What is the minimum length of service for pension payment?

Work experience is the total duration of work and other activities. For the payment of a pension, the insurance period is important, i.e. the periods of time when a person received income and the employer made contributions to the Pension Fund for the person. If it is less than established by law, then he will not be able to be assigned an old-age insurance pension.

The minimum period of work is not the only condition for assigning insurance pension payments. In the Russian Federation, the so-called point system is used. A person needs to score a certain number of points (receive the appropriate individual pension coefficient (IPC)), otherwise, even if he has the required period for paying insurance premiums, he will not be assigned an old-age insurance pension.

It is also useful to read: How pension points are calculated

Important! Disabled people receive insurance pension payments provided they work at least 1 day.

The system with points and insurance (work) experience began to be used in 2015. Before this time period, different rules applied.

It is also useful to read: How to increase pension points

What to do if you don’t have enough experience?

There is no need to despair. In this case there are two ways. Firstly, if a citizen has reached retirement age, but does not have enough experience, then he can simply buy more. Each year of experience will cost 29,779.20 rubles, for an individual entrepreneur - 29,354 rubles.

You can deposit this money in installments. Whether this will be beneficial must be considered in each specific case. If you are just a few years away, then this scheme is definitely a good option.

If you do not want to pay the state for not working the required 15 years for your retirement pension, there is a second option for you. You have the right to count on social benefits. However, to receive it, there are a number of conditions:

- you need to reach the age of: women - 65 years, men - 70;

- do not officially work anywhere.

If an elderly person decides to work, he will lose his social pension. However, if he ends his working career, he can re-submit documents for payment.

Sources:

Law on labor pensions in the Russian Federation

Assignment of social pension

Types of work experience

Russian legislation regulating pension payments actively uses the concept of seniority. But it is necessary to take into account that there are different types of it, each of which plays an important role in certain situations.

The following types of work experience are distinguished:

- General – takes into account the total duration of work or activity useful to society. Calculated on a calendar basis. Actively used until 2002.

- Insurance – the total duration of activity when insurance premiums were paid. This is what is used now when determining the possibility of assigning a pension.

- Special – periods when a person worked in a profession or under conditions that provided for the assignment of pension payments on preferential terms or in a special manner. Plays an important role in determining the start time of payments. It includes a significantly limited list of activities.

- Continuous – the duration of continuous work at 1 enterprise or in several organizations, if the transition period does not exceed the norms established by law. Currently, this concept has been completely eliminated in the pension system.

It is also useful to read: How to calculate total work experience

The most important factors for assigning pension payments are insurance and special service. The age at which a person can retire and various payment parameters directly depend on them.

Length of service refers to special length of service, but it in itself is a legal fact sufficient to assign a pension. If you have the required length of service, the person’s age and other parameters will not be important for assigning a pension.

Read more: What is length of service?

Do you always have to wait until retirement age?

As we said above, as a general rule, men retire at 65, women at 60. But you don’t always have to wait until this age to receive a pension. To retire earlier, you need to be:

- A pilot on a civilian ship. He can retire at 50;

- A doctor or a teacher. To do this, you need to work in the village for 20 years or in the city for 30 years;

- An employee of the Ministry of Emergency Situations or the fire service. A man with 25 years of experience will be able to retire at 55, and a woman with 20 years of experience will be able to retire at 50;

- Employee of the textile industry. He has the right not to wait until retirement age if he has worked for 20 years;

- Miner. Men can rest from the age of 50. However, they need to work in the mine for at least 10 years, and the total experience must be 20 years. Women are entitled to a pension at the age of 45, but they need to work for 15 years, including at least 7.5 years as a miner;

- A mother who raised three or four children. She is entitled to a pension at age 57.

- A mother who has raised five or more children - at 50 years old.

In addition, northerners can count on early retirement (but they still need to work for 15 years). Men - at 60 years old, women at 55. However, if a worker has two or more children, she can go on vacation already at 50.

