In accordance with Federal Law No. 167-FZ[1], state (municipal) institutions that make payments to individuals are policyholders. This status imposes certain obligations on these organizations, which, in particular, include the obligation to timely and in full transfer insurance premiums, submit documents necessary for maintaining individual (personalized) records, as well as for the assignment (recalculation) and payment of compulsory insurance coverage . In turn, the Pension Fund of the Russian Federation has the right to check documents related to the appointment (recalculation) and payment of compulsory insurance coverage, the provision of information on individual (personalized) accounting of insured persons, as well as to demand and receive from insurers the necessary documents, certificates and information on issues arising in during these checks. In this article we will consider issues related to the implementation of such checks.

As follows from Art. 11 of Federal Law No. 27-FZ[2], insurers (including state (municipal) institutions) submit individual personalized accounting information to the territorial bodies of the Pension Fund of the Russian Federation at the place of their registration:

1) annually no later than March 1 of the year following the reporting year - information about each insured person working for them (including persons who have entered into contracts of a civil law nature, for remuneration for which insurance premiums are charged in accordance with the tax legislation of the Russian Federation), including :

insurance number of an individual personal account;

- last name, first name and patronymic;

- the date of hiring (for an insured person hired by this policyholder during the reporting period) or the date of concluding a civil law contract, for the remuneration for which insurance premiums are calculated in accordance with the legislation of the Russian Federation;

- the date of dismissal (for an insured person dismissed by this policyholder during the reporting period) or the date of termination of a civil contract for which insurance premiums are calculated in accordance with the legislation of the Russian Federation;

- periods of activity included in the length of service in the relevant types of work, determined by special working conditions, work in the Far North and equivalent areas;

- other information necessary for the correct assignment of an insurance pension and funded pension;

- the amount of pension contributions paid for an insured person who is a subject of the early non-state pension system;

- periods of labor activity included in the professional experience of the insured person who is a subject of the early non-state pension system;

- documents confirming the right of the insured person to early assignment of an old-age insurance pension;

2) no later than 20 days from the end of the quarter - information provided for in Part 4 of Art.

9 of the Federal Law of April 30, 2008 No. 56-FZ “On additional insurance contributions for funded pensions and state support for the formation of pension savings”; 3) no later than the 15th day of the month following the reporting period - month - information about each insured person working for them (including persons who have entered into contracts of a civil law nature, the subject of which is the performance of work, the provision of services) (according to the SZV form -M).

In turn, the territorial bodies of the Pension Fund of the Russian Federation exercise control over the correctness of the provision of personalized accounting information by policyholders, including checking the accuracy of the information provided for the assignment (recalculation) of the amounts of compulsory insurance coverage for employees who have benefits in connection with special working conditions (Article 16 of Federal Law No. 27 -FZ, Article 13 of Federal Law No. 167-FZ). Let us remind you that according to Art. 3 of Federal Law No. 27-FZ, one of the goals of individual (personalized) accounting is to ensure the reliability of information about length of service and earnings (income), which determine the size of the pension when it is assigned.

Below we will consider issues related to the implementation of control measures, as well as the interaction of the institution with the inspectors of the Pension Fund of Russia.

What is the procedure for assigning a check?

As follows from paragraph 5 of Methodological Recommendations No. 11p[3], documentary (on-site) checks of the reliability of individual information provided by policyholders on the length of service and earnings (remuneration), income of insured persons in the state pension insurance system are carried out on the basis of a decision (resolution) of the head ( deputy head) of the territorial body of the Pension Fund, which is formalized in the prescribed manner.

It does not follow from the text of the above document that the policyholder is notified in advance of the inspection. Consequently, if an institution has not carried out an audit of personalized accounting for a long time, the accounting service should be prepared for a control measure on the part of the territorial bodies of the Pension Fund of the Russian Federation.

The procedure for confirming work experience

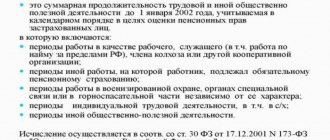

The main way to confirm work experience for calculating pensions and other social benefits is to provide the relevant documents. This is especially true for the periods before 2002, when there was no unified system of personalized accounting. The main document in this case is the work book, information not reflected in which, however, can be confirmed by other papers from employers.

