Last modified: February 2021

The usual procedure for calculating wages is not enough; the organization has the right to take actions to increase the labor income of employees. Many employers use incentive payments, and their share of earnings can be significant. This fact forces us to study in more detail the procedure for calculating and assigning incentive bonuses to public sector employees. For them, incentive payments often make up a significant portion of their income.

Types of payments: incentive or compensation

The use of incentive payments is regulated by the Labor Code of the Russian Federation, the main document containing the norms of labor relations between management and employees.

Explanations of what applies to incentive payments are contained in the following provisions of the Labor Code:

- Art. 57 describes the basic principles for drawing up contracts with employees, including the requirement to indicate payment terms, including incentive payments, in the document.

- Art. 129 contains descriptions of what is included in an employee’s salary.

- Art. 135 establishes the obligation to record the conditions for calculating earnings and incentive payments in documents at the local level (internal regulations, orders, collective agreement).

- Art. 191 determines the rules for processing labor incentives from employers to employees.

Incentive payments are incentives that increase the value of the current employer in the eyes of employees. Labor legislation describes general standards for calculating the income of employees, however, it is impossible to provide for all cases within the framework of the Labor Code - and this is solved by issuing special acts and regulations, for example, stimulating public sector employees through various bonuses.

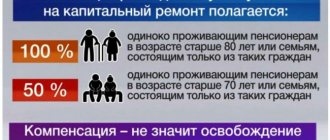

It is worth learning to distinguish between compensation and incentive payments to public sector employees and other employees, including commercial structures. Incentive bonuses are aimed at rewarding conscientious workers for effective work, therefore they are a type of incentive. Compensation transfers are intended for certain categories of employees, paid in any case, regardless of the results of work and attitude towards it.

At the same time, such payments cannot be considered bonuses and remunerations not related to performance. Many enterprises practice deduction of the 13th salary, while the results and achievements of employees are unimportant.

According to Russian laws, management does not have the right to fine employees or reduce the salary or wage scale, even if the employee made mistakes or was negligent in his work. Disciplinary violations are not a reason for the enterprise to fine citizens.

Compensating bonuses differ from incentive bonuses

These two types of monetary incentives have two characteristic differences. Incentives - depend directly on the employer’s desire to reward its employees, and is not the employer’s responsibility.

Whereas the provision of compensatory benefits depends on the conditions provided at the workplace. As an example, compensation for employees occurs when working in hazardous conditions.

Citizens who may qualify for such a payment are listed in labor law.

This payment is not limited in size.

Options for processing incentive payments

- How is overtime paid under the Labor Code?

If you need to legally formalize additional payments to the main part of your earnings, you will need to understand the forms of incentive payments and their correct purpose.

- Surcharge. They are associated with the direct performance of duties according to the job description and additional obligations. Overtime, schedules with night shifts and other work options that require increased pay are not considered additional pay.

- Allowances. For the purpose of incentives, sometimes management, in addition to the salary or tariff rate, adds its own payment system, under which employees have the right to count on an increase in labor income. The nature of the surcharges and the period of their application are determined by the enterprise independently, in accordance with the adopted regulatory act

- Awards. Bonuses are used most often. Management, intending to reward distinguished employees, more often resorts to a bonus system, independently determining the parameters of merit for which bonuses can be awarded. Similar options include bonuses in kind, but according to the law, the amount of such bonuses should not exceed a fifth of the salary.

Different enterprises have their own specific activities, and the administration has the right to develop its own incentive mechanisms for employees, stimulating staff to continue working and achieve high results, since there is no direct ban on the development of individual bonus systems by law.

How are preschool employees encouraged?

The Ministry of Education determines the provision according to which funds allocated from the state and municipal budgets for wages, material and educational needs, must be distributed by the preschool institution itself.

It is recommended to allocate up to forty percent of the total funds provided for incentive payments. The final values are set at the individual institution level.

The evaluation criteria in the preschool educational institution are the following:

- Contacting parents;

- Determining the characteristics of children;

- Teaching a child to understand the world;

- Improvement of development programs;

- Compliance with health procedures for children;

- Ensuring a comfortable stay in preschool educational institutions for children from disadvantaged families;

- Preparation of posters, crafts and other visual elements.

Funds from state and municipal budgets must be distributed by the preschool institution itself

How is the incentive payment assigned?

The purpose of incentive payments is regulated by law (Labor Code of the Russian Federation). Despite the presence of many deviations and the need for individual regulation, there are general principles for assigning incentives, according to the law.

The sequence of processing an incentive payment is presented in several steps:

- The employer sets out the procedure for providing incentive payments in the documentation - contract and internal regulations. Only entrepreneurs classified as micro-organizations do not have the right to make such orders, reflecting the terms of incentive payments in the contract.

- The hired employee must be familiar with the provisions of the act establishing the procedure for assigning incentive payments.

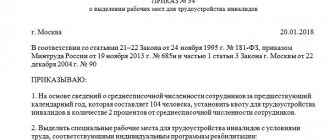

- If the employee fulfills the conditions for additional payment, the manager orders the person to be rewarded by drawing up a separate order individually or for the entire staff at once.

