The state pension is regular support for citizens holding various vacancies and leaving the civil service upon reaching seniority, old age or disability. Pension benefits are provided to citizens in various types. This is quite significant support for disabled citizens.

State pension. Varieties, who can order, sizes in 2021

What is a state pension, what law is it regulated by?

A special budget is provided for the state pension system.

From this fund, citizens deprived of income are provided with regular assistance. This may look like compensation for lost earnings, but support is also intended for needy or deserving elderly people. Important! Not everyone can claim the right to support, but only certain individuals, and which ones are specified in Federal Law No. 166, it is called “State pension provision in the Russian Federation.”

For example, the following have priority rights:

- Federal civil servants.

- Military.

- Participants of the Second World War.

- Residents of besieged Leningrad.

- Cosmonauts, pilots.

- Disabled people.

- Accident victims.

- Close people of these categories of citizens.

If stateless persons or foreigners fall under this category, they also have the right to apply for a pension. At the same time, it is important to continuously stay in the Russian Federation. Sometimes one person falls under different types of government support. Specialists will provide more favorable conditions for obtaining it. It is not uncommon for one person to receive several different types of pensions. It is advisable to find out in advance about the options that you can count on.

Types of state pension

Federal Law No. 166 provides for different types of pensions for citizens. A pension can be considered state support:

- For experience.

- According to the age.

- For receiving disability.

- For the loss of a breadwinner.

- Social pension.

The issue related to the registration of several pensions at the same time is worth special consideration.

| Citizens | Types of subsidies |

| Military disabled people | For disability + insurance |

| WWII participants | |

| Residents of besieged Leningrad | |

| Parents of deceased conscripts | For loss of a breadwinner + insurance + social + for length of service |

| Spouses of fallen soldiers | |

| Citizens, participants in emergency situations who became disabled | For loss of breadwinner + insurance + social |

| Federal employees | For length of service + insurance |

| Military, with the exception of conscripts | Insurance + for length of service + for disability |

Many people are concerned about the question: how much state support is there and who is entitled to it. More on this below.

State old age pension

Many citizens can count on this type of subsidy, but only after reaching a certain age. The conditions for granting an old-age pension vary. Federal Law-166 provides for the following gradations:

- Participants of the Chernobyl Nuclear Power Plant - 50 years for men, 45 years for women.

- Those who have had radiation sickness are 55 years old for men, 50 years old for women.

- IDPs from the zone are three years earlier than the standard age.

- Residents who voluntarily moved – two years earlier.

- Preferential social economic status – a year earlier.

When assigning this pension, length of service will be provided. Legislation stipulates:

- 5 years – from December 15, 2001.

- 15 years – from 05/15/1991.

All pension-related benefits are assigned from the moment of application and are paid further indefinitely.

Law, theory and concept of law

The concept of a state pension pension . State pension pension of age (disability) pension; or for the purpose of compensation for damage caused to the health of citizens during military service, as a result of radiation or man-made disasters, in the event of disability or loss of a breadwinner, upon reaching the legal age; or disabled citizens in order to provide them with a means of subsistence. The state pension provision pension is assigned and paid in accordance with the Federal Law “On State Pension Provision in the Russian Federation”. Pensions provided for by the Federal Law “On State Pensions in the Russian Federation” are established and paid regardless of receipt of the funded part of the labor pension in accordance with the Federal Law “On Labor Pensions in the Russian Federation”. Types of pensions for state pension provision'. long service pension; old age pension; disability pension; social pension.

See Federal Law “On State Pension Provision in the Russian Federation” dated December 15, 2001 No. 166-FZ (as amended on November 11, 2003). 2. The right to a pension under state pension provision. The following have the right to state pension provision: %/ citizens of the Russian Federation, subject to the conditions stipulated by the Federal Law “On State Pension Security in the Russian Federation” for various types of pensions for state pension provision; • foreign citizens and stateless persons permanently residing in the territory of the Russian Federation - on the same grounds as citizens of the Russian Federation, unless otherwise provided by law. The following have the right to receive a state pension: federal civil servants; military personnel; participants of the Great Patriotic War; citizens affected by radiation or man-made disasters; disabled citizens. Family members of these citizens have the right to a pension in cases