Periods after 2002 are confirmed based on information from the PFR personalized accounting system.

This applies only to the time when insurance premiums were paid for the employee.

Sometimes a procedure is used to confirm experience with the testimony of witnesses. However, it can only be used in the absence of other evidence of work activity.

What documents will be required during the inspection?

An approximate list of documents on the basis of which the reliability of individual information about the length of service and earnings of the insured person can be verified is given in Appendix 1 to Methodological Recommendations No. 11p. Here are some of the documents listed:

- constituent documents;

- the organization's staffing table, a list of freelance workers, a list of employees working under civil contracts, the subject of which is the performance of work and the provision of services;

- lists of employees retiring this year and in the next two years;

- settlement, settlement and payment, payroll statements;

- personal accounts of employees;

- orders (on hiring, transfer to another job, granting leave, termination of an employment contract, etc.);

- workers' work books;

- time sheet;

- documents confirming additional indicators (factors) of employment in hazardous working conditions.

Please note: since verification of information about experience and earnings is carried out for two completed calendar years preceding the verification, it is necessary to prepare documents for this period (see paragraph 7 of Methodological Recommendations No. 11p).

The main parameter for checking the authenticity of a work book

Upon presentation of the drawn book to the Russian Pension Fund, the validity of such “literature” will cease immediately. Pensions are calculated not according to memoirs, but according to taxes actually paid. No matter what unique profession is indicated in the false document, no matter how many labor awards and encouragements are listed there, the main thing is missing from it. The work books do not indicate the employee’s earnings, there is no information about taxes paid, which is the basis for calculating a pension.

By presenting “this” to a serious organization that is interested in the candidate’s previous work experience, the security service will conduct the check. At smaller enterprises, HR officers can also check recent records. But life shows that fewer and fewer employers are interested in entries in work books - they don’t even ask for them. Entries are made at the insistence of the employee in compliance with the law.

But the fact remains a fact. Forgery of work records, if not flourishing, is flourishing. Sometimes, without delving into the subtleties, people themselves, with their false entries, cast doubt on the authenticity of the document being presented. For example, information about work experience from 1991 to 1995 is entered into a form that came out of the printing house in 2012.

Another reason to consider the book counterfeit is the illiterate records of the personnel department employees responsible for this. But it is permissible to make changes and corrections to work books, so there is no point in falsifying anything. Not only gratitude, but also negative characteristics entered into the work book can also serve as a reason for creating a new, clean work biography.

Checking the work record according to these parameters is the main thing. There are no forms on sale that were printed even 10 years ago, not to mention earlier editions. Employees of HR departments of enterprises have long learned to check the presented work book by series and number. But here only the compliance of the date of issue of the form with the date of the first entry about the workplace is checked.

For submission to the Pension Fund, records of existing experience made in sample books from 1974 to 2003 are currently recognized as legitimate, and since 2004 - according to new, latest design and protection options. Until 2003, 10 series of TK 1974 samples were released, from AT I to AT X. The series and book number are indicated on the first page in red font.

The general design of TC forms changed significantly in 2004. We changed the size, format, color and series designation. They became smaller in size, the dark gray cover was made denser. But the main difference is the numbering. The series is printed in black, and the serial number is printed in red. On the last page it says “MPF Goznak. 2003".

It’s the same here: the inscription 2003 does not indicate the date of printing, but the date of approval of the sample. The actual year of manufacture corresponds to the total series and number indicated on the 1st page. You can find the layout of the series according to the time of printing of work record forms on the Internet - this will bring you closer to solving the authenticity of the work record.

So, the forms with the series:

- TCs were printed in 2004-2005;

- TK-I – in 2006-2007;

- TK-II – from 2008 to June 2010;

- TK-III – from June 2010-2012;

- TK-IV – since 2013.

On all pages of the Labor Code, the inscription “Work book” glows greenish in ultraviolet light. The “TK” watermarks are visible all over the page in a random arrangement when viewed in the light. The sheets are now stitched with two-color strong thread.

