Cases related to debts are territorial. That is, before filing papers to collect money from a person who does not voluntarily repay the debt, you need to find out which territorial district the borrower belongs to. Therefore, determining the bailiff department at the address is considered perhaps one of the most important tasks in the process of fully developing a bankruptcy case. If you transfer a court order to the wrong FSSP branch, unpleasant problems may arise, even to the point that the case will not be opened. As a result, time is wasted and debt collection becomes much more difficult.

How to determine the address of bailiffs using the debtor's address

What to do if you don’t know which department of bailiffs you should contact?

Please note! There are several ways to understand the situation. But the most popular of them are available with official papers:

- The first method is to contact the federal service department. Using this service, the easiest way is to obtain the necessary information about the location of the borrower against whom proceedings are ongoing in court. In this case, you will have to write an application for collection. The appeal is drawn up addressed to the head of the department related to the territorial district where the proceedings are taking place. Having accepted the application, the department employees clarify the information, and after 5 days they forward the document to the appropriate territorial department;

- The second method is to use the Internet to determine the FSSP department corresponding to the debtor’s place of residence. How does the search process work? First of all, you should go to the official FSSP page of the borrower’s region of residence. Having opened it, you need to find the section “Identification of the FSSP department by address” and go into it. After a form with fields appears on the screen, each line is filled in with the requested data (it is important to know the street and house number of the debtor). Click the “Check” button. If everything is done correctly, information about the bailiff department will appear on the screen, where the interested person should contact.

If a document requires immediate execution, the papers will be sent to the required address immediately after they are received. No 5 days will be needed to review them.

Attention! In accordance with the established rules, writs of execution must be transferred to the department where the debtor:

- is in fact;

- resides;

- its legally registered company (branch, representative office) is located;

- his property is located.

As you can see, papers can be submitted to different departments, so it’s easy to get confused, and debt collection results in more problems. To avoid such difficulties, start by checking the information about the borrower available in the writ of execution. When preparing the sheet, such information must be entered. Once you have received the required data, enter it into the form on the website.

Lack of information is not a reason to give up. Contact the database of enforcement proceedings. As a basis, take the place where the most proceedings have been opened against your debtor. If the answer is found, it is better to clarify it by calling the department. Once you find confirmation that your actions are correct, continue further.

Reasons why it is more convenient to act at the debtor’s real address

Federal Law No. 229 explains to us that enforcement documents are always transferred to the FSSP service at the real address of residence of the defaulter. There are no other options and there should not be, and the plaintiff is deprived of the right to choose the place where it would be more convenient for him to start the case.

This is also interesting because even if the defaulter is actually located on the other side of Russia, the plaintiff will still have to endure inconvenience in order to return his funds . Although there are opinions that it would be much more convenient to open such cases at the place of actual residence of the creditor, i.e., the injured party. Situations where problems arise with debt repayment are actually quite common. Therefore, it is more expedient for bailiffs to act in the territory of the defaulter, since in this territory they have more opportunities to complete the task. In a certain sense, they have a “free hand,” that is, they can carry out actions that would be impossible in the territory of someone else’s jurisdiction. We are talking, for example, about an inventory of property. About a procedure that simply cannot be carried out remotely.

The bailiff appointed in the case pays a visit to the debtor and makes an inventory of property, the sale of which can cover the debt. The higher the amount of debt, the larger the inventory. The greater the amount of property reserves, including real estate, as well as vehicles, is needed to repay the debt. Blocking accounts can be no less effective. This action is performed to exclude the possibility of the debtor withdrawing funds that could fully or partially cover his current debts.

There is also the option of taking away and selling things to compensate for the debt. The only alternative option is to engage a contractor located in the designated region . Moreover, such a service is one-time and is possible only when part of the defaulter’s property is located in another area. In this option, responsibilities are shared. But this kind of action is too expensive financially and not very convenient, so it is more expedient if all the necessary operations are carried out on the territory of the guilty defaulter.

Which bailiffs execute a court decision?

The debt can be collected at the location of the debtor. It is on this principle that the FSSP branch is selected.

Please note! If the borrower is an individual, bailiffs have the right to work:

- at the place of registration of the debtor;

- at the borrower’s place of residence, if he does not live at the registered address;

- at the location of property owned personally by the debtor, for example, real estate.