provided for by the Federal Law “On State Pension Provision in the Russian Federation”. 3. The right to simultaneously receive two pensions . The right to simultaneously receive two pensions in accordance with the Federal Law “On State Pension Provision in the Russian Federation” is granted to: citizens who have become disabled as a result of a military injury. They may be entitled to a disability pension and an old-age labor pension; participants of the Great Patriotic War. They may be entitled to a disability pension and an old-age labor pension; parents of military personnel who served in conscription, died (died) during military service or died as a result of a military injury after dismissal from military service (except for cases where the death of military personnel occurred as a result of their unlawful actions). They may be entitled to a pension for the loss of a breadwinner and a labor pension for old age (disability) or a pension for the loss of a breadwinner and a social pension (with the exception of a social pension assigned in connection with the death of a breadwinner); widows of military personnel who died in the war with Finland, the Great Patriotic War, and the war with Japan, who did not remarry. They may be entitled to a pension for the loss of a breadwinner and a labor pension for old age (disability) or a pension for the loss of a breadwinner and a social pension (with the exception of a social pension assigned in connection with the death of a breadwinner); • disabled family members of citizens: those who received or have suffered radiation sickness and other diseases associated with radiation exposure as a result of the disaster at the Chernobyl nuclear power plant or work to eliminate the consequences of this disaster; those who became disabled as a result of the disaster at the Chernobyl nuclear power plant; who took part in eliminating the consequences of the disaster at the Chernobyl nuclear power plant in the exclusion zone. They may be entitled to a survivor's and labor pension, an old-age (disability) pension or a survivor's pension and a social pension (with the exception of a social pension assigned in connection with the death of a breadwinner). The long-service pension in accordance with the Federal Law “On State Pension Provision in the Russian Federation” is assigned to: federal civil servants; military personnel.

An old-age pension in accordance with the Federal Law “On State Pension Provision in the Russian Federation” is assigned to: • citizens injured as a result of radiation or man-made disasters. A disability pension in accordance with the Federal Law “On State Pension Provision in the Russian Federation” is assigned to: military personnel; participants of the Great Patriotic War; citizens affected by radiation or man-made disasters.

The social pension in accordance with the Federal Law “On State Pension Provision in the Russian Federation” is assigned to: • disabled citizens. 4. Work experience. If the assignment of the appropriate pension provided for by the Federal Law “On State Pension Provision in the Russian Federation” requires work experience of a certain duration, it includes periods of work and other socially useful activities counted towards the insurance period required to receive the labor pension provided for by the Federal Law. Law “On Labor Pensions in the Russian Federation”.

State long service pension

This type of government assistance is paid to the military, federal government employees, pilots, and astronauts. For example, to receive a subsidy from the state, male cosmonauts need 25 years of experience, and women 20. Military personnel and test pilots will need the same experience. It takes 16.6 years for federal employees to work, and until 2021, it was enough for this category of people to work 15 years in one position.

State disability pension

Disabled people of various groups may not have any work experience at all, but receive government support due to their disability. Obtaining disability in this case is supervised by a medical and social examination, which then itself sends the papers to the Pension Fund.

The justification in this case is not always indefinite, but the benefit will be issued for the entire period of the established disability, regardless of the circumstances.

If a disabled person has reached retirement age and has 15 years of experience, as well as 30 coefficient points, he will be assigned standard additional payments, operating on a general basis. Important! The standard monthly pension requires some additional payments, for example, if you have dependents or if you live in the Far North.

State survivor's pension

This type of pension can be paid to many citizens. For example, disabled family members of a serviceman, in the event of his death, victims of man-made disasters. This type of support is as regular as the others, assigned from the moment of application. Detailed conditions below:

- Death of a military personnel during service or within three months after discharge.

- Death of a military personnel due to injury or illness arising from work activities.

- Victims of radiation sickness.

- Those who received disabilities due to the Chernobyl nuclear power plant.

- Death of astronauts or test pilots.

Not only the conditions, but also the amount of payments are regulated by law. For example, if a military injury was received, due to which the breadwinner died, then a subsidy of 250% of the amount of social subsidy is due. If there are other disabled persons in the family, then a pension is paid to everyone in the amount of 125%. Each disabled member of the astronaut's family will also receive a subsidy, but its amount is calculated at 40% of earnings.

