General list of taxes and mandatory payments from the payroll

In accordance with Russian legislation, individual entrepreneurs, all enterprises and institutions that hire employees, act as their tax agents and make monthly deductions from the payroll fund.

The employees themselves, that is, individuals, are excluded from the process of transferring taxes. They can only find out about the payment of mandatory payments from a salary “receipt” or a certificate in form 2-NDFL.

This procedure was adopted for the convenience of the federal tax service. It is easier for its employees to control organizations than to deal with each taxpayer separately.

Charges to the wage fund appear monthly.

Charges to the wage fund appear monthly. The task of each employer is to pay them within the period prescribed by law and in full. This list includes:

- Taxes on personal income - on employee wages, sick leave and vacation pay, bonuses and other payments that are transferred to employees based on the results of their professional activities.

- Mandatory transfers to specialized funds - pension, as well as social and health insurance.

Deduction rules

The updated Tax Code, namely Chapter 34 introduced in 2021, regulates the relationship between Russian employers and funds: how much is transferred to the Pension Fund from salaries, how much to the Mandatory Medical and Social Insurance Funds, and the KBK codes by which transfers are made.

Pexels Photos

The current fiscal legislation establishes that the employer, be it an organization or an individual entrepreneur who uses hired labor in his activities, is obliged to calculate and pay insurance contributions from wages to the state budget, which, depending on their purpose, are sent to the appropriate extra-budgetary funds. The funds are then used as financing:

- pensions and pension savings of Russian citizens;

- free medical care;

- benefits and payments for temporary disability of workers, including maternity.

Let us note that employers must transfer contributions from accidents and occupational diseases to the Social Insurance Fund. The specifics of the application of this type of insurance coverage are enshrined in Law No. 255-FZ.

In addition to insurance coverage, employers calculate income tax on wages to the Federal Tax Service, for which a progressive interest rate has been introduced in 2021.

Timely payment of personal income tax for all employees is an important part of payroll payments

The main payroll tax is personal income tax , a tax on personal income. The amount of this tax paid by residents of the Russian Federation - and this includes the majority of employees - is 13% of the total accrual amount.

If the organization’s staff includes a foreign citizen, that is, a tax resident of another state, 30% of the accrual amount is required to be paid to the Russian budget. Such situations occur much less frequently in practice, but they are still worth remembering.

Tax payment is made on the same day as the transfer (issue) of money to the employee. Most often, personal income tax is paid on wages , as well as on vacation pay, sick leave and bonuses. Please note that it is necessary to pay personal income tax on wages only once a month; payment of this tax on the so-called “advance” is not provided.

What does the amount of deductions depend on?

The amount of salary deductions in 2021 to the budget depends on several factors:

- the organizational and legal form of the employer - individual entrepreneurs, unlike organizations, pay taxes not only for their employees, but also for themselves;

- employee status - taxation of a non-resident of the country differs from taxation of a Russian citizen;

- the type and scale of the company’s activities - for some insurers the state establishes preferential rates of contributions from employee income.

As part of the introduction of business support measures due to the difficult economic situation, reduced tariffs were applied from April 2021. This has not changed; salary contributions remain reduced in 2021. Organizations belonging to small and medium-sized businesses have the right to use them. Let's see how contributions are calculated in 2021 and what are the criteria for applying reduced tariffs.

Mandatory payments from the payroll to various funds

The law also obliges employers to make monthly several types of mandatory payments for employees in favor of various insurance funds - social and medical. It is also the responsibility of entrepreneurs and organizations to pay pension contributions for all their employees.

Currently, the following rates are provided for these categories of payments (of the total payment amount)::

- health insurance - 5.1%;

- social insurance - 2.9% (may be increased in hazardous and hazardous industries);

- pension contributions - 22%.

Please note that individual entrepreneurs are not required to pay social security contributions ; this category only applies to legal entities. An exception is the situation when an entrepreneur wants to transfer funds to social insurance voluntarily.

The law obliges employers to make monthly several types of mandatory payments for employees in favor of various insurance funds.

Table - all payments and transfers are clear

In order not to get confused in the list of mandatory payments assessed by the state on the wage fund of individual entrepreneurs and legal entities, use the simple and convenient table presented below .

| Tax, contribution or payment | Rate (based on the amount charged) | Some nuances |

| Personal income tax | 13% or 30% | Tax residents of Russia pay personal income tax in the amount of 13%, citizens of foreign countries - 30%. |

| Pension contributions | 22% | Pension contributions are also paid by certain categories of foreign citizens, this is due to the status of their presence on the territory of the Russian Federation. |

| Social insurance contributions | 2,9% | This is a standard rate, which can be increased depending on the harmfulness and danger of production. Paid only by legal entities, individual entrepreneurs - only at will. |

| Health insurance | 5,1% | – |

Russian legislation provides for penalties for non-payment of any taxes and mandatory payments.

