Concept and composition of salary

Remuneration is one of the main conditions of labor relations between the employee and the employer. This concept includes:

- calculation rules;

- size;

- payment terms;

- components.

Based on Art. 57 of the Labor Code of the Russian Federation, the most important information about payment (size, salary allowances) must be included in the employment contract, and additional information (for example, specific terms, calculation rules, etc.) should not change the position of the employee for the worse compared with the law.

You can find the correct employment contract in ConsultantPlus. Get free trial access to the system and proceed to the sample.

From the definition enshrined in Art. 129 of the Labor Code of the Russian Federation, it follows that salary means employee remuneration, taking into account:

- specific qualifications;

- complexity of conditions;

- workload.

This concept also includes:

- compensation payments;

- incentive payments (including various salary supplements and bonuses).

It is necessary to dwell on the composition of payments in more detail. For a simpler understanding, we will show the important components of the salary with examples in the table.

| What is included in the salary | ||

| Main part | Incentive payments | Compensation payments |

| Salary (tariff rate) | Prize | Additional payment for traveling nature of work |

| Bonus for experience | Allowance for work in special climatic conditions (heat, frost, high humidity, etc.) | |

| Additional pay for performing management functions | Additional payment for irregular working hours | |

| Financial incentives or rewarding with a valuable gift for a holiday (anniversary) | Premium for “harmfulness”, i.e. for the negative impact of production factors | |

The concept of a payslip

In accordance with the Labor Code of the Russian Federation, each employer must provide the employee with a payslip when issuing wages. In practice, however, this requirement is not observed by all employers. To understand the essence of the pay slip and its significance for labor relations, let us turn directly to the issue of its appearance, form, and the need to comply with the rules contained in Article 136 of the Labor Code of the Russian Federation.

Wages are essentially a reward for work, which is determined by the professionalism of the employee, the complexity, quality, quantity and conditions of the work performed (Article 129 of the Labor Code). The salary consists of:

- compensating payments (additional payments and allowances, including for work that differs in its conditions from normal, for example, in non-standard climatic conditions or in radioactively contaminated (RB) territory);

- incentive payments (additional payments and percentage allowances, accruals that perform an incentive function, for example, bonuses).

Article 136 of the Labor Code of the Russian Federation obliges the employer to send written notice to the employee about the shares of wages due to him. This requirement applies not only to main workers and employees, but also to part-time workers and temporary employees.

What is included in the main (net) part of the salary?

The main part of the salary includes only the salary (tariff rate). This is a fixed part of the salary. It is reflected in the employment contract and the employer’s staffing table. The introduction of other payments to the salary (based on the law or at the will of the parties to the employment agreement) is additional, but in some cases the salary can only be a fixed salary. The opposite situation, when the salary consists only of additional payments without a salary (tariff rate), is not provided for by law.

Consequently, salary refers to the minimum amount of money that an employee has the right to claim when performing a certain job function for a specified period of time.

To set the salary level, the most important indicator is the qualifications of the employee. Its concept includes:

- having a certain level of education;

- previous practice of carrying out the relevant work;

- qualification category (if available).

Two other indicators - complexity and volume of work - are no less important, since qualifications are closely related to them. It is this that presupposes the possibility of performing a labor function with a certain level of complexity and volume. It is important not to confuse this level with personal indicators (for example, resistance to stress, independent decision-making). As a rule, personal indicators have a greater influence on the level of the position held than on the salary.

Place of payment of wages

Traditionally, employees are paid their salaries at the place where they perform their work functions. However, in some cases, an employee works in enterprises and organizations located in different places. In such a situation, the administration is obliged to ensure that wages are paid to the employee exactly in the place where he performs his labor functions.

The issue is resolved in a similar way in cases where an employee performs his duties in another company or is on a business trip.

A collective agreement often includes an indication of where wages will be paid to employees of various divisions of an organization or enterprise.

An employee's salary is also made by transfer to his personal bank account or by postal transfer through a post office. This can only be done at the employee’s own request. In this case, the employer is obliged to pay for banking services for transferring wages to the employee.

Incentive payments and salary supplements

For the most part, incentive payments are made through bonuses (we will focus on this in a separate subsection). But there are other ways.

For example, appropriate additional payments and bonuses are intended to encourage the employee to various achievements related to work through certain material incentives.

Let us give an example of one of the types of such payments: an allowance for length of service at one enterprise. In particular, it aims to:

- reward an employee for a long period of work in a particular organization;

- encourage him to continue working in this organization;

- to orient other employees to the fact that long work experience at this enterprise provides certain material benefits, and to deter them from looking for another job.

