- a) length of service, which gives the right to early assignment of a labor pension in old age, provided that on January 1, 2003 or at the time of assignment of a pension in 2002, the person applying for a pension has at least half of the required special experience;

b) length of service, which gives the right to early assignment of an old-age labor pension, regardless of the duration of the special work experience existing on January 1, 2003.

However, the Constitutional Court of the Russian Federation in its Determination indicated that these norms do not prevent the early assignment of an old-age labor pension, regardless of the period in which - before or after January 1, 2003 - work was performed under special working conditions [1].

Currently, such work experience includes the following types of work (Article 27 of the Law on Labor Pensions):

- 1) underground work, work with hazardous working conditions and in hot shops [2];

- 2) work under difficult working conditions;

- 3) for women - work as tractor drivers in agriculture and other sectors of the economy, as well as as drivers of construction, road and loading and unloading machines;

- 4) for women - work in the textile industry in jobs with increased intensity and severity;

- 5) work as working locomotive crews and workers of certain categories who directly organize transportation and ensure traffic safety on railway transport and the subway, as well as as truck drivers directly in the technological process in mines, open-pit mines, mines or ore quarries for export coal, shale, ore, rock;

- 6) work in expeditions, parties, detachments, on sites and in teams directly on field geological exploration, prospecting, topographic-geodetic, geophysical, hydrographic, hydrological, forest management and survey work;

- 7) work as workers, foremen (including senior ones) directly at logging and timber rafting sites, including servicing mechanisms and equipment;

work as machine operators (docker-mechanizers) of complex teams during loading and unloading operations in ports;

work as machine operators (docker-mechanizers) of complex teams during loading and unloading operations in ports;- 9) work as a crew member on ships of the sea, river fleet and fishing industry fleet (with the exception of port ships constantly operating in the port water area, service and auxiliary and traveling ships, suburban and intracity traffic vessels);

- 10) work as drivers of buses, trolleybuses, trams on regular city passenger routes;

- 11) full-time work in underground and open-pit mining (including personnel of mine rescue units) in the extraction of coal, shale, ore and other minerals and in the construction of mines and mines;

- 12) work on vessels of the marine fleet of the fishing industry in the production, processing of fish and seafood, acceptance of finished products in the fishery (regardless of the nature of the work performed), as well as on certain types of vessels of the sea, river fleet and fishing industry fleet;

- 13) work as a civil aviation flight crew;

- 14) work on direct control of civil aviation flights;

- 15) work in the engineering and technical staff for direct maintenance of civil aviation aircraft;

- 16) work as rescuers in professional emergency rescue services, professional emergency rescue units of the Ministry of Emergency Situations of Russia) and those participating in the liquidation of emergency situations;

- 17) work with convicted persons as workers and employees of institutions executing criminal penalties in the form of imprisonment;

- 18) work in positions of the State Fire Service (fire protection, fire protection and emergency rescue services) of the Ministry of Emergency Situations of Russia;

- 19) persons who carried out teaching activities in institutions for children, regardless of their age;

- 20) persons who carried out medical and other activities to protect public health in health care institutions;

- 21) persons who carried out creative activities on stage in theaters or theatrical and entertainment organizations.

Lists of relevant jobs, industries, professions, positions, specialties and institutions (organizations), taking into account which an old-age labor pension is assigned, the rules for calculating periods of work (activity) and the assignment of said pension, if necessary, are approved by the Government of the Russian Federation.

The above conditions for assigning an old-age labor pension after the date of entry into force of the federal law on professional pension systems [3] apply if, on the day of entry into force of this law, the insured person has completed at least half of the length of service in the relevant types of work required for establishment of early labor pension in old age. If the specified conditions are met, the insured persons are provided with an old-age labor pension in accordance with the Law on Labor Pensions.

Persons who have worked in the relevant types of work for less than half the required period, as well as those hired to perform these works after the date of entry into force of the federal law on professional pension systems, are established with professional pensions regulated by the relevant federal law.

