- home

- Reference

- Old age pension

Based on the pension system, all citizens must go on vacation equally, for which they must reach a specific age. But based on legal requirements, some people working in difficult or specific conditions have the right to early receipt of state benefits.

For this purpose, a long-service pension is issued. It is assigned only to persons working in certain specialties, and their length of service in this position is also taken into account.

What it is

The long-service pension is an official state benefit, which is assigned only to some citizens who have work experience in special professions established at the legislative level. This payment is assigned to the following persons :

- civil servants;

- military;

- astronaut;

- teachers and specialists working in the medical field;

- persons engaged in labor activities in the northern regions of the country;

- flight test personnel.

Each category has its own requirements and conditions. At the regional level, local authorities can make their own adjustments, but they cannot contradict federal regulations.

Read more about the long service bonus

Government regulation

There are more than 1.7 thousand professions for which citizens apply for early payment. In this case, requirements are imposed on length of service or other factors. Basic information is contained in Federal Law No. 400 , which provides a list of beneficiaries. At the same time, all professions are divided into different categories, and also contain data on the required amount of experience.

Important! A feature of Russian pension legislation is that for women the number of years that need to be worked in a specific profession is 5 years less than for men.

Additionally, there are special clarifying lists of professions. They indicate work in which many negative factors affect the human body. Therefore, citizens can go on vacation early. Information about benefits that can be used by doctors or employees of educational institutions is included in the provisions of Government Decree No. 781.

To whom is it assigned?

Early retirement is granted only if the basic requirements of the law are met. Conditions of appointment include :

- having experience in a profession that is classified as preferential;

- reaching a certain age;

- management pays increased contributions to state funds for citizens;

- a preliminary labor assessment is carried out to determine which hazard class is assigned to a specific workplace in order to establish membership in the preferential list.

The amount of contributions paid by the employer depends on the hazard class, for which interest rates established at the legislative level are taken into account. These include :

- when working in conditions that fall into hazard class 4, the employer will have to pay an additional 8% of insurance premiums for the employee, which depend on the specialist’s earnings;

- if the assessment results indicate class 3, subclass 3.4, then 7% is paid;

- in grade 3 – 6%;

- if hazard class 2 is approved, then the additional payment is 4%;

- for 1st class, insurance premiums increase by 2%.

Reference! If a special assessment of labor has not been carried out, then insurance premiums will still increase, but individual tariffs will be taken into account. For professions included in the first list, an additional 9% is paid, and for professions on the second list, insurance premiums increase by 6%.

First list

This includes people working in difficult conditions, so for them early retirement depends on age and length of service. These persons work underground or in a hot shop. Additionally, specialists who work under conditions that are dangerous to life or health are entitled to a long service pension.

| Conditions for granting a pension | Men | Women |

| Work experience | 20 years | 15 years |

| Work experience in hazardous industries | 10 years | 7.5 years |

| Age | 50 years | 45 years |

It is possible to assign a pension ahead of schedule if a little special experience is missing, but the requirements for general insurance experience are met.

Second list

This includes specific professions whose work involves difficult conditions.

| Conditions of registration | Men | Women |

| Total experience | 25 years | 20 years |

| Special experience | 12.5 years | 10 years |

| Citizen's age | 55 years | 50 years |

These parameters are minimal, and relaxations are allowed in each individual case. This list includes persons working in ironwork or construction.

Full information about the lists

Teachers

Persons working in the educational sector face psycho-emotional stress, and therefore cannot cope with such working conditions until retirement age. Therefore, they can apply for an early pension if they have at least 25 years of service. This applies to specialists working in the following organizations :

- general education or correctional schools;

- institutions of further education;

- gymnasiums and lyceums;

- orphanages;

- kindergartens or nurseries;

- vocational schools;

- Secondary schools.

Teachers, directors, educators, speech therapists or head teachers can apply for early retirement.

More information about pensions for teachers

Medical workers

Doctors work in a stressful and risky atmosphere, so they are offered preferential treatment during their holidays. But at the same time, requirements are imposed not only on length of service, but also on the place of work, as well as the chosen position.

