Now, having worked for 35 years, a pensioner has the right to claim an additional payment to the basic benefit. It is worth noting that the longer the work experience, the greater the additional payment to the pension.

The influence of the number of years worked by citizens on the increase in pension funds

The new program for calculating pensions is aimed by the state to ensure that the population is interested in increasing their work experience. This is expressed in the form of bonuses for work of 35 years or more (find out what kind of pension the state has prepared for Russians with 35 years of service or more). Additional pension points are awarded according to a certain scheme :

- Women and men who have worked for 30 and 35 years receive 1 bonus point for each year in excess of the indicator.

- Activities for 35 and 40 years entitle you to an additional 5 points.

Additional pension payments are not always greater for those who have devoted many years to work. The amount of the bonus is influenced by the level of average wages.

So, for example, if one pensioner worked for 43 years, and the level of white wages did not exceed the minimum, the pension may be significantly lower than that of a pensioner who worked 10 years less, but at the same time officially received a salary above the average. The amount and procedure for calculating additional payments are stipulated in Federal Law No. 400 of 2013.

What factors may influence the content of the list of benefits provided?

There are a number of factors that can have a significant impact on whether a particular citizen is provided with certain benefits or not. Such criteria include:

- the citizen’s membership in the group of federal beneficiaries (persons with disabilities and veterans);

- the place of residence of the pensioner, for example, in one region pensioners are completely exempt from paying land tax, but in another, only a 50% discount is provided;

- place of employment or affiliation with a specific department. It is worth noting here that the benefits for pensioners of the Ministry of Internal Affairs are more extensive than, for example, for teachers or medical workers. If an employee has 20 years of pure military experience, then he can retire at any time, regardless of age.

All these parameters influence what benefits and privileges pensioners are entitled to receive after entering their well-deserved retirement after their years of service.

How much work do you need to do to receive the minimum payment?

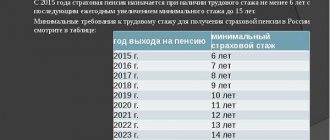

In Soviet times, to obtain the right to a pension, a person had to work for at least 25 years (how to correctly calculate pension points for Soviet experience?). Later, the government of the Russian Federation established that the minimum work experience is 5 years. With the latest reforms, the government decided that Russian citizens need to work for at least 15 years to qualify for a pension .

The rules for calculating length of service have also changed. Now, studies at a higher educational institution will not be taken into account, but maternity leave and military service will also be counted towards work experience.

Compensation for landline telephone

You should find out about compensation for a landline telephone in the regions from the social security authorities at your place of residence.

In Moscow, compensation for telephone payments is assigned to those pensioners who belong to one of the following categories:

- home front workers;

- veterans of labor or veterans of military service (including veterans of labor and veterans of military service of pre-retirement age - 55 years for women and 60 years for men, who received status in order to provide additional social support measures);

- rehabilitated persons;

- disabled people of the Great Patriotic War, disabled combat veterans and persons equivalent to them;

- participants of the Great Patriotic War;

- persons awarded the badge “Resident of besieged Leningrad”;

- persons awarded the medal “For the Defense of Moscow”;

- visually impaired people of the 1st group;

- non-working pensioners who have dependent children under 18 years of age;

- single pensioners (women over 55 years of age and men over 60 years of age), families consisting only of pensioners (women over 55 years of age and men over 60 years of age).

You can find out the current amount of compensation on the website of the Moscow Department of Labor and Social Protection.

Increases for work carried out beyond this period

If you have 30/35 years of experience (for women and men, respectively), the state expects to award bonuses in the form of additional points, which are taken into account when calculating pension payments. As mentioned above, when a person works for more than 35 years, 1 point is awarded every subsequent year . If a citizen has worked for 35/40 years, then the bonus is 5 points.

Activity over 45 years plays virtually no role when calculating such bonuses. In addition, benefits for long-term work at one enterprise have been abolished.

Will everyone have them and from when?

Working for 35 years or more does not guarantee receiving decent pension payments . This is directly related to the contributions made by employers.

If there were no such deductions (i.e. the work was unofficial) or they were insignificant (the “white” salary was less than actually due to the employer’s evasion of paying full taxes), there is no need to count on additional payments. Only those individuals who worked officially and did not hide their real income from the state will be able to see a significant difference.

Is it available to those who are already receiving pension payments?

Women and men who have worked for more than 35 years and are already receiving a pension have the right to claim additional accruals. So for their work activity they will receive an additional 5 additional points. When calculating, it is worth remembering that the time spent on parental leave is taken into account in full if the total amount does not exceed 4.5 years.

Procedure for appointment and registration

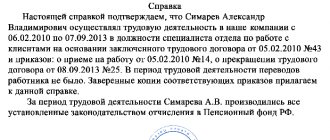

To receive a pension supplement, you need to visit the Pension Fund with documents:

- passport;

- personal account insurance number (SNILS);

- pensioner's ID;

- work book;

- other documents confirming work activity.

A PF employee accepts a package of documents from the applicant and, within a specified time, checks them for the possibility of accruing additional payments to the pension.

In cases of refusal to a person who applied to the Pension Fund, a meaningful response is drawn up as to the reason for the refusal of additional benefits and how the decision can be appealed.

Reasons for refusal to receive additional payment may include::

- providing false or incomplete data;

- clarification of the fact that during the period of employment the employer did not make contributions to pension and other funds for employees;

- not developing experience;

- performance of work or other activities during the period of which the recipient is subject to compulsory pension insurance - Federal Law No. 167 of December 15, 2001.

To prevent such incidents from happening, it is important to correctly calculate the length of service and provide only reliable and complete information to the Pension Fund. If a refusal is received for unknown reasons, it is recommended to apply for benefits to a higher authority.

