Types of bonuses for employees

There are two types of awards:

- A production bonus is included in the remuneration system and is paid regularly, for example, monthly. The size of the bonus depends on specific indicators and bonus conditions.

- A non-production bonus does not apply to wages. It is paid one-time, regardless of the economic result of the employee’s work.

The conditions for paying bonuses are prescribed in a local act, collective or employment agreement.

What types of awards are there?

There are two main groups of rewards.

Labor bonus . A one-time bonus may be given for introducing new technology or performing one-time work that is not part of daily duties.

Often, the employer introduces rewards for exceeding the production or sales plan. The bonus is an agreed percentage of the salary; it is paid not once, but monthly.

Social bonus . This type of bonus is not related to work achievements. The remuneration is paid one-time for any reason. For example, February 23, March 8, New Year, birthday and so on.

Regulations on bonus payments to employees

The regulation on bonuses for employees is an act issued by the organization, which spells out everything related to bonuses:

- positions that are entitled to a bonus,

- bonus conditions: indicators, results,

- frequency of payments - monthly, quarterly, annually,

- bonus amount: scale, percentage, fixed amount. The maximum amount of the premium may be specified,

- grounds for reducing the premium. For example, for being late for work.

The Bonus Regulations can also list events upon the occurrence of which the employer will pay bonuses. For example, in connection with the employee reaching the anniversary age of 50, 60, 70 years.

An anniversary bonus is considered a production bonus, although it is not directly related to production.

The logic is this: since the remuneration is written down in the document, it affects the employee’s performance. When hired and during work, he can count on this bonus.

The same applies to bonuses for organization birthdays and professional holidays.

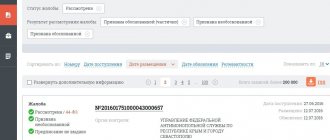

Sample order for awarding a bonus

The order is issued using two forms:

- T-11 for individual payments, when the bonus amount and terms of appointment are different for each employee;

- T-11a for a group of people (organization, department, workshop, etc.), when all team members are in the same conditions.

ATTENTION! The order specifies the details of the company, full name and position of the employee, the wording of the award, the type of remuneration and the basis for accrual.

Sample orders for bonuses for good work are available at the following links: T-11, T-11a

How to pay a premium

The organization itself determines how to control that the employee fulfills the bonus conditions. This could be, for example, a sales report, a memo, or the amount of revenue for the period.

According to the bonus regulations, when serving from 100 to 150 clients per month, the employee is entitled to a bonus of 5,000 rubles, when serving 151-200 clients - 10,000 rubles, when serving 201 or more clients - 15,000 rubles.

Master Leonova served 130 clients, which means she has the right to receive a bonus of 5,000 rubles. To receive it, Leonova must prepare a sales report and provide the manager with a customer log.

If an organization has several structural divisions, bonus indicators are often controlled by department heads. They also send memos to the manager or other documents justifying the payment of the bonus.

Based on these documents, the employer issues a bonus order. You can use the unified order form No. T-11, or develop your own.

The procedure for calculating the bonus

If an enterprise issues collective remuneration, the HR department must convey information about this to each employee. The employee must understand why he receives additional payment and for what reason he may lose it. The decision on accruals is made not by the employee’s boss, but by the person or group of people who pay bonuses to the staff.

Calculation formula

Let's consider various cases of calculating bonuses for employees.

If a monthly remuneration is assigned to the entire team in the amount of 50% of wages, the bonus is calculated using the following formula:

- 30,000 x 50% = 15,000, where 30 thousand is the salary.

- 30 000 + 15 000 = 45 000

- 45,000 x 1.1 = 49,500, where 1.1 is the regional coefficient.

- 49,500 × 0.87 = 42,565 rubles – the amount of remuneration after deducting income tax (13%).

The formula for calculating bonuses for employees whose salary depends on the number of hours worked: the amount at the tariff rate is multiplied by the percentage of the bonus, then everything is calculated according to the scheme above. The tariff amount is calculated by multiplying the number of hours worked by the standard per hour.