What is the minimum length of service for calculating a pension in Russia?

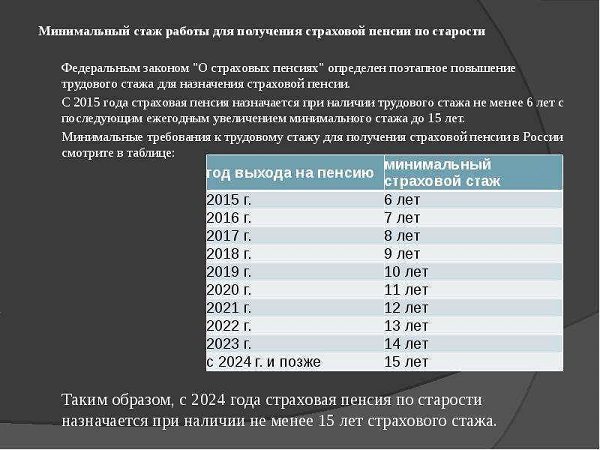

Initially, the system of calculating pensions based on length of service and points began to be used in 2015, but the transition to it is being carried out gradually. Every year the number of points increases, and the period for payment of insurance premiums for retirement increases.

If in 2015, 6 years of payment of insurance premiums and 6.6 points (coefficients) were enough to receive, then in 2021 the requirements are already much higher - 10 years and 16.2 points. In 2024, the requirements for the period for payment of insurance contributions reached its maximum - 15 years (in this case it will be necessary to have at least 28.2 points), and in 2025 the transition to a new system for assigning pensions will be fully completed, and the requirements for the coefficient will increase to the maximum - thirty.

Table. Requirements for the minimum duration of periods for paying insurance premiums and the individual coefficient in different years.

| Year of retirement | Minimum IPC value (points) | Requirements for the duration of payment of insurance premiums (years) |

| 2015 | 6.6 | 6 |

| 2016 | 9 | 7 |

| 2017 | 11.4 | 8 |

| 2018 | 13.8 | 9 |

| 2019 | 16.2 | 10 |

| 2020 | 18.6 | 11 |

| 2021 | 21 | 12 |

| 2022 | 23.4 | 13 |

| 2023 | 25.8 | 14 |

| 2024 | 28.2 | 15 |

| 2025 | 30 |

The minimum requirements for IPC and periods for payment of insurance premiums are the same for women and men. But one more condition is that the age attainment will vary.

Reference! In 2021, a law was passed to raise the retirement age. Now there is a gradual increase in it.

Women

Starting from 2021, there is a gradual increase in the age for determining payments from the Pension Fund for women. If before 2021 it was 55 years, then by 2023 it will reach 60 years. The retirement age is raised gradually - 1 year is added annually.

Women who, according to the old rules, were supposed to retire in 2021 and 2021, were given a small benefit. They will be able to arrange payments six months earlier than provided for by the new rules, i.e. at the age of 55.5 and 56.5 years, respectively.

For men

For men, the retirement age is also raised by 5 years. Until 2018, they could retire at age 60 according to standard rules, but from 2023 this will only be possible at age 65. The increase also occurs gradually - 1 year is added to the age of future pensioners annually.

In 2021 and 2021, benefits are also provided for the assignment of pensions six months earlier than required under the new rules.

New requirements for retirement

In 2021, the age limit was raised to 60 for women and 65 for men who are entitled to an old-age pension.

But the fact of reaching the established age is not yet a sufficient basis to count on the accrual of an insurance pension. In addition, the pensioner will have to accumulate the necessary work experience to calculate a pension and accumulate approved points in the form of an individual pension coefficient (IPC). Minimum length of service for calculating an old-age pension:

- from 2021 it is set at 10 years,

- from 2024 this value will increase to 15 years.

The minimum length of service is the same for everyone, regardless of the gender of the pensioner.

The pension coefficient for a pensioner will be:

- for 2021 - 16.2 points,

- and by 2025 the number of points will increase to 30.

