The amount of sick leave benefits for child care is calculated based on the employee’s average earnings for the two calendar years preceding the date of issue of sick leave, the same as in the case of illness of the employee himself. However, there are differences when paying sick leave for care and for illness of the employee himself.

Firstly, all days of sick leave for child care that are subject to payment are paid in full from the Social Insurance Fund.

Secondly, when an employee is dismissed, sick leave for child care must be paid if the child falls ill no later than the date of the employee’s dismissal.

Thirdly, if a child falls ill during an employee’s annual paid leave, days of incapacity for work falling during the vacation are not paid, and the employee’s vacation itself is not extended or postponed (Clause 1, Part 1, Article 9 of the Federal Law of December 29, 2006 No. 255-FZ; clauses 40, 41 of the Procedure for issuing sick leave, approved by order of the Ministry of Health and Social Development of Russia No. 624n; letter of Rostrud dated June 1, 2012 No. PG/4629-6-1).

Features of paying sick leave for child care

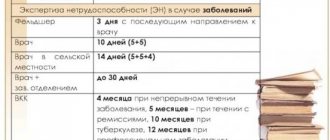

In addition, there are also features related to determining the percentage of average earnings used in calculating benefits and the number of paid sick days. For these purposes, it is necessary to take into account the age of the child, as well as the nature of his illness and treatment (Clause 5, Article 6 of Law No. 255-FZ).

The limit of paid sick leave days is determined by the child’s age. It is determined at the beginning of the year.

The nature of the disease is determined by the code indicated in the field of the sick leave certificate “Cause of disability”:

- 09 – caring for a sick family member with a common illness or injury;

- 12 – disease included in the special List, approved. by order of the Ministry of Health and Social Development of February 20, 2008 No. 84n;

- 13 – disabled child;

- 14 – post-vaccination complication or malignant neoplasm;

- 15 – HIV-infected child.

Sick leave for care with codes 13–14 is paid according to the same rules, regardless of the age of the children until they reach 18 years of age.

Whether the child was in a hospital or treatment was carried out on an outpatient basis will also be clear from the sick leave. For inpatient treatment, the line “Stayed in the hospital” will be filled in and the dates of stay in the hospital will be indicated.

Functions of disability codes

The main function of codes on a sick leave certificate is to protect medical confidentiality. However, this is not the only reason why they were approved for the entire territory of the Russian Federation. Other features are:

- optimization of the work of the personnel and accounting departments (funds are accrued using two-digit or three-digit codes for periods of absence from work);

- saving space on the form (some names of diseases are too long);

- opportunity to work internationally.

All ciphers are developed in accordance with international standards. If a person was undergoing treatment abroad, the code for the cause of disability will be the same for countries participating in international cooperation. This significantly simplifies the work of medical institutions, as well as the HR department in the organization.

Sick leave for caring for a child under 7 years of age

The maximum number of days to care for a sick child under 7 years of age, which must be paid during the year, is (Part 5, Article 6 of Law No. 255-FZ):

- if the code “09” is indicated in the “code” field on the sick leave certificate – no more than 60 calendar days;

- if the code “12” is indicated in the “code” field on the sick leave certificate – no more than 90 calendar days.

The number of paid days for each case of illness within these time limits is not limited.

The employee must be paid benefits in the following amounts (clause 1, 2, part 3, article 7 of Law No. 255-FZ):

- when treating a child on an outpatient basis in the amount of:

— 60, 80 or 100 percent of average earnings, depending on the employee’s insurance coverage, for the first 10 calendar days of sick leave;

- 50 percent of average earnings - for the following days;

- when treating a child in an inpatient setting - in the amount of 60, 80 or 100 percent of average earnings, depending on the employee’s insurance length for all days subject to payment.

EXAMPLE OF CALCULATION OF SICK LEAVE FOR CARE OF A CHILD UP TO 7 YEARS OLD WITH A GENERAL ILLNESS The employee’s insurance period is 7.5 years.