Contributions from payroll

All organizations are required to pay contributions to the Federal Tax Service on payments made to their employees as wages. The amount of insurance premiums is established in Articles 426-429 of the Tax Code of the Russian Federation. The total percentage of contributions from wages paid is 30% and is the standard amount. However, some organizations have the right to pay contributions at reduced rates (Article No. 427 of the Tax Code of the Russian Federation):

- enterprises involved in innovative areas of activity;

- non-profit (except state and municipal) and charitable organizations operating under a simplified taxation system;

- organizations that pay wages to crew members of ships registered in the Russian International Register of Ships;

- enterprises operating under a simplified taxation system and producing food products, clothing, sporting goods and toys, computers, medicines, etc.;

- pharmacies and other pharmaceutical organizations;

- working under a patent;

- organizations involved in Skolkovo;

- organizations participating in regional programs in Crimea, Vladivostok, Kaliningrad region;

- organizations producing animated films.

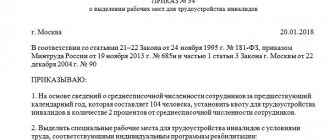

In addition, employers are required to pay insurance premiums (workplace accidents and occupational diseases) to the Social Insurance Fund, the tariffs of which remained the same in 2021: thirty-two tariffs are in effect from 0.2 to 8.5% (the average is 0.51%) , which are assigned depending on the form of organization of the legal entity, the duration of its work, the presence of employees with disabilities, etc.

Contributions to the Social Insurance Fund are paid monthly for the past month no later than the 15th.

Example of calculations and transfers - calculation of payroll and all mandatory payments

Let's look at how the volume of taxes and mandatory payments from the payroll fund is calculated in 2021 using the example of the fictitious organization LLC "Flowers". Let’s assume that the organization employs 18 employees, 16 of whom are tax residents of Russia (that is, they pay 13% personal income tax), and the other 2 are non-residents (that is, 30% personal income tax for them).

The salary of 5 employees is 15,000 rubles (including two foreign citizens), 5 others - 18,000 rubles, 3 - 25,000 rubles, 4 - 30,000 rubles and 1 - 40,000 rubles. No other accruals other than employee wages were made this month. First, we calculate the size of the wage fund for this month:

(5 * 15,000) + (5 * 18,000) + (3 * 25,000) + (4* 30,000) + 40,000 = 400,000 rubles.

At the same time, the total salary of tax residents is 370,000 rubles, and non-residents - 30,000 rubles. Now let’s calculate what and in what amount the employer will pay to the budget and insurance funds:

- Personal income tax of tax residents. 370,000 * 13% = 48,100 rubles.

- Personal income tax of non-residents. 30,000 * 30% = 9,000 rubles.

- Pension contributions. 400,000 * 22% = 88,000 rubles.

- Health insurance premiums. 400,000 * 5.1% = 20,400 rubles.

- Social insurance contributions. 400,000 * 2.9% = 11,600 rubles.

Thus, the total value of all mandatory payments to the budget and insurance premiums for an organization whose monthly payroll amounted to 400,000 rubles will be 177,100 rubles. That is, the cost of paying employees and accompanying accruals will be equal to 577,100 rubles.

Rates and deductions

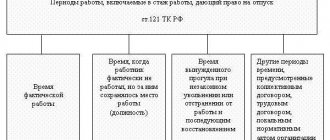

Currently, employers withhold personal income tax on all income of their employees at a rate of 13% until annual payments exceed 5 million rubles. Officials have provided a number of tax deductions for working professionals.

Thus, an employee has the right to claim a child deduction - the most common in Russia. Legislators also provided for professional, property, investment and social tax benefits.

Payroll taxes in 2021: table

The following basic rates are established for all salary taxes:

| Tax/fee | Base rates | Addiction |

| Personal income tax | 13%, 15% or 30% | Are directly related to tax residence and the employee’s annual income |

| Pension contributions | 22% or 10% | The rate depends on the employee’s total income |

| Social on VNiM | 2.9% or 0% | |

| Medical | 5,1% | |

| For injuries | Individual | Employer's main OKVED code |

—

Let's look at each tax in more detail. Let's start with personal income tax.

For income tax, the Tax Code of the Russian Federation provides for five rates, but only three of them are applicable to wages. Moreover, one of these three rates is new and applies from 2021. It applies to employee income over 5 million rubles. in year.

| Employee category | Personal income tax rate |

| Tax resident of the Russian Federation, a foreigner working under a patent, a highly qualified foreign specialist, non-resident – participant in state programs according to Presidential Decree No. 637 of June 22, 2006. Refugee | 13% |

| Tax resident with income over 5 million rubles. per year 650 thousand rubles. | + 15% of income over 5 million rubles. |

| Tax non-resident of the Russian Federation | 30% |