Important! Employees of hospitals, antenatal clinics, clinics, maternity hospitals, dispensaries, the Ministry of Emergency Situations, EMS, FAP or military hospitals, as well as blood transfusion stations can apply for preferential benefits.

A preferential pension is provided for doctors and nursing staff, which includes nurses, paramedics, laboratory assistants and midwives. It can also be completed by specialists who work in administrative positions and therefore do not engage in medical activities. But it is important to work in your chosen position for at least 30 years. If a specialist works in a rural area, then the length of service is reduced to 25 years.

More information about superannuation benefits

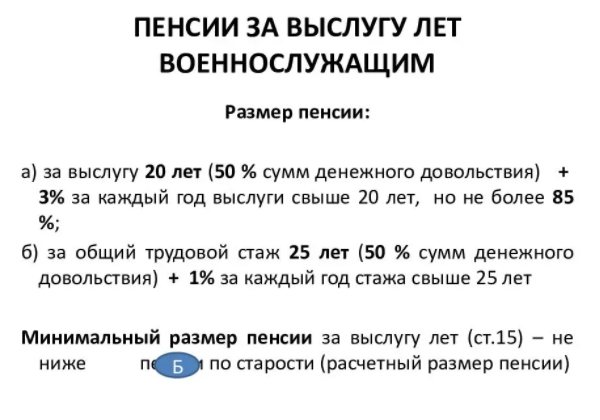

Military

Preferential payments are assigned to military personnel who serve under contract in various government organizations. A pension based on length of service is issued to officers, soldiers, sailors, sergeants and military personnel with other ranks. You can serve in the Ministry of Internal Affairs, the National Guard, the Armed Forces, the border service, the military prosecutor's office or other services.

To grant a pension, you must have at least 20 years of service, and you must also resign from service. If you do not have the required military experience, a preferential pension may still be awarded under the following conditions :

- age from 45 years;

- total work experience of 25 years;

- military experience of 12.5 years.

If, under such conditions, the military man still faces a refusal, then it can be challenged in court.

Full article about military pensions

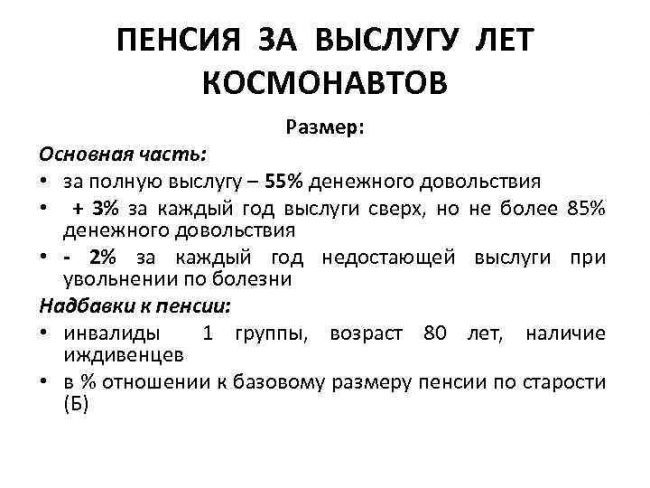

Astronauts

People working as astronauts can retire early based on length of service if the following conditions are met:

- work experience for men from 25 years and from 20 years for women;

- Men must work in a flight test unit for at least 10 years, and for women this period is reduced to 7.5 years;

- if a citizen cannot continue working for health reasons, then 20 or 15 years of service is required for men and women, but the requirements for work in the flight test unit remain the same.

Testers, researchers and instructors can count on a preferential pension.

More information about cosmonaut pensions

Residents of the northern regions

People working in the northern regions receive various support measures from the state. These include early retirement. But at the same time, the following requirements are imposed on employees :

- 15 years of work experience in the Far North;

- if a citizen lives and works in areas equated to the North, then the length of service increases to 20 years.

It does not matter what type of work a person does.

