The amount of maternity benefits (maternity benefits) is not included in the total monthly (annual) taxable income of the taxpayer, which means that personal income tax is not withheld from it.

However, despite this, you will still have to notify the tax authorities about the amount of accrued benefits. The employer in this case is the tax agent. He is required to submit tax form No. 1DF. The amount of maternity leave is reflected in the tax calculation under the indicator of income “128” as social payments from the relevant budgets ( see subcategory 103.25 of the “ЗИР” system

).

Social guarantees of the state

Every working woman has the right to take annual paid leave at the workplace before or after maternity leave - this is stipulated in Article 260 of the Labor Code.

At 30 weeks of pregnancy, a girl has the right to draw up a certificate of incapacity for work and contact her employer with a request to establish a part-time working day or working week. This is guaranteed by Article 93 of the Labor Code of the Russian Federation.

In addition to maternity leave, legislation provides the opportunity to take leave to care for a child for up to three years. This right comes into force immediately after the end of maternity leave.

Since 2009, the Constitutional Court has simplified the ability to take parental leave for men, so that women have the opportunity to smoothly return to work after maternity leave.

In addition, all relatives of the child have the opportunity to take care leave. Until the child reaches one and a half years old, parents are entitled to payments in the amount of 40% of average earnings. An employer does not have the right to fire a woman on maternity leave, except for the complete closure of the company.

It is also important to consider the following points: not every employee receives payments of 100% of the average salary. Sometimes benefits are determined according to the minimum wage. In all these cases, the employer can pay the employee a certain amount in order to ensure that the benefit is equal to the real average salary. This is an additional payment up to average earnings.

The employer makes payments from his own pocket, and not from the Social Insurance Fund. For this reason, the additional payment is subject to personal income tax, since it does not apply to state benefits. This rule is stipulated by Articles 209 and 217 of the Tax Code of the Russian Federation. Moreover, the additional payment must be paid to insurance contributions to various funds (for example, to the Social Insurance Fund).

There are exceptions to this rule. The law allows entrepreneurs to provide financial support to employees and not pay tax on it. The “loophole” can be found in Article 217 of the Tax Code of the Russian Federation. According to the law, personal income tax will not be assessed on additional payments of up to 50 thousand rubles paid within a year from the birth of the baby. That is, the manager can make a one-time payment within the prescribed limits.

How are benefits paid for caring for a child under 1.5 years old?

Benefits are issued by the employer for the entire period during which the employee will be on maternity leave. Every woman can go on such leave from the 30th week of pregnancy. If an employee is expecting twins or triplets, then sick leave according to the BiR is granted to her several weeks earlier.

To apply for benefits, the employer must receive a document from the pregnant employee that will serve as the basis for its appointment and issuance. They can serve as a certificate from a doctor from the antenatal clinic or a birth certificate of the baby, if at the time of processing the payments the child was already born. All documentation is attached to an application written by the woman in her own hand, on the basis of which the employer creates an order to accrue benefits that, as mentioned earlier, are not subject to taxation according to the general rules.

On what basis are women entitled to payments?

Maternity leave is a kind of sick leave, and accordingly, it must also be paid. However, regular sick leave is paid for by the employer for the first three days. In contrast to this document, all expenses for the maintenance of a pregnant and postpartum woman are borne by the Social Insurance Fund.

Labor legislation states that an employee of an enterprise, being in the late stages of pregnancy, has every right not to come to the workplace. The legislator provides her with a certain period before and after the birth of the child, enshrining it in legal acts.

We are talking about 70 days before the birth of the baby and the next 70 days after the birth of the child. This is actually maternity leave. This period is often confused with vacation, when a woman who has become a mother takes care of her child. But these are different things.

It is during these 140 days that the employee has the legal right to receive maternity benefits. This is the official income of an employee on maternity leave. The employee is entitled to the money and must be paid in full.

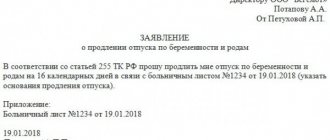

The basis for granting leave is the position of the woman, and the necessary set of documents must be provided. To qualify for certain benefits, you must submit the following documents:

- Certificate of incapacity for work.

- Calculation of the benefit itself using the BiR form.