Separately, the Law on Labor Pensions distinguishes this type of special work experience, such as work in flight test crews

, directly in flight tests (research) of experimental and serial aviation, aerospace, aeronautical and parachute equipment. The list of relevant positions, taking into account which an old-age labor pension is assigned, the rules for calculating periods of work (activity) and the assignment of the specified pension, if necessary, are approved by the Government of the Russian Federation.

In this case, periods of military service in the positions of flight personnel and (or) periods of work in positions of civil aviation flight personnel are counted towards the length of service that gives the right to early assignment of an old-age labor pension, if the citizen has at least two-thirds of the flight test personnel the specified length of service falls on periods of work (activity) in positions that give the right to early assignment of an old-age labor pension.

Work experience in a certain area:

- 1) any work for a certain period of time in the Far North or equivalent areas;

- 2) work of persons permanently residing in the regions of the Far North and equivalent areas as reindeer herders, fishermen, and commercial hunters.

When assigning an old-age labor pension, taking into account such work experience, the list of regions of the Far North and equivalent localities is used, which was used when assigning state old-age pensions in connection with work in the Far North as of December 31, 2001 [4]

- 2. Special length of service allocated for socially significant circumstances (Article 28 of the Law on Labor Pensions):

- 1) women who have given birth to five or more children and raised them until they reach the age of eight; one of the parents of disabled people since childhood, who raised them until they reached the age of eight; guardians of disabled people from childhood or persons who were guardians of disabled people from childhood, raising them until they reached the age of eight;

- 2) women who have given birth to two or more children and have worked for a certain time in the Far North or equivalent areas;

- 3) disabled people due to military trauma;

- 4) visually impaired people with disability group I;

- 5) citizens suffering from pituitary papism (Lilliputians), and disproportionate dwarfs.

All these persons have the right to receive an old-age labor pension before reaching the generally established (60 years for men, 55 years for women) retirement age.

3. Civil service experience , which gives the right to a pension for long service in accordance with the Law on Pensions, is the total duration of periods of civil service and other activities taken into account when determining the right to a pension of federal civil servants and when calculating the amount of this pension ( Art.

2 of the Pension Law).

The period of service (work) in positions of the federal state civil service and other positions determined by the President of the Russian Federation is included in the length of service of the state civil service for the purpose of assigning a pension for length of service of federal state civil servants in the manner established by the Government of the Russian Federation [5].

4. Military length of service , which gives the right to pensions in accordance with the Military Pensions Law.

According to Art. 18 of this Law, the following periods are counted towards the length of service for granting a pension:

- • military service;

- • service in positions of ordinary and commanding personnel in internal affairs bodies, the State Fire Service; in the authorities for control over the circulation of narcotic drugs and psychotropic substances; service in institutions and bodies of the penal system;

- • service in Soviet partisan detachments and formations;

- • time of work in government and administrative bodies, civilian ministries, departments and organizations with retention in military service or in the personnel of the Ministry of Internal Affairs of Russia, authorities for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system;

- • time of work in the system of the State Fire Service of the Ministry of Emergency Situations of Russia (fire protection of the Ministry of Internal Affairs of Russia, fire-fighting and emergency services of the Ministry of Internal Affairs of Russia, State Fire Service of the Ministry of Internal Affairs of Russia), immediately preceding their appointment to positions filled by ordinary and commanding personnel and military personnel of the State Fire Service ;

- • time spent in captivity, if the captivity was not voluntary and the serviceman, while in captivity, did not commit a crime against the Motherland;

- • the time of serving the sentence and detention of military personnel, privates and commanding officers who were unjustifiably brought to criminal liability or repressed and subsequently rehabilitated.

The length of service for assigning a pension to officers dismissed from service and persons in command of internal affairs bodies, the State Fire Service, bodies for control over the circulation of narcotic drugs and psychotropic substances may also include the time of their study before assignment to service (but not more than five years) from calculating one year of study for six months of service.

The time spent serving under special conditions is subject to counting towards the length of service for the purpose of granting a pension on a preferential basis.