If the debtor is a legal entity, the bailiffs are guided by:

- to the place of registration of the borrower's property;

- to the location of the branch or representative office.

Since the lender is interested in returning his funds, he should find as much information as possible about the borrower’s property and its location. It is also important to know where this person is registered and where he lives. If such information is at the disposal of the creditor, the debtor has no chance of escaping liability.

Sometimes debtors go into hiding and it is impossible to find their whereabouts. In this case, the executors are sent to the place where the debtor recently lived. But this state of affairs is unlikely to suit the creditor. Therefore, the case can be considered at the location of the lender. The situation will change as soon as the location of the borrower becomes known.

Important! Actions of the bailiff in case of discovery of the debtor:

- If the debtor is found in the territory under the jurisdiction of the selected department, the bailiff continues to carry out the actions required by the procedure. Sometimes the situation is such that the case is being considered in the region in charge of this department, but some issues need to be resolved outside this territory. In this situation, the bailiff in charge of the case transfers authority to another bailiff who has certain powers. After resolving the issues that have arisen in another region, the bailiff returns to fulfilling his duties;

- If a persistent defaulter is discovered in another region, the case is redirected to another bailiff located at the debtor’s current location. Although there is also one nuance in this situation. The case is redirected if there is no property owned by the borrower in this region.

Active actions of the bailiff begin if the borrower’s place of residence is known. If there is no information, the executor faces another task - to find the debtor. After discovering the location of the defaulter, the bailiff who found him or another executor to whom the case was transferred is sent to him. His first action is an inventory of property.

Certain conditions relating to the property must be met. It should:

- be owned by the debtor;

- not to be mortgaged;

- its assessed value corresponds to the size of the debt.

Regarding the last point, it is necessary to clarify that the inventory is made only if the debt is more than 1,000,000 rubles.

How to confirm the fact that the property belongs to the borrower?

To do this, you need to submit papers about receiving an inheritance, a sales contract, a deed of gift, checks, receipts, invoices, etc.

How bailiffs carry out court orders

It is established that overdue debts are collected at the place where the defaulter is currently located. Taking this fact into account, the selection of the required body of the FSSP of the Russian Federation is made. In cases where the defaulter is an individual, bailiffs can carry out actions at the place where he is registered.

When the specified unscrupulous citizen is not found where he is registered, the bailiffs may well act in relation to the place where the unscrupulous payer actually lives, when it is known. Another option when an appointed bailiff can and must work is the territory where the borrower’s property is located, such as real estate, for example.

If the defaulter is a legal entity, we focus on the address where his property is registered as a legal entity, as well as the places of representative offices of his companies and branches. To speed up the start of the process, the creditor should be in full information readiness, finding out in advance what property the defaulter owns and where it is actually located, the actual location of the defaulter himself, temporary or permanent. Then the debtor himself will have to hide his property reserves much more carefully and hide himself.

Of course, there are times when there is no way to find out where the borrower is currently located. The bailiffs must visit the last of all previously known points. If such variations do not suit the creditor, it is possible to consider the case at the current location of the creditor. This is possible before the information of interest about the missing defaulter becomes available.

When the unscrupulous citizen is nevertheless found, the bailiff will continue the procedure in the case where the specified defaulter was discovered in the territory of the jurisdiction of the elected branch and his property reserve was discovered in this territory. A moment may arise when an open case is already being considered in the area of jurisdiction, but some issues need to be resolved in a completely different area or region - without the presence of an appointed bailiff. Then, according to the rules, he transfers authority to another appointed FSSP service employee who has the necessary competence.

When the issues are resolved in another region, the case can again continue to be considered in the region where it was previously opened. In another case, the bailiff may redirect the case. This happens if the designated defaulter is hiding in another district, city, region and the contractor is deprived of the opportunity to deal with him. It is redirected to the local bailiff service, where the defaulter actually resides. But it must be taken into account that at the place where the case was opened there was no property of the debtor left at all.

If the bailiff knows exactly the address where the defaulter lives or is temporarily located, he begins to take active actions; if not, the person is put on the wanted list. When the location of the borrower’s identity has already been established, a visit from the bailiff (the one who was involved in the search or the one to whom the case was subsequently transferred) is organized, and the discovered property of the unscrupulous citizen is described. It is important that such property is not pledged, all its parts or shares belong to the said defaulter, and its sale could cover the debt. For example, real estate is subject to description only if the amount of debt exceeds one million Russian rubles.