- Application for maternity leave. This application is usually not submitted; a simple sick leave certificate is sufficient.

The sheet may indicate the amount of earnings on the basis of which payments will be calculated. Other places where the woman managed to work may also be taken into account. As for the sick leave, it is drawn up by her attending gynecologist. If a girl works in several places at the same time and is going to receive benefits at each of them, there should be several such sheets.

After taking leave due to pregnancy, the calculation and payment of funds is made in the first 10 days from the moment the employee applied for them.

Direct Payments Program

A FSS project called “Direct Payments” has been launched in a number of constituent entities of the Russian Federation. This program involves receiving benefits directly through the Social Insurance Fund. If you wish to participate in the project, the employer of a pregnant employee must submit documentation to the Social Insurance Fund. In some cases, a woman can do this on her own.

Such a project not only significantly simplifies the work of the accounting department and fund specialists, but also allows the pregnant woman to count on guaranteed payments at the right time, regardless of the financial situation of the employer. This program protects workers from unscrupulous organizations that may delay payment of benefits for various reasons.

Maternity leave and taxes

By law, any monetary income is taxed. Is the income of individuals (abbreviated as personal income tax) paid as maternity leave taxed? Employees and their employers are certainly interested in the question: will certain tax levies be made on maternity benefits?

Of course, no one wants this money to be deducted by the authorities. Women want to receive all payments without any deductions that reduce the total amount of vacation pay. In this regard, the question arises: “If tax levies cannot be circumvented, how can they be reduced?”

Such questions are best answered by a qualified lawyer, but in this case you can delve into some of the subtleties on your own, especially since the legislative norms quite clearly state what happens to vacation pay, whether they are taxed or not. In any case, the answer to the question of whether they are taxed is clear - withholding personal income tax from maternity leave is unacceptable. Maternity benefits are not taxed because it is against the law.

Despite the fact that it is illegal to collect personal income tax from maternity leave, there are cases when taxation of cash payments received on maternity leave still occurs. If, despite all this, the accountant at the enterprise withheld a certain amount as tax, it must subsequently be returned to the employee. To return the money, an employee or employee of the organization must write a written statement addressed to the head of the company or accountant, after which the woman will be returned the money due.

The issue of tax withholding from the benefits in question is directly linked to the issue of calculating these payments accrued to a pregnant woman taking maternity leave. According to the existing law, all benefits provided by the state itself are actually exempt from personal income tax.

The only exception is taxes aimed at subsidies for temporary inability to carry out labor activities. That is, the exception is when you are on forced sick leave with a sick child. Unlike other payments, maternity benefits are not subject to any taxes also because these benefits are fully provided by the state.

Is personal income tax withheld from maternity benefits?

Family law > Benefits/payments/benefits > Is personal income tax withheld from maternity benefits?

Having children is always associated with huge financial expenses..

No matter how desired and long-awaited a child may be, parents do not always have the opportunity to carefully prepare everything in advance. And approach this event appropriately.

It is quite natural that additional help will not be superfluous to anyone. In Russia, pregnancy and the birth of babies are given special attention by the state.

Social security provides for material payments . Therefore, the question of whether maternity benefits are subject to personal income tax in 2019 remains relevant.

Maternity leave, highlights

Whether personal income tax is calculated from sick leave for pregnancy and childbirth is a question that worries not only a pregnant woman, but also accountants who deal with salary issues.

The presence of errors has very negative consequences, which are fraught with fines or refusal of the Social Insurance Fund to reimburse due payments.

Unlike regular sick leave, where the employer pays for the first three days, maternity pay is fully paid by the Social Insurance Fund.

The procedure for calculating and paying maternity benefits is regulated by Federal Law No. 255.

To obtain them you will need the following documents:

- Certificate of incapacity for work.

- A certificate of salary for those years for which data will be taken to calculate sick leave payments, if during this time the woman changed her place of work.

Social guarantees of the state

As part of social security, the state provides the following material payments:

- Maternity benefit.

- A one-time benefit for women who registered with a medical institution in the early stages of pregnancy.

- One-time benefit for the birth of a child.

- Monthly child care allowance.

Maternity benefits are issued to a woman immediately for the entire period of the relevant leave if she has a sick leave certificate issued for 140 days. A woman receives sick leave 70 calendar days before the birth of her baby.

