Any staff member may be temporarily unable to work due to illness or caring for an unhealthy family member. During this period, drawn up with a special document - a certificate of incapacity for work - the employee does not perform his immediate duties, but still receives money in the amounts specified by law.

- Do I need to withhold personal income tax from these funds?

- How is this reflected in the company's accounting documents?

- What exactly are the funds used to make up this tax payment?

Find out from the article.

To whom and at whose expense is sick leave paid?

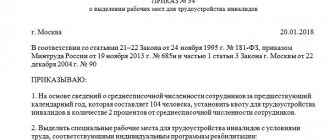

According to Article 2 of Law No. 255-FZ of December 29, 2006, temporary disability benefits are mandatory paid only to employees hired under an employment contract. Is sick leave subject to personal income tax in the case of payments to performers providing services under a civil contract? No, because these individuals cannot qualify for sickness compensation from the employer and the Social Insurance Fund, respectively, and tax withholding does not occur due to the lack of a tax base.

The benefit for the first three days of illness of an employee is paid at the expense of the employer, the remaining days until the restoration of working capacity or the establishment of disability - at the expense of the Social Insurance Fund. Insurance premiums are not charged on the benefit amount. The employer must accrue the money within 10 days from the date of presentation of the certificate of incapacity for work, and transfer it along with the payment of the next salary.

Features of the reflection of information in the personal income tax certificate-2

Currently (in 2021) there is a form of certificate of income for individuals, which was approved by the order of the Federal Tax Service No. ММВ-7-11/485 dated October 30, 2015. Despite the fact that most often “sickness” compensation is paid simultaneously with wages, The documentation will indicate different numbers:

- for salary (column code 2000) – the last day of the month of its accrual;

- for compensation (column code 2300) – the day it is accrued.

For example, in October 2021, an employee was sick for 5 days, from October 25 to October 29. Part of his salary for October, along with sickness benefits, was paid to him on November 10. The personal income tax certificate will show 2 different dates, because salary income is legally considered to be received in November, and sick leave income is considered to be received in October, although the money will be received on the same day.

Transfer of personal income tax from sick leave in 2021

When paying for sick leave, the employer acts as a tax agent, i.e. must withhold income tax and transfer it to the budget. The personal income tax rate for sick pay in 2021 has not changed and is set at 13%.

As for the tax base for calculating personal income tax, it depends on whether your region is participating in the Social Insurance Fund pilot project. In general, income tax is withheld from the entire payment, without dividing it into the part that is paid by the employer and the part that is paid additionally by social insurance.

Example: Employee of Vega LLC Alekseeva N.A. I was treated in the hospital for 10 days. Based on the certificate of incapacity for work, the accountant calculated the patient’s benefit in the amount of 12,780 rubles. Of these, three days were paid for at the expense of the organization (1278 * 3 = 3834 rubles), and another 7 days were paid for at the expense of the Social Insurance Fund (1278 * 7 = 8946 rubles). Considering that the entire amount was paid by the company along with the salary, personal income tax is withheld by the organization as a tax agent. Let's calculate the income from benefits: 12780 * 13% = 1661.4 rubles. Alekseev will receive 12780 – 1661.4 = 11118.6 rubles.

How to calculate the amount of personal income tax from sick leave

So, for funds paid towards any sick leave, except for pregnancy, it is necessary to withhold personal income tax in the usual manner, just as it happens when calculating wages. The income tax rate in 2021 has not changed and remains the usual 13% for entrepreneurs and employees. The calculation principle also remains the same.

NOTE! In addition to income tax, social insurance contributions are withheld from the income of citizens working under an employment contract: to the Pension Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund. The deduction of social contributions does not apply to “hospital” payments.

An example of calculating personal income tax from temporary disability compensation

An employee of Lorelei LLC, Natalya Levanevskaya, was admitted to the hospital due to acute appendicitis and was treated for 14 days. The average daily earnings of N. Levanevskaya, calculated by an accountant, is 1,456 thousand rubles. per month Thus, based on the data on the certificate of incapacity for work provided by the employee, she is entitled to compensation in the amount of 14 x 1456 = 20,384 rubles. This money was credited to her along with her salary for this month. The organization must withhold personal income tax from this amount, the amount of which will be 20,384 x 13% = 2,649 rubles. 92 kopecks Thus, the amount of 20,384 – 2650 = 17,734 rubles is intended for payment under a certificate of incapacity for work for N. Levanevskaya.

If Lorelei LLC belonged to the jurisdiction of one of the “pilot” regions, for example, the Yaroslavl region, the calculation would look a little different. At the expense of Lorelei LLC, the recovered employee would receive compensation only for the first three days of illness, that is, 1456 x 3 = 4395 rubles. The company will withhold personal income tax only from these funds: 4395 x 13% = 571 rubles. Thus, in addition to the salary, N. Levanevskaya will receive 4395 – 571 = 3,824 rubles.

The remaining funds (for 11 days of incapacity) will be transferred to her by the FSS, who will also act as a tax agent for income tax on them.

11 x 1456 = 16,016 rubles. – the full amount due on sick leave.

16,016 x 13% = 2,082 rubles. – personal income tax amount.

16,016 – 2082 = 13,934 rubles. - for the extradition of N. Levanevskaya.

At the same time, the employer is not responsible for transferring tax funds to the address, that is, to the INFS; his powers and responsibilities are limited only to the amount of 571 rubles. for the first three non-working days.

Personal income tax on sick leave: pilot project of the Social Insurance Fund

In the example above, the employer withheld tax on all income, including the portion paid from the social security fund. In general, the FSS reimburses this amount after the employer submits an application for debt reimbursement according to Form 4-FSS.

