Tax office – an executive body that monitors compliance with tax legislation in Russia. Monitors the accuracy of accruals and timely payment of tax payments. Receives citizens' requests in several ways, including via a hotline. This method of communication will help resolve issues of interest if it is impossible to personally visit a real institution.

About the Federal Tax Service of Russia

The Federal Tax Service is a body whose main task is state economic supervision. This is a structure of the executive power, which is under the jurisdiction of the Ministry of Finance of the Russian Federation. The Federal Tax Service performs the following tasks:

- Monitoring compliance with regulations on taxes and fees.

- Control over timely payment of taxes to the budget.

- Monitoring the correctness of tax calculations.

- Monitoring compliance with the currency law of the Russian Federation.

Also, the Federal Tax Service is considered an authorized executive body, whose powers include registration of legal entities, farming communities, and individual entrepreneurs. The activities of the Tax Service are regulated by the Tax Code of the Russian Federation. The Federal Tax Service includes the central apparatus and interregional structures. The total number of government employees exceeded 170 thousand people, according to data for 2021.

Contacts of the Federal Tax Service: official website

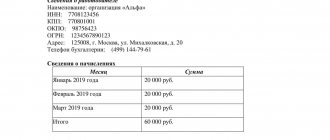

Contacts of the Federal Tax Service:

- Official website of the Federal Tax Service of Russia: www.nalog.ru

- Taxpayer personal account for individuals: lkfl.nalog.ru

- Personal account for individual entrepreneurs: lkip.nalog.ru

- Taxpayer personal account for legal entities: lkul.nalog.ru

- Send a request: www.nalog.ru

- Social networks: Facebook, VKontakte, Twitter

- Nalog.ru website support email: [email protected]

Hotline of the Tax Service of the Federal Tax Service of Russia

The contact center was created by the state so that citizens could ask the necessary questions to Federal Tax Service employees. without leaving home. The hotline is called by people who, for some reason, cannot get to the inspection department in person, or by those citizens who want to get advice on certain issues without documentation - in this case, it is more advisable to call the contact number than to go to the department and wait your turn.

8-800-222-2222

8-800-222-2222 is a single number of the Federal Tax Service, which is free to call. Here you can ask any questions related to tax fees, changes in legislation, and taxpayers' rights. This contact number works throughout Russia. Calls are received daily:

- Monday, Wednesday - from 9 am to 6 pm.

- Tuesday, Thursday - from 9 am to 8 pm.

- Friday - from 9 am to 5 pm.

The contact center is closed on Saturdays and Sundays. During non-working hours, citizens receive the necessary answers to questions using an automatic informant. However, he will not be able to answer some questions. Only during business hours do Russians have the opportunity to directly contact the operator. Every year, the Federal Tax Service tries to improve the quality of service and expand the number of operators in order to reduce the waiting time for a response on the line.

Online tax consultation via internet, skype, icq for organizations, individual entrepreneurs and individuals

Part one of the Tax Code of the Russian Federation, in particular, has been supplemented with provisions ensuring wider use of electronic documents in interaction with tax authorities. Certain concepts and terms used in the Code have been clarified; responsibilities of taxpayers (regarding the submission of reports on separate divisions); procedure for calculating tax (in cases where the responsibility for calculating tax is assigned to the tax authorities, a requirement is established to notify the taxpayer of the payment amount no later than 30 days from the date of payment). In addition, in particular, the following has been adjusted: the procedure for recognizing as uncollectible and writing off arrears and debt on penalties and fines; the procedure for granting a deferment, installment plan, investment loan, the procedure for sending a request for tax payment (the total period for its execution has been reduced from 10 to 8 days); the procedure for suspending transactions on taxpayer accounts (in the event of an unlawful decision by the tax authority to suspend transactions, interest will be accrued and payable to the taxpayer); procedure for registration and deregistration with tax authorities. The amendments have clarified the elements of tax offenses and also increased the level of liability for their commission. So, for example, the fine for violating the deadline for registration will be 10 thousand rubles, for conducting activities without registering with the tax authority - a minimum fine of 40 thousand rubles; for failure to submit a tax return - at least 1000 rubles, for violation of the method of submitting a declaration - 200 rubles (Directory of new fines of the Tax Code of the Russian Federation from 09/02/2010).