More about Northern Experience

Civil servants

They are assigned a preferential pension according to Federal Law No. 166, and this regulatory act includes data on the required length of service and other conditions. Starting from 2021, the length of service is increasing gradually, so if previously it was required to work for at least 15 years, then by 2026 this figure will increase to 20 years.

If a civil servant resigns before he reaches retirement age for an old-age pension, then he has the right to receive a preferential payment if the length of service is at least 25 years, and if the person filled a position, then at least 7 years of experience is required.

Reference! The long-service pension is established in addition to the insurance pension, so citizens receive two government payments at once.

Read more about civil servants' pensions

Other professions

Additionally, the following persons can count on a service pension::

- Flight test personnel. Requires 25 years of experience for men and 20 years for women.

- Ministry of Emergency Situations specialists. They must have at least 20 years of experience, but for fire department employees the term increases to 25 years.

- Workers in hazardous industries. To assign an early pension, a preliminary labor assessment is required. A long-service pension is issued to women with 10 years of service, and men must work in such conditions for at least 12.5 years.

- Theater figures. The registration conditions differ significantly, but you need 15 to 30 years of experience.

Citizens must apply for a pension themselves, since it is not assigned automatically.

Early retirement, how to apply

- Categories of persons applying for early retirement Early retirement in case of reduction

According to current legislation, men retire at age 60 and women at age 55. However, there are also cases where, subject to strictly regulated conditions, you can start receiving a pension several years earlier than the due date. Let's look at some common situations, such as early retirement in old age, early retirement due to layoffs, and others.

Categories of persons applying for early retirement

Many people are concerned about the question: is it possible to retire early? This is possible, but only if you belong to at least one of the following categories that are entitled to a preferential pension:

- Women with at least 5 children have the right to apply for a pension from the age of 50. It is necessary to fulfill 2 important conditions: the duration of the insurance period is at least 15 years and the upbringing of each child is at least 8 years.

- Men over 55 and women over 50 can apply for early retirement if they are the parents of a child who has been disabled since childhood. This right is granted only to the mother or father of one unhealthy child. Mandatory condition: the length of insurance experience is at least 20 years for men and 15 years for women. To grant an early pension, it is necessary that the child being raised has reached at least 8 years of age - the age when skills for independent care appear. Guardians raising disabled children also fall under this standard. Moreover, every 1.5 years of raising a disabled child counts as 1 year of reduction in the retirement age, but in total up to 5 years. Such relief for these categories of people is associated with significant financial costs and increased emotional stress experienced when raising sick children.

- Unemployed citizens who do not have the opportunity to find a job after the reduction or liquidation of an enterprise. Early retirement in the event of a layoff is usually offered by the employment service. It requires the consent of the employee himself and the simultaneous fulfillment of the following requirements:

- reaching a specific age: women 53 years old, men 57 years old;

- official recognition of a citizen as unemployed;

- developing a full work history that allows you to retire in old age;

- the inability of the employment service to provide a suitable place of work;

- the reason for dismissal is not related to the employee’s professional skills (liquidation of the organization, reduction of staff or the total number of employees).

- Visually impaired. This applies to disabled people of group I only. Women retire on this basis at the age of 40, men - at the age of 50, if by this time they have completed 10 and 15 years of service, respectively.

- Men who worked for at least 25 years, and women - 20 years, who subsequently became disabled due to military injury.

- Persons who, due to rare diseases, are dwarfs or midgets and have work experience: women - 15 years, and men - 20 years. They retire on preferential pensions at 40 and 45 years old, respectively.

- Persons who have lived and worked in the Far North for at least some time.

- 57-year-old men and 53-year-old women who have 25 and 20 years of insurance experience, respectively, and can confirm the following types of work:

- heavy duty textile production;

- working under very difficult working conditions;

- underground works;

- pedagogical activity;

- medical activity.

Documents for early retirement

To apply for and start receiving a preferential pension, you must submit the following documents:

- passport with attached photocopies of all its pages;

- work book;

- military ID (if military service is required);

- certificates of average monthly wages for the past 5 years of work.

