Refinancing involves full repayment of the mortgage loan by drawing up a new loan agreement on more favorable terms, possibly with another bank.

Military personnel who have already received a mortgage loan using NIS can refinance it in order to reduce the amount of monthly payments and overpayment on the loan (Resolution No. 370 of the Government of the Russian Federation).

From this article you will learn which banks refinance military mortgages and under what conditions this is done.

Reasons for refinancing a military mortgage

Refinancing a military mortgage loan has the following advantages:

- The loan amount for the purchase of residential property increases;

- The interest rate decreases;

- Credit terms change;

- Regular deadlines are aligned and changed;

- The client may be granted temporary holidays;

- Updating the bank and service system.

Refinancing may be refused in the following cases:

- Downsizing in the workplace;

- Debt amounting to less than 0.4 million or more than the military 2.4 million;

- The state cannot help the borrower, and the serviceman himself does not have enough money;

- Presence of arrears in the credit history.

Carrying out the process of refinancing a client is beneficial if the borrower has access to budget funds under the condition of participation in the savings mortgage system.

If you have a loan agreement drawn up before receiving government money (for the first 36 months of work in law enforcement), the loan will be renewed at a low interest rate at the initial stage.

conclusions

The presented material allows us to formulate the following conclusions:

- Refinancing a military mortgage is a profitable procedure that allows you to reduce the burden on the family budget.

- Additional expenses accompanying the transaction are paid by the borrower independently.

- The terms offered by lenders are almost the same. Only the analysis processes and automation of some actions differ.

- Contributions from the state to the savings system have not been indexed for the last few years.

- The review period in various organizations can be up to 5 days.

- Not all banks work with the program; at the moment the choice is very limited.

- Even though the premiums are paid from savings in the mortgage system, the lender may refuse to refinance.

Was the article helpful? Like and repost. The portal's lawyer on duty will help you sort out any unclear issues.

Read on for an interesting article about the savings system.

Conditions for refinancing mortgages in Russian banks

There are many financial institutions in Russia, and most of them provide on-lending services.

In large banks in the country you can get a new loan on top of the old one at the following interest rates:

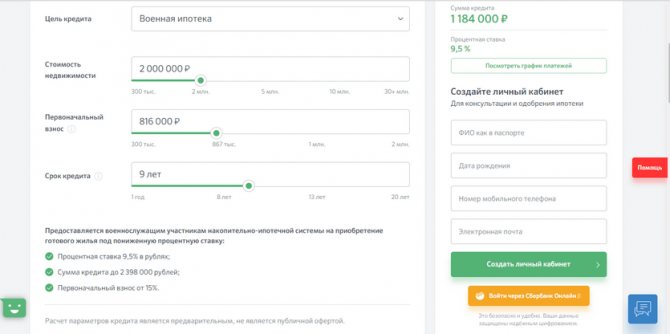

- at Sberbank, 9.5% will issue military mortgages;

- at VTB – 9.7%;

- in Otkritie – 10%;

- in Absolute – 10.9%;

- in SvyazBank – 10.9%;

- in UralSib – 10.9%.

Sberbank provides lower interest rates on loans and more often accepts applications from clients. VTB 24 offers additional benefits for military personnel in the form of a slight deferment. The terms of refinancing depend on the policy of the financial institution.

The main provisions in force in many banks include the following:

- Age restrictions. Minimum 21 years old, maximum 65;

- No delays;

- Having enough income to pay off the debt;

- Small financial burden.

In order for a loan to be refinanced, three parties are involved: the borrower and two banks.

Required documents and steps

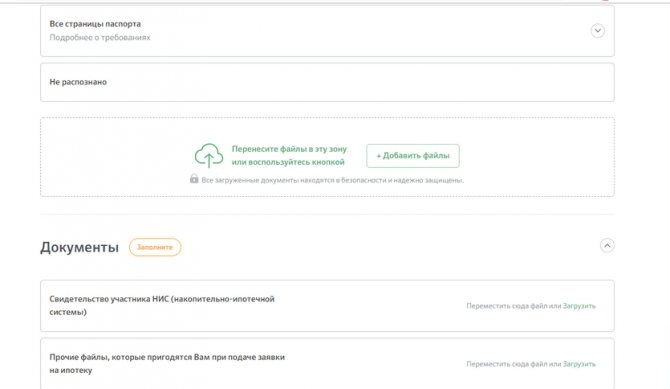

Before you begin the procedure for refinancing a military mortgage at a lower interest rate at Sberbank or another financial organization that works with such programs, you should collect a package of necessary documents:

- passport or similar document proving the identity of the applicant;

- a second such document (most often used is SNILS or TIN);

- certificate of income of the applicant;

- military ID;

- permit certificate for the savings system program;

- documents for living space, including a mortgage agreement;

- bank certificate about the loan balance.