This information is accessible, and anyone interested can master it - both those who want to falsify records and those who are forced to check them.

What will inspectors pay special attention to?

Please note that, first of all, the individual information of employees retiring (reaching retirement age) within the next two years is checked.

If there are no such employees in the institution and the number of employees is up to 30 people, a check of individual information will be carried out in relation to all employees. If the organization has a large number, then a random check is carried out (at least 7% of the total number). However, please note that if false information is established, PFR specialists have the right to conduct a full inspection (clause 7 of Methodological Recommendations No. 11p).

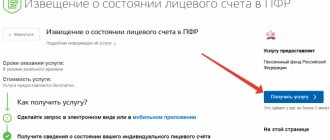

How to submit a request to the pension fund?

Appeals to the Pension Fund are made for all pension matters. The need for the initial assignment of a pension, an application for an early pension, a requirement for recalculation - all this necessitates the need to submit a request to the pension fund. Compliance with this procedure is also mandatory for subsequent appeals to the judicial authorities.

As a general rule, the application under consideration is submitted at the citizen’s place of residence. Therefore, when deciding how to start applying for an old-age pension, you should initially decide on a specific territorial pension authority. This is of fundamental importance, since an incorrectly selected recipient of the application will almost certainly cause a refusal to grant a pension.

It is noteworthy that it is for the initial assignment of any type of pension that the law establishes a mandatory application form. In all other situations, there are no requirements for the form and text of appeals.

You can apply for a pension in one of the following ways:

- Through the State Services system

- Personal appeal

- By Russian Post

- Express delivery

A citizen, at his own discretion, has the right to choose any of the listed options for delivering a completed application to the Pension Fund. The method of submission has no significance for the pension authority making a final decision on the application.

However, in some cases, for example, on the issue of how a long-service pension is calculated for teachers, a more convenient way of filing will obviously be in person or through the mail. This is due to the need to attach, as a rule, a large number of documents confirming the preferential nature of the work and its period. In addition, when applying for an early pension, it is mandatory to confirm the appropriate qualifications of the employee. Providing a work record book about work, for example, as an employee of a medical organization, will not be a sufficient basis for granting a pension. Even at the stage of submitting an application to the Pension Fund of the Russian Federation, sufficient evidence should be sent to the body that the citizen actually had the necessary qualifications for the position held. A similar requirement applies to the employer.

It is worth remembering that the pension fund carries out careful work to answer the question in what cases an early pension is granted for each application. For these purposes, the government agency may question the reality of the work. Taking into account these circumstances, in addition to the application, it is important to attach documents from the employing company, which will also help for a positive outcome when assigning a pension. Documents of this kind must confirm that the enterprise had the necessary equipment, in cases provided for by law, a special permit for such work, and so on.

Also watch our video from the YouTube channel with advice from a lawyer, write comments on the video and you will receive a professional answer, which is an advantageous offer with a reduction in time for receiving feedback:

What if errors and inconsistencies are found?

In accordance with Art.

17 of Federal Law No. 27-FZ, if errors and (or) inconsistencies are detected in the data provided by the policyholder with the information available to the Pension Fund, the fund’s specialists send a notification to eliminate them within five working days. The notice is delivered to the policyholder personally against signature, sent by registered mail or transmitted electronically via telecommunications channels. If the notice is sent by registered mail, the date of delivery of this notice is considered to be the sixth day from the date of sending the registered letter. When an offense is identified, liability for which is established by this article, an official of the territorial body of the Pension Fund of the Russian Federation draws up an act, which is signed by him and the person who committed the offense. A corresponding entry is made in it regarding the refusal of the person who committed the offense to sign the act.

For failure by the policyholder to provide within the prescribed period or provision of incomplete and (or) false information provided for in paragraphs 2 - 2.2 of Art. 11 of Federal Law No. 27-FZ, financial sanctions in the amount of 500 rubles are applied to such an insured. for each insured person.

The act, within five days from the date of its signing, must be delivered to the person who committed the offense in person against signature, sent by registered mail or transmitted electronically via telecommunication channels. If the act is sent by registered mail, the date of delivery of this act is considered to be the sixth day from the date of sending the registered letter.

