Each employer can independently decide which remuneration system will be used in his company. All varieties of such systems have certain positive and negative parameters. The salary system used in different organizations is considered widespread. It refers to a type of time-based payment, but at the same time it involves the strict assignment of a certain constant salary to a specific specialist. This system has several advantages, but it is not without its disadvantages.

System concept

Employers often think about what it is – a salary system. It is represented by a certain method of calculating salaries to employees. It is a subtype of time payment. In another way it is called a fixed salary.

Companies often use a salary system. What kind of system is this? It lies in the fact that a particular employee has a fixed salary that does not change over time. It does not depend on the number of working days in a month, but this applies only to salary without taking into account bonuses. Therefore, in February, where there are only 20 working days, the salary will be the same as in March.

An exception would be a situation where a hired employee does not work all working days, but goes on sick leave or takes leave without pay. In this case, his earnings will decrease. To do this, during the calculation, the accountant takes into account the exact number of days worked by the employee in the company.

Salary remuneration system: concept, advantages and disadvantages, calculation rules

The salary system as a method of paying employees is one of the most used tariff systems in large private and public enterprises. The use of this method of calculation is advisable only with a clear understanding of the principles of its operation and the financial future of the enterprise.

The concept of the salary system

The salary payment system is a type of time-based tariff system, when the salary is set as a monthly fixed amount, which is issued to employees in installments 2 times a month.

This article talks about typical ways to resolve the issue, but each case is unique. If you want to find out how to solve your particular problem, call :

- Moscow.

- Saint Petersburg.

Or on the website. It's fast and free!

The amount of an employee’s monthly income does not depend on the number of working days, holidays and weekends in a month, unless the employee takes time off, extra shifts or goes on sick leave.

Monthly income structure:

- flashing part;

- bonuses and compensation;

- social payments.

The amount of social benefits is determined by law if the employee has benefits and other legal grounds.

The amount of salary and bonus is determined by an employment or collective agreement, while the salary is not subject to change regardless of output, and the employer pays the bonus at its own discretion, depending on the employees’ compliance with labor discipline and implementation of the plan.

In fact, the bonus part, which in most cases ranges from 30 to 100% of the salary, is a tool for punishing or rewarding employees.

It is important to take into account that the total monthly income (salary and all additional payments) cannot be lower than the minimum wage - 11,280 rubles from January 1, 2019. The minimum wage may be increased in certain regions.

Sometimes the salary can be floating and depend on the following indicators:

- employee's length of service;

- qualifications;

- presence of harmful and dangerous conditions at work;

- availability of specialized education.

At the same time, it is important to remember that it is impossible to set different salaries for two employees with the same job functions and the above indicators (Article 132 of the Labor Code).

Areas of use

Basically, the salary payment system is used:

- in state, municipal and government institutions;

- when registering military personnel under a contract;

- when calculating with teams working on a five-day schedule;

- for technical and support personnel;

- for permanent maintenance staff;

- for administrators, accountants , etc.

A monthly fixed salary should not be used for temporary work, as well as for employees whose work results directly depend on their efforts (for the production sector) or the number of clients (for the service sector).

The use of a salary system for workers on a shift schedule is used less frequently due to more complex rules for accounting for weekends and holidays, which preclude automation of the accounting department.

The work of technical personnel (cleaners, storekeepers) is difficult to calculate in volume, so the salary system is also convenient for them.

Payroll rules

An employee’s monthly income under a salary payment system is calculated using the formula:

C = (O + D + P) * (1 – B / N) + 2 * B * (O + P + D) / N,

where O is the amount of salary, D is compensation and social benefits, P is bonus, B is the number of days (hours) that the employee took as time off or spent on sick leave, N is the number of working days (hours) in the month, C is the number overtime working days (hours), which are paid double. The multiplier (O + P + D) / N is the payment for one shift (or one hour) in a given month.

The formula is given without taking into account sick pay, since they are calculated individually based on length of service.