To prove the rights to your property, in particular to real estate, you must present documents of acquisition, purchase/sale agreements, donations of real estate, all receipts, checks and invoices, certificates for things received as an inheritance and those still available.

Why does the FSSP work at the debtor’s residential address?

According to Federal Law No. 229, executive documentation is transferred to the FSSP. Territorial departments are selected at the place of actual residence of the defaulter.

The plaintiff does not have the right to personally choose the regional branch of the joint venture. And there is a logical explanation for this. As is known, bailiffs can seize the debtor’s property, block his bank accounts, etc.

In order to do all this promptly, they need to be in the place where the debtor is, since it is impractical to perform such actions at a distance. That is why enforcement matters are transferred to departments.

Watch the video. The order of work of bailiffs:

Bailiffs - find out the debt by last name through the official website of the FSSP RosDolgi

According to the new legislation, you may not be allowed to leave the country if you have debts from court cases. It is recommended to regularly check your debt to avoid getting into a difficult situation. Bailiffs seize bank accounts and impose restrictions on travel outside the homeland. Please note that by court decision, you may have a debt to bailiffs if:

- — The traffic police fine was not paid on time

- — Didn’t pay the loan, mortgage, etc.

- — Statement of claim (individual/legal entity) against you

- — Tax evasion

- — Failure to fulfill other debt obligations

The main thing is a ban on any travel outside the country for 3 years. Seizure of all bank accounts and cards. The debtor will be obliged to repay the debt within the specified period; otherwise, the bailiffs will begin the procedure for confiscation of property. In order for citizens to independently find out their debts due to bailiffs and repay them on time, an online debt checking website was created.

25 Apr 2021 urisgkmo 273

Share this post

- Related Posts

- Sample Application for Appeal to Review a Decision to Refuse a Visa

- Standard of Liquid Household Waste for Labor Veterans in 2021 Altai Territory

- When does your last name change after marriage?

- Where can a military veteran go for free dental prosthetics in Perm?

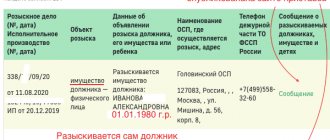

Search for the debtor's address on the official website of the FSSP

Finding the debtor will be much easier if the creditor has his exact address. To decide on the joint venture department, you need to know the address where the borrower lives or is registered. You can also use information about the defaulter’s property.

If the listed data is available, you can check the bailiff, that is, clarify that the application is being sent to the right department.

Attention! Let's consider the search algorithm:

- go to the official website of the SP service -;

- find the “Services” tab, left-click on it;

- in the window that opens, find “Department definition...” and activate the section;

- wait for the form to open;

- Specify what information you need to enter. Write down the region, city, street name and house number. Double-check what you wrote to avoid any misunderstandings.

It will take no more than two seconds to find information. You will see the address of the department to which cases of a particular region are transferred. Sometimes you have to repeat the request, as problems may arise due to testing the service.

Website of bailiffs "FSSP" of Russia

Attention: reliable and safe sites do not require payment for their activities. If, before issuing information, they offer to send an SMS to a short number or pay for a service, you can safely close the site - these are scammers. There are a lot of them. Therefore, verification services are often not in demand.

Determine SSP by debtor's address

Use the Internet to determine exactly which department of the OSB is suitable according to the existing address of the debtor. To apply this method, you need to find the official page of the FSSP (the region where the debtor lives). Next, find the section “Identification of the FSSP department by address” and click on it. A form will open with fields that need to be filled out.

What to do if there is no residence data

Rarely do refund cases go quickly and smoothly. It all depends on the debtor’s willingness to cooperate with the bailiff, which rarely happens. More often than not they hide. Therefore, the plaintiff faces difficulties, because the application can only be filed if the location of the defendant is clarified.

What to do if the search for the debtor reaches a dead end?

In this case, the application is submitted to the territorial branch of the joint venture, where the trial took place. The department already decides to redirect the application or leave the paper in the department. To do this, the bailiffs have 5 days (counting starts from the day the documentation is submitted).