Amendments have been made to part two of the Tax Code of the Russian Federation concerning, among other things, the procedure for paying VAT, personal income tax, corporate income tax, state duty and some other taxes. For example, it is possible to prepare invoices electronically by mutual agreement of the parties and if they have compatible hardware and software. The name of the currency has been added as one of the invoice details. The list of income not subject to personal income tax includes the income of the borrower (his legal successor) in the form of the amount of debt under the loan agreement, interest and penalties, repaid by the beneficiary creditor at the expense of insurance compensation. The responsibilities of tax agents have been clarified regarding keeping records of tax deductions provided to individuals, calculated and withheld tax amounts, as well as the return of excessively withheld personal income tax amounts. For the purposes of calculating corporate income tax, property is now considered depreciable if its original cost is 40 thousand rubles (previously - 20 thousand rubles); The procedure for attributing certain taxpayer expenses to expenses, including interest on debt obligations, has been clarified. The amount of state duty for issuing permits for the transboundary movement of hazardous waste and ozone-depleting substances, as well as for the import of toxic substances into the territory of the Russian Federation, is set at a fixed amount (200 thousand rubles, 100 thousand rubles and 200 thousand rubles, respectively).

The Code of the Russian Federation on Administrative Offenses has been supplemented with a new article providing for liability for illegal denial of access to an official of a tax authority to inspect the territories of a taxpayer in respect of whom a tax audit is being carried out.

How to call the Russian Federal Tax Service hotline

To reach the Tax Service department, you need to dial 8-800-222-2222 on a weekday and wait for a response from an available operator. It is worth considering that the line receives a lot of calls, so sometimes the waiting time can reach 10-15 minutes. When the response is received, the citizen needs to introduce himself and ask the operator to connect him with the desired department of the tax inspectorate or the specialist himself. The following are several possible scenarios:

- The operator answers the question of the person who called, the issue is resolved, and the call ends.

- A citizen who calls the hotline is connected to the required department, after which he receives advice directly from a representative of the Tax Service.

- If there is no one in the required department, the call center operator may offer to switch the calling citizen to the taxpayer relations department.

Another possible outcome is that the citizen can be transferred to the local branch of the Federal Tax Service, which is located in the city where the taxpayer lives. Here the subscriber can describe his problem and receive detailed advice regarding his question. Persons who are abroad and need urgent consultation with Federal Tax Service employees can call the hotline at +7-495-276-22-22. Here you need to take into account that the cost of the call may vary depending on the rules of the local operator.

What issues are covered by the Tax Service hotline?

On the Federal Tax Service hotline, you can resolve various issues related to paying taxes, taxpayer rights, creating a personal account, and choosing a tax regime. Citizens can also ask individual questions to contact center specialists. It is worth considering that call center consultants do not have the authority to make any decisions related to the collection of taxes. They only advise citizens on issues that interest them. All decisions are made by authorized employees of the Federal Tax Service.

Payment of taxes and insurance premiums

By calling the tax hotline, you can find out:

- What percentage tax rate applies to individuals and legal entities.

- How can I pay the tax fee?

- Is it possible to pay taxes through a personal account?

- Is it possible to defer payment or split it into several parts?

- What are insurance premiums and who should pay them?

- What standards govern insurance premiums?

- What is the percentage of insurance premiums?

- What types of insurance premiums are there?

- What payments do not require payment of an insurance premium?

- What system are insurance premiums calculated by?

- Where can you make a payment and how will the fact of payment of the tax fee be verified?

Contact center specialists will also be able to tell you what documents need to be presented to the Tax Inspectorate when checking the payment of insurance premiums. In the contact center you can learn about liability for individuals and legal entities who evade paying the insurance premium.

Assistance in registration and liquidation of enterprises

By calling the Federal Tax Service hotline, you can clarify the situation on the following points:

- Method of company registration.

- Creating an organization name.

- Selecting activity codes that will be displayed in the state register.

- Choice of authorized capital.

- Features of creating an agreement on establishment: all the nuances, regulations, documentation.

- Preparation of the enterprise charter.

- Features of drawing up an application for registration: deadlines, documentation, regulatory requirements.

- Amount of state duty, terms of its payment.

- Choosing a tax system that will be appropriate in a particular case.

- Features of preparing a power of attorney for submitting documentation.

- Features of accounting.

- Features of liquidation, the need to notify the Tax Service and the Pension Fund of Russia.

- Rules for preparing an interim liquidation balance sheet, deadlines for its submission to the Tax Service.

- The need to close debts as a result of liquidation of the company, timing.

- Features of drawing up the final liquidation balance sheet.

- Rules for preparing reports on taxes and personnel who have been fired.

- Peculiarities of submitting documentation for liquidation of an enterprise to the Federal Tax Service.

The contact center specialist will tell you about the stages of registration and liquidation of an enterprise, the amount of state duty, some regulatory nuances, as well as the responsibility for citizens who evade legal norms.

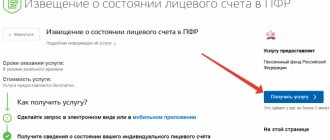

Personal Area

Today, all taxpayers in the country can pay taxes and receive additional services through the taxpayer’s personal account. This is an interface that makes the life of citizens much easier. It makes it possible to perform any operation from a mobile phone or computer anywhere in the world. The call center operator will be able to tell the caller about the following points:

- Features of creating a taxpayer’s personal account, how you can register a personal account.