Her average daily earnings for the purpose of calculating temporary disability benefits is 1,400 rubles. The employee was on sick leave to care for a five-year-old child from May 5 to May 19, 2021 (15 days). The child was treated on an outpatient basis. Before this, during 2021, the employee was already on sick leave to care for the same child: - from January 9 to January 24 (16 days); - from March 17 to April 3 (18 days). Since the beginning of the last sick leave (May 5), the total number of days of benefit payment since the beginning of the year was 33 days. (16 days + 17 days). Therefore, the employee needs to pay for all days of her last sick leave. At the same time, she will be able to pay for another 12 days before the end of the year. (60 days – 33 days – 15 days). For the first 10 days of the child’s illness, the benefit amount will be 11,200 rubles. (RUB 1,400 × 80% × 10 days), for subsequent periods – RUB 4,900. (RUB 1,400 × 50% × 5 days). The total amount of the benefit is 16,100 rubles. (RUB 11,200 + RUB 4,900). If a child suffers from a particularly serious illness and at the same time falls ill with common colds or acute respiratory viral infections, when paying for sick leave, the maximum limit of paid days is taken as the maximum, that is, 90 calendar days. But at the same time, sick leave with codes 09 is paid only until the total number of sick days (both with code 09 and code 12) reaches 60 calendar days. Further, only sick leave with code 12 is subject to payment.

EXAMPLE OF DETERMINING THE NUMBER OF SICK DAYS FOR CARING FOR A CHILD WITH ILLNESS ACCORDING TO CODE 12 The employee’s child is 5 years old. In connection with the illness of a child suffering from a serious illness from the List, she was issued sick leave from May 5 to May 19, 2021 (15 days) - in connection with a common illness (code 09). As of May 5, 2021, she had already been paid 50 calendar days for caring for a sick child, both for ordinary illnesses and for the disease specified in the List. The total number of sick days to pay for sick leave due to a common illness (code 09) will be 65 days. (50 days + 15 days). This means that only 10 days of the last sick leave are subject to payment, 5 calendar days of sick leave are not paid (65 days - 60 days).

Cause of disability 05 and 020

The initial sick leave is issued with code 05. Later, the employee can submit the following sheet, which will indicate the reason for disability 05 and additional ones. code 020. This is how the form is filled out when a woman should be granted additional maternity leave. This is a continuation of the insured event established in the first sheet; it is issued the next day after the end of the previous vacation.

In what cases is an increase in maternity days issued:

- if instead of one expected child, 2 or more babies were born;

- complications arose during childbirth.

Sick leave with the disability reason code 05 020 in the first case is issued for 54 days, in the second - for 16. In fact, this means that the woman needs additional leave, which the employer is obliged to provide her.

Sick leave for caring for a child aged 7 to 15 years

The maximum number of days to care for a sick child from 7 to 15 years old, which must be paid during the year, is 45 calendar days (Part 5, Article 6 of Law No. 255-FZ). At the same time, the number of paid days for each case of illness is limited to 15 calendar days.

The employee must be paid benefits in the same amount as when caring for a child under 7 years of age (clause 1, 2, part 3, article 7 of Law No. 255-FZ):

- when treating a child on an outpatient basis in the amount of:

— 60, 80 or 100 percent of average earnings, depending on the employee’s insurance coverage, for the first 10 calendar days of sick leave;

— 50 percent of average earnings for the following days;

- when treating a child in an inpatient setting - in the amount of 60, 80 or 100 percent of average earnings, depending on the employee’s insurance length for all days subject to payment.

EXAMPLE OF CALCULATION OF SICK AWAY FOR CARE OF A CHILD FROM 7 TO 15 YEARS OLD DURING INPATIENT TREATMENTThe employee’s insurance period is 7.5 years.

Her average daily earnings for the purpose of calculating temporary disability benefits is 1,400 rubles. The employee’s child is 8 years old. She was on sick leave to care for this child from May 5 to May 21 (17 days). The child was in the hospital. Before this, during 2021, the employee was not on sick leave to care for a child. By the day the sick leave began (May 5), the total number of days of benefit payment since the beginning of the year is the maximum amount - 45 days. However, only 15 days are payable. sick leave. The benefit amount will be 16,800 rubles. (RUB 1,400 × 80% × 15 days). It happens that on sick leave to care for a child, only a portion of the days are spent on inpatient treatment. You need to keep track of days spent on different treatments separately.

EXAMPLE OF CALCULATION OF SICK AWAY FOR CARE OF A CHILD FROM 7 TO 15 YEARS OLD DURING OUTPATIENT AND INPATIENT TREATMENT The employee’s insurance experience is more than 7.5 years. The limit of paid days on sick leave for child care for the year has not been exceeded. The employee’s child is 8 years old. She was given sick leave to care for this child from May 5 to 21 (17 days): - for 3 calendar days from May 5 to 7 - for outpatient treatment; - for 8 calendar days from May 8 to 15 - for inpatient treatment; - for 5 calendar days from February 20 to February 25 - for outpatient treatment. All sick days are subject to payment in the amount of 80 percent of the employee’s average earnings, since the 10-day limit of days paid based on length of service for outpatient treatment has not been exceeded.