If the borrower is not found, the case will be considered in the department that the authority will select. But as soon as the borrower shows up, the case will be redirected according to the discovered data.

What to do when changing your place of residence

Borrowers who borrow money are not always able or willing to pay it back. They often hide from creditors. From a legal standpoint, this is a violation. If a defaulter participating in enforcement proceedings decides to change his place of residence, according to the requirements of the law, he is obliged to notify the FSSP about this. In this case, the summons will be sent to the last place of residence.

Please note! Without notifying the bailiffs about the move, the defendant will incur administrative costs. punishment (Article 17.14 of the Code of Administrative Offenses of the Russian Federation):

- fine for physical persons will be from 1,000 to 2,500 rubles;

- officials will pay from 10,000 to 20,000 rubles;

- fine imposed by legal individuals – from 30,000 to 100,000 rubles.

When the summons is sent to the debtor's last place of residence, it is considered served.

That is, in this case we are talking about more serious problems. Everything may end in criminal liability for financial fraud. And the reason for this will be banal irresponsibility.

There are no specific deadlines for notice of relocation. But it is already clear that this should happen as soon as possible, especially since the size of the fine is large, especially when it comes to legal entities. persons This behavior of the defaulter will not help in any way in the case of debt collection.

Contacting the FSSP department

The bailiff of the relevant authority is an authorized person who enforces court decisions. At the moment, the type of work presented is fully regulated by Russian laws. The legal basis and obligations of the bailiff can be found by opening a specific bill.

When a person wants to ask the bailiffs for help, this can be done through a written application, which is drawn up based on the standards and rules of correspondence among persons participating in litigation in court.

To write a written application to an authorized person, you only need a blank piece of paper and a pen. In the upper right corner you should indicate the name and location of the institution where you want to send the written application. Below is the surname, initials and address at the place of residence.

The paper describes in detail the essence of the question or petition with which the citizen addresses the bailiff. At the end, after the text, a signature is placed on the right side, and on the left - the date of signing the paper.

In certain situations, it is required to attach specific documentation or bank card details to the application. Everything depends on the nature of the problem that is raised in the written application. The bailiff service in the judicial authority is required to receive a written document and, within the shortest possible time, notifies of the actions taken after its receipt.

You can also seek advice from a law office that provides this type of service. They will provide assistance in drawing up a written application in accordance with all the rules and standards of laws in Russia. Competent application execution will help achieve the desired effect.

The system of judicial workers is well established in our state. By sending an application to any city, you can be sure that the written application will not only reach the addressee, but also the issue described in it will be resolved.

How to report a move to the FSSP

If the borrower changes place of residence, it is necessary to notify the FSSP. The application is submitted personally to the service or sent by mail (by registered mail with acknowledgment of receipt).

Important! The notice states the following:

- recipient's details (name of the territorial department of the FSSP, full name, bailiff position);

- sender's details (full name, address where the borrower plans to live);

- direct information for the FSSP;

- signature, date.

If a person is not ready to repay debts, he will not inform about the move. Although this information may also come from a creditor who learned about such an action by the debtor. And this will speed up the time for debt collection.

Features of treatment

Bailiffs provide their services not only to lenders, but also to borrowers. Therefore, the latter can also receive advice on the nuances of enforcement proceedings that interest them, and also demand the documents on the basis of which it was initiated. Employees of the Federal Bailiff Service are required to inform you about the current accounts through which payment must be made, and within what time frame it occurs on a voluntary basis.

If you do not have the opportunity to contact us here yourself, you must send a registered letter. If accompanying documents are added to it, they are described in a separate paper. After the start of enforcement proceedings, an official will be assigned to you who will oversee your case. Through it you will be able to carry out all requests. To make your interaction with an employee as convenient and productive as possible, record his personal data and contacts. It should not take more than 30 days to consider your appeal from the date of its registration. If the process lasts longer than this period, you have every right to appeal the work of the bailiff and accuse him of inaction.

ATTENTION! Our portal has a free legal section, where our experts answer pressing questions from our readers. All you need to do is fill out the form below and wait for a response from our specialist within 5 minutes. For your convenience, consultations are held at any time of the day (24/7). Ask a question:

How to apply to the Office of the Federal Bailiff Service in 2021

An application to the Office of the Federal Bailiff Service can be submitted in two ways - drawn up on paper or electronically. In the latter case, the claimant needs to register as a user on the FSSP website; you can also use the State Services portal.

