What is included in the calculation

The final amount due to a person when he leaves his job includes:

- payment for the time actually worked;

- compensation for unfulfilled vacation;

- severance pay;

- other payments provided for by law and the employment contract (depending on the individual characteristics of each case of dismissal).

Moreover, if an employee has a debt to the company (and such cases are not so uncommon), then when calculating the calculated payments from the total amount, the amount of the debt is minus.

Debts are considered not only advances issued, but also days of rest actually not worked out, but taken towards the future vacation.

Employer's liability in case of non-payment

Upon dismissal, payment should be made on the last working day. Otherwise, the employer will be held liable.

This is important to know: What to do if the employer does not want to fire at his own request

Financial liability is assigned under Article 236 of the Labor Code of the Russian Federation. In case of delay in payments, the employer is responsible for issuing money with interest in the amount of not less than 1/150 of the current key rate of the Central Bank for each day of delay. Or he faces criminal liability under Article 145.1 of the Criminal Code of the Russian Federation, which provides for partial non-payment for more than three months:

- or deprivation of the right to hold certain positions for a period of up to 1 year;

- or forced labor for up to 2 years;

- or imprisonment for up to 1 year.

For complete non-payment for more than two months:

- or forced labor for a period of up to 3 years with or without deprivation of the right to hold certain positions;

- or imprisonment for a term of up to 3 years with or without deprivation of the right to hold certain positions.

What does the document provide?

If the request was made for reasons that previously prevented the receipt of a payment on the day of dismissal (for example, with a fixed-term employment contract, when its termination occurred during the employee’s illness), the employer is obliged to satisfy the request of the former subordinate within one day from the receipt of this document.

If the demand is made due to the employee’s disagreement with the settlement payments assigned to him, then the employer must without delay pay the amount that is not disputed by him, and the remaining money will have to be discussed in the labor inspectorate or court.

In this case, in court, the former employee of the company will have the opportunity not only to demand payments in full, but also compensation for their retention.

When is severance pay paid?

Article 178 of the Labor Code implies payment of severance pay in the following cases:

- Liquidation of company;

- reduction of employees according to the updated staffing table;

- refusal of an employee to perform job duties in the event of a significant change in them and changes in working conditions;

- conscription into the army;

- illness that prevents you from continuing to work.

The amount of these payments varies from payment for two weeks to payments for three months of work.

In case of non-payment of severance pay, the employee has the right to go to court, and if the decision is positive, the employer will pay the plaintiff not only the amount due, but also compensation for the delay.

Compensation is calculated using the formula:

unpaid amount (minus personal income tax) × rate of the Central Bank of the Russian Federation (you must select the desired period, since the rate changes frequently) / 150 × number of calendar days of delay.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

Waiting for a court decision is not a reason to refuse payments to an employee at all. The employer is obliged to pay the employee the amount that is “indisputable”; the rest is subject to a court decision.

Features of the requirement, general points

The requirement for payment upon dismissal can be written in any form - today there is no legally established unified form.

The document can be drawn up on a simple blank sheet of paper of any suitable format (A4 is usually used). You can write it manually or type it on a computer, but with subsequent mandatory printing - this is necessary so that you can put a personal signature on the request.

It is better to make the form in two identical copies . One should be given to the employer’s representative, the second should be kept with you (after having previously obtained the signature of the company representative on it to receive a copy). You should also ensure, if possible, that the claim has been recorded in the appropriate log book.

You should be extremely careful when drawing up the document, taking into account all its nuances and subtleties, not forgetting that this form may later be useful both in the labor inspectorate and in court or in the prosecutor's office.

Within what time and how should the money be paid?

Let's consider when the final settlement with the employee must be made, depending on the situation, but at the same time taking into account the requirements of current legislation.

When should the payment be given if the employee was absent on the last working day?

This situation is also discussed in Art. 140 Labor Code of the Russian Federation. It is indicated that the employer is given a day to make the calculation, but from the moment when the dismissed employee demands payment of funds. It turns out that the employee himself, after dismissal, must contact his former manager and demand that he make a settlement with him.

Read about what payments an employee is entitled to upon dismissal here, and from this article you will learn whether you can expect to receive a bonus after dismissal.

How to submit an application to receive payment?