Another similar bonus may be established for the employee for regular professional development, acquisition of additional skills, and in other cases.

The procedure for such payments varies. For example, a payment or gift could be:

- one-time (for a professional holiday, anniversary) or periodic (based on the results of fulfilling the quarterly plan, etc.);

- set at a fixed amount or calculated as a percentage of the salary.

Based on Art. 135 of the Labor Code of the Russian Federation, such subtleties are reflected in employment contracts, collective agreements, and local regulations.

IMPORTANT! If the employee’s salary includes not only salary, but also other payments, then personal income tax must be withheld from all these payments and insurance premiums must be paid.

What is the best way to pay an employee - a fixed amount or a percentage of earnings?

The Labor Code does not prohibit the payment of wages for half a month based on a percentage of the salary (rate). For the employer, this method is even considered more convenient, because the accountant will not waste time calculating the amount and entering data on the time worked, and the employee himself expects a certain amount, which he receives regularly when transferring income for the first half of the month.

The accountant calculates a certain percentage, most often no more than 40-45% of the approximate monthly earnings. With this distribution of income, payments for the first and second half of the month are almost equal.

But, as practice shows, this method of payment will be incorrect, because an employee can provide sick leave or ask for time off, go on vacation, i.e. do not work fully half the month. Accordingly, the amount of income for half the month will be calculated incorrectly and will exceed the employee’s earned income. There may also not be enough accruals to withhold personal income tax.

There are cases when, at an enterprise with approximately the same level of remuneration, an accountant considers the option of using advance payments in a fixed amount. But if we talk about a fixed payment of income for half a month, then it is better not to use such accruals in practice, because inspection inspectors (controllers) regard it as a violation of employee rights and discrimination in the labor sphere (letter of the Ministry of Labor dated 08/10/2017 No. 14-1/B-725, letter of the Ministry of Finance dated 03/29/2016 No. 02-07-05/17670).

Bonuses

Quite often you can hear the phrase “net salary without bonuses.” It is not entirely correct, because the bonus, regardless of the basis for the payment, is included in the salary. Bonuses in themselves are one of the forms of material incentives for employees who perform their work efficiently (Part 1 of Article 191 of the Labor Code of the Russian Federation). Specific criteria for receiving a bonus are usually prescribed in a local act of the organization (for example, in the bonus rules). Such an act should include:

- lists of employee positions for which it applies;

- specific conditions, calculation procedure and bonus amounts;

- periods and terms for calculating the bonus (for example: the quarterly bonus is calculated and paid no later than the next salary payment date following the bonus period).

The letter of the Ministry of Labor of Russia dated September 21, 2016 No. 14-1/-911 emphasizes that the bonus period should be longer than half a month, and the bonuses themselves are paid based on the results of an assessment of relevant indicators and achievements in work activity.

From another conclusion of the Ministry of Labor, reflected in the said letter, it follows that it is possible to reflect in a local act:

- specific dates for bonus payments;

- specific months or other bonus payment periods.

Choosing any of these options will not be considered a violation of labor laws.

For information on how bonuses affect the payment of vacation pay, read the article “Are bonuses taken into account when calculating vacation pay?”

What amount should I pay to an employee who has just been hired?

Tax inspectors believe that an employee who has just been hired and worked only one day in the billing period already has the right to receive income for the first half of the month (Article 136 of the Labor Code of the Russian Federation). You just need to calculate his income in proportion to the time worked. And if you don’t pay, the employer can be punished and held accountable under Part 6 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

For example, the deadline for paying wages for the first half is the 30th (31st), payment of wages is on the 15th. Markov A. M. was hired on the 14th, for a position with a salary of 44,000 rubles. According to the production calendar, there are 22 working days in October. When determining the amount of income for the first half of the month, we will apply the conditions in proportion to the time worked for half the month. By the time of payment, two days have been worked, which means the payment amount will be 4,000 rubles. The employee will receive this amount on the 31st.

Since the situation with the hired employee is considered controversial, when determining the amount of earnings for the first half of the month, it is better to use a calculation proportional to the time worked.