You can decide on the branch of the joint venture at the Federal Bailiff Service.

Important! The official statement contains the following information:

- details of the writ of execution (number), date of receipt, name of the body that compiled the papers;

- put forward requirements;

- personal data of the defaulter, address (registration and actual);

- creditor account details (funds are transferred to this account in case of debt collection);

- Full name, passport details, citizenship, residential address of the claimant - for an individual; TIN, extract from the Unified State Register of Legal Entities, place of registration, address - for a legal entity.

If the application is submitted by a representative of the creditor, a notarized power of attorney will be required, which indicates the powers of this person.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

Free online legal advice on all legal issues

But it is of interest why this is so, because it would be much more convenient if the case were considered on the territory of the injured party. Actually this is not true. If a problematic case is being considered on the territory of the debtor, the bailiffs have a free hand. They can carry out legal procedures that are not available to them in areas outside their jurisdiction.

How to determine the address of bailiffs using the debtor's address

- Let's turn to the official website of the FSSP at: https://fssprus.ru

- Find the “Services” tab

- Next, the tab “Identification of the FSSP department by address”

- A form to fill out will appear here. Fill in the fields according to their names: region, city, street, house number

- Check that the entered data is correct. This is important to obtain the correct result.

- Perform a search. This may take a few seconds.

- Get information about the desired FSSP branch where you need to submit documents.

An application to the Office of the Federal Bailiff Service can be submitted in two ways - drawn up on paper or electronically. In the latter case, the claimant needs to register as a user on the FSSP website; you can also use the State Services portal.

In case of violation of the principle of territoriality, the application will be forwarded to the department at the debtor’s place of residence. Notice of action is provided to the applicant (by regular mail or email, depending on the method of application).

How to apply to the Office of the Federal Bailiff Service in 2021

- If the debtor is found in the territory under the jurisdiction of the selected department, the bailiff continues to carry out the actions required by the procedure. Sometimes the situation is such that the case is being considered in the region in charge of this department, but some issues need to be resolved outside this territory. In this situation, the bailiff in charge of the case transfers authority to another bailiff who has certain powers. After resolving the issues that have arisen in another region, the bailiff returns to fulfilling his duties,

- If a persistent defaulter is discovered in another region, the case is redirected to another bailiff located at the debtor’s current location. Although there is also one nuance in this situation. The case is redirected if there is no property owned by the borrower in this region.

- Describe the debtor's property that can be sold at auction and repay the debt. The amount of property that will be described depends on how large the borrower's debt obligations are. When it comes to large sums, everything is described, right down to housing and cars.

- Block the borrower's bank accounts. The bailiff can partially or completely cover the debts with money from the accounts, and blocking is necessary so that the funds are not withdrawn by the debtor.

- Seize and sell property to cover debts.

- The debtor disappeared, and his property remained in the territory under the jurisdiction of the bailiff, then he has the right to seize his property for further sale in order to cover the debt.

- The debtor has moved to a territory beyond the control of the bailiff, then he has the right to transfer the case to the appropriate department of the FSSP for the region where the borrower is hiding.

Changing of the living place

If you need to determine the borrower's address, you must first obtain a writ of execution from the court. With him, personally contact the FSSP department - it can be any nearest one - and find out the necessary data from the bailiffs on the basis of a document from the court. This method is used if neither the required FSSP branch nor the address of the debtor is known.

After the application is received by the Federal Bailiff Service, it must be registered by the records management department within 3 days. The application must be reviewed within 30 days from the date of registration. If there are exceptional reasons, this period may be extended by the chief bailiff for another 30 days.

If the collector does not know where exactly the defaulter lives and he cannot find out, the appeal must be submitted to the chief bailiff of the region of the Russian Federation where the trial on the issue of debt collection took place. The decision to forward the said application to the ROSP (district department of bailiffs) is made by the chief bailiff within 5 days from the date of its receipt. And in the case when the document on debt collection from the defaulter is subject to immediate execution, then you need to decide on redirecting the application on the day the application is submitted.