Who is covered by treasury support?

According to current legislation, Treasury support is used in the execution of state defense contracts (Law No. 275-FZ). The winning supplier must open an account with one of the authorized banks. All proceeds under the contract will be made specifically for it. This allows the customer and regulatory authorities to track the chain of payments from the budget to the subcontractor.

The procedure for treasury support this year was approved by Government Resolution No. 1552 of December 30, 2021. It also regulates the rules of support for the next two years. This procedure applies to certain categories of government procurement, the terms of which provide for the payment of an advance. Namely, if the amount of the advance exceeds 100 million rubles and if there is no security for it. Support also includes subcontracts with advances that are concluded within the framework of a government contract with support.

Registration in the ERUZ UIS

From January 1 2020 , in order to participate in bidding under 44-FZ, 223-FZ and 615-PP, registration in the ERUZ register (Unified Register of Procurement Participants) on the EIS (Unified Information System) portal in the field of procurement zakupki.gov is .ru.We provide a service for registration in the ERUZ in the EIS:

Order registration in the EIS

What does the Treasury control?

Treasury support means the obligation of large recipients of budget money to open accounts with the Federal Treasury. The mechanism is provided for budget funds, the provision of which is carried out with subsequent confirmation of their use in accordance with the conditions and purposes for which they are provided. Such money is called target funds.

In some cases, in addition to control, treasury security for obligations will also be required - when transferring money within the limits allocated for payment for goods, works, and services actually delivered. Such situations are provided for in Part 8 of Art. 5 385-FZ, clause 9 of RF PP No. 2106. For example, in relation to targeted funds that are provided to legal entities under government contracts for the construction (reconstruction) of state-owned facilities, and contracts that are concluded as part of their execution.

IMPORTANT!

Such property is included in the Federal Targeted Investment Program (FAIP) for 2021.

Treasury provision of obligations is carried out for subsidies allocated by order of the Government of the Russian Federation and the state corporations Roscosmos and Rosatom, and for situations defined in Part 2 of Art. 5 385-FZ. The final payment through the Treasury is carried out as follows: funds for payment of obligations of legal entities are transferred only after receiving security from the Treasury. And it is carried out within the amount necessary to pay for the goods actually delivered.

Conditions of the government contract with treasury support

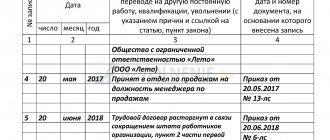

Government contracts that are subject to the requirement to be accompanied by the Treasury impose additional responsibilities on the contractor. The supplier under such a government contract must:

- identify subcontractors;

- open accounts with the Treasury for your company and subcontractors;

- provide the Treasury with supporting primary documents for target expenses (acts, invoices);

- indicate the government contract identifier in payment and settlement documents.

The supplier and its contractors will receive all funds received during the execution of the government contract into accounts in the Treasury. They will be able to receive funds into their regular current accounts in strictly specified cases.

Where to start to conclude a Comprehensive Support Agreement

First of all, you need to submit an application for tender support by filling out the registration form: experts will check your organization for compliance with the criteria of state programs and provide an extract from the unified register of small businesses. After verification, lawyers will prepare a cooperation agreement indicating further actions to support bidding when participating in tenders. After signing the package of documents and paying the tariff, a personal manager will be appointed who will manually select the nearest transactions according to your criteria, according to which advance payment and short payment terms are approved. The Multifunctional Account, in turn, will provide you with the necessary information:

- The entire list of existing small business support programs

- Full list of customers and their Partnership Program registries

- Schedule of direct purchases and subcontracts for the coming year

- Register of banks providing lending to small and medium-sized enterprises under the state program

- Training materials, webinars and video instructions for work

Essence of accompaniment

The winning supplier, as well as subcontractors who will be involved in the execution of the contract, open accounts in the territorial divisions of the Treasury. Each of these divisions has its own account with the Central Bank of the Russian Federation. The advance payment stipulated by the contract is transferred to these accounts. Further, at the request of the executor, the Treasury transfers funds to accounts in territorial divisions (after making sure of the intended use).

Using a special number - the contract identifier - the entire path of funds associated with it is tracked. The identifier must be indicated in all payment documents.