Rules for calculating work experience

Today, three types of length of service are used to calculate various types of pension benefits in Russia:

- Total work experience. It should be understood as the total working time of a citizen.

- Insurance experience. The period for which contributions to the Pension Fund were deducted in favor of the employee. Citizens who are entrepreneurs are required to pay for themselves. Contributions are also deducted from payments under GPC agreements.

- Special, preferential experience. It means working in exceptional, difficult conditions, in hazardous industries, as well as working in specialized positions in healthcare and educational organizations.

Accounting is carried out according to the following rules:

- Calendar calculation of periods is used on the principle of deducting the start date from the end date of work activity, plus one day.

- If a citizen worked two jobs (part-time), then priority is given to that period of concurrent work activity, the calculation of which is most profitable for calculating a pension.

- To calculate any type of length of service, a work book is used - the first document that can confirm the periods of an employee’s work activity. To be submitted to the Pension Fund, it must be completed correctly, that is:

- All entries in it must be reflected in the employer’s local documents - orders. The work book must indicate their details (number and date).

- Records of dismissal must be sealed with the organization's seal. This rule does not apply to work for individual entrepreneurs, for whom, in principle, the presence of a seal was an optional condition for conducting the relevant activity.

- Blots and corrections in the work book are unacceptable.

In accordance with legal norms, length of service, in addition to performing a work function under an employment contract, includes:

- "sick leave";

- time spent on parental leave up to 1.5 years;

- period of care for disabled citizens (under a number of conditions);

- service in the army and equivalent structures (under a number of conditions);

- period of being in the status of unemployed with receiving the corresponding benefits (under a number of conditions);

- time spent with a spouse who is a contract serviceman in an area where work activity is not possible.

The following periods are not included in the length of service:

- training at universities and colleges;

- undergoing industrial practice;

- serving a sentence in prison;

What is the procedure for reviewing inspection materials?

The act, as well as documents and materials submitted by the person who committed the offense, must be reviewed by the head (deputy head) of the territorial body of the Pension Fund.

A decision on them must be made within 10 days from the date of expiration of the period during which the policyholder could submit written objections to the act. This period may be extended, but not more than one month.

The territorial body of the Pension Fund of Russia notifies the institution of the time and place of consideration of the act. The failure of a duly notified person or his representative to appear does not deprive the head (deputy head) of the territorial body of the Pension Fund of the Russian Federation from considering the act in the absence of this person.

Based on the results of consideration of the act, as well as the documents and materials attached to it, a decision is made (Article 17 of Federal Law No. 27-FZ):

- on bringing to justice for committing an offense;

- on refusal to prosecute for committing an offense.

The decision, within five days after the day of its issuance, can be delivered to the person being inspected (his authorized representative) in person against signature, sent by registered mail or transmitted electronically via telecommunication channels. If the decision is sent by registered mail, the date of delivery of this decision is considered to be the sixth day from the date of sending the registered letter.

Collection of documents for confirmation

To calculate your pension, it is important to take care in advance of collecting documents that confirm periods of work. It is best to do it 2-3 months in advance, as the procedure may be delayed.

If a work book is available and all periods of work are reflected in it, then in addition to it you may need:

- military ID;

- certificates of maternity leave;

- documents confirming the change of personal data (full name) of the applicant.

To confirm work experience that is not reflected in the work book (for example, while working under the civil process, subject to the deduction of appropriate contributions), you can request a certificate from the pension fund.

It is needed, first of all, for submission to third-party bodies, for example, to the court. You can obtain it either by contacting the Pension Fund in person, or through electronic services, for example, “Gosuslugi”, as well as by registering in your personal account on the appropriate resource in the Pension Fund on the Internet.

Sample certificate

If information about the employee’s length of service is not in the work book, or there are no corresponding records in the personalized accounting system, then there are other methods of confirmation, such as: certificates from the archive and witness testimony.

Is it possible to appeal the decision?

A person against whom a decision has been made to prosecute for committing an offense has the right, within three months from the day on which he learned or should have learned of a violation of his rights, to appeal this decision to a higher authority of the Pension Fund of the Russian Federation.