An application is submitted to the bank after all documents have been collected. An application drawn up according to a bank template is attached to the package of papers. If the bank changes, then an additional agreement is drawn up. After everything is done and no problems have arisen, the organization issues a transfer to the old loan account, thereby closing it. For early repayment, a statement from the borrower is used, which confirms his intentions to close the debt earlier. If the bank has been changed, then confirmation of the closure of debt obligations will need to be provided from the first bank.

Options for refinancing a military mortgage in 2019

In the current 2021, military personnel have a great benefit in receiving money with two options: a reduced rate and an increased loan amount. A loan renewal must be made if a loan transaction has been concluded with another financial institution. The bank with which the new agreement is concluded transfers the money to another bank account.

Next, the loan payment will be sent to the new bank for a new payment. If the property was used as collateral, it is also transferred to the new bank.

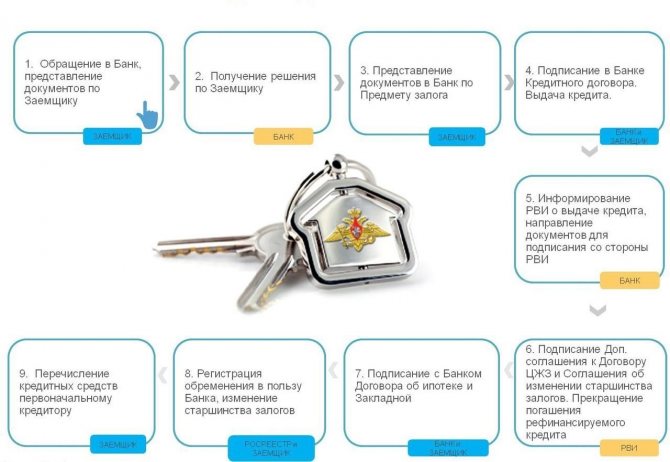

To carry out the procedure, the client goes through the following steps:

- The loan agreement is being studied and the possibility of refinancing is being explored.

- View the market and analyze competing banks. The conditions are studied mainly in Sberbank or VTB.

- Contacting a financial institution. A questionnaire is being written to obtain a housing loan from Sberbank or to discuss reducing the interest rate. If this program is not available at the bank, you should contact another financial institution that is ready to provide on-lending.

Then an agreement is concluded and funds are transferred from one bank to another.

How to submit an online application to the bank

Refinancing a military mortgage is getting a new loan at a lower interest rate. You can renew your loan agreement either at your bank or at any other bank that works with this program. As an additional option, you can increase the loan term in order to reduce the monthly payment amount.

You can make a preliminary application on the official websites of banks. Sberbank offers to make calculations using a calculator, register in your personal account, ask the necessary questions to a specialist and get approval immediately.

After making calculations on the website, you need to fill out information about yourself, passport data and attach copies of documents.

It’s all easy to do, and if you have any questions, you can write to the chat and get advice from a specialist.

Refinancing for the military at a lower interest rate

The loan renewal at a lower lending rate is carried out at the same financial institution. This process also has another name – contract recruitment.

See on the same topic: 13 percent refund from the purchase of an apartment in [y] year

If payment terms are maintained and the interest rate is reduced at the end of the loan, payments will not be reduced. People come to refinancing if it is not possible to pay regular payments under other conditions.

Recruitment is carried out after an application has been written and a decision has been received from the head of the bank. When contacting the bank, the following information must be indicated:

- Requests regarding payment changes;

- Information confirming the inability to pay the existing debt. For this purpose, documents are submitted in the form of certificates.

Few bank clients agree to refinance the mortgage and re-register documents for a slight reduction in interest. A large number of documents will be collected and approval is possible only in 70% of cases.

Which banks provide on-lending?

Attention! Refinancing a military mortgage can be done at many banks.