QUESTIONS AND ANSWERS: PRACTICE OF TREASURY SUPPORT OF STATE CALCULATIONS.

Legislation in the field of state defense orders does not prohibit paying with one’s own funds from the current account to the supplier’s current account. At the same time, payments from a personal account to a supplier’s personal account are the priority form of payment. According to Treasury employees, the law (see paragraph 2, part 4, article 5 of Law No. 380 - Federal Law on the Budget for 2021 and the planning period 2021-2022) directly provides for the obligation to open a personal account for making payments within the framework of treasury support GOZ. In addition, according to clause 36 of the Treasury Support Rules, approved. PP No. 1819 (valid in 2020), the Head executor (executor) is obliged to use for settlements under the contract (agreement) a personal account opened in the territorial body of the Federal Treasury for the contractor with whom the head executor (executor-customer) entered into a contract (agreement) ). Refusal (or evasion) of opening a personal account by your supplier (co-contractor) may be considered as evasion of concluding a contract under the terms of the state defense order. However, according to clause 6.1 of Art. 6 of Federal Law No. 275-FZ, the obligation to conclude a contract under the State Defense Order is provided only for organizations occupying a dominant position (dominant position is determined in accordance with the provisions of Article 14 of Federal Law No. 275-FZ - including on the basis of the inclusion of PKI in your TU (or other TD)). Unit the supplier (organization occupying a dominant position) may refuse to enter into a state defense contract, incl. with a form of payment to a special account (offer a different form of payment) if it has economic (or other) reasons (arguments). Such reasons must be stated in writing and supported. Therefore, liability (coercive measures) for refusal to work using a personal account can only be applied to organizations that occupy a dominant position (including Article 7.29.1 of the Code of Administrative Offenses). It is impossible to oblige other organizations (not occupying a dominant position) to conclude a state defense contract (under the terms of 275-FZ and PP No. 1819) (there are no grounds or measures of influence). Those. refusal to open a personal account can be qualified as evasion of concluding a contract under the State Defense Order (since, according to clause 6.1 of Article 6 of Law No. 275-FZ, such actions are prohibited). Such an organization may be fined and (or) forced (given an order that it must conclude a contract on the terms proposed by the customer). Thus, since payment for products from personal account to personal account is the priority (main) form of settlements between participants in the cooperation of works under the state defense order, when making settlements using your current account, “questions” may arise - from treasury employees precisely in the conditions of having your personal account and cash balances at the time of making payments without using such a personal account (from your current account). Such “questions” may arise precisely at the moment when you go to reimburse such expenses. At the same time, please note that according to the current rules (personal account regime), you CAN reimburse expenses incurred (part of the expenses) provided that you submit copies of payment orders, registers of payment orders and other documents confirming payment of expenses (part of them) made by the main executor (executor). expenses) (see 12 Rules, approved by PP No. 1819 - valid in 2020). There are no restrictions (mandatory conditions) in this paragraph that would indicate the impossibility of reimbursing such expenses incurred if there are funds in the personal account. The rule on the possibility of reimbursement of expenses incurred (part of the expenses) only if these expenses were incurred before the funds were received in the personal account (or if there are insufficient funds in the personal account) is NOT included in the current version of the Rules on treasury support of state defense funds (PP No. 1819)! ! To carry out reimbursement, you only need to have conditions in your contract regarding the right to such reimbursement (the specific amount is not indicated in the contract, but the Information should provide for this type of expense according to the advisory code - 9300 (for the purchase of PKI) or 9200 (work)). With treasury support, compensation is made at any time (during the execution of the contract) if there are funds in the personal account and upon submission of supporting documents to TOFK. There is no need to wait for the completion of the contract (as in banking support) for reimbursement. Taking into account the above, you will be able to reimburse expenses incurred during the execution of a government contract if you provide all supporting documents. But we recommend that you receive a written refusal to open a personal account. It is also advisable in such an agreement to necessarily indicate a reference to the State Defense Order (Federal Law No. 275-FZ), and also, if possible, to highlight (this can be a separate specification) the volume of obligations (price) and the IGK that you will reimburse from this personal account. If you have such documents, it will be “easier” for you and it will be enough to “simply” confirm the fact that the expenses incurred belong to the execution of this state. contract and carry out reimbursement. At the same time, please note that according to Art. 8 (clause 3, part 1 or 2 of Federal Law No. 275-FZ), you, as the customer, being the main contractor of the State Defense Order, are OBLIGATED to notify co-executors that the contract is being concluded and executed in order to fulfill the state defense order (clause 12, part. 2 art. and clearly indicate this in the text of the contract. Otherwise, you will violate the requirements of Federal Law No. 275-FZ (you are required to do this if the purchase was under the State Defense Order).