Possible error codes

The employer will receive information about the certificate of incapacity for work only with a certain status.

Otherwise, the protocol will be returned - sick leave is unavailable due to an error and its code. To understand the reason, refer to the list of statuses of the electronic certificate of incapacity for work. Decoding status codes

| Code | Explanation |

| 010 | Open |

| 020 | Extended |

| 030 | Closed |

| 040 | Sent to ITU |

| 050 | Supplemented with ITU results |

| 060 | This means that the sick leave is filled by the policyholder |

| 070 | The PVSO register has been transferred (this code is used in the regions of the pilot project for direct payment of benefits from the Social Insurance Fund) |

| 080 | Benefit paid |

| 090 | Canceled |

The electronic number that is still being processed at a medical institution has limited access, which means status 010 in the email. sick leave, as well as 020, 040 and 050. Neither the employee nor the employer will be able to see this sheet until the registration is completed by the medical institution.

Sick leave for caring for a child aged 15 to 18 years

The maximum number of days to care for a sick child, which must be paid during the year, in this case is 30 calendar days (Part 5, Article 6 of Law No. 255-FZ). At the same time, the number of paid days for each case of illness is limited to 7 calendar days. Such sick leave is paid in the amount of 60, 80 or 100 percent of average earnings, depending on the employee’s length of insurance for all days subject to payment.

EXAMPLE OF CALCULATION OF SICK LEAVE FOR CARE OF A CHILD FROM 15 TO 18 YEARS OLD The employee’s child is 16 years old. She was given sick leave to care for this child from April 18 to April 24 (7 days). The average daily earnings of a female employee is 1,400 rubles, the insurance period is 7.5 years. The benefit for 7 days of sick leave will be 7,840 rubles. (RUB 1,400 × 80% × 7 days).

note

According to the rules according to which sick leave is paid for caring for a child from 15 to 18 years old, sick leave is paid for caring for any adult family member.

2-NDFL no more

In 2021, instead of 2-personal income tax, employers will issue employees a new form, “Certificate of income and tax amounts of an individual.” A separate report no longer exists; the certificate has become an appendix to the calculation of 6-NDFL, which is submitted annually. The format and procedure for filling out the new form were approved by Federal Tax Service order No. ED-7-11/753 dated October 15, 2020, which states which sick leave code in the 2-NDFL certificate to indicate to tax agents.

The new application from 6-NDFL and the previous form 2-NDFL differ slightly. The new form no longer contains fields for entering data about the tax agent; they are indicated on the title page of 6-NDFL. The field “Amount of tax not withheld by the tax agent” was removed and a new separate section 4 “Amount of income from which tax was not withheld by the tax agent and the amount of tax not withheld” was introduced. In section 3 on deductions, fields have been added for entering information about notifications from the Federal Tax Service.

The procedure for coding income has changed slightly, but the sick leave code in the 2-NDFL certificate has not changed in 2021.

For more information about the design of the new form - “Certificate 2-NDFL in 2021: form, codes and procedure for issuing to employees.”

Sick leave for care with codes 13, 14 and 15

The maximum number of days for caring for a sick disabled child (code 13), which must be paid during the year, is 120 calendar days. Moreover, the number of paid days for each case of illness within this limit is not limited (clause 3, part 5, article 6 of Law No. 255-FZ).

The maximum number of paid days on sick leave for child care with code 14 or 15 is not limited.

In each case, the employee must be paid benefits in the same amounts as when caring for a child under 7 or 15 years old (clause 1, 2, part 3, article 7 of Law No. 255-FZ).

And who will pay?

Previously, all payments for sick leave, including those with cause of incapacity 05, were made by the employer. Now, since 2015, a pilot project of the Social Insurance Fund has been operating. According to it, he pays only for three days, provided that they use the code 01, 02, 06, 10, 11, 12, 13, 14, 15.

The remaining portion exceeding this period is paid by the Social Insurance Fund. To do this, the employer sends data on sick leave, as well as the amount of earnings to the fund for payment.

How is the calculation made for code 05? The entire amount is paid by the Social Insurance Fund. The employee must bring a certificate of incapacity for work, drawn up in accordance with all the rules, to the accounting department. Next, fill out the application. It contains the employee’s data, details for transferring benefits, as well as some information about sick leave. Within five days from submitting the application, the employer is obliged to transfer all data to the Social Insurance Fund. They, in turn, pay sick leave for twelve days. You should check your details carefully! You can receive benefits to a bank account, to a salary card, or by postal order.