Depending on the circumstances for which early retirement is assigned, the following documents are additionally submitted:

- about disability;

- confirming the disability of a family member and his or her dependent status;

- evidence of sufficient insurance coverage for retirement;

- about place of residence and work in the Russian Federation or abroad;

- about changing the surname;

- about confirmation of visual impairment or the presence of serious illnesses;

- about the birth of a child and his upbringing up to 8 years of age;

- on classification as a people of the North or confirming activities in the Far North.

How to retire early?

Registration of a preferential pension is regulated by Article 32 of the Russian Law “On Employment”. The decision is made by employment service employees. Each specific case is considered individually. If a person has the right to apply for early retirement, he must:

- Compile and send an application to the employment service.

- Receive an offer and referral for applying for a preferential pension.

- These documents, together with a certificate of periods of work included in the length of service, should be sent to the body responsible for pension provision.

- The pension fund decides whether it is advisable to assign an early pension and notifies the employment service about this.

If a decision is made to assign an early pension, this person is deprived of the opportunity to receive unemployment payments. The pension fund assumes responsibility for reimbursement of costs associated with preferential payment of pensions. If during this time the citizen manages to officially find a job, then the early old-age pension is not paid, and upon entering retirement age, payments are resumed.

Appointment procedure

The pension is not provided automatically, therefore it is issued exclusively on an application basis. The rules for receiving it include :

- the citizen independently draws up an application, which is submitted to the employees of the Pension Fund branch at the place of registration;

- it is allowed to bring documentation not only in person, but also through a representative, and it can also be sent by mail;

- registration can be done on the PF website or the State Services portal;

- documentation is reviewed within 10 days, but if there are compelling reasons, the period can be extended to three months;

- if a positive decision is made, the benefit is paid from the moment the application is submitted;

- To apply for a long-service pension, you need a passport, an application, a certificate from the place of registration, a work book, SNILS and a certificate containing information about the amount of income for 5 years;

- documents are collected containing information about the hazard class of the workplace and allowances, which will allow PF representatives to correctly calculate the amount of benefits.

Both originals and copies of these documents are prepared.

How is the payment amount determined?

The amount of superannuation varies significantly from one recipient to another as it is influenced by different factors. This takes into account what position the specialist held, as well as what salary he received. For the calculation, a formula is used into which the following values are entered :

- work experience;

- average earnings;

- coefficients that can be either increasing or decreasing;

- allowances;

- indexing;

- deductions from pensions.

Each specialist will have their own calculation procedure.:

- If a serviceman applies for a service pension, then the amount of his payment will be: ((rate by position + rate by rank) * 50% + (rate by position + rate by rank) * 3% * 7)) * reduction factor.

- For civil servants, a different formula is used: (45% of the average income - the amount of the old-age pension) + average income * 3% * length of service.

- If the calculation is carried out for a health worker, then the formula is used: pension points * point price + fixed payment.

- For teachers, the following indicators are used: fixed payment + number of points * point price.

If a person retires later than expected, he can take advantage of the increasing coefficient. The payment amount regularly increases due to indexation.

Attention! The long-service pension cannot be more than 75% of the average income of a civil servant, and for the military, the size of the benefit cannot exceed 85% of the salary.

Retirement after 42 years of service

The right to early retirement for men with more than 42 years of experience is enshrined in Part 1.2 of Art. 8 of Law No. 400-FZ of December 28, 2013 “On insurance pensions”. This rule has been in effect since January 1, 2021, that is, it will apply to those citizens who plan to receive pension payments after this date. The law provides that the retirement age of men is reduced by 2 years, but not more than to 60 (this is the lower limit). The retirement table for men with long work experience (more than 42 years) is presented below:

According to the old law (until the end of 2021) PVDVPP According to the new law (from 2019) PVDVPS taking into account the benefit for 42 years of experience. PVDVPP

| 60 | ||||

| 2019 | 2020 | 2021 | 2022 | 2023 |

| 60,5 | 61,5 | 63 | 64 | 65 |

| 2019-2020 | 2021-2022 | 2024 | 2026 | 2028 |

| 60 | 61 | 62 | 63 | |

| 2019 | 2020 | 2022 | 2024 | 2026 |

The following abbreviations are used in the table: PV - retirement age, DVP - date of retirement. The values given in the table are indicated taking into account the fact that the man has already developed the required length of service .

