What types of internships are there?

Work experience is the period of time when a person was employed or engaged in socially useful activities defined by law. A document confirming a person’s work experience is usually a work book. If it is lost, certificates confirming the employee’s salary can play the role of proof of official employment.

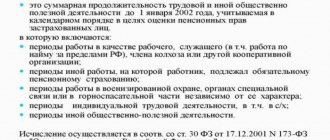

Before the 2002 reform, the concept of “ total length of service ” was valid - the sum of all periods of work activity mentioned in legislative acts, excluding breaks. At that time, such periods included full-time study at a university or special educational institutions. An entry about the period of study was made in the work report.

Since the beginning of 2002, the new Federal Law “On Labor Pensions in the Russian Federation” has replaced the general labor pension with the term “ insurance period ”. From the definition itself, the main feature by which an activity is suitable for work experience is clear: it is necessary that during the person’s employment there are legal contributions to the Pension Fund (in Soviet times, contributions to state insurance).

IMPORTANT INFORMATION! It does not take into account whether there were breaks between employment: “continuous experience” has been abolished.

Sometimes in special documentation there may be other concepts of length of service that affect the calculation of various accruals:

- experience in public service – work in government organizations;

- continuous service is a concept eliminated on January 1, 2007. It is not taken into account when calculating accruals for pensions and sick leave. It may turn out to be significant only when compared with the insurance experience after a year of reform (if the continuous experience exceeds the insurance period, the pension will be calculated based specifically on the continuous one);

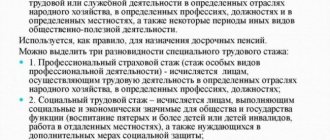

- special insurance experience is a job that gives the citizens employed in it the right to early retirement.

In what cases SHOULD it be necessary to include studies in your work experience?

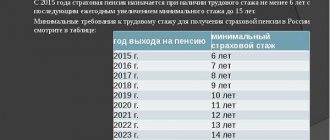

The number of years of service currently affects the size of the pension. The assessment of pension rights formed by a citizen before 2002 depends on the length of service.

As we wrote in the article on calculating pensions, for periods since 2002, the amount of the pension depends only on the insurance contributions transferred to the Pension Fund.

For previous years (up to 2001), the assessment of pension rights can be carried out in two ways. In particular, the estimated pension amount as of December 31, 2001 is calculated in two ways

:

- the ratio of the average salary of an employee to the national average in the same period (no more than 1.2) is multiplied by the length of service coefficient

and by 1,671 rubles; - The average employee salary is multiplied by the length of service coefficient

. This option has a limit on the total amount of 555.96 rubles

After calculating the pension for each option, the option that gives the largest amount is selected.

In both options there is a length of service coefficient, but it is calculated in different ways:

| Option 1 (clause 3 of Article 30 of Federal Law-173) | Option 2 (clause 4 of Article 30 of Federal Law-173) |

The principle of calculating the length of service coefficient:

| |

What counts towards experience:

| What counts towards experience:

|

This is the problem with the advisability of including study in the length of service for calculating a pension: in order for study to be taken into account as length of service, the pension as of December 31, 2001 must be calculated only through the second option, and this is unprofitable for most pensioners

. Here the main role is played by the limitation of the maximum amount of the pension calculated in this way - 555.96 rubles.

For example, when calculating a pension according to the first option, if the employee had a salary close to the national average, the amount will be equal to 919.05 rubles , which is much higher than 555.96 rubles - the limit under the second option.

Mathematically, it can be calculated that it is advisable to include study in the length of service only for those whose salary in the Soviet years and in the 90s was at 60% or below the national average , and the total length of service (as of December 31, 2001) will be more than 20 years for women and 25 years for men.

For example, if a person’s salary certificate shows the average salary for 60 months as 90 rubles, and the average salary in the country in the same period was equal to 130 rubles not to include studies (the ratio with the average will be at 70%) .

When establishing an insurance pension, Pension Fund employees are required to carry out calculations using both options

, and then choose the most profitable one from it (that is, with a larger amount). If you have doubts about the correctness of the calculation, you can request official clarification.

Studentship and experience

The years that a person devotes to learning his chosen profession while studying at a college, school, or university are quite long time periods associated with future employment directly or indirectly. Will they be included in the insurance period? We reason logically and without contradicting the law.