- How can you access your personal account?

- Methods for obtaining a password from your personal account.

- How to enter your personal account.

- Features of registering a personal account for legal entities.

- Connecting a personal account for individual entrepreneurs.

- Methods of paying tax through the taxpayer’s personal account.

- Overpayment of tax, how to return part of the funds.

- Filing a complaint to the Tax Service through your personal account.

A call center specialist will be able to explain to the caller how to use the mobile version of your personal account, where to download the application and how to log in to it.

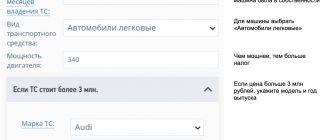

Selecting a tax regime

By calling the Federal Tax Service hotline, you can find out about the features of choosing a tax system and all other nuances:

- Choosing a tax regime for individual entrepreneurs and LLCs.

- Features of the general taxation system.

- Features of the simplified taxation system.

- Features of the single tax on imputed income.

- Features and rules of the patent tax system.

- Unified agricultural tax.

- Which tax regime is more advantageous in this or that case?

A contact center specialist will be able to tell you about the pros and cons of each taxation system and help you choose the appropriate regime for individual entrepreneurs and LLCs. You can also find out about mandatory insurance premiums for entrepreneurs and enterprises by calling the hotline number.

Individual solutions to citizens' issues

You can contact the Federal Tax Service via the hotline with any questions related to taxation in the Russian Federation:

- The amount of tax fees, features of new laws, current innovations.

- Rights and obligations of taxpayers in Russia.

- Rules and deadlines for filling out a tax return.

- The procedure for calculating tax fees.

- Procedure for calculating tax on donated property.

Using the contact center, citizens will be able to get a detailed answer to their question without visiting the Federal Tax Service department. This way you can save significant time.

Taxpayer personal account www.nalog.ru

A taxpayer’s personal account for individuals allows you to perform the following actions:

- Register or find out your own TIN from the Tax Service;

- Have information about possible debts for any types of taxes and fees, pay off said debts online, and also return excessively transferred tax amounts to your own account;

- Provide an online declaration of your income;

- Receive the tax compensation due to you;

- Consult on the full range of tax issues;

- File a complaint against the actions or, conversely, inaction of tax officials.

Taxpayer personal account for individuals

A personal account for individual entrepreneurs allows you to:

- Provide a package of documents necessary for registering a business online on the website of the Tax Service of the Russian Federation;

- Bring to the attention of the tax authorities about the fact of a change in the status of the current account;

- Check counterparties;

- Provide your own tax and accounting reports;

- Receive information about the possible lack of payment for any fees; if necessary, you can deposit the required amount in real time, as well as return excessively collected tax amounts to your current account;

- Provide the necessary data to begin the procedure for ending the activities of an individual entrepreneur;

- Receive detailed explanations on the questions asked;

- Complain about the actions of the tax authorities.

Personal account for individual entrepreneurs

The taxpayer’s personal account for legal entities allows you to:

- Provide the documents necessary for registration of a legal entity online;

- Notify the tax department about the opening or closing of all types of accounts;

- Conduct a check of counterparties using the Federal Tax Service database;

- Provide all necessary tax and accounting documents in a timely manner;

- Receive information about incomplete payment of taxes, pay it online, and, if necessary, return incorrectly paid tax amounts to your own accounts;

- Provide the entire set of documents required to complete the organization’s activities or initiate bankruptcy proceedings for a given legal entity;

- Receive all currently necessary explanations on tax issues.

Taxpayer personal account for legal entities

Free helpline of the Tax Service

Citizens can also use the Tax Inspectorate hotline, where issues related to corruption among some branches of the Federal Tax Service are discussed. The state has created a special communication channel through which citizens will be able to promptly report corruption within the Federal Tax Service for a timely response to violations of legal norms. At the same time, you can report violations not only to the departments of the Federal Tax Service, but also to services that are under the supervision of Tax structures. To file a complaint, you need to call the all-Russian helpline - +7-495-913-00-70. The service operates 24 hours a day. The waiting time for an operator response can range from 1 to 10 minutes.

In what situations is it necessary to send an appeal to the tax office?

The list of circumstances and situations in which it is required to file with the tax service is quite long. However, for the most part, citizens file complaints about unlawful actions of inspectorate employees, and also demand clarification on the application of tax legislation in relation to their specific situation.

These situations include, but are not limited to:

- incorrectly calculated tax amount;

- erroneous tax assessment;

- refusal to provide a tax deduction;

- unlawful actions of tax inspectors, expressed in various forms;

- blocking of bank accounts, as well as suspension of actions on them.

