payment is also necessary for work in dangerous or harmful conditions, as well as when transferring an employee to a position that is lower paid.

Let us consider in detail additional payments for labor when combining professions (positions), expanding service areas, increasing the volume of work, or performing the duties of a temporarily absent employee without release from work specified in the employment contract.

Combining professions is an example of solving personnel problems during times of economic difficulties. Combining professions allows you to reduce labor costs, which ultimately leads to lower costs, increased competitiveness of manufactured products, as well as the economic stability of the organization.

The article discusses the procedure for additional payment for combinations, as well as some organizational issues.

From a letter to the editor:

“In our organization, for optimization purposes, a decision was made to combine professions. In particular, the duties of the storekeeper are planned to include unloading finished products upon their arrival at the warehouse, i.e. The storekeeper will actually perform the duties of a loader.

How should this combination be formalized and what is the procedure for remuneration in this case? When calculating the average daily earnings for assigning temporary disability benefits, should an additional payment for combined work be included?

Alla Mikhailovna, payroll accountant"

Let's look at the provisions of the Labor Code of the Republic of Belarus (hereinafter referred to as the Labor Code) regarding the combination of professions (positions). Combination of professions (positions) is the performance by an employee, along with the main work stipulated by the employment contract, of work in another profession (position) without exemption from his main job during the working day established by law (Article 67 of the Labor Code).

Combination or part-time?

It is necessary to distinguish between part-time work and combination work (Articles 67, 343, 346 of the Labor Code) (see Table 1):

Based on the above, I advise you to study the employment contract concluded with your employee performing the duties of a storekeeper. If the contract provides for the performance of the duties of a loader upon receipt of finished products at the warehouse, then the employee fulfills his duties within the framework of an already concluded employment contract and combination in this situation is no longer considered. Otherwise, changes must be made to the employment contract. When establishing a combination of positions for an employee, in the employment contract concluded with him, you will need to additionally indicate the name of the position being combined and the amount of additional payment for the combination, having received the employee’s consent.

Important! A combination can be established for an employee only with his consent (part four of Article 19 of the Labor Code). In case of refusal, the employee can continue to work under the same conditions. An entry about combining positions is not made in the work book.

The basis for assigning additional work to an employee is the presence of a vacant unit or its share in the staffing table (for example, 0.25 of the rate).

The amount of additional payment for combining positions is established by the employer by agreement with the employee (Article 67 of the Labor Code). The amount of the additional payment for combined work may differ from the amount of the official salary of the vacant unit.

For example, in order to effectively use the wage fund, the additional payment for combining jobs should not exceed the tariff rate for the combined vacant unit. The specific amount of additional payments is determined based on the complexity of the work performed, its volume, and the employee’s employment in the main and combined work. It is advisable to establish additional payments in an absolute amount or as a percentage of the monthly tariff rate (official salary) for the combined position. In addition, the employer has the right to charge a bonus for the additional payment established to the employee if the local regulatory legal act of the organization provides for the procedure and amount of the bonus for the additional payments established for employees.

Example 1

Additional payment for combining duties when performing the duties of a temporarily absent employee

By order of the director of the trade organization, the performance of official duties of the head of the haberdashery section Ivanova I.I. for the period of her illness was entrusted to commodity expert P.P. Petrova. with her consent. By agreement of the parties, the additional payment for combination work is set at 80% of the official salary of the head of the section. According to the staffing table, the salary of a section manager is 5,400,000 rubles, and a commodity expert’s salary is 4,900,000 rubles. Temporary disability of Ivanova I.I. lasted from April 11 to April 25 (11 working days according to the organization’s work schedule).

The additional payment for combining will be RUB 2,262,857. (RUB 5,400,000 / 21 working days in April × 11 combined days × 80%).