The procedure for calculating length of service for assigning a pension is determined by the Government of the Russian Federation [6].

When calculating pension contributions, various factors are taken into account, including the citizen’s place of employment. Some persons working in specific conditions receive not ordinary labor service, but special insurance experience. This allows them to retire much earlier than expected.

What it is

The official definition of special length of service for assigning a pension is given in Art. 27 Federal Law “On Labor Pensions”.

It is accrued when working in hazardous conditions that negatively affect the health of the hired specialist. Additionally, this includes work with intense loads.

In order for a person to count on early retirement based on special service, certain conditions must be met.

These include:

- specific duration of work in difficult conditions;

- the presence of documents that confirm that the citizen worked under the right conditions.

A special feature of special experience is that it refers to periods of work under special conditions. This does not take into account how many insurance premiums were paid by the employer for the employee.

When is the work period inclusion process necessary?

When a claim is required against the pension fund to include periods of work in the length of service:

The main document that confirms the amount of experience and its exact size has always been the work book. Unfortunately, throughout his life, a person does not always work continuously all his life. Experience may be interrupted for some reasons that do not always depend on the person:

- illness, pregnancy and childbirth;

- moving to another place of residence;

- the need to leave a permanent place of work in connection with caring for a sick person;

- imprisonment and much more.

There are also situations when, due to the employer’s violation of the rules for drawing up a work book, the length of service is interrupted, although the employee will fulfill his job duties at this time. For example, this happens when an employer forgets to submit a report, confuses the job title in the work book, etc.

ATTENTION: more details on the issue of how to restore seniority (more details at the link).

Rules for calculating years worked

To determine the duration of special service, the total number of days of production is calculated. To receive an early pension, you must work in the Far North or under dangerous conditions.

If a woman works under such conditions and is pregnant, she is transferred to safe work, but the entire period is counted as special work experience.

In order to correctly perform the calculation, special lists approved by the Government of the Russian Federation, as well as those available in the provisions of Federal Law No. 400, are taken into account.

During the calculation, the following rules are taken into account:

- the retirement age is reduced for a period of 5 to 10 years;

- usually more favorable conditions are offered for women;

- for some positions, special rules are provided for the influence of special experience on reducing the retirement age;

- to confirm the harmfulness of work, it is necessary to focus on the results of a special assessment, which is carried out annually after 2012;

- Work that is carried out in the Far North or other areas equated to northern conditions has a huge impact on the length of service.

Before the adoption of Federal Law No. 400 in 2013, slightly different rules for calculating special service were applied, which are still used in determining the current retirement age.

When a pension is assigned based on special service

Federal Law No. 400 lists the main types of activities for which special experience is accrued.

These include work:

- in hot shops;

- underground;

- in difficult conditions;

- in logging or timber rafting;

- on long-distance vessels;

- on trucks or railways;

- in fire services, etc.

The following periods are included in the special period:

- temporary disability;

- maternity leave;

- downtime due to the fault of the employer.

If a person worked in rural and urban conditions, then a mixed work experience is formed. If the work is carried out in a village, then for 1 year of work an experience of 1 year and 3 months is accrued. For medical employees, a special correction factor is applied during calculation.

Expert opinion

Kuzmin Sergey Yaroslavovich

Lawyer with 8 years of experience. Specializes in the field of civil law. Legal expert.

For example, for surgeons, traumatologists and ophthalmologists working in surgical departments, one year is equivalent to 1 year and 6 months. The same conditions are offered to persons working in intensive care units.

When calculating the length of service of medical employees, the provisions of numerous regulations are taken into account, which can be not only federal, but also regional.

General terms

On a general basis, special experience is accrued if a citizen works in a specific profession or position that is included in the list of Federal Law No. 400. At the same time, certain requirements are presented to each specialist, which must be confirmed by official documents.

Work in the North

People who choose to work in the northern regions of the Russian Federation work under difficult conditions, so they can count on different preferences from the state. These include the early one.