Social pension

This type of subsidy is paid to a large number of disabled citizens:

- Disabled people of all groups.

- Disabled since childhood.

- Disabled children.

- Loss of parents - children under 18 years old, students under 23 years old.

Important! Registration of almost all types of pensions requires permanent residence in Russia and recognition of incapacity for work. Payment terms may vary.

Long service pension for civil servants

This type of pension is issued not by the Pension Fund, but by the personnel officer at the place of work. The payment will be assigned from the moment of application or upon reaching the length of service. If you reach the age for assigning an insurance pension at the same time, you can contact the Pension Fund for assignment of a second payment.

A civil servant must have served for 16 years and 6 months. The increase occurs from 2021, each time for six months. The indicator is planned to increase to 20 years by 2026. The work experience of a public sector employee must be uninterrupted for one year.

Amount of state old age pension in 2021

For citizens who live or work in the Far North and areas with similar cold climates, the amount of pension payments is based on :

Attention, if you have any questions, you can ask them to a lawyer on social issues by calling 8 804 333 16 88 or ask your question in a chat to the lawyer on duty. Calls are accepted 24 hours a day. The call is free! Call and solve your problem!

- individual territorial coefficients from 1.15 to 2 ;

- personal accumulated points for work and non-work experience;

- salary and insurance payments;

- increased territorial fixed pension rate.

The fixed payment is set as a percentage of the social pension; additional payments may be accrued, taking into account the presence or absence of a dependent.

The size of the social pension in 2021 after indexation on April 1 will be 5,653.72 rubles. Accordingly, the amount of payment will be determined as follows:

- For persons who do not have insurance experience and have reached the ages of 65 and 70 years (women and men) - 5653.72 rubles .

- Persons who suffered from emissions of the Chernobyl power plant and were its liquidators receive a pension in the amount of 250% of the established social pension - 14,134.3 rubles .

- Those who live or work in the contaminated area - 200% or 11,307.44 rubles.

- For each dependent - 1884.57 rubles , but not more than for 3 people.

Grounds for applying for a state old-age pension

The population that suffered material, physical, or social damage in a catastrophe, cataclysm, or emergency is entitled to a state old-age pension . Persons can receive it ahead of schedule if they are citizens and residents of the Russian Federation and fall into one of the following categories:

- civilians, as well as liquidators who received disabled status due to exposure, in the early stages (1986-1987) retire from the age of 45 - women, men - from the age of 50 , if the work experience is 5 or more full years ;

- liquidators and citizens with radiation sickness or disabilities who were in the affected area in 1988-1990. , retire at the age of 50 (women) and 55 years (men) with 5 years of work experience ;

- citizens who were forcibly removed from their permanent place of residence due to a disaster or who work in a radioactive zone have the opportunity to bring their retirement age closer by 3-7 years if they have 5 years of work experience ;

- voluntary migrants and persons who live in a permissible zone with the right to resettle can reduce their working age by 1-5 years also if they have at least 5 years .

The remaining categories of the population that suffered as a result of man-made disasters or radioactive exposure are determined in their rights and benefits by the legislation of the Russian Federation on a private basis.

Residents of the Far North, persons who worked in the Far North or in areas with a similar climate, are also entitled to receive an old-age pension. Citizens retire early if:

- have worked in the Far North for at least 15 years or at least 20 in similar conditions, and the total length of service is 20 and 25 years, respectively;

- have worked for at least 7.5 years in the Far North, then each calendar year brings the retirement age closer by 4 full months (subject to retirement age of 60 for men, 55 for women);

- worked for 20 years (women) and 25 years (men) and permanently lived in the Far North as reindeer herders, fishermen or commercial hunters, then retire at 45 and 50 years old, respectively;

- a woman gave birth to two children before the age of 50 , has 20 or more years of work experience, where 12 or more years - in northern conditions, then her retirement age is 50 years .

Procedure for receiving state old-age pension

You need to submit an application (view and download here: [Sample application for a state old-age pension]) and a package of documents to the Pension Fund or multifunctional center no earlier than a month before the established or planned early retirement age. The period for consideration of the application is no more than 30 calendar days .