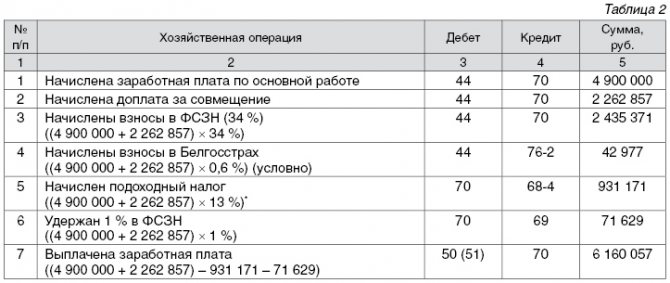

The following entries are made in accounting (see Table 2):

__________________________ * In April, the employee lost the right to apply a standard tax deduction in the amount of 830,000 rubles, since the accrued wages in April, taking into account the additional payment for combination work, exceeded the amount of income upon receipt of which a standard tax deduction could be provided (in 2021 - not more than 5,010,000 rubles (Article 164 of the Tax Code of the Republic of Belarus)).

Example 2

Accrual of premium for additional payment for combination

By order of the director of the cafe, the duties of chef Sidorov S.S., who is on social leave from April 1 to 30, are entrusted to the 6th category cook Kuznetsov K.K. (official salary - 4,800,000 rubles) with his consent. The employer's order established an additional payment for combination in the amount of RUB 1,250,000.

In accordance with the Regulations on bonuses for the organization, a bonus is awarded for the time actually worked in the amount of 30% of the official salary at the main place of work, and for additional payments for combining positions, expanding the service area, performing the duties of a temporarily absent employee - in the amount of 20% of the additional payment amount.

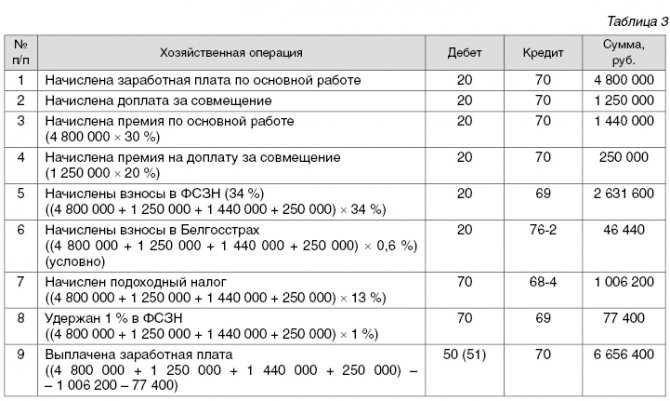

The following entries are made in accounting (see Table 3):

Example 3

Combining positions and calculating average daily earnings for calculating benefits for temporary disability, vacation pay and business trips

In March 2021, the legal adviser combined work during his main working hours with the work of a personnel inspector. For the combination, he was paid an additional payment in the amount of the salary of a personnel inspector.

Let's consider 3 situations that may arise in this case.

1. In April, the employee submitted a certificate of temporary disability due to a general illness for the period from April 15 to April 19, 2021 (5 calendar days).

2. The employee wrote an application to be granted labor leave from May 16, 2021 for 24 calendar days.

3. The employee was sent on a business trip from April 15 to April 17, 2016.

So, let's look at these situations:

1. To calculate temporary disability benefits, we determine the amount of the employee’s average daily earnings. For the purpose of calculating benefits for temporary disability, earnings include types of remuneration (with the exception of payments of a one-time nature), for which mandatory insurance contributions are charged in accordance with the law.

Wages, allowances and additional payments to them are included in the earnings of the month for which they are accrued (clause 24 of the Regulations on the procedure for providing benefits for temporary disability and pregnancy and childbirth, approved by Resolution of the Council of Ministers of the Republic of Belarus dated June 28, 2013 No. 569).

Thus, when calculating the average daily earnings for the purpose of temporary disability benefits, the additional payment for combining positions should be included in earnings for March 2016.

2. The procedure for determining average earnings, which is used to calculate vacation pay during labor leave, as well as for paying compensation for unused labor leave, is established by the Instruction on the procedure for calculating average earnings, maintained in cases provided for by law, approved by the resolution of the Ministry of Labor of the Republic of Belarus dated 04/10/2000 47 (hereinafter referred to as Instruction No. 47).

When calculating average daily earnings for calculating vacation pay, you must be guided by the List of payments taken into account when calculating average earnings, approved by Resolution of the Ministry of Labor and Social Protection of the Republic of Belarus dated September 18, 2008 No. 134 (hereinafter referred to as List No. 134).