If an employee is expecting several babies at once, sick leave is provided 84 calendar days before the birth. It indicates 194 calendar days. If the birth is difficult, then it is extended for another 16 days.

When adopting a baby under the age of three months, maternity benefits are paid to one of the parents from the date of adoption until the expiration of 70 calendar days from the date of birth of the adopted baby . When adopting multiple children, the calculation uses 110 calendar days from the date of their birth.

Sometimes it happens that maternity leave and parental leave for up to 1.5 years fall at the same time.

In this case, a woman cannot take advantage of two benefits at once. She has the right to choose the largest of them and write a statement about this to the accounting department.

Maternity benefits are paid in the amount of 100% of average earnings based on the amount of all payments for which insurance contributions to the Social Insurance Fund are calculated for the last 2 years. In this case, the standards for maximum and minimum benefit amounts are taken into account.

General information about personal income tax

Personal income tax is an abbreviation for the concept of personal income tax.

In accounting, this tax is taken from all income received, which will be the object of taxation.

It is calculated for each billing period and paid to the state budget. Calculations and payments must be made by the personal income tax payer, who is the employee.

Personal income tax is taken from the following profits:

- Salary.

- Various types of rewards.

- Present.

- Payments due for temporary disability.

- Cash received from the sale of property.

According to the rules established by the tax legislation of the Russian Federation, the personal income tax interest rate on income received is 13%.

But there are exceptions in which it can decrease to 9% or increase to 35%:

- A reduced rate of 9% is applied to dividend payments that are transferred to all participants in the authorized capital of a company.

- The standard rate of 13% is charged in most cases.

- The increased rate applies:

- for income of non-residents - 30%;

- for individuals who made a profit as a result of winning or receiving a prize - 35%.

Tax legislation also establishes persons who must pay personal income tax on their profits:

- Tax residents who receive their income from sources not only within the country, but also outside it. A mandatory condition is to stay in the country for more than 183 days.

- Non-residents who receive income from sources located within our country.

This tax is deducted not only from individuals, but also:

- From legal entities and individual entrepreneurs who are employers and withhold tax from the salaries of their employees.

- Individual entrepreneurs who have income from their business activities.

- Individuals, if they received income independently and personal income tax was not withheld from it.

What sick leave is not subject to personal income tax?

If a company employee works for it under an employment contract or on the basis of a contractual agreement, then personal income tax will not be withheld from his sick leave. But not everyone falls into this category.

Personal income tax is not taken from sick leave for pregnancy and childbirth. This is provided for in Article 217 of the Tax Code of the Russian Federation.

This article defines all types of employee profit from which personal income tax is not withheld:

- State benefits, except for auxiliary cash payments, which are subject to sick leave, which confirms the temporary disability of its owner.

- Payments of compensation.

- Unemployment benefits.

- Maternity benefit.

Thus, to the question whether maternity benefits are subject to personal income tax or not, there is a clear negative answer.

This type of income is determined by the tax legislation of the Russian Federation to be non-taxable. This is clearly stated in paragraph 1 of Article 217 of the Tax Code of the Russian Federation.

Features of sick leave for pregnancy and childbirth

In 2021, a single form is provided for sick leave for pregnancy and childbirth.

It is filled out in a medical institution by the responsible medical professional:

- obstetrician-gynecologist;

- general practitioner;

- family doctor;

- paramedic

Sick leave is issued at 30 or 28 weeks of pregnancy. The number of days is:

- 140 in a normal pregnancy, half before birth and half after birth;

- 194 days - if a woman is carrying more than one fetus - 84 days before childbirth and 110 days after the birth of children.

In practice, these periods may be reduced. A pregnant woman can continue to work after 30 weeks. In this case, the start of sick leave will be recorded from the moment you contact the doctor for this document.

Payments for disability compensation will directly depend on the duration of sick leave.

Maternity leave

Accounting employees are often interested in the question of whether it is necessary to issue a 2-NDFL certificate for an employee who is on maternity leave.

In some cases, such a certificate can be issued, but in general, there is simply no need for it.

There are two possible options:

- During the period of maternity leave, the employee does not have any additional income, then a 2-NDFL certificate does not need to be issued.