This norm is enshrined in Art. 17 of Federal Law No. 27-FZ. If the decision of the higher body of the Pension Fund of the Russian Federation does not satisfy the policyholder, he has the right to go to court (Article 18 of Federal Law No. 27-FZ). [1] Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation.” [2] Federal Law No. 27-FZ dated April 1, 1996 “On individual (personalized) registration in the compulsory pension insurance system.”

[3] Methodological recommendations for organizing and conducting documentary verification of the reliability of individual information provided by policyholders on work experience and earnings (remuneration), income of insured persons in the state pension insurance system, approved. Resolution of the Board of the Pension Fund of January 30, 2002 No. 11p.

Who issues a certificate of insurance experience

A few months before retirement age, it is recommended to visit the Pension Fund branch to clarify whether everything is in order with the documents for obtaining a labor pension. Almost always, employees report that, among other things, a certificate of experience is required. This document will serve as confirmation of a long career.

The need for a certificate of work experience may arise not only for applying for a pension, but also in the event of a transition to a new place of work.

A potential employee who has not acquired a work book may be asked to confirm that he actually worked in his specialty. This can be done by providing a certificate confirming your work experience.

But in the vast majority of cases, it has to be requested after contacting the PRF regarding the upcoming assignment of a pension.

Confirmation of length of service for working in the Pension Fund of the Russian Federation is carried out by obtaining a certificate from the enterprise where the future pensioner works. If the activity took place in different organizations, then, as a rule, more requests will need to be made to obtain a document for the Pension Fund. Thus, documentation confirming the length of a worker’s career will consist of several certificates.

What kind of document is this

Upon receipt of answers to requests, the employee will have an official document in his hands showing the total period of employment, as well as the presence of grace periods. It confirms the length of service even if the situation with the assignment of a pension turns out to be controversial and will have to be resolved in the courtroom.

Why is it needed?

You will need to confirm your work experience for the Pension Fund if there is something wrong with the work record or there are other reasons for questions. It is necessary to clarify information about salary and length of stay at work in some organization when the entry in the labor record:

- absent;

- it is difficult to read or make out what is indicated on the seal impression;

- done carelessly or corrected;

- They didn’t certify it by putting a stamp.

A period of time that is not reflected in the worker’s main document may be excluded from the grace period. For example, related to maternity leave or granted without pay.

The request is usually sent to the last place of employment if the provided copy of the work book contains all the necessary information. To prepare a response, the employer is given the period established by Art.

62 Labor Code of the Russian Federation. The certificate, in accordance with Order of the Ministry of Labor No. 958n for 2014, was included in the documents used to calculate pension experience. The calculation of the duration of employment is carried out in accordance with the requirements of Art.

10 Federal Law No. 173.

There is no special form for an application for obtaining data from the Pension Fund of Russia, but in order for it to be accepted, it is enough to reflect the standard data.

The existing regulatory framework is quite sufficient to respect the rights of workers who request any information at the place of employment or in the state archive.

When you need to get a certificate of work experience, it is important to immediately figure out where to go. This will allow you to collect the necessary information in full, without needlessly burdening yourself or other people.

It is also advisable to clarify how to correctly compose such a request so that you do not have to apply again.

Where and how to get

There is not a single sample of a certificate of experience, nor a single way to obtain it. A written request is a mandatory element of the procedure. However, the practice of small companies shows that an oral request is sufficient.

There is a possibility that the requested information was sent to the state archives. Then you will have to address the petition to the archives of the city where the applicant’s activities took place.

In the event of a reorganization of the company, it will have to deal with its successor.

If the employer has lost information about the employee’s employment, then restoration will have to be carried out in court.

A person who continues to work will have the easiest time obtaining a certificate confirming their length of service. It is enough to contact the secretary of the organization with a request for this. To write the application, the secretary will also include an example from the place of work to make it easier.

The former employee will have to come with a passport and ask the secretary to endorse a copy of the application. Then you can be sure that the document is registered and will not get lost.

To draw up a response, the organization’s personnel department will use a copy of the work record book received when the employee was hired.