The number of working days in a month on a five-day schedule is calculated by simply adding up weekdays and subtracting public holidays.

In addition to calculating by day, calculation by hour is more often used; in this case, the number of working days is replaced by the number of working hours, and it must be taken into account that the last day before weekends and holidays is shorter by 1 hour.

Calculation by the hour allows you to take into account overtime and days off that last several hours. To calculate working hours, 2 indicators are important:

- working day duration;

- length of the working week.

A working week under a salary system can last 40, 36 or 24 hours.

Example of calculating monthly income

An employee of a team with a 40-hour work week worked 19 days in January 2019, while he was on sick leave for 2 days and went home 4 times 2 hours later due to urgent work. Also, this employee was once 3 hours late, which is why he was deprived of his bonus by 25%. The employee's salary is 20,000 rubles, the bonus is 10,000 rubles, there are no additional payments.

Income for January is equal to (O + D + P) * (1 – B / N) + 2 * B * (O + P + D) / N

In January 2021, there are 17 working days, taking into account all holidays, with a 40-hour working week - 136 hours (N).

Sick hours plus lateness – 19 hours (B).

The number of overtime hours is 4 * 2 = 8 (B).

Prize 10,000 * (100 – 25)% = 7,500 rubles.

The income was (20,000 + 7,500) * (1 – 19 / 136) + 2 * 8 * (20,000 + 7,500) / 136 = 26,893.38 rubles.

The salary system is applicable in large enterprises with a stable income and a large number of employees, as well as for office and service personnel. When using this system, it is important to specify in detail in the collective agreement the grounds for possible deprivation of bonuses.

Loading…

Source: https://pravo.team/trudovoe/oplata/okladnaa-sistema.html

System Features

The salary system of remuneration is considered simple to calculate, since the calculation requires adding up the salary per month with different bonuses and additional payments. The earnings of each employee of the company consists of a fixed part, represented by salary, as well as a variable part, which is various additional payments, allowances or other payments.

Additional payments are assigned in certain situations, which include:

- the specialist is engaged in his work duties at odd hours;

- a citizen works on holidays or weekends;

- engages in labor activity at night;

- benefits are provided to mothers or pregnant women;

- work is carried out in harmful or completely dangerous conditions;

- teenagers get jobs;

- accrual of money for downtime associated with equipment repairs.

The salary is assigned without the influence of the above factors, so its amount remains unchanged.

What does the salary depend on?

The regular salary system of remuneration is considered interesting and in demand for many organizations. It allows you to fairly distribute funds among all specialists, but at the same time it is possible to single out specific employees by paying a high bonus.

The salary depends on various factors, which include:

- employee qualifications;

- degrees, awards or achievements held;

- length of service;

- the presence of various unique skills or knowledge, which include knowledge of a foreign language or the ability to work with complex computer programs;

- effective employee activity leading to an increase in sales volume;

- combination of several professions by one specialist;

- work experience and existing education.

A fair salary system is established, so certain specialists working in the organization are not discredited in any way.

The company's salary increases only for employees who deserve such encouragement. Therefore, based on various achievements, the salary increases, for which the director of the company issues a corresponding order.

What is the difference between a tariff rate and a salary?

Salary has a lot in common with rate. Official salary is the amount of payment for work established for a selected period of time. You need to learn to distinguish between terms and their meaning in order to correctly evaluate work and calculate labor income.

A common characteristic is that these values are used to determine the minimum income of a person, below which payment is impossible. Despite this, the differences between the terms are significant:

- Salary implies an exact monetary amount established for a month of work, subject to the employee performing the types of work expected according to the position. For a tariff rate, the value is defined as a fixed payment for the execution of an assigned norm of a certain level of complexity for a specific period of time - an hour, a day, a month.

- The salary amount is influenced by the qualifications of the person working in a particular position. The tariff rate assumes dependence on the rank held by the employee at a given enterprise.