The largest ones include the following:

- Severgasbank – mortgage at 8.8% per annum up to a maximum of 3.010 million rubles.

- Otkritie Bank offers on-lending at a rate of 8.8% with a maximum amount of 2.8 million rubles.

- URALSIB - offers a rate of 9.4% with a loan of up to 3,159,716 million rubles.

- Absolut Bank - interest rate 9.95% per annum for amounts up to 2,656 million rubles.

- Rosselkhozbank offers refinancing at a rate of 8.4% for an amount of up to 2.7 million rubles.

- Gazprombank – on-lending at a rate of 8.5% in the amount of up to 2.97 million rubles.

- Promsvyazbank – refinancing at a rate of 8.2% for an amount of up to 3.065 million rubles.

- DOM.RF - at a rate of 9.1% in the amount of 2.758 million rubles.

- RNKB - at a rate of 8.65% in the amount of 2.946 million rubles.

- VTB - at a rate of 8.5% in the amount of 2.99 million rubles.

- Sberbank - at a rate of 8.8% in the amount of 2.629 million rubles.

Refinancing a mortgage after leaving military service

After a person is discharged from a military unit, the state budget will no longer receive payment for the mortgage. Therefore, the payment falls on the former employee. Due to the fact that the client changes his status, he will be able to qualify for other programs. Before contacting another bank, you should find official earnings.

On-lending is carried out in the following cases:

- Mortgage money was provided after accrual of funds from the state;

- The amount to pay off the debt to the military is paid independently.

The documents required for the procedure vary depending on the situation.

Step-by-step instruction

Let's look at the procedure for refinancing a military mortgage step by step.

- Selecting a creditor bank. As mentioned earlier, not all organizations provide the service; the offers are approximately in the same price range. At this stage, you should study the details of the procedure, review deadlines, and document requirements.

- Carrying out calculations. The borrower should decide on the parameters of the future loan. According to the rules of all banks, the amount of the new loan cannot exceed the outstanding balance on the existing military mortgage. Therefore, the borrower must decide what loan term will be most comfortable for him.

- Submitting an application form and a set of documents for approval of refinancing. Some banks allow you to send the kit remotely - by email or through special services. For example, Sberbank uses the Dom Click portal for communication between the bank and the borrower.

- Waiting for the bank's decision. The average processing time for an application is from 1 to 5 days. During this period, you can gradually begin to prepare a collateral review kit.

- Preparation of documents for the apartment. You will need to order a cost estimate and a current extract from Rosreestr. Preparation of the report takes about 5 days depending on the selected company. As for statements, some banks order an electronic version on their own through special access to the Rosreestr portal.

- Obtaining a decision on the collateral. Consideration of the possibility of pledging an apartment takes on average 1-3 business days. After receiving approval, preparations for the transaction begin.

- Opening a current account with a new lender. The operation is performed on the same day of treatment. A passport will be required. The documents will be prepared by bank employees.

- Coordination of the approved loan with Rosvoenipoteka. For approval, you must submit documents for the new loan - agreement and payment schedule.

- Registration of financial protection for the life, health of the borrower, as well as structural elements. When refinancing a military mortgage, you must purchase a new policy. The borrower can choose the company independently. Read more on our portal about the types of mortgage insurance and how to purchase a contract.

- Signing the documentation. The borrower is invited to a bank branch to conclude a mortgage agreement. During the transaction, the manager checks the original documents and explains further actions.

- Transfer of money to the previous creditor and early repayment of the debt. After signing a new agreement, the funds are sent to the previous lender. The payment is made using the previously provided details. Interbank transfers take place throughout the day. After receiving the money, the borrower submits an application for full repayment. Some banks allow you to submit an application through your personal account.

- Applying to the registration authority to remove the encumbrance and establish a new one in favor of the new creditor. Sets of documents for the registrar are prepared by bank employees.

Today there is no need to contact Rosreestr. Documents can be submitted through the MFC. You can submit two sets for registration at once. The process will take 15 working days. If an error is found in the documents, the registrar issues a suspension order for 30 days.

The entire procedure for refinancing a military mortgage will take about 1.5 months.

Appraisal of an apartment during refinancing

A mortgage loan involves an appraisal of the property. The procedure is carried out only by special companies recommended by lenders who issue a loan for a military personnel. The following documents are required for the assessment:

- Passport details of the person;

- The right to use real estate in the form of contracts;

- Technical documentation.