At the same time, payments from a personal account to a supplier’s personal account are the priority form of payment. According to Treasury employees, the law (see paragraph 2, part 4, article 5 of Law No. 380 - Federal Law on the Budget for 2021 and the planning period 2021-2022) directly provides for the obligation to open a personal account for making payments within the framework of treasury support GOZ. In addition, according to clause 36 of the Treasury Support Rules, approved. PP No. 1819 (valid in 2020), the Head executor (executor) is obliged to use for settlements under the contract (agreement) a personal account opened in the territorial body of the Federal Treasury for the contractor with whom the head executor (executor-customer) entered into a contract (agreement) ). Refusal (or evasion) of opening a personal account by your supplier (co-contractor) may be considered as evasion of concluding a contract under the terms of the state defense order. However, according to clause 6.1 of Art. 6 of Federal Law No. 275-FZ, the obligation to conclude a contract under the State Defense Order is provided only for organizations occupying a dominant position (dominant position is determined in accordance with the provisions of Article 14 of Federal Law No. 275-FZ - including on the basis of the inclusion of PKI in your TU (or other TD)). Unit the supplier (organization occupying a dominant position) may refuse to enter into a state defense contract, incl. with a form of payment to a special account (offer a different form of payment) if it has economic (or other) reasons (arguments). Such reasons must be stated in writing and supported. Therefore, liability (coercive measures) for refusal to work using a personal account can only be applied to organizations that occupy a dominant position (including Article 7.29.1 of the Code of Administrative Offenses). It is impossible to oblige other organizations (not occupying a dominant position) to conclude a state defense contract (under the terms of 275-FZ and PP No. 1819) (there are no grounds or measures of influence). Those. refusal to open a personal account can be qualified as evasion of concluding a contract under the State Defense Order (since, according to clause 6.1 of Article 6 of Law No. 275-FZ, such actions are prohibited). Such an organization may be fined and (or) forced (given an order that it must conclude a contract on the terms proposed by the customer). Thus, since payment for products from personal account to personal account is the priority (main) form of settlements between participants in the cooperation of works under the state defense order, when making settlements using your current account, “questions” may arise - from treasury employees precisely in the conditions of having your personal account and cash balances at the time of making payments without using such a personal account (from your current account). Such “questions” may arise precisely at the moment when you go to reimburse such expenses. At the same time, please note that according to the current rules (personal account regime), you CAN reimburse expenses incurred (part of the expenses) provided that you submit copies of payment orders, registers of payment orders and other documents confirming payment of expenses (part of them) made by the main executor (executor). expenses) (see 12 Rules, approved by PP No. 1819 - valid in 2020). There are no restrictions (mandatory conditions) in this paragraph that would indicate the impossibility of reimbursing such expenses incurred if there are funds in the personal account. The rule on the possibility of reimbursement of expenses incurred (part of the expenses) only if these expenses were incurred before the funds were received in the personal account (or if there are insufficient funds in the personal account) is NOT included in the current version of the Rules on treasury support of state defense funds (PP No. 1819)! ! To carry out reimbursement, you only need to have conditions in your contract regarding the right to such reimbursement (the specific amount is not indicated in the contract, but the Information should provide for this type of expense according to the advisory code - 9300 (for the purchase of PKI) or 9200 (work)). With treasury support, compensation is made at any time (during the execution of the contract) if there are funds in the personal account and upon submission of supporting documents to TOFK. There is no need to wait for the completion of the contract (as in banking support) for reimbursement. Taking into account the above, you will be able to reimburse expenses incurred during the execution of a government contract if you provide all supporting documents. But we recommend that you receive a written refusal to open a personal account. It is also advisable in such an agreement to necessarily indicate a reference to the State Defense Order (Federal Law No. 275-FZ), and also, if possible, to highlight (this can be a separate specification) the volume of obligations (price) and the IGK that you will reimburse from this personal account. If you have such documents, it will be “easier” for you and it will be enough to “simply” confirm the fact that the expenses incurred belong to the execution of this state. contract and carry out reimbursement. At the same time, please note that according to Art. 8 (clause 3, part 1 or 2 of Federal Law No. 275-FZ), you, as the customer, being the main contractor of the State Defense Order, are OBLIGATED to notify co-executors that the contract is being concluded and executed in order to fulfill the state defense order (clause 12, part. 2 art. and clearly indicate this in the text of the contract. Otherwise, you will violate the requirements of Federal Law No. 275-FZ (you are required to do this if the purchase was under the State Defense Order).