Retirement and well-deserved rest imply a person’s advance compliance with a number of formalities and a trip to the Pension Fund. The first thing that officials from the Pension Fund of the Russian Federation will require is a certificate confirming your work experience, if you do not have a work book or the information in it is incomplete.

Such a certificate may also be required in the event of employment at a new place of work, in the absence of a work book. Thus, a certificate of work experience is an official document certified by an authorized person, containing information about the organizations in which the person worked, the length of work experience in each of them, and changes in positions.

One certificate serves as proof of the length of service acquired by a citizen from one employer. If there were several places of work, you will have to collect the appropriate number of certificates.

The purpose of providing a certificate is to confirm work experience in a particular place. Previously, work experience was divided into general and continuous.

Now there is no such division, and the total years of work have retained the name - insurance experience.

Its calculation is carried out according to the rules of Article 10 of Federal Law No. 173 (by adding the length of service from all places of work from which the necessary contributions were transferred to the Pension Fund).

Also, a certificate confirming work experience is required when a citizen has worked all his life without a work book, but contributions to the Pension Fund were still transferred from his salary.

This happens in cases:

- Work until 2013 under civil contracts (contract, agency agreement).

- Work for an employer – an individual (IP).

Any certificate confirming work experience in a specific organization is issued within three working days. The responsibility for issuing it lies with the employer (the human resources department of the organization where the applicant for the certificate once worked). It is issued free of charge upon the written application of a former employee (in accordance with Article 62 of the Labor Code of Russia).

The employer has the right to send a certificate and other documents confirming the length of service to the former employee by mail, subject to the latter’s consent. The employer can also send a certificate by mail directly to the Pension Fund if it turns out that the employee will not be able to receive it by mail within three working days.

If the request is made to the State Archive, then Russian legislation gives this institution thirty days to issue a certificate to the applicant.

As mentioned above, a certificate confirming work experience can be obtained from the personnel department of the previous place of employment. To do this, you need to submit an application addressed to your former employer (or the head of the city or rural archive), which should indicate:

- Name of the enterprise, individual entrepreneur or archive (in case of a request to the archive).

- Last name, first name, patronymic of the applicant, date of birth, registration address and telephone number for contact.

- Duration of employment in this organization (start and end date of work).

- Please issue an archival certificate addressed to the applicant.

- Information about where the certificate should go (Russian Pension Fund).

- Date of document preparation and signature of the applicant.

If the organization has already submitted all information about the former employee to the State Archives, an application for a certificate to confirm the length of service must be submitted to the State Archives of the city or locality of the former place of work. You can submit such an application via the Internet (website of the Unified Portal of Public Services).

If an employer has lost information about an employee and has not archived it, then the length of service will have to be proven in court. In addition to a citizen who was once employed under an employment contract with an employer, the following have the right to write an application for a certificate:

- A legal entity (organization, enterprise) in relation to its employee.

- A citizen or legal entity (at their request) on the basis of a court decision in a case regarding the assignment of a pension or restoration of seniority.

After the expiration of the period established by law, the applicant must receive a certificate confirming his work experience in a specific organization or individual entrepreneur.

To the head of the collective farm-tribal agricultural cooperative A. I. Sukhanitsky. Dovlata, 54, Stavropol region. Arzgir district, village Arzgir

Sidorchuk Viktor Pavlovich, p. Arzgir, Lenin street, 18.

STATEMENT

It's fast and free!

- What kind of document?

- When will it be needed?

- How to calculate work experience?

- What do you need to receive?

- Step-by-step instructions for compiling

- Submission procedure

- What to do after?

What kind of document? A certificate confirming your work experience is needed not only for the pension fund. It must also be presented when applying for a new job if you do not have a work book.

It is necessary to pay attention to the fact that the Certificate of Work Experience provided to the pension fund is nothing more than an official document certified by an authorized person; the document contains information about the period of work in the organization and changes in positions.

the purpose of the document is to confirm that a person worked in a particular place.

If a certificate is needed to assign a preferential pension, then it must include a more detailed description of work activity, and also indicate the presence of the following documents:

- Orders on transfer to another position;

- Order to assign a rank to an employee;

- Order on combining positions.