Thus, the salary is determined according to the position and achieved qualifications of the employee, based on the education received and experience

For the rate, the complexity of the tasks performed, the intensity of the work process, employment conditions and the importance of the actions are more important

Accrual methods

With a salary system of remuneration, the salary is accrued either in a specific organization or entirely in a separate industry. In the first case, the enterprise is private, so the director independently decides to increase the salaries of his employees.

If the salary in a particular industry increases, then such changes will affect only government agencies and their employees.

The size of the salary is directly affected by the area in which the citizen works. The region of residence is also taken into account, since the minimum wage and other indicators differ significantly in different cities. Art. 129 of the Labor Code contains information about what the minimum salary is with different allowances, so employers cannot pay funds that are less than this indicator.

Unique order to change (increase) official salary

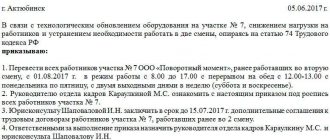

A change in an employee's salary can be initiated by a memo indicating the reasons for the change in salary. If the salary is subsequently reduced, the wishes of the line manager will not be taken into account.

Reasons for increasing the salary may be:

- systematic overfulfillment of the plan;

- training;

- successfully completed certification;

- extensive work experience.

In addition, salary increases may be initiated as a result of changes in job responsibilities.

To raise the issue of a salary increase:

- The employee's manager must provide his superiors with a memo containing information about the reasons for increasing the salary of his subordinate.

- Subsequently, the document must be agreed upon with an authorized person or director of the organization.

- After the salary increase is approved, the HR department employee must prepare a unique order to adjust the salary portion of the employee’s salary, as well as to make adjustments to the staffing table.

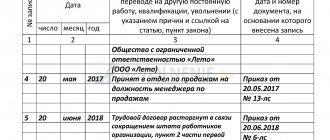

- In addition, all changes must be reflected in the employment contract. To do this, it is necessary to prepare an additional agreement, which will subsequently be signed by both parties.

- If an agreement of any kind is reached, a unique order is drawn up to change the official salary and an additional agreement to the employment contract.

Since this order does not have a form approved at the legislative level, any institution has the right to draw it up in a free format on the company’s letterhead

It is extremely important that the order reflects the following data:

- information about the enterprise;

- order details;

- the city or town where the order was drawn up;

- date of document preparation;

- changes in working conditions;

- argumentation of the need to change the official salary;

- signatures of the parties.

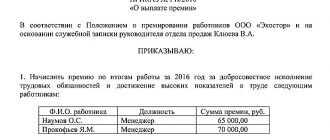

Thus, the final version of the order to change the salary of an official will look something like this:

Organizational and legal form

ORDER No. (order number)

City

date

about a salary increase (employee's name in the dative case)

In connection with (reason for salary increase, for example: improvement of quality indicators / change in staffing / expansion of functionality) I ORDER:

- Set (position and full name of the employee) official salary in the amount of (new salary amount in figures and words) rubles from (date of salary change).

- The chief accountant (full name of the accountant) must ensure timely payments of the salary specified in paragraph 1 of this order and other amounts calculated on the basis of it, as well as monitor the correctness of execution of all personnel documents.

- The HR department inspector (full name of the HR department employee) makes changes to the staffing table (date and number of the staffing table), setting the salary for the position (position name) in the amount of (amount of the new salary).

- The HR department inspector (full name of the HR department employee) prepares an additional agreement to the employment contract (date and number of the employee’s employment contract) with (employee’s full name) on setting a salary in the amount of (amount of the new salary) from (date of salary change).

- The inspector of the HR department (full name of the HR department employee) familiarizes himself with this order (full name of the employee) against signature.

Reason: (name, date and number of the document that initiated the salary increase, for example: memorandum from the head of the department / order to amend the staffing table)

General Director (company name) (full name)_______________(signature)__

I have read the order (full name of the chief accountant)_________________ (signature) __ I have read the order (full name of the HR department employee)___________ (signature) __ I have read the order (full name of the employee)___________________________ (signature) __

Changes in the terms of payment for professional activities will come into force immediately after the documents are signed by both parties.