If an employee's salary depends on production, then the amount of production is multiplied by the incentive percentage. Calculation of output is the product of the quantity of manufactured products and the production rate.

The bonus for a quarter or a year is calculated by adding up all salaries without coefficients for the designated period, then multiplying the amount by a percentage. Next, wages are calculated according to the scheme above.

Labor Merit Award

An award for special merit or accomplishment of an important task is given to people working in law enforcement or military organizations.

Those working in “civilian” professions may be paid an incentive bonus for their labor merits. For example, for the proposal and implementation of successful sales or production technology.

In addition, as part of the incentive, such people may be nominated for the title of the best in their profession, they may be thanked, given a certificate or a valuable gift.

| An entry on the payment of a bonus as an incentive for labor merit must be made in the work book (clause 24 of the Decree of the Government of the Russian Federation “On work books” dated April 16, 2003 No. 225). |

Can the bonus be greater than the salary and what is its maximum amount?

The current legislation does not in any way limit the amount of additional incentive payments. Therefore, the amount of bonuses can be any, and amount to an amount exceeding the employee’s salary.

Restrictions on the amount of bonuses apply to managers, their deputies and chief accountants of government agencies at the federal, regional and municipal levels. Such restrictions are established in accordance with the rules of Art. 145 Labor Code of the Russian Federation. The Labor Code of the Russian Federation requires compliance with the maximum permissible limit for the ratio of the average salary of management personnel and ordinary employees, which is established:

- at the federal level - by acts of the Government of the Russian Federation;

- at the regional level - by acts of the constituent entities of the Russian Federation;

- at the municipal level - by acts of local authorities.

For the federal level, in terms of this ratio, one should focus on the Decree of the Government of the Russian Federation dated August 5, 2008 No. 583, which applies to employees of budgetary, state-owned and autonomous institutions (Resolution of the Government of the Russian Federation dated December 10, 2016 No. 1339). Regional and municipal authorities, when establishing the maximum ratio of salaries of management and employees, should be guided by the federal maximum equal to 8. That is, the salary of the manager, any of his deputy or chief accountant cannot be more than the average salary of employees multiplied by 8. An exception is made for the chairmen of state non-budgetary funds : their average salary can exceed the average salary of their subordinates by a maximum of 10 times (Resolution of the Government of the Russian Federation of November 29, 2016 No. 1259).

If it is decided to reduce the premium, then issue an order to reduce the premium. ConsultantPlus experts explained how to do this correctly. Study the material by getting trial access to the K+ system for free.

To learn about situations in which paying a bonus to a manager will become illegal, read the material “Unreasonable accrual and payment of bonuses .

Is paying a bonus a right or an obligation of the employer?

Payment of bonuses can be both the right of the employer and his obligation. This depends on the wording in the employment contract and local regulations.

If the documents do not contain conditions for paying bonuses, then the employer will decide whether to give it to the employee or not.

If the employment contract or bonus regulations do not state that the bonus is guaranteed or that it is part of the salary, the employer is not obliged to pay it.

If the employment contract states that wages are salary + bonus, and the documents specify the conditions for payment of the bonus, then its payment becomes the responsibility of the employer. Of course, if the employee fulfills the listed conditions.

An employer who fails to fulfill the obligation to pay bonuses may be held liable under Art. 5.27 Code of Administrative Offences.

Submit reports without accounting knowledge

Elba is suitable for individual entrepreneurs and LLCs with employees.

The service will prepare all the necessary reporting, calculate salaries, taxes and contributions, and generate payments. Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

Results

The bonuses that are present in the description of the wage system approved by the employer form part of the employee’s salary and, as part of this salary, must be indicated in the employment agreement with the employee.