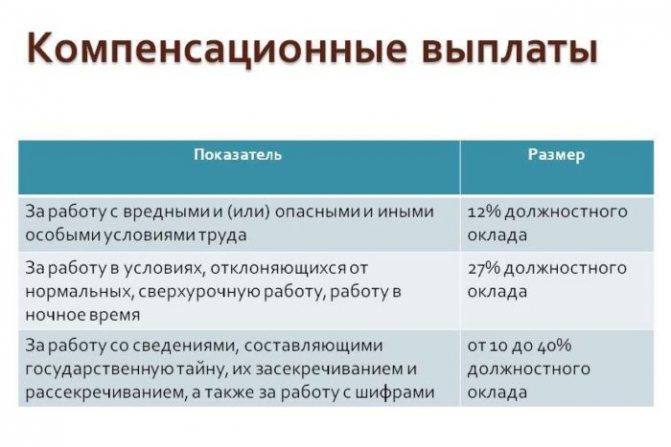

Additional payments of a compensatory nature

This part of the salary should be distinguished from compensation for costs associated with the performance of labor duties and guaranteed by law (Article 164 of the Labor Code of the Russian Federation). These include, in particular, payments:

- for business trips;

- for transfer to work in another area;

- in case of downtime due to the fault of the employer;

- for delay in issuing a work book, etc.

The number of “salary” compensations includes, for example:

- payments for special working conditions;

- compensation for work in certain areas with an unfavorable climate;

- when combining positions;

- for overtime work, etc.

Let's look at some of them in more detail.

For example, according to Art. 146 of the Labor Code of the Russian Federation, employees who work in conditions recognized as dangerous or harmful to health are entitled to a higher level of remuneration compared to other employees. The list of factors that have a negative impact on the human body was approved by order of the Ministry of Health and Social Development of Russia dated April 12, 2011 No. 302n.

Read about some of the nuances of harmful working conditions here .

Certain areas for which work in which a compensation bonus is awarded include:

- regions of the Far North;

- areas equated to the northern regions;

- other areas with special climatic conditions.

When determining the coefficient of the corresponding additional payment to wages, it is necessary to take into account the legislation:

- federal (norms of the Labor Code of the Russian Federation, Law of the Russian Federation dated February 19, 1993 No. 4520-1);

- regional (increased rates of coefficients may be established);

- THE USSR.

IMPORTANT! Many Soviet norms and regulations continue to apply in this area.

For more information about bonuses for work in certain areas, read the article “What benefits are available to workers in the Far North?”

About basic and additional wages

What is basic and additional salary?

The basic salary can be considered the money paid to the employee for the fact that work has been performed in full.

The basic part includes:

- payments for a specific area of work;

- payment for work on holidays or weekends, accrual is made at double the tariff rate or official salary;

- awarding bonuses for special labor achievements, fulfillment of production tasks and other merits related to the employee’s work activity;

- additional payment for harsh climatic conditions, for example, for work in northern or Ural climates;

- payments for work that was carried out in excess of the required working time, that is, the employee remained to complete the production task after the main work.

Types and forms of remuneration

Let us briefly consider the forms and systems of remuneration.

The types of remuneration include its classification into basic and additional.

The main forms of remuneration include:

- remuneration for hours worked;

- payment at various rates and prices;

- allowances for the quality and timeliness of performance of job duties;

- increased pay for working on holidays and weekends.

Additional types include:

- payment for rest time;

- benefits for dismissal of employees, etc.

IMPORTANT! One of the basic principles of labor law is to ensure payment of wages not lower than the minimum wage (Article 2 of the Labor Code of the Russian Federation). Find its size for 2021 and previous years in this article.

There are 2 main types of wages: time-based and piece-rate.

Time wages are based on the number of hours worked and are not related to actual work results.

Based on Part 1 of Art. 150 of the Labor Code of the Russian Federation, work with time-based wages, involving the performance of duties of various qualifications, is subject to payment according to a higher qualification.

For minor workers, wages are calculated taking into account their reduced working time. If desired, the employer has the right to pay additional payments to such employees.

Piecework payment depends directly on the results of work, but is not related to the time spent on it.

If an employee performs work of various qualifications on a piecework basis, then his salary is calculated according to the corresponding prices for the work performed.

Read about the salary calculation procedure here .

In some cases, employers use a tariff-free wage system. For a description of such a remuneration system, see ConsultantPlus. If you do not have access to the K+ legal reference system, get a trial demo access for free.

Structure according to the Labor Code of the Russian Federation

There have been some changes in the legislation (No. 90-FZ), in particular in Article 129 of the Labor Code of the Russian Federation, and remuneration is currently synonymous with wages.

Wages (employee remuneration) are remuneration for work, which depends on its qualifications, quality and complexity.

Compensation charges are also included in the concept of wages, including for work in difficult conditions, as well as payments motivating work (additional payments and bonuses).

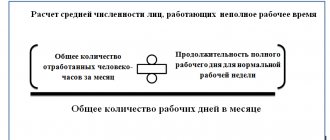

This structure consists of the following parts (see diagram):

- basic (main) part;

- compensation payments;

- incentive payments.