- In 2021 and 2021, the age limit is shifted by less than 2 years - only by six months and a year and a half. This is due to the fact that the law provides a lower limit to which the age can be reduced (up to 60).

- Subsequently, starting from 2021, the benefit is provided in full - the reduction is 24 months.

- In 2023, the final retirement age will be fixed, which means that men will retire based on length of service at a fixed age - 63.

Table by year of birth

To determine when men will take early retirement if they have 42 years of work experience , you can use the table below by date of birth.

Date of birthPVDAccording to the new lawPVDVPS taking into account the benefit for 42 years of experience.PVDVP

| 1 p. 1959 | 2 p. 1959 | 1 p. 1960 | 2 p. 1960 | 1961 | 1962 | 1963 |

| 60,5 | 61,5 | 63 | 64 | 65 | ||

| 2 p. 2019 | 1 p. 2020 | 2 p. 2021 | 1 p. 2022 | 2024 | 2026 | 2028 |

| 60 | 61 | 62 | 63 | |||

| 1 p. 2019 | 2 p. 2019 | 1 p. 2020 | 2 p. 2020 | 2022 | 2024 | 2026 |

The following abbreviations are used in the table: PV - retirement age, DVP - date of retirement, p. - half a year of the corresponding year. The values given in the table are indicated taking into account the fact that the man has already developed the required length of service .

When the transitional provisions of the law on raising the retirement age are completed, a fixed age for early retirement will be fixed based on length of service. This will apply to men born in 1963. and younger - they will retire early when they reach 63 years of age (provided that they have worked for at least 42 years).

Rules for registration of pensions

Citizens entitled to a preferential pension can apply for it at any time. To do this, a correct application is drawn up and other documentation is prepared. Papers are submitted to the Pension Fund office at the place of registration of the applicant.

It is also possible to use alternative design methods, which include:

- submitting an electronic application on the PF website;

- using the services of the State Services portal if you have an identified account;

- sending documents by mail;

- using the services of an intermediary, for whom a power of attorney, certified by a notary, is previously drawn up;

- submission of documents through MFC employees.

If a citizen lives and works in the Far North, then in order to receive a preferential pension he will have to submit an application at the place of registration in these regions.

If a civil servant is in charge of applying for a pension, he can submit an application through the federal government agency in which he served as a civil servant. If this institution is liquidated or reorganized, then you need to contact the organization to which the functions of this enterprise have been transferred.

New basis for early retirement

From January 1, 2021, for citizens who have a long work history, a new basis for early retirement is provided. Women can exercise the right to retire 2 years earlier than generally established periods if they have 37 years of work experience and men with 42 years of work experience, but not earlier than reaching the age of 55 years for women and 60 years for men.

Since the retirement age will be raised gradually, in 2019, if you have a long period of service, you can become an early retiree only six months earlier than the stipulated period. The general retirement age in 2021 is 55 years and 6 months for women and 60 years and 6 months for men, respectively.

For example: a man with a date of birth of 05/15/1959 has the right to retire at 60 years and 6 months, that is, 11/15/2019. However, if he has 42 years of service, he can retire at 60 years old - that is, 05/15/2019.

If a citizen completes the above number of years of work experience in 2022, for example, this is a woman born in 1966, then she has the right to retire at 56 years old, 2 years earlier than the generally established period.

What is included in the length of service for early retirement?

— To assign an early pension due to long service, periods of work that were performed on the territory of the Russian Federation and for which insurance contributions were paid to the Pension Fund, as well as periods of receiving compulsory social insurance benefits during the period of temporary disability are taken into account. Non-insurance periods, such as military service, parental leave, periods of receiving unemployment benefits are not included in the length of service.

