How to use the calculator

Instructions for using the overtime calculator

- Enter the cost per hour for work in your organization. If you don’t know it, click “Calculate hourly cost”, enter the salary amount, select the accounting year and click on “Calculate hourly cost”. The program will calculate the cost of an hour using the formula: salary amount / (annual hours according to the production calendar / 12)

- Indicate how many hours and minutes of overtime were worked.

- Click "CALCULATE". The result will show both the total amount and separately for the first 2 hours and subsequent ones.

The overtime hours calculator works taking into account the requirements of Art. 152 of the Labor Code of the Russian Federation, that is, it includes in its algorithm payment differentiation depending on the number of overtime hours worked.

When you can't refuse overtime

In Art. 99 of the Labor Code of the Russian Federation lists circumstances that do not require the consent of subordinates to work beyond time limits. When the unexpected happens, you need to act quickly and consistently, regardless of time: this is the responsibility of every employee. You need to do everything in your power without looking at your watch in the following situations:

- eliminating the results of man-made disasters, industrial accidents, and the consequences of rampant natural disasters;

- performing actions designed to prevent an emergency;

- when an accident occurred with socially necessary communications, such as communications, transport, water supply, heating, gas, electricity, etc.;

- it is necessary to act immediately due to the declaration of a state of emergency or martial law;

- something happened that endangered life and health or created abnormal living conditions for a significant part of the population (hunger, natural disasters, epidemics, animal attacks, and other similar situations).

Standard calculation method

In accordance with Art. 152 of the Labor Code of the Russian Federation, overtime hours worked are paid according to the scheme outlined below:

- the first two hours of overtime work - at a coefficient of not less than 1.5;

- third and further hours of overtime work - at a factor of 2 or more.

The procedure for calculating payment is established at the local level through a collective agreement, individual employment contracts and relevant orders of the head of the enterprise or organization. At the same time, the procedure established at the local level should not worsen the employee’s position in comparison with the amount of payment established by the Labor Code of the Russian Federation.

The formula for calculating overtime hours is not regulated; however, Letter No. 16-4/2059436 of the Ministry of Health of the Russian Federation contains a completely workable calculation formula.

So, in accordance with the Letter of the Ministry of Health, overtime can be calculated by performing the arithmetic operation O / (GN / 12) = PO, where:

- O is the salary size;

- GN – annual norm according to the production calendar;

- 12 – months of the calendar year;

- PO – hourly salary.

For example, take the following hypothetical conditions.

Loader A. worked 3 hours overtime. The salary of a loader is 15,000 rubles. Taking into account a 40-hour work week, loader A. worked 1970 hours during the billing period. We calculate payment for overtime work:

15,000 / (1970/12) = 91 rubles 40 kopecks cost of one standard hour. Next, we calculate the hours taking into account the coefficient:

- 91.40 × 2 × 1.5 (one and a half coefficient) = 274 rubles 20 kopecks payment for the first two overtime hours;

- 91.40 × 1 × 2 = 182 rubles 80 kopecks for the third overtime hour;

- 272.20 + 182.80 = 455 rubles payable for 3 overtime hours.

Let them work if doctors allow them

Some categories of workers, even if they agree to work overtime, cannot be involved in it without a positive medical report. Order of the Ministry of Health and Social Development of Russia No. 411n dated May 2, 2012 requires that a certificate of no contraindications to additional work for health reasons be issued to:

- disabled workers at the enterprise;

- working mothers of children under 3 years old.

IMPORTANT! In addition to the authorizing medical document and consent, these categories of employees are required to confirm in the form of a handwritten signature that they are aware of the right to refuse to work overtime.

Calculation taking into account shift work schedule

When calculating the amount of payment for overtime hours during a shift work schedule, it is advisable to use the summarized accounting of working hours in the accounting period. The accounting period can be any period of time from one month to one year.

If we return to our example above about loader A. and slightly change the conditions, then the calculation will be made as follows.

With the previous salary of 15,000 rubles, we will take one month as the accounting period, during which the loader worked 176 hours, while the standard hours for the same month are 159.