The base part is determined from the basic payment system for the work.

Its amount cannot be less than the minimum wage.

The basic part represents the basis of the salary and its size is not affected by the number of sales, income received and other nuances. The basic salary is determined for the actual period of time worked, or for the results of work performed according to official salaries.

When a manager displays the basic part of the salary, he must keep in mind the following data:

- an employee’s salary can be determined based on his qualifications, volume of work and complexity of production tasks;

- no discrimination should be allowed when determining the terms of payment for work;

- payment must correspond to the work performed.

Compensatory payments represent a variable share of salary , and it in turn depends on the conditions and guarantees of accruals for work from a particular manager. These payments do not depend on remuneration for actual time worked or actual tasks completed.

Compensation payments are characterized by a method of local regulation. This applies to the greatest extent to incentive payments when basic rules are established by law. The legislation defines a list of compensation payments, and the manager must pay them:

- for performing tasks under certain circumstances (working in difficult conditions, with hazardous substances, in areas with a specific climate);

- for performing work in areas where radioactive contamination has occurred;

- for work under circumstances that are not considered normal (performing additional tasks due to the absence of another worker, working at night or overtime, as well as work on holidays and weekends).

The amount of compensation payments is determined based on agreements and collective agreements . The amount of these payments cannot be less than those established by law. Along with this, the legislation determines a higher payment for work for those citizens who work on a rotational basis or in the Far North.

the reimbursement of excessive labor costs of an employee, which depend on the work schedule and conditions for completing tasks.

Compensation payments are made as an increase to official salaries and tariff rates. Incentive payments are considered to be a variable component of the salary, and it depends on the basic income, on the specific result of the employee’s work, and so on.

Incentive payments, as well as the bonus part, are not subject to regulation by law.

the manager’s right to make such payments . It is necessary to make a note that if motivating payments are provided for in the remuneration regime, then the manager must implement them, and the employee can demand them if he fulfills the work plan.

It can be concluded that incentive payments fall under the characteristics of financial payments for the performance of specific work tasks.

Motivational payments are needed so that employees have an incentive to achieve those results for which the calculation of the basic salary is not enough, as well as encouraging the desire of workers to improve their skills and minimize staff turnover.

Incentive payments are assigned in the following cases:

- for professionalism;

- excellent qualifications;

- years of production at the enterprise;

- knowledge of foreign languages.

It should be noted that to motivate employees to work, enterprises have a bonus system . Bonuses are paid as a reward for the quality performance of an employee’s work. The bonus system is divided into two parts:

- Rewards that are included in payment for work.

- Incentives that are not specified in the salary plan.

The employee is entitled to this remuneration, and this means that the manager must make this payment if the employee fulfills specific plans for which the bonus is due . Under other circumstances, an employee cannot ask for a bonus.

Such payments are made in a lump sum at the request of the manager. Incentives are not paid every month, but are carried out based on specific achievements of the employee . In this circumstance, the manager is not obliged to make such payments, but they can be made at his request.

Results

The wage clause is mandatory to be included in the employment agreement between the employee and the employer.

The salary includes the main part (salary) and additional incentive and compensation payments. The salary must take into account the specific qualifications of the employee, the complexity of the working conditions and its volume. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is basic salary

The amount of this payment, based on the requirements of legislative acts, cannot be lower than the minimum subsistence level. This is the basic part, which represents the basis of the salary.

In general, its calculation cannot in any way be influenced by the quantity of goods sold, the profit received by the enterprise, the volume and quality of products produced, and other criteria. The basic component is the main time worked by the employee, as a rule, this is the official salary or tariff rate.

When determining the payment of the basic part of the salary to employees of the enterprise, the following is taken into account:

- employee qualifications;

- complexity of production tasks;

- the amount of functionality assigned to the employee.

The employer does not have the right to discriminate when calculating the main part of earnings. Direct payment must correspond to the parameters of the work.

That is, having worked a certain amount of time at the enterprise, the employee has the right to at least a payment in the amount of the established salary or tariff.

Rules for the formation of wage funds

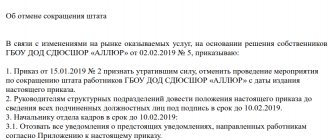

In a market economy, in order to stay afloat, an enterprise needs to pay its employees in a timely manner and in full. For these purposes, a wage fund is formed in accordance with the established procedure, and the employer issues an order to form the fund. Funds are allocated from the pay fund for the employee’s salary, incentive and bonus payments, and payments for time not worked.

