What it is

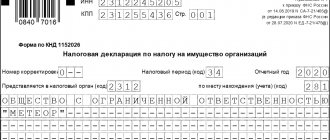

TN is a mandatory payment that is collected from the owner of a vehicle that has passed the registration procedure. This tax is regional - the authorities of a specific subject of the Russian Federation establish the amount, period, payment procedure, and reporting forms. The following are subject to taxation:

- Cars and trucks.

- Motorcycles, regardless of the power characteristics of the power unit and the fuel used.

- Buses, trolleybuses and other vehicles that move on caterpillar, pneumatic tracks.

- Airplanes and helicopters are owned by individuals and organizations.

- Motor ships, boats, sailing vessels and other floating craft.

Tax rates in the Russian Federation for different types of vehicles can vary significantly. The rate is set by regional authorities and depends on a number of factors that are unique to each region.

The transport tax of the Russian Federation came into force on September 1, 2003

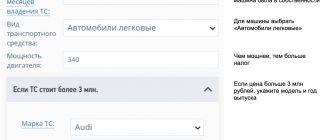

The total amount of mandatory payment collected from the owner of a registered vehicle depends on the following factors:

- Power of the power unit.

- Turbine engine thrust.

- Gross tonnage of the vehicle, if we are talking about buses, trolleybuses, passenger ships or airplanes.

- Vehicle categories.

Do not forget that in accordance with the resolution of the Federal Antimonopoly Service of the Moscow Region No. KA-A40/10504-09, the owner of, for example, a car, and not the person who operates it, must pay the TN.

Even the presence of information about the operator in the documents is not a basis for “shifting” tax obligations to him. Thus, an organization engaged in the transportation of goods cannot force a driver who uses a truck owned by the company to pay TN on duty. According to Article 260 of the Tax Code of the Russian Federation, such a tax payment must be collected every year.

Consequences of non-payment of transport tax

It was previously noted that even if the receipt did not arrive at the place of registration or residence, the owner of the vehicle must independently deal with the problem. According to established laws, after 6 days from the moment the receipt is sent, it is considered delivered and no one cares whether it reached the recipient.

The consequences of non-payment are that the tax service considers the owner of the vehicle to be an evader. Punishment may be an administrative fine.

In conclusion, we note that the case under consideration, when the receipt does not reach the owner of the vehicle, is quite common and tax officials go to meet people who are trying to correct their mistake.

Therefore, if a receipt does not arrive by the end of the payment period, you should take care of the problem yourself.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

Free online consultation with a car lawyer

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

Who is eligible for benefits?

The Tax Code of the Russian Federation states that certain categories of citizens can receive benefits for paying TN. These include:

- Veterans of the Great Patriotic War.

- Liquidators of man-made disasters and citizens exposed to radiation during nuclear weapons testing.

- Persons awarded the title Hero of the Soviet Union or Russia.

- Drivers who are not vehicle owners, but are engaged in transporting an incapacitated disabled person in his vehicle, which has special equipment.

- Knights of the Order of Glory.

- Parents in a large family.

- Owners of cars with power up to 70 hp. With.

- Military pensioners who participated in battles (Chechnya, Afghanistan).

- Citizens with group I or II disabilities.

- Legal guardians of a disabled child.

Owners of Daewoo Matiz pay a minimum transport tax, which depends on the region of registration

The benefits established for pensioners for the payment of transport tax do not apply everywhere. For example, in regions where the amount of subsidies has been significantly reduced or completely canceled. This should be taken into account when applying for benefits or purchasing cars in a specific region of Russia. Also, this factor can have a significant impact on the activities of private entrepreneurs or other organizations.

Vehicles offering benefits

Funds are allocated from the federal or regional budget to provide benefits to citizens who are owners of:

- Boats with oars.

- Aviation transport. However, it must belong to sanitary or medical institutions.

- Passenger cars that are specially equipped for transporting people with disabilities.