The main thing to remember is that no matter how the terms of payment for work change, if any agreement is reached, an order and an additional agreement to the employment contract on changing working conditions must be drawn up between the parties. Without this documentation, the change to the salary portion will be considered invalid.

How is the system used in companies?

If an employer decides to use a regular wage system, then he must understand how it is established at the enterprise. To do this, the following nuances are taken into account:

- the system is introduced by a collective agreement or an internal regulatory act of the organization;

- if there is a trade union at the enterprise, then its opinion must be taken into account when introducing such a scheme;

- the salary is set in the form of a fixed amount, which is paid if the employee works the required number of hours in the company;

- For each specialist, the salary is determined individually, since his work experience, qualifications, complexity of activity and other significant factors are taken into account;

- different skills and abilities of an employee can be taken into account separately or in combination, so the salary of employees occupying the same position may differ slightly or even significantly;

- If the same salary is set for all employees of one position, then the earnings of specialists are regulated by assigning different additional payments and bonuses, for which the qualifications or complexity of the work are taken into account.

Therefore, the application of the salary system is considered a rather complex process, since the employer must take into account many nuances so as not to offend any employee in any way.

Legal basis

The salary system of payment implies the accrual of remuneration to the employee, carried out monthly for the performance of direct duties of a certain complexity. What is an employee’s salary according to the Labor Code of the Russian Federation? The definition is contained in Article 129, according to which the official salary is a fixed amount of money for performing the work provided for by the employment contract, job description and standard regulations on remuneration, excluding compensation, incentives and social payments.

For employees of state and municipal organizations, it is specified what the basic salary is. Basic means the established minimum for employees included in a certain qualification group without including additional payments.

The salary system is established depending on the following factors:

- qualifications and professionalism of the performer;

- volume and level of complexity of work;

- quality component of labor and performance conditions.

The main responsibility of the employer when establishing a regular salary system of remuneration is to argue for a different approach to the size of the fixed salary and the availability of additional payments and allowances. If there is a trade union organization, management is obliged to take into account the opinion of activists of the elected body.

When occupying identical positions, a mechanism for establishing additional payments that regulate the final amount of remuneration is possible. The reason is the presence of different qualifications in accordance with the conclusions made by Rostrud in letter No. 1111-6-1 dated April 27, 2011.

In addition to additional payments and allowances, the official salary can also be different, despite the requirements of Article 22 of the Labor Code of the Russian Federation regarding equal pay for work of equal value. The basis - the difference in the duties performed formed the basis for the determination of the Krasnoyarsk court in case No. 33-6699 of July 22, 2013.

Where is it used?

In Russian companies, such a system is used quite often. It is not very relevant to use a salary system during a shift schedule, since the employer and employees do not have accurate information about how many hours will be worked during the month. Therefore, difficulties will arise with calculating wages when an employee goes on sick leave or unpaid leave.

This system is most often used in state or municipal institutions. Salaries are assigned to employees who have a minimal impact on the income received by the company. Typically, a time-based salary system is used for accountants or managers, civil servants or administrators.

Even some military personnel working under contract are paid salaries. The salary system for work on a shift schedule can be used, but the accountant may have serious difficulties when calculating the earnings of specialists. Therefore, the enterprise should keep a time sheet.

Advantages and disadvantages

Payroll technology has a number of distinctive characteristics.

| pros | Minuses |

| Stability and guarantee of salary receipt | Mainly low wages |

| A decrease in company income does not affect employee salaries | Lack of opportunity to motivate staff |

| Standardized working day | An increase in company income does not affect employee salaries |

| Easy payroll calculation | The need to pay for non-working days in the same amount as workers (according to Article 112 |

| Establishment of a trusting relationship between the employer and employees (in most cases) | |

| Ability to plan budget expenses | |

| No staff turnover |

Advantages of the system for company managers

Often different companies establish a salary system for calculating employee earnings. Employee earnings remain unchanged over a long period of time. Therefore, salary payment is automated. For employers, the use of a salary system for remunerating employees has the following positive parameters:

- the company's expenses are clearly planned;

- it is possible to individually encourage any specialists, for which various bonuses, remunerations or additional payments are assigned;

- Due to the fact that the salary does not depend on the company’s income, savings are provided for the organization’s budget.