You can submit the relevant documents during a personal visit to the Pension Fund, online with subsequent delivery of all documents, by registered mail or with the help of an authorized representative. The pensioner will be notified of the pension assignment after consideration of the application.

Delivery of pension payments is carried out in three ways . The pensioner himself chooses the best option, based on convenience and physical capabilities:

- Post office. Makes monthly payments on the due date. Delays occur for several days due to weekends, holidays and transportation of cash to the branch. Receipt at the post office at the place of registration or personally at home through the postman. You must provide a passport and pension card for identification. If the payment has not been received by the addressee for more than six months, payments are frozen indefinitely. To restore transfers, you must visit the Pension Fund and write a statement in person.

- Bank. The pension is credited to the account on the day it is transferred to the PF. Additionally, a bank electronic card is issued for free for withdrawals and payments. It makes no difference whether a private or state bank provides financial services. The client himself chooses a suitable banking institution.

- Pension delivery organizations. The official list of active verified companies has a PF. Therefore, it is important to familiarize yourself with it before transferring pension responsibilities to such organizations. The principle of operation is similar to postal service.

It is important to know that no commission is due for receiving or withdrawing a pension.

List of required documents

List of papers for registration of state financial benefits by age for northerners:

- a passport or document that confirms Russian citizenship, place of residence and registration, and the age of the citizen;

- work record book, certificates of work experience (years of work in the Far North);

- certificate of dependents or disabled family members, certificate of number of children (for women);

- certificate of registration of place of residence;

- an extract about the change of full name (if this happened).

Citizens who worked in the Far North have the right to retire early if they have already completed the required length of service in accordance with the law. In some cases, length of service is determined personally for a specific profession.

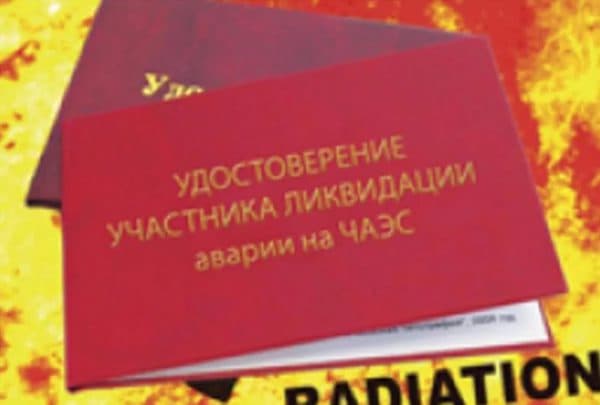

Victims of the Chernobyl disaster, liquidators and residents of contaminated zones present the following documents:

- passport;

- work record book and certificates of length of service and places of work;

- certificates of health, radiation sickness, injuries and damage, disability due to exposure to radioactive rays;

- certificate of participation in the liquidation of the Chernobyl nuclear power plant;

- certificate of residence or work in the contaminated area.

An example of assigning a state old-age pension

Yaroslav Samoilenko was born in 1950 in Pripyat. In 1988, he took part in work at the Chernobyl nuclear power plant. Being a citizen of Ukraine until 2010, he received a pension due to Group II disability, which developed due to radioactive intervention. From 2011 to 2016, he was officially employed in construction in St. Petersburg. In 2015, Y. Samoilenko married Yu. Volkova, a native of St. Petersburg, and received Russian citizenship. Can a citizen resume payments on the territory of the Russian Federation?

Based on current No. 1244-1, No. 166, a citizen has the right to state benefits in old age. Taking into account his work experience of more than 5 years in the Russian Federation and participation in the liquidation of the Chernobyl Nuclear Power Plant, Yaroslav Samoilenko will receive payments in the amount of 250% of the established minimum social pension .

Conclusion

The state old-age pension provides for the possibility of approaching retirement age, increasing payments and directly addressing two categories of the population: residents and workers of the Far North and people affected by radiation. Both categories differ significantly from each other in terms of the conditions for receiving a pension and the amount of payments.

The prerequisite must be:

- having citizenship of the Russian Federation;

- reaching the retirement age required in a particular case ( 45 years or more );

- the presence of work experience is also individual for the situation ( from 5 years or more );

- documents confirming participation in one of two preferential categories.