- Vehicles used in operational, military work or similar activities.

- Vessels used to transport goods or passengers across seas or rivers.

- Equipment used for agricultural needs.

The amount of the benefit for a specific type of transport is set individually. Detailed information about it and its design features can be obtained by reading the relevant articles in the tax legislation and appendices to them.

Is it possible not to pay tax if the receipt has not arrived?

If ignorance of the laws does not exempt you from liability, then the absence of a receipt in the mailbox also does not mean that you can not pay tax. If the car owner has not received a receipt by August, then there is a chance that it was sent to the wrong address or there were other problems.

In any case, you will have to resolve the issue yourself; then it will be impossible to prove that the tax was not paid due to improper work of one of the government agencies responsible for sending the receipt. This is due to the fact that all the same adopted laws oblige the taxpayer to contact the Federal Tax Service in the case under consideration.

Who is exempt from paying

In accordance with Article 358 of the Tax Code of the Russian Federation, some citizens are exempt from paying transport tax. These include owners:

- Vehicles whose power unit power does not exceed 50 hp. With.

- Stolen cars (an extract obtained from the competent authorities can serve as proof of the theft of a vehicle).

- Passenger cars with specialized equipment for transporting disabled people, for example disabled people of groups I and II.

- Airplanes and helicopters owned by sanitary or medical services.

- Vehicles obtained from special structures with a power of up to 100 hp. With.

- Vessels registered in international registries.

- Fixed, floating platforms, as well as installations intended for drilling.

- Vessels owned by private entrepreneurs. However, the tax is not levied if passenger transportation by river or sea is the main activity.

Owners of some vehicles can count on both benefits and full exemption from TN, for example, owners of aircraft owned by sanitary or medical services, or passenger ships.

Ambulance helicopters are not subject to taxation

Transport tax is most often not levied on veteran organizations, for example, those who have a car and use it exclusively for work.

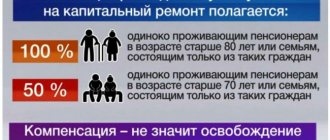

Do pensioners pay transport tax?

Pensioners are completely exempt from TN if the power of the registered vehicle does not exceed 100 hp. With. If the power characteristics of the engine exceed this mark, then the pensioner is obliged to make annual payments, but can take advantage of the benefits provided by law.

The amount of benefits is determined by regional authorities. Moreover, any pensioner can take advantage of the right to tax exemption or benefits, regardless of whether he continues to perform work duties after reaching the legal age or not.

Pensioners receive benefits only if they contact the Tax Service with the appropriate application and the necessary package of documents

For citizens whose retirement age has been reduced due to work duties in hazardous production or in the northern regions of Russia, it is also possible to use benefits or receive a full exemption from annual payments.

Do not forget that the regional tax rate established for pensioners can range from 5 to 25 rubles. Its value directly depends on the average income level of citizens in a particular region, as well as the general condition of roads. Therefore, for owners of vehicles of the same brand in different regions, different amounts of payments may be established.

To receive benefits, a pensioner must submit a corresponding application and attach to it:

- A copy of the pension certificate.

- Technical passport for the vehicle.

- Additional documents confirming the rights of a citizen of retirement age to receive benefits. Their role can be played, for example, by a certificate of disability of the first group.

- Pensioner's identity card, namely passport and its copy.

It is worth considering the collection of the listed documents carefully, since their lack will most likely lead to problems during registration.

Large families

Tax benefits for registered vehicles are established by federal law, and decisions on their provision are made by regional authorities. To receive benefits for such taxation, you need to make sure that a particular family has been assigned the status of a large family. It can be obtained if there are more than two children in the family who are under 18 years of age. Children may also be under the age of 23 for full-time students.