The work of a specialist costs 3-4 thousand rubles, and the verification process takes about a week. You can use the services of an independent appraiser or a bank appraiser.

Features of the loan program

The main source of housing purchases for military personnel is the savings-mortgage system, founded back in 2005. Last year, the amount of annual savings was about 260 thousand rubles, and the length of participation in the program had to be at least three full years. The funds that have been accumulated in the program are the basis for the down payment when purchasing residential space with a mortgage.

When a serviceman purchases an apartment, it remains pledged not only to the bank, as is the case with civilians, but also to the supervising organization - Rosvoenipoteka. The function of this service is to certify military personnel who wish to participate in or benefit from the accrual program. It is she who will pay 1/12 of the savings each month towards the mortgage. Today this amount is equal to 21,666 rubles. In simple words, Rosvoenipoteka pays this amount, and if a larger payment is required, the difference is paid by the borrower.

Recently, interest rates on housing loans have decreased. Therefore, many borrowers who entered into a debt agreement several years ago have a completely reasonable question about refinancing a military mortgage at a lower interest rate. But, unlike conventional civil lending, this targeted program has its own characteristics that should also be taken into account.

Documentation

The following documents are submitted:

- Additional agreement to the contract for a targeted housing loan. The agreement specifies the fact of replacement of the creditor bank. The document is needed in triplicate, signed by the serviceman.

- A copy of the updated loan agreement with a new payment schedule in one copy, certified by a bank employee.

- A copy of the contractual terms of the bank account where the money will be received in the form of one copy certified by the creditor. Paper will not be needed in all cases. The bank may have a direct agreement to credit money, about which the bank will provide information.

- Documentation in the form of copies that confirms the issuance of new loan funds. The document must be certified by the lender.

- Copy of passport data.

All documentation from the list can be completed at the banking institution where the additional transaction is concluded.

Refinancing procedure

In order for the terms of the mortgage to be revised, the borrower should contact the bank with a request to select a suitable refinancing scheme. The proposed conditions must be agreed upon with Rosvoenipoteka, the institution that controls the expenditure of funds under the state program for military personnel. To do this, you need to prepare a package of documents, including:

- passport;

- copies of previous and new loan agreements;

- planned mortgage repayment schedule;

- bank account details for transactions with targeted loan funds.

Rosvoenipoteka has the right to both approve a new loan and reject the application. The reason for refusal may be incorrect paperwork or lack of any documents.

What is the procedure

To refinance a military mortgage, follow these steps:

- The balance of the current loan is indicated (indicated online on the website or a bank statement is requested).

- The personal current rate for military lending is indicated (it is prescribed in contractual relations, and you can also contact the bank’s hotline).

- Selecting a suitable financial institution.

- Indication of your data. Age is an important characteristic. The bank may indicate a smaller amount for refinancing, so the additional payment will be made from personal money. Such actions of the bank are explained by restrictions on the age of military personnel.

- Choosing the most profitable loan products: in terms of interest, terms and other parameters. There is an automatic transmission of information about the reduction of credit and monetary benefits.

Depending on which bank was chosen, the client will be forced to go through the steps to conclude the transaction.

Possible reasons for refusal

Despite the fact that the debt is paid with public funds, the bank may refuse to refinance a military mortgage.

A negative decision is made based on a number of factors:

- There are arrears on an existing loan.

- Age approaching 50 years. The term for providing military mortgage refinancing is limited to the end of service.

There are situations when the bank approves the mortgage amount, but makes a negative decision on the apartment. Failure may be caused by:

- The presence of unregistered redevelopments.

- Carrying out redevelopment that cannot be legalized - dismantling part of the load-bearing walls, moving a wet point. When drawing up a report, the appraiser indicates the cost of legalization or makes a note about the impossibility of registration. To obtain approval, the comments must be corrected.

- Errors in registration documents.

Where to go - review of banks

A military mortgage has clear and understandable conditions: low interest rates, government assistance. But credit renewal occurs more often according to a different pattern. The same financial companies that help in obtaining military mortgages participate in the refinancing program.

You can apply for a new loan in the following banks:

- in Sberbank;

- at VTB24;

- Gazprombank;

- Bank Otkritie;

- RNKB;

- Bank Zenit;

- Uralsib;

- Absolutely;

- Rosselkhozbank.