Reference! You can write an appeal to the Federal Tax Service not only on an issue related to the activities of this department, but for other reasons, for example, reporting illegal commercial activities of third parties.

In addition, not only citizens who are individuals, but also those who have the status of individual entrepreneurs, as well as legal entities, can apply to the fiscal authorities.

All contacts of the Federal Tax Service of Russia

It often happens that the Tax Inspectorate telephone line is very overloaded, so the subscriber is unable to reach the operator. In this case, you can use other methods of communication with Federal Tax Service employees.

Official sites

https://www.nalog.ru/ - official website of the Tax Inspectorate. Here you can get acquainted with all the innovations, enter your personal account, learn about debt and unpaid payments. The official website has an email address for a government agency. By mail, you can ask your question and receive an answer within a few days. To make a request, you must go to the message sending form, indicate the topic of the problem, explain the situation in detail, and attach files if necessary. After this, the message can be sent. The official website of the tax service has a virtual reception for citizens. Here you can make an appointment with the Federal Tax Service online. This is a convenient option that helps save extra time.

Forum

The Tax Inspectorate of the Russian Federation has an official forum - forum.nalog.ru. Here, users create various topics in order to get help from citizens who have already encountered similar problems. At the same time, here you can find separate threads and forums for specific territorial subjects of Russia and get an answer to your question from residents of your city. It is worth considering that information received from unauthorized citizens may not always be reliable. Therefore, in any case, it is worth undergoing a consultation at the Federal Tax Service office or via the hotline.

Chatbot

Recently, the Tax Inspectorate of the Russian Federation launched a chatbot, which can be found on the official website of the state structure. With the help of a chatbot, citizens can resolve various issues related to taxation. The bot answers almost all questions about taxes. It is believed that for the most part it is intended for communication only with individuals. You can also make an appointment with the Federal Tax Service using a virtual assistant. The chatbot is still considered an innovation, so it is at the testing stage. It is better for legal entities to address questions via the Tax Inspectorate e-mail or hotline.

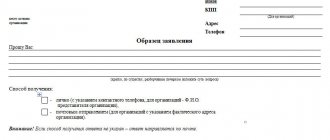

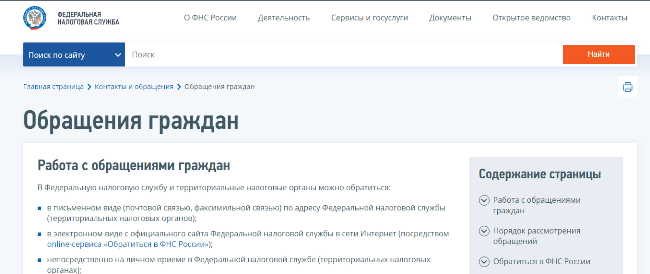

Feedback form

You can leave your request or message via the feedback form - nalog.ru/rn77/service/obr_fts. Most often, all applications are registered within a day. The only exceptions may be weekends or holidays. Messages are reviewed in order of priority. This may take up to 30 days. When filling out the form, citizens must indicate postal or email addresses to which Federal Tax Service employees will send a response. If there is no contact information, the user will not receive a response message. Applications must be correctly written, not contain obscene language, and describe the situation in detail. If necessary, it is necessary to attach regulatory documents and certificates.

Methods

You can contact the tax office in various ways, including by submitting an electronic document. A prerequisite for accepting it for work is to provide reliable information about the person who submits it. Anonymous complaints, demands, statements and other types of requests without attribution will not be considered.

Free legal consultation

+7 800 350-51-81

In writing

The appeal is drawn up in the form of a paper document, which can be sent to the Federal Tax Service by mail or during a personal visit to the inspectorate. In the latter case, the document should be drawn up in 2 copies, one of which will remain with the applicant (with an acceptance mark affixed by an authorized employee).

When using postal services, the document should be sent by special registered mail with return receipt requested (this will confirm that it was sent and received by Federal Tax Service officials). If any documents, including copies, are attached to the application, then an inventory of the contents in the postal item should be made.

Electronically and online

To send an application to the tax service electronically, go to the Federal Tax Service website. Then, in the “Electronic Services” section, select “Contact the Federal Tax Service of Russia.” On the page that appears, you should click the “Create a request” button if the applicant is an individual and his question is related to tax payments or the “Other requests” button in all other cases.

This will be followed by a transition to a page where the user must select the situation with which he is contacting the Federal Tax Service, after which the essence of the complaint or request is written down.

Important! Unless otherwise specified, the response to an electronic request will also be sent electronically by e-mail. In this regard, it is always important to provide a correct email address.

In addition, you can send a complaint through the taxpayer’s personal account or by email, which also operates on the Federal Tax Service website, but to do this you must have a confirmed account on the State Services portal.

Send an appeal to the Federal Tax Service