Since 2008, the number of regions and cities that are considered equivalent to the Far North has increased . If a person worked in these entities before 2008, then the experience gained will not be considered special, and after 2008 new calculation rules apply.

The latest adjustments were made by regulations of 2012, so before starting the calculation it is recommended to study the current data.

By length of service

Thanks to special experience, citizens have the right to take advantage of their length of service in order to retire earlier than expected. In this case, it is not the person’s age that is taken into account, but the required number of years of experience.

This provision is important for the military, since during their service no funds are transferred to the Pension Fund for them, but their length of service is taken into account to calculate their future pension, and a length of service benefit is also offered. Not only military personnel, but also civil servants, miners or persons whose work is equivalent to military activity can count on such concessions.

It is required to obtain at least 25 years of experience, and for civil servants at the federal level, this period is reduced to 15 years. Local regulations apply correction factors during calculations.

Other situations

Sometimes the length of service includes not only periods of direct work, when the employer transferred funds to the Pension Fund for a person, but also other periods. These include obtaining education in the field of medicine or pedagogy. Additionally, this includes the period of military service.

Periods and types of activities counted in the total length of service

The periods included in the TTS are listed in paragraph 3 of Art. 30 Federal Law “On Labor Pensions in the Russian Federation”:

- periods of work as a worker, employee (including hired work outside the territory of the Russian Federation), member of a collective farm or other cooperative organization; periods of other work in which the employee, not being a worker or employee, was subject to compulsory pension insurance; periods of work (service) in paramilitary security, special communications agencies or in a mountain rescue unit, regardless of its nature; periods of individual labor activity, including in agriculture;

- periods of creative activity of members of creative unions - writers, artists, composers, filmmakers, theater workers, as well as writers and artists who are not members of the relevant creative unions;

- service in the Armed Forces of the Russian Federation and other military formations created in accordance with the legislation of the Russian Federation, internal affairs bodies of the Russian Federation, foreign intelligence agencies, FSB bodies, federal executive authorities that provide for military service, former state security bodies of the Russian Federation, as well as in state bodies security and internal affairs bodies of the former USSR (including during periods when these bodies were called differently), stay in partisan detachments during the civil war and the Great Patriotic War;

- periods of temporary disability that began during the period of work, and the period of being on disability of groups I and II, received as a result of an injury associated with production or an occupational disease;

- the period of stay in places of detention beyond the period assigned during the review of the case;

- periods of receiving unemployment benefits, participating in paid public works, moving in the direction of the employment service to another area and finding employment.

Calculation of the duration of periods of labor and other socially useful activities before January 1, 2002, included in the total length of service in accordance with this paragraph of the law, is carried out in calendar order according to their actual duration, with the exception of:

- periods of work during a full navigation period on water transport and periods of work during a full season in organizations of seasonal industries, which are included in the total length of service for a full year of work, regardless of the actual duration of these periods;

- periods of work in leper colonies and anti-plague institutions, which are included in the total length of service at double the rate;

- periods of service in military units, headquarters and institutions that are part of the active army, in partisan detachments and formations during hostilities, as well as time spent in treatment in medical institutions due to military trauma, periods of military service in the exclusion zone, determined in accordance with The Law of the Russian Federation “On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant”, which are included in the total length of service in triple amount;

- periods of work in the city of Leningrad during the blockade (from September 8, 1941 to January 27, 1944), which are included in the total length of service in triple the amount;

- periods of work during the Great Patriotic War (from June 22, 1941 to May 9, 1945), with the exception of work in areas temporarily occupied by the enemy, which are included in the total length of service at double the rate;

- periods of work in the regions of the Far North and areas equated to regions of the Far North, which are included in the total length of service at one and a half times;

- periods of conscription military service, which are included in the total length of service at double the rate;

- periods of detention, stay in places of detention and exile for citizens who were unjustifiably prosecuted, unjustifiably repressed and subsequently rehabilitated, including from among the repressed peoples, who are included in the total length of service in triple the amount;

- periods of residence in the besieged city of Leningrad and stay in concentration camps during the Great Patriotic War, which are included in the total length of service at double the rate;

- periods of work or service (with the exception of military service) in the exclusion zone, determined in accordance with the Law of the Russian Federation “On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant,” which are included in the total length of service at one and a half times.

