During the transitional state of the state from the Soviet Union to the Russian Federation, officials adopted one of the most important legislative acts, exempting pensioners from paying land tax. After time, this measure was revised, taxation was returned, but payment benefits were left for many pensioners.

The low land tax rate allows even pensioners not to think too much about this item of expenditure in their budget. Few of them know about the existence of various benefits. This article is intended to answer many questions regarding the relationship between pensioners and land tax.

General provisions on land tax and its payment

Federal legislative acts establish the procedure for calculating tax on land plots owned by citizens. Regional authorities set rates for this fee and distribute benefits.

There are a number of criteria for which a plot of land is exempt from taxation:

- The land plot is occupied by a water body.

- The allotment is part of the forestry sector.

- The site has some restrictions on circulation, or has been removed from it by law.

- The plot of land belongs to objects recognized as cultural heritage.

Payers can be individuals, individual entrepreneurs or organizations. Rights to a plot are determined by ownership, possession without a term, or by inheritance rights.

The land tax rate for pensioners is no more than three tenths of a percent of the value indicated in the cadastral documentation. In this case, the value according to cadastral records acts as the main base from which the fee required to be paid by the owner is calculated for the period.

Only residents of the northern borders of the state are fully exempt from land tax. The rest are obliged to transfer a certain amount of money to the budget once a year, in the form of a fee. If there is some kind of benefit that is applicable to a citizen, then he has every right to collect the necessary package of documents and apply for a relief on the payment of the land tax.

A plot of land is subject to taxation as soon as it is included in the cadastral list by municipal authorities. If entry into the cadastral list is carried out with a delay, tax payment is made for three years preceding the date of filing the notification.

Having decided on general issues, let’s move on to analyzing the benefits that can be provided to pensioners upon payment.

How to get

To apply for benefits, pensioners must deal with this issue independently. No organizations will take care of the rights of citizens for themselves. This is not in their competence. Without a submitted application and documents, the tax authority will by default assume that the owner does not have any privileges.

The application must be submitted in a timely manner so that the tax authorities have time to consider it, make a decision and include it in the reporting period. Each case will be considered individually.

Documents to be submitted:

- Personal passport of a pensioner;

- Pension certificate;

- Certificate of monthly pension;

- Papers confirming ownership of the land.

You need to contact any branch at your place of residence or location of the land. If any of the specified documents is missing, you must first take care of obtaining it, and only then go to the tax authority to receive benefits. No one will formalize anything with an incomplete list. The applicant will simply waste his own and other people’s time.

If a citizen has other reasons for receiving privileges from the state, they must be provided as well, although they are unlikely to affect the amount of the benefit.

Land tax benefits provided to pensioners

The state equates pensioners to a socially vulnerable segment of the population, and therefore they are provided with a number of concessions, including taxation. All issues in this area are resolved by local administrative authorities.

At the federal level, a number of categories of pensioners are prescribed who are partially exempt from paying land taxes.

These include:

- disabled people of groups I and II (a restriction has been introduced for group II - only those who received it before the beginning of 2004);

- citizens who are disabled from birth;

- citizens who received the title of Hero of the country (including the USSR);

- veterans of various actions equated to combat;

- citizens who took part in the elimination of man-made disasters.

Regional laws establish the size of the discount received by these categories of citizens.

The maximum possible benefit should not exceed ten thousand rubles. An important note is that the plot of land subject to taxation and applying for relief should not be involved in business activities. Otherwise, the concessions do not apply and the owner, no matter what, pays the land tax in full.

Benefits are provided only to those pensioners who have already completed their working career, and at the same time are citizens of the Russian Federation. It is also a mandatory condition that the applicant registers in the same area to which the land plot eligible for benefits belongs.

The concept of land tax and who benefits from it

Payment of land tax is made by persons who own land plots as their own property or by the right of indefinite or lifelong use.

Despite the fact that land tax is enshrined in the legislation of the Russian Federation, its amount

is established directly by local municipal authorities in the regions of the Russian Federation.

This category includes:

- heroes of the Soviet Union;

- citizens who have the title of full holder of the Order of Glory;

- citizens with ;

- citizens who are ;

- citizens who are recognized as WWII veterans.

In addition to these persons, benefits may include:

and citizens who:

- took an active part in biochemical testing of nuclear weapons;

- are accident liquidators at various nuclear installations;

- have radiation sickness.

Particular examples of benefits by region

Many local authorities offer pensioners interesting benefits on paying taxes on land plots.

Let's look at some regions.

- The Moscow region gives relief to pensioners who own land plots not exceeding one thousand two hundred square meters in area.

- Twenty-five percent of the assessed land tax is paid by pensioners of the city of Lotoshin.