Disabled persons who have a work (insurance) length of service starting from one day and above are assigned an insurance pension. If a disabled person cannot prove his work experience, he will have to rely only on social benefits.

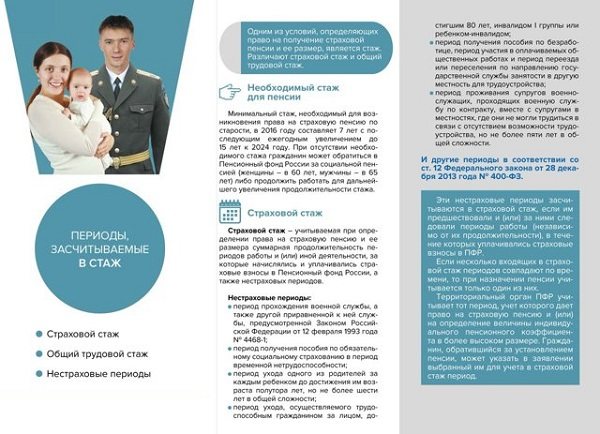

What periods of work experience are taken into account?

The work experience takes into account according to standard rules the periods when contributions to the Pension Fund were made. This reflects the essence of the ongoing reforms, as a result of which pension provision will have to be based on the insurance principle.

Typically, contributions to the Pension Fund per person are paid by the employer. This rule is met if the citizen is officially employed and the employing organization makes all transfers to extra-budgetary funds required by law. All funds received from the employer are accounted for in a separate personal account, and point coefficients are calculated based on their amount.

All reports to the Pension Fund for the correct assignment of pension benefits in the future are also submitted by the employer. The citizen himself can at any time request from the Pension Fund a certificate of his personal account and find out about the accumulated coefficients and other important information.

Important! If a person operates as an individual entrepreneur, then he pays contributions to the Pension Fund for himself.

Read more: Individual entrepreneur pension

Additional time is included in the length of service when a person is on sick leave, on leave to care for a child up to 1.5 years old, or undergoing military service. If a citizen has to care for a disabled child, an elderly relative, etc., then this time will also be included when calculating the insurance period.

Read more: Is maternity leave included in seniority?

This video talks about periods of work and other periods that are counted towards the insurance period for a pension:

What counts towards experience?

To receive a pension, your length of service also takes into account some periods when you did not work at all. These include:

- military service by conscription;

- child care up to 1.5 years old. If there are several children, then in total no more than 4.5 years;

- caring for a disabled person of group I, a disabled child or an elderly citizen over 80 years of age;

- living with a military spouse if he/she is serving in a place where it is impossible to find a job (no more than five years in total);

- living abroad with a spouse if he/she works at a consulate, diplomatic or trade mission of Russia.

However, for this experience to be included, you need to work officially before or after. For those who neglect this rule, this unearned time will not be counted for calculating the pension.

These periods also affect the amount of payments. For example, for 1 year of military service or caring for a disabled relative, 1.8 points will be awarded. If you were babysitting, you will receive the same point for a year of vacation for 1 child. Accordingly, for two children - 3.6, for three - 5.4.

But studying at an institute or technical school is not included in the length of service required to receive a pension. The government believes that those who receive education will earn good money and will catch up with the scores of those who did not study.

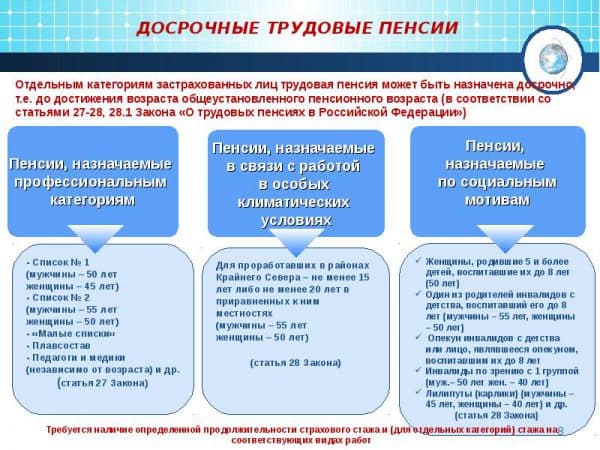

Who can apply for an early retirement pension?