Additional payments for combining professions (positions), expanding the service area (increasing the volume of work performed), performing the duties of a temporarily absent employee, and for leading a team are taken into account when calculating the average daily earnings (clause 1.11 of List No. 134).

Thus, when calculating average daily earnings for calculating vacation pay, the additional payment for combining positions should be included in earnings for March 2021.

3. Average earnings for the period the employee is on a business trip are calculated in accordance with Instruction No. 47 and taking into account List No. 134.

Average earnings to pay for the time spent performing state or public duties and for other cases provided for by law are calculated based on the wages accrued to the employee for 2 calendar months of work (from the 1st to the 1st day) preceding the month of the start of these payments (p 20 Instructions No. 47).

When calculating the average earnings maintained during a business trip, wages for work performed and time worked are taken into account, including additional payment for part-time work (subclause 1.11 of List No. 134).

Thus, the additional payment for combining jobs should be included in the calculation of average daily earnings.

I hope I answered all your questions.

Sincerely yours, Olga Pavlovna

Criteria for the amount of surcharge

The criteria for the payment of incentive payments are determined in a local regulatory act (this may be a collective agreement, regulations on bonuses, etc.). If there is a representative body of workers, then according to Part 4 of Art. 135 of the Labor Code of the Russian Federation, acts that establish the wage system are adopted by management, taking into account the opinion of this body.

The size of the tariff rate or salary in the employment contract is indicated in numerical terms.

As for additional payments due to employees, in addition to the direct indication in the employment contract, it may contain a reference to a collective agreement or local regulation that provides for the conditions and grounds for their payment.

For example, the amount of additional payment for combining positions is provided by agreement between management and the employee, taking into account the nature of the additional work and its content. The law does not regulate the minimum amount of additional payment. The payment is made both in a fixed sum of money and as a percentage of the employee’s salary (tariff rate) or salary.

Features of calculations for combining positions (professions)

- Several employees can hold one position. Then the amount of all additional payments should not exceed 100% of the rate for this position according to the staffing table.

For more information about salaries in the staffing table, see the article “Unified form No. T-3 - staffing table (form)” .

- One employee can combine several positions. This aspect causes a lot of controversy, however, the Labor Code of the Russian Federation in Art. 276 prohibits combining work in the internal supervisory structures of the same organization only by the manager (for example, as an auditor). There are no other restrictions. There is also no rationing of additional payments for several combinations. The amount established by agreement between the employee and the employer will be valid.

- The management team can combine (and replace) positions and receive compensation for this.

You can find out how to register substitution/combination during the absence of the head of the organization from ConsultantPlus. Get a free trial of the legal system and proceed to the HR Guide.

Payment for combining professions

In addition to the main functions of one employer, performing additional work in the same or another profession (position) is called combining positions. Management assigns additional work to an employee only with his written consent. In addition, the employee must agree in writing to the deadline for completing the additional work, as well as agree on issues regarding its volume and content.

If its fulfillment is a condition of the employment contract, the employee’s consent is not required.

Additional work for the same position means expanding service areas or increasing the volume of work. The implementation of combining positions is carried out within the framework of the duration of work provided for the employee. An employee has the right to refuse to perform additional work ahead of schedule, and management has the right to cancel its order to perform it ahead of schedule, if the employer is warned about this in writing no later than 3 working days. Such refusal of additional work is the right of the worker and no sanctions can be applied to him.

Combination restrictions

The code does not contain information about restrictions on combining positions. Almost any employee in an organization can be assigned this type of work. There are two important factors to consider:

Any combination must be included in working hours, and not in excess of its norm.

It is advisable to combine positions of similar professions or employee qualifications. This is due to more competent performance of duties without wasting time on training.

However, we should not forget about the privileged category of citizens: pregnant women, disabled people, minor employees and mothers with children under three years of age. Although the law does not prohibit them from increasing the load, it is better to insure against unpleasant consequences.

This is important to know: Zemstvo teacher: content of the program

To do this, you can discuss all working conditions, assess their applicability to these individuals and sign all the necessary documents.