Residents of St. Petersburg and the Leningrad Region can check their current length of service in the citizen’s Personal Account on the Pension Fund website or on the government services portal. Information about experience can also be obtained from the client services of the Pension Fund and the MFC.

If you believe that any information has not been taken into account or has not been taken into account in full, contact your employer to clarify the data and submit it to the Pension Fund.

Statistics:

As of May 1, 2021, on the above basis, pensions were assigned to 162 citizens, of whom 26 were men and 136 women.

For information:

Table of ages for early retirement for long service

| Year of birth | Men | Released to retire after 42 years of service | |||

| Retirement age giving the right to an old-age pension | Right to an insurance pension | Retirement age with 42 years of service | |||

| 1959 | 60 years 6 months | II half of 2019 I half of 2020 | 60 | 2019 | |

| 1960 | 61 years 6 months | II half of 2021 I half of 2022 | 60 | 2020 | |

| 1961 | 63 | 2024 | 61 | 2022 | |

| 1962 | 64 | 2026 | 62 | 2024 | |

| 1963 onwards | 65 | 2028, etc. | 63 | 2026, etc. | |

| Year of birth | Women | Released to retire after 37 years of service | |||

| Retirement age giving the right to an old-age pension | Right to an insurance pension | Retirement age with 37 years of service | |||

| 1964 | 55 years 6 months | II half of 2019 I half of 2020 | 55 | 2019 | |

| 1965 | 56 years 6 months | II half of 2021 I half of 2022 | 55 | 2020 | |

| 1966 | 58 | 2024 | 56 | 2022 | |

| 1967 | 59 | 2026 | 57 | 2024 | |

| 1968 onwards | 60 | 2028, etc. | 58 | 2026, etc. | |

Changes for 2021

Since the beginning of 2021, adjustments have been made regarding the process of early retirement . On March 9, Mishustin signed an order to increase the list of periods that are included in the length of service.

Now the time that doctors and teachers spend on training and advanced training is counted. But during this period, the specialist must retain his salary and job. Therefore, the employer is obliged to pay insurance premiums. We invite you to watch a video on the topic of the article:

Who will be affected by the new early retirement rules?

On Tuesday, Russian Prime Minister Mikhail Mishustin signed a decree expanding the list of periods included in their work experience. Rossiyskaya Gazeta reported at the end of February that such a document was being considered. Then it became known that the Ministry of Labor had developed a draft resolution of the Government of the Russian Federation introducing changes to the lists of jobs, industries, professions, positions, specialties and institutions (organizations), taking into account which an old-age insurance pension is assigned early (this is 665 Resolution of the Government of the Russian Federation of July 16 2014).

It was proposed to include periods of vocational training and additional professional education of workers in the lists giving the right to early retirement.

Previously, the length of service that gives the right to early retirement included periods of work that were performed continuously during a full working day. In other words, we were talking only about the full-time presence of employees at the workplace. The length of service also included periods of receiving state social insurance benefits during periods of temporary disability, as well as periods of annual basic and additional paid leave.

At the same time, doctors and teachers must constantly undergo advanced training courses, without which they simply will not be able to provide care to ever-increasing standards. The same applies to pilots and machinists who need to master new equipment. Accordingly, at this time they are absent from work. Until recently, they had no experience in such periods.

According to the Cabinet of Ministers, now periods of study and additional professional education, including advanced training courses, will now be counted towards the length of service giving the right to early retirement.

The main condition is that during this time employees retain their jobs and salaries, and that employers make contributions to compulsory pension insurance for them.

Now workers in hazardous and hazardous industries (for example, textile industry, logging, railway drivers, bus and trolleybus drivers, miners) are entitled to early retirement. Depending on the nature of the work, profession and length of service, they can retire at the age of 45-50. Doctors, teachers, and artists can also retire early. Their pension is assigned not upon reaching retirement age, but after acquiring the necessary length of service (special length of service). The minimum required specialized experience is from 25 to 30 years.