This can be done either by referring from the text of the employment contract to the internal regulatory act on bonuses, or by recording the terms of bonuses directly in the provisions of the employment agreement. The bonus, which is part of the payment for labor, is taken into account when calculating average earnings. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to deprive an employee of bonuses

Rostrud clarified that deprivation or reduction of bonus payments is the prerogative of the employer. He is not obliged to pay it monthly, but must comply with the procedure and terms of payment that he himself established.

Therefore, the premium can be reduced or deprived if:

- it is included in part of the salary,

- the grounds for bonus deduction are specified in the local act, which contains the conditions for payment of the bonus. For example, it is often written that bonuses are not paid if there is a loss at the end of the month/quarter/year.

An employer who decides to pay a smaller bonus does not need to refer to local regulations.

A loss is not a reason to refuse a bonus

Many companies provide bonuses to their most valuable employees even when they experience losses.

In such a situation, the inspectorate will probably remove the expenses as unreasonable. Is it possible to somehow resist them?

Can. The main argument: the award was not given for the profitability of the business, but for other achievements that contributed to an increase in revenue.

You can come up with different options, for example:

- for promoting the brand;

- for the development and implementation of new product models;

- for successfully representing the interests of the company in negotiations and concluding a profitable contract;

- for completing a particularly difficult urgent task;

- for using a non-standard (creative) approach to solving the issue, etc.

At the same time, it is important to describe in the order specifically what lucrative contract was concluded and with whom, what specific urgent or particularly complex task the employee completed, etc.

Resolution No. F06-20220/2013 dated February 17, 2015 demonstrates that when awarding bonuses to an employee for the introduction of new product models, it is necessary to have detailed information about them, as well as about new sources of financing that have emerged in connection with their implementation.

The main thing is to make it clear: the bonus is not issued for increasing or achieving profit in the company’s work, but for increasing revenue. That is, this is another indicator of activity. Even with an increase in revenue, a loss may be incurred at the end of the period.

It is better if the bonus documents speak not about profit, but about revenue. It will be difficult for the inspectorate to refute this, and then the additional tax assessment can be challenged (see, for example, the resolution of the Federal Antimonopoly Service of the Moscow District dated February 6, 2014 No. A40-33091/13).

Taxation

The procedure for assessing personal income tax does not depend on what the one-time bonus is paid for. It is taxed in the general manner. The most common tax rate is 13%, established for taxpayers who are residents of the Russian Federation.

There are no special features in calculating insurance premiums for one-time employee incentives related to performance indicators. But there are two points of view regarding the taxation of accruals on holidays. The Ministry of Finance believes that they must be taxed in full, citing the fact that these payments are not designated as non-taxable in Art. 422 of the Tax Code of the Russian Federation (Letter No. 03-15-06/76608 dated October 25, 2018).

The judges do not support the Ministry of Finance and express a different point of view. The Supreme Court of the Russian Federation, in Determination No. 310-KG17-19622 dated December 27, 2017, concluded that bonuses for a holiday are not subject to insurance premiums, since they are not related to wages.

Thus, if you do not charge contributions for this payment, then the tax office during the audit will most likely charge additional contributions, penalties and a fine. But there is a chance to defend your position in court.

Accounting and tax accounting

Accounting provides for the reflection of accruals on the credit of account 70. If the accrual relates to labor activity, then it must be corresponded with cost accounts. And if the payment is of a social nature, then with account 91 “Other income and expenses”.

| Debit | Credit | Operation |

| 20,25,26,44 | 70 | A one-time bonus was awarded based on performance results |

| 91 | 70 | A lump sum payment was accrued for the holiday date |

Accounting for bonuses in tax accounting depends on whether they relate to the performance of work duties or not.

If bonuses are paid based on work results, then the payment is recognized as an organization’s expenses for the purpose of calculating income tax in accordance with Article 255 of the Tax Code of the Russian Federation.

If the accrual is made as an incentive for a holiday, then it will not be possible to recognize it as an expense, since it is not related to production results (Mifin’s Letter No. 03-03-06/1/474 dated July 21, 2010).