The wage fund is calculated using a special formula used at the enterprise; to calculate it, you need to know the number of employees of the organization, the amount of time worked, and data on the achievements of employees. Typically the fund is formed for a month and includes the following elements:

- employee salaries;

- bonuses and compensation payments;

- financial assistance to employees;

- vacation pay.

Deadlines for payment of wages

The Labor Code has not developed specific deadlines for payment of wages. The administration can determine the deadlines itself by fixing them in the clauses of the collective agreement or labor agreement with the employee. But in any case, employees of the enterprise must receive salaries at least every half month.

Federal law may establish other deadlines for a certain category of persons. If the payment of wages falls on a weekend or holiday, then it should be paid on the eve of such a day. Vacation must be paid three days before it starts.

Violation of the terms of payment of wages entails financial liability for the employer, which is provided for by law.

It consists of the administration paying the amounts due to the employee with additional monetary compensation, the amount of which is set at 1/300 of the current refinancing rate of the Central Bank of the Russian Federation for unpaid amounts for each day of delay.

Monetary compensation can be increased according to a collective agreement or employment contract. In addition, violation of deadlines for payment of wages entails, depending on the situation, administrative or even criminal liability.

Author of the article

Salary calculation procedure

Salaries at the enterprise are calculated in the manner established by the enterprise. Every worker and employee must be familiar with this procedure. When calculating the amount of wages, it is necessary to take into account the existing remuneration system in a given organization, established specifically for a specific category of employees, social and other benefits, penalties and incentives.

Pension and insurance contributions are paid from the employer's own reserves. Wages should be calculated from the first day the employee joins the service.

After the employee submits his application and all the necessary documents to the HR department, he receives the right to sign an employment contract with the employer.

This document should indicate in detail all aspects of the employment relationship - from the working hours to the payment of the thirteenth salary, as well as the conditions associated with termination of the contract. An order regarding the timing of payment of wages must also be communicated to him.

When calculating wages, you should take into account the wage system - time-based, piece-rate or mixed. For dismissed employees, the date of dismissal is required, as well as information about unused vacation days.

Methods of wage regulation

From a legal point of view, methods of regulating wages are considered to be a set of procedures aimed at providing employees with decent remuneration for their work, and in case of non-compliance with their rights, guaranteeing them legal protection. This is necessary in all cases if the company has hired employees whose work must be paid on time.

The principles on which legal support for labor remuneration is based:

- the lowest wage cannot be less than the minimum wage approved at the state level;

- it is prohibited to discriminate against people based on their pay (for equal employment, personnel with equal qualifications must receive the same pay);

- the amount of wages may vary depending on the following factors: specialization, specific labor functions (their volume and complexity), conditions for their implementation, quality of work;

- nuances regarding the calculation of salaries, bonuses and other deductions are regulated by companies independently in the relevant internal documents (except for budgetary organizations, where this happens centrally).

There are two options for legal regulation of a citizen’s earnings: decentralized and centralized.

Centralized

The centralized method of regulating wages is also called state.

The centralized method covers the regulation of the income of citizens within the territory of the country, including the level of constituent entities of the Russian Federation. The need for state supervision is determined by the fact that the formation of the amount of wages is subjective in nature, not directly related to market influences.

The state regulates issues of labor remuneration through the Labor Code of the Russian Federation; basically, the guarantees are contained in Chapter 21. These include a number of the most important legal provisions regarding wages.

- The value of the minimum wage (minimum wage), below which it is impossible to assign a salary for a month of work in a normal temporary mode (Article 133 of the Labor Code of the Russian Federation).

- The largest possible amount of deductions from the monthly salary (Article 137 of the Labor Code of the Russian Federation).

- Tariff system of payment for labor (Article 143 of the Labor Code of the Russian Federation).

- The procedure for calculating wages upon dismissal (Article 140 of the Labor Code of the Russian Federation).

- Features of remuneration in special conditions:

- harmful and/or dangerous (Article 147 of the Labor Code of the Russian Federation);

- severe climatic conditions (in the Far North and equivalent territories) (Article 148 of the Labor Code of the Russian Federation);

- others, different from normal (Article 149 of the Labor Code of the Russian Federation);

- overtime work (Article 152 of the Labor Code of the Russian Federation);

- work at night (Article 154 of the Labor Code of the Russian Federation);

- work on weekends and holidays (Article 153 of the Labor Code of the Russian Federation).

- Remuneration in special production situations:

- in the manufacture of defective products (Article 156 of the Labor Code of the Russian Federation);

- during downtime (Article 157 of the Labor Code of the Russian Federation).

- Responsibility of the employer for violations of the rights of personnel regarding remuneration (Article 142 of the Labor Code of the Russian Federation).