The most popular questions and answers about the state old age pension

Question: My mother, born in 1975, worked for 9 years at a fish farm, living in the city of Igarka (Krasnoyarsk Territory). Has four adult children. We really want to find out if she can retire 5 years earlier , being a native of the Far North? Is she entitled to an old-age pension?

Answer: based on the information provided on the PF website, your mother can start receiving an old-age pension 3 years earlier than due, that is, from 52.5 years old . If a native resident of the Far North has less than 15 but more than 7.5 years , as in your case, then each year worked reduces the working age by 4 months .

Unfortunately, she does not fall under the 5-year . This requires at least 20 years 12 of which in the Far North. 3 years of full-time work in northern conditions are missing

List of laws

- Federal Law No. 1244-1

- Federal Law No. 166

Samples of applications and forms

You will need the following sample documents:

- Sample application for state old-age pension

Conditions for assigning a state pension

Each type of pension has its own terms and conditions of assignment. To receive government support, you can follow some rules. For example, study the latest editions of modern legislation. This will help you better determine your own case and ultimately gain greater opportunities for government support.

Next, you can begin collecting documentation. When preparing documents according to the list, you can contact Pension Fund employees in advance. Specialists will give more accurate advice. Today, the application can be filled out not only in writing, but also electronically, using various government portals. After completing the application, you will have to wait some time. In any case, the pension will be assigned from the moment the application is submitted. The decision-making should not be delayed for more than one calendar month.

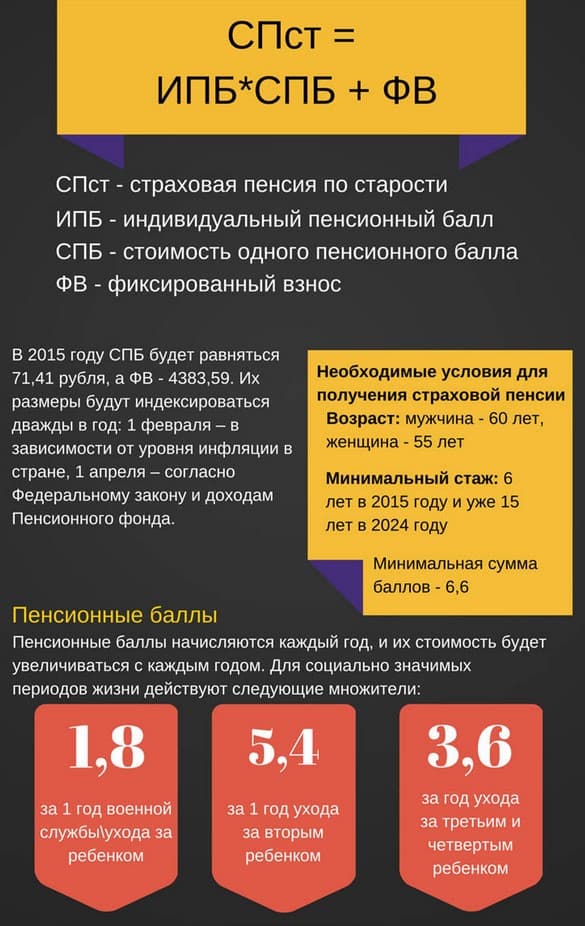

How is the pension calculated?

Calculations usually take into account 12 months of income and the number of years of service. You can calculate this yourself. For example, take into account the average earnings for the last year, along with bonuses and allowances, deduct sick leave and leave, including maternity leave.

If the minimum length of service has been completed, then state assistance will amount to 45% of the average monthly income. With greater output, another three percent will be added from the minimum for each year. The pension amount is limited to 75% of average monthly income.

How to calculate a superannuation pension

Calculation of due payments occurs in accordance with length of service. With a minimum length of service, which by law is 15 years, its amount is equal to 45% of the salary.

The maximum allowable amount should not exceed 75% of wages, including old-age or disability pension. An additional year of experience gives an increase of 3%, that is, beyond the specified minimum experience of 15 years.