Although the state is raising the retirement age, benefits have been maintained for many categories of the population. They allow you to count on the assignment of collateral from the Pension Fund much earlier.

The main types of benefits for early registration of a labor pension:

- Professional. If a person works in difficult and/or dangerous conditions, then he may be granted the right to receive security from the Pension Fund of the Russian Federation earlier than generally established norms. For example, miners or workers in hot shops can take advantage of this benefit.

- Territorial. If a citizen works in the Far North, then he can count on the opportunity to finish his working career and retire before reaching the generally established age. These benefits are also available to certain other individuals.

- Social. Having a certain social status allows you to retire earlier than is established for citizens without such status. For example, mothers with many children, representatives of indigenous peoples, if they lead a traditional lifestyle, etc. have the right to take advantage of such a benefit.

Important! Having the right to benefits does not lead to exemption from the need to fulfill requirements for individual coefficients, deadlines for paying insurance premiums, etc.

There is no work, but the work experience is ongoing

Not only that, the law on insurance pensions (No. 400 of December 28, 2013) provided for the possibility of including in the length of service the following cases of forced cessation of work, however, provided that the person worked before and after such a “break”:

- time of military service;

- the period when the person was unemployed and received benefits;

- moving to a new place of work in the direction of the employment service;

- illness during which social benefits were paid;

- caring for children until they are one and a half years old (maximum six years; that is, caring for a fifth child will no longer be included in the experience);

- care for the elderly and disabled;

- lack of employment opportunity itself (applies to families of military personnel, diplomats and consular workers, but not longer than five years in total);

- time of cooperation with units conducting operational-search activities (provided that such cooperation was the main activity of the person);

- the period when a person was arrested or served a sentence (only subject to illegal arrest, prosecution and subsequent rehabilitation).

Is it possible to receive a pension if there is insufficient or no experience?

The Russian state is rightfully considered social. Even if a person has never officially worked in his life, and deductions have never been made for him to extra-budgetary funds, he will not be left without a means of subsistence in old age.

In the absence or insufficient experience, as well as in a situation where a person has no or insufficient points, he is assigned a social pension. It has several significant differences:

- Can only be assigned to disabled persons. It is impossible to work and receive social pension payments at the same time.

- The size of insurance pension payments, of course, will be greater than social ones. But it's still better than nothing.

- The age for assigning social benefits is higher. It is increased by 5 years and rises along with the standard age for assigning pension benefits.

Read more: Old-age pension without work experience

Having a certain length of work experience is an important condition for assigning pension insurance. If it is not enough, then the person can only count on social pension payments, which are assigned 5 years later. But we must not forget that in order to retire and receive the required monetary support from the state, other conditions must also be met.

How to calculate the length of work experience?

Until 2015, you only had to work for 5 years. After such work experience, you could well count on a pension. However, everything has changed. The government revised the law and decided from 2015 until 2024 to add one more year to the five-year length of service every year. For example, if your retirement age falls in 2020, then you need to work for 11 years.

Moreover, these rules apply to Russian citizens regardless of gender. There are no distinctions here, unlike the retirement age, which is:

- 65 years for men;

- 60 years for women.

If you retire after 2024, you will need to work for at least 15 years. In the case when you get legal rest earlier, you need less work experience.

The amount of your pension will depend not only on how much you worked, but also on the size of your “white” salary. Since the payment is formed from contributions that were made by the employer for you to the Pension Fund.

All calculations are made in points. To receive a pension, you need to accumulate at least 30. Naturally, the higher this figure, the more money will be transferred to you.