This method determines only the lowest value of labor remuneration for citizens (Article 133 of the Labor Code of the Russian Federation) and establishes some guarantees regarding payment, including:

- prohibition, when setting the amount of payment, of discrimination depending on nationality, gender, age and other factors not related to the qualitative and quantitative characteristics of the work performed;

- ensuring an increase in the actual content of earnings, including through indexation due to changes in the market value of goods (Article 134 of the Labor Code of the Russian Federation), the payment mechanism for which and the procedure for conducting the procedure are specified in Federal Law No. 122 (08/22/2004);

- establishing the maximum value of taxes based on the base of taxable income (earnings), the reasons and amounts of deductions from income by decision of the employer;

- limiting options for paying remuneration in kind;

- providing a citizen with the opportunity to receive the income due to him for work performed upon termination of the functioning of the employing organization (insolvency, bankruptcy);

- state control over payments (completeness, timeliness), compliance with guarantees relating to issues of payment for work;

- liability of enterprises for non-compliance with agreements, requirements of legislative and regulatory documents, including the Labor Code of the Russian Federation;

- terms and frequency of payment of earnings.

The following are centrally established by categories of citizens employed in the public sector:

- the procedure for determining the conditions for remuneration;

- amount, salary scheme;

- options for allowances and surcharges;

- provisions for payment of remuneration under non-standard working conditions;

- options for maintaining payment of part or full average earnings, calculating average earnings.

Regulation of payments by industry is carried out using industry (inter-industry) agreements that define:

- the lowest wage rates in the industry (in an amount greater than that established by the Federal Law);

- the ratio of rates by tariffs, categories, qualification categories of citizens;

- the amount of remuneration for work in conditions other than normal;

- frequency and procedure for adjusting salaries (rates) due to inflationary processes in the economy;

- allowances and surcharges for industry enterprises.

The conditions adopted by the organization for the payment of labor remuneration to citizens are formalized in the form of collective agreements, orders for payment and bonuses, which link the earnings of a particular citizen to the results of his activities.

Important! The documents adopted by the organization when resolving the issue of payment for the activities performed by the employee cannot contain conditions that violate the social guarantees provided for by the Federal Law. If clauses are found in the text of a collective agreement that worsen the situation of a citizen in comparison with legally defined criteria, the document is considered invalid.

Decentralized

The decentralized method consists in regulating the earnings of citizens through employment contracts, documents on social partnership or local regulatory documents of the organization (Article 41 of the Labor Code of the Russian Federation, Federal Law No. 2490 (03/11/1992)).

The decentralized method for regulating earned remuneration spread due to changes in the country's economy, which led to the emergence of a variety of equal forms of ownership.

Regulation at the contract level is divided into:

- collective, carried out by drawing up collective agreements, sectoral, regional agreements;

- individual, acting on the basis of an employment contract on the amount and conditions of payment for work between the employee and the employer.

There is a relationship between the current methods of regulating remuneration for work performed. According to social partnership agreements, the criteria for remuneration for a citizen’s work cannot be worse than those provided for in the regulatory or legislative documents of the Russian Federation.

But partnership agreements affect employment law documents. Before the State Duma of the Russian Federation considers the annual draft federal budget, the special commission on labor relations makes proposals regarding the terms of payment for citizens employed in budgetary organizations (Article 135 of the Labor Code of the Russian Federation). These recommendations are used by executive and local government structures when calculating funding for budgetary structures (culture, education, science, healthcare).

Procedure for payment of wages

1. How often and within what time frames must wages be paid to employees? 2. How to determine the amount of advance payment due to employees. 3. In what order are insurance premiums and personal income tax from wages and advance payments calculated and paid? “The main thing in settlements with employees regarding wages is to correctly calculate the amounts due to them.” This statement is only half true: it is important not only to correctly calculate employee salaries, but also to pay them correctly. At the same time, the stumbling block for many is paying advances to employees. Is it necessary to split the salary into an advance payment and a final payment if the amount is already small? Is an advance paid to external part-time workers? How to calculate the advance amount? We will look into these and other issues related to the payment of wages to employees in this article.

Frequency of salary payment

The Labor Code of the Russian Federation establishes the obligation of the employer to pay wages to employees at least every half month (Article 136 of the Labor Code of the Russian Federation). It should be noted that the Labor Code does not contain such a thing as an “advance” at all: according to its wording, this is wages for the first half of the month. And the widely used concept of “advance” came from a Soviet-era document, Resolution of the USSR Council of Ministers dated May 23, 1957 No. 566 “On the procedure for paying wages to workers for the first half of the month,” which is still in effect to the extent that does not contradict the Labor Code of the Russian Federation. Therefore, to make it easier to understand, in this article, advance means wages for the first half of the month.