Increasing the volume of work and expanding service areas

The procedure for assigning additional work to an employee when service areas or the volume of work increases is carried out by analogy with the procedure for assigning additional work to him to combine positions. The parties agree on the amount of additional payment for expanding the service area taking into account the volume or content of additional work. Labor legislation does not regulate the minimum amount of additional payment and the rules for determining it in the event that there is an expansion of the service area. The size and rules regarding surcharges in this case are covered by the agreement of the parties.

Rules for registration of combination

If an employee decides to earn a little extra money, then he can make a request to be assigned the duties of a temporarily absent employee.

All changes in job functions must be documented. At the enterprise, an additional agreement is concluded with the employee, which stipulates the amount of additional payment, the replacement period, and also signs.

The next point is that an order to combine work is issued, certain points are indicated:

- for what reason did it become necessary to take over someone else’s work, for example, sick leave;

- the period during which it will be necessary to replace an absent colleague;

- list of transferred job responsibilities.

Carrying out the duties of a temporarily absent employee

The duties of an absent employee are temporarily assigned to one of the employees or distributed among several employees (performance of the duties of an absent employee in accordance with Article 60.2 of the Labor Code of the Russian Federation). When an employee performs duties for a vacant position without being relieved of his work, we can talk about combining positions or that there is an expansion of service areas or an increase in the volume of work. Fulfilling the duties of a temporarily absent employee is the performance by one of the employees of the labor functions provided for in the employment contract for the relevant employee.

However, the absent person retains his place of work. In this case, the employee performs both his functions and the functions of a temporarily absent person.

When performing the duties of a temporarily absent employee, his “deputy” may be assigned additional work in the same profession or in a different one. Delegating the duties of an absent employee to another employee is possible only if he has given his consent. The period during which additional work will be performed, and what concerns its content and scope, is provided by the employer with the written consent of the employee. The employee has the right to early refusal to perform an additional amount of work in case of written warning to the other party no later than 3 working days. The amount of additional payment is by agreement of the parties, taking into account the content and (or) volume of this work.

During vacation

The most common occurrence when it is necessary to register a combination of positions is the vacation of one of the company’s employees. Most often, a temporary executor is appointed for the period of vacation of the main employee.

In any case, an additional agreement and an order for combination or replacement are drawn up. The job responsibilities that the employee must perform during his working hours are specified separately. The peculiarity of such work is its short duration.

Usually the vacation dates are known and are written down in all documents. This type of combination is called “for the period of vacation of the main employee.” Compensation for the bonus is paid for the entire period of work. If it lasts less than a month, it is calculated in proportion to the time worked.

Cases of surcharge using specific examples

Example 1. Ivanova combines her main position as a secretary with the additional position of a cashier. The Regulations on Remuneration establishes that the additional payment for combining positions, if the salary (tariff rate) for any of the positions is not higher than 10 thousand rubles, will be 50% of the salary (tariff rate) for the main position. For August 2021, Ivanova was accrued the following monetary amounts for her main position:

- salary - 8000 rubles;

- additional payment for overtime work - 1000 rubles.

So, Ivanova’s salary for August with an additional payment for combining positions is 13,000 rubles. (8000 rub. + 8000 rub. x 50% + 1000 rub.).

The following example is about expanding the service area. So, the salary of the waitress Kazankova is 10,000 rubles. Due to the dismissal of several employees, she needs to expand the service area, that is, serve not 8 tables, but 14. The management, together with Kazankova, decided that the amount of her additional payment for each month would be proportional to the number of tables added to the service. Guided by a written agreement between the employee and the employer, her monthly additional payment for expanding the service area is 7,500 rubles. (RUB 10,000: 8 tables x (14 tables - 8 tables)). Example 3. The head of the legal department, Klimenko, went on vacation. The performance of his duties was temporarily assigned to senior lawyer Komanich. The agreement between the employee and management provides that additional payment for performing the duties of a temporarily absent employee is made in the amount of the difference between the salary of the head of the legal department and the salary of a senior lawyer in proportion to the time the duties are performed. The salary of the head of the legal department Klimenko is 18,000 rubles, and the senior lawyer’s salary is 10,000 rubles. So, the monthly additional payment will be 8,000 rubles. (RUR 18,000 – RUR 10,000). A senior lawyer has a 5-day work week and 2 days off (Saturday and Sunday). In September 2010, Komanich temporarily performed part of the duties of the head of the legal department without being released from his main job for 10 working days. Since there are 22 working days in September, the amount of additional payment for a temporarily absent person will be 3,636.36 rubles. (RUR 8,000: 22 days x 10 days).

