A funded pension is available only to those born after 1967. The formula, which includes the funded part of pension provision, has been used in the Russian Federation since 2002.

Accordingly, the employer transfers 22 percent of the salary to the Pension Fund for the employee. 16 percent of the salary goes to the insurance part, 6 percent to the funded part.

Below you can find ways to check the size of your savings.

Existing methods

The funded pension can be stored either in the Pension Fund or in a non-state fund (NPF). To transfer savings to a non-state pension fund, it was necessary to submit an application to the Pension Fund before 2015. If such a petition was not submitted, it means that the Russian’s savings are still stored in the Pension Fund. Otherwise, you need to try to find an agreement with the NPF. It must indicate the name of the fund in which the money is stored.

If there is no agreement, information about the funded pension can be obtained using another method. To do this, you need to prepare a SNILS with your passport. Next, you need to perform one of the following steps:

- Visit the Pension Fund in person to fill out an application for information.

- Contact the employer (the accounting department of the company).

- Apply through the government services website.

You can also contact large banking organizations and non-state pension funds with a request for information. However, in this case it will take a lot of time.

Online

To check the amount of pension savings online, you can use both the government services portal and the Pension Fund website.

Public services

Follow this algorithm:

- Go to the government services website.

- Authorization in your personal account.

- Go to the “Pension, benefits and benefits” subsection.

- Selecting the item “Notification of personal account status.”

- Click on the “Get service” button.

After this you need to wait 30-60 s. During this time, the system will process your request and provide information. If necessary, you can print the requested information.

Personal account on the Pension Fund website

Here the algorithm will be as follows:

- Go to the PFR web portal.

- Pressing the “Citizen’s Personal Account” button.

- Login to your account on the government services website.

- Go to the “Individual personal account” subsection.

- Click on the “Get information about generated rights” button.

- Pressing the “Information on earnings and experience reflected in the ILS” button.

If you want to print a statement, click on the “Get information about the status of the ILS” button.

Personal appeal to the Pension Fund of Russia

Every year, the Pension Fund of Russia sends notifications to the postal addresses of citizens, which indicate how much a person has accumulated over the years of work. Also, any Russian can visit a nearby Pension Fund of Russia unit, provide the institution’s employee with a passport and SNILS, and write an application. The Pension Fund employee must issue an extract and send it to your place of residence within 3-5 days.

Find out the size of your pension by SNILS number

With the help of SNILS and information technology, the process of control over the savings funds of a future pension has become more accessible to ordinary citizens. Currently, there are 2 options to clarify this issue for yourself: contact any branch of the Pension Fund of the Russian Federation with the provision of SNILS and a passport, or use the official Internet resources of the Pension Fund of the Russian Federation, NPF and the State Services website.

Algorithm for obtaining information through the Pension Fund website

- Go to the pfrf.ru portal and select “Citizen’s Personal Account” in the bottom menu.

- Find the section “Formation of pension rights” by clicking on “get information”.

- Enter email email and password previously registered on the State Services portal, where SNILS was required. If there are none, then you must go through the registration procedure.

Algorithm of actions on the State Services website

- Log in to the website gosusligi.ru or register by entering your full name, phone number or email. address according to SNILS number.

- Get a password and log in.

- On the main page of the resource, select the “Popular on the portal” section and find the “Find out the status of your personal account” item.

- Or in the “Service Category” click on the section “Pension, benefits and benefits”, “notification of the status of the personal account in the Pension Fund of the Russian Federation”.

- In the window that appears, click on the “Get service” button.

Once the information is generated (this may take several minutes), the required page will open, which can be opened, saved on a computer, or printed by clicking on the menu item “Information about the status of an individual personal account.”

If my savings are in NPF

If your funded pension is stored in a non-state pension fund, then you can obtain information on it from Sberbank and Lukoil Garant. It would be useful to find out how the funded part of the pension is calculated. According to Art. 7 of Federal Law No. 424, the funded part is calculated by taking into account:

- employer contributions;

- additional insurance premiums;

- contributions to co-finance pensions;

- maternity capital funds;

- invested funds.

The amount of pension savings is divided by the payment period, which is determined by law each year. Today it is equal to 246 months. When calculating a funded pension, the payment period must be at least 168 months. For urgent payment, the minimum period is reduced to 10 years.

The change in the amount of the urgent payment is carried out on August 1 of each year by summing the current payment amount and the quotient obtained by dividing the amount of pension savings (as of July 1) by the payment period.

The amount of pension provision will be greater if a citizen submits an application for payments several years after the right to them arises. In this case, the payment period will be reduced by one year for every 12 months that have passed since the date of retirement.

Reference! The advantage of a funded pension is that it can be transferred to a non-state pension fund. However, it is not indexed once a year, therefore, citizens cannot count on its increase when stored in the Pension Fund.