So, for wages, the frequency of payment is established at least every half month. At the same time, other payments to employees have their own deadlines:

- vacation pay must be paid no later than 3 days before the start of the vacation;

- Severance pay must be paid on the day the employee leaves.

But the payment of sick leave is precisely tied to the payment of wages: benefits must be paid on the day closest to the date of payment of wages after the award of benefits. If such the nearest day is the day of payment of the advance, then the benefits must be paid along with it.

Please note: the requirement of the Labor Code to pay wages at least twice a month does not contain any exceptions and is mandatory for all employers to fulfill in relation to all employees (Rostrud Letter No. 3528-6-1 dated November 30, 2009). That is, the advance must be paid, including:

- if the employee is an external part-time worker;

- if the employee voluntarily wrote an application for payment of wages once a month;

- if local regulations of the employer, employment contracts, etc. Payment of wages is established once a month. This provision is void and cannot be enforced, as it violates the requirements of the Labor Code of the Russian Federation.

- regardless of the amount of earnings and the accepted wage system.

If the employer nevertheless neglected the requirements of the Labor Code of the Russian Federation to pay wages to employees at least every half month, then in the event of an inspection by the labor inspectorate he faces liability in the form of a fine (Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

- for officials – from 1,000 rubles. up to 5,000 rub.

- for individual entrepreneurs - from 1,000 rubles. up to 5,000 rub.

- for legal entities – from 30,000 rubles. up to 50,000 rub.

Deadlines for payment of wages

Currently, labor legislation does not contain specific terms for payment of wages, that is, the employer has the right to set them independently, enshrining them in the internal labor regulations, collective agreement, and employment contracts with employees (Article 136 of the Labor Code of the Russian Federation). The following must be taken into account:

- The time interval between salary payments should not exceed half a month. In this case, payments do not have to fall within one calendar month (Letter of the Ministry of Labor of Russia dated November 28, 2013 No. 14-2-242). For example, if wages for the first half of the month are paid on the 15th day, then for the second - on the 30th (31st) of the current month, if for the first - on the 25th, then for the second - on the 10th of the next month, etc. . In addition, the employer can set the frequency of payment of wages more often than once every half month, for example, every week - this approach is acceptable since it does not worsen the situation of employees and does not contradict the requirements of the Labor Code of the Russian Federation.

- The timing of payment of wages must be indicated in the form of specific days, and not time periods (Letter of the Ministry of Labor of Russia dated November 28, 2013 No. 14-2-242). For example: 10th and 25th of every month. A wording such as “from the 10th to the 13th and from the 25th to the 28th” is unacceptable, since in fact the requirement of the Labor Code of the Russian Federation to pay wages at least every half month may be violated: the employee will receive a salary on the 10th, and the next payment will be on the 28th, that is, the gap between payments will exceed half a month.

- If the established payment day falls on a weekend or non-working holiday, then wages must be paid on the eve of this day (Article 136 of the Labor Code of the Russian Federation).

Please note: The employer is liable for failure to pay wages on time (including advances and other payments to employees): financial, administrative, and in some cases even criminal.

Advance amount

The Labor Code does not contain requirements regarding the proportions (amounts) in which parts of wages should be paid. However, Decree No. 566, which was already mentioned above, provides that the amount of the advance must not be lower than the worker’s tariff rate for the time worked. Despite the fact that this resolution deals with the wages of workers, a similar approach can be used in relation to other workers.

The amount of advance payment to be paid to the employee can be calculated in one of the following ways:

- in proportion to the time worked;

- in the form of a fixed amount, for example, calculated as a percentage of the salary.

Using the second option, paying an advance in a fixed amount, has one significant drawback - the likelihood that the employee will not work off the advance received. For example, in cases where an employee was on sick leave for most of the month, on leave without pay, etc. and was paid an advance, at the end of the month the accrued wages may not be enough to cover the advance payment. In this case, the employee has arrears of wages, the retention of which is associated with certain difficulties for the employer.

Using the first option, paying an advance in proportion to the time actually worked, is more preferable, although more labor-intensive for the accountant. In this case, the amount of the advance is calculated based on the employee’s salary and the days he actually worked for the first half of the month (based on the time sheet), so the possibility of “transferring” the advance is practically excluded. Rostrud specialists in Letter No. 1557-6 dated 09/08/2006 also recommended that when determining the amount of the advance, take into account the time actually worked by the employee (actually completed work).