The time of study in any educational institution is not mentioned in Art. 12 Federal Law No. 400 “On Insurance Pensions” dated January 1, 2015. A student citizen does not make pension contributions, and this is the main argument for a negative answer.

NOTE! If a student worked before starting his studies and has a work book, the time spent working, but not studying, will be counted in the insurance period. When he finds a job after graduating from an educational institution, his length of service will increase, because breaks are not taken into account.

The only exception

The law will include university studies in the insurance period only in two cases:

- the educational institution is under the jurisdiction of the Russian Ministry of Defense;

- The university trains future law enforcement officers (Ministry of Internal Affairs).

Students of these universities are equated to military conscripts, and this activity, as Article 10 of the Federal Law “On Pensions in the Russian Federation” says, is included in the length of service.

If the employee studied during the USSR

For a large number of people preparing to receive a pension, their education ended before 1991, when the concept of general work experience was in force, which included their stay in educational institutions.

However, Art. 10 Federal Law of December 17, 2001 excludes this time from the length of service, even if such a citizen’s pension was accrued before the reform.

Part-time work while studying

While studying, a student can officially find a job:

- by concluding an employment contract for a “conscript” (for example, during the holiday months);

- performing home work under an employment contract;

- by choosing formalized remote collaboration.

Since, while working, he will also make pension contributions, accordingly, these periods will count towards his length of service.

Does the work experience include years of study at college and technical school?

Good afternoon. Does the work experience include years of study at college and technical school?

Lawyer Antonov A.P.

Good afternoon

According to Art. 12 of the Federal Law “On Insurance Pensions”, the insurance period, along with periods of work and (or) other activities provided for in Article 11 of this Federal Law, includes the following:

1) the period of military service, as well as other service equivalent to it, provided for by the Law of the Russian Federation of February 12, 1993 N 4468-I “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, and control over the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, troops of the National Guard of the Russian Federation, and their families";

2) the period of receiving compulsory social insurance benefits during the period of temporary disability;

3) the period of care of one of the parents for each child until he reaches the age of one and a half years, but not more than six years in total;

4) the period of receiving unemployment benefits, the period of participation in paid public works and the period of moving or resettlement in the direction of the state employment service to another area for employment;

5) the period of detention of persons who were unjustifiably prosecuted, unjustifiably repressed and subsequently rehabilitated, and the period of serving their sentences in places of imprisonment and exile;

6) the period of care provided by an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80 years; 7) the period of residence of spouses of military personnel performing military service under a contract, together with their spouses, in areas where they could not work due to lack of employment opportunities, but not more than five years in total;

9) the period counted towards the insurance period in accordance with Federal Law of August 12, 1995 N 144-FZ “On Operational Investigative Activities”;

10) the period during which persons who were unjustifiably brought to criminal liability and subsequently rehabilitated were temporarily suspended from office (work) in the manner established by the criminal procedural legislation of the Russian Federation;

11) the period of exercise of powers by the judge in accordance with the Law of the Russian Federation of June 26, 1992 N 3132-I “On the status of judges in the Russian Federation”. The periods provided for in Part 1 of this article are counted in the insurance period if they were preceded and (or) followed by periods of work and (or) other activities (regardless of their duration) specified in Article 11 of this Federal Law.