For large families, transport benefits apply only to one car

Only one of the parents has the right to apply for social support and only for one vehicle that can be chosen. Do not forget that the role of such transport can be played by a car equipped with a power unit with a power of up to 150 hp. s, motorcycle or scooter. If a person is raising more than three children alone, then he can count on a complete exemption from paying transport tax.

If a large family decides to receive tax breaks, then one of the parents, guardians or adoptive parents needs to contact the regional authorities with a corresponding application. It requires special attention to be filled out, since violation of established standards is likely to cause delays and difficulties during registration. Moreover, the application must be accompanied by documents, namely:

- Passport of the applicant, whose role is played by the taxpayer.

- Birth certificates for children in a large family.

- A certificate confirming that a particular family has been assigned the status of a large family.

If a transport tax benefit has been approved in a particular region, then it is enough to declare it at once. In the future, specialists will take into account the right to a “discount” assigned to a specific family until it loses its status or sells the vehicle.

Disabled people

Disabled people of groups I and II have the right to receive benefits for the payment of transport tax. Thus, the state is trying to facilitate the movement of citizens with disabilities as much as possible. To receive such a “discount” you must have the appropriate certificate, as well as use a car purchased with funds provided by the guardianship authorities.

In most regions of the country, disabled people of groups I and II receive transport tax benefits

For registration, you need to submit a package of documents to the tax office, which includes:

- Application for benefits drawn up in free form.

- Notarized power of attorney. It needs to be prepared if a person with disabilities cannot independently go through the registration procedure and submit documents.

- Proof of identity and citizenship of the Russian Federation, the role of which can be played by a passport or a copy of it.

- PTS.

- Certificate of permanent disability (if available).

Do not forget that organizations that are associations of disabled people who use vehicles to perform any work duties are entitled to special benefits.

It is noteworthy that people with disabilities who have disability group III cannot take advantage of transport tax benefits. According to the law, although such people need social protection, they are quite capable of taking care of themselves on their own, since they are legally capable.

Legal ways to avoid tax

Every citizen of Russia who is not one of the beneficiaries wants to reduce or avoid the annual payment of tax on registered vehicles (preferably on a legal basis). Car enthusiasts should know that there are several ways to avoid such taxation or reduce the amount of payment:

- Completing the procedure for registering a vehicle in a region with a reduced transport tax coefficient. In such a situation, it is important to remember that the tax fee is set depending on the place of registration of the owner, so you will have to register the car to another person.

- Registration of a vehicle for a citizen of another country. A car that has foreign license plates cannot be subject to taxation on the territory of the Russian Federation.

- Registration of a car for a beneficiary. It is the simplest and most popular way. You can continue to use the car, but you must add your name to the MTPL policy.

- Purchasing a Russian-made car with a power unit power of less than 70 hp. With. In some regions, owners of such vehicles can count on benefits established by regional authorities.

- Registration of a car in the name of a child under 18 years of age. According to the law, minors are not required to pay TN.

Do not forget that annual payments must be made regardless of whether the owner operates the vehicle or not. To avoid problems with the tax service, you need to deregister the car. However, it will not be possible to use the vehicle in such a situation legally.

If a citizen has not received a receipt for payment, then the transport tax also does not have to be paid.

There are few ways to legally evade transport tax that do not cause inconvenience to the motorist, but even they are not suitable for all citizens. If a person is not a benefit recipient, then tax evasion (even legal) is associated with a certain risk. In the worst case, the car owner will have to bear responsibility.

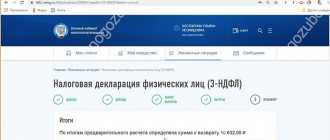

When and how does the transport tax arrive?

Transport tax is an amount that is paid by vehicle owners, regardless of their form of ownership. This tax must be paid for one year. It usually arrives by registered mail.

It may arrive in the middle of the year; exact dates have not been established. But the tax must be paid before December 1 of the next year at any convenient time. If it hasn’t arrived and the deadline is about to expire, then you can pay the tax without a receipt.