- Based on the issued order, the accountant calculates and organizes the issuance of funds to everyone mentioned in the list.

When the order is executed, it is transferred to the archive for storage for up to 75 years.

For state employees

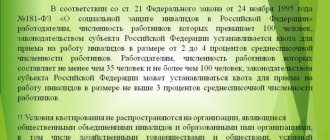

If within commercial organizations the issue is resolved quickly - by adopting an internal regulatory document, then in the budgetary sphere management is not vested with the right to dispose of the organization’s funds and income, which means that the formation of conditions for calculating wages is beyond the competence of the administration.

However, incentive payments remain available to public sector employees. They are simply guided by different standards established at the federal level. The basis is the provisions of Order of the Ministry of Health and Social Development No. 818, issued in 2007.

- Remuneration for work on holidays and weekends

It contains standards for the use of incentive surcharges and their types:

- By length of service, continuous experience.

- For quality work results.

- For results and intense work.

- Based on the results of the completed amount of work.

Other local standards are not applicable to public sector employees, and when assigning incentives, it is necessary to be guided by general provisions.

The manager must understand that when issuing an order for a payment of this kind, the enterprise can organize a check on the proper expenditure of funds from the budget.

Educational field

A large share of incentive payments is used for teachers and people working in the field of education. In relation to the personnel of educational institutions, a system of calculating points is used, according to which additional payment is determined. The weight of 1 point in monetary terms is set taking into account the available wage fund.

A separate evaluation sheet is created for each employee, where the results of work are reflected and the amount of the additional payment due is calculated. After determining the total number of points earned by all employees of the organization, the cost of 1 point is calculated. Next, the number of points awarded to a specific person is multiplied by the calculated cost.

In addition to performance indicators in the classroom, extracurricular activities, participation in excursions, organization of events, and hikes are of particular value.

They also take into account work on studying student performance, work with parents, the activity of students at competitions at various levels, and work with families classified as disadvantaged.

The higher the activity of the teacher, the more points and, accordingly, the higher the salary and additional payment as an incentive for the employee.

- Reduction of wages at the initiative of the employer under the Labor Code of the Russian Federation

When determining incentive payments for preschool institutions, they proceed from the division of personnel into educators and teachers. 60% of the total salary fund is allocated to them. However, besides them, the organization’s staff includes representatives of other professions: watchman, cook, cleaner, etc.

The value when establishing the amount of payment in a preschool institution is determined by the success achieved when working with clubs, additional educational programs and electives.

For management personnel, the level of additional payment is determined differently. The director of an educational institution and the head of a preschool institution expect to increase income due to:

- Active work with parents;

- No complaints;

- Conducting specialized training;

- Involving young people in the teaching field;

- Achieved level of Unified State Examination results.

- Development of talents, discovery of gifted students.

Each educational organization establishes its own Regulations, with mandatory consideration of the requirements of the law and approval of the Regulations, which are adopted after preliminary agreement with the staff.

Health workers

Medical workers are subject to uniform rules set out in a special program after the start of the modernization of this area, launched in 2011.

Thanks to recent changes in the salaries of employees of medical institutions, both specialists and nurses (middle and junior level) can now count on incentives.

Responsibility for making any decisions regarding additional payments to health workers rests with representatives of regional health care structures, and the amount of additional payments is set within the medical institution.

Parameters that influence stimulants:

- Population;

- residential density;

- advantageous age;

- characteristics and predisposition to diseases;

- mortality.

In addition to these characteristics, incentive additional payments are influenced by the range of medical services provided, location, specifics and level of the institution.

In some cases, the incentive payment is not applicable:

- in relation to the heads of the institution, if they are not included in the category of practicing specialists;

- to doctors who have already established payment for a participant in the national health project;

- for persons working on high-tech equipment and receiving additional payments for this.

The management of the organization reserves the right to refuse additional payment if there are complaints about the quality and volume of work performed.

Cultural sphere

Employees in the field of cultural development have their own types of payments - with regular or one-time use.

Among the regular payments fixed at the federal level, there are additional payments for professional skills, inclusion in a “national” or “honored” title, length of service, awarded degree, and other important indicators.

Payments for university teachers

Teachers' salaries are divided into two parts: basic and incentive. Following the current legislation, part of the funds intended for this group of public sector employees is no less than seventy percent for the teaching staff of universities, and no less than sixty percent for other educational institutions.

The remaining funds allocated by the state for wages are supposed to be incentive payments. An individual incentive payment is calculated in accordance with the regulatory documents of each individual educational institution.

The development of plans for bonuses for employees operating in education is carried out by the economic departments of educational institutions, together with representatives of the governing council of education, the trade union and members of the work team.

After the final calculation of the rules, conditions and amounts of incentive payments, the information is published on the institution’s website in the public domain.

The effectiveness of teaching activities, as well as the assessment of other teaching criteria, helps to calculate the number of expected incentives.

In most cases, incentive funds are divided among teachers based on accumulated points and evaluation sheets that help record teacher achievements.