In order to additionally receive a share of the insurance part of the pension, it is also necessary to have work experience in other areas after the appointment and registration of a long-service pension. At the same time, its receipt does not deprive the right to preferential payments to the fixed part of the insurance pension: based on age, the presence of dependents and disabled family members.

Possible supplements to the state pension

Such allowances are called additional financial support and are usually paid monthly along with pensions. The amount of payments is usually fixed and ranges from 500 to 1000 rubles, depending on the purpose. For example, disabled people, WWII participants, prisoners, blockade survivors, military personnel, and other categories of citizens can receive them.

For example, disabled people can count on EDV - monthly cash payments, which are indexed along with the pension. These payments are considered federal. The amounts are small, but for some citizens they can be quite significant:

- Disabled people of group 1 – 4044.49 rubles.

- Disabled people of group 2 – 2888.41 rubles.

- Disabled people of group 3 – 2312.20 rubles.

If the pension is below the subsistence level, then the pensioner will be given an additional payment up to the level accepted in the region. According to the latest data, the Pension Fund has counted approximately 3.3 million people who can receive social payments. They are regular, so the budgets allocated for these purposes are quite large. In addition to monthly payments, one-time types of assistance can also be received towards your pension. For example, the Pension Fund pays funeral benefits to all non-working pensioners. The size of the subsidy varies and in 2021 is 6 thousand 351 rubles. 48 kopecks

Disabled citizens can count on the care of their relatives, who will receive a subsidy from the state for this. These payments are a fixed amount and are usually provided to all citizens over 80 years of age. Today it is about 1,400 rubles. If the parent is disabled, then the amount increases to 10 thousand rubles.

Anyone wishing to relax in the sanatorium can count on compensation for the cost of travel. This payment, as many often believe, is due not only to disabled people, but also to ordinary pensioners who have received free vouchers from a medical institution. The PFR budget annually allocates fabulous sums for these purposes. For example, 4.7 billion rubles are planned for 2021.

Amount and possible surcharges

The amount of state old-age benefits for citizens affected by the Chernobyl accident is influenced by the established basic amount of social benefits. In accordance with Federal Law No. 166 Art. 17 disabled Chernobyl victims who have groups 1 and 2 are paid 250% of this figure. In 2021, the amount is 13,101.63 rubles.

Persons who work and live in the polluted zone receive 200% of the social pension.

State support for the military is determined by Law No. 4468/1. Its size depends on indicators in the form:

- official salary;

- rank allowances;

- additional payments for length of service.

The amount of state support for the loss of a breadwinner is regulated by Art. 43 Federal Law No. 4468-1 and constitutes 50% of the salary of a contract soldier who died from injury, 40% from illness while in the army.

Data on the status of the pension account can be checked on the State Services portal using the SNILS number

If a military man has served for 20 years, monthly allowance is calculated. The amount of additional payments is multiplied by this amount. The basic pension is adjusted by a factor set by the government.

Relatives of a citizen who served in conscription and who died from a military injury are paid 200% of the amount of social benefits, 150% of those who died from a disease.

As of January 1, 2021, this amount is respectively 10068.5 and 7558.31 rubles.

Additional payments for the loss of a breadwinner are assigned to disabled people of 1gr., dependents over 80 years old in the amount of 100 percent, 32% for children left without parents or who have had groups 1 and 2 since childhood.

The circle of persons provided with state disability pensions is described in the article.

New formula

The amount of state benefits is revised annually, which makes it possible to support people who are not able to survive on their own. The amount of payments to citizens with health problems is regulated by Federal Law No. 181 “On the social protection of disabled people in the Russian Federation.” As of 2021 it is.

| Category | Amount, rub. |

| Disabled children 1 gr. | 11903 |

| Disabled children of childhood 2 gr. | 9919 |

| 1 group | 9919 |

| 2 | 4959 |

| 3 | 4215 |

| Chernobyl 1 and 2 | 13101 |

The pension for such citizens is paid in the amount established by the government, regardless of place of residence. It is slightly higher in the Far North and is determined according to the group.

The new system involves increasing the length of service to 15 years

How to apply for a state pension

Different pensions are issued upon achievement of certain conditions. For example, a standard old-age subsidy is due upon reaching a certain age. The application along with the necessary documents is submitted to:

- Local authority of the Pension Fund of the Russian Federation at the place of registration.