The disadvantages of using such a system for an employer include the fact that employees lack motivation to increase production or sales. This disadvantage is eliminated by assigning different additional payments or bonuses. Another negative point is that you have to pay not only for working days, but also for weekends.

Time-based wage system

» Remuneration » Time-based remuneration system

The time-based wage system involves calculating wages depending on the time worked. This system is divided into simple time-based, time-based bonus, salary and contract. Let's look at each of them in more detail.

A simple time-based remuneration system is the usual payment to an employee for the actual period of time worked, according to the approved tariff, without taking into account the number of works.

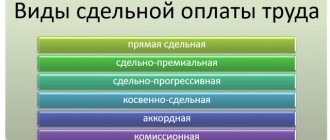

Other remuneration systems:

- piecework;

- tariff-free;

- mixed.

Calculation of payments under a simple time-based system can be carried out according to the following principles:

- Hourly calculation

- Calculation for each day worked

- Calculation per month

For this type of payment, it is required to maintain time records of the time interval worked. It is also necessary to separate tariffs by rank and position in accordance with regulatory documents. Standards are being determined that could regulate the work of time workers. Workplaces must comply with standards that ensure labor efficiency.

The most significant disadvantage of a simple time-based system is that it provides the least incentive for staff to complete tasks effectively, since the amount of payment does not depend on the result of work.

Time-bonus wage system

Time-bonus wages are a time-based simple payment supplemented by a bonus for high quality performance indicators. The payment of bonuses is subject to the established principles of bonuses written down in the collective agreement.

The size of the bonus is determined according to the timing and quality of work performed. The employee will receive a bonus only if the conditions for the bonus are met.

Often this type of payment is practiced when calculating wages not only for management and specialists, but also for a huge number of ordinary workers.

Salary system of remuneration

Salary payment is a system according to which the employee’s salary is calculated at a fixed monthly rate. Unlike time-based, it does not take into account the fact that different months have different numbers of working days.

But if the number of days actually worked is less (due to sick leave) than the number of days that needed to be worked, wages are calculated based on the sum of the daily pay and the amount of time actually worked.

With this type of remuneration, a system of bonuses and additional payments, which are provided for by law, is also assumed. Additional payments can be made for overtime work, night work, downtime during multi-machine patronage due to major repairs, refilling, refueling, and cleaning. Additional payments are also provided to nursing mothers with children.

To summarize, we can say that the amount of wages calculated using the salary method consists of a monthly rate, bonus and additional payments.

Contract wage system

Contract is a system that involves signing a contract between an employee and an employer for a certain period of time.

When an employee is hired, a contract (in this case an employment contract) must be concluded in writing and secured with appropriate signatures and a seal. Only in this case will it have legal force.

The contract contains information such as its validity period, working conditions, rights and obligations of the employee and employer, working hours, and the amount of remuneration. The sanctions that will be applied in the event of premature termination of one of the participating parties must be prescribed.

The contract can be concluded for the period of the employee’s stay in the organization and represents time-based payment, or for a volume of work or a specific task with a limited time frame, which is piecework payment.

The contract system provides for various additional payments and bonuses that are due to an employee for a high level of qualifications, mastery in a given profession, and for extreme working conditions. This clause must also be stated in the text of the contract.

| Didn't find the answer to your question in the article? Get instructions on how to solve your specific problem. Call the phone right now: +7 – Moscow – CALL +7 – St. Petersburg – CALL +8 (800) 500-27-29 ext.849 – St. Petersburg – CALL here – if you live in another region. It's fast and free! |

Source: https://rabotniks.ru/povremennaya-sistema-oplaty-truda/

Example system

You can consider the salary system using the example of an organization engaged in food production. All employees receive the same salary, but the results of their activities are taken into account.