There are also Home Mortgage Lending Agencies where mortgage refinancing can take place. These organizations are intermediaries who find offers from other banks that are convenient for the client based on their requests. Every year the list of banks expands, as do the opportunities for the military.

Transfer of loan to another bank

Last year was marked by a new opportunity that made it possible to transfer mortgage debt obligations to another credit institution. The essence of the procedure for refinancing a military mortgage, the conditions and stages are the same as during restructuring: the new bank allocates funds that cover the old debt, but a new agreement is opened with a smaller amount of payments to the account of another bank. The benefit of the financial organization is to receive interest for the use of its money.

Unfortunately, this option may already have some problems for registration in the case of military personnel. They are most often associated with the fact that before the mortgage is repaid, the owner of the apartment is also Rosvoenipoteka, since it is at the expense of this organization that all or most of the payment is repaid. Thus, it is impossible to carry out such transactions without notifying the state. This circumstance will not play a role if the payer is no longer a military personnel. After leaving the army, the state stops paying its share, which removes his right to mortgage the apartment.

Military mortgage insurance

Banks require insurance of the collateral for the loan, as well as the life and health of a person, regardless of the loan product offered. If a civil loan is issued, your risks are leveled by increasing the rate after refusing insurance. But in the case of a military mortgage, the loan may be refused if an insurance agreement is not signed.

Taking out real estate insurance for a military mortgage will allow the lender to prevent damage through fire, natural disasters and other misfortunes. The insurer is selected independently. But banks have partners who offer insurance without unnecessary document fees.

How to refinance a civilian mortgage to a military one

Military personnel can take out a mortgage on a general basis for various reasons. For example, they did not want to wait three years or decided to purchase real estate in other buildings than those offered by the program. Everyone makes their own decision. But in any case, when 36 months have passed since joining NIS, you can refinance the loan.

To do this, the following conditions must be met:

- The serviceman is the sole owner of the purchased housing.

- The borrower of the loan is the army man, and not his wife.

- The client has been a member of NIS for more than three years.

To change the terms of the loan, you must submit a corresponding application to Rosvoenipoteka. The appeal will be considered and a decision will be made on it.

If the mortgage amount covers the loan balance, then the mortgagee changes. Now the borrower will only have to pay to the state, and the loan will be repaid from budget funds.

If the loan balance is greater than the target program limit, then it must be repaid by the serviceman himself.

So, we can conclude that the transfer of a civilian mortgage to a military one is possible. They have no right to refuse a preferential loan.

Mortgage from SKB Bank

A serviceman will be able to receive a housing loan from this bank on the following conditions:

- interest rate 10.3% per annum;

- limit from 300,000 to 2,368,978 rubles;

- mandatory advance 20%;

- loan term is 20 years.

SKB-Bank will notify you of the decision on your application within two days.

So, you can convert a civilian mortgage to a military one at many banks. It must be remembered that there is a limit on the amount of the soft loan. On average, the size of a targeted loan does not exceed 2.4 million rubles. The debt must be paid in full before the military retires, that is, before the age of 45.

How is refinancing carried out?

The re-registration procedure depends on which bank the home loan was originally received from. If this institution operates the Military Mortgage program, then minor changes will need to be made to the loan agreement. In particular, indicate that the state will now pay the debt and change the interest rate.

If the borrower took money from a bank that does not issue a preferential loan, then changing the conditions will be more difficult. The client’s request will be considered individually and an appropriate decision will be made.

Which banks can change a civilian mortgage to a military one?

As part of the government program, many financial institutions provide loans to military personnel. Among them are market leaders Sberbank, VTB, Gazprombank, Rosselkhozbank, as well as such large banks as Severgazbank, Saratov, Sibsotsbank, Tavrichesky.

Important!

Choosing a new lender should be taken seriously. If a serviceman decides to retire early, he will need to repay the loan himself.

The terms and conditions for this product are shown in the following table.

| Bank | Rate, per annum | Maximum amount, rubles | Prepaid expense, % |

| Bank Russia | 9,5 | 2.5 million | 10 |

| Altaicapitalbank | 9,0 | 2 486 535 | 20 |

| VTB | 9,8 | 2.45 million | 15 |

| Bank "Saint-Petersburg" | 10,75 | 100 million | 15 |

| SKB-Bank | 10,3 | 2 368 978 | 20 |