According to clause 4 of Art. 30 of the Federal Law “On Labor Pensions in the Russian Federation”, in order to determine the estimated size of the labor pension of insured persons in accordance with this paragraph, the total length of service is understood as the total duration of labor and other socially useful activities until January 1, 2002, which includes: periods of work as a worker, employee (including hired work before the establishment of Soviet power and abroad), a member of a collective farm or other cooperative organization, other work in which the worker, not being a worker or employee, was subject to state social insurance, work (service) in paramilitary security, in special communications agencies or in a mine rescue unit, regardless of its nature, individual labor activity, including in agriculture; periods of creative activity of members of creative unions of the USSR and union republics - writers, artists, composers, cinematographers, theater workers and others, as well as writers and artists who are not members of the corresponding creative unions; service in the Armed Forces of the Russian Federation and other military formations created in accordance with the legislation of the Russian Federation, the United Armed Forces of the Commonwealth of Independent States, the Armed Forces of the former USSR, internal affairs bodies of the Russian Federation, foreign intelligence agencies, federal security service agencies, federal executive authorities and federal government bodies that provide for military service, former state security bodies of the Russian Federation, as well as in state security bodies and internal affairs bodies of the former USSR (including during periods when these bodies were called differently), stay in partisan detachments in the period of the Civil War and the Great Patriotic War; periods of preparation for professional activity - training in colleges, schools and courses for personnel training, advanced training and retraining, in educational institutions of secondary vocational and higher vocational education (in secondary specialized and higher educational institutions), stay in graduate school, doctoral studies, clinical residency; periods of temporary incapacity for work that began during the period of work, and disability of groups I and II due to injury associated with production or an occupational disease; periods of care for a disabled person of group I, a disabled child, an elderly person, if he needs constant care based on the conclusion of a medical institution; periods of care of a non-working mother for each child under three years of age and 70 days before his birth, but not more than nine years in total; periods of residence of spouses of military personnel serving under contract with their spouses in areas where they could not work in their specialty due to lack of employment opportunities; periods of residence abroad of spouses of employees of Soviet institutions and international organizations, but not more than 10 years in total; periods of stay in places of detention beyond the period assigned during the review of the case; periods of payment of unemployment benefits, participation in paid public works and moving in the direction of the employment service to another area and employment; periods of detention, stay in places of detention and exile for citizens who were unjustifiably brought to criminal liability, unjustifiably repressed and subsequently rehabilitated; citizens who lived in areas temporarily occupied by the enemy during the Great Patriotic War and who reached 16 years of age on the day of occupation or during its period - the time of their stay at the age of 16 years and older in the occupied territory of the USSR or other states, as well as in the territories of states who were in a state of war with the USSR, except for cases when they committed a crime during the specified period; citizens who lived in the city of Leningrad during the period of its siege (from September 8, 1941 to January 27, 1944), as well as citizens - prisoners of fascist concentration camps - the time respectively of living in the besieged city of Leningrad and being in concentration camps during the Great Patriotic War, with the exception of cases where they committed a crime during the specified period.

Thus, the period of training is counted towards the length of service only if the training took place before January 1, 2002.

Sincerely, lawyer Anatoly Antonov, managing partner of the law firm Antonov and Partners.

Still have questions for your lawyer? Ask them right now here, or call us by phone in Moscow +7 (499) 288-34-32 or in Samara +7 (846) 212-99-71 (24 hours a day), or come to our office for a consultation (by pre-registration)!

Study while working - but what about the experience?

It is not uncommon for working citizens to undergo on-the-job training. Naturally, studying employees have a question: how does the time spent on studying compare with their work experience, since they are not working during this time?

Art. 173 of the Labor Code of the Russian Federation guarantees employees sent for training by the employer or enrolled independently, additional study leaves, for which payment continues to be in the amount of average earnings. Since wages have been maintained, required Pension Fund contributions are also made on time. Thus, the educational leave on which the employee goes, like all types of paid leaves, will be counted towards the insurance period.

Study and special work experience

When a person works in difficult conditions and/or in harsh territories, such as the Far North, his work experience is calculated according to a special, preferential scheme - with a special coefficient. Therefore, the employee gets the opportunity to take a well-deserved rest before the usual deadline.

If, during study and work, an employee performed his job duties in dangerous and harmful conditions or in specified territories, the procedure for calculating special preferential length of service is applicable to him. These conditions can be confirmed by the presence of a corresponding entry in the work book.

When else, while studying, can you not lose experience?

In the life of employees, there are moments of varying duration when they do not actually perform their job function, but their service is not interrupted. Naturally, the length of service will continue to increase if during such a special period the person is also studying. According to the law, the insurance period continues to run if the employee is employed:

- military service or cooperation with the Ministry of Internal Affairs;

- improvement of health (with an official certificate of incapacity for work);

- your baby up to 1.5 years of age;

- looking after a disabled person of group 1 (including a child), an elderly relative (after 80 years);

- being on the way for employment in another area, if the referral was received from the employment service;

- community service;

- serving the sentence;

- evidence of the unfoundedness of criminal prosecution.

IMPORTANT! The listed periods are included in the insurance period if before these events or immediately after them the person was employed and made contributions to the Pension Fund of the Russian Federation.