- Pensioners of the city of Korolev can apply for a discount of half the amount of the accrued land tax, but only if the area of the land plot does not exceed one thousand two hundred square meters.

- Pensioners of the Chita region are completely exempt from paying land tax, but only if there is a residential building on the desired site. The same benefit applies in the vicinity of Voronezh.

- Samara offers a benefit to pensioners who own a plot of no more than six acres.

Recently, regional authorities have been reconsidering the issue of land taxation for pensioners, so it is better to find out the latest news on this issue from local services.

Pensioners

In the early 90s. This category of the population was exempt from paying land taxes. With the update of the Tax Code in 2005, this privilege was abolished. Now pensioners pay land taxes in full on an equal basis with the working population.

Tax benefits are possible at the municipal level. Thus, tax privileges depend on the location of the land plot. You can find out whether benefits are available and what their size is from the regulations governing taxation at the local level. It can be downloaded from the official website of the municipality.

In addition to benefits, authorized bodies have the right to establish requirements, upon fulfillment of which an individual can take advantage of the opportunity to reduce tax or not pay it at all. Most often, these are: permanent registration in the territory of the municipality, lack of official employment, etc.

The procedure for obtaining tax benefits and the scheme for their payment can be found at the territorial tax office.

To reduce the tax base, a pensioner must provide:

- pensioner's ID;

- land documents confirming ownership;

- passport;

- work book (if necessary).

Thus, land tax benefits for pensioners are the exclusive prerogative of the local government level. Mainly used as a measure of social support for low-income groups of the population.

How can a pensioner get a land tax benefit?

If the owner of a plot of land is absolutely sure that in his region of residence there are benefits for this taxation, he must submit an application to the tax office, providing the necessary documentation:

- identification documents;

- a document confirming the right of ownership of the land plot;

- additional documents confirming that the pensioner belongs to preferential categories.

If all documents are correct, the benefit is provided in a given region - the tax service will accept the application and, from the next tax period, will charge the amount of the fee in a different, edited value.

To ensure the availability of preferential offers for pensioners in terms of land tax, you should seek advice from your local fiscal authorities.

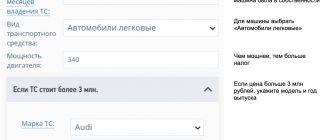

How the rate changes

The size of the tax rate today depends on the cadastral value of the land, which is influenced by the area of the real estate, its location and intended purpose. If tax benefits are issued on time, they are also taken into account. At the same time, the cadastral value is recalculated annually, which means the tax amount can also change every year.

For individuals, which include pensioners, the tax rate is calculated by the relevant authorities, after which property owners receive notifications. They indicate who must pay for what and how much. To independently check whether everything was calculated correctly, you should find out the current cadastral value of your land. Such information can be obtained via the Internet, by telephone or during a personal visit to the tax authority.

If the land is in shared ownership, the pensioner has the right to apply for benefits only for his part of the property. For the remaining shares, co-owners will pay the full amount, unless they also fall into preferential categories. At the same time, the legislation provides for an annual increase in the tax rate by twenty percent, which makes pension benefits significant.

How can you find out about concessions for pensioners in a particular region?

To find out whether a pensioner’s land ownership has certain benefits in a particular region, you need to go through the following steps:

- Send an information request to the regional department of the tax service to provide information about the availability of certain preferences and benefits that apply in a given region;

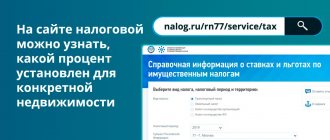

- Use the special Internet service of the fiscal service, where you can find all the information regarding this issue.

To obtain this type of information, it is necessary to indicate the region of the Russian Federation, as well as the municipality, along with the choice of the time period for which such data will be provided.

About military pensioners

I am also interested in the question about military pensioners: do they pay taxes on their land? By right, this category of persons enjoys a wider range of privileges, even in relation to ordinary pensioners. Previously, there were additional benefits for military personnel of retirement age, which were completely exempt from land tax and applied to all pensioners. However, since they were taken away from the latter, this also affected the military. In fact, they were equated with ordinary pensioners.

Now there are completely different rules for paying taxes on land, so you can count on significant discounts or tax abolition for yourself only if the local municipality has signed the corresponding acts. Whether this is worth demanding is for citizens to decide for themselves. Since pensioners usually own not so large territories, the amount of tax is quite acceptable, and it would not be entirely correct to call it burdensome.

Of course, if military retirees have additional reasons for providing them with privileges, they have the right to claim benefits on their own behalf on an individual basis.

The information in this article is provided for informational purposes only. We recommend that you contact our lawyer.