- If a woman worked part-time while on maternity leave, which means she received some income, then a 2-NDFL certificate must be issued.

In the latter case, the woman must choose what type of income is suitable for her. This could be receiving maternity payments without personal income tax withholding or a salary at 0.5 rate. But you cannot receive both maternity benefits and wages.

The 2-NDFL certificate will be issued according to the general rules, including for workers who work part-time.

Child care benefits up to 1.5 years old are considered the same social benefits and income tax is not withheld from it. But it is important not to confuse this with sick leave to care for a sick child.

This type of benefit, as well as for temporary disability, is subject to personal income tax..

Therefore, if the mother received sick leave due to the child’s illness, then in the 2-NDFL certificate this benefit should be noted as the taxpayer’s income.

Like regular sick leave benefits, this income is recorded with code 2300.

In some cases, when the calculated maternity benefits are less than the average salary of an employee, the company can make an additional payment to her and pay her more than expected . Average earnings cannot exceed the contribution base limit.

This type of additional payment does not apply to state benefits. Thus, personal income tax must be withheld from this amount. Such additional payment must be noted in the 2-NDFL certificate.

Nuances of personal income tax

In order to correctly determine and make personal income tax payments, experts advise taking into account some important points:

- The reporting tax period is 1 year.

- If the reporting tax period has ended, to calculate personal income tax you need to determine:

- tax base;

- the amount of tax that is payable.

Payers have the right to tax deductions in accordance with Article 218-221 of the Tax Code of the Russian Federation . If individuals carry out calculations on their own, they must submit declaration documentation to the local tax office.

Thus, personal income tax is not withheld from maternity benefits, as well as from child care benefits up to 1.5 years.

This applies to all cases where the benefit is calculated according to the general rules.

If the amount of maternity pay is less than the average salary of a pregnant woman, then the employer can make additional payments to its employees.

Such payments are not considered state benefits and are therefore subject to income tax.

:

Source: //semeinoe-pravo.net/oblagaetsya-li-ndfl-posobie-po-beremennosti-i-rodam/

Is income tax deducted from maternity sole proprietors?

Financing of maternity payments is fully undertaken by the Social Insurance Fund of the Russian Federation, which is carried out through insurance contributions for social insurance for disability and maternity. Each employer (both legal entities and individual entrepreneurs) must pay such contributions.

From 2021, insurance premiums are transferred not to the fund itself, but to the Federal Tax Service. However, the functions of checking the correctness of accrual of maternity benefits and making a decision on their compensation to the employer remained with the Social Insurance Fund.

In this case, the woman entrepreneur herself may be left without maternity leave. They are due only in one case - if she entered into a voluntary insurance agreement with the Social Insurance Fund and paid contributions for the full calendar year before going on maternity leave.

For example, having entered into an agreement with the Social Insurance Fund in 2021, a woman must pay contributions for the entire year by December 31. Then the right to insurance coverage will begin on 01/01/2020.

If a woman is employed by several employers at the same time, she can receive maternity leave for all places of her work. An employer in a non-principal place of work is obliged to accrue maternity benefits in exactly the same order as for the main one.

Income tax on maternity leave

There have been no changes in the rules for calculating maternity benefits or in the issue of taxation of their personal income tax in 2021. This means that in 2019, income tax is still not taken from maternity workers. However, traditional changes have been made to the amounts depending on the size of the minimum wage and the value of the employee’s income, within the limits of which this income is subject to contributions for disability and maternity insurance.

Based on these values, from 01/01/2019 for maternity leave:

- the minimum value in connection with the next increase in the minimum wage (up to 11,280 rubles) will be 51,919 rubles.

in case of normal birth (within 140 days); - the minimum amount for complicated childbirth (for 156 days) will be 57,852.60 rubles.

; - the minimum amount for a multiple pregnancy (for 194 days) will be 71,944.90 rubles.

; - the maximum for normal childbirth (for 140 days) is at the level of 301,095.20 rubles.

; - the maximum for complicated childbirth (for 156 days) will be 335,506.08 rubles

; - the maximum amount of benefits for multiple pregnancies (for 194 days) will be 417,231.92 rubles.

What taxes are paid on sick leave?