If any specialist exceeds the established plan, he can count on a high bonus. If he goes on sick leave, his salary is not reduced due to absence from work for a certain amount of time. Such a system is considered effective for a manufacturing company, since it is possible to easily plan the organization’s expenses for paying employees.

Differences from salary

So what is salary? Let's try to understand in more detail the concept that interests us.

The salary is the so-called base from which one starts when calculating wages.

What is the difference between salary and salary? First, tax deductions are primarily based on salary. Secondly, appropriate increases can be accrued in case of processing. From there, penalties for damage to property or other fines are deducted, and incentives or bonuses are added.

This is interesting! Posadovy salary in Ukrainian is an official salary.

As a result, the salary is what the employee receives in his hands. It can be either less or more than the salary. As a rule, the salary amount is agreed upon in advance for a certain amount of hours of work, but if during the process the employee exceeded the norm at the request of his superiors by working overtime, then he should be compensated for this.

What salary size is clearly regulated by the legislation of the Russian Federation? It is a fixed amount, which must be prescribed when drawing up an employment contract with an employee, and changing the salary is hardly possible. In order for the concept under consideration to change its size, a number of conditions are necessary. One of them is the Order. In this case, the salary, or rather, changing it, would be advisable. But the salary is a calculated amount, so it is not written down anywhere in advance.

An employee should carefully monitor the amount of his salary, because sometimes the employer writes off damage to materials or equipment as a deduction for the employee’s monetary compensation, although the latter is not actually to blame for anything (indirectly or directly).

For such a gross violation of laws, you can sue the employer.

The work of counselors at a summer camp can serve as the most striking example of such a case. Some property damage is deducted from new caregivers' pay when management does not verify that the previous shift was completed.

The employee has every right to be informed of all deductions of his wages.

So, what is salary in an employment contract? After all, everyone knows that for some important reasons and in some cases, drawing up this type of agreement is simply necessary. Whether the concept itself and the size and other characteristics are indicated in it, we will consider further.

The employment contract must specify the salary of an employee of the enterprise, the procedure for calculating it and increasing it.

As a rule, the salary is calculated based on the remuneration system, which is:

- tariff-free – wages are calculated based on the company’s final profit;

- tariff - the employer evaluates the employee’s work results based on the agreed norm and production time;

- mixed - the employer takes into account the total profit of the company and the contribution of a specific employee to it.

Advantages and disadvantages for employees

There are pros and cons of the salary system for employees of different enterprises. The positive aspects of its use include the following:

- the specialist is confident that, regardless of the result of work, downtime or other specific factors, he will receive a fixed salary, so no external or internal circumstances can affect his earnings;

- salaries can be calculated independently, so employees themselves can control the work of the accountant;

- all citizens have approximately the same salary, so there is no injustice in the company;

- if one of the employees is distinguished by any unique achievements, then he can count on encouragement in the form of a bonus or other rewards;

- Team unity is ensured through transparency of salary calculations.

The disadvantages of such a system for workers include the fact that they cannot independently influence the amount of their monthly income. They can only hope that their employer will award them a bonus for their various achievements and actions. Employees of the organization cannot count on any part of the profit, so if the organization receives a large amount of money in one month, only the company’s management will feel it.

Evaluation of the salary system from the employee’s perspective

The advantages of the payroll system under consideration from the employee’s perspective include the following:

- Whatever the area of the market it concerns, the presence of a salary gives the employee confidence in receiving a certain amount, regardless of external and internal circumstances.

- A simple formula for calculating salaries.

Another advantage of salary is the approximately equal level of salary between employees, which does not give rise to a feeling of injustice, but, on the contrary, promotes team unity. This aspect is equally positive for both employees and employers.