The rating list for receiving payment is compiled according to the following algorithm:

- The total number of accumulated points for each teacher is determined;

- Payroll is divided by the total number of points scored, reflected in the cost of one point;

- The total number of points is multiplied by the cost of one of them.

The compiled rating list clearly identifies those teachers who will receive well-deserved bonuses.

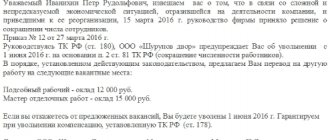

Punishment as a means of motivating employees

Some companies prefer to punish more, others prefer to encourage more, somewhere they have really found a middle ground. The level of punishment depends primarily on the goals of the impact. The main purpose of punishment is to prevent actions that could harm the company. That is, punishment is valuable not in itself, as “revenge” for the wrong actions of a subordinate, but as a barrier that will not allow this person to repeat these actions in the future and will serve as an example to the entire work collective.

However, practical experience shows that a manager should not overindulge in inspired stories about the abuses of his employees.

Thus, punishment is effective when it is focused on providing the required psychological impact on the employee and the entire team. At the same time, by punishing undesirable actions, we in a certain way encourage those employees who work in the permitted direction.

When punishing an employee, there must be an explanation as to why and why the punishment is applied. The punishment must necessarily correspond to the offense. Material punishment is permissible in the case when the actions of an employee of the organization actually caused direct material damage, which can be measured and calculated. In many cases, after a subordinate’s misconduct, it is enough for the boss to simply talk to him, and the issue is closed. If the main rational goal of using punishment in an organization is to avoid failures, then, accordingly, the use of rewards expresses the desire to achieve better results and development.

Social policy of the organization

Also the most important tool for economic stimulation:

- Firstly, the organization implements benefits and guarantees within the framework of social protection of employees (social insurance for old age, temporary disability, unemployment, etc.), established at the state or regional level.

- Secondly, organizations provide their employees and members of their families with additional benefits related to elements of material incentives using funds allocated for these purposes from the organization’s social development funds.

Thus, the social policy of an enterprise (organization) as an integral part of the personnel management policy represents activities related to the provision of additional benefits, services and social payments to employees.

The greater the number of benefits and services provided, including those not expressly stated in the current legislation, the higher the interest of employees in working for an organization and its successful economic activities. This leads to a reduction in employee turnover, since the employee is unlikely to want to lose numerous benefits when leaving. Such policies may provide additional income to workers when wages are low (for example, in state-owned enterprises) or proposed in the interests of attracting and retaining a skilled workforce when wages are high.

Foreign and domestic experience in implementing social policy in organizations allows us to compile an approximate enlarged list of payments of benefits and social services provided in various forms.

- Tangible monetary form : payments for the acquisition of property and assets of the company (purchase of company shares by employees at a reduced price); provision of preferential loans; expenses for non-state health insurance; travel insurance; employee property insurance; paid temporary release from work (for example, upon marriage); paid working hours with a shortened pre-holiday day; payment for employee training at various courses or educational institutions; provision of places in preschool institutions on preferential terms and payment for them; payment and provision of study leaves to persons combining work with study in accordance with labor legislation; provision of paid holidays established by law and additional holidays; monetary rewards and compensation provided in connection with personal celebrations, round dates of work or holidays, death of relatives, emergencies - thefts, fires and others (monetary amounts); additional compensation payments (for example, compensation for travel by rail during the next vacation); subsidies for food in the organization’s canteens; Payment of utility services; payment of mobile bills when connecting at a corporate rate; payment for travel to the place of work and around the city; provision of a company car for use; payment for car parking for employees; progressive payments for length of service; “golden parachutes” - payment of several official salaries when an employee retires in old age; corporate pension - an addition to the state pension from enterprise funds; one-time remuneration to pensioners from the company (enterprise).

- Material non-monetary form : use of social institutions of the organization; use of holiday homes, children's health camps (for children of employees) on discounted vouchers; purchasing products produced by the organization at prices below the selling price or free of charge, as well as remunerations associated with changing the workplace; increasing the technical equipment and comfort of the workplace; improvement of social working conditions; increasing work schedule flexibility; introduction of a shortened working week or day; providing free subscriptions to periodicals; provision of tickets to attend various cultural events; free Internet access and others.

To eliminate the physical and moral discomfort of workers, it is advisable to invest small amounts of money monthly in providing recreational opportunities.

For example, one of the latest innovations is the installation of special rooms in companies for employees to relax. Western companies have begun to understand: if people are not allowed to rest, they will not be able to work productively. If you let an employee feel at home, then most likely he will take on his work more diligently. Part of the organization's social policy includes company-wide events - holidays, for example, dedicated to the release of a new product model, company days, excursion trips, paid centralized lunches, parties. The advantages of such events are to ensure good rest for company employees and eliminate accumulated fatigue among employees.

In addition to the relaxation that is useful for the company and pleasant for employees, it is in various corporate holidays, as in other corporate events, that it is possible to unite the organization’s employees, develop team spirit, and form a positive corporate culture. Research shows that the location of the holiday does not play a big role; success will depend mainly on the program of the holiday, on the ability to organize and conduct it, on the created atmosphere.