A sick leave certificate is a document of strict accountability. Issued in case of serious violations in human health. The reason for issuing the disability document directly affects the amount of the benefit.

These accruals do not constitute payment there, since professional activities were not carried out.

Based on sick leave, the following are carried out:

- calculations for temporary disability;

- benefits for pregnant women and women who have given birth.

When issuing a document due to injury, illness, or caring for a needy family member, the accrued monetary compensation is subject to personal income tax. It is withheld from the entire accrued amount.

Before the benefit is issued, personal income tax is withheld from it, and the employee receives compensation minus it. No other deductions are made from sick leave. No deductions are deducted from the amount of compensation for pregnancy and childbirth, as this is stipulated by law

. All disability payments are not subject to insurance premiums.

Personal income tax from sick leave due to pregnancy

217 of the Tax Code, namely clause 1. This section clearly states that income tax is not levied on benefits under the BiR, in contrast to ordinary cases of disability. Working employees have the right to receive maternity benefits; conscripted military wives; female students; contract military personnel; as well as pregnant women dismissed due to the liquidation of the company.

As you can see, there have been no changes in legislation this year.

And if the employer’s accountant reports that maternity benefits are subject to personal income tax, this indicates an incorrect interpretation of the Tax Code of the Russian Federation. Besides the question: Benefit

Is income tax withheld from maternity benefits?

46 of this Order states that a sick leave certificate is issued by an obstetrician-gynecologist or a general practitioner; in the absence of the latter, a medical assistant can issue a sick leave certificate.

The sheet is issued in one document at once and confirms the woman’s right to leave for a total duration of 70 days before the birth occurs and 70 days after the birth (in general).

The following categories of women have the right to receive maternity benefits:

- military personnel who serve under a contract.

- full-time students in educational institutions;

- those who were dismissed due to circumstances beyond their control, in particular, the liquidation of the employer, but on the condition that the woman registers as having lost her job in a timely manner;

- carrying out activities under an employment contract;

The timing of the accrual and payment of maternity benefits is regulated by current laws. After completing maternity leave, within 6 months the woman is required to provide a complete package of documents, which is the basis for assigning payment.

Is sick leave subject to personal income tax in 2021?

But compensation for sick leave is an exception to the rule.

The taxation of benefits for certificates of incapacity for work by personal income tax is regulated by:

- (establishes the rates of basic taxes, tax bases, fees and payments to the budget);

- ;

- .

- (regulates the relationship between employees and employers) and (indicates the possibility of receiving social assistance during periods of temporary disability) - are the main regulations in the field of social services. provision of enterprise employees;

- (guarantees compliance with the rights of workers on the part of employers, approves the basis for the application of legislative acts in the field of social security);

- In order (approved);

Personal income tax is not charged on any government benefits, but sick leave payments and benefits for caring for an unhealthy child are exceptions.

Personal income tax is included in the list of the most important tax collections in the country.

Personal income tax in 2021 from sick leave for pregnancy and childbirth

But in some cases, both its reduction (up to 9%) and its increase (up to 35%) are provided - Tax Code, Article No. 224:

- Increased rate:

- The standard rate is 13% (in almost all cases).

- Reduced rate – 9% (taken from dividend payments that are transferred to all participants in the authorized capital of a company).

- 30% (income of non-residents is taxed);

- 35% (set for individuals who received profit as a result of a win/prize, etc.).

Also, the tax legislation of our country names those who must pay personal income tax on profits received:

- non-residents who have income from sources located within our country.

- tax residents who receive their income from sources not only in the territory, but also outside it (a mandatory condition is staying in the territory of our country for more than 183 days) - Tax Code, Article No. 207;

Are maternity benefits subject to personal income tax?

Is this legal and where to go? Works in a large trading and retail company.

//www.youtube.com/watch?v=qmpy8f4ccac

Thanks in advance for your answers. First, try to find out from the company’s accounting department what kind of deduction it was. Since 18 tr. - this is not 13% of 170 tons.

A property deduction is provided on the basis of a written application from the taxpayer when submitting a tax return to the tax authorities at the end of the tax period or before the end of the tax period from the employer on the basis of a notification received from the tax authority confirming the right to the deduction.

Is sick leave subject to personal income tax in 2021?

However, today this rule has been canceled. Therefore, business accountants need to clearly know the answers to the following questions:

- What types of sick leave are not withheld?