- According to temporary registration.

- At the place of actual residence.

Documents are usually submitted personally by the citizen himself. If special circumstances arise, a representative may contact you. For this purpose, a separate power of attorney is issued by a notary. Without a power of attorney, you can submit an application through a representative at multifunctional centers of State Services. The application date will be considered the day the application and documents are received.

In special cases, it is possible to send an application via mail or in the form of electronic document exchange.

How to apply for benefits

To receive support from the state, you need to send an application to the branch of the pension fund where the citizen lives or stays. You can submit it:

- independently or through a representative;

- by mail;

- through a multifunctional center;

- through the “Personal Account” by registering on the PF website.

Participants in the liquidation of the Chernobyl accident also receive state benefits

Widows and children of military personnel killed while serving have the right to apply for a state pension in the event of the loss of a breadwinner.

Required documents

To assign an old-age pension, a person who suffered as a result of the Chernobyl disaster must attach to the application, in addition to his passport and work book, the following certificates:

- about health, about diseases that are associated with radiation exposure;

- on participation in the liquidation of an accident;

- about living in a contaminated area;

- about working in a 30-kilometer zone.

To apply for a social disability pension, you need to collect a large number of papers, including an identity card, documents from a medical commission, certificates from the place of residence, about the number of family members, about the absence of other benefits.

Establishing payments from the state for children who were dependent on a citizen who died in service in the Russian army requires submitting along with the application a death certificate, documents confirming family ties and length of service, and a certificate from the place of residence.

Review period

After sending the application through the multifunctional center, in person or through a representative to the pension fund branch, specialists check the correctness of all documents, and a decision is made within a calendar month.

The most convenient way to submit documents is through the MFC

List of documents for obtaining a state pension

You can start applying for a standard pension a month before the age specified in the legislation. Submitting an application is accompanied by the preparation of a package of documents:

- Passport.

- SNILS.

- Employment history.

- Certificate of dependents.

- Certificate of earnings.

- Registration documents.

- Certificate of disability (if available).

- Papers confirming the fact of a change in name.

The content of the application is usually standard; pension fund employees or MFC specialists help to complete it.

Application consideration period

Pension Fund or MFC specialists very clearly monitor the rules and carry out personal identification according to all parameters. The submitted copies will be scrupulously checked against the originals, and an incomplete package of documents is unlikely to be accepted.

Review of documents involves their list-by-list registration with the issuance of a receipt indicating the date of acceptance. Specific deadlines may be provided for providing missing documents. Usually no more than ten days from the date of application. Studying the applicant’s documents entails the following employee actions:

- Checking the validity of the accrual.

- Evaluation of the information contained.

- Collection of information in the individual accounting system.

- Making a decision to assign payments or refuse.

The period for full consideration of the package should not exceed 30 days from the date of application. Therefore, pensioners are recommended to apply a month before the conditions for the appointment of a state subsidy.

State pension indexation

All pensioners can expect a non-periodic increase in their income and this process is called indexation. The state gradual increase in pensions is provided from 04/01/2019. Indexation depends on inflation and is carried out in proportion to the cost of living of a pensioner for a certain period in a particular region. When increasing each time, standard coefficients are taken into account. For example, to find out the pension from April 2021, you need to multiply the subsidies received by 1.02. In other years, this figure may be increased or decreased.

Thus, a large number of people can count on government support. When contacting the Pension Fund or the HR department, you need to take into account the legal grounds, but in any case you will have to take care of yourself. In modern realities, the assignment of pension payments is carried out not only by the Pension Fund, but also by the MFC. Both organizations must be contacted in person. Only disability pensions will be issued by ITU bodies; these categories of citizens will not have to knock on the thresholds of numerous authorities.

What is a superannuation pension?

This type of state pension is available to citizens whose working conditions and field of activity, in accordance with the law, give them the right to receive a long-service pension. This is primarily due to difficult working conditions, increased psychophysical stress and other negative circumstances.

The long-service pension is calculated:

- Civil servants.

- Employees of the Ministry of Internal Affairs.

- Employees of the prosecutor's office.

- Military personnel.