How to use the calculator

Instructions for using the property tax calculator for legal entities

- Enter the tax rate (default 2.2%) and the residual value of fixed assets (property) for all periods.

- Click "CALCULATE". The calculator will calculate the total amount of property tax for the year, the average annual value of the property, the amount of advance payments and the amount of tax to be paid additionally.

The property tax calculator for legal entities is a simple and reliable assistant to the accountant in working on tax reports, including in calculating the property tax of a business entity.

New calculation procedure

According to the current rules of fiscal legislation, the calculation of property tax depends on what exactly is the taxable base.

IMPORTANT!

As of 01/01/2019, the calculation rules have been changed. Now the tax base for property tax is real estate. Movable assets are completely excluded from taxable items. Introduced by Law No. 302-FZ of August 3, 2018.

The property contribution is a regional obligation. Rates, deadlines for payment of advance payments, benefits and exemptions are required to be established by the authorities of the relevant region, subject or region.

Use free instructions from ConsultantPlus experts to pay your property taxes.

Working with the calculator

To start making calculations, you should know the tax rate for the property tax of legal entities.

Let us clarify that tax rates are set at the regional level. This means that the rate is accepted by the representative bodies of the constituent entity of the Russian Federation within the limits established by Chapter 30 of the Tax Code of the Russian Federation.

Equally at the regional level, the following are also established:

- specific features of calculating the tax base;

- tax benefits;

- conditions for the application of benefits by business entities.

In relation to the calculator, this means that the tax rate and other indicators necessary for the calculation must be entered by the user himself - the taxpayer in accordance with Article 474 of the Tax Code of the Russian Federation, since not a single calculator is able to take into account all regional features.

In the windows specially designated for this, enter the residual value of all fixed assets on the balance sheet according to the following indicators:

- at the beginning of each month;

- at the end of the year.

The calculator has a separate window for each month. Thus, 13 indicators will need to be entered into 12 fields, two of which are for December.

After filling out all the fields, left-click on the “Calculate” button. The data obtained as a result of the calculation will be displayed in the table below.

What does the tax amount depend on?

Regions independently set the property tax rate, since the payment applies to local ones. The tax amount is affected by the price of the property; the higher it is, the greater the payment amount. The highest rate in Russia is 2%. On the tax website you can find out what percentage is set for a particular object. You will need to enter the tax type, region and year for which you plan to pay real estate taxes.

From the beginning of 2021, property taxes are calculated based on cadastral value. This price is determined not by the owner himself or the market, but by a government agency. But the cost is not much different from the market price. Recalculation of the cadastral valuation of real estate takes place every 5 years. The obtained data is published on the Rosreestr website.

Until the end of 2021, in some areas and regions, the tax was based not on the cadastral value, but on the inventory value; it was calculated according to the degree of depreciation of the object. Now there is no such thing, and all real estate taxes in the Russian Federation are calculated in a single way - at the price indicated in the cadastre.

The tax rate for individual entrepreneurs or individuals will depend on the type of object, cadastral value and location. For example, for the Yaroslavl region for 2021:

| Type of object, cadastral value and location | Interest rate |

| Housing priced up to 2 million rubles | 0,10 |

| Housing from 2 million to 5 million rubles | 0,15 |

| Unfinished residential building | 0,15 |

| Residential buildings costing more than 5 million rubles | 0,20 |

| Non-residential outbuildings up to 50 sq.m. m. | 0,15 |

| Residential complexes, garages, parking spaces | 0,15 |

| Objects whose cadastral value exceeds 300 million rubles | 2,00 |

| Other objects | 0,50 |

No one needs to calculate how much they need to pay into the budget. The tax office sends a letter indicating both the deadline and the amount. The Federal Tax Service sends out notifications once a year, and payment must also be made in one payment before December 1 of the next year. That is, upon receipt of a letter on January 1, 2021 to pay tax for 2021, it must be paid no later than December 1, 2020. There is no need to report with a separate declaration or write a report.

General information on property tax for legal entities

From the tax base, in accordance with Art. Art. 374, 381 of the Tax Code of the Russian Federation should be excluded:

- property objects included in the first and second groups of the classifier;

- land plots and other environmental facilities;

- elements of movable fixed assets, with the exception of the objects listed in Art. 105.1 Tax Code of the Russian Federation;

- elements of the fixed assets not accepted onto the balance sheet of the enterprise.

Budgetary organizations, as a rule, determine the amount of tax based on the average annual cost. Since at the regional level there may be significant differences in the calculation procedure, before taking on the report, we recommend that you obtain qualified advice from the territorial Federal Tax Service.

Movable property taken onto the balance sheet as a result of reorganizations or liquidations that took place before January 1, 2013 is not included, in accordance with Art. 381 of the Tax Code of the Russian Federation, into the tax base.

Which individual entrepreneur can avoid paying property tax?

Individual entrepreneurs are regarded as individuals and according to the same scheme they pay property tax. Starting from 2019, individual entrepreneurs make payments only for real estate that:

- already refers to the housing stock - apartments, houses, cottages, if the building has a connection with the land;

- non-residential objects - garages, parking spaces;

- any other residential and non-residential finished buildings or those that are just being rebuilt, but are already registered as property.

At the same time, entrepreneurs on imputed income, patent or agricultural tax, do not pay for the real estate that is needed for work. For example, if they rented or bought an object for equipment, a workshop or a warehouse.

Those individual entrepreneurs who work on the main taxation system are required to pay real estate tax. Tax is also paid by simplified entrepreneurs if they have a store, retail space or office, as well as premises for the provision of services, which is included in the list of cadastral real estate.

In the Russian Federation, an entrepreneur has 5 taxation options when opening an individual entrepreneur:

- general taxation system - OSN;

- patent - PSN;

- simplified - simplified tax system;

- single tax on imputed tax - UTII;

- unified agricultural tax - Unified Agricultural Tax.

If the individual entrepreneur has not submitted an application to the tax service to change the tax regime, then according to the legislation of the Russian Federation he will work under the OSN.

To understand whether or not an individual entrepreneur should pay property tax, you can follow this rule:

- There is no need to pay for real estate for work under a patent, imputation or agricultural tax. In a simplified way, you need to check whether the property belongs to the cadastral value or not. If not, then the individual entrepreneur does not pay tax; if yes, then he pays.

- Entrepreneurs who operate under the basic taxation system are required to pay property taxes to the budget. It does not matter whether the property is included in the cadastral list or not.

Therefore, the tax regime and inclusion in the cadastre are the determining parameters.

Where to submit reports

Organizations are generally required to report property taxes at the location of each facility. A company that owns several real estate properties has the right to submit a single property tax return. To do this, three conditions must be met.

- All objects are located on the territory of one subject of the Russian Federation.

- Property tax is fully credited to the budget of a given subject of the Russian Federation without deductions to local budgets.

- Property tax for all specified objects is calculated based on the average annual value, not the cadastral value.

If the conditions are met, the organization can choose an inspection agency to submit reports to. You must notify the regional department of the Federal Tax Service of your choice no later than March 1 of the year that is the tax period. The chosen procedure for submitting a single declaration is maintained until the end of the tax period. Next year you need to either abandon the single declaration or send a new notification.

* The guidelines were approved by order of the Ministry of Finance dated October 13, 2003 No. 91n..

Tax calculation procedure

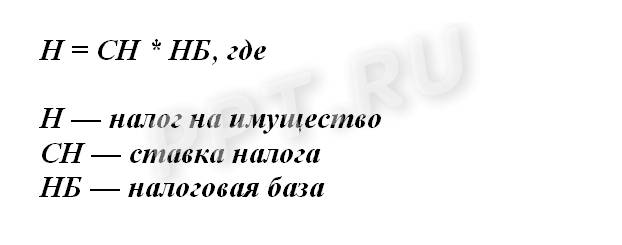

The tax amount is determined as the product of the tax base and the rate approved by the regional authorities for the reporting period. Rate indicators differ depending on the territorial affiliation of the taxpayer. Check the current values on the Federal Tax Service website. The maximum value does not exceed 2.2%. The general formula for calculating corporate property tax is:

First of all, we determine the tax base.

Option No. 1. At average annual cost

The calculation is carried out using the formula:

SrGodSt = (OS1 + OS2 + … + OSp1 + OSp2) / (M + 1),

Where:

- SrGodSt - average annual value of property for the tax period;

- OS1, OS2... - residual value (VV) of the property as of the 1st day of each month of the tax period;

- OSp1 - OS of property as of the 1st day of the last month of the tax period;

- OSp2 - OS of property as of the last day of the last month of the tax period;

- M is the number of months in the tax period.

According to general rules, taxpayers are required to calculate and pay advance payments based on the results of reporting periods (quarters). For example, to calculate the advance payment for 9 months of 2021, enter 10 (9+1) as the denominator. Divide the resulting amount by 4, and only then apply the tax rate.

Option No. 2. At cadastral value

We carry out the calculation using the formula:

Contribution amount = cadastral value × rate.

To calculate, use the value of the cadastral price of the property approved as of January 1 of the year for which you are calculating the contribution. Find out the indicator online on the official website of Rosreestr.

IMPORTANT!

If the company has owned the property for less than a full year, the coefficient Kv in the property tax is applied - an index that reduces the base in proportion to the time of ownership of the property.

The coefficient is determined as follows:

Kv = number of complete months of ownership / number of months in the billing period.

Calculate the advance payment using the formula:

Advance payment = cadastral price × rate / 4.

Do not forget that obligations to pay advance payments are established by regional authorities.

Let's look at an example of calculating property tax based on cadastral value in 2021: a company owns a building that is included in the regional cadastre list. The cadastral price of the property as of 01/01/2021 is 1,500,000 rubles.

Contribution amount for the year = 1,500,000 × 2.2% = 33,000 rubles.

Advance = 33,000 / 4 = 8250 for each quarter.