In Sberbank and Lukoil Garant

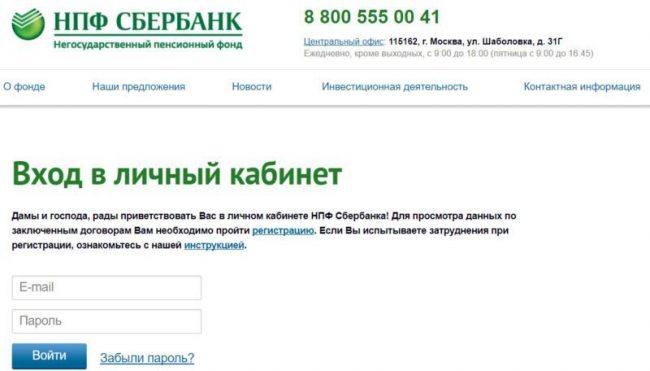

In order to check the amount of pension savings through Sberbank, you need to visit any bank institution with a passport and SNILS. A bank employee will provide you with all the necessary information within 15 minutes. Another option is to control your savings through your personal account.

NPF Lukoil Garant was recently renamed NPF Otkritie. If your funded pension is stored in this fund, then you can obtain information on it on the NPF website.

To do this, follow this algorithm:

- Go to the Otkritie NPF website

- Click on the “Request copies of documents online” button.

- Authorization in your personal account. Authorization through the government services portal is allowed.

After authorization, submit your application. The data will be provided to you within a minute.

Clients of NPF Otkrytie have 2 more ways to check their funded pension. They can write a letter requesting information and send it to the address: 300013, Tula region, Tula city, Radishcheva street, building 8. You can also call the phone number +7-800-200-59-99 and the operator.

How to find out where my pension savings are using the State Services portal

The legislation provides working persons with the opportunity to independently choose a pension fund into which the employer will transfer mandatory insurance contributions. After the law establishing such an employee’s right came into force, numerous non-state pension funds began active efforts to attract citizens’ pension savings for the purpose of subsequently investing them in their own financial projects. Some unscrupulous organizations, when working with the public, provided incorrect information and deliberately misled people, after which they transferred their savings to their accounts without fully realizing the significance of their actions.

That is why cases in which future pensioners, applying to the Pension Fund of Russia at the time of reaching retirement age and receiving the right to accrue insurance payments, learned that their funds were stored in a third-party pension fund, are quite common.

To avoid finding yourself in such a situation, it is worth checking in advance which fund the employer makes monthly pension contributions to. This can be done either by personally contacting the territorial branch of the State Pension Fund, or via the Internet, using a specialized free service.

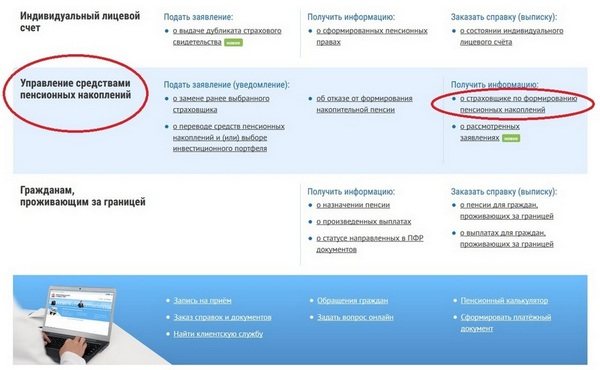

An Internet service designed to obtain information about the location of a citizen’s pension contributions

In order to obtain information about where his pension contributions are located, the user must perform the following steps:

Register on the government services portal (www.gosuslugi.ru). Registration can be carried out either at an accredited certification center or directly on the website, followed by receiving a password to enter your personal account by mail.

Log in to the user’s personal account on the website of government services or the Pension Fund. To authorize on both sites, you use the mobile phone number and password received when registering on the public services portal.

How to find out the amount of the funded pension of a deceased relative

In accordance with legislative norms, family members of the deceased have the right to inherit the funded part of his pension. In addition, the successor who was appointed by the deceased during his lifetime has the right of inheritance. To receive savings, family members or a legal successor must contact the Pension Fund.

The application must be submitted to the institution located at the registered address of the deceased. The applicant will need to prepare:

- document that proves his identity (passport);

- death certificate;

- documents that confirm the presence of family ties with the deceased.

The Pension Fund employee will check the received papers. If they are completed correctly, the Pension Fund will pay out the money that has accumulated in the deceased’s account in a lump sum. Usually money is sent by postal service. Sometimes they are transferred to the bank deposit of a relative of the deceased.

Attention! Checking your pension savings online is the easiest way to obtain information about the status of your individual personal account. If for some reason you cannot use this method, you can personally visit the Pension Fund office .

This method is not as convenient as using the government services website or the Pension Fund portal, since you need to spend your time visiting the Pension Fund and also stand in line. However, you can always take a coupon in advance to arrive at the appointed time and immediately get an appointment with a Pension Fund employee.

Find out online

Important! On the Internet, information about your Fund is stored only by the portals of State Services and the Pension Fund of the Russian Federation. Third-party verification services, which may or may not require money but promise “true information,” work to obtain your passport information (and sometimes funds) for their own purposes. Be careful!

On the State Services portal

The website https://www.gosuslugi.ru collects all current data about you in your personal account for more convenient information. In your State Services profile there is a whole section dedicated to savings that should go towards retirement. It is there that you can see the name of the Fund in which the money is stored.

To do this you must:

- Go to the website.

- Log in to your profile with your username and password - if you don’t have them yet, you will need to register, the button is located under the login form.

- Go to the pensions section.

- There you will have access to information about contributions and the Fund to which they go.