- Is it necessary to collect personal income tax from payment for sick leave?

- How to fill out a payment order?

- How to correctly reflect a transaction in accounting documentation?

So, let's take a closer look at each point and consider what procedure has been approved for 2021.

To better understand how compensation for sick days is made, let’s first explain the following concepts:

- A sick leave form is a special form of strict reporting, which is filled out only by an employee of a medical institution treating a sick worker or his relative, subject to the latter’s round-the-clock care for him. The document contains the following information: name of the hospital; Full name and place of work of the worker; diagnosis or other reason for issuing sick leave; treatment period.

alishavalenko.ru

But not everyone falls into this category. What specific sick leaves will not be subject to personal income tax? This article defines all types of worker profit that are legally exempt from taxation:

- Maternity benefits.

- State benefits (except for auxiliary cash payments, which are subject to sick leave confirming the temporary disability of its owner).

- Compensation payments.

- Unemployment benefits.

Thus, in 2021, personal income tax from sick leave for pregnancy and childbirth is not withheld, since this type of income is determined by the tax legislation of our state to be non-taxable - Tax Code, Article No. 217, paragraph 1.

Info This means that if the employer pays a large amount, the Social Insurance Fund will reimburse the costs only within the established limit.

Is personal income tax deducted from sick leave for pregnancy and childbirth?

But in some cases, both its reduction (up to 9%) and its increase (up to 35%) are provided - Tax Code, Article No. 224:

- Reduced rate – 9% (taken from dividend payments that are transferred to all participants in the authorized capital of a company).

- The standard rate is 13% (in almost all cases).

- Increased rate:

- 35% (set for individuals who received profit as a result of a win/prize, etc.).

- 30% (income of non-residents is taxed);

Also, the tax legislation of our country names those who must pay personal income tax on profits received:

- tax residents who receive their income from sources not only in the territory, but also outside it (a mandatory condition is staying in the territory of our country for more than 183 days) - Tax Code, Article No. 207;

- non-residents who have income from sources located within our country.

Is sick leave for pregnancy and childbirth subject to personal income tax in Russia in 2021?

It is mandatory to pay, the amount of benefits depends on the complexity of the birth and the number of children Personal income tax Direct tax levy in the amount of thirteen percent, levied on the income of officially working citizens and payments equivalent to them Insurance length of the employee The time period during which the citizen worked, and with his income was made by the employer in the Social Insurance Fund. A certificate of incapacity for work is an official document drawn up by the attending physician in the event of an employee’s illness or injury.

Source: //advokatssr.ru/ndfl-s-bolnichnogo-po-beremennosti-12148/

Legislation

In fact, maternity benefits, like pregnancy benefits, are a special case of insurance. Payment is made one-time, together with receipt of the last salary before going on vacation. The employer pays the amount. However, in those regions of Russia where the FSS pilot project operates, payment is made by the social fund. The same thing happens when paying benefits to a student or unemployed person.

Accrual and payment of BiR is carried out in accordance with several legal acts:

- clause 1 art. 217 of the Tax Code of the Russian Federation regulates the issue of taxation of maternity and care benefits;

- Federal Law No. 81 dated May 19, 1995 lists the categories of citizens entitled to such assistance;

- Federal Law No. 255 dated December 29, 2006 indicates that social insurance for mothers is mandatory;

- Order of the Ministry of Labor of Russia dated April 30, 2013, regulates the forms and issuance of certificates, which allows you to correctly calculate the amount;

- The order of the Ministry of Health and Social Development of Russia dated December 23, 2009 approves the procedure and lists the terms of payment.

According to paragraphs. 165.1.1 of the Tax Code of Ukraine, the total monthly (annual) taxable income of a taxpayer does not include the amount of state and social material assistance, state assistance in the form of targeted payments and the provision of social and rehabilitation services in accordance with the law, housing and other subsidies or subsidies, compensation (including monetary compensation for disabled people, disabled children during the implementation of individual rehabilitation programs for disabled people, the amount of maternity benefits), remuneration and insurance payments that the taxpayer receives from the budgets and funds of compulsory state social insurance. This is confirmed by the State Fiscal Service in subcategory 103.04 of the ZIR system.