Author of the article

Answers to frequently asked questions

Question No. 1: The employer assigned his employee to perform one more duties (new job). The parties reached certain agreements, but there was no formalization. Can an employee, under these circumstances, demand payment for combining?

This is important to know: Order to amend the order: sample 2021

Maybe, and by all available legal means. But if the case goes to court, then the person in question will need to prove that he actually combined work, provide documentary evidence, etc. In the absence of any evidence, it will be very difficult for the employee to achieve a positive decision.

Question No. 2: Are there additional days off for combined work? And are they paid?

No. The Labor Code of the Russian Federation does not provide for additional rest in such cases. But when calculating vacation pay for the main paid vacation, an additional payment for combined work is included in the calculation base.

Order on combining positions

For such a document, the legislation provides a unified form - “KP-152“. However, the manager has the right to draw up an order without complying with it, using the official letterhead of the organization.

An order may be issued both in written and electronic form. In the second case, the signatures of the participating parties must be affixed by their owners themselves.

Design rules

Regardless of the form used, the order must include the following information:

- registration number of the form;

- full name of the company indicating the form;

- FULL NAME. employee;

- Kind of activity;

- Job title;

- list of assigned labor obligations;

- validity;

- terms of payment;

- Date of preparation.

Before registering a document, the employee must be familiar with its contents and sign it.

A sample order is available here.

What is the additional payment?

The amount of payment is specified in the additional agreement. It is usually calculated for the amount of work actually completed or for the time worked by the employee.

There are two types of surcharge:

- fixed size, it is indicated in the additional agreement;

- as a percentage of the salary at the main place of work.

The law does not establish a threshold for the minimum or maximum amount of payment. In each case, the employer individually considers the request and sets the amount depending on the volume and complexity of the work, and the qualifications of the specialist. The amount of payment is usually specified in the collective agreement at the enterprise.

The amount of the additional payment cannot be higher than the salary of the position being filled, taking into account all allowances, even if the responsibilities are distributed among several people.

In addition, the following nuances need to be taken into account:

- new responsibilities and the amount of payment should not worsen the main points of the employee’s employment contract;

- for any performance of someone else’s duties, payment is required; it is indicated in the additional agreement;

- the additional payment is taken into account when calculating average earnings, accordingly the regional coefficient and other allowances are calculated on it;

- income tax is withheld from the accrued amount, since the payment is equivalent to compensation;

- the amount of the surcharge should not go beyond the payroll savings at the enterprise.

Performing duties while combining positions is unacceptable without drawing up an additional agreement or without payment; in this case, the employee may refuse to perform someone else’s work.

Supervisory authorities suppress any violations of the Labor Code of the Russian Federation.

How to calculate additional pay for combining positions

For clarity, we provide several examples of calculations in Table No. 2.

| Type of allowance | Situation and example |

| Fixed surcharge | Situation: The employee's salary is 25 thousand rubles. A fixed additional payment of 10 thousand rubles has been established. Calculation:

|

| Percentage of salary | Situation: The employee's salary is 20 thousand rubles. For combination work, you are entitled to a 40% bonus from your salary. Calculation:

|

If the employee did not perform his duties for a whole month, then the amount of compensation payment is calculated in proportion to the actual time worked.

What income code is indicated for personal income tax?

All enterprises provide quarterly information to the tax authorities on the types and amounts of income and the amount of deductions. In accordance with letters from the tax authorities, codes for each source of income and a specific code for tax deductions have been approved.

It is necessary to use only current information from the Federal Tax Service, taking into account the amendments established for 2021. When paying additionally for combination, the income code is indicated - 2000.

This is justified by the fact that such an increase is compensatory in nature. Usually assigned for expanding the work area and increasing the volume of work performed, it is included in the salary and does not apply to bonus payments.

When configured correctly, enterprise payroll programs automatically generate 2-NDFL certificates and upload them to the tax authorities.