0

4.25

When to apply

It is impossible to say exactly when a person will be able to apply for a pension, since he can start working under difficult conditions at different ages. In this case, lists of professions are taken into account, which are regularly changed and supplemented by federal regulations.

Therefore, the following rules are taken into account:

- if a woman worked under particularly difficult and dangerous conditions, then she will be able to retire at the age of 45, but this requires at least 15 years of experience, and of these 15 years, at least 7.5 must be worked in hazardous production;

- if a man works under such conditions, then retirement is possible for him from the age of 50 with 20 years of experience, with 10 years of special experience required;

- if the work is carried out in simply dangerous conditions, then women retire at 50 years old with 20 years of experience, and men at 55 years old, and their experience should be 25 years.

The full list of professions and conditions can be studied on the website of the Government of the Russian Federation, and changes and additions are regularly made.

Each profession has its own nuances. For example, medical workers who work in villages can count on a pension payment from the state 25 years after employment.

If the work is carried out in the city, then 30 years of experience is required. At the same time, special coefficients are offered for surgeons and some other doctors.

If a teacher applies for early retirement, then not only work in the profession is taken into account, but also postgraduate studies, as well as occupation of other positions in the educational field.

Documents for confirmation

When applying for an early pension, it is necessary to prepare evidence of special experience.

for this :

- a work book designed to record all places of employment of a citizen;

- salary transfer invoices, which can be replaced by pay slips;

- labor agreements drawn up and signed with employers;

- extracts made from orders of the leadership of various organizations;

- certificates from institutions that contain information about the terms of work, position held and other relevant data.

The need to obtain certificates and other documents arises if PF employees, for various reasons, do not have information about all places of employment of a citizen applying for early retirement. Therefore, if a citizen is previously denied a payment, he will have to collect the necessary documentation within 5 days.

If the organizations in which the citizen worked are already closed, then you will have to use the services of the archive. The certificates must contain information not only about the periods of work and the name of the organization, but also about the position held, as well as about the dangerous or difficult conditions under which labor duties were performed.

These documents confirm that the work was indeed dangerous and difficult. Job descriptions and employment agreements may be used for this purpose.

If the company where the citizen worked was not an official enterprise with special conditions, then such length of service is not considered special. In this case, even the testimony of other workers is not taken into account.

What is special work experience, its types

The dry formulation of special work experience (STS) states that this is a certain period of time during the entire working life of a citizen, which applies to work in special social conditions or to the implementation of one’s professional skills in special working conditions. It is taken into account primarily when calculating pension benefits, namely: for early termination of work or receiving increased payments based on its results.

As a rule, STS is a period of work under conditions that can be called:

- heavy;

- harmful;

- dangerous.

In addition, STS is assigned based on the performance of duties while in certain positions. It is often equated with professional length of service, which is assigned to citizens employed in:

- pedagogical field;

- healthcare system;

- civil aviation;

- government agencies;

- Armed Forces, as well as persons in military service (this includes internal organs);

- the field of art.

Of course, the wording is quite vague, but at the moment it is not fixed by law. It was first adopted on November 20, 1990 in the Law of the Russian Federation, which has lost its force, namely: “On state pensions in the Russian Federation.”

The STS also provides for a special regime for calculating pensions for citizens, regardless of the interruption/duration of employment or conducting socially useful activities:

- in climatic zones with difficult weather conditions, in particular the Far North;

- in areas of radioactive contamination;

- in underground or hot work.

Lawyer for inclusion of work experience in Yekaterinburg

The main requirements from the social security authorities are that a person has a certain amount of work experience, incl. regarding the appointment of a preferential pension. Based on deductions made during labor functions, a person can receive any social benefits. That is why there may be a need to include periods of work in the insurance period.