In total, loader A. worked 17 hours above the norm. We make the calculation:

- we calculate wages for standard hours - 176 × (15000/159) = 16,603.77 for 159 hours;

- We calculate the additional payment for hours worked in excess of 17 hours. We multiply the first two hours by a factor of one and a half, all subsequent hours by a factor of 2. From the example above, we remember that an hour of work for a loader costs 91.40. Thus, 91.40 × 2 × 1.5 = 274.20 rubles. for the first two overtime hours and 91.30 × 15 × 2 = 2848.20 for the remaining overtime hours;

- We calculate the payment for 17 hours worked overtime - 274.20 + 2849.20 equals 3133 rubles payable.

Shift duration for this type of work

The duration of overtime work is specified in many regulations. What are these norms? More precisely, there is a permissible number of hours that an employee can work additionally. In case of irregular working hours, the number of additional hours should not exceed 4 hours for two days in a row. In total overtime for 1 year, overtime work should not exceed 120 hours.

In some cases, additional conditions for overtime work are established by internal documents of the organization.

For example, this applies to subway or railway workers. Their working day, even including overtime, should not exceed 12 hours. And the duration of overtime work should not exceed these standards. Otherwise, the employer will break the law. And even more, the employer is obliged to strictly control the recording of working hours, since this is his direct responsibility.

Author of the article

How to use the calculator

There are a total of five windows in the calculator in which you will need to enter the following data:

- the cost of one working hour - in the first field;

- hours and minutes worked within the first two hours at a factor of 1.5;

- hours and minutes worked within subsequent hours at a factor of 2.

Immediately after filling out each field, an intermediate answer will appear, to which, as new values are added, adjustments will be made until the calculation is completed.

Recommendations for employers on registering overtime work

- Do not forget to request the employee’s consent to work overtime and clarify the opinion of the trade union organization.

- Do not disregard the medical report if it prohibits such work.

- Reflect in the collective agreement and employment contracts the regime for attracting and paying overtime.

- Mark the schedule for involving workers in overtime in a special journal. Overtime per year should not exceed the legal 120 hours.

- Document all relations with the employee in writing: issue an order on overtime work, indicating the amount of compensation and overtime hours, and obtain written consent from the employee.

During a business trip

Overtime work during a business trip is determined by the main article on overtime work. Article 99 of the Labor Code of the Russian Federation states that an offer for overtime employment must come from the immediate supervisor.

During a business trip, he can send an official letter ordering overtime work. Unfortunately, actual overtime on a business trip is more difficult to prove if there is no official document. Additional work must be documented.

While on a business trip, an employee can keep a time sheet.

Is it legal to exchange overtime hours for time off? They’ll tell you in the video:

Work on weekends and holidays

Working on a weekend or holiday is not overtime work, since they are determined by different articles of the Labor Code. In both cases, the employer is obliged to add payment for additional work to the basic salary.

According to Article 153 of the Labor Code of the Russian Federation, working the hours specified by law on a weekend or holiday will provide the employee with an increase in salary. The standard hourly or daily wage is added to the salary.

Working overtime on a weekend or holiday will allow you to earn double the rate. The employer does not have the right to make a smaller increase.

The law leaves the employee the right to choose: receive financial compensation for work or another day off. Having chosen a vacation, the employee will receive standard pay for going on a holiday or day off. The rest day will not be paid.

The amount of additional payments or rest is agreed upon in advance in a collective employment contract.

Download a sample collective labor agreement here for free.

Calculation of overtime with summarized recording of working time

According to Art. 104 of the Labor Code of the Russian Federation, in cases where it is impossible to comply with the daily (8 hours in the general case) or weekly (40 hours) standard working time, it is permissible to introduce a summarized recording of working time in the organization. Working hours are counted not for a week, but for the period established by the organization. This could be a month, a quarter or a year. Such accounting is introduced so that the duration of working hours does not exceed the normal number of working hours in the entire allotted period. In this case, one week an employee may work more than normal, and the next week, on the contrary, less. The employer will evaluate the time worked after the end of the accounting period - month, year or quarter.

Summarized accounting is convenient for companies with a shift schedule, in which employees work every other day, two to two, or several shifts a day. With such accounting, overtime may also arise, for which it is necessary to calculate payment.

Additional payment for extracurricular work in the case of cumulative recording of working hours is made after the end of the accounting period. Let's look at how overtime is calculated using an example.