Since 2012, the Social Insurance Fund launched a pilot project “Direct Payments”, within the framework of which the part that is supposed to be paid from social insurance funds is sent directly to the employee. The goal of the project is to effectively use budget funds, protect the interests of workers from unscrupulous employers who delay or fail to pay benefits, reduce cases of insurance fraud, and reduce errors in calculations.

According to the Decree of the Government of the Russian Federation dated April 21, 2011 No. 294, the following regions are participating in the implementation of the pilot project:

| Region | Period of participation in the project |

| Karachay-Cherkess Republic and Nizhny Novgorod region | 01.01.2012 – 31.12.2019 |

| Khabarovsk Territory and Astrakhan, Kurgan, Novgorod, Novosibirsk, Tambov regions | 01.07.2012 – 31.12.2019 |

| Republic of Crimea, Sevastopol | 01.01.2015 – 31.12.2019 |

| Republic of Tatarstan and Belgorod, Rostov, Samara regions | 01.07.2015 – 31.12.2019 |

| Republic of Mordovia and Bryansk, Kaliningrad, Kaluga, Lipetsk, Ulyanovsk regions | 01.07.2016 – 31.12.2019 |

| Republic of Adygea, Republic of Altai, Republic of Buryatia, Republic of Kalmykia, Altai and Primorsky territories, Amur, Vologda, Magadan, Omsk, Oryol, Tomsk regions and Jewish Autonomous Region; | 01.07.2017 – 31.12.2019 |

| Republic of Sakha (Yakutia), Trans-Baikal Territory, Vladimir, Volgograd, Voronezh, Ivanovo, Kemerovo, Kirov, Kostroma, Kursk, Ryazan, Smolensk, Tver regions; | 01.07.2018 – 31.12.2019 |

| Republic of Dagestan, Republic of Ingushetia, Republic of Karelia, Republic of Komi, Republic of North Ossetia-Alania, Republic of Khakassia, Kabardino-Balkarian Republic, Udmurt Republic, Chechen Republic, Chuvash Republic, Arkhangelsk, Tula, Yaroslavl regions | 01.07.2019 – 31.12.2019 |

Is personal income tax deducted from sick leave during the pilot project? Yes, of course, but in a special order:

- The employer pays from his own funds only three sick days and withholds personal income tax only from this amount;

- Starting from the 4th day of illness, the benefit is transferred at the expense of the Social Insurance Fund, which also acts as a tax agent for this amount.

If we return to our example, the accountant of Vega LLC will withhold income only from the amount that was paid from the organization’s funds (1278 * 3 = 3834 rubles). The income tax will be 3834 * 13% = 498.42 rubles, and the employee will receive 3335.58 rubles. The rest of the money will be transferred directly to her by the FSS.

In this case, the tax agent for the amount transferred from social insurance funds is the fund itself. The employer is not responsible for withholding and transferring income tax to the budget from this part of the income.

When to transfer income tax from sick leave

When to transfer personal income tax from sick leave in 2021? Before January 1, 2021, the deadlines for paying income tax on employee income were as follows:

- no later than the day of receipt of cash from the bank or transfer to the account of an individual;

- in other cases (for example, when paying income from proceeds) - no later than the day following the day of actual receipt of income.

By Law of May 2, 2015 N 113-FZ, this procedure was changed, and from January 1, 2021, personal income tax on sick leave and vacation pay must be transferred no later than the last day of the month in which such income was paid (Article 226 (6) of the Tax Code of the Russian Federation).

Don’t want to experience difficulties in maintaining accounting and tax records? Open a current account with Tinkoff Bank and get online accounting for free.

Personal income tax from sick leave in certificate 2-NDFL

In 2021, the form of a certificate of income for individuals is in effect, approved by order of the Federal Tax Service dated January 17, 2021 No. ММВ-7-11 / [email protected] The code for payment for temporary disability has not changed, so code 2300 must be indicated on the help page. This category includes only sick leave payments, because maternity payments are not subject to income tax.

Please note that although the benefit is paid on the same day as the next next salary, the dates for receiving these two types of income differ:

- the date of receipt of income in the form of wages is the last day of the month for which it was accrued;

- the date of receipt of income for the period of illness is the day of payment to the employee.

For example, in August 2021, the employee was accrued wages and benefits for the period of incapacity for work in the same month, and on September 5 they were paid. The month of receiving income in the form of salary (code 2000) in the certificate will be August, and sick leave (code 2300) will be September, although both amounts were paid at the same time.

The procedure for correctly accounting for taxes on sick leave benefits

In accounting, when drawing up a document, it is necessary to start from the type of taxation in force at the enterprise. Most often, the calculation is based on the following types:

- income tax;

- payments to the state pension fund;

- payments to the social insurance fund;

- contributions for the needs of the social sphere.

Payments for sick leave are carried out according to the same rules that apply to taxation of employee wages.

The state income tax amount was adopted back in 2013; to date, no changes have been made. Deductions due to temporary disability amount to thirteen percent of the employee’s average salary (income).

The structure and mode of payments also have special rules. The first three days from the moment of a citizen’s incapacity for work are taken over by the company’s management. The accounting department calculates the amount of three-day financial compensation that will be provided to the employee at the time he returns to work. Dates of incapacity are determined solely by the patient's attending physician and are not subject to review. The subsequent period is compensated by the social insurance fund, which has the main powers in this area. Note! Financial compensation for sick leave for caring for a minor child is covered by the social insurance fund in full. The reason for receiving funds from this source is the girl’s official employment.

Paragraph 2 of Article 4 of the Federal Law regulates certain rules, according to which an employee has every right to demand financial support from the organization after the date of dismissal from the enterprise.