The disadvantage is that the employee is unable to manage and regulate the amount of his monthly income. This minus is especially relevant for cases when, as a result of the activities of a particular employee, the company’s profit significantly increases - management skims the cream, while an ordinary employee who ensures income growth has the right to receive only a salary, if so stated in the employment contract.

Calculation examples

The peculiarity of the salary system is that the calculation is simple if there is accurate information about how much time the specialist worked per month. The company may not provide additional payments to employees, so specialists can only receive a constant salary.

For example, the company has introduced a salary system. All employees receive the same salary, equal to 20 thousand rubles. per month. One specialist worked completely for the entire month, but one day was spent on field activities, for which he was given a bonus of 3 thousand rubles. Therefore, his earnings will be 23 thousand rubles.

How to use coefficients to calculate salary

Application of coefficients when calculating salaries

In the process of forming basic remuneration, many companies use a system of coefficients that take into account the individual characteristics of the employee’s work, his level of workload, responsibility, and the complexity of the final result. The application of coefficients may vary. Let's look at the most common ways to calculate salary using coefficients.

The remuneration system is based on coefficients. In some cases, in order not to recalculate the entire salary grid, employers introduce a system of coefficients for each position.

In this case, the actual calculation of the official salary is based on the minimum salary of an unskilled worker of the company, which is initially charged at a coefficient of 1.0. In the future, when wages rise, the level of the base salary simply changes, and all other salaries are simply recalculated by mathematically multiplying this indicator by coefficients.

Individual coefficients for employees. Sometimes employers introduce individual increases for the most qualified employees in order to increase their remuneration level. This is done by order of the enterprise; further calculation of all remuneration is carried out based on the salary multiplied by the individual coefficient.

Regional odds. They are established at the legislative level (for the conditions of the Far North) or at the level of local constituent entities of the Federation (for example, Moscow, St. Petersburg).

The coefficient is calculated on the base level of remuneration. If other types of coefficients that increase his salary are applied to an employee, then the regional one is applied last. In other words, initially you multiply the base salary by all individual increasing coefficients, and then also multiply by the regional allowance.

If an employee's income level increases, the employer is not required to inform the employee about such changes. At the same time, if the employee’s remuneration level is to be reduced, he will have to be notified of this at least two months in advance. And if the employee does not agree with such changes, he may be fired as he refused to continue working under the new conditions.

Features of calculation when working on weekends or holidays

Often companies need to hire specialists to work on holidays or weekends for various reasons. If employees receive a salary, then when calculating their earnings, the provisions of Art. 153 TK. Therefore, the calculation rules include:

- if the day worked is included in the monthly norm, then, in addition to the salary, a one-time daily rate or hourly rate is assigned;

- if it is established that working on a non-working day resulted in overtime for an employee of the organization, then it exceeds the monthly norm, therefore a double rate per day or hour is applied.

Difficulties may arise for an accountant when determining an hourly or daily rate, since the law does not have rules for calculating these indicators. Therefore, based on Rostrud letter No. 2822-6-1, to calculate the hourly rate, it is required to divide the monthly tariff by the number of working hours in one month. It is important to take into account possible shortened days.

Nuances of a shift schedule

If a decision is made to use a salary in the presence of a shift schedule, then some important features of the process are taken into account. These include:

- if a specialist works fully for the entire month, then he is paid the full salary;

- if the period is not fully worked out, then the amount of income is reduced in proportion to the number of days worked;

- If overwork is detected, then additional funds are transferred to the employee in the form of an additional payment.

During shift work, the accountant has to pay a lot of attention to recording the working hours worked by each employee. For this purpose, the enterprise maintains a special working time log. It must have a unified form and contain important information for the calculation.

How is overtime paid?

If overtime is detected, then such overtime work must be paid in an increased amount. For the first two hours of overtime, the hourly wage increases by 1.5 times. If the processing time exceeds 2 hours, then the subsequent time is paid at double the rate.

To determine the optimal payment amount, it is necessary to determine the exact number of overtime hours, after which the hourly salary is calculated. The resulting values are multiplied.