How the process works

After the conclusion of a government contract, within 21 days, an act is issued indicating which specific department of the Treasury is entrusted with its support. The supplier applies there with a government contract and its own application. An account is opened for him within one or two business days.

The amounts stipulated by the state contract are stored in Treasury accounts. Funds are transferred to an account opened for the contractor or his contractors with the territorial authority upon request. In this case, only expenses for certain purposes that are specified in the contract are paid. For example, for the purchase of materials, wages for employees, and others.

The funds received must be spent for their intended purpose. They cannot be deposited or made as a contribution to the authorized capital or property of another organization. Also, these funds cannot be transferred to the bank accounts of the contractor or subcontractor, except for certain purposes. Thus, funds can be transferred to the contractor’s account to pay wages or amounts due as payment for work performed. Such funds are transferred to subcontractors, for example, to pay for utilities and to purchase travel documents.

Payment can be made either in advance or upon expenses. In the first case, the supplier presents the contract and the invoice issued to him, and the Treasury pays it. When postpaying, along with the contract, the supplier submits to the Treasury documents that confirm the delivery of goods, performance of work or provision of services. In this case, funds can be withdrawn to current accounts.

What funds does it apply to?

The following expenses fall under the control exercised by the Treasury:

- Funds transferred under government contracts, the price of which exceeds 100 million rubles .

- Funds for state defense orders according to Law No. 275-FZ.

- Budgetary investments and subsidies made on the basis of agreements or legal acts.

- Targeted budget funds, at the expense of which shares in the authorized (share) capital or property of legal entities are acquired.

- Funds used to pay for various types of contracts that were concluded as part of the execution of government contracts and agreements.

What can change for the customer

So, for now, treasury support is the job of only part of the procurement. But if the bill that we mentioned at the beginning of the article is adopted, this may become a concern for every supplier participating in government procurement. True, it is not clear from the draft law who its requirements will apply to. Perhaps the largest and/or strategically important purchases will fall under them. However, over time, treasury support will likely be extended to most purchases.

It is clear that the new requirements will be associated with additional burden on the supplier. Namely, document flow will increase, because in order to receive funds, you will need to confirm expenses. In addition, for many territorial divisions of the Treasury, contract support is not yet a well-established process, so suppliers may have difficulties in interacting with the service. In addition, Treasury offices are not as widespread, so suppliers from smaller communities will have to spend additional time traveling. Although the solution to the last problem can be electronic document management.

Will treasury support have a positive effect on suppliers? At first glance, there are three advantages. Firstly, competition will decrease. Some participants, especially unscrupulous ones, will simply be scared off by the new rules. Secondly, targeted expenses will be paid without any excuses. If today a customer may complain that money has not yet been transferred from the budget, then with treasury support this is excluded. Thirdly, the execution of the contract will become more transparent. If a supplier uses many subcontractors, it is often difficult to monitor the progress of the contract. The introduction of treasury support should significantly improve this situation.

conclusions

So, treasury support is an additional way to control the intended use of budget funds. It introduces some difficulties into the process of interaction between the customer and the supplier - the need to open accounts with the Treasury, provide additional documents, and use the contract identifier. However, this has a positive effect not only for the budget, but also for the parties to the contract:

- For the customer:

- the Treasury exercises control over the entire chain of executors;

- an additional “filter” arises that filters out unreliable suppliers.

- For the contractor, the advantage is that the customer will not be able to refer to the lack of budgetary funds and delay payment.

We recommend reading the article about FAS inspections in the field of procurement under 44-FZ.