An example of calculating overtime hours with a salary

Salary of employee Malofeeva L.G. is 25,000 rubles per month. In September 2021, the employer delayed him twice: on September 1 for 3 hours, on September 8 for 1 hour. We will calculate overtime if the norm is for Malofeev L.G. 40-hour, five-day work week.

The first method (based on the average monthly number of working hours in 2016):

In 2021, the average annual working time for a 40-hour week is 1974 hours (see production calendar). Let’s calculate the hourly part of Malofeev’s salary in average form:

For overtime work on September 1, Malofeev L.G. will receive:

For September 8:

In total, the employee was credited 759.85 + 227.95 = 987.80 rubles in September 2021. for working overtime.

Second method (based on the actual number of working hours per month):

In September 2021, the average monthly working time for a 40-hour week is 176 hours (see production calendar). Let us calculate the hourly part of L.G. Malofeev’s salary. based on the actual (not average) number of working days in September:

We see that the result is a completely different amount of hourly earnings than when calculating using the first method (almost 10 rubles less). But at the same time, in another calendar month - in which the number of labor hours is less than in September - the amount obtained, on the contrary, will be greater than with the average annual calculation.

For September 1, Malofeev will receive:

For September 8:

Total for September 2021 Malofeeva L.G. overtime accrued: 710.20 + 213.06 = 923.26 rubles.

The amount turned out to be less than in the first case, which is unprofitable for the employee. The Ministry of Labor in letter No. 1202-21 dated 08/09/2002 recommends using the first method of calculating overtime if this improves the employee’s financial situation.

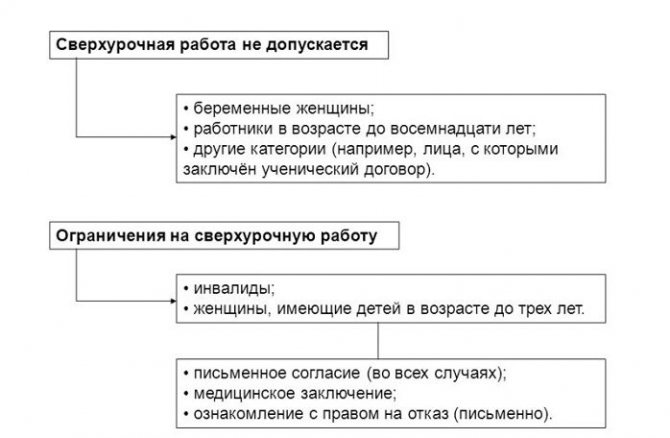

What restrictions are there?

not all categories of individuals can be assigned overtime work

Certain rules regarding the duration of such a day and some additional regulations have also been adopted. In this regard, we suggest that you familiarize yourself with the current restrictions regarding overtime work:

- A ban has been introduced on the employment of women employees under the age of majority, as well as certain other groups of individuals, for work that lasts longer than the generally accepted standard working day; a ban on overtime work has been established through other federal laws.

- There are some restrictions for attracting individuals who are unable to work due to disability, as well as for employees with children who have not yet reached the age of three.

To assign overtime work hours for a given group of people, you must first familiarize yourself with their right to refuse such work, and then get their signature on the appropriate document.

Then you should issue a consent indicating that the employee belonging to this category of persons does not object to overtime.

And as a final stage, employees must provide a certificate from a medical institution , which confirms the fact that the employee’s state of health allows the employee to perform his duties.

An employer does not have the right to engage an employee overtime if he does not have the latter’s consent, and the basis for engagement is not included in the list of reasons described in the first and second parts of Article 99 of the Labor Code.

Moreover, this rule applies to absolutely all categories of individuals.

What is the maximum number of hours allowed per year?

Russian legislation, namely Article 56 of the Labor Code , establishes a certain standard for the maximum number of hours per year.

It is 120 hours for one employee.

Employees holding administrative positions in the organization for which the employee works are responsible for ensuring that this annual norm does not exceed the maximum volume.

Their responsibilities include counting, strictly monitoring and recording the amount of time during which an individual works overtime on the initiative of the employer.

Thus, if an employee has already been involved in overtime work for 5 months in a number of hours equal to 24 for each month , then the employer no longer has the right to offer him overtime work for this year.

Since the product of the monthly number of hours exceeding the standard working day (24 hours) and the number of months when the employee worked overtime is exactly 120 hours , which is the maximum number of overtime hours per year by law.