Since a person submits an appeal on the basis of his disagreement with the decision of the pension authority, he must argue that the reason for the refusal is not legal, provide additional evidence, certificates, and witness testimony.

A pension lawyer from the Law Office “Katsailidi and Partners” will help you do everything: professionally, on favorable terms of the agreement for the provision of legal assistance and on time. Call today!

Legislative framework regulating issues related to STS

A single legal act that unites all the norms regulating labor relations is the Labor Code of the Russian Federation. It was accepted on December 21, 2001, but it does not contain the concept of special work experience, although there are occasional references to special working conditions.

Special working conditions are separately stipulated in government decree No. 665. It was adopted on July 16, 2014; the text lists in detail all the lists of jobs, positions, professional activities and existing industries that can be classified as harmful, dangerous, and difficult.

Expert opinion

Kuzmin Sergey Yaroslavovich

Lawyer with 8 years of experience. Specializes in the field of civil law. Legal expert.

In addition, there are many federal laws of the Russian Federation with all the amendments and changes that regulate employment, benefits and features of the subsequent calculation of pensions for different categories of citizens. In particular:

- No. 400-FZ (1.01.15), which determines, among other things, the calculation of insurance pensions;

- No. 173-FZ (12/17/01), adopted to determine different types of activities when calculating seniority;

- No. 166-FZ (12/15/01), which generally regulates pension provision;

- No. 10-FZ (12.01.96), respectively - trade unions;

- No. 3061-I (06.18.92) - for all categories of citizens who experienced the consequences of the Chernobyl explosion;

- No. 384 (5.07.91) - for aviation services employees.

The lists of positions, specialties, special works and industries that are declared in the 29th resolution of the Ministry of Labor of the Russian Federation (05.22.96) are still relevant. True, they are now recorded in government decree No. 781 (10.29.02) and No. 516 (07.11.02). They are used when assigning long-service pensions, early retirement, and also when determining special working conditions. They approve the possibility of early termination of work and retirement. Read more about the minimum length of service here.

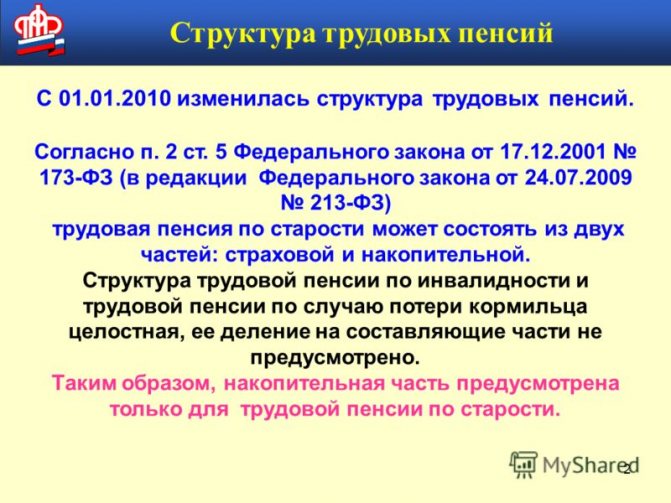

Legislative basis for calculating length of service

In Russia, there is a basic Federal Law that defines the rules for calculating labor (insurance) pensions, their types, calculation formulas, and categories of citizens who are entitled to accruals. Federal Law-173 “On Labor Pensions...” was adopted in 2001. Amendments were made in July 2013. However, such measures were insufficient to improve the pension system.

From January 1, 2015, Federal Law 173 is not applied (except for calculation rules and formulas) in connection with the release of another document, namely Federal Law No. 400 “On Insurance Pensions”. The changes and additions came into force at the beginning of 2021.

All articles, clauses and amendments introduced into the Federal Laws do not contradict the Constitution of the Russian Federation. The main document of the state contains nine chapters, as well as final and transitional provisions.

work as machine operators (docker-mechanizers) of complex teams during loading and unloading operations in ports;

work as machine operators (docker-mechanizers) of complex teams during loading and unloading operations in ports;