This issue is not addressed in the legislation. It seems that the best thing to do is to submit a written statement with approximately the following content:

“I, Ivan Vasilievich Petrov, was dismissed from Magnat LLC at my own request on April 18, 2021. On the day of dismissal, I was absent from the workplace due to a day off, I ask you to make a full payment to me within the time limits established by labor legislation.”

You must include the date the application was written and a signature.

If desired or necessary, the application can be submitted not in person, but by mail or through a representative.

However, the former employee of the organization himself is interested in the issue of receiving funds. Therefore, it is better to contact the company’s office yourself. Most likely, the money will be issued immediately.

What if an employee wants to quit while going on vacation?

The situation is more difficult to interpret if the employee goes on vacation with subsequent dismissal. On what day is the employee paid in this case?

Art. 140 of the Labor Code of the Russian Federation, as noted, says that the calculation must be made on the day of dismissal or, if the employee is not in his place on that day, no later than the day following the date the dismissed person applied for the payments due.

Thus, the following logical conclusions can be made:

- If an employee is on vacation, his place of work must be retained.

- Accordingly, the calculation must be made after the vacation ends.

These conclusions are erroneous. In fact, vacation time is not taken into account. This follows from the provisions of Art. Art. 84.1 and 127 of the Labor Code of the Russian Federation. Thus, the employee has the right to receive all payments due on the last working day. Or the next day after he contacted the employer for a settlement, if the employee, for one reason or another, was not present at the workplace on the date of dismissal.

We recommend that you read our other articles about calculations upon dismissal:

- How is compensation calculated for unused vacation? Formulas used for calculations.

- Are taxes and contributions charged on compensation payments for unused vacation? How to correctly reflect this in reporting?

- What is severance pay, how much and to whom is it paid?

- How are personal income tax and insurance contributions for severance pay calculated?

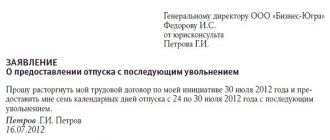

An example of drawing up an application for payment upon dismissal

The requirement has a completely standard structure and is not that difficult to compose. At the very top of the document (right or left, it doesn’t matter) it says:

- addressee - position and full name of the manager, name of the employing organization;

- Full name of the resigned employee, his passport and contact details (address and telephone number);

- date of preparation of the notification (it must coincide with the date of its submission to the interested party).

After this comes the actual demand (in the first person). Here you need to indicate:

- Full name of the applicant, his position while an employee of the enterprise, period of work in the organization and date of dismissal;

- the reason for which the demand is being made (i.e. write why the settlement payments were not received directly on the day of dismissal);

- if possible, provide some figures (for example, the amount that was accrued to the employee and the amount for which he is claiming).

It is good to support this document with links to the relevant articles of the Labor Code of the Russian Federation.

Finally, the requirement is signed and handed over to its destination.

How to make an application

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

Legislators have not approved a special form for such an appeal. Therefore, you will have to prepare your application in free time. However, when compiling, be guided by the following rules:

This is important to know: An example of pension indexation after the dismissal of a working pensioner

- The document can be handwritten or prepared using printing technology.

- In the header of the application, indicate the position and full name. the head of the employing organization, then write down the name of the institution.

- Now write down information about the applicant: full name, address, passport details.

- In the middle of the new line, enter the name of the document.

- We write the text of the document on a new line: we describe the essence of the appeal in detail. Be sure to write down the position of the dismissed person and the periods of his work in this institution. Then indicate the reason why you did not show up for the money on the appointed day, or write down a claim regarding disagreement with the amount of the estimated payment.

- List the documents that you are attaching to your application as confirmation. For example, indicate the number and date of the sick leave or the name and date of the mathematical calculation of the expected amount of payments.

- Put your handwritten signature and indicate the date the document was compiled.

Hand over the completed paper to the employer personally or hand it to his official representative. For example, give it to your secretary, HR officer or accountant.

How to submit a request

You can transfer the document to the employer in different ways:

- the most reliable and fastest way is best - personally from hand to hand to a responsible employee of the company right at his workplace;

- send the demand by mail - registered mail with return receipt requested - this method guarantees receipt of the letter by the addressee;

- It is also possible to send the demand with a proxy, but only on the condition that the representative has a notarized power of attorney in his hands.