Please note: The Labor Code obliges the employer to notify the employee in writing for each payment of wages (including advance payments) (Article 136 of the Labor Code of the Russian Federation):

- on the components of wages due to him for the relevant period;

- on the amount of other amounts accrued to the employee, including monetary compensation for the employer’s violation of the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee;

- about the amounts and grounds for deductions made;

- about the total amount of money to be paid.

The specified information is contained in the pay slip, the form of which is approved by the employer himself, taking into account the opinion of the representative body of employees.

Methods of payment of wages

Wages are paid to employees either in cash from the employer's cash desk or by bank transfer. In addition, labor legislation does not prohibit part of wages (no more than 20%) from being paid in kind, for example, in finished products (Part 2 of Article 131 of the Labor Code of the Russian Federation). In this case, the specific method of payment of wages must be specified in the employment contract with the employee. Let us dwell in more detail on monetary forms of payment of wages.

1. Payment of wages in cash

Payment of wages to employees from the cash register is documented with the following documents:

- payment (form T-53) or payroll (form T-49);

- expense cash order (KO-2).

If the number of employees is small, then the payment of wages to each employee can be processed using a separate cash order. However, with a large staff, it is more convenient to draw up a payroll (settlement and payment) statement for all employees and make one expense order for the entire amount paid according to the statement.

2. Transfer of wages to a bank card

The conditions for paying wages in non-cash form must be specified in the collective agreement or employment contract with the employee. For the convenience of transferring wages, many employers enter into appropriate agreements with banks for the issuance and servicing of salary cards for employees. This allows the entire amount of wages to be transferred in one payment order with a register attached, which specifies the amounts to be credited to the card account of each employee.

Please note: it is possible to transfer wages in non-cash form only with the consent of the employee and only using the details specified in his application. In addition, the employer cannot “bind” its employees to a specific bank: labor legislation gives the employee the right at any time to change the bank to which his wages should be transferred. In this case, it is enough for the employee to notify the employer in writing about the change in payment details for payment of wages no later than five working days before the day of payment of wages (Article 136 of the Labor Code of the Russian Federation).

The procedure for calculating and paying personal income tax and insurance contributions from wages

We found that employees must be paid at least twice a month. In this regard, many people have a question: is it necessary to calculate insurance premiums and personal income tax from the advance payment? Let's figure it out. According to the law, insurance premiums must be calculated based on the results of the month for which wages are accrued (Clause 3, Article 15 of Federal Law No. 212-FZ). As for personal income tax, in accordance with the Tax Code, the date of receipt of income in the form of wages is recognized as the last day of the month for which income was accrued for work duties performed (clause 2 of Article 223 of the Tax Code of the Russian Federation). Thus, neither insurance premiums nor personal income tax need to be charged on the advance payment.

The deadlines for payment of insurance contributions from wages are the same for all employers and do not depend on the date of payment of wages. Currently, contributions to extra-budgetary funds must be paid before the 15th day of the month following the month of salary calculation (clause 5 of Article 15 of Law No. 212-FZ). An exception is insurance contributions to the Federal Social Insurance Fund of the Russian Federation against accidents and occupational diseases - they must be paid on the day established for receiving funds from the bank to pay wages for the past month (clause 4 of Article 22 of Law No. 125-FZ).

Unlike insurance premiums, the deadline for paying personal income tax depends on the date and method of payment of wages:

- In cash from proceeds - no later than the day following the day of salary payment;

- In cash from funds withdrawn from the current account for payment of wages - no later than the day of receipt of funds from the bank;

- By bank transfer to employee cards - no later than the day the funds are transferred to employees.

Payroll accounting

In accounting, the calculation of wages, as well as personal income tax and insurance contributions, is reflected on the last day of the month worked. In this case, the following entries are made: Date Account debit Account credit Contents of transaction Date established for payment of wages for the first half of the month 70 50(51) Wages paid for the first half of the month from the cash register (transferred to employee cards) Last day of the month 20(23 , 26, 44) 70 Wages accrued Last day of the month 70 68 Personal income tax withheld from wages Last day of the month 20 (23, 26, 44) 69 Insurance contributions accrued from wages Date set for payment of wages for the second half of the month (final calculation) 70 50(51) Wages paid from the cash register (transferred to employee cards) The last day of the deadline established for the payment of wages according to the statement from the cash register 70 76 The amount of uncollected wages was deposited The next day after the end of the period established for the payment of wages according to the statement from the cash register 51 50 The amount of the deposited salary was credited to the current account When an employee applied for wages that were not received on time 50 51 Money was received from the current account for the issuance of a deposited salary When an employee applied for wages that were not received on time 76 50 The deposited salary was issued