If you receive an unreasoned refusal, it is recommended to immediately file a lawsuit with the provision of all documents and a written refusal from the Pension Fund.

Dependence of pension on length of service

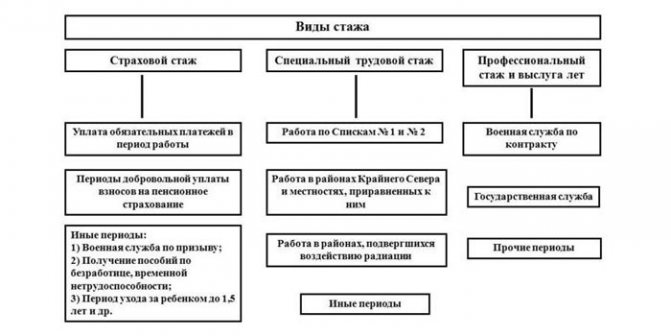

According to Russian pension legislation, citizens are awarded an insurance, state or social pension. Work experience is important when assigning only an insurance pension. For the state, length of service is taken into account, and social is assigned even to those who have not worked at all.

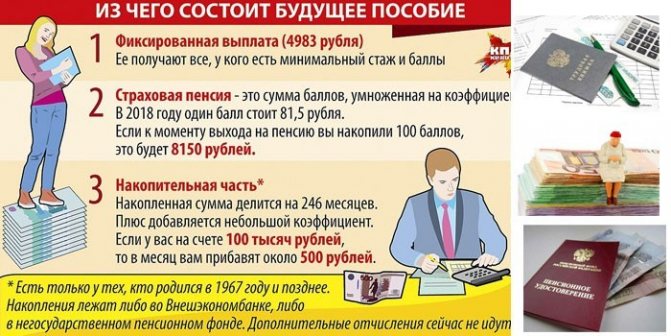

The amount of pension insurance is calculated for each applicant individually. It consists of two main parts:

- a fixed payment, the amount of which is determined for each category of applicants by decree of the Government of the Russian Federation;

- insurance part (individual pension coefficient multiplied by the cost of one pension point).

In 2021, to assign a monthly payment, you must have an insurance period (the time during which the employer made insurance contributions to the Pension Fund) of at least 10 years and an individual pension coefficient (sum of pension points) of at least 16.2.

The duration of official employment affects the possibility of receiving a bonus in the following cases:

- there is unaccounted experience due to the lack of supporting documents;

- the citizen continues to work after entering a well-deserved retirement;

- deferred retirement (for each year an increasing coefficient is applied to the fixed payment and the insurance part);

- The number of years worked allows you to receive the title “Veteran of Labor”.

What is included in work experience?

It is important to distinguish between the concepts of labor and insurance experience. The first is applied when assessing the pension rights of an applicant who was listed as employed before January 1, 2002. The length of work experience affects the calculated amount of the pension, which is subsequently converted into pension points using a special formula.

After January 1, 2002, the amount of the pension is affected by the amount of insurance contributions paid by the employer. From this moment on, the concept of “insurance period” appears.

When calculating it, all periods of official work during which the Pension Fund received contributions from the employer are taken into account. Additionally, the so-called “non-insurance periods” are taken into account. This is the time when a citizen did not work due to certain circumstances:

- military service as a conscript soldier;

- maternity leave to care for a child from birth to one and a half years (no more than 6 years in total);

- caring for a disabled child, a citizen over 80 years of age or a disabled person of group 1;

- the time of serving the criminal sentence, if the person was subsequently rehabilitated;

- period of residence abroad if the spouse is a member of a diplomatic mission (no more than 5 years in total);

- time spent with a military spouse in an area where it is impossible to find employment in a specialty (maximum 5 years);

- receiving compulsory social insurance benefits during a period of temporary disability;

- time of receiving unemployment benefits;

- participation in paid public works.

The following periods are not taken into account when calculating the length of insurance that gives the right to receive additional payment:

- off-the-job training;

- caring for a child over 1.5 years old;

- lack of official employment without registration at the labor exchange;

- unofficial work activity.

- What benefits will cease to apply on April 1

- Which pensioner will have their pension increased to 30 thousand rubles?

- Redcurrant Pie

What is required in the law on benefits in Russia?

In a world of rising prices, living on one pension is quite difficult. In this regard, the state has identified a number of measures to improve the standard of living of citizens who have reached a certain age.

The procedure for paying cash benefits or providing privileges is determined by Federal Law No. 400 of December 28, 2013 “On Insurance Pensions.”

List of federal benefits provided in old age

According to federal law, a pensioner is entitled to four categories of benefits:

- social: travel on public transport;

- medical: provision of medications free of charge or at a significant discount;

- pension: has the opportunity to submit an application to the Pension Fund with a request to recalculate individual points accumulated during work after retirement;

- tax concessions: exemption from personal income tax on pensions.

What regional benefits are available to old-age pensioners?

In the regions, old-age pensioners are entitled to the following benefits:

- monthly cash payment (MCV);

- compensation for part of the costs of housing and communal services and major repairs (usually 50%);

- compensation for travel expenses in urban and suburban public transport;

- reimbursement of costs for landline telephone communications;

- free dental prosthetics and denture repairs;

Benefits are also provided to veterans of labor and armed conflicts, as well as family members of deceased war participants, home front workers, and pensioners over 80 years of age.

What social benefits are available when retiring in old age?

A citizen has the right to expect compensation for part of the costs of housing and communal services and public transport. Those who have an income below the subsistence level are paid an additional social supplement at the regional level.

A citizen who has completed his working career and lives in the